Key Insights

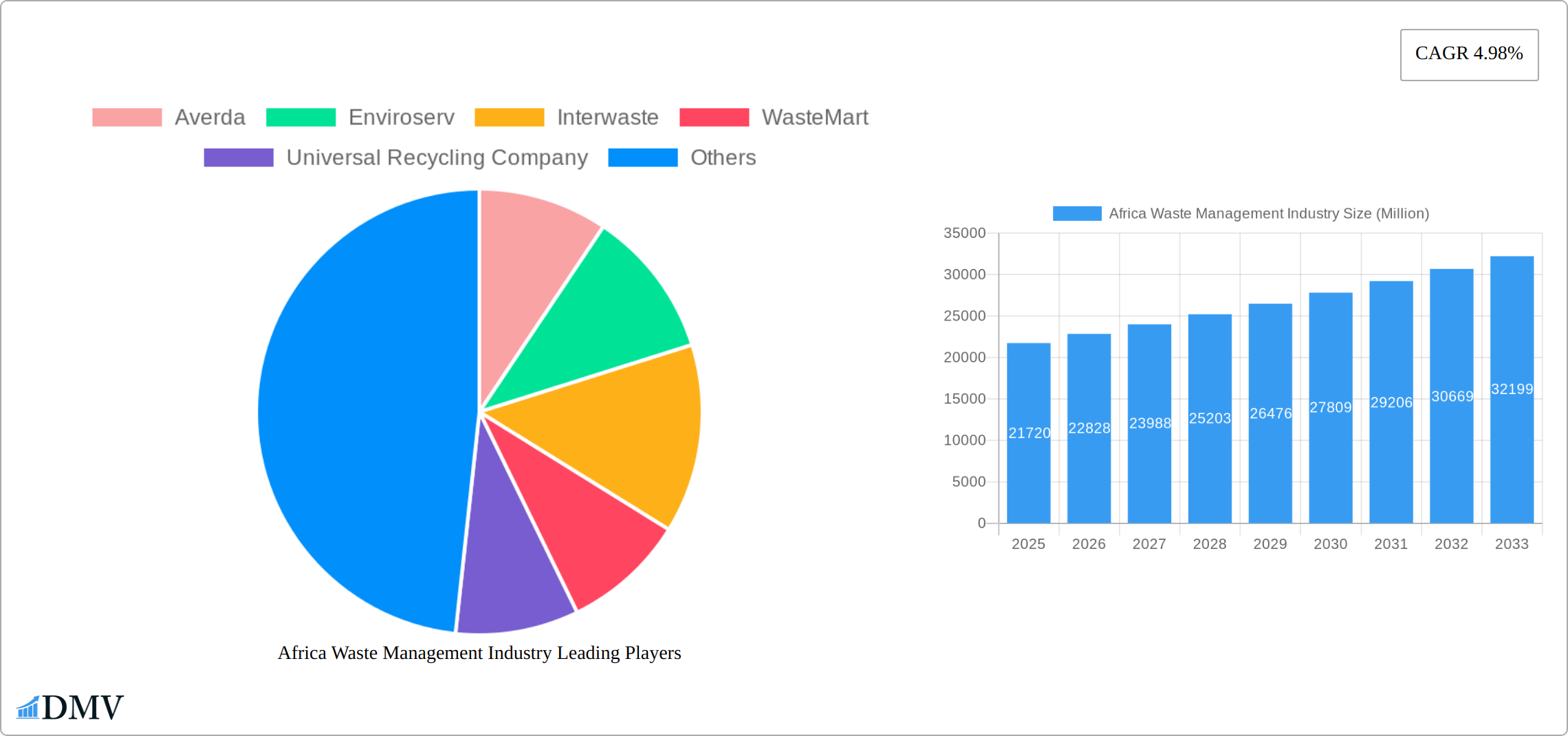

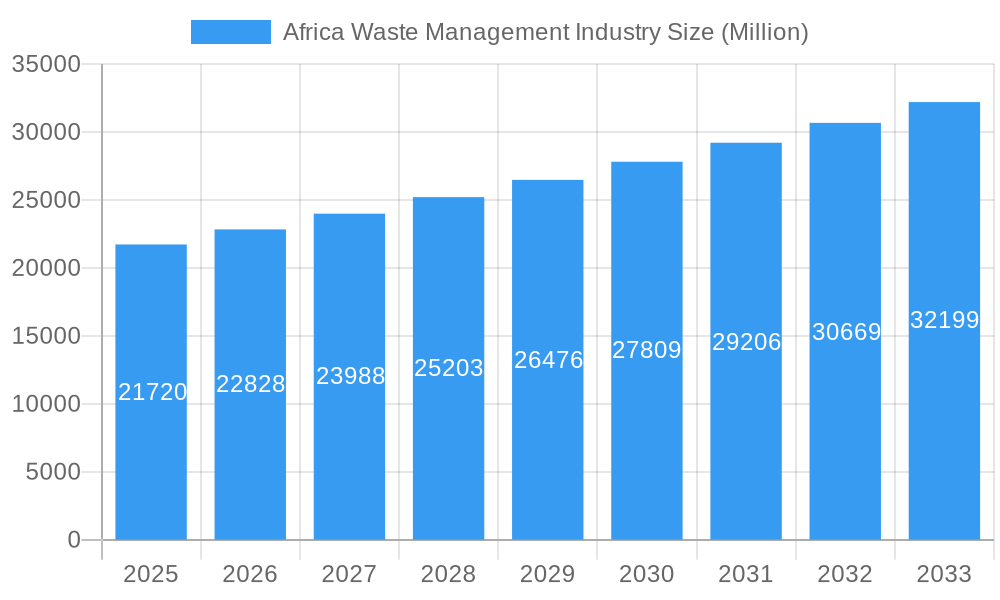

The African waste management industry, currently valued at $21.72 billion in 2025, is poised for significant growth, projected to expand at a compound annual growth rate (CAGR) of 4.98% from 2025 to 2033. This growth is fueled by several key factors. Rapid urbanization across the continent is leading to increased waste generation, creating a pressing need for efficient waste management solutions. Furthermore, rising environmental awareness among governments and citizens is driving demand for sustainable waste disposal methods, including recycling and composting initiatives. Increased investment in infrastructure development, particularly in waste collection and processing facilities, is also contributing to market expansion. Challenges remain, however, including inadequate funding, limited technological adoption in certain regions, and inconsistent waste management regulations across different countries. The industry is fragmented, with a mix of large multinational companies like Averda and Enviroserv, alongside smaller local players and informal waste pickers. This presents opportunities for consolidation and the development of innovative, technology-driven solutions tailored to the diverse needs of the African landscape.

Africa Waste Management Industry Market Size (In Billion)

The industry's segmentation is largely driven by waste type (municipal solid waste, industrial waste, hazardous waste, etc.) and service type (collection, processing, recycling, disposal). Key market trends include the increasing adoption of public-private partnerships to finance waste management projects, the rise of circular economy models promoting waste reduction and resource recovery, and a growing focus on improving waste worker safety and welfare. Companies are focusing on technological advancements, such as smart waste bins, waste-to-energy plants, and advanced recycling technologies, to enhance efficiency and sustainability. The forecast period of 2025-2033 will be marked by substantial investment in infrastructure and technological solutions to address the growing waste management challenges and opportunities in Africa.

Africa Waste Management Industry Company Market Share

Africa Waste Management Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the burgeoning Africa Waste Management Industry, offering a comprehensive overview of market dynamics, key players, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an indispensable resource for stakeholders seeking to navigate this rapidly evolving sector. The report leverages extensive data analysis from the historical period (2019-2024) and incorporates recent key developments to provide accurate projections and actionable intelligence. The total market size is predicted to reach XXX Million by 2033.

Africa Waste Management Industry Market Composition & Trends

This section provides a comprehensive analysis of the African waste management market's competitive dynamics. We delve into market concentration, identify key innovation drivers, scrutinize the evolving regulatory landscape, assess the impact of substitute products, profile key end-user segments, and examine the significance of mergers and acquisitions (M&A) activity. Our analysis maps out market share distribution among prominent players and quantifies the financial implications of notable M&A transactions.

-

Market Concentration: The African waste management sector is characterized by a dynamic blend of established multinational corporations and agile, locally-rooted enterprises. Market share is currently divided among key entities such as Averda, Enviroserv, and Interwaste, alongside numerous smaller players who hold considerable regional influence. While precise market share figures are subject to ongoing analysis, estimations indicate that the top 5 players collectively manage approximately [Insert Estimated Percentage]% of the market, with the remaining share being fragmented across a broader spectrum of providers.

-

Innovation Catalysts: A confluence of escalating urbanization, heightened environmental consciousness, and increasingly supportive government policies are acting as powerful catalysts for innovation within waste management. This is particularly evident in the development and adoption of advanced waste-to-energy solutions and cutting-edge recycling technologies designed to maximize resource recovery and minimize landfill dependency.

-

Regulatory Landscape: The regulatory environment governing waste management in Africa presents a complex tapestry, varying significantly from nation to nation and presenting both hurdles and opportunities. While certain countries have enacted robust regulations to champion recycling and waste reduction initiatives, others are still in the nascent stages of developing comprehensive waste management policies, creating a patchwork of compliance requirements.

-

Substitute Products: The market's reliance on and the cost-effectiveness of traditional waste disposal methods, such as landfills, continue to influence the adoption rate of more advanced waste management solutions. While cheaper alternatives pose a competitive challenge, the burgeoning global and local emphasis on environmental sustainability is steadily propelling the demand for greener and more circular economy-aligned waste management practices.

-

End-User Profiles: Our analysis meticulously dissects end-user demand across a diverse range of sectors, including residential, commercial, industrial, and municipal waste streams. This profiling highlights the distinct needs, operational requirements, and evolving preferences characteristic of each segment, informing tailored waste management strategies.

-

M&A Activities: Recent significant M&A transactions, exemplified by the strategic acquisition of EnviroServ by SUEZ, underscore the growing international interest and investment in the African waste management landscape. The cumulative value of M&A deals observed between 2019 and 2024 is estimated at [Insert Estimated Value] Million, signifying robust activity and a strategic drive towards industry consolidation and capacity expansion.

Africa Waste Management Industry Industry Evolution

This section provides a detailed examination of the African waste management industry's evolutionary trajectory. We meticulously analyze market growth trends, technological breakthroughs, and the shifting landscape of consumer preferences. Our report presents specific data points, including historical growth rates and the adoption metrics of key waste management technologies. The industry has demonstrated a robust and significant growth pattern in recent years, primarily propelled by the accelerating pace of urbanization and a burgeoning environmental consciousness across the continent.

The sector is undergoing a profound transformation, driven by a synergistic combination of increasingly stringent government regulations, rapid technological advancements (such as the implementation of AI-powered waste sorting systems and the widespread adoption of anaerobic digestion for biogas generation), and a dynamic consumer base that is actively seeking more eco-friendly and sustainable waste management solutions. The market is projected to expand at a Compound Annual Growth Rate (CAGR) of approximately [Insert Projected CAGR]% from 2025 to 2033, with an anticipated market valuation reaching an estimated [Insert Projected Market Value] Million by the end of the forecast period. The adoption of sophisticated recycling technologies is progressively gaining momentum, with an estimated market penetration of [Insert Estimated Adoption Percentage]% anticipated by 2033. The increasing involvement of the private sector in spearheading waste management projects further attests to the industry's sustained growth and considerable future potential.

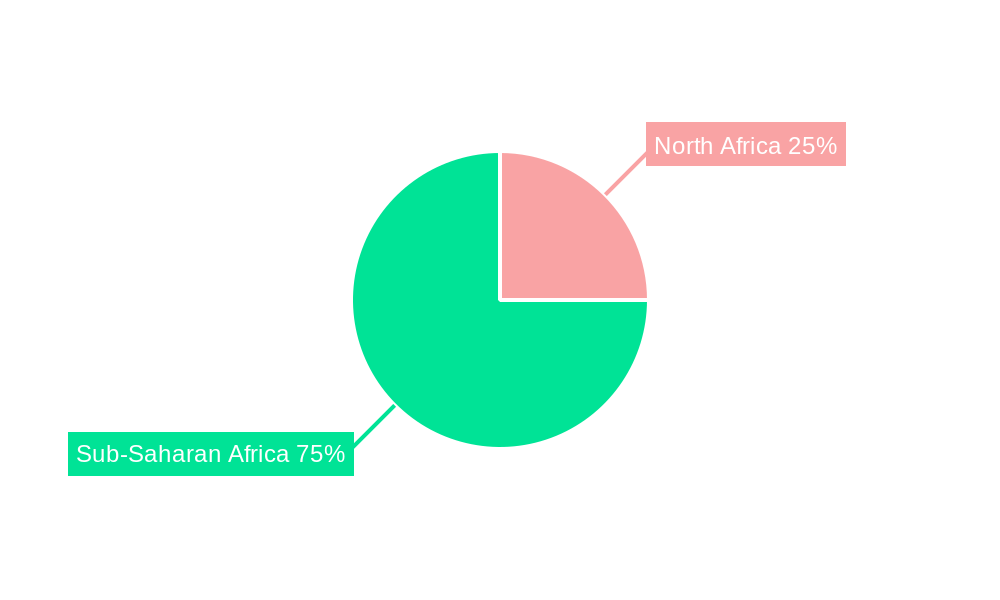

Leading Regions, Countries, or Segments in Africa Waste Management Industry

This section identifies the dominant regions, countries, and segments within the African waste management market. We analyze the key factors contributing to their dominance, focusing on investment trends and regulatory support.

Key Drivers:

- South Africa: South Africa's robust regulatory framework, significant investments in waste management infrastructure, and well-established private sector participation makes it the leading market.

- North Africa: Strong government initiatives and increasing urbanization contribute to rapid growth in North African nations like Egypt and Morocco.

- East Africa: Kenya and Tanzania are experiencing substantial growth driven by rising environmental awareness and increased foreign investment.

Dominance Factors: The dominance of specific regions and countries is driven by several factors including; existing infrastructure, government policies and regulations, economic development and funding for waste management projects. South Africa, for instance, benefits from a relatively developed infrastructure and a supportive regulatory environment that attracts substantial investment from international players.

Africa Waste Management Industry Product Innovations

The African waste management industry is currently experiencing a surge in product innovation, driven by the imperative to develop solutions that are not only efficient and cost-effective but also environmentally benign. Emerging technologies are being actively developed and deployed, including advanced sorting systems that leverage artificial intelligence and machine learning to significantly enhance recycling rates. Waste-to-energy technologies are also gaining considerable traction, presenting a sustainable pathway for waste management while simultaneously generating valuable renewable energy. The overarching objective of these innovations is to enhance operational efficiency, minimize environmental footprints, and unlock significant economic opportunities inherent in waste streams.

Propelling Factors for Africa Waste Management Industry Growth

A confluence of influential factors is actively propelling the growth of the African waste management industry. The relentless pace of urbanization directly correlates with an increasing volume of waste requiring sophisticated management. A heightened global and local environmental awareness among both consumers and governing bodies is actively stimulating demand for sustainable waste management alternatives. Supportive government regulations, encompassing mandates for recycling, waste reduction, and extended producer responsibility, are instrumental in fostering a more structured market, thereby incentivizing both investment and innovation. Furthermore, the observed rise in disposable income across numerous African nations is significantly boosting private sector investment in comprehensive waste management services and infrastructure development.

Obstacles in the Africa Waste Management Industry Market

Notwithstanding its substantial growth potential, the African waste management market is confronted by several formidable challenges. Pervasive infrastructural deficiencies in many regions impede the efficient collection, transportation, and processing of waste materials. The inconsistency and variability of regulatory frameworks across different African nations create significant complexities for businesses operating on a multi-regional scale, necessitating adaptive compliance strategies. Moreover, persistent funding gaps and investment constraints often hinder the development and large-scale implementation of advanced waste management technologies. The presence and activity of informal waste pickers can also present unique challenges, sometimes disrupting established formal waste management systems and collection pathways.

Future Opportunities in Africa Waste Management Industry

The African waste management market presents several exciting opportunities for growth. The expansion of waste-to-energy technologies offers a substantial opportunity for renewable energy generation. Opportunities also exist in improving recycling infrastructure and rates, especially for plastics and other valuable recyclables. The growing focus on sustainable waste management solutions presents opportunities for investors in green technologies. Moreover, the emergence of innovative digital solutions and waste management applications is further increasing efficiencies.

Major Players in the Africa Waste Management Industry Ecosystem

- Averda

- Enviroserv

- Interwaste

- WasteMart

- Universal Recycling Company

- Desco

- PETCO

- The Glass Recycling Company

- Oricol Environmental Services SA (PTY) LTD

- WeCyclers

- The Waste Group (Pty) Ltd

- SA Waste (PTY) Ltd

(List Not Exhaustive)

Key Developments in Africa Waste Management Industry Industry

- October 2022: SUEZ, Royal Bafokeng Holdings (RBH), and African Infrastructure Investment Managers (AIIM) finalized the acquisition of EnviroServ, strengthening SUEZ's African presence.

- May 2022: IFC provided a USD 30 Million loan to Averda International, supporting its expansion in Africa and the Middle East. This significant investment highlights the growing interest in the private sector within the African waste management market.

Strategic Africa Waste Management Industry Market Forecast

The African waste management industry is poised for significant growth, driven by urbanization, increased environmental awareness, and supportive government policies. Opportunities exist in adopting advanced technologies, improving recycling rates, and developing sustainable waste-to-energy solutions. The market is projected to experience robust growth over the forecast period, with substantial potential for both domestic and international players. The predicted market value for 2033 presents a significant opportunity for investment and growth within this sector.

Africa Waste Management Industry Segmentation

-

1. Waste type

- 1.1. Industrial waste

- 1.2. Municipal solid waste

- 1.3. Hazardous Waste

- 1.4. E-waste

- 1.5. Plastic waste

- 1.6. Bio-medical waste

-

2. Disposal methods

- 2.1. Landfill

- 2.2. Incineration

- 2.3. Dismantling

- 2.4. Recycling

Africa Waste Management Industry Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa Waste Management Industry Regional Market Share

Geographic Coverage of Africa Waste Management Industry

Africa Waste Management Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.98% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increasing Awareness towards the Waste Management

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Waste Management Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Waste type

- 5.1.1. Industrial waste

- 5.1.2. Municipal solid waste

- 5.1.3. Hazardous Waste

- 5.1.4. E-waste

- 5.1.5. Plastic waste

- 5.1.6. Bio-medical waste

- 5.2. Market Analysis, Insights and Forecast - by Disposal methods

- 5.2.1. Landfill

- 5.2.2. Incineration

- 5.2.3. Dismantling

- 5.2.4. Recycling

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Waste type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Averda

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Enviroserv

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Interwaste

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 WasteMart

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Universal Recycling Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Desco

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 PETCO

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 The Glass Recycling Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Oricol Environmental Services SA (PTY) LTD

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 WeCyclers

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 The Waste Group (Pty) Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 SA Waste (PTY) Ltd **List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Averda

List of Figures

- Figure 1: Africa Waste Management Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Africa Waste Management Industry Share (%) by Company 2025

List of Tables

- Table 1: Africa Waste Management Industry Revenue Million Forecast, by Waste type 2020 & 2033

- Table 2: Africa Waste Management Industry Volume Billion Forecast, by Waste type 2020 & 2033

- Table 3: Africa Waste Management Industry Revenue Million Forecast, by Disposal methods 2020 & 2033

- Table 4: Africa Waste Management Industry Volume Billion Forecast, by Disposal methods 2020 & 2033

- Table 5: Africa Waste Management Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Africa Waste Management Industry Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Africa Waste Management Industry Revenue Million Forecast, by Waste type 2020 & 2033

- Table 8: Africa Waste Management Industry Volume Billion Forecast, by Waste type 2020 & 2033

- Table 9: Africa Waste Management Industry Revenue Million Forecast, by Disposal methods 2020 & 2033

- Table 10: Africa Waste Management Industry Volume Billion Forecast, by Disposal methods 2020 & 2033

- Table 11: Africa Waste Management Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Africa Waste Management Industry Volume Billion Forecast, by Country 2020 & 2033

- Table 13: Nigeria Africa Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Nigeria Africa Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: South Africa Africa Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: South Africa Africa Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: Egypt Africa Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Egypt Africa Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Kenya Africa Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Kenya Africa Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Ethiopia Africa Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Ethiopia Africa Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Morocco Africa Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Morocco Africa Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Ghana Africa Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Ghana Africa Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Algeria Africa Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Algeria Africa Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Tanzania Africa Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Tanzania Africa Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Ivory Coast Africa Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Ivory Coast Africa Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Waste Management Industry?

The projected CAGR is approximately 4.98%.

2. Which companies are prominent players in the Africa Waste Management Industry?

Key companies in the market include Averda, Enviroserv, Interwaste, WasteMart, Universal Recycling Company, Desco, PETCO, The Glass Recycling Company, Oricol Environmental Services SA (PTY) LTD, WeCyclers, The Waste Group (Pty) Ltd, SA Waste (PTY) Ltd **List Not Exhaustive.

3. What are the main segments of the Africa Waste Management Industry?

The market segments include Waste type, Disposal methods.

4. Can you provide details about the market size?

The market size is estimated to be USD 21.72 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increasing Awareness towards the Waste Management.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

October 2022- In line with the conditions stated on June 9, 2022, SUEZ, Royal Bafokeng Holdings (RBH), and African Infrastructure Investment Managers (AIIM) finalized the acquisition of EnviroServ Proprietary Holdings Ltd and its subsidiaries (collectively, "EnviroServ") after receiving permission from the regional antitrust authorities. By this purchase, SUEZ will be able to solidify both its presence in Africa and its position as a global leader in the treatment of municipal and industrial waste.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Waste Management Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Waste Management Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Waste Management Industry?

To stay informed about further developments, trends, and reports in the Africa Waste Management Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence