Key Insights

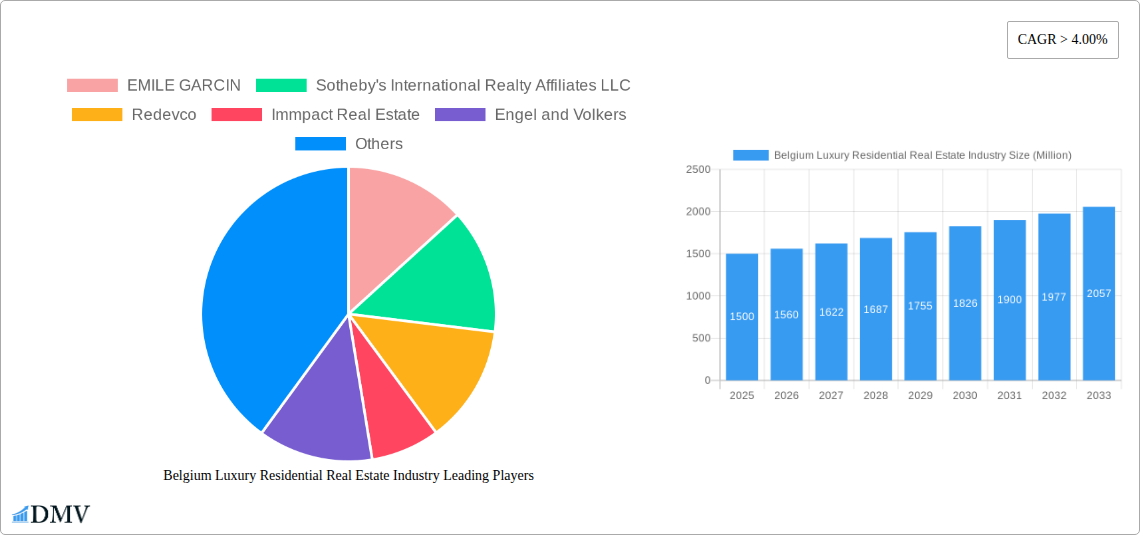

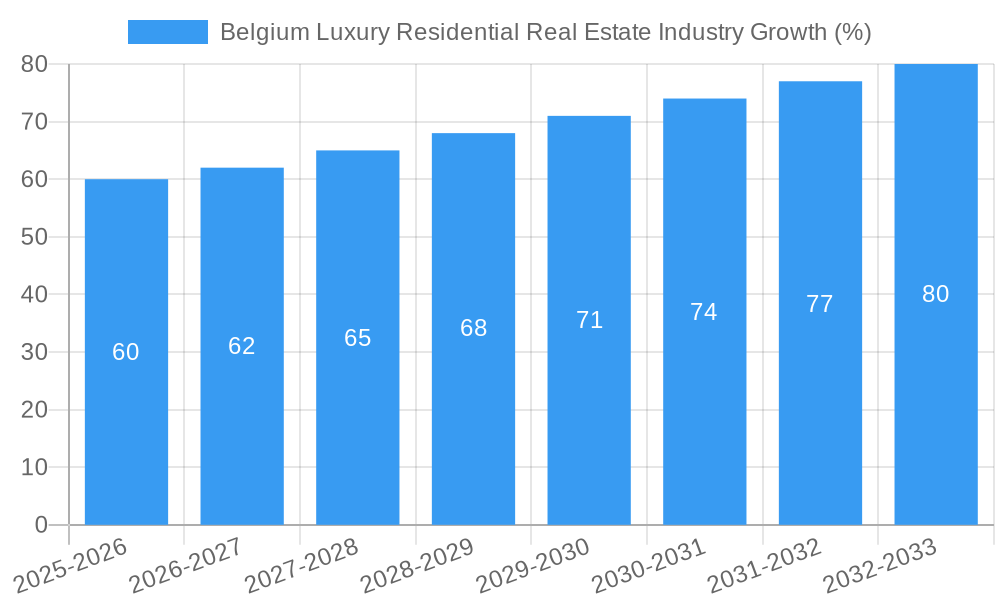

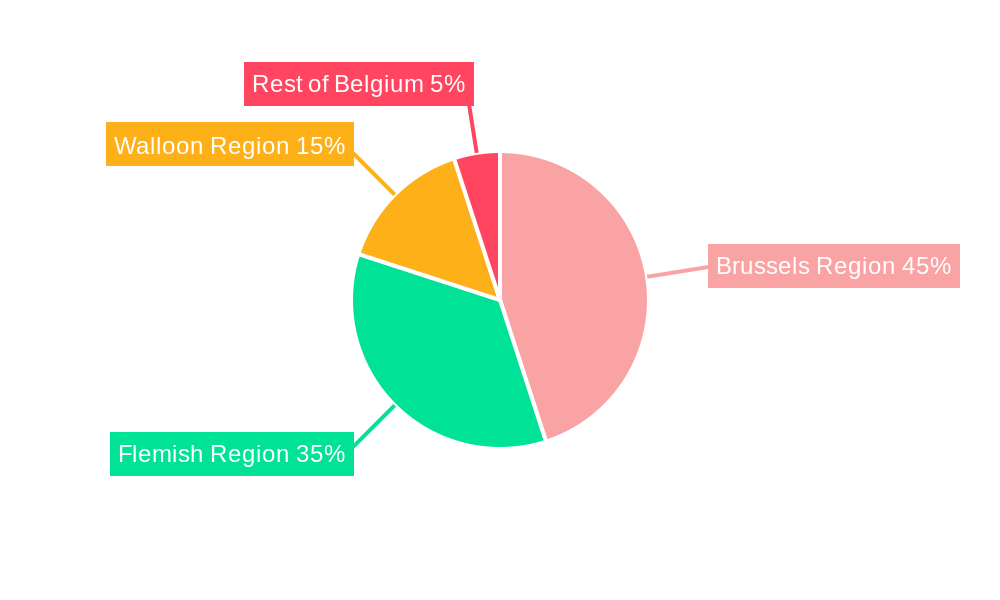

The Belgium luxury residential real estate market, valued at approximately €1.5 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) exceeding 4% through 2033. This upward trajectory is fueled by several key drivers. Firstly, a strong influx of high-net-worth individuals (HNWIs), both domestic and international, seeking prime properties in desirable locations within Belgium's three regions – Walloon, Brussels, and Flemish – is boosting demand. Secondly, low interest rates in previous years (though this may be shifting) and favorable lending conditions have made luxury properties more accessible, further stimulating market activity. Thirdly, the ongoing appeal of Belgium's cultural richness, historical significance, and strategic location within Europe continues to attract buyers. The market is segmented by property type (apartments and condominiums, landed houses and villas) and by region, reflecting varying price points and preferences across these areas. Brussels, with its international institutions and cosmopolitan atmosphere, commands the highest prices, followed by the Flemish Region and then the Walloon Region.

However, the market is not without its challenges. Rising construction costs and a limited supply of luxury properties, particularly in prime locations within Brussels, act as significant restraints. Furthermore, potential economic downturns or changes in government policies could impact buyer sentiment and investment. Despite these constraints, the overall outlook remains positive, with continued growth anticipated driven by strong underlying demand and the attractiveness of the Belgian luxury residential market to both domestic and international investors. Key players such as Emile Garcin, Sotheby's International Realty, and Redevco are well-positioned to capitalize on this growth, although competition is fierce within this niche sector. The market's performance will hinge on factors like economic stability and the ongoing appeal of Belgium as a desirable location for luxury property ownership.

Belgium Luxury Residential Real Estate Industry: Market Report 2019-2033

This comprehensive report provides an in-depth analysis of the Belgian luxury residential real estate market, covering the period from 2019 to 2033. With a focus on market trends, leading players, and future opportunities, this report is an invaluable resource for investors, developers, and industry professionals seeking to navigate this dynamic sector. The report incorporates detailed market sizing and forecasting, identifying key growth drivers and challenges impacting the Belgian luxury residential real estate market. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period is 2025-2033, and the historical period is 2019-2024.

Belgium Luxury Residential Real Estate Industry Market Composition & Trends

This section delves into the composition and trends shaping the Belgian luxury residential real estate market. We analyze market concentration, identifying key players and their respective market shares. Innovation catalysts, such as technological advancements and shifting consumer preferences, are examined, alongside the regulatory landscape and its impact on market dynamics. Substitute products and their influence on market competition are also assessed. Finally, we analyze end-user profiles, understanding the motivations and preferences of high-net-worth individuals purchasing luxury properties in Belgium. Mergers and acquisitions (M&A) activities are reviewed, including deal values and their strategic implications for the market.

Market Concentration: The Belgian luxury residential real estate market exhibits a moderately concentrated structure, with key players like EMILE GARCIN, Sotheby's International Realty Affiliates LLC, Redevco, Immpact Real Estate, Engel and Volkers, Be Luxe Belgium, Christies International Real Estate, Home Invest Belgium, and IMMOBEL holding significant market share. Precise market share distribution is detailed within the full report. XX% of the market is controlled by the top 5 players.

M&A Activity: The historical period (2019-2024) witnessed a total M&A deal value exceeding EUR xx Million, with an average deal size of EUR xx Million. The full report provides a detailed breakdown of these transactions.

Innovation Catalysts: The increasing adoption of virtual tours, online platforms, and data analytics is driving innovation within the industry, enhancing both buyer and seller experiences.

Belgium Luxury Residential Real Estate Industry Industry Evolution

This section details the evolution of the Belgian luxury residential real estate market. We examine market growth trajectories throughout the study period, analyzing historical data and projecting future growth rates. The influence of technological advancements, including digital marketing, virtual reality, and property management software, on market dynamics is explored. Additionally, we analyze the shifting consumer demands, including preferences for sustainable features, smart home technology, and prime locations, and their impact on market trends.

The market experienced a compound annual growth rate (CAGR) of xx% during the historical period (2019-2024), driven by factors such as increasing high-net-worth individuals and a strong economy. This growth trend is projected to continue, albeit at a slightly moderated pace, during the forecast period (2025-2033), with a projected CAGR of xx%. The adoption rate of virtual property tours increased by xx% between 2019 and 2024. Demand for sustainable features in luxury properties rose by xx% in the same period.

Leading Regions, Countries, or Segments in Belgium Luxury Residential Real Estate Industry

This section identifies the dominant regions and property types within the Belgian luxury residential real estate market. We analyze the factors driving the success of these leading segments, examining investment trends, regulatory support, and other key market dynamics.

Dominant Region: The Brussels Region consistently dominates the market due to its high concentration of high-net-worth individuals, international businesses, and strong infrastructure.

Dominant Property Type: Landed houses and villas command the highest price points and represent a larger share of the luxury market, driven by a preference for spacious living and outdoor areas.

Key Drivers (Brussels Region):

- High concentration of international organizations and diplomatic missions.

- Strong economic growth and high disposable incomes.

- Robust infrastructure and accessibility.

- Prestigious neighborhoods with significant historical and cultural value.

Key Drivers (Landed Houses & Villas):

- Demand for spacious living and privacy.

- Increased preference for outdoor spaces and gardens.

- Higher perceived investment value compared to apartments.

- Potential for customization and bespoke features.

Belgium Luxury Residential Real Estate Industry Product Innovations

Recent innovations include the integration of smart home technology into luxury properties, enhancing energy efficiency and user experience. Virtual staging and 3D walkthroughs have become increasingly popular, enabling potential buyers to view properties remotely. Sustainable building materials and eco-friendly design are also gaining traction, reflecting a growing emphasis on environmentally conscious luxury living. These innovations offer unique selling propositions and cater to the evolving demands of high-net-worth individuals seeking both luxury and sustainability.

Propelling Factors for Belgium Luxury Residential Real Estate Industry Growth

Several factors drive the growth of Belgium's luxury residential real estate market. A strong economy and increasing disposable incomes among high-net-worth individuals contribute significantly. Government initiatives supporting real estate investment and favorable tax policies also play a role. Furthermore, the influx of international investment and a growing tourism sector further stimulate market demand, particularly in prime locations such as Brussels and coastal areas.

Obstacles in the Belgium Luxury Residential Real Estate Industry Market

Despite positive growth trends, the market faces some obstacles. Stringent regulations governing property development and transactions can sometimes create hurdles. Supply chain disruptions, particularly in sourcing high-end materials, may lead to delays and increased costs. Intense competition among established players and new entrants also presents challenges in securing high-value properties and attracting affluent clients. These factors could potentially impact market growth in the coming years by reducing the volume of transactions.

Future Opportunities in Belgium Luxury Residential Real Estate Industry

The Belgian luxury residential real estate market presents several promising opportunities. The increasing demand for sustainable and energy-efficient properties creates a niche for eco-friendly developments. The rise of remote work and digital nomadism could stimulate demand in locations offering attractive lifestyles beyond major cities. Investing in cutting-edge technology, such as virtual reality and augmented reality, to enhance the buyer experience presents another significant opportunity.

Major Players in the Belgium Luxury Residential Real Estate Industry Ecosystem

- EMILE GARCIN

- Sotheby's International Realty Affiliates LLC

- Redevco

- Immpact Real Estate

- Engel and Volkers

- Be Luxe Belgium

- Christies International Real Estate

- Home Invest Belgium

- IMMOBEL

- Luxe Places International Realty

Key Developments in Belgium Luxury Residential Real Estate Industry Industry

June 2023: Christie's International Real Estate enters the Belgian market, partnering with a leading brokerage, gaining access to advanced marketing and technology, and enhancing international exposure for luxury listings.

April 2022: A EUR 30 Million (USD 32.56 Million) property sale by BARNES Léman highlights the potential for high-value transactions in the market.

Strategic Belgium Luxury Residential Real Estate Industry Market Forecast

The Belgian luxury residential real estate market is poised for sustained growth, driven by economic factors, technological advancements, and evolving consumer preferences. The projected CAGR indicates a significant market expansion, creating numerous investment and development opportunities. The increasing adoption of sustainable practices and technological innovations will shape the market’s future, attracting both domestic and international investors seeking high-value properties in prime locations.

Belgium Luxury Residential Real Estate Industry Segmentation

-

1. Type

- 1.1. Apartments and Condominiums

- 1.2. Landed Houses and Villas

Belgium Luxury Residential Real Estate Industry Segmentation By Geography

- 1. Belgium

Belgium Luxury Residential Real Estate Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Smart Homes and Automation4.; Wellness and Health focused Amenities

- 3.3. Market Restrains

- 3.3.1. 4.; High Cost

- 3.4. Market Trends

- 3.4.1. IoT-enabled home automation is driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Belgium Luxury Residential Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Apartments and Condominiums

- 5.1.2. Landed Houses and Villas

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Belgium

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 EMILE GARCIN

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sotheby's International Realty Affiliates LLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Redevco

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Immpact Real Estate

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Engel and Volkers

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Be Luxe Belgium

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Christies International Real Estate

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Home Invest Belgium

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 IMMOBEL**List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Luxe Places International Realty

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 EMILE GARCIN

List of Figures

- Figure 1: Belgium Luxury Residential Real Estate Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Belgium Luxury Residential Real Estate Industry Share (%) by Company 2024

List of Tables

- Table 1: Belgium Luxury Residential Real Estate Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Belgium Luxury Residential Real Estate Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Belgium Luxury Residential Real Estate Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Belgium Luxury Residential Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Belgium Luxury Residential Real Estate Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 6: Belgium Luxury Residential Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Belgium Luxury Residential Real Estate Industry?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the Belgium Luxury Residential Real Estate Industry?

Key companies in the market include EMILE GARCIN, Sotheby's International Realty Affiliates LLC, Redevco, Immpact Real Estate, Engel and Volkers, Be Luxe Belgium, Christies International Real Estate, Home Invest Belgium, IMMOBEL**List Not Exhaustive, Luxe Places International Realty.

3. What are the main segments of the Belgium Luxury Residential Real Estate Industry?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Smart Homes and Automation4.; Wellness and Health focused Amenities.

6. What are the notable trends driving market growth?

IoT-enabled home automation is driving the market.

7. Are there any restraints impacting market growth?

4.; High Cost.

8. Can you provide examples of recent developments in the market?

June 2023: Christie's International Real Estate is now open in Belgium and they've teamed up with one of the top real estate brokerages in the country. As the only Belgian affiliate of Christie's International Real Estate, they'll get access to top-notch marketing and tech, get national and international exposure for their listings, and have a link to the world-famous Christie's auction house for referral art and luxury items.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Belgium Luxury Residential Real Estate Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Belgium Luxury Residential Real Estate Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Belgium Luxury Residential Real Estate Industry?

To stay informed about further developments, trends, and reports in the Belgium Luxury Residential Real Estate Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence