Key Insights

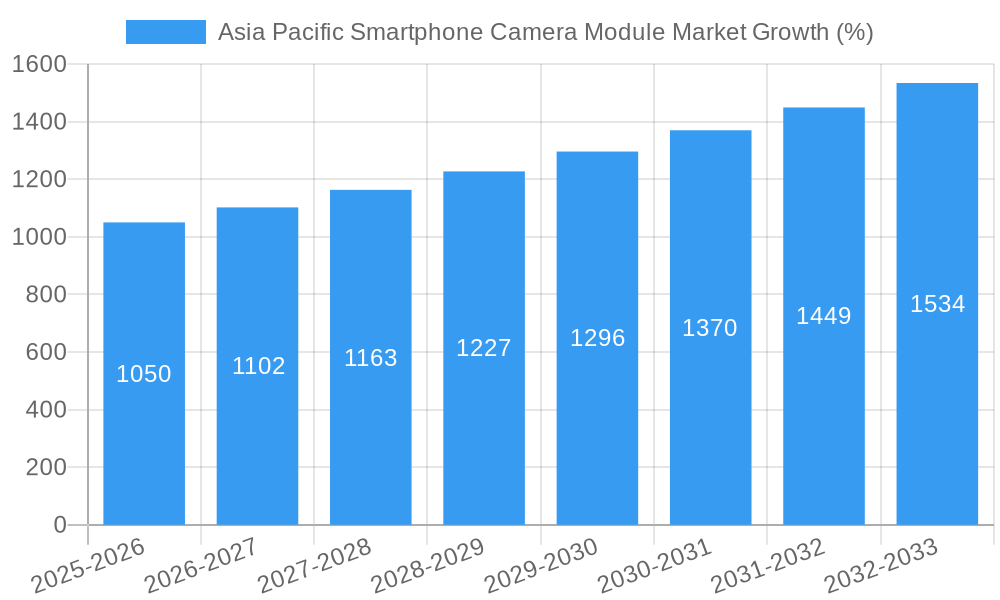

The Asia Pacific smartphone camera module market is experiencing robust growth, driven by increasing smartphone penetration, particularly in rapidly developing economies like India and China. The market's Compound Annual Growth Rate (CAGR) of 7.00% from 2019 to 2024 suggests a significant upward trajectory, indicating strong consumer demand for advanced camera features. This growth is fueled by several key trends: the rising popularity of multi-camera setups, the integration of advanced image processing technologies like AI-powered photography, and the increasing adoption of high-resolution cameras. Furthermore, the demand for innovative camera features, such as ultra-wide lenses, telephoto lenses, and macro lenses, is driving innovation and pushing market expansion. While the precise market size for 2024 isn't provided, extrapolating from a CAGR of 7% and an estimated 2025 market size of XX million (assuming XX is available from original, unprovided data and represents a reasonable value given industry estimates), a plausible market size for 2024 would be slightly below XX million. Leading players such as Sony, Samsung Electro-Mechanics, OmniVision, and Sunny Optical are actively investing in R&D to develop advanced camera modules, enhancing competition and accelerating technological advancements.

Despite this positive growth, the market faces certain constraints. These include fluctuating component costs (especially in the current global environment), supply chain disruptions, and the potential for market saturation in mature economies like South Korea and Japan. However, the market's future growth is anticipated to be driven by the ongoing expansion into emerging markets within the Asia Pacific region, coupled with continuous advancements in camera technology and increasing consumer preference for higher quality mobile photography. This dynamic interplay of drivers and constraints suggests a continuously evolving landscape, with continued growth expected throughout the forecast period (2025-2033). Specific regional performance will be influenced by local economic growth, smartphone adoption rates, and the competitive dynamics within each market.

Asia Pacific Smartphone Camera Module Market: A Comprehensive Report (2019-2033)

This insightful report provides a comprehensive analysis of the Asia Pacific Smartphone Camera Module market, offering a detailed overview of market trends, competitive dynamics, and future growth prospects. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033, this study is essential for stakeholders seeking to understand and capitalize on opportunities within this rapidly evolving sector. The market size is projected to reach xx Million by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of xx%.

Asia Pacific Smartphone Camera Module Market Composition & Trends

The Asia Pacific smartphone camera module market is characterized by a dynamic interplay of factors influencing its composition and future trajectory. Market concentration is moderately high, with key players like Samsung Electro-Mechanics, Sunny Optical, and LG Innotek holding significant shares. However, the presence of numerous smaller, specialized companies fosters intense competition. Innovation is a crucial driver, with advancements in optical zoom capabilities (as evidenced by Samsung Electro-Mechanics' 10x optical zoom module) and 3D sensing technology (highlighted by LG Innotek's partnership with Microsoft) pushing market boundaries. Regulatory landscapes, varying across different Asia-Pacific countries, impact market access and compliance. Substitute products, such as software-based image enhancement solutions, present a competitive challenge, albeit a limited one given the current consumer preference for high-quality hardware. The end-user profile primarily comprises smartphone Original Equipment Manufacturers (OEMs), driving demand based on evolving consumer preferences for high-resolution cameras and advanced features. Mergers and acquisitions (M&A) activity, although not exceptionally high in recent years, represents a strategic avenue for expansion and technological integration. Deal values have ranged from xx Million to xx Million in recent transactions.

- Market Share Distribution: Samsung Electro-Mechanics: xx%; Sunny Optical: xx%; LG Innotek: xx%; Others: xx%.

- M&A Deal Values (2019-2024): Averaged xx Million per transaction.

Asia Pacific Smartphone Camera Module Market Industry Evolution

The Asia Pacific smartphone camera module market has experienced significant evolution, driven by a confluence of technological advancements, evolving consumer preferences, and robust economic growth in key markets like China and India. From 2019 to 2024, the market witnessed a CAGR of xx%, fueled by increasing smartphone penetration and a rising demand for premium features. Technological advancements, including improved image sensors, advanced lens systems, and innovative image processing algorithms, have been instrumental in enhancing camera quality and functionalities. Consumer demand has shifted towards high-resolution cameras, multiple lenses, and features like optical zoom and night mode, creating opportunities for module manufacturers to offer sophisticated and feature-rich products. The adoption rate of advanced camera technologies, such as 3D sensing and periscope lenses, is steadily increasing, indicating a trend towards higher-end modules. The market is expected to maintain a strong growth trajectory, projected at a CAGR of xx% from 2025 to 2033, driven by sustained demand for innovative smartphone camera technologies and increasing affordability of smartphones in emerging markets.

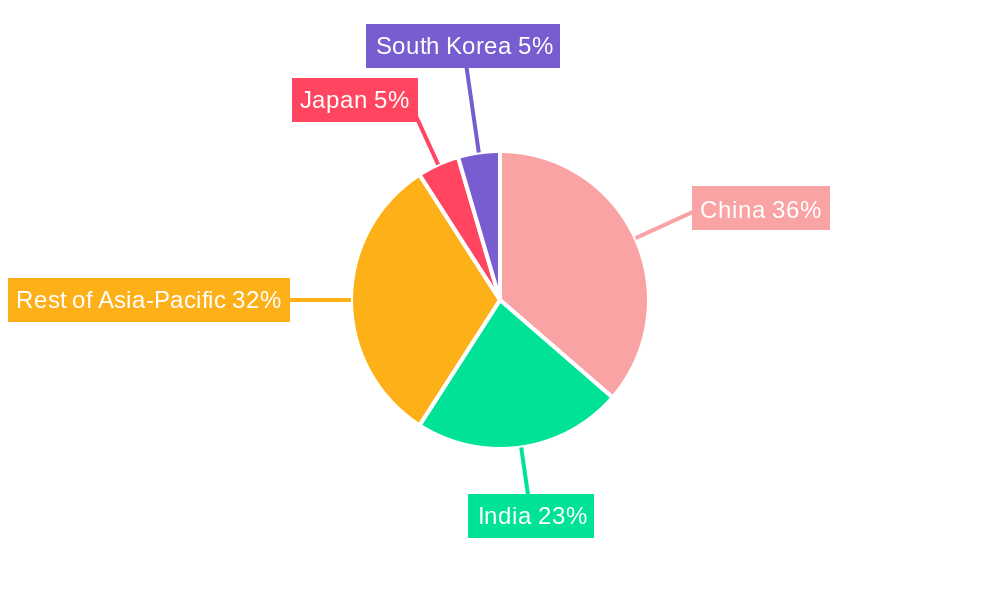

Leading Regions, Countries, or Segments in Asia Pacific Smartphone Camera Module Market

China dominates the Asia Pacific smartphone camera module market, driven by a large and rapidly growing smartphone market, robust domestic manufacturing capabilities, and significant investments in research and development. India presents a significant growth opportunity, with rising smartphone adoption rates and increasing consumer spending power. The Rest of Asia-Pacific region contributes meaningfully to the overall market.

Key Drivers for China's Dominance:

- Massive Smartphone Market: China boasts the world's largest smartphone market, creating enormous demand for camera modules.

- Strong Domestic Manufacturing Base: A well-established manufacturing infrastructure supports module production and reduces reliance on imports.

- Government Support & Investments: Government initiatives and substantial investment in technology sectors further propel growth.

India's Emerging Role:

- Rapid Smartphone Penetration: India's burgeoning smartphone user base fuels demand for camera modules.

- Growing Affordability: Increasing affordability of smartphones expands the potential customer base.

- Government Initiatives: "Make in India" initiative stimulates local manufacturing and promotes self-reliance.

Rest of Asia-Pacific: This region demonstrates sustained growth propelled by factors including increasing smartphone penetration, expanding middle classes, and rising disposable incomes in several key markets. However, the growth rate is slightly lower compared to China and India, primarily due to smaller market sizes.

Asia Pacific Smartphone Camera Module Market Product Innovations

The Asia Pacific smartphone camera module market is witnessing a surge in product innovations focused on enhancing image quality, expanding functionalities, and reducing module size. Recent breakthroughs include advancements in optical zoom technology, with multiple-lens systems and periscope designs offering significant improvements in magnification and image clarity. 3D sensing modules are gaining traction, enabling advanced features such as facial recognition and augmented reality applications. Improved image stabilization mechanisms and enhanced low-light performance are also key areas of innovation. The integration of Artificial Intelligence (AI) in image processing algorithms is enhancing features such as object detection, scene recognition, and automated image adjustments, resulting in superior image quality and user experience. These innovations are driving the adoption of advanced camera systems in smartphones across all price ranges, making them a key selling point for smartphone manufacturers.

Propelling Factors for Asia Pacific Smartphone Camera Module Market Growth

Several factors propel the growth of the Asia Pacific smartphone camera module market. Firstly, the relentless technological advancements in image sensor technology, lens design, and image processing algorithms fuel demand for higher-quality camera modules. Secondly, the increasing affordability of smartphones, particularly in developing economies, expands the market significantly, making advanced camera features accessible to a broader audience. Thirdly, the growing consumer preference for advanced camera functionalities, such as multiple lenses, enhanced zoom capabilities, and advanced low-light performance, creates opportunities for manufacturers to develop and market innovative camera modules. Finally, supportive government policies in several Asia-Pacific countries, incentivizing domestic manufacturing and technology adoption, further contribute to market growth.

Obstacles in the Asia Pacific Smartphone Camera Module Market

Despite significant growth potential, several challenges hinder the Asia Pacific smartphone camera module market. Supply chain disruptions, particularly concerning the availability of critical components like image sensors and specialized lenses, pose a significant threat. Geopolitical uncertainties and trade tensions can disrupt manufacturing and distribution networks, impacting production timelines and increasing costs. Intense competition among module manufacturers, with major players vying for market share, puts pressure on profit margins and necessitates constant innovation to remain competitive. Stricter regulatory requirements in certain countries related to data privacy and environmental sustainability can increase compliance costs for manufacturers. These challenges necessitate a strategic approach by manufacturers to mitigate risks and ensure sustained market presence.

Future Opportunities in Asia Pacific Smartphone Camera Module Market

The future of the Asia Pacific smartphone camera module market presents significant opportunities. The increasing adoption of 5G technology creates demand for camera modules capable of supporting higher bandwidth and data transfer rates for improved video capabilities. The expansion of augmented reality (AR) and virtual reality (VR) applications opens up opportunities for advanced 3D sensing and depth-mapping modules. The growth of the foldable smartphone market necessitates the development of innovative camera modules designed to integrate seamlessly with flexible display technologies. Further advancements in AI-driven image processing capabilities, offering enhanced features and improved user experiences, will drive future market expansion. Finally, the exploration of new markets, especially in Southeast Asia and the Pacific Islands, presents promising untapped potential for growth.

Major Players in the Asia Pacific Smartphone Camera Module Market Ecosystem

- Q Technology (Group) Company Limited

- OmniVision Technologies Inc

- Samsung Electro-Mechanics Co Ltd and Samsung Group

- Foxconn Technology Group (Sharp)

- Largan Precision Co Ltd

- O-Film Tech Co Ltd

- LG Innotek Co Ltd

- Sunny Optical Technology Company Limited

- Luxvisions Innovation Limited

- JiangXi Holitech Technology Co Ltd

- Sony Corporation

Key Developments in Asia Pacific Smartphone Camera Module Market Industry

- March 2021: Samsung Electro-Mechanics announced the development and supply of an optical 10x zoom folding camera module to global smartphone manufacturers. This innovation significantly enhances zoom capabilities in smartphones.

- March 2021: LG Innotek partnered with Microsoft to develop cloud-connected 3D sensing smartphone camera modules, expanding the application areas of 3D sensing technology.

Strategic Asia Pacific Smartphone Camera Module Market Forecast

The Asia Pacific smartphone camera module market is poised for continued robust growth, driven by technological innovation, rising consumer demand, and expanding smartphone penetration across the region. The increasing adoption of advanced camera technologies, such as 3D sensing, periscope lenses, and AI-powered image processing, will fuel market expansion. The emergence of new markets and the continuous evolution of consumer preferences for high-quality camera features will create significant opportunities for established and emerging players in the market. The forecast period from 2025 to 2033 anticipates a sustained CAGR of xx%, indicating significant market potential and a promising outlook for industry stakeholders.

Asia Pacific Smartphone Camera Module Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Asia Pacific Smartphone Camera Module Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Smartphone Camera Module Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Evolution of Multiple Camera Approaches and Introduction of Advanced Camera Technologies

- 3.3. Market Restrains

- 3.3.1. Slower Rate of Penetration of Telematics in Developing Regions; Delayed Regulatory Sanctions

- 3.4. Market Trends

- 3.4.1. Introduction of Advanced Camera Technologies is Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Smartphone Camera Module Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. China Asia Pacific Smartphone Camera Module Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia Pacific Smartphone Camera Module Market Analysis, Insights and Forecast, 2019-2031

- 8. India Asia Pacific Smartphone Camera Module Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia Pacific Smartphone Camera Module Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia Pacific Smartphone Camera Module Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia Pacific Smartphone Camera Module Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia Pacific Smartphone Camera Module Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Q Technology (Group) Company Limited

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 OmniVision Technologies Inc *List Not Exhaustive

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Samsung Electro-Mechanics Co Ltd and Samsung Group

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Foxconn Technology Group (Sharp)

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Largan Precision Co Ltd

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 O-Film Tech Co Ltd

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 LG Innotek Co Ltd

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Sunny Optical Technology Company Limited

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Luxvisions Innovation Limited

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 JiangXi Holitech Technology Co Ltd

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Sony Corporation

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.1 Q Technology (Group) Company Limited

List of Figures

- Figure 1: Asia Pacific Smartphone Camera Module Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia Pacific Smartphone Camera Module Market Share (%) by Company 2024

List of Tables

- Table 1: Asia Pacific Smartphone Camera Module Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia Pacific Smartphone Camera Module Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Asia Pacific Smartphone Camera Module Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Asia Pacific Smartphone Camera Module Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Asia Pacific Smartphone Camera Module Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Asia Pacific Smartphone Camera Module Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Asia Pacific Smartphone Camera Module Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Asia Pacific Smartphone Camera Module Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: China Asia Pacific Smartphone Camera Module Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Japan Asia Pacific Smartphone Camera Module Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: India Asia Pacific Smartphone Camera Module Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: South Korea Asia Pacific Smartphone Camera Module Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Taiwan Asia Pacific Smartphone Camera Module Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Australia Asia Pacific Smartphone Camera Module Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of Asia-Pacific Asia Pacific Smartphone Camera Module Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Asia Pacific Smartphone Camera Module Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 17: Asia Pacific Smartphone Camera Module Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 18: Asia Pacific Smartphone Camera Module Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 19: Asia Pacific Smartphone Camera Module Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 20: Asia Pacific Smartphone Camera Module Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 21: Asia Pacific Smartphone Camera Module Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: China Asia Pacific Smartphone Camera Module Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Japan Asia Pacific Smartphone Camera Module Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: South Korea Asia Pacific Smartphone Camera Module Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: India Asia Pacific Smartphone Camera Module Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Australia Asia Pacific Smartphone Camera Module Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: New Zealand Asia Pacific Smartphone Camera Module Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Indonesia Asia Pacific Smartphone Camera Module Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Malaysia Asia Pacific Smartphone Camera Module Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Singapore Asia Pacific Smartphone Camera Module Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Thailand Asia Pacific Smartphone Camera Module Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Vietnam Asia Pacific Smartphone Camera Module Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Philippines Asia Pacific Smartphone Camera Module Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Smartphone Camera Module Market?

The projected CAGR is approximately 7.00%.

2. Which companies are prominent players in the Asia Pacific Smartphone Camera Module Market?

Key companies in the market include Q Technology (Group) Company Limited, OmniVision Technologies Inc *List Not Exhaustive, Samsung Electro-Mechanics Co Ltd and Samsung Group, Foxconn Technology Group (Sharp), Largan Precision Co Ltd, O-Film Tech Co Ltd, LG Innotek Co Ltd, Sunny Optical Technology Company Limited, Luxvisions Innovation Limited, JiangXi Holitech Technology Co Ltd, Sony Corporation.

3. What are the main segments of the Asia Pacific Smartphone Camera Module Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Evolution of Multiple Camera Approaches and Introduction of Advanced Camera Technologies.

6. What are the notable trends driving market growth?

Introduction of Advanced Camera Technologies is Expected to Drive the Market.

7. Are there any restraints impacting market growth?

Slower Rate of Penetration of Telematics in Developing Regions; Delayed Regulatory Sanctions.

8. Can you provide examples of recent developments in the market?

March 2021 - Samsung Electro-Mechanics announced that it has developed and is supplying an optical 10x zoom folding camera module to worldwide smartphone manufacturers. In smartphone cameras, it delivers a folding optical 10x zoom. Higher optical zoom is achieved when the focus point, or the distance between the image sensor and lens, is bigger.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Smartphone Camera Module Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Smartphone Camera Module Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Smartphone Camera Module Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Smartphone Camera Module Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence