Key Insights

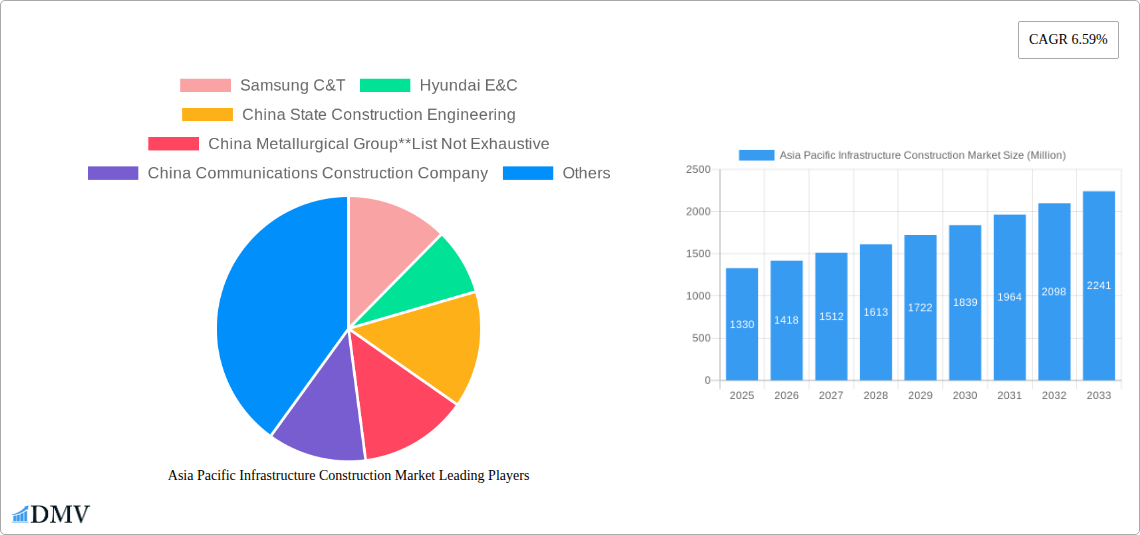

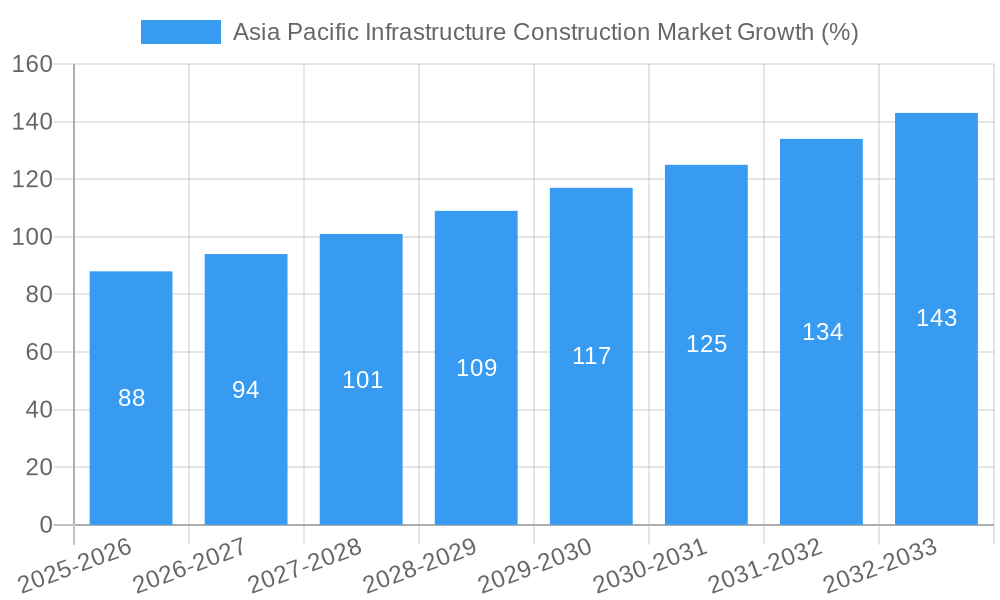

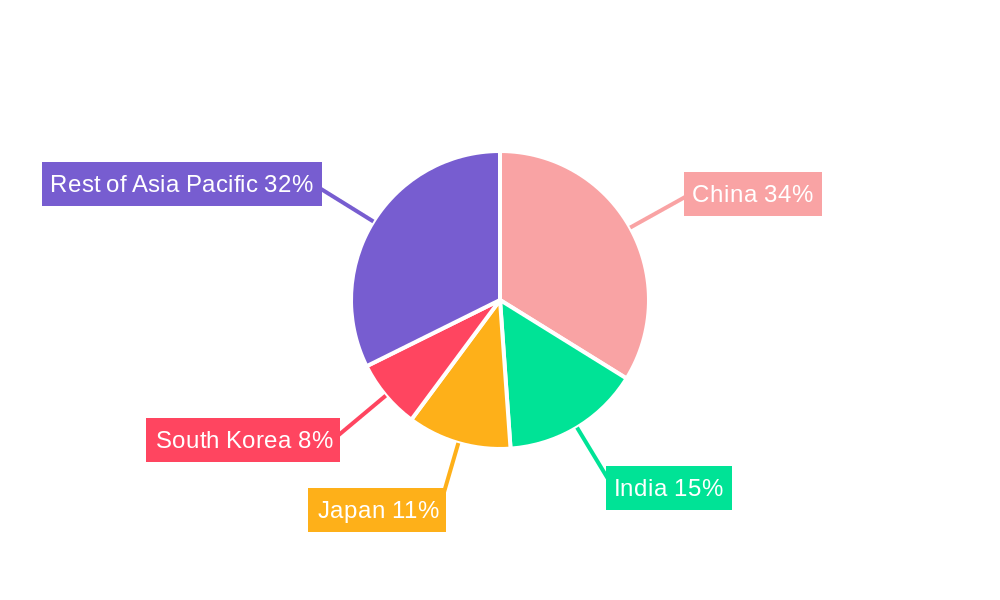

The Asia-Pacific Infrastructure Construction market, valued at $1.33 billion in 2025, is projected to experience robust growth, driven by significant investments in social infrastructure development across the region. Governments in major economies like China, India, Japan, and South Korea are prioritizing large-scale projects encompassing transportation (high-speed rail, roads, ports), waterways, and other essential utilities. This surge in public spending, coupled with increasing private sector participation fueled by burgeoning urbanization and rising disposable incomes, is a primary catalyst for market expansion. The consistent 6.59% CAGR projected through 2033 indicates a substantial increase in market value over the forecast period. Furthermore, technological advancements in construction techniques, materials, and project management are enhancing efficiency and reducing project timelines, contributing positively to market growth. While challenges such as regulatory hurdles and potential labor shortages exist, the overall outlook remains positive, with significant opportunities for established players and emerging contractors alike. The market segmentation reveals a strong focus on telecoms manufacturing infrastructure and a significant contribution from China, which is expected to remain a key driver for regional growth.

The dominance of China within the Asia-Pacific market underscores its massive infrastructure development initiatives. However, other countries like India, with its focus on expanding its transportation network and urban infrastructure, and Japan and South Korea, with their continued modernization efforts, are also significantly contributing to the market's expansion. The diverse infrastructure segments, including social infrastructure, transportation, and water management, reflect the wide-ranging needs of a rapidly developing region. Competition among major players like Samsung C&T, Hyundai E&C, and several Chinese state-owned enterprises is intense, fostering innovation and pushing down costs. The market’s growth trajectory will likely be influenced by factors such as government policies, economic growth rates in individual countries, and global economic stability. Successfully navigating these dynamic factors will be crucial for companies seeking sustained success in this thriving market.

Asia Pacific Infrastructure Construction Market: A Comprehensive Report (2019-2033)

This insightful report provides a deep dive into the dynamic Asia Pacific infrastructure construction market, offering a comprehensive analysis of its current state, future trajectory, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for stakeholders seeking to understand and capitalize on the opportunities within this rapidly evolving sector. The market is projected to reach xx Million by 2033, exhibiting significant growth potential.

Asia Pacific Infrastructure Construction Market Composition & Trends

This section evaluates the market's competitive landscape, innovative drivers, regulatory frameworks, substitute products, end-user profiles, and merger & acquisition (M&A) activities. We analyze market concentration, revealing the dominant players and their respective market shares. For instance, China State Construction Engineering and Samsung C&T are anticipated to hold significant market share in 2025, estimated at xx% and xx%, respectively. The report also explores the impact of regulatory changes on market dynamics, analyzing the influence of policies promoting sustainable infrastructure development across the region. The total M&A deal value in the Asia Pacific infrastructure construction market during the historical period (2019-2024) is estimated at xx Million.

- Market Concentration: High, with a few major players dominating the market.

- Innovation Catalysts: Growing adoption of Building Information Modeling (BIM), prefabrication, and sustainable construction practices.

- Regulatory Landscape: Varied across countries, impacting project timelines and costs.

- Substitute Products: Limited, with the focus primarily on improving existing construction methods and materials.

- End-User Profiles: Government bodies, private developers, and public-private partnerships (PPPs).

- M&A Activities: Significant activity, driven by expansion strategies and technological advancements.

Asia Pacific Infrastructure Construction Market Industry Evolution

This section provides a detailed analysis of the Asia Pacific infrastructure construction market's growth trajectory, technological advancements, and evolving consumer demands from 2019 to 2033. We examine the market's historical growth (2019-2024) and project its future expansion (2025-2033), highlighting key factors influencing these trends. The market experienced a Compound Annual Growth Rate (CAGR) of xx% during 2019-2024 and is projected to grow at a CAGR of xx% during 2025-2033. This growth is primarily driven by increasing government investments in infrastructure projects, rapid urbanization, and the rising demand for improved transportation and communication networks. Technological advancements such as automation, 3D printing, and AI are expected to further enhance efficiency and sustainability in the sector.

Leading Regions, Countries, or Segments in Asia Pacific Infrastructure Construction Market

This section identifies the leading regions, countries, and segments within the Asia Pacific infrastructure construction market. China is projected to remain the dominant market, driven by substantial government investments in infrastructure projects like the Belt and Road Initiative. India also presents significant growth opportunities due to its expanding population and economic development.

- Key Drivers (China): Massive government investment in infrastructure, rapid urbanization, and strong industrial growth.

- Key Drivers (India): Government initiatives like "Make in India," rising urbanization, and increasing demand for housing and transportation infrastructure.

- Key Drivers (Transportation Infrastructure): Growing population and economic activity leading to increased demand for efficient transport networks.

- Key Drivers (Telecoms Manufacturing Infrastructure): Expansion of 5G networks and the rise of digital economies.

The Philippines, Japan, and South Korea also contribute significantly to the overall market size, fueled by their own unique infrastructure development needs and economic growth trajectories.

Asia Pacific Infrastructure Construction Market Product Innovations

Recent innovations focus on sustainable and efficient construction methods, including prefabricated modular buildings, 3D-printed structures, and the wider adoption of Building Information Modeling (BIM). These innovations aim to reduce construction time, minimize waste, and improve overall project quality. The unique selling propositions of these innovations include reduced costs, improved sustainability, and enhanced project management capabilities.

Propelling Factors for Asia Pacific Infrastructure Construction Market Growth

Several factors contribute to the market's growth. Government initiatives promoting infrastructure development, particularly in emerging economies, play a crucial role. Economic expansion and urbanization drive the demand for improved infrastructure, while technological advancements increase efficiency and reduce costs. Favorable regulatory environments facilitate private sector investment.

Obstacles in the Asia Pacific Infrastructure Construction Market

Challenges include securing funding for large-scale projects, navigating complex regulatory landscapes, and managing supply chain disruptions. Competition among major players can also intensify pressure on profit margins. These factors can lead to project delays and cost overruns, impacting the overall market growth.

Future Opportunities in Asia Pacific Infrastructure Construction Market

Future opportunities lie in sustainable infrastructure development, smart city initiatives, and the adoption of advanced technologies such as AI and robotics. Expanding into less developed regions and focusing on resilient infrastructure capable of withstanding natural disasters presents significant potential.

Major Players in the Asia Pacific Infrastructure Construction Market Ecosystem

- Samsung C&T

- Hyundai E&C

- China State Construction Engineering

- China Metallurgical Group

- China Communications Construction Company

- L&T

- Shanghai Construction Group

- Obayashi Corporation

- Power Construction Corporation of China

- China Petroleum Engineering Corporation

Key Developments in Asia Pacific Infrastructure Construction Market Industry

- 2023 (Q3): Samsung C&T secured a major contract for a high-speed rail project in India, significantly boosting its market presence.

- 2022 (Q4): China State Construction Engineering partnered with a local firm in the Philippines to develop a large-scale residential project, signifying a strategic expansion.

- 2021 (Q1): Significant investment in sustainable construction technologies was observed across the region.

Strategic Asia Pacific Infrastructure Construction Market Forecast

The Asia Pacific infrastructure construction market is poised for substantial growth, driven by continued government investment, urbanization, and technological advancements. The focus on sustainable and resilient infrastructure will shape future projects, attracting further investment and fostering innovation. The market's potential is substantial, particularly in emerging economies, presenting lucrative opportunities for established players and new entrants alike.

Asia Pacific Infrastructure Construction Market Segmentation

-

1. Infrastructure segment

-

1.1. Social Infrastructure

- 1.1.1. Schools

- 1.1.2. Hospitals

- 1.1.3. Defence

- 1.1.4. Other social infrastructures

-

1.2. Transportation Infrastructure

- 1.2.1. Railways

- 1.2.2. Roadways

- 1.2.3. Airports

- 1.2.4. Waterways

-

1.3. Extraction Infrastructure

- 1.3.1. Power Generation

- 1.3.2. Electricity Transmission & Disribution

- 1.3.3. Gas

- 1.3.4. Telecoms

-

1.4. Manufacturing Infrastructure

- 1.4.1. Metal and Ore Production

- 1.4.2. Petroleum Refining

- 1.4.3. Chemical Manufacturing

- 1.4.4. Industrial Parks and clusters

- 1.4.5. Other manufacturing infrastructures

-

1.1. Social Infrastructure

Asia Pacific Infrastructure Construction Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Infrastructure Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.59% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Asia Pacific countries are investing in infrastructure projects to improve regional connectivity and promote economic integration; The Asia Pacific region has a large and growing population

- 3.2.2 along with a rising middle class

- 3.3. Market Restrains

- 3.3.1. Limited public budgets and difficulties in attracting private investment can hinder the financing of large-scale projects; Delays in land acquisition can significantly impact project timelines and costs

- 3.4. Market Trends

- 3.4.1. Increasing Investments in Infrastructure Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Infrastructure Construction Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Infrastructure segment

- 5.1.1. Social Infrastructure

- 5.1.1.1. Schools

- 5.1.1.2. Hospitals

- 5.1.1.3. Defence

- 5.1.1.4. Other social infrastructures

- 5.1.2. Transportation Infrastructure

- 5.1.2.1. Railways

- 5.1.2.2. Roadways

- 5.1.2.3. Airports

- 5.1.2.4. Waterways

- 5.1.3. Extraction Infrastructure

- 5.1.3.1. Power Generation

- 5.1.3.2. Electricity Transmission & Disribution

- 5.1.3.3. Gas

- 5.1.3.4. Telecoms

- 5.1.4. Manufacturing Infrastructure

- 5.1.4.1. Metal and Ore Production

- 5.1.4.2. Petroleum Refining

- 5.1.4.3. Chemical Manufacturing

- 5.1.4.4. Industrial Parks and clusters

- 5.1.4.5. Other manufacturing infrastructures

- 5.1.1. Social Infrastructure

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Infrastructure segment

- 6. China Asia Pacific Infrastructure Construction Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia Pacific Infrastructure Construction Market Analysis, Insights and Forecast, 2019-2031

- 8. India Asia Pacific Infrastructure Construction Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia Pacific Infrastructure Construction Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia Pacific Infrastructure Construction Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia Pacific Infrastructure Construction Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia Pacific Infrastructure Construction Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Samsung C&T

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Hyundai E&C

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 China State Construction Engineering

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 China Metallurgical Group**List Not Exhaustive

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 China Communications Construction Company

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 L&T

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Shanghai Construction Group

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Obayashi Corporation

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Power Construction Corporation of China

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 China Petroleum Engineering Corporation

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Samsung C&T

List of Figures

- Figure 1: Asia Pacific Infrastructure Construction Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia Pacific Infrastructure Construction Market Share (%) by Company 2024

List of Tables

- Table 1: Asia Pacific Infrastructure Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia Pacific Infrastructure Construction Market Revenue Million Forecast, by Infrastructure segment 2019 & 2032

- Table 3: Asia Pacific Infrastructure Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Asia Pacific Infrastructure Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: China Asia Pacific Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Japan Asia Pacific Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: India Asia Pacific Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: South Korea Asia Pacific Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Taiwan Asia Pacific Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Australia Asia Pacific Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Asia-Pacific Asia Pacific Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Asia Pacific Infrastructure Construction Market Revenue Million Forecast, by Infrastructure segment 2019 & 2032

- Table 13: Asia Pacific Infrastructure Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: China Asia Pacific Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Japan Asia Pacific Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: South Korea Asia Pacific Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: India Asia Pacific Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Australia Asia Pacific Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: New Zealand Asia Pacific Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Indonesia Asia Pacific Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Malaysia Asia Pacific Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Singapore Asia Pacific Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Thailand Asia Pacific Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Vietnam Asia Pacific Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Philippines Asia Pacific Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Infrastructure Construction Market?

The projected CAGR is approximately 6.59%.

2. Which companies are prominent players in the Asia Pacific Infrastructure Construction Market?

Key companies in the market include Samsung C&T, Hyundai E&C, China State Construction Engineering, China Metallurgical Group**List Not Exhaustive, China Communications Construction Company, L&T, Shanghai Construction Group, Obayashi Corporation, Power Construction Corporation of China, China Petroleum Engineering Corporation.

3. What are the main segments of the Asia Pacific Infrastructure Construction Market?

The market segments include Infrastructure segment.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.33 Million as of 2022.

5. What are some drivers contributing to market growth?

Asia Pacific countries are investing in infrastructure projects to improve regional connectivity and promote economic integration; The Asia Pacific region has a large and growing population. along with a rising middle class.

6. What are the notable trends driving market growth?

Increasing Investments in Infrastructure Sector.

7. Are there any restraints impacting market growth?

Limited public budgets and difficulties in attracting private investment can hinder the financing of large-scale projects; Delays in land acquisition can significantly impact project timelines and costs.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Infrastructure Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Infrastructure Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Infrastructure Construction Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Infrastructure Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence