Key Insights

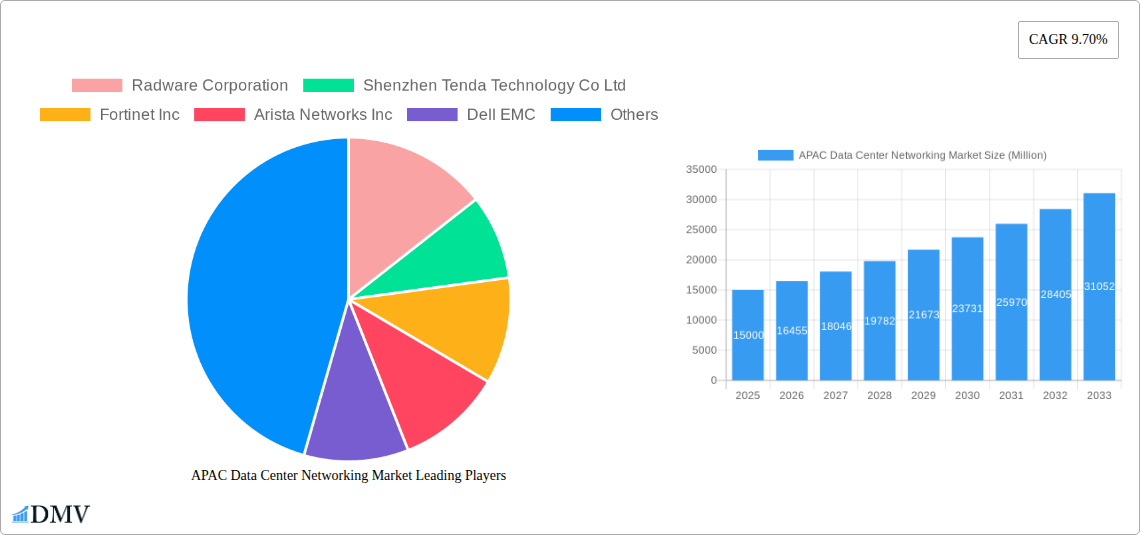

The Asia-Pacific (APAC) data center networking market is experiencing robust growth, driven by the increasing adoption of cloud computing, big data analytics, and the Internet of Things (IoT) across various sectors. The region's burgeoning digital economy, coupled with substantial investments in infrastructure development, particularly in countries like India, China, and Indonesia, fuels this expansion. A compound annual growth rate (CAGR) of 9.70% from 2019 to 2024 suggests a significant market expansion, and this momentum is expected to continue through 2033. Key drivers include the rising demand for high-bandwidth, low-latency networks to support data-intensive applications, the growing adoption of Software-Defined Networking (SDN) and Network Function Virtualization (NFV) technologies for improved network agility and efficiency, and increasing government initiatives promoting digital transformation across various sectors like BFSI (Banking, Financial Services, and Insurance), IT & Telecommunications, and Media & Entertainment. The market segmentation reveals significant opportunities within various components (products like routers, switches, and other networking equipment, alongside services like consulting and managed services) and end-user segments. Competition is fierce, with both established players like Cisco, Juniper, and Hewlett Packard Enterprise, and rapidly growing regional vendors, vying for market share.

The APAC data center networking market's growth is, however, subject to certain restraints. These include the high initial investment costs associated with upgrading network infrastructure, the complexity of implementing new technologies, and the potential security risks associated with increasingly interconnected networks. Furthermore, variations in regulatory landscapes across different APAC countries can pose challenges for vendors. Despite these challenges, the long-term growth outlook remains positive, driven by the sustained growth of digital technologies and the increasing need for robust and scalable data center networks across the region. The market is poised to witness further consolidation as vendors seek to expand their presence and offer comprehensive solutions catering to the evolving needs of APAC businesses.

APAC Data Center Networking Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Asia-Pacific (APAC) data center networking market, offering a comprehensive overview of its current state, future trajectory, and key players. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. This report is crucial for stakeholders seeking to understand the market dynamics, identify growth opportunities, and make informed strategic decisions within this rapidly evolving landscape. The market is projected to reach xx Million by 2033.

APAC Data Center Networking Market Composition & Trends

This section delves into the intricate makeup of the APAC data center networking market, analyzing market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and merger & acquisition (M&A) activities. The analysis incorporates detailed market share distribution among key players and examines the financial implications of significant M&A deals.

Market Concentration: The APAC data center networking market exhibits a moderately concentrated structure, with a few dominant players commanding significant market share. However, the presence of several smaller, specialized companies contributes to a dynamic competitive landscape. Precise market share figures for key players will be presented in the full report.

Innovation Catalysts: Advancements in technologies such as Software-Defined Networking (SDN), Network Function Virtualization (NFV), and 5G are driving significant innovation and shaping the market's future. The increasing adoption of cloud computing and the Internet of Things (IoT) further fuels this innovation.

Regulatory Landscape: Varying regulatory frameworks across APAC nations influence market growth, with some regions exhibiting more supportive regulatory environments than others. Specific regulatory impacts on market segments will be detailed in the full report.

Substitute Products: While traditional networking equipment remains dominant, the emergence of cloud-based networking solutions and alternative technologies presents a degree of substitutability, influencing market competition.

End-User Profiles: The report examines the diverse end-user landscape, including IT & Telecommunication, BFSI (Banking, Financial Services, and Insurance), Government, Media & Entertainment, and other sectors, outlining their specific networking needs and technological preferences.

M&A Activities: The report analyzes recent M&A activity within the APAC data center networking market, including deal values and their strategic implications for market consolidation and technological advancements. xx Million in M&A deals were recorded in the last 5 years.

APAC Data Center Networking Market Industry Evolution

This section provides a detailed analysis of the APAC data center networking market's evolutionary path, examining market growth trajectories, technological advancements, and the shifting demands of consumers. The analysis incorporates specific data points, such as growth rates and adoption metrics, to illustrate the market's dynamic nature. The market experienced a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024) and is projected to maintain a CAGR of xx% during the forecast period (2025-2033). Key factors contributing to this growth include the increasing adoption of cloud computing, the expansion of 5G networks, and the rising demand for high-bandwidth, low-latency connectivity. The growing adoption of SDN and NFV technologies is also significantly impacting the market, leading to more flexible and efficient network architectures. The shift toward software-defined data centers, coupled with the increasing adoption of AI-powered network management solutions, is further driving market growth. The demand for improved security measures in data centers is also a key driver, pushing the market toward more secure and robust networking solutions. Consumer demands are increasingly focused on speed, security, and scalability, shaping vendor strategies and driving innovation.

Leading Regions, Countries, or Segments in APAC Data Center Networking Market

This section identifies the dominant regions, countries, and segments within the APAC data center networking market.

Dominant Regions/Countries: China, India, and Japan are expected to remain the leading markets in APAC due to their robust economic growth, substantial investments in IT infrastructure, and expanding data center footprints. Other high-growth markets include South Korea, Australia, Singapore, and other Southeast Asian countries.

Dominant Segments:

By Component: The market is segmented by product (switches, routers, and other networking equipment) and services (managed services, professional services, and support and maintenance services). The product segment is anticipated to hold a larger market share due to the increasing need for high-speed networking solutions in data centers.

By End-User: The IT & Telecommunication sector is the largest end-user segment, owing to its substantial investments in network infrastructure to support various business operations and services. The BFSI sector and the Government sector are significant contributors to market growth.

Key Drivers (by region/segment):

China: Government initiatives promoting digitalization and cloud adoption, coupled with a massive domestic market, are key growth drivers.

India: Rapid growth of the IT services industry and increasing government focus on digital infrastructure initiatives.

IT & Telecommunication: Demand for high-bandwidth, low-latency connectivity to support cloud computing, 5G deployments, and IoT applications.

BFSI: Stringent regulatory requirements for data security and compliance drive investment in robust data center networking solutions.

APAC Data Center Networking Market Product Innovations

Recent innovations include the development of high-speed Ethernet switches with increased port density and advanced features like SDN/NFV support. Other notable advancements involve the introduction of AI-powered network management tools for enhanced automation, optimization, and security. These innovations improve network performance, scalability, and manageability, offering significant advantages to data center operators. The unique selling propositions of these products are primarily focused on speed, efficiency, scalability and security improvements, differentiating them in a competitive market.

Propelling Factors for APAC Data Center Networking Market Growth

Several factors are driving the growth of the APAC data center networking market. Technological advancements, such as the widespread adoption of cloud computing and the rise of 5G, are significantly impacting market expansion. Furthermore, robust economic growth across several APAC nations creates increasing demand for improved IT infrastructure. Favorable government policies and investments in digital infrastructure projects further bolster market growth.

Obstacles in the APAC Data Center Networking Market

Challenges include the complexities of navigating diverse regulatory landscapes across the region, potential supply chain disruptions, and intense competition among established players and emerging vendors. These factors can impact market growth and profitability. Increased cybersecurity threats and the need for robust security solutions to mitigate the associated risks also add to the challenges.

Future Opportunities in APAC Data Center Networking Market

Future opportunities lie in the increasing adoption of emerging technologies such as edge computing and AI-powered network management systems. The expansion of 5G networks across the region and the growing demand for private 5G networks also present significant opportunities for growth. Furthermore, the increasing focus on sustainability and energy efficiency in data centers is creating new market opportunities for vendors offering energy-efficient networking solutions.

Major Players in the APAC Data Center Networking Market Ecosystem

- Radware Corporation

- Shenzhen Tenda Technology Co Ltd

- Fortinet Inc

- Arista Networks Inc

- Dell EMC

- ARRAY NETWORKS INC

- Hewlett Packard Enterprise Development LP

- Juniper Networks Inc

- Extreme Networks Inc

- NEC Corporation

- A10 Networks Inc

- TP-Link Corporation Limited

- Moxa Inc

- H3C Holding Limited

- VMware Inc

Key Developments in APAC Data Center Networking Market Industry

July 2023: Moxa Inc. launched its MDS-G4020-L3-4XGS series of Ethernet switches, enhancing flexibility and scalability for various applications. This launch expands Moxa's product portfolio and strengthens its position in the market.

March 2023: Arista Networks, Inc. introduced the Arista WAN Routing System, modernizing wide-area networks and simplifying network management. This comprehensive solution addresses the growing need for efficient and scalable WAN solutions.

Strategic APAC Data Center Networking Market Forecast

The APAC data center networking market is poised for significant growth, driven by technological advancements, increasing digitalization, and rising investments in IT infrastructure. The continued expansion of cloud computing, the widespread adoption of 5G, and the increasing demand for robust cybersecurity solutions will propel market growth in the coming years. The market is expected to witness substantial expansion across various segments and geographies, presenting lucrative opportunities for vendors and investors alike.

APAC Data Center Networking Market Segmentation

-

1. Component

-

1.1. By Product

- 1.1.1. Ethernet Switches

- 1.1.2. Router

- 1.1.3. Storage Area Network (SAN)

- 1.1.4. Application Delivery Controller (ADC)

- 1.1.5. Other Networking Equipment

-

1.2. By Services

- 1.2.1. Installation & Integration

- 1.2.2. Training & Consulting

- 1.2.3. Support & Maintenance

-

1.1. By Product

-

2. End-User

- 2.1. IT & Telecommunication

- 2.2. BFSI

- 2.3. Government

- 2.4. Media & Entertainment

- 2.5. Other End-Users

APAC Data Center Networking Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

APAC Data Center Networking Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Need of Cloud Storage and Rsing Demand for Reliable Application Performance; Increasing Cyberattacks Among Enterprises

- 3.3. Market Restrains

- 3.3.1. Increasing Network Complexity

- 3.4. Market Trends

- 3.4.1. IT and Telecom to Hold Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Data Center Networking Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. By Product

- 5.1.1.1. Ethernet Switches

- 5.1.1.2. Router

- 5.1.1.3. Storage Area Network (SAN)

- 5.1.1.4. Application Delivery Controller (ADC)

- 5.1.1.5. Other Networking Equipment

- 5.1.2. By Services

- 5.1.2.1. Installation & Integration

- 5.1.2.2. Training & Consulting

- 5.1.2.3. Support & Maintenance

- 5.1.1. By Product

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. IT & Telecommunication

- 5.2.2. BFSI

- 5.2.3. Government

- 5.2.4. Media & Entertainment

- 5.2.5. Other End-Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America APAC Data Center Networking Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. By Product

- 6.1.1.1. Ethernet Switches

- 6.1.1.2. Router

- 6.1.1.3. Storage Area Network (SAN)

- 6.1.1.4. Application Delivery Controller (ADC)

- 6.1.1.5. Other Networking Equipment

- 6.1.2. By Services

- 6.1.2.1. Installation & Integration

- 6.1.2.2. Training & Consulting

- 6.1.2.3. Support & Maintenance

- 6.1.1. By Product

- 6.2. Market Analysis, Insights and Forecast - by End-User

- 6.2.1. IT & Telecommunication

- 6.2.2. BFSI

- 6.2.3. Government

- 6.2.4. Media & Entertainment

- 6.2.5. Other End-Users

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. South America APAC Data Center Networking Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. By Product

- 7.1.1.1. Ethernet Switches

- 7.1.1.2. Router

- 7.1.1.3. Storage Area Network (SAN)

- 7.1.1.4. Application Delivery Controller (ADC)

- 7.1.1.5. Other Networking Equipment

- 7.1.2. By Services

- 7.1.2.1. Installation & Integration

- 7.1.2.2. Training & Consulting

- 7.1.2.3. Support & Maintenance

- 7.1.1. By Product

- 7.2. Market Analysis, Insights and Forecast - by End-User

- 7.2.1. IT & Telecommunication

- 7.2.2. BFSI

- 7.2.3. Government

- 7.2.4. Media & Entertainment

- 7.2.5. Other End-Users

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Europe APAC Data Center Networking Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. By Product

- 8.1.1.1. Ethernet Switches

- 8.1.1.2. Router

- 8.1.1.3. Storage Area Network (SAN)

- 8.1.1.4. Application Delivery Controller (ADC)

- 8.1.1.5. Other Networking Equipment

- 8.1.2. By Services

- 8.1.2.1. Installation & Integration

- 8.1.2.2. Training & Consulting

- 8.1.2.3. Support & Maintenance

- 8.1.1. By Product

- 8.2. Market Analysis, Insights and Forecast - by End-User

- 8.2.1. IT & Telecommunication

- 8.2.2. BFSI

- 8.2.3. Government

- 8.2.4. Media & Entertainment

- 8.2.5. Other End-Users

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Middle East & Africa APAC Data Center Networking Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. By Product

- 9.1.1.1. Ethernet Switches

- 9.1.1.2. Router

- 9.1.1.3. Storage Area Network (SAN)

- 9.1.1.4. Application Delivery Controller (ADC)

- 9.1.1.5. Other Networking Equipment

- 9.1.2. By Services

- 9.1.2.1. Installation & Integration

- 9.1.2.2. Training & Consulting

- 9.1.2.3. Support & Maintenance

- 9.1.1. By Product

- 9.2. Market Analysis, Insights and Forecast - by End-User

- 9.2.1. IT & Telecommunication

- 9.2.2. BFSI

- 9.2.3. Government

- 9.2.4. Media & Entertainment

- 9.2.5. Other End-Users

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Asia Pacific APAC Data Center Networking Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Component

- 10.1.1. By Product

- 10.1.1.1. Ethernet Switches

- 10.1.1.2. Router

- 10.1.1.3. Storage Area Network (SAN)

- 10.1.1.4. Application Delivery Controller (ADC)

- 10.1.1.5. Other Networking Equipment

- 10.1.2. By Services

- 10.1.2.1. Installation & Integration

- 10.1.2.2. Training & Consulting

- 10.1.2.3. Support & Maintenance

- 10.1.1. By Product

- 10.2. Market Analysis, Insights and Forecast - by End-User

- 10.2.1. IT & Telecommunication

- 10.2.2. BFSI

- 10.2.3. Government

- 10.2.4. Media & Entertainment

- 10.2.5. Other End-Users

- 10.1. Market Analysis, Insights and Forecast - by Component

- 11. North America APAC Data Center Networking Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe APAC Data Center Networking Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia APAC Data Center Networking Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Australia and New Zealand APAC Data Center Networking Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Latin America APAC Data Center Networking Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Middle East and Africa APAC Data Center Networking Market Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1.

- 17. Competitive Analysis

- 17.1. Global Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 Radware Corporation

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Shenzhen Tenda Technology Co Ltd

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 Fortinet Inc

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Arista Networks Inc

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Dell EMC

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 ARRAY NETWORKS INC

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Hewlett Packard Enterprise Development LP

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Juniper Networks Inc

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 Extreme Networks Inc

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 NEC Corporation

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.11 A10 Networks Inc

- 17.2.11.1. Overview

- 17.2.11.2. Products

- 17.2.11.3. SWOT Analysis

- 17.2.11.4. Recent Developments

- 17.2.11.5. Financials (Based on Availability)

- 17.2.12 TP-Link Corporation Limited

- 17.2.12.1. Overview

- 17.2.12.2. Products

- 17.2.12.3. SWOT Analysis

- 17.2.12.4. Recent Developments

- 17.2.12.5. Financials (Based on Availability)

- 17.2.13 Moxa Inc *List Not Exhaustive

- 17.2.13.1. Overview

- 17.2.13.2. Products

- 17.2.13.3. SWOT Analysis

- 17.2.13.4. Recent Developments

- 17.2.13.5. Financials (Based on Availability)

- 17.2.14 H3C Holding Limited

- 17.2.14.1. Overview

- 17.2.14.2. Products

- 17.2.14.3. SWOT Analysis

- 17.2.14.4. Recent Developments

- 17.2.14.5. Financials (Based on Availability)

- 17.2.15 VMware Inc

- 17.2.15.1. Overview

- 17.2.15.2. Products

- 17.2.15.3. SWOT Analysis

- 17.2.15.4. Recent Developments

- 17.2.15.5. Financials (Based on Availability)

- 17.2.1 Radware Corporation

List of Figures

- Figure 1: Global APAC Data Center Networking Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America APAC Data Center Networking Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America APAC Data Center Networking Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe APAC Data Center Networking Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe APAC Data Center Networking Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia APAC Data Center Networking Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia APAC Data Center Networking Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Australia and New Zealand APAC Data Center Networking Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Australia and New Zealand APAC Data Center Networking Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Latin America APAC Data Center Networking Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Latin America APAC Data Center Networking Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: Middle East and Africa APAC Data Center Networking Market Revenue (Million), by Country 2024 & 2032

- Figure 13: Middle East and Africa APAC Data Center Networking Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America APAC Data Center Networking Market Revenue (Million), by Component 2024 & 2032

- Figure 15: North America APAC Data Center Networking Market Revenue Share (%), by Component 2024 & 2032

- Figure 16: North America APAC Data Center Networking Market Revenue (Million), by End-User 2024 & 2032

- Figure 17: North America APAC Data Center Networking Market Revenue Share (%), by End-User 2024 & 2032

- Figure 18: North America APAC Data Center Networking Market Revenue (Million), by Country 2024 & 2032

- Figure 19: North America APAC Data Center Networking Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: South America APAC Data Center Networking Market Revenue (Million), by Component 2024 & 2032

- Figure 21: South America APAC Data Center Networking Market Revenue Share (%), by Component 2024 & 2032

- Figure 22: South America APAC Data Center Networking Market Revenue (Million), by End-User 2024 & 2032

- Figure 23: South America APAC Data Center Networking Market Revenue Share (%), by End-User 2024 & 2032

- Figure 24: South America APAC Data Center Networking Market Revenue (Million), by Country 2024 & 2032

- Figure 25: South America APAC Data Center Networking Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Europe APAC Data Center Networking Market Revenue (Million), by Component 2024 & 2032

- Figure 27: Europe APAC Data Center Networking Market Revenue Share (%), by Component 2024 & 2032

- Figure 28: Europe APAC Data Center Networking Market Revenue (Million), by End-User 2024 & 2032

- Figure 29: Europe APAC Data Center Networking Market Revenue Share (%), by End-User 2024 & 2032

- Figure 30: Europe APAC Data Center Networking Market Revenue (Million), by Country 2024 & 2032

- Figure 31: Europe APAC Data Center Networking Market Revenue Share (%), by Country 2024 & 2032

- Figure 32: Middle East & Africa APAC Data Center Networking Market Revenue (Million), by Component 2024 & 2032

- Figure 33: Middle East & Africa APAC Data Center Networking Market Revenue Share (%), by Component 2024 & 2032

- Figure 34: Middle East & Africa APAC Data Center Networking Market Revenue (Million), by End-User 2024 & 2032

- Figure 35: Middle East & Africa APAC Data Center Networking Market Revenue Share (%), by End-User 2024 & 2032

- Figure 36: Middle East & Africa APAC Data Center Networking Market Revenue (Million), by Country 2024 & 2032

- Figure 37: Middle East & Africa APAC Data Center Networking Market Revenue Share (%), by Country 2024 & 2032

- Figure 38: Asia Pacific APAC Data Center Networking Market Revenue (Million), by Component 2024 & 2032

- Figure 39: Asia Pacific APAC Data Center Networking Market Revenue Share (%), by Component 2024 & 2032

- Figure 40: Asia Pacific APAC Data Center Networking Market Revenue (Million), by End-User 2024 & 2032

- Figure 41: Asia Pacific APAC Data Center Networking Market Revenue Share (%), by End-User 2024 & 2032

- Figure 42: Asia Pacific APAC Data Center Networking Market Revenue (Million), by Country 2024 & 2032

- Figure 43: Asia Pacific APAC Data Center Networking Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global APAC Data Center Networking Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global APAC Data Center Networking Market Revenue Million Forecast, by Component 2019 & 2032

- Table 3: Global APAC Data Center Networking Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 4: Global APAC Data Center Networking Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global APAC Data Center Networking Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: APAC Data Center Networking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global APAC Data Center Networking Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: APAC Data Center Networking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global APAC Data Center Networking Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: APAC Data Center Networking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global APAC Data Center Networking Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: APAC Data Center Networking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global APAC Data Center Networking Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: APAC Data Center Networking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global APAC Data Center Networking Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: APAC Data Center Networking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global APAC Data Center Networking Market Revenue Million Forecast, by Component 2019 & 2032

- Table 18: Global APAC Data Center Networking Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 19: Global APAC Data Center Networking Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: United States APAC Data Center Networking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Canada APAC Data Center Networking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Mexico APAC Data Center Networking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global APAC Data Center Networking Market Revenue Million Forecast, by Component 2019 & 2032

- Table 24: Global APAC Data Center Networking Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 25: Global APAC Data Center Networking Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Brazil APAC Data Center Networking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Argentina APAC Data Center Networking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Rest of South America APAC Data Center Networking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Global APAC Data Center Networking Market Revenue Million Forecast, by Component 2019 & 2032

- Table 30: Global APAC Data Center Networking Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 31: Global APAC Data Center Networking Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: United Kingdom APAC Data Center Networking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Germany APAC Data Center Networking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: France APAC Data Center Networking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Italy APAC Data Center Networking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Spain APAC Data Center Networking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Russia APAC Data Center Networking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Benelux APAC Data Center Networking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Nordics APAC Data Center Networking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Rest of Europe APAC Data Center Networking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Global APAC Data Center Networking Market Revenue Million Forecast, by Component 2019 & 2032

- Table 42: Global APAC Data Center Networking Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 43: Global APAC Data Center Networking Market Revenue Million Forecast, by Country 2019 & 2032

- Table 44: Turkey APAC Data Center Networking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Israel APAC Data Center Networking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: GCC APAC Data Center Networking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: North Africa APAC Data Center Networking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: South Africa APAC Data Center Networking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Rest of Middle East & Africa APAC Data Center Networking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Global APAC Data Center Networking Market Revenue Million Forecast, by Component 2019 & 2032

- Table 51: Global APAC Data Center Networking Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 52: Global APAC Data Center Networking Market Revenue Million Forecast, by Country 2019 & 2032

- Table 53: China APAC Data Center Networking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: India APAC Data Center Networking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Japan APAC Data Center Networking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: South Korea APAC Data Center Networking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: ASEAN APAC Data Center Networking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Oceania APAC Data Center Networking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Rest of Asia Pacific APAC Data Center Networking Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Data Center Networking Market?

The projected CAGR is approximately 9.70%.

2. Which companies are prominent players in the APAC Data Center Networking Market?

Key companies in the market include Radware Corporation, Shenzhen Tenda Technology Co Ltd, Fortinet Inc, Arista Networks Inc, Dell EMC, ARRAY NETWORKS INC, Hewlett Packard Enterprise Development LP, Juniper Networks Inc, Extreme Networks Inc, NEC Corporation, A10 Networks Inc, TP-Link Corporation Limited, Moxa Inc *List Not Exhaustive, H3C Holding Limited, VMware Inc.

3. What are the main segments of the APAC Data Center Networking Market?

The market segments include Component, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Need of Cloud Storage and Rsing Demand for Reliable Application Performance; Increasing Cyberattacks Among Enterprises.

6. What are the notable trends driving market growth?

IT and Telecom to Hold Significant Share.

7. Are there any restraints impacting market growth?

Increasing Network Complexity.

8. Can you provide examples of recent developments in the market?

July 2023: Moxa Inc. launched its MDS-G4020-L3-4XGS series of Ethernet switches, a versatile line of Layer 3 full Gigabit modular managed switches that support four 10GbE ports and sixteen Gigabit ports, including four embedded ports. Additionally, the series boasts four interface module expansion slots and two power module slots, providing users with the flexibility required for a wide range of applications.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Data Center Networking Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Data Center Networking Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Data Center Networking Market?

To stay informed about further developments, trends, and reports in the APAC Data Center Networking Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence