Key Insights

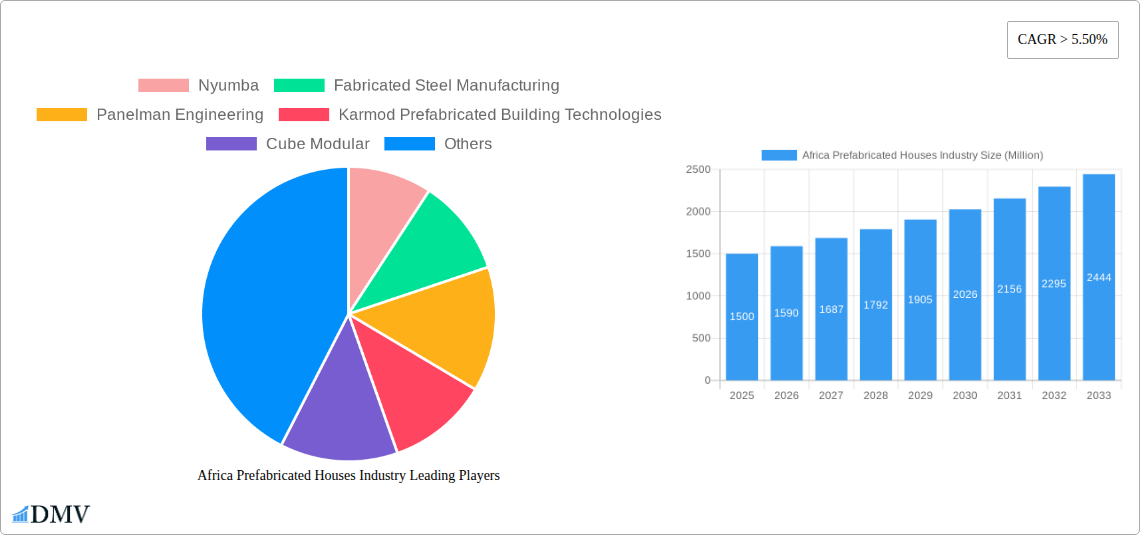

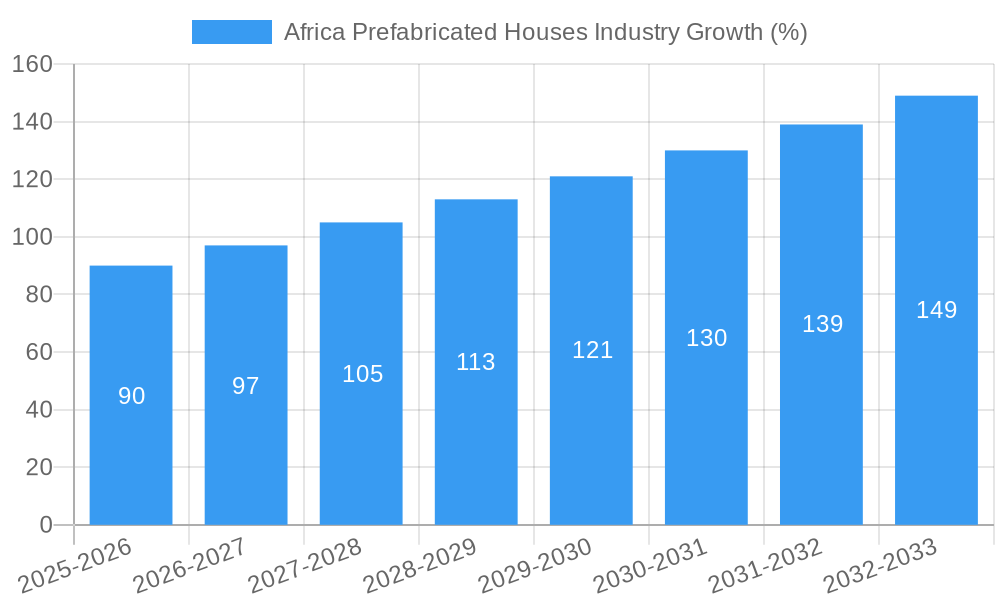

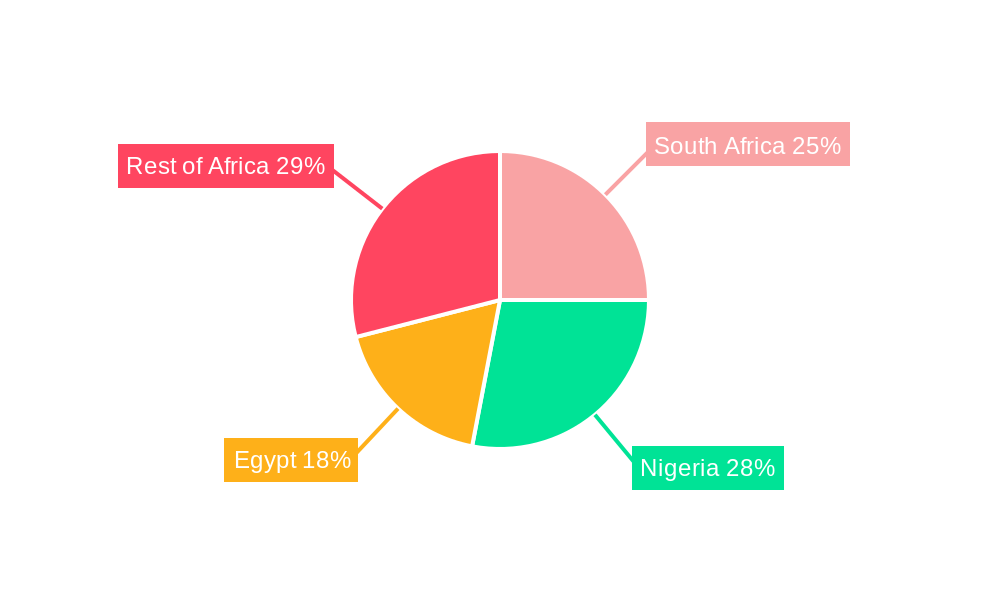

The African prefabricated houses market is experiencing robust growth, driven by factors such as rapid urbanization, increasing construction costs of traditional houses, and a growing need for affordable and quickly deployable housing solutions. The market's Compound Annual Growth Rate (CAGR) exceeding 5.50% signifies a significant expansion, projected to continue throughout the forecast period (2025-2033). Key market segments include single-family and multi-family dwellings, with Nigeria, Egypt, and South Africa representing the largest national markets. The industry benefits from a relatively lower labor cost compared to traditional construction, faster construction times, and reduced material waste, making prefabricated housing a cost-effective solution, especially in regions with limited skilled labor. Furthermore, government initiatives promoting affordable housing and sustainable construction practices are further boosting market growth. Companies like Nyumba, Karmod, and Cube Modular are actively shaping the market landscape through innovation and expansion, offering diverse product lines and catering to varying customer needs. However, challenges remain, including infrastructure limitations in certain regions and the need for increased awareness and acceptance of prefabricated housing among consumers. The market's growth trajectory presents attractive opportunities for both established players and new entrants, particularly those focused on sustainable and technologically advanced building solutions tailored to the specific requirements of the African context.

The substantial growth in the African prefabricated housing sector is further fueled by the increasing demand for resilient and disaster-resistant housing, especially in regions prone to natural calamities. Prefabricated structures are often designed to withstand harsh weather conditions more effectively than traditional construction methods. The ongoing advancements in prefabrication technology, such as the integration of smart home features and sustainable materials, are also significantly impacting the market. Moreover, the rising middle class across various African nations is directly impacting the demand for better housing, thus strengthening the market's growth potential. While challenges remain in terms of regulatory frameworks and standardization, the overall outlook for the African prefabricated houses market remains extremely positive, indicating substantial investment opportunities and promising returns for stakeholders involved in the construction and real estate sectors. Future growth will likely hinge on effective collaborations between governments, private sector companies, and research institutions to promote sustainable, technologically advanced, and affordable housing solutions across the African continent.

Africa Prefabricated Houses Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the burgeoning Africa Prefabricated Houses industry, offering a comprehensive overview of market dynamics, key players, and future growth prospects. Covering the period 2019-2033, with a focus on 2025, this report is an essential resource for stakeholders seeking to understand and capitalize on this rapidly expanding sector. The market is projected to reach xx Million by 2033.

Africa Prefabricated Houses Industry Market Composition & Trends

This section delves into the intricate structure of the African prefabricated houses market, examining its concentration, innovation drivers, regulatory landscape, and competitive dynamics. We analyze the market share distribution among key players, including Nyumba, Fabricated Steel Manufacturing, Panelman Engineering, Karmod Prefabricated Building Technologies, Cube Modular, Concretex, Kwikspace Modular Buildings Ltd, M Projects, House-it Building, and Global Africa Prefabricated Building Solutions Ltd (list not exhaustive). The report also assesses the impact of M&A activities, with an estimated xx Million in deal value recorded during the historical period.

- Market Concentration: The market exhibits a [Describe concentration level - e.g., moderately concentrated] structure, with the top five players holding an estimated xx% market share in 2024.

- Innovation Catalysts: Growing urbanization, increasing demand for affordable housing, and government initiatives promoting sustainable construction are driving innovation in design, materials, and construction techniques.

- Regulatory Landscape: A detailed analysis of building codes, permits, and environmental regulations across key African countries influencing the market. Specific regulatory challenges and opportunities are highlighted, considering regional variations.

- Substitute Products: Competition from conventional construction methods is analyzed, along with the examination of substitute materials and their market impact.

- End-User Profiles: This section profiles the diverse end-users, including government agencies, private developers, and individual homeowners, along with their specific needs and preferences impacting market demand.

- M&A Activities: The report tracks significant mergers and acquisitions in the industry, assessing their impact on market consolidation and competitive dynamics.

Africa Prefabricated Houses Industry Industry Evolution

This section meticulously charts the evolution of the African prefabricated houses industry, analyzing its growth trajectory, technological advancements, and the evolving preferences of consumers. From 2019 to 2024, the market experienced a Compound Annual Growth Rate (CAGR) of xx%, driven by [mention specific drivers, e.g., rising disposable incomes, government housing initiatives]. The forecast period (2025-2033) projects a CAGR of xx%, reflecting the sustained demand and ongoing technological advancements. This section explores the impact of technological innovations such as 3D printing and modular construction, along with shifting consumer preferences towards sustainable and aesthetically pleasing designs. Adoption rates of new technologies and materials are quantified, providing a granular understanding of industry transformation. The analysis also incorporates the influence of macroeconomic factors such as economic growth, population dynamics, and urbanization rates on market growth.

Leading Regions, Countries, or Segments in Africa Prefabricated Houses Industry

This section identifies the leading regions, countries, and segments within the African prefabricated houses market. While specific market share data requires further analysis, several regions and segments are likely to hold prominent positions.

By Country:

- Nigeria: High population growth and urbanization drive significant demand. Investment in infrastructure projects and government housing schemes further contribute to its leading role.

- Egypt: Similar to Nigeria, a large population and ongoing urbanization contribute to robust market growth. Government initiatives and private sector investments play a crucial role.

- South Africa: A relatively advanced construction sector and higher disposable incomes among a segment of the population fuel this market.

- Rest of Africa: This segment presents immense potential for growth due to burgeoning populations and developing economies, although significant infrastructure challenges need to be addressed.

By Type:

- Single Family: This segment is expected to dominate owing to increased demand for affordable single-family homes.

- Multi-Family: This segment shows promising growth due to the rise in urban populations and the need for high-density housing solutions.

The dominance of specific regions and segments is analyzed in-depth, exploring factors such as infrastructure development, government policies, economic growth rates, and consumer preferences.

Africa Prefabricated Houses Industry Product Innovations

The African prefabricated houses market is witnessing a surge in product innovations, driven by a need for cost-effective, sustainable, and adaptable housing solutions. Manufacturers are incorporating advanced materials, such as lightweight steel and composite panels, to enhance durability and reduce construction time. Innovations include prefabricated modular units designed for easy assembly and customization, catering to diverse climatic conditions and consumer preferences. Smart home integration is also gaining traction, offering energy-efficient features and enhanced security. These innovations are enhancing the unique selling propositions of prefabricated houses, promoting their widespread adoption across different segments.

Propelling Factors for Africa Prefabricated Houses Industry Growth

Several key factors are driving the growth of the African prefabricated houses market:

- Rapid Urbanization: The rapid movement of populations to urban centers necessitates the development of affordable and sustainable housing solutions.

- Government Initiatives: Government support for affordable housing and infrastructure development is creating a favorable environment for market expansion.

- Technological Advancements: Innovations in design, materials, and construction techniques are lowering costs and improving the quality of prefabricated houses.

- Cost-Effectiveness: Prefabricated construction often presents a more cost-effective solution compared to traditional methods.

Obstacles in the Africa Prefabricated Houses Industry Market

Despite the positive outlook, several obstacles hinder the growth of the African prefabricated houses market:

- Infrastructure Challenges: Inadequate infrastructure in some regions increases transportation and logistics costs.

- Regulatory Hurdles: Varying building codes and regulations across different countries can create complexities and delays in project implementation.

- Skills Gap: A shortage of skilled labor specialized in prefabricated construction techniques can impede project completion.

- Financing Constraints: Securing adequate funding for large-scale housing projects can be challenging, particularly for smaller developers.

Future Opportunities in Africa Prefabricated Houses Industry

The African prefabricated houses market presents significant future opportunities:

- Expansion into Underserved Markets: Many African regions still lack access to affordable housing, offering immense potential for market expansion.

- Technological Advancements: The integration of new technologies, such as 3D printing and sustainable building materials, will further enhance the efficiency and sustainability of prefabricated construction.

- Government Partnerships: Collaboration between the private sector and governments can unlock large-scale housing projects, fueling market growth.

Major Players in the Africa Prefabricated Houses Industry Ecosystem

- Nyumba

- Fabricated Steel Manufacturing

- Panelman Engineering

- Karmod Prefabricated Building Technologies

- Cube Modular

- Concretex

- Kwikspace Modular Buildings Ltd

- M Projects

- House-it Building

- Global Africa Prefabricated Building Solutions Ltd

Key Developments in Africa Prefabricated Houses Industry Industry

- May 2023: Amsterdam-based architecture firm NLE develops a new prefab housing structure, installing a model in Cape Verde to assess the viability of floating houses as a cost-effective solution.

- January 2022: Addis Ababa City Administration lays the foundation for 5,000 prefabricated houses and announces plans to build 2 Million houses over ten years, addressing the city's housing shortage.

Strategic Africa Prefabricated Houses Industry Market Forecast

The African prefabricated houses market is poised for significant growth over the forecast period (2025-2033), driven by increasing urbanization, supportive government policies, and technological advancements. The market's expansion will be influenced by factors such as economic growth, infrastructure development, and evolving consumer preferences. The continued innovation in design, materials, and construction techniques, coupled with the growing demand for affordable and sustainable housing, presents lucrative opportunities for industry players. The market is expected to reach xx Million by 2033, representing substantial growth potential.

Africa Prefabricated Houses Industry Segmentation

-

1. Type

- 1.1. Single Family

- 1.2. Multi Family

Africa Prefabricated Houses Industry Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa Prefabricated Houses Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growth in Commercial Activities and Increased Competition4.; Increasing Demand for Affordable Housing Units

- 3.3. Market Restrains

- 3.3.1. 4.; Lack of Housing Spaces and Mortgage Regulation can Create Challenges

- 3.4. Market Trends

- 3.4.1. Shift Towards Prefab Housing due to High Pricing in Egypt

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Prefabricated Houses Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Single Family

- 5.1.2. Multi Family

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. South Africa Africa Prefabricated Houses Industry Analysis, Insights and Forecast, 2019-2031

- 7. Sudan Africa Prefabricated Houses Industry Analysis, Insights and Forecast, 2019-2031

- 8. Uganda Africa Prefabricated Houses Industry Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania Africa Prefabricated Houses Industry Analysis, Insights and Forecast, 2019-2031

- 10. Kenya Africa Prefabricated Houses Industry Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa Africa Prefabricated Houses Industry Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Nyumba

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Fabricated Steel Manufacturing

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Panelman Engineering

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Karmod Prefabricated Building Technologies

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Cube Modular

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Concretex

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Kwikspace Modular Buildings Ltd

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 M Projects**List Not Exhaustive

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 House-it Building

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Global Africa Prefabricated Building Solutions Ltd

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Nyumba

List of Figures

- Figure 1: Africa Prefabricated Houses Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Africa Prefabricated Houses Industry Share (%) by Company 2024

List of Tables

- Table 1: Africa Prefabricated Houses Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Africa Prefabricated Houses Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Africa Prefabricated Houses Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Africa Prefabricated Houses Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: South Africa Africa Prefabricated Houses Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Sudan Africa Prefabricated Houses Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Uganda Africa Prefabricated Houses Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Tanzania Africa Prefabricated Houses Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Kenya Africa Prefabricated Houses Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of Africa Africa Prefabricated Houses Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Africa Prefabricated Houses Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 12: Africa Prefabricated Houses Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Nigeria Africa Prefabricated Houses Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: South Africa Africa Prefabricated Houses Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Egypt Africa Prefabricated Houses Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Kenya Africa Prefabricated Houses Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Ethiopia Africa Prefabricated Houses Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Morocco Africa Prefabricated Houses Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Ghana Africa Prefabricated Houses Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Algeria Africa Prefabricated Houses Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Tanzania Africa Prefabricated Houses Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Ivory Coast Africa Prefabricated Houses Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Prefabricated Houses Industry?

The projected CAGR is approximately > 5.50%.

2. Which companies are prominent players in the Africa Prefabricated Houses Industry?

Key companies in the market include Nyumba, Fabricated Steel Manufacturing, Panelman Engineering, Karmod Prefabricated Building Technologies, Cube Modular, Concretex, Kwikspace Modular Buildings Ltd, M Projects**List Not Exhaustive, House-it Building, Global Africa Prefabricated Building Solutions Ltd.

3. What are the main segments of the Africa Prefabricated Houses Industry?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growth in Commercial Activities and Increased Competition4.; Increasing Demand for Affordable Housing Units.

6. What are the notable trends driving market growth?

Shift Towards Prefab Housing due to High Pricing in Egypt.

7. Are there any restraints impacting market growth?

4.; Lack of Housing Spaces and Mortgage Regulation can Create Challenges.

8. Can you provide examples of recent developments in the market?

May 2023: A new prefab housing structure is under development by Amsterdam-based architecture firm NLE. They installed a model in Africa's Cape Verde to understand its viability's various aspects as floating houses. The idea is to reduce the overall cost emanating from land prices.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Prefabricated Houses Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Prefabricated Houses Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Prefabricated Houses Industry?

To stay informed about further developments, trends, and reports in the Africa Prefabricated Houses Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence