Key Insights

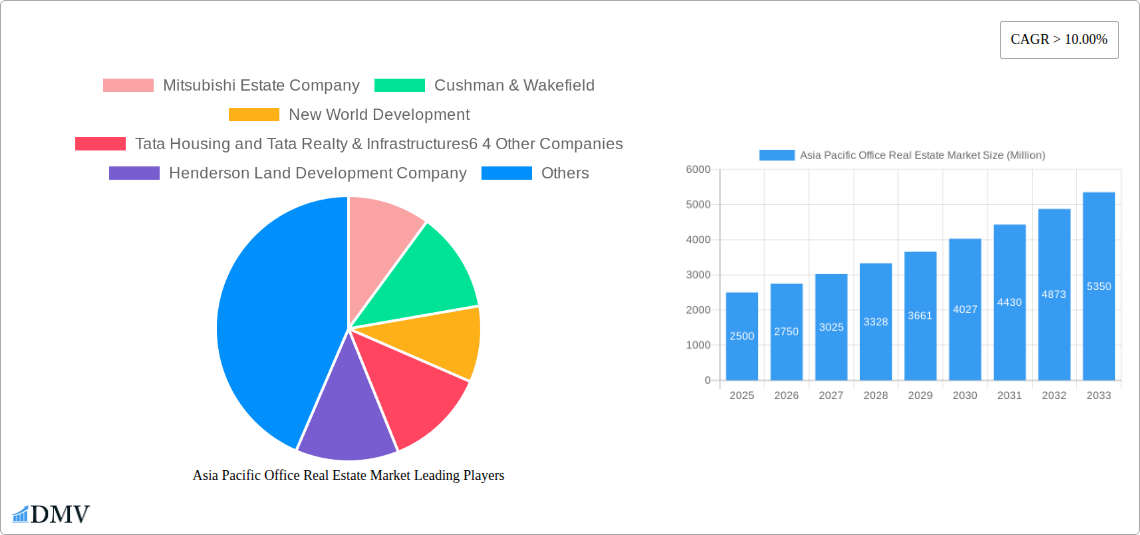

The Asia Pacific office real estate market is experiencing robust growth, driven by a confluence of factors. A consistently expanding middle class across major economies like China, India, and South Korea fuels increasing demand for office space, particularly in burgeoning tech sectors and burgeoning financial centers. Furthermore, government initiatives promoting infrastructure development and attracting foreign investment are bolstering market expansion. Strong economic growth in the region, coupled with urbanization trends, contributes to a sustained need for modern and efficient office spaces. While the pandemic initially impacted the market, the shift towards hybrid work models has led to a focus on flexible and technologically advanced office solutions, creating new opportunities for landlords and developers. Competition among leading companies like Mitsubishi Estate, Cushman & Wakefield, and others further intensifies market activity.

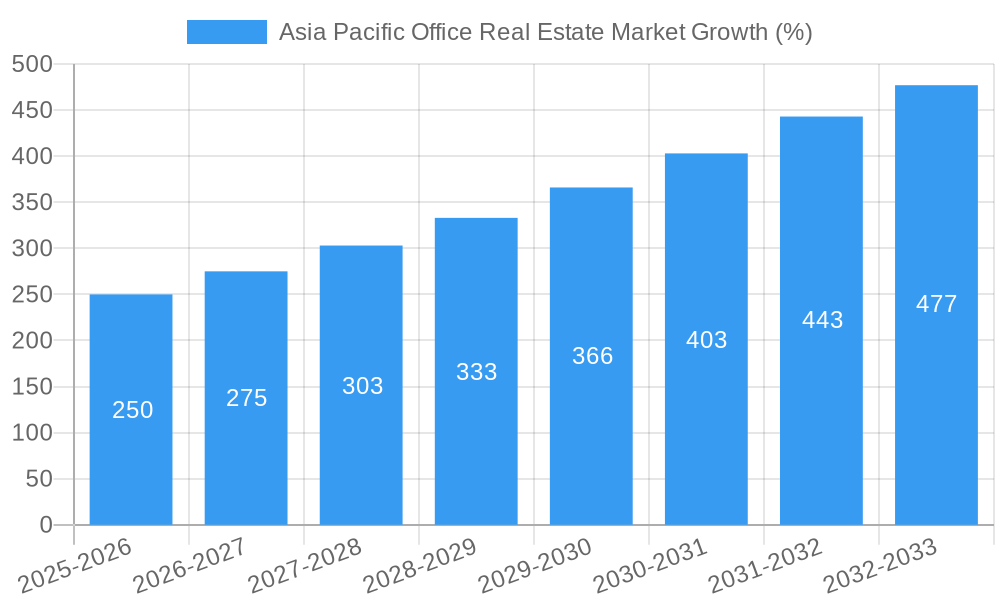

However, challenges remain. Geopolitical uncertainties and economic fluctuations can impact investor confidence. Supply chain disruptions and rising construction costs could constrain new developments, potentially impacting affordability. Furthermore, the market’s susceptibility to fluctuations in global financial markets remains a significant consideration. Nevertheless, the long-term outlook remains positive, especially for prime office spaces in key metropolitan areas across the region. The continued economic expansion in Asia Pacific, along with the ongoing evolution of workplace dynamics, suggests sustained growth in the office real estate sector, with the market projected to maintain a Compound Annual Growth Rate (CAGR) above 10% over the forecast period (2025-2033). The dominance of countries like China, Japan, and India will likely continue to shape overall market trends, while emerging economies within the region will also contribute to its expansion.

Asia Pacific Office Real Estate Market: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the Asia Pacific office real estate market, encompassing historical data (2019-2024), the base year (2025), and a comprehensive forecast (2025-2033). It offers invaluable insights for stakeholders, investors, and industry professionals seeking to understand the market's dynamics, growth trajectory, and future opportunities. The study period covers significant market shifts, allowing for a robust understanding of current trends and future projections.

Asia Pacific Office Real Estate Market Composition & Trends

This section delves into the intricate composition of the Asia Pacific office real estate market, examining key trends shaping its evolution. We analyze market concentration, revealing the market share distribution amongst key players like Mitsubishi Estate Company, Cushman & Wakefield, New World Development, Tata Housing and Tata Realty & Infrastructures, Henderson Land Development Company, Frasers Property, JLL, CDL, Colliers, and CBRE. The report also explores innovation catalysts driving market growth, including technological advancements and sustainable building practices. A thorough examination of regulatory landscapes across various Asia-Pacific nations (China, Japan, India, Australia, South Korea, and Rest of Asia-Pacific) is included, highlighting their impact on market dynamics. Furthermore, the report considers substitute products and their potential impact, analyzes end-user profiles across different industry sectors, and scrutinizes M&A activities, providing a comprehensive overview of deal values (estimated at xx Million USD) and their implications for market consolidation.

- Market Share Distribution: Detailed breakdown of market share held by leading players in each key country.

- M&A Activity: Analysis of significant mergers and acquisitions, including deal values and strategic implications. (Estimated total M&A deal value: xx Million USD)

- Regulatory Landscape Analysis: Comprehensive overview of key regulations impacting the office real estate market in each major country.

- Substitute Product Analysis: Evaluation of alternative workspace solutions and their influence on market demand.

- End-User Profile: Detailed segmentation of end-users by industry, highlighting their specific needs and preferences.

Asia Pacific Office Real Estate Market Industry Evolution

This section provides a detailed analysis of the Asia Pacific office real estate market's evolutionary path from 2019 to 2033. It meticulously tracks market growth trajectories, highlighting fluctuations and periods of significant expansion or contraction. The report incorporates data points such as compound annual growth rates (CAGR) for the historical period and projected CAGR for the forecast period. Technological advancements influencing workspace design, building management, and property management are examined, showcasing their impact on market efficiency and tenant satisfaction. The shifting consumer demands, driven by factors like remote work trends and the rise of co-working spaces, are analyzed. The impact of these trends on market segmentation and future demand is thoroughly assessed. Specific examples of technological adoption and the growth rate of specific segments are provided, adding granularity to the analysis. The evolution of market structures and competitive dynamics is also discussed in detail.

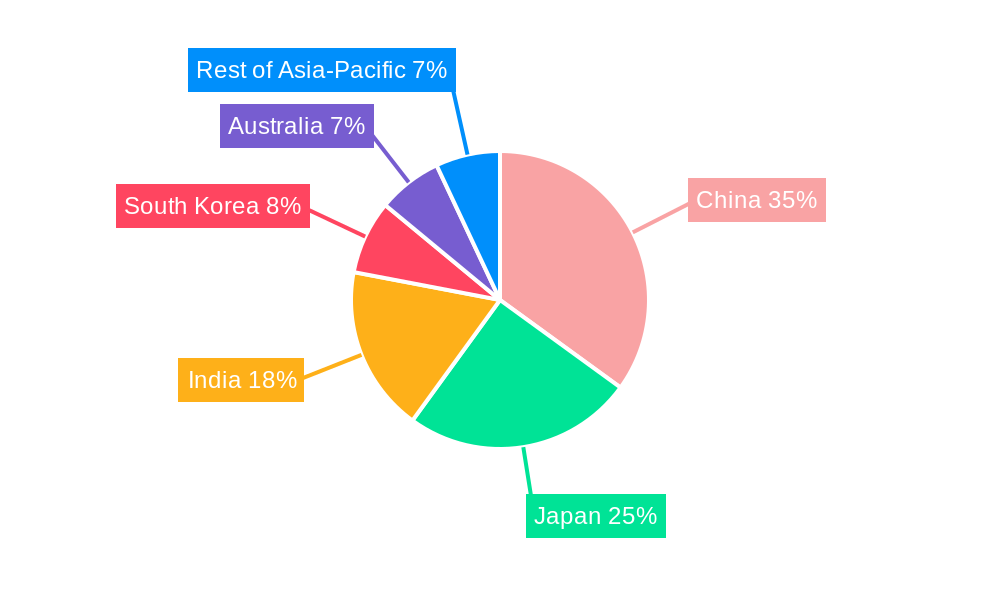

Leading Regions, Countries, or Segments in Asia Pacific Office Real Estate Market

This section identifies the dominant region, country, or segment within the Asia Pacific office real estate market. While precise market dominance will be determined by the data analysis, we anticipate a strong focus on key markets such as China, Japan, India, and Australia. The report examines the factors contributing to their prominence, including investment trends, regulatory support, and economic growth.

- China: Key drivers include rapid urbanization, robust economic growth, and increasing foreign investment.

- Japan: Key drivers include strong institutional investment, a mature market with high-quality infrastructure, and a focus on sustainable development.

- India: Key drivers encompass a burgeoning IT sector, increasing foreign direct investment (FDI), and a growing middle class.

- Australia: Key drivers include a stable political and economic environment, strong infrastructure, and attractive investment opportunities.

- South Korea: Key drivers include its advanced technological infrastructure and substantial foreign investment in tech hubs.

- Rest of Asia-Pacific: Growth is driven by factors such as rising urbanization, increasing business activity, and government initiatives promoting economic development.

The analysis will offer a granular view into the specific drivers for each country and region, detailing the nuanced reasons for their dominance.

Asia Pacific Office Real Estate Market Product Innovations

This section explores recent product innovations in the Asia Pacific office real estate market, focusing on new building technologies, smart building solutions, and sustainable design practices. We will highlight unique selling propositions and technological advancements that are transforming the industry, such as the integration of IoT (Internet of Things) sensors for enhanced energy efficiency and building management systems. The impact of these innovations on building performance, tenant experience, and operational costs will be assessed.

Propelling Factors for Asia Pacific Office Real Estate Market Growth

Several key factors are driving the growth of the Asia Pacific office real estate market. Strong economic growth across the region fuels demand for office spaces. Technological advancements, such as smart building technologies and flexible workspace solutions, are enhancing efficiency and attracting tenants. Government initiatives promoting urban development and infrastructure investment also contribute to market expansion. Finally, the increasing urbanization in many Asian countries drives the demand for office spaces, particularly in major cities.

Obstacles in the Asia Pacific Office Real Estate Market

Despite the positive growth outlook, the Asia Pacific office real estate market faces challenges. Regulatory hurdles and bureaucratic complexities in certain countries can impede project development and investment. Supply chain disruptions caused by global events can affect construction timelines and costs. Intense competition among developers and landlords can pressure rental rates and profit margins. These factors, along with others, can influence the overall market trajectory.

Future Opportunities in Asia Pacific Office Real Estate Market

The Asia Pacific office real estate market presents several promising opportunities. The expansion of tech hubs in major cities will fuel demand for modern and adaptable office spaces. The adoption of sustainable building practices offers a competitive edge and aligns with growing environmental awareness. Growth in e-commerce and related industries will necessitate more warehouse and logistics space. These trends will shape the market's future.

Major Players in the Asia Pacific Office Real Estate Market Ecosystem

- Mitsubishi Estate Company

- Cushman & Wakefield

- New World Development

- Tata Housing

- Tata Realty & Infrastructures

- Henderson Land Development Company

- Frasers Property

- JLL

- CDL

- Colliers

- CBRE

Key Developments in Asia Pacific Office Real Estate Market Industry

- February 2022: Real estate firm Hulic and Japan Excellent executed a purchase agreement to exchange trust beneficiary rights in the Shintomicho Building for JPY 3.1 billion (USD 25.4 million). This transaction highlights ongoing investment activity in Tokyo's office market.

- July 2022: Google leased 1.3 million sq. ft of office space in Bengaluru, India, signifying strong demand from tech companies and a positive outlook for the Indian office market.

Strategic Asia Pacific Office Real Estate Market Forecast

The Asia Pacific office real estate market is poised for continued growth, driven by robust economic expansion, technological advancements, and supportive government policies. However, navigating challenges such as supply chain disruptions and regulatory complexities will be crucial for sustained success. The market's future will be shaped by the adoption of sustainable practices and the ongoing evolution of workspace solutions to meet changing tenant demands. We project significant growth in key markets and expect ongoing consolidation amongst major players.

Asia Pacific Office Real Estate Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Asia Pacific Office Real Estate Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Office Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 10.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing geriatric population; Growing cases of chronic disease among senior citizens

- 3.3. Market Restrains

- 3.3.1. High cost of elderly care services; Lack of skilled staff

- 3.4. Market Trends

- 3.4.1. Rise in Demand for Coworking Spaces

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Office Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. China Asia Pacific Office Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia Pacific Office Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 8. India Asia Pacific Office Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia Pacific Office Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia Pacific Office Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia Pacific Office Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia Pacific Office Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Mitsubishi Estate Company

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Cushman & Wakefield

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 New World Development

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Tata Housing and Tata Realty & Infrastructures6 4 Other Companies

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Henderson Land Development Company

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Frasers Property

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 JLL

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 CDL

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Colliers

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 CBRE

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Mitsubishi Estate Company

List of Figures

- Figure 1: Asia Pacific Office Real Estate Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia Pacific Office Real Estate Market Share (%) by Company 2024

List of Tables

- Table 1: Asia Pacific Office Real Estate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia Pacific Office Real Estate Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Asia Pacific Office Real Estate Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Asia Pacific Office Real Estate Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Asia Pacific Office Real Estate Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Asia Pacific Office Real Estate Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Asia Pacific Office Real Estate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Asia Pacific Office Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: China Asia Pacific Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Japan Asia Pacific Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: India Asia Pacific Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: South Korea Asia Pacific Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Taiwan Asia Pacific Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Australia Asia Pacific Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of Asia-Pacific Asia Pacific Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Asia Pacific Office Real Estate Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 17: Asia Pacific Office Real Estate Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 18: Asia Pacific Office Real Estate Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 19: Asia Pacific Office Real Estate Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 20: Asia Pacific Office Real Estate Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 21: Asia Pacific Office Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: China Asia Pacific Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Japan Asia Pacific Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: South Korea Asia Pacific Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: India Asia Pacific Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Australia Asia Pacific Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: New Zealand Asia Pacific Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Indonesia Asia Pacific Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Malaysia Asia Pacific Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Singapore Asia Pacific Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Thailand Asia Pacific Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Vietnam Asia Pacific Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Philippines Asia Pacific Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Office Real Estate Market?

The projected CAGR is approximately > 10.00%.

2. Which companies are prominent players in the Asia Pacific Office Real Estate Market?

Key companies in the market include Mitsubishi Estate Company, Cushman & Wakefield, New World Development, Tata Housing and Tata Realty & Infrastructures6 4 Other Companies, Henderson Land Development Company, Frasers Property, JLL, CDL, Colliers, CBRE.

3. What are the main segments of the Asia Pacific Office Real Estate Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing geriatric population; Growing cases of chronic disease among senior citizens.

6. What are the notable trends driving market growth?

Rise in Demand for Coworking Spaces.

7. Are there any restraints impacting market growth?

High cost of elderly care services; Lack of skilled staff.

8. Can you provide examples of recent developments in the market?

February 2022 - Real estate firm Hulic and Japan Excellent executed a purchase agreement to exchange trust beneficiary rights in the Shintomicho Building for JPY 3.1 billion (USD 25.4 million). Japan Excellent mostly invests in office buildings in Tokyo. Two phases will be involved in the transfer of the Trust Beneficiary Rights in the Shintomicho Building: the first phase will involve the transfer of 40% ownership for JPY 1,24 billion (USD 10.1 million), and the second phase will involve the transfer of the remaining 60% ownership for JPY 1.86 billion (USD 15.3 million).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Office Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Office Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Office Real Estate Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Office Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence