Key Insights

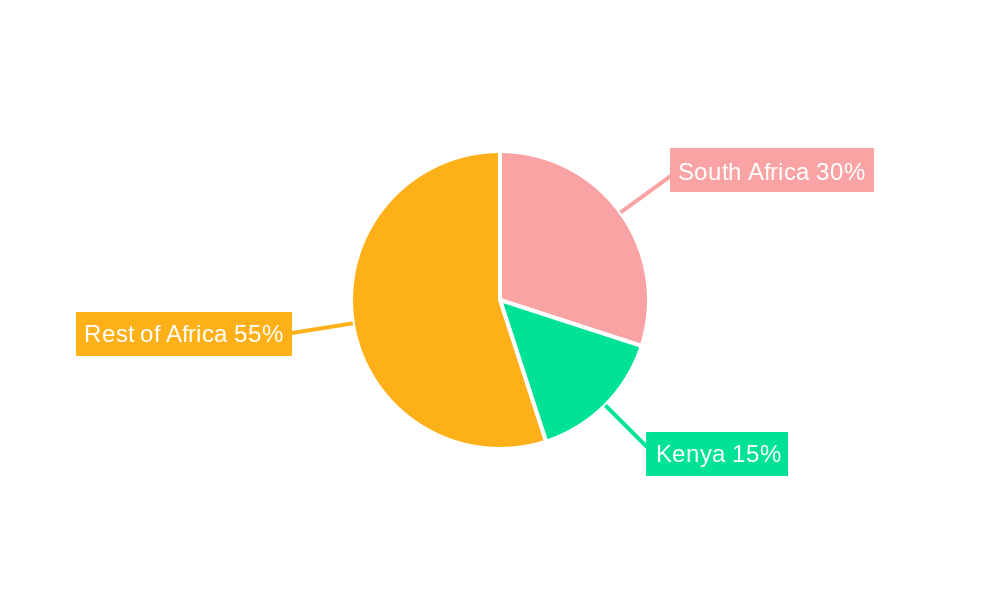

The African endoscopy devices market, valued at approximately $50 million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 7.20% from 2025 to 2033. This expansion is driven by several key factors. Increasing prevalence of chronic diseases like gastrointestinal cancers and respiratory ailments necessitates advanced diagnostic and minimally invasive treatment procedures, fueling demand for endoscopy devices. Furthermore, rising healthcare expenditure, coupled with government initiatives to improve healthcare infrastructure across several African nations, is creating a favorable environment for market growth. The increasing adoption of minimally invasive surgical techniques, preference for advanced visualization systems, and the growing number of specialized medical centers are also contributing factors. The market is segmented by device type (endoscopes, robot-assisted endoscopes, visualization systems), application (gastroenterology, pulmonology, cardiology, urology, neurology, gynecology, and other applications), and geographic regions within Africa, with South Africa, Kenya, and other rapidly developing nations emerging as significant markets. Challenges remain, however, such as limited healthcare infrastructure in some areas, high costs associated with advanced technology, and a shortage of trained medical professionals capable of operating and maintaining sophisticated endoscopy equipment.

Despite these constraints, the long-term outlook for the African endoscopy devices market remains positive. The market is expected to benefit from ongoing technological advancements, including the development of smaller, more flexible endoscopes and improved imaging capabilities. The increasing availability of training programs for medical professionals and the growing partnerships between international medical device manufacturers and local healthcare providers will help overcome existing challenges and accelerate market penetration. The market's potential for future growth is significant, driven by a rising population, increasing urbanization, and the growing awareness of the benefits of minimally invasive procedures. Focus on affordable and accessible solutions will be crucial for widespread market adoption across the diverse African landscape.

Africa Endoscopy Device Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the burgeoning Africa endoscopy device industry, offering invaluable market intelligence for stakeholders seeking to navigate this dynamic landscape. The study covers the period 2019-2033, with a focus on the forecast period 2025-2033 and a base year of 2025. The market size is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period. This comprehensive analysis delves into market segmentation, competitive dynamics, technological advancements, and future opportunities, providing crucial data points for informed decision-making.

Africa Endoscopy Device Industry Market Composition & Trends

This section evaluates the competitive landscape of the African endoscopy device market, analyzing market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and merger and acquisition (M&A) activities. The market is moderately fragmented, with key players such as Steris Corporation, Olympus Medical Systems Corporation, Medtronic PLC, Richard Wolf GmbH, Stryker Corporation, Karl Storz GmbH & Co KG, Johnson & Johnson, B Braun Melsungen AG, Boston Scientific Corporation, and Fujifilm Holdings Corporation holding significant, but not dominant, market share.

- Market Share Distribution: Olympus and Medtronic currently hold the largest market share, estimated at xx% and xx% respectively in 2025. Other players collectively account for the remaining xx%.

- Innovation Catalysts: Increasing prevalence of chronic diseases, technological advancements in minimally invasive surgical procedures, and government initiatives promoting healthcare infrastructure development are key innovation drivers.

- Regulatory Landscape: Regulatory approval processes vary across African nations, presenting both opportunities and challenges for market entry. Harmonization efforts are underway to streamline regulations.

- Substitute Products: While endoscopy remains the gold standard for many procedures, alternative techniques like laparoscopy pose some competitive pressure, depending on specific applications.

- End-User Profiles: Hospitals and specialized clinics constitute the primary end-users. However, the growing number of ambulatory surgical centers is emerging as a new segment.

- M&A Activities: The market has witnessed xx M&A deals in the last five years, with an aggregate value of approximately xx Million. These activities have primarily focused on expanding product portfolios and market reach.

Africa Endoscopy Device Industry Industry Evolution

The Africa endoscopy device market has experienced significant growth, driven by factors such as rising healthcare expenditure, increasing awareness of minimally invasive procedures, and improving healthcare infrastructure. The historical period (2019-2024) witnessed a CAGR of xx%, while the forecast period (2025-2033) is projected to experience a CAGR of xx%. Technological advancements, particularly in areas like robotic-assisted endoscopy and advanced visualization systems (4K, 3D, NBI), have substantially improved diagnostic and therapeutic capabilities, driving market expansion. The demand for high-quality, reliable endoscopy devices is steadily increasing, influenced by changing consumer expectations and preference for minimally invasive interventions. Specific applications, such as gastroenterology, are experiencing rapid growth due to the increasing prevalence of gastrointestinal diseases. The adoption rate of advanced endoscopy technologies is growing at an estimated xx% annually, highlighting the progressive nature of the market.

Leading Regions, Countries, or Segments in Africa Endoscopy Device Industry

The South Africa and Egypt markets currently dominate the African endoscopy device industry, accounting for an estimated xx% of the total market revenue in 2025. North Africa shows faster growth rate compared to sub-Saharan Africa. This dominance is attributed to several factors:

- Key Drivers in South Africa and Egypt:

- Higher healthcare expenditure per capita.

- Well-established healthcare infrastructure.

- Increased investment in medical technology.

- Favorable government policies and regulatory frameworks.

- Dominance Factors:

- High concentration of hospitals and specialized clinics.

- Greater awareness and adoption of minimally invasive procedures.

- Presence of key market players with established distribution networks.

Within the segments, Gastroenterology holds the largest share (xx%), followed by Urology (xx%) and Cardiology (xx%). This is largely due to the high prevalence of gastrointestinal and urological disorders in the region. The growth of robot-assisted endoscopy is significantly lower than traditional endoscopy, but is expected to witness robust growth over the forecast period.

Africa Endoscopy Device Industry Product Innovations

Recent innovations focus on enhancing visualization capabilities, improving device ergonomics, and expanding procedural applications. The introduction of 4K and 3D visualization systems, along with narrow band imaging (NBI) technology, significantly improves diagnostic accuracy. Miniaturized endoscopes and single-use devices are enhancing accessibility and reducing infection risks. These innovations address unmet clinical needs and improve patient outcomes. The development of AI-powered diagnostic tools is emerging as a significant area of technological advancement.

Propelling Factors for Africa Endoscopy Device Industry Growth

Several factors are contributing to the growth of the African endoscopy device market. These include:

- Technological Advancements: Introduction of advanced imaging techniques and robotic-assisted systems.

- Economic Growth: Rising disposable incomes and increasing healthcare expenditure in several African countries.

- Government Initiatives: Investments in healthcare infrastructure and supportive regulatory policies to promote medical technology adoption. Specific examples include programs aimed at improving access to healthcare in underserved communities.

Obstacles in the Africa Endoscopy Device Industry Market

Despite the significant growth potential, the African endoscopy device market faces certain challenges:

- Regulatory Hurdles: Varied regulatory landscapes across different countries creating challenges in market entry and product registration.

- Supply Chain Disruptions: Logistical difficulties and infrastructure limitations can lead to supply chain bottlenecks and increased costs.

- Competitive Pressures: The presence of both international and local players creates intense competition in some segments of the market.

Future Opportunities in Africa Endoscopy Device Industry

The future holds substantial growth opportunities for the African endoscopy device market:

- Expanding Market Reach: Penetration into underserved regions with limited access to advanced medical technologies.

- Technological Advancements: Adoption of AI-powered diagnostic tools and further development of robotic-assisted systems.

- Telemedicine Integration: Integration of endoscopy with telemedicine platforms to extend access to specialists.

Major Players in the Africa Endoscopy Device Industry Ecosystem

- Steris Corporation

- Olympus Medical Systems Corporation

- Medtronic PLC

- Richard Wolf GmbH

- Stryker Corporation

- Karl Storz GmbH & Co KG

- Johnson & Johnson

- B Braun Melsungen AG

- Boston Scientific Corporation

- Fujifilm Holdings Corporation

Key Developments in Africa Endoscopy Device Industry Industry

- September 2022: Sony Corporation, Olympus Corporation, and Sony Olympus Medical Solutions Inc. formed a joint venture to develop a surgical endoscopy system with advanced visualization features (4K, 3D, IR imaging, NBI), impacting the market by introducing cutting-edge technology.

- February 2022: Karl Storz joined the IFC Africa Medical Equipment Facility (AMEF), expanding access to endoscopic equipment for smaller healthcare businesses in East and West Africa. This significantly improves equipment availability in underserved areas.

Strategic Africa Endoscopy Device Industry Market Forecast

The African endoscopy device market is poised for robust growth over the forecast period, driven by technological innovation, increased healthcare spending, and favorable government initiatives. The continued adoption of minimally invasive surgical techniques, coupled with the expansion of healthcare infrastructure, will further propel market expansion. Emerging markets and the adoption of advanced technologies present significant opportunities for market players. The focus on improving access to quality healthcare across the continent will significantly impact the market's growth trajectory.

Africa Endoscopy Device Industry Segmentation

-

1. Endoscopy Devices

-

1.1. Endoscopes

- 1.1.1. Flexible Endoscopes

- 1.1.2. Rigid Endoscopes

- 1.1.3. Capsule Endoscopes

- 1.1.4. Robot-assisted Endoscopes

-

1.2. Endoscopic Operative Devices

- 1.2.1. Irrigation/Suction System

- 1.2.2. Access Devices

- 1.2.3. Wound Protector

- 1.2.4. Insufflation Devices

- 1.2.5. Operative Manual Instruments

- 1.2.6. Other Endoscopic Operative Devices

-

1.3. Visualization Systems

- 1.3.1. Endoscopic Camera

- 1.3.2. SD Visualization System

- 1.3.3. HD Visualization System

-

1.1. Endoscopes

-

2. Application

- 2.1. Gastroenterology

- 2.2. Pulmonology

- 2.3. Cardiology

- 2.4. Urology

- 2.5. Neurology

- 2.6. Gynecology

- 2.7. Other Applications

-

3. Geography

- 3.1. South Africa

- 3.2. Egypt

- 3.3. Nigeria

- 3.4. Kenya

- 3.5. Rest of the Africa

Africa Endoscopy Device Industry Segmentation By Geography

- 1. South Africa

- 2. Egypt

- 3. Nigeria

- 4. Kenya

- 5. Rest of the Africa

Africa Endoscopy Device Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Technological Advancements Leading to Enhanced Applications; Rising Prevalence of Diseases that Require Endoscopy

- 3.3. Market Restrains

- 3.3.1. Infections Associated with Endoscopy; High Cost of Endoscopy Procedures and Equipment

- 3.4. Market Trends

- 3.4.1. Gastroenterology Segment is Expected to Witness a Significant Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Endoscopy Device Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Endoscopy Devices

- 5.1.1. Endoscopes

- 5.1.1.1. Flexible Endoscopes

- 5.1.1.2. Rigid Endoscopes

- 5.1.1.3. Capsule Endoscopes

- 5.1.1.4. Robot-assisted Endoscopes

- 5.1.2. Endoscopic Operative Devices

- 5.1.2.1. Irrigation/Suction System

- 5.1.2.2. Access Devices

- 5.1.2.3. Wound Protector

- 5.1.2.4. Insufflation Devices

- 5.1.2.5. Operative Manual Instruments

- 5.1.2.6. Other Endoscopic Operative Devices

- 5.1.3. Visualization Systems

- 5.1.3.1. Endoscopic Camera

- 5.1.3.2. SD Visualization System

- 5.1.3.3. HD Visualization System

- 5.1.1. Endoscopes

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Gastroenterology

- 5.2.2. Pulmonology

- 5.2.3. Cardiology

- 5.2.4. Urology

- 5.2.5. Neurology

- 5.2.6. Gynecology

- 5.2.7. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. South Africa

- 5.3.2. Egypt

- 5.3.3. Nigeria

- 5.3.4. Kenya

- 5.3.5. Rest of the Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South Africa

- 5.4.2. Egypt

- 5.4.3. Nigeria

- 5.4.4. Kenya

- 5.4.5. Rest of the Africa

- 5.1. Market Analysis, Insights and Forecast - by Endoscopy Devices

- 6. South Africa Africa Endoscopy Device Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Endoscopy Devices

- 6.1.1. Endoscopes

- 6.1.1.1. Flexible Endoscopes

- 6.1.1.2. Rigid Endoscopes

- 6.1.1.3. Capsule Endoscopes

- 6.1.1.4. Robot-assisted Endoscopes

- 6.1.2. Endoscopic Operative Devices

- 6.1.2.1. Irrigation/Suction System

- 6.1.2.2. Access Devices

- 6.1.2.3. Wound Protector

- 6.1.2.4. Insufflation Devices

- 6.1.2.5. Operative Manual Instruments

- 6.1.2.6. Other Endoscopic Operative Devices

- 6.1.3. Visualization Systems

- 6.1.3.1. Endoscopic Camera

- 6.1.3.2. SD Visualization System

- 6.1.3.3. HD Visualization System

- 6.1.1. Endoscopes

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Gastroenterology

- 6.2.2. Pulmonology

- 6.2.3. Cardiology

- 6.2.4. Urology

- 6.2.5. Neurology

- 6.2.6. Gynecology

- 6.2.7. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. South Africa

- 6.3.2. Egypt

- 6.3.3. Nigeria

- 6.3.4. Kenya

- 6.3.5. Rest of the Africa

- 6.1. Market Analysis, Insights and Forecast - by Endoscopy Devices

- 7. Egypt Africa Endoscopy Device Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Endoscopy Devices

- 7.1.1. Endoscopes

- 7.1.1.1. Flexible Endoscopes

- 7.1.1.2. Rigid Endoscopes

- 7.1.1.3. Capsule Endoscopes

- 7.1.1.4. Robot-assisted Endoscopes

- 7.1.2. Endoscopic Operative Devices

- 7.1.2.1. Irrigation/Suction System

- 7.1.2.2. Access Devices

- 7.1.2.3. Wound Protector

- 7.1.2.4. Insufflation Devices

- 7.1.2.5. Operative Manual Instruments

- 7.1.2.6. Other Endoscopic Operative Devices

- 7.1.3. Visualization Systems

- 7.1.3.1. Endoscopic Camera

- 7.1.3.2. SD Visualization System

- 7.1.3.3. HD Visualization System

- 7.1.1. Endoscopes

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Gastroenterology

- 7.2.2. Pulmonology

- 7.2.3. Cardiology

- 7.2.4. Urology

- 7.2.5. Neurology

- 7.2.6. Gynecology

- 7.2.7. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. South Africa

- 7.3.2. Egypt

- 7.3.3. Nigeria

- 7.3.4. Kenya

- 7.3.5. Rest of the Africa

- 7.1. Market Analysis, Insights and Forecast - by Endoscopy Devices

- 8. Nigeria Africa Endoscopy Device Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Endoscopy Devices

- 8.1.1. Endoscopes

- 8.1.1.1. Flexible Endoscopes

- 8.1.1.2. Rigid Endoscopes

- 8.1.1.3. Capsule Endoscopes

- 8.1.1.4. Robot-assisted Endoscopes

- 8.1.2. Endoscopic Operative Devices

- 8.1.2.1. Irrigation/Suction System

- 8.1.2.2. Access Devices

- 8.1.2.3. Wound Protector

- 8.1.2.4. Insufflation Devices

- 8.1.2.5. Operative Manual Instruments

- 8.1.2.6. Other Endoscopic Operative Devices

- 8.1.3. Visualization Systems

- 8.1.3.1. Endoscopic Camera

- 8.1.3.2. SD Visualization System

- 8.1.3.3. HD Visualization System

- 8.1.1. Endoscopes

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Gastroenterology

- 8.2.2. Pulmonology

- 8.2.3. Cardiology

- 8.2.4. Urology

- 8.2.5. Neurology

- 8.2.6. Gynecology

- 8.2.7. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. South Africa

- 8.3.2. Egypt

- 8.3.3. Nigeria

- 8.3.4. Kenya

- 8.3.5. Rest of the Africa

- 8.1. Market Analysis, Insights and Forecast - by Endoscopy Devices

- 9. Kenya Africa Endoscopy Device Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Endoscopy Devices

- 9.1.1. Endoscopes

- 9.1.1.1. Flexible Endoscopes

- 9.1.1.2. Rigid Endoscopes

- 9.1.1.3. Capsule Endoscopes

- 9.1.1.4. Robot-assisted Endoscopes

- 9.1.2. Endoscopic Operative Devices

- 9.1.2.1. Irrigation/Suction System

- 9.1.2.2. Access Devices

- 9.1.2.3. Wound Protector

- 9.1.2.4. Insufflation Devices

- 9.1.2.5. Operative Manual Instruments

- 9.1.2.6. Other Endoscopic Operative Devices

- 9.1.3. Visualization Systems

- 9.1.3.1. Endoscopic Camera

- 9.1.3.2. SD Visualization System

- 9.1.3.3. HD Visualization System

- 9.1.1. Endoscopes

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Gastroenterology

- 9.2.2. Pulmonology

- 9.2.3. Cardiology

- 9.2.4. Urology

- 9.2.5. Neurology

- 9.2.6. Gynecology

- 9.2.7. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. South Africa

- 9.3.2. Egypt

- 9.3.3. Nigeria

- 9.3.4. Kenya

- 9.3.5. Rest of the Africa

- 9.1. Market Analysis, Insights and Forecast - by Endoscopy Devices

- 10. Rest of the Africa Africa Endoscopy Device Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Endoscopy Devices

- 10.1.1. Endoscopes

- 10.1.1.1. Flexible Endoscopes

- 10.1.1.2. Rigid Endoscopes

- 10.1.1.3. Capsule Endoscopes

- 10.1.1.4. Robot-assisted Endoscopes

- 10.1.2. Endoscopic Operative Devices

- 10.1.2.1. Irrigation/Suction System

- 10.1.2.2. Access Devices

- 10.1.2.3. Wound Protector

- 10.1.2.4. Insufflation Devices

- 10.1.2.5. Operative Manual Instruments

- 10.1.2.6. Other Endoscopic Operative Devices

- 10.1.3. Visualization Systems

- 10.1.3.1. Endoscopic Camera

- 10.1.3.2. SD Visualization System

- 10.1.3.3. HD Visualization System

- 10.1.1. Endoscopes

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Gastroenterology

- 10.2.2. Pulmonology

- 10.2.3. Cardiology

- 10.2.4. Urology

- 10.2.5. Neurology

- 10.2.6. Gynecology

- 10.2.7. Other Applications

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. South Africa

- 10.3.2. Egypt

- 10.3.3. Nigeria

- 10.3.4. Kenya

- 10.3.5. Rest of the Africa

- 10.1. Market Analysis, Insights and Forecast - by Endoscopy Devices

- 11. South Africa Africa Endoscopy Device Industry Analysis, Insights and Forecast, 2019-2031

- 12. Sudan Africa Endoscopy Device Industry Analysis, Insights and Forecast, 2019-2031

- 13. Uganda Africa Endoscopy Device Industry Analysis, Insights and Forecast, 2019-2031

- 14. Tanzania Africa Endoscopy Device Industry Analysis, Insights and Forecast, 2019-2031

- 15. Kenya Africa Endoscopy Device Industry Analysis, Insights and Forecast, 2019-2031

- 16. Rest of Africa Africa Endoscopy Device Industry Analysis, Insights and Forecast, 2019-2031

- 17. Competitive Analysis

- 17.1. Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 Steris Corporation

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Olympus Medical Systems Corporation

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 Medtronic PLC

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Richard Wolf GmbH

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Stryker Corporation*List Not Exhaustive

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Karl Storz GmbH & Co KG

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Johnson & Johnson

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 B Braun Melsungen AG

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 Boston Scientific Corporation

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 Fujifilm Holdings Corporation

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.1 Steris Corporation

List of Figures

- Figure 1: Africa Endoscopy Device Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Africa Endoscopy Device Industry Share (%) by Company 2024

List of Tables

- Table 1: Africa Endoscopy Device Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Africa Endoscopy Device Industry Revenue Million Forecast, by Endoscopy Devices 2019 & 2032

- Table 3: Africa Endoscopy Device Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Africa Endoscopy Device Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: Africa Endoscopy Device Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Africa Endoscopy Device Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: South Africa Africa Endoscopy Device Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Sudan Africa Endoscopy Device Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Uganda Africa Endoscopy Device Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Tanzania Africa Endoscopy Device Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Kenya Africa Endoscopy Device Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Africa Africa Endoscopy Device Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Africa Endoscopy Device Industry Revenue Million Forecast, by Endoscopy Devices 2019 & 2032

- Table 14: Africa Endoscopy Device Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 15: Africa Endoscopy Device Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 16: Africa Endoscopy Device Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Africa Endoscopy Device Industry Revenue Million Forecast, by Endoscopy Devices 2019 & 2032

- Table 18: Africa Endoscopy Device Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 19: Africa Endoscopy Device Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 20: Africa Endoscopy Device Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Africa Endoscopy Device Industry Revenue Million Forecast, by Endoscopy Devices 2019 & 2032

- Table 22: Africa Endoscopy Device Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 23: Africa Endoscopy Device Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 24: Africa Endoscopy Device Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Africa Endoscopy Device Industry Revenue Million Forecast, by Endoscopy Devices 2019 & 2032

- Table 26: Africa Endoscopy Device Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 27: Africa Endoscopy Device Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 28: Africa Endoscopy Device Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 29: Africa Endoscopy Device Industry Revenue Million Forecast, by Endoscopy Devices 2019 & 2032

- Table 30: Africa Endoscopy Device Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 31: Africa Endoscopy Device Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 32: Africa Endoscopy Device Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Endoscopy Device Industry?

The projected CAGR is approximately 7.20%.

2. Which companies are prominent players in the Africa Endoscopy Device Industry?

Key companies in the market include Steris Corporation, Olympus Medical Systems Corporation, Medtronic PLC, Richard Wolf GmbH, Stryker Corporation*List Not Exhaustive, Karl Storz GmbH & Co KG, Johnson & Johnson, B Braun Melsungen AG, Boston Scientific Corporation, Fujifilm Holdings Corporation.

3. What are the main segments of the Africa Endoscopy Device Industry?

The market segments include Endoscopy Devices, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Technological Advancements Leading to Enhanced Applications; Rising Prevalence of Diseases that Require Endoscopy.

6. What are the notable trends driving market growth?

Gastroenterology Segment is Expected to Witness a Significant Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Infections Associated with Endoscopy; High Cost of Endoscopy Procedures and Equipment.

8. Can you provide examples of recent developments in the market?

In September 2022, Sony Corporation, Olympus Corporation, and Sony Olympus Medical Solutions Inc. entered into a joint venture to develop a surgical endoscopy system that offers surgical visualization features, including 4K, 3D, IR imaging, and NBI. This joint venture will also value the endoscopic devices of Africa.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Endoscopy Device Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Endoscopy Device Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Endoscopy Device Industry?

To stay informed about further developments, trends, and reports in the Africa Endoscopy Device Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence