Key Insights

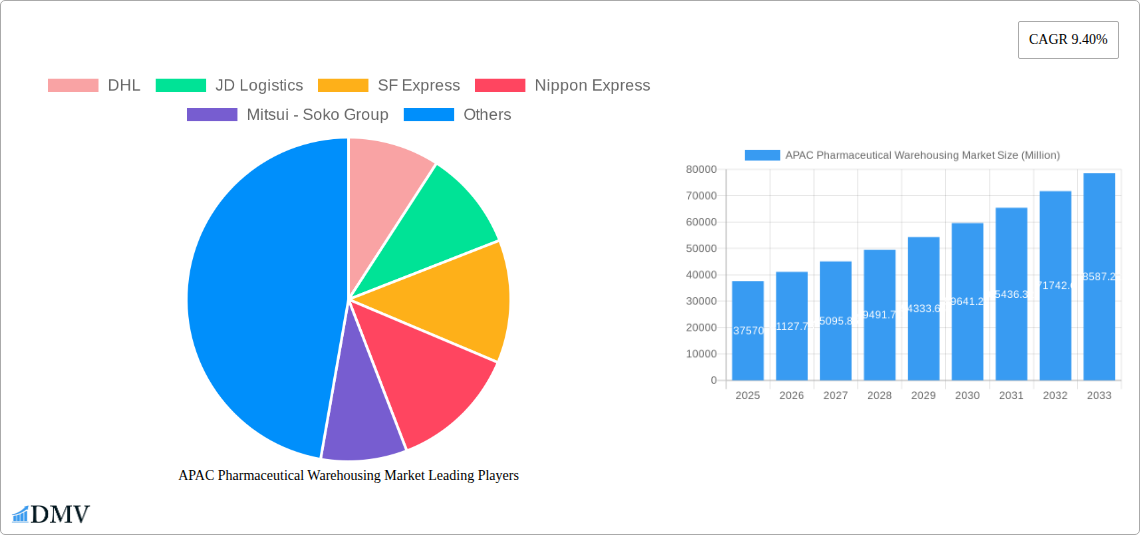

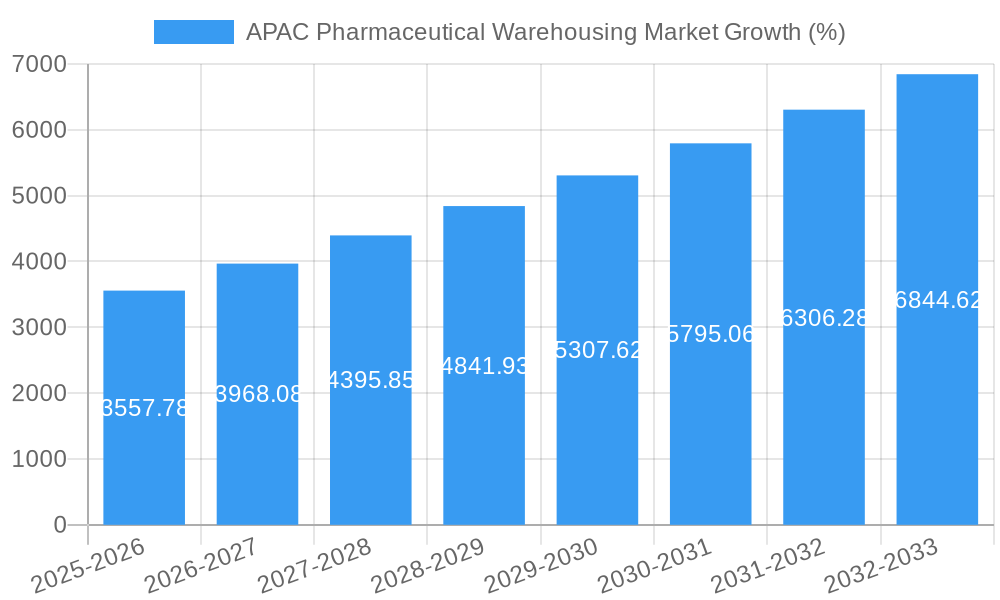

The Asia-Pacific (APAC) pharmaceutical warehousing market is experiencing robust growth, driven by the expanding pharmaceutical industry, increasing healthcare expenditure, and the rising prevalence of chronic diseases across the region. The market, valued at $37.57 billion in 2025, is projected to exhibit a Compound Annual Growth Rate (CAGR) of 9.40% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the increasing demand for temperature-sensitive pharmaceutical products necessitates the growth of cold chain warehousing facilities. Secondly, stringent regulatory requirements regarding drug storage and handling are pushing companies to invest in advanced warehousing solutions. The growth is further propelled by e-commerce penetration in pharmaceuticals and the rising adoption of advanced technologies like automation and IoT in warehouse management. Significant growth is expected from countries like China, India, and Japan, which possess substantial pharmaceutical manufacturing capacities and expanding healthcare infrastructures. The market segmentation reveals a significant share held by cold chain warehousing due to the nature of many pharmaceutical products. Pharmaceutical factories, pharmacies, and hospitals constitute the major application segments, reflecting the critical role of warehousing in the entire pharmaceutical supply chain.

Competition within the APAC pharmaceutical warehousing market is intense, with both global giants like DHL, JD Logistics, and SF Express, and regional players vying for market share. These companies are constantly innovating to offer better services, including enhanced storage capabilities, improved logistics, and advanced technology integration. The market's future trajectory is highly promising, yet challenges such as infrastructure limitations in some regions, the need for skilled labor, and maintaining stringent quality control standards remain. Despite these challenges, the overall positive growth outlook suggests a significant expansion of the APAC pharmaceutical warehousing market over the coming years, driven by both organic growth and strategic mergers and acquisitions within the sector. The consistent demand for efficient and reliable pharmaceutical storage and distribution will continue to drive this growth.

APAC Pharmaceutical Warehousing Market: A Comprehensive Report (2019-2033)

This insightful report provides a comprehensive analysis of the Asia-Pacific Pharmaceutical Warehousing Market, offering a detailed overview of market dynamics, key players, and future growth prospects. The study period covers 2019-2033, with 2025 as the base and estimated year, and a forecast period of 2025-2033. This report is invaluable for stakeholders including pharmaceutical companies, logistics providers, investors, and regulatory bodies seeking to navigate this rapidly evolving market. The market is projected to reach xx Million by 2033.

APAC Pharmaceutical Warehousing Market Composition & Trends

This section delves into the intricate structure of the APAC pharmaceutical warehousing market, examining market concentration, innovation drivers, regulatory landscapes, substitute products, end-user profiles, and merger & acquisition (M&A) activities. The market exhibits a moderately concentrated structure, with a few major players holding significant market share. The top 5 players, including DHL, JD Logistics, and SF Express, collectively account for approximately xx% of the market share in 2025. Innovation is driven by advancements in cold chain technology, automation, and data analytics. Stringent regulatory frameworks, particularly regarding temperature control and data security, shape market practices. Substitute products are limited due to the specialized nature of pharmaceutical storage and handling. End-users comprise pharmaceutical factories, pharmacies, hospitals, and other healthcare institutions.

- Market Share Distribution (2025): DHL (xx%), JD Logistics (xx%), SF Express (xx%), Nippon Express (xx%), Others (xx%)

- M&A Activity (2019-2024): A total of xx M&A deals were recorded, with a cumulative value of approximately xx Million. These deals primarily involved smaller players being acquired by larger logistics providers.

- Regulatory Landscape: Stringent guidelines regarding Good Distribution Practices (GDP) and temperature-sensitive drug storage are key factors influencing market operations.

APAC Pharmaceutical Warehousing Market Industry Evolution

This section analyzes the evolution of the APAC pharmaceutical warehousing market, encompassing growth trajectories, technological progress, and changing consumer demands from 2019 to 2024. The market experienced a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024), driven by factors such as increasing pharmaceutical production, growing healthcare expenditure, and expanding e-commerce channels for pharmaceutical products. Technological advancements, such as automated storage and retrieval systems (AS/RS), warehouse management systems (WMS), and real-time temperature monitoring, have significantly enhanced efficiency and security. The rising demand for temperature-sensitive medications (e.g., biologics, vaccines) is fueling the growth of the cold chain warehousing segment. Adoption rates for advanced technologies are increasing, with xx% of warehouses now employing AS/RS and xx% utilizing sophisticated WMS. The market is expected to continue its robust growth trajectory, with a projected CAGR of xx% during the forecast period (2025-2033).

Leading Regions, Countries, or Segments in APAP Pharmaceutical Warehousing Market

This section identifies the leading regions, countries, and segments within the APAC pharmaceutical warehousing market.

By Type:

Cold Chain Warehouse: This segment dominates the market due to the increasing demand for temperature-sensitive pharmaceuticals. Key drivers include:

- Significant investments in cold chain infrastructure.

- Stringent regulatory requirements for temperature-controlled storage and transportation.

- Growing demand for biologics, vaccines, and other temperature-sensitive drugs.

Non-Cold Chain Warehouse: This segment caters to pharmaceuticals that do not require temperature-controlled storage. Its growth is relatively slower compared to the cold chain segment.

By Application:

- Pharmaceutical Factories: This segment constitutes a major portion of the market, driving the demand for large-scale warehousing solutions.

- Pharmacies: The growing number of pharmacies, particularly in urban areas, is driving the demand for smaller, strategically located warehouses.

- Hospitals: Hospitals require specialized warehousing solutions to manage their inventory of pharmaceuticals and medical supplies.

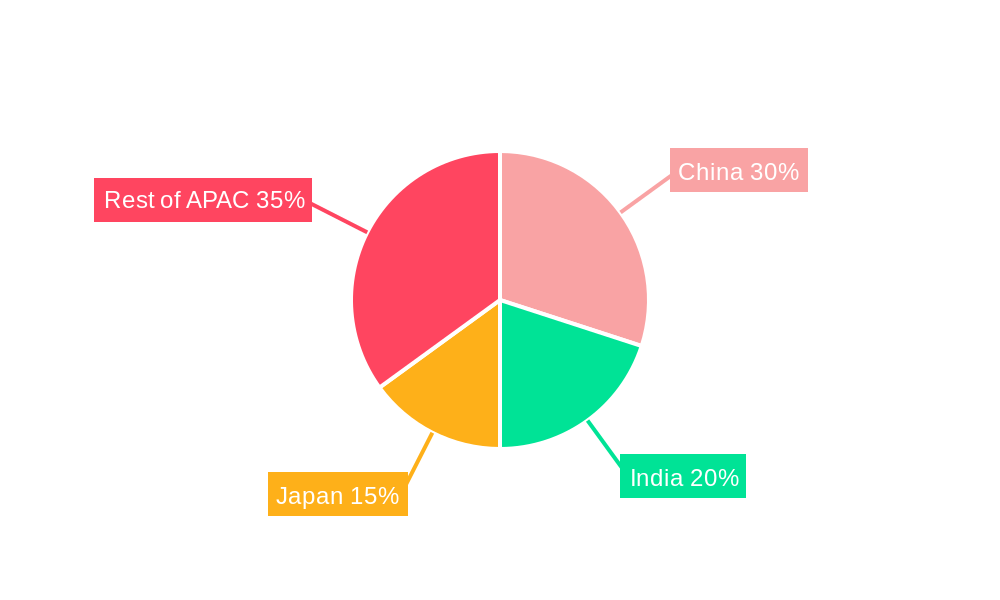

Dominant Regions: China, India, and Japan are the leading markets, driven by factors such as robust pharmaceutical industries, expanding healthcare infrastructure, and rising disposable incomes. China’s pharmaceutical market has exhibited the highest growth rate due to its large population, government initiatives promoting healthcare access, and investments in cold chain logistics.

APAC Pharmaceutical Warehousing Market Product Innovations

Recent innovations include the development of smart warehouses incorporating IoT sensors for real-time temperature monitoring and automated inventory management. These technologies enhance efficiency, improve data accuracy, and reduce the risk of spoilage or degradation of temperature-sensitive medications. The integration of AI and machine learning algorithms in WMS further optimizes warehouse operations and inventory planning. Unique selling propositions for warehousing providers are centered around superior temperature control, advanced security measures, and streamlined supply chain management.

Propelling Factors for APAC Pharmaceutical Warehousing Market Growth

Several factors are driving the growth of this market, including the increasing prevalence of chronic diseases and growing demand for pharmaceutical products. Government regulations mandating specific storage conditions for temperature-sensitive drugs are also contributing factors. Advancements in technology, such as automated systems, are also increasing efficiency. Finally, the expansion of e-commerce for pharmaceuticals is fueling the need for efficient warehousing solutions, with a projected increase of xx% in online pharmaceutical sales by 2033.

Obstacles in the APAC Pharmaceutical Warehousing Market

The market faces challenges like stringent regulatory compliance which requires significant investment in infrastructure and technology, making entry difficult for smaller players. Supply chain disruptions caused by natural disasters or geopolitical events can impact operations and costs. Intense competition among existing players, especially larger, established logistics providers, can put downward pressure on pricing.

Future Opportunities in APAP Pharmaceutical Warehousing Market

Future opportunities lie in expanding into emerging markets within APAC, particularly Southeast Asia, where healthcare infrastructure is developing rapidly. The adoption of advanced technologies, such as blockchain for improved traceability and AI-powered predictive analytics for optimized inventory management, presents significant growth avenues. Furthermore, catering to the growing demand for personalized medicine and specialized pharmaceutical products offers substantial market potential.

Major Players in the APAC Pharmaceutical Warehousing Market Ecosystem

- DHL (DHL)

- JD Logistics (JD.com)

- SF Express (SF Express)

- Nippon Express (Nippon Express)

- Mitsui - Soko Group

- Yunda Holding

- Sankyu

- SG Holdings

- Goke Hengtai (Beijing) Medical Technology Co Ltd

- Kerry Logistics (Kerry Logistics)

- Yamato Holdings (Yamato Holdings)

- Sinopharm Logistics

- CJ Rokin Logistics

- DSV (DSV)

Key Developments in APAC Pharmaceutical Warehousing Market Industry

- July 2023: JD established a 10,000-square-meter warehouse in Shenyang, signifying the company's strategic investment in expanding its pharmaceutical warehousing capabilities and meeting the rising demand for 3PL services.

- April 2022: GEODIS obtained CEIV Pharma certification, strengthening its position in the temperature-controlled pharmaceutical air freight market and enhancing the reliability and quality of its services.

Strategic APAC Pharmaceutical Warehousing Market Forecast

The APAC pharmaceutical warehousing market is poised for continued robust growth, driven by technological advancements, expanding healthcare infrastructure, and increasing demand for pharmaceutical products. The market is expected to witness significant investments in cold chain logistics, automation, and data analytics, which will further enhance efficiency, security, and compliance. Emerging markets within APAC present significant opportunities for expansion and diversification, while the integration of advanced technologies offers substantial potential for improving operational efficiency and enhancing customer satisfaction. The market's growth trajectory is expected to remain positive throughout the forecast period, leading to considerable market expansion.

APAC Pharmaceutical Warehousing Market Segmentation

-

1. BY Type

- 1.1. Cold Chain Warehouse

- 1.2. Non-Cold Chain Warehouse

-

2. Application

- 2.1. Pharmaceutical Factory

- 2.2. Pharmacy

- 2.3. Hospital

- 2.4. Other Applications

-

3. Geography

-

3.1. Asia-Pacific

- 3.1.1. Australia

- 3.1.2. China

- 3.1.3. India

- 3.1.4. Indonesia

- 3.1.5. Japan

- 3.1.6. Malaysia

- 3.1.7. Vietnam

- 3.1.8. Thailand

- 3.1.9. Rest-of-APAC

-

3.1. Asia-Pacific

APAC Pharmaceutical Warehousing Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. Australia

- 1.2. China

- 1.3. India

- 1.4. Indonesia

- 1.5. Japan

- 1.6. Malaysia

- 1.7. Vietnam

- 1.8. Thailand

- 1.9. Rest of APAC

APAC Pharmaceutical Warehousing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rapidly Expanding Pharmaceutical Industry4.; Government Regulations and Intiatives

- 3.3. Market Restrains

- 3.3.1. 4.; Supply Chain Disruptions4.; Temperature Controlled and Cold Chain Management

- 3.4. Market Trends

- 3.4.1. Increase in Cold Storage Warehouses is driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. APAC Pharmaceutical Warehousing Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by BY Type

- 5.1.1. Cold Chain Warehouse

- 5.1.2. Non-Cold Chain Warehouse

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Pharmaceutical Factory

- 5.2.2. Pharmacy

- 5.2.3. Hospital

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Asia-Pacific

- 5.3.1.1. Australia

- 5.3.1.2. China

- 5.3.1.3. India

- 5.3.1.4. Indonesia

- 5.3.1.5. Japan

- 5.3.1.6. Malaysia

- 5.3.1.7. Vietnam

- 5.3.1.8. Thailand

- 5.3.1.9. Rest-of-APAC

- 5.3.1. Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by BY Type

- 6. Australia APAC Pharmaceutical Warehousing Market Analysis, Insights and Forecast, 2019-2031

- 7. China APAC Pharmaceutical Warehousing Market Analysis, Insights and Forecast, 2019-2031

- 8. India APAC Pharmaceutical Warehousing Market Analysis, Insights and Forecast, 2019-2031

- 9. Indonesia APAC Pharmaceutical Warehousing Market Analysis, Insights and Forecast, 2019-2031

- 10. Japan APAC Pharmaceutical Warehousing Market Analysis, Insights and Forecast, 2019-2031

- 11. Malaysia APAC Pharmaceutical Warehousing Market Analysis, Insights and Forecast, 2019-2031

- 12. Vietnam APAC Pharmaceutical Warehousing Market Analysis, Insights and Forecast, 2019-2031

- 13. Thailand APAC Pharmaceutical Warehousing Market Analysis, Insights and Forecast, 2019-2031

- 14. Rest of APAC APAC Pharmaceutical Warehousing Market Analysis, Insights and Forecast, 2019-2031

- 15. Competitive Analysis

- 15.1. Market Share Analysis 2024

- 15.2. Company Profiles

- 15.2.1 DHL

- 15.2.1.1. Overview

- 15.2.1.2. Products

- 15.2.1.3. SWOT Analysis

- 15.2.1.4. Recent Developments

- 15.2.1.5. Financials (Based on Availability)

- 15.2.2 JD Logistics

- 15.2.2.1. Overview

- 15.2.2.2. Products

- 15.2.2.3. SWOT Analysis

- 15.2.2.4. Recent Developments

- 15.2.2.5. Financials (Based on Availability)

- 15.2.3 SF Express

- 15.2.3.1. Overview

- 15.2.3.2. Products

- 15.2.3.3. SWOT Analysis

- 15.2.3.4. Recent Developments

- 15.2.3.5. Financials (Based on Availability)

- 15.2.4 Nippon Express

- 15.2.4.1. Overview

- 15.2.4.2. Products

- 15.2.4.3. SWOT Analysis

- 15.2.4.4. Recent Developments

- 15.2.4.5. Financials (Based on Availability)

- 15.2.5 Mitsui - Soko Group

- 15.2.5.1. Overview

- 15.2.5.2. Products

- 15.2.5.3. SWOT Analysis

- 15.2.5.4. Recent Developments

- 15.2.5.5. Financials (Based on Availability)

- 15.2.6 Yunda Holding

- 15.2.6.1. Overview

- 15.2.6.2. Products

- 15.2.6.3. SWOT Analysis

- 15.2.6.4. Recent Developments

- 15.2.6.5. Financials (Based on Availability)

- 15.2.7 Sankyu

- 15.2.7.1. Overview

- 15.2.7.2. Products

- 15.2.7.3. SWOT Analysis

- 15.2.7.4. Recent Developments

- 15.2.7.5. Financials (Based on Availability)

- 15.2.8 SG Holdings

- 15.2.8.1. Overview

- 15.2.8.2. Products

- 15.2.8.3. SWOT Analysis

- 15.2.8.4. Recent Developments

- 15.2.8.5. Financials (Based on Availability)

- 15.2.9 Goke Hengtai (Beijing) Medical Technology Co Ltd

- 15.2.9.1. Overview

- 15.2.9.2. Products

- 15.2.9.3. SWOT Analysis

- 15.2.9.4. Recent Developments

- 15.2.9.5. Financials (Based on Availability)

- 15.2.10 Kerry Logistics

- 15.2.10.1. Overview

- 15.2.10.2. Products

- 15.2.10.3. SWOT Analysis

- 15.2.10.4. Recent Developments

- 15.2.10.5. Financials (Based on Availability)

- 15.2.11 Yamato Holdings

- 15.2.11.1. Overview

- 15.2.11.2. Products

- 15.2.11.3. SWOT Analysis

- 15.2.11.4. Recent Developments

- 15.2.11.5. Financials (Based on Availability)

- 15.2.12 Sinopharm Logistics

- 15.2.12.1. Overview

- 15.2.12.2. Products

- 15.2.12.3. SWOT Analysis

- 15.2.12.4. Recent Developments

- 15.2.12.5. Financials (Based on Availability)

- 15.2.13 CJ Rokin Logistics

- 15.2.13.1. Overview

- 15.2.13.2. Products

- 15.2.13.3. SWOT Analysis

- 15.2.13.4. Recent Developments

- 15.2.13.5. Financials (Based on Availability)

- 15.2.14 DSV

- 15.2.14.1. Overview

- 15.2.14.2. Products

- 15.2.14.3. SWOT Analysis

- 15.2.14.4. Recent Developments

- 15.2.14.5. Financials (Based on Availability)

- 15.2.1 DHL

List of Figures

- Figure 1: APAC Pharmaceutical Warehousing Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: APAC Pharmaceutical Warehousing Market Share (%) by Company 2024

List of Tables

- Table 1: APAC Pharmaceutical Warehousing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: APAC Pharmaceutical Warehousing Market Revenue Million Forecast, by BY Type 2019 & 2032

- Table 3: APAC Pharmaceutical Warehousing Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: APAC Pharmaceutical Warehousing Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: APAC Pharmaceutical Warehousing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: APAC Pharmaceutical Warehousing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Australia APAC Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: China APAC Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: India APAC Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Indonesia APAC Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Japan APAC Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Malaysia APAC Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Vietnam APAC Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Thailand APAC Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of APAC APAC Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: APAC Pharmaceutical Warehousing Market Revenue Million Forecast, by BY Type 2019 & 2032

- Table 17: APAC Pharmaceutical Warehousing Market Revenue Million Forecast, by Application 2019 & 2032

- Table 18: APAC Pharmaceutical Warehousing Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 19: APAC Pharmaceutical Warehousing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Australia APAC Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: China APAC Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: India APAC Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Indonesia APAC Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Japan APAC Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Malaysia APAC Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Vietnam APAC Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Thailand APAC Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Rest of APAC APAC Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Pharmaceutical Warehousing Market?

The projected CAGR is approximately 9.40%.

2. Which companies are prominent players in the APAC Pharmaceutical Warehousing Market?

Key companies in the market include DHL, JD Logistics, SF Express, Nippon Express, Mitsui - Soko Group, Yunda Holding, Sankyu, SG Holdings, Goke Hengtai (Beijing) Medical Technology Co Ltd, Kerry Logistics, Yamato Holdings, Sinopharm Logistics, CJ Rokin Logistics, DSV.

3. What are the main segments of the APAC Pharmaceutical Warehousing Market?

The market segments include BY Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 37.57 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Rapidly Expanding Pharmaceutical Industry4.; Government Regulations and Intiatives.

6. What are the notable trends driving market growth?

Increase in Cold Storage Warehouses is driving the market.

7. Are there any restraints impacting market growth?

4.; Supply Chain Disruptions4.; Temperature Controlled and Cold Chain Management.

8. Can you provide examples of recent developments in the market?

July 2023: JD established a 10,000-square-meter warehouse in Shenyang to meet the increasing demand for pharmaceutical products. This facility provides 3PL (3rd party logistics) services specifically for medicines and medical equipment. With distinct temperature zones catering to various drug requirements, including cold, room temperature, fridge, and freezer.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Pharmaceutical Warehousing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Pharmaceutical Warehousing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Pharmaceutical Warehousing Market?

To stay informed about further developments, trends, and reports in the APAC Pharmaceutical Warehousing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence