Key Insights

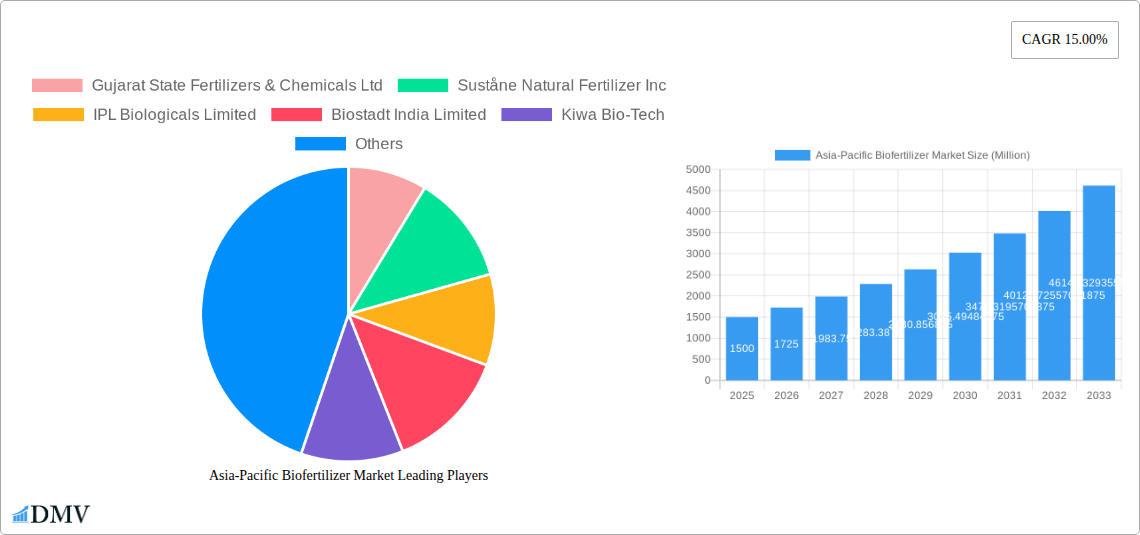

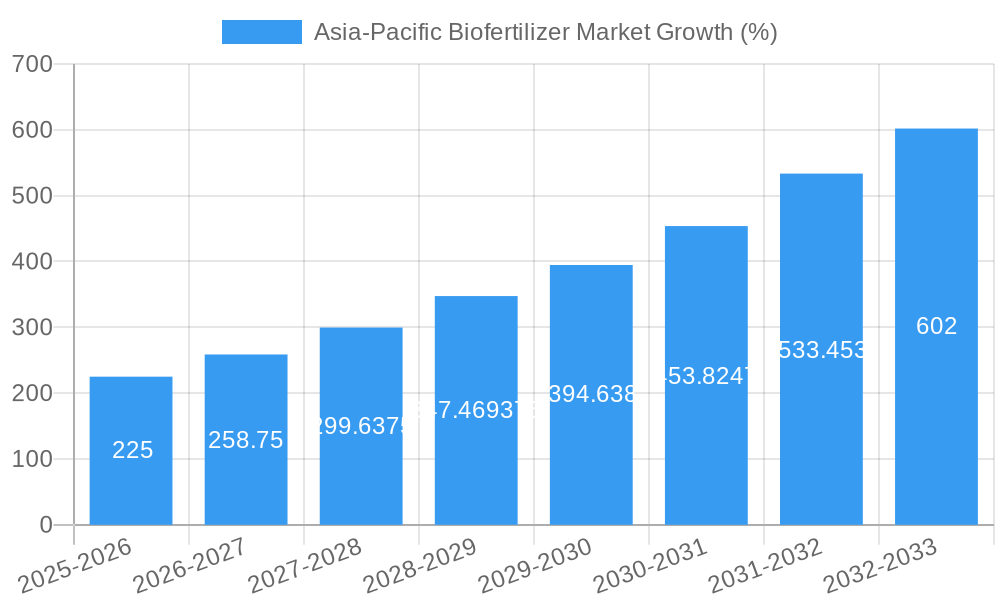

The Asia-Pacific biofertilizer market is experiencing robust growth, driven by increasing awareness of sustainable agricultural practices, stringent government regulations promoting environmentally friendly farming methods, and the rising demand for high-quality, safe food products across the region. A compound annual growth rate (CAGR) of 15% from 2019-2033 indicates a significant expansion, with the market expected to reach a substantial size. Key drivers include the growing adoption of biofertilizers as a cost-effective and eco-friendly alternative to chemical fertilizers, particularly in countries like India and China, where large-scale farming operations are prevalent. Furthermore, government initiatives supporting sustainable agriculture and promoting the use of biofertilizers are fostering market growth. The market segmentation reveals strong demand across various crop types (cash crops, horticultural crops, and row crops), with Azospirillum, Azotobacter, and Mycorrhiza leading the form segment. While challenges such as limited awareness in certain regions and inconsistent product quality exist, the overall market trajectory points towards continued expansion fueled by rising consumer demand for organically produced food and the region's large agricultural sector.

The dominant players in the Asia-Pacific biofertilizer market are strategically expanding their product portfolios and investing in research and development to meet the increasing demand. Companies like Gujarat State Fertilizers & Chemicals Ltd, Suståne Natural Fertilizer Inc, and IPL Biologicals Limited are actively involved in production and distribution, leveraging their established market presence. The geographical distribution of the market is largely influenced by the agricultural landscape and government policies, with China, India, and other rapidly developing Southeast Asian economies showcasing strong growth potential. Future market expansion will hinge on factors like increasing farmer awareness through targeted education programs, consistent product quality control, and continued research into innovative biofertilizer formulations to address specific crop needs and regional climates. The market is expected to witness further consolidation as larger companies acquire smaller players, leading to increased economies of scale and enhanced market reach.

Asia-Pacific Biofertilizer Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Asia-Pacific biofertilizer market, projecting a market value of xx Million by 2033. It covers the period from 2019 to 2033, with 2025 as the base year and a forecast period from 2025 to 2033. The report delves into market dynamics, competitive landscape, and future growth potential, offering invaluable insights for stakeholders across the biofertilizer value chain.

Asia-Pacific Biofertilizer Market Composition & Trends

The Asia-Pacific biofertilizer market is characterized by a moderately fragmented landscape, with several key players vying for market share. Innovation is driven by the increasing demand for sustainable agricultural practices and stringent regulations aimed at reducing chemical fertilizer use. Substitute products, such as chemical fertilizers, continue to pose a challenge, although the growing awareness of environmental concerns and the benefits of biofertilizers is gradually shifting consumer preferences. The market witnesses significant M&A activity, reflecting the strategic importance of biofertilizer technologies. End-users include large-scale commercial farms, smallholder farmers, and horticultural businesses.

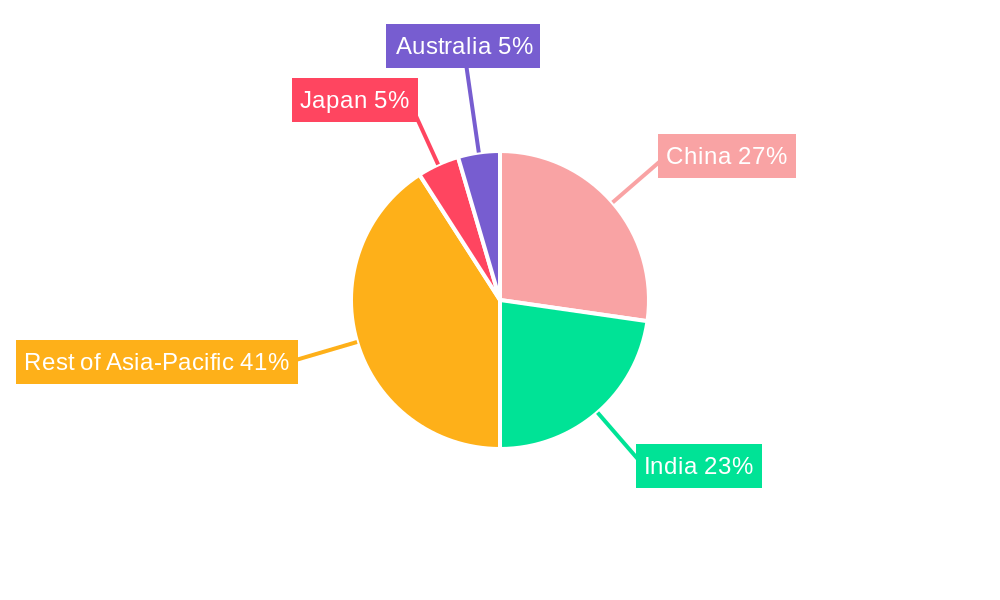

- Market Share Distribution (2024): India holds the largest share (xx%), followed by China (xx%) and Indonesia (xx%). The remaining share is distributed among other Asia-Pacific countries.

- M&A Activity (2019-2024): A total of xx M&A deals were recorded, with an aggregate value of xx Million. Notable deals include Corteva Agriscience's acquisition of Symborg Inc.

- Regulatory Landscape: Government initiatives promoting sustainable agriculture are key drivers. Variations in regulations across countries influence market penetration.

Asia-Pacific Biofertilizer Market Industry Evolution

The Asia-Pacific biofertilizer market has witnessed significant growth from 2019 to 2024, expanding at a CAGR of xx%. This growth is fueled by rising awareness of the environmental impact of chemical fertilizers, increasing government support for sustainable agriculture, and technological advancements in biofertilizer production and application. Consumer demand for organically produced food is also driving adoption. The market is expected to continue its upward trajectory, driven by factors such as increasing crop yields, improved soil health, and reduced reliance on chemical fertilizers. Technological advancements, including the development of more effective and targeted biofertilizers, are further accelerating growth. Adoption rates are increasing steadily, with a notable rise in the usage of biofertilizers among smallholder farmers in key countries like India and Indonesia.

Leading Regions, Countries, or Segments in Asia-Pacific Biofertilizer Market

India currently dominates the Asia-Pacific biofertilizer market, driven by a large agricultural sector, supportive government policies promoting sustainable farming, and a growing awareness among farmers about the benefits of biofertilizers. China is another major market, with significant potential for future growth due to its vast agricultural lands and increasing focus on environmentally friendly agricultural practices.

Key Drivers in India:

- High agricultural land area and diverse cropping patterns

- Government subsidies and awareness campaigns

- Growing preference for organic farming

Key Drivers in China:

- Government regulations limiting chemical fertilizer use

- Growing demand for high-quality agricultural produce

- Increasing investment in agricultural technology

Dominant Form: Phosphate solubilizing bacteria and Rhizobium are currently the most widely used biofertilizer forms.

Dominant Crop Type: Row crops (rice, wheat, corn) account for the largest share of biofertilizer consumption.

Asia-Pacific Biofertilizer Market Product Innovations

Recent innovations include the development of biofertilizers with enhanced efficacy, targeted delivery systems for improved nutrient uptake, and formulations that combine multiple beneficial microorganisms. These advancements aim to optimize nutrient availability, improve crop yields, and enhance overall plant health. The unique selling propositions often include improved crop productivity, reduced environmental impact, and cost-effectiveness compared to chemical fertilizers. Advancements in microbial strain selection and formulation techniques are crucial factors driving innovation.

Propelling Factors for Asia-Pacific Biofertilizer Market Growth

Several factors are driving growth in the Asia-Pacific biofertilizer market. Technological advancements, leading to more efficient and cost-effective biofertilizer production, play a crucial role. Government policies supporting sustainable agriculture and organic farming are also providing strong impetus. The increasing consumer demand for sustainably produced food, along with growing concerns regarding environmental pollution from chemical fertilizers, contributes significantly to market expansion. Economic factors, such as rising agricultural income in several Asian countries, are also encouraging greater adoption of biofertilizers.

Obstacles in the Asia-Pacific Biofertilizer Market

Despite the positive outlook, the Asia-Pacific biofertilizer market faces challenges. Regulatory inconsistencies across countries create hurdles for market expansion, while the cost-effectiveness of biofertilizers compared to chemical alternatives can be a limiting factor for some farmers. Supply chain inefficiencies can impact the timely distribution of biofertilizers, especially in remote areas. Intense competition from established chemical fertilizer manufacturers adds to the obstacles faced by biofertilizer companies. The lack of standardized quality control measures remains a major challenge.

Future Opportunities in Asia-Pacific Biofertilizer Market

Future opportunities lie in expanding into new markets within the Asia-Pacific region, focusing on specific niche crop types and improving biofertilizer efficacy through technological innovation. The development of biofertilizers tailored to specific soil and climatic conditions holds significant promise. Educating farmers about the benefits of biofertilizers and promoting sustainable agricultural practices will contribute to long-term market growth. The development of innovative delivery systems, such as biofertilizer coated seeds, promises enhanced market penetration.

Major Players in the Asia-Pacific Biofertilizer Market Ecosystem

- Gujarat State Fertilizers & Chemicals Ltd

- Suståne Natural Fertilizer Inc

- IPL Biologicals Limited

- Biostadt India Limited

- Kiwa Bio-Tech

- Biolchim SpA

- The Fertilizers and Chemicals Travancore Limited

- Indian Farmers Fertiliser Cooperative Limited

- Symborg Inc

- Atlántica Agrícola

Key Developments in Asia-Pacific Biofertilizer Market Industry

- November 2019: IPL Biologicals Limited launched four new biofertilizer products in Maharashtra, India.

- January 2021: Atlántica Agrícola developed Micomix, a novel biostimulant.

- September 2022: Corteva Agriscience acquired Symborg Inc., strengthening its global biofertilizer presence.

Strategic Asia-Pacific Biofertilizer Market Forecast

The Asia-Pacific biofertilizer market is poised for significant growth driven by rising demand for sustainable agricultural practices, increasing awareness of environmental benefits, and technological advancements. Government initiatives and supportive policies further enhance market potential. The market is expected to witness a surge in product innovation and adoption, shaping a more sustainable and productive agricultural landscape in the region. The continued expansion into untapped markets and a focus on tailored solutions will fuel sustained growth over the forecast period.

Asia-Pacific Biofertilizer Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Asia-Pacific Biofertilizer Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Biofertilizer Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 15.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand For Landscaping Maintenance; Adoption of Green Spaces and Green Roofs

- 3.3. Market Restrains

- 3.3.1. Shortage of Labor In Landscaping; High Maintenance Cost of Lawn Mowers

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Biofertilizer Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. China Asia-Pacific Biofertilizer Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia-Pacific Biofertilizer Market Analysis, Insights and Forecast, 2019-2031

- 8. India Asia-Pacific Biofertilizer Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia-Pacific Biofertilizer Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia-Pacific Biofertilizer Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia-Pacific Biofertilizer Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia-Pacific Biofertilizer Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Gujarat State Fertilizers & Chemicals Ltd

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Suståne Natural Fertilizer Inc

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 IPL Biologicals Limited

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Biostadt India Limited

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Kiwa Bio-Tech

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Biolchim SpA

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 The Fertilizers and Chemicals Travancore Limite

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Indian Farmers Fertiliser Cooperative Limited

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Symborg Inc

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Atlántica Agrícola

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Gujarat State Fertilizers & Chemicals Ltd

List of Figures

- Figure 1: Asia-Pacific Biofertilizer Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific Biofertilizer Market Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific Biofertilizer Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific Biofertilizer Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Asia-Pacific Biofertilizer Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Asia-Pacific Biofertilizer Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Asia-Pacific Biofertilizer Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Asia-Pacific Biofertilizer Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Asia-Pacific Biofertilizer Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Asia-Pacific Biofertilizer Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: China Asia-Pacific Biofertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Japan Asia-Pacific Biofertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: India Asia-Pacific Biofertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: South Korea Asia-Pacific Biofertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Taiwan Asia-Pacific Biofertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Australia Asia-Pacific Biofertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of Asia-Pacific Asia-Pacific Biofertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Asia-Pacific Biofertilizer Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 17: Asia-Pacific Biofertilizer Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 18: Asia-Pacific Biofertilizer Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 19: Asia-Pacific Biofertilizer Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 20: Asia-Pacific Biofertilizer Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 21: Asia-Pacific Biofertilizer Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: China Asia-Pacific Biofertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Japan Asia-Pacific Biofertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: South Korea Asia-Pacific Biofertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: India Asia-Pacific Biofertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Australia Asia-Pacific Biofertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: New Zealand Asia-Pacific Biofertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Indonesia Asia-Pacific Biofertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Malaysia Asia-Pacific Biofertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Singapore Asia-Pacific Biofertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Thailand Asia-Pacific Biofertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Vietnam Asia-Pacific Biofertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Philippines Asia-Pacific Biofertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Biofertilizer Market?

The projected CAGR is approximately 15.00%.

2. Which companies are prominent players in the Asia-Pacific Biofertilizer Market?

Key companies in the market include Gujarat State Fertilizers & Chemicals Ltd, Suståne Natural Fertilizer Inc, IPL Biologicals Limited, Biostadt India Limited, Kiwa Bio-Tech, Biolchim SpA, The Fertilizers and Chemicals Travancore Limite, Indian Farmers Fertiliser Cooperative Limited, Symborg Inc, Atlántica Agrícola.

3. What are the main segments of the Asia-Pacific Biofertilizer Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Demand For Landscaping Maintenance; Adoption of Green Spaces and Green Roofs.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Shortage of Labor In Landscaping; High Maintenance Cost of Lawn Mowers.

8. Can you provide examples of recent developments in the market?

September 2022: Corteva Agriscience agreed to acquire Symborg Inc. to strengthen its global presence with a strong distribution network.January 2021: Atlántica Agrícola’s developed Micomix, a biostimulant composed primarily of mycorrhizal fungi, rhizobacteria, and chelated micronutrients. The presence and development of these microorganisms in the rhizosphere create a symbiotic relationship with the plant that favors the absorption of water and mineral nutrients and increases its tolerance to water and salt stress.November 2019: IPL Biologicals Limited launched four new biofertilizer products, including Nitrogcea, Phosphacea, Potacea, and Zinkaacea, in Maharashtra, India.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Biofertilizer Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Biofertilizer Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Biofertilizer Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Biofertilizer Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence