Key Insights

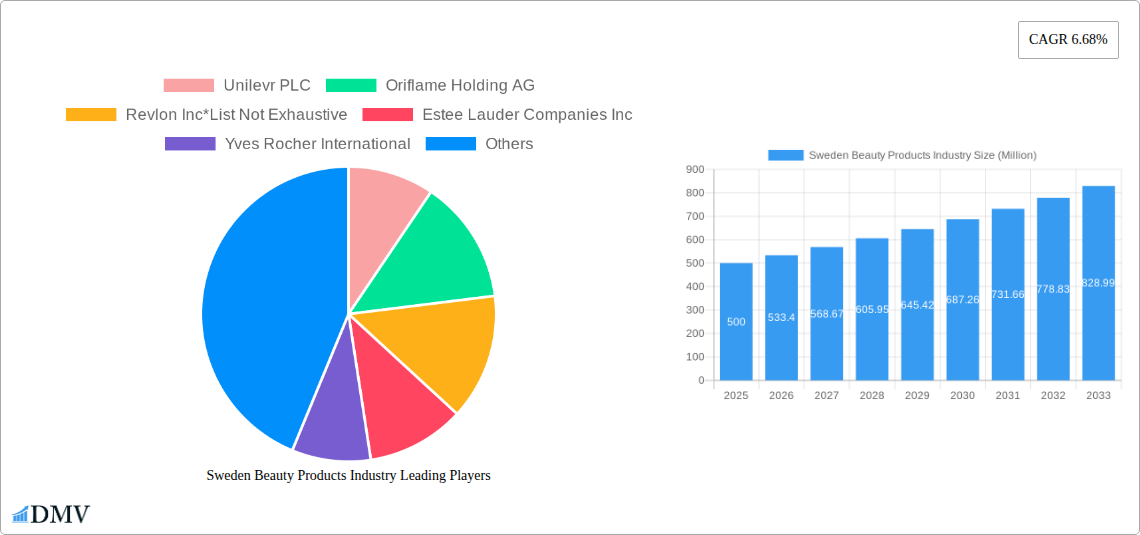

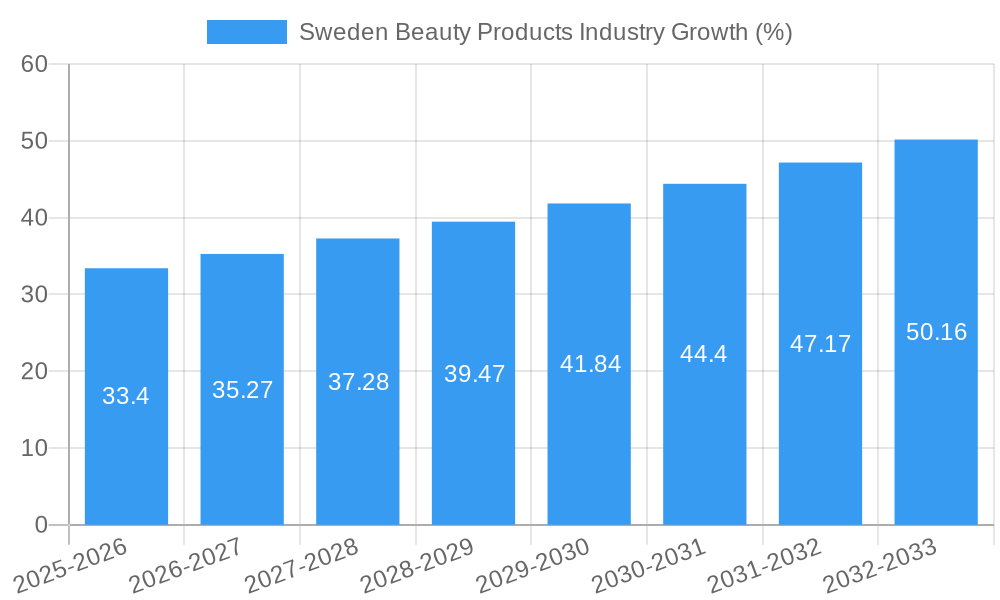

The Swedish beauty products market, valued at approximately €500 million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 6.68% from 2025 to 2033. This expansion is fueled by several key drivers. A rising disposable income among Swedish consumers, coupled with a growing awareness of personal care and beauty trends, is significantly boosting demand for a wide range of products, from color cosmetics and lipsticks to hair styling and coloring solutions. The increasing prevalence of online retail channels offers convenient access and broadens the market reach for both established brands and emerging players. Furthermore, a surge in popularity of premium and natural beauty products caters to the growing consumer preference for high-quality, sustainable, and ethically sourced options. However, the market faces certain restraints, including intense competition from both domestic and international brands and potential fluctuations in consumer spending due to economic uncertainties. The market segmentation reveals a diverse landscape, with supermarkets/hypermarkets and online retail stores emerging as dominant distribution channels. The premium segment is experiencing rapid growth driven by a willingness to invest in high-end products. Leading players like L'Oréal SA, Unilever PLC, and Oriflame Holding AG are well-positioned to capitalize on these opportunities, leveraging their established brands and extensive distribution networks.

The forecast period (2025-2033) suggests a promising outlook for the Swedish beauty market. Continued growth will be driven by innovations in product formulations, particularly in areas like sustainable and eco-friendly cosmetics. The increasing influence of social media and beauty influencers will also shape consumer preferences and drive demand for specific products and brands. Market players will need to focus on effective marketing strategies targeting specific demographic segments, emphasizing product efficacy and sustainability to maintain a competitive edge. Expansion into niche segments like organic and vegan beauty products will further drive market diversification and growth. Competition is expected to intensify, prompting companies to invest in research and development, enhance their supply chains, and build strong brand loyalty. The market's future success hinges on the ability of businesses to adapt to evolving consumer preferences and leverage technological advancements to optimize their operations and reach broader customer bases.

Sweden Beauty Products Industry: Market Analysis & Forecast 2019-2033

This comprehensive report provides an in-depth analysis of the Sweden beauty products industry, offering valuable insights for stakeholders seeking to navigate this dynamic market. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report meticulously examines market trends, competitive dynamics, and future growth prospects, incorporating data from the historical period (2019-2024). The total market value in 2025 is estimated at xx Million.

Sweden Beauty Products Industry Market Composition & Trends

This section delves into the intricate structure of the Swedish beauty products market, encompassing market concentration, innovation drivers, regulatory frameworks, substitute products, end-user demographics, and mergers & acquisitions (M&A) activities.

Market Concentration & Share Distribution: The Swedish beauty market exhibits a moderately concentrated landscape, with a few major players like L'Oréal S.A., Unilever PLC, and Oriflame Holding AG holding significant market share. However, smaller niche brands and online retailers are also gaining traction. The estimated market share distribution in 2025 is: L'Oréal S.A. (xx%), Unilever PLC (xx%), Oriflame Holding AG (xx%), Others (xx%).

Innovation Catalysts: The industry is driven by continuous innovation in product formulations (e.g., natural and organic ingredients, sustainable packaging), technological advancements (e.g., personalized beauty solutions, AR/VR applications), and marketing strategies (e.g., influencer marketing, social media engagement).

Regulatory Landscape: Stringent regulations concerning product safety, labeling, and environmental sustainability shape the industry's operating environment. Compliance with EU regulations and Swedish-specific standards is crucial for market entry and success.

Substitute Products: The market faces competition from substitute products like homemade beauty remedies and alternative wellness practices. These alternatives can pose a challenge, especially in the mass market segment.

End-User Profiles: The target audience encompasses a diverse range of consumers, categorized by age, gender, income level, and lifestyle preferences. Understanding consumer preferences and adapting product offerings are critical for success.

M&A Activities: The Swedish beauty market has witnessed several M&A activities in recent years, although the total deal value for the period 2019-2024 is estimated at xx Million. These activities reflect strategic consolidation and expansion efforts by major players.

Sweden Beauty Products Industry Industry Evolution

This section analyzes the evolutionary path of the Swedish beauty products industry, focusing on market growth trajectories, technological progress, and shifting consumer demands.

The Swedish beauty market has experienced a steady growth trajectory throughout the historical period (2019-2024), fueled by rising disposable incomes, increasing awareness of personal care, and the expanding e-commerce sector. The compound annual growth rate (CAGR) during this period is estimated at xx%. Technological advancements, such as personalized beauty products and advanced skincare formulations, have significantly shaped the industry landscape. The adoption rate of online retail channels has increased dramatically, with online sales accounting for xx% of the total market value in 2024. Consumer demands are shifting towards natural, sustainable, and ethically sourced products, forcing companies to adjust their product offerings and supply chains accordingly. The demand for premium products is also increasing, driven by an expanding middle class and a growing desire for luxurious self-care experiences. The expected CAGR for 2025-2033 is estimated at xx%, driven by continued innovation and evolving consumer preferences.

Leading Regions, Countries, or Segments in Sweden Beauty Products Industry

This section identifies the dominant segments within the Swedish beauty market, exploring their key drivers and dominance factors.

By Distribution Channel:

- Online Retail Stores: Experiencing the fastest growth, driven by increased internet penetration and convenience. Key drivers include robust logistics networks and targeted digital marketing.

- Specialty Stores: Maintain a significant share, offering expert advice and a curated selection of products. Key drivers include strong brand loyalty and a focus on customer experience.

- Supermarkets/Hypermarkets: Capture a large share of the mass market segment due to accessibility and wide product ranges. Key drivers include competitive pricing and convenient locations.

By Product Type:

- Skincare Products: Represents the largest segment, driven by growing awareness of skin health and aging. Key drivers include innovation in active ingredients and personalized solutions.

- Hair Styling and Coloring Products: Show steady growth, influenced by evolving haircare trends and technological advancements in hair coloring techniques. Key drivers include diversification in product formats and convenient at-home solutions.

- Color Cosmetics: Remains a significant segment, driven by trends in makeup application and social media influence. Key drivers include innovation in colors, textures, and formulas.

By Category:

- Premium: Experiencing strong growth due to increasing consumer willingness to invest in high-quality, luxurious beauty products. Key drivers include superior product performance and prestige branding.

- Mass: Maintains a significant market share, targeting price-conscious consumers. Key drivers include value-for-money propositions and accessibility.

Sweden Beauty Products Industry Product Innovations

The Swedish beauty market is characterized by constant innovation in product formulations, packaging, and delivery systems. Recent innovations include personalized skincare solutions based on individual skin profiles, sustainable and eco-friendly packaging options, and advanced technologies like AR/VR tools for virtual makeup try-ons. These innovations aim to enhance product performance, improve user experience, and address consumer demand for ethical and sustainable beauty products. Unique selling propositions often center around natural ingredients, unique textures, and advanced technological functionalities.

Propelling Factors for Sweden Beauty Products Industry Growth

Several factors propel the growth of the Swedish beauty products industry. Increased disposable incomes empower consumers to spend more on personal care. Evolving consumer preferences towards natural and sustainable products fuel innovation and market expansion. Furthermore, technological advancements, such as personalized beauty solutions and e-commerce platforms, enhance convenience and accessibility. Favorable regulatory environments encourage market growth and investor confidence.

Obstacles in the Sweden Beauty Products Industry Market

The Swedish beauty market faces several challenges. Intense competition among established brands and emerging players creates pressure on pricing and margins. Supply chain disruptions, particularly related to sourcing raw materials and packaging, can impact production and profitability. Stringent regulations regarding product safety and sustainability necessitate significant investments in compliance. Fluctuating economic conditions can affect consumer spending on non-essential goods, impacting market demand.

Future Opportunities in Sweden Beauty Products Industry

The future of the Swedish beauty market holds promising opportunities. The rise of personalized beauty solutions, driven by advanced technologies, offers significant growth potential. Expanding into new product categories, such as men's grooming and wellness products, presents avenues for market expansion. Leveraging digital channels and influencer marketing enhances brand visibility and engagement with target audiences. Focusing on sustainable and ethical sourcing practices addresses growing consumer demand for responsible beauty products.

Major Players in the Sweden Beauty Products Industry Ecosystem

- Unilever PLC

- Oriflame Holding AG

- Revlon Inc

- Estee Lauder Companies Inc

- Yves Rocher International

- L'Oréal S.A.

- Shiseido Co Ltd

- Kao Corporation

- Solstice Holdings Inc

- Kose Coporation

Key Developments in Sweden Beauty Products Industry Industry

- July 2021: L'Oréal group launched its first-ever TikTok beauty channel, showcasing its science, innovations, and technology. This move significantly enhanced brand visibility and consumer engagement.

- February 2021: Revlon Inc. partnered with MDR Brand Management to create a global expansion strategy, aiming to increase market share in key regions. This partnership boosted Revlon's international presence and market reach.

Strategic Sweden Beauty Products Industry Market Forecast

The Swedish beauty products market is poised for continued growth, driven by innovation, evolving consumer preferences, and expanding e-commerce channels. The increasing focus on sustainability and ethical sourcing will shape future product development. The market is expected to witness further consolidation through mergers and acquisitions, leading to a more concentrated landscape. The strong focus on personalized beauty solutions and technological advancements will continue to shape market dynamics and growth opportunities throughout the forecast period (2025-2033).

Sweden Beauty Products Industry Segmentation

-

1. Product Type

-

1.1. Color Cosmetics

- 1.1.1. Facial Make-up Products

- 1.1.2. Face Bronzers

- 1.1.3. Lip stick Products

-

1.2. Hair Styling and Coloring Products

- 1.2.1. Hair colors

- 1.2.2. Hair Styling Products

-

1.1. Color Cosmetics

-

2. Category

- 2.1. Mass

- 2.2. Premium

-

3. Distribution Channel

- 3.1. Supermarkets/Hypermarkets

- 3.2. Specialty Stores

- 3.3. Pharmacy and Drug Stores

- 3.4. Convenience/Grocery Stores

- 3.5. Online Retail Stores

- 3.6. Other Distribution Channels

Sweden Beauty Products Industry Segmentation By Geography

- 1. Sweden

Sweden Beauty Products Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.68% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Aging Population drives the Market Growth; Technological Advancement and Product Innovation

- 3.3. Market Restrains

- 3.3.1. Product Misrepresentation and Counterfeit Concerns

- 3.4. Market Trends

- 3.4.1. Rising Beauty Consciousness to Support Market Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Sweden Beauty Products Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Color Cosmetics

- 5.1.1.1. Facial Make-up Products

- 5.1.1.2. Face Bronzers

- 5.1.1.3. Lip stick Products

- 5.1.2. Hair Styling and Coloring Products

- 5.1.2.1. Hair colors

- 5.1.2.2. Hair Styling Products

- 5.1.1. Color Cosmetics

- 5.2. Market Analysis, Insights and Forecast - by Category

- 5.2.1. Mass

- 5.2.2. Premium

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarkets/Hypermarkets

- 5.3.2. Specialty Stores

- 5.3.3. Pharmacy and Drug Stores

- 5.3.4. Convenience/Grocery Stores

- 5.3.5. Online Retail Stores

- 5.3.6. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Sweden

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Unilevr PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Oriflame Holding AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Revlon Inc*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Estee Lauder Companies Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Yves Rocher International

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 L'Oreal S A

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Shiseido Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kao Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Solstice Holdings Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Kose Coporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Unilevr PLC

List of Figures

- Figure 1: Sweden Beauty Products Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Sweden Beauty Products Industry Share (%) by Company 2024

List of Tables

- Table 1: Sweden Beauty Products Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Sweden Beauty Products Industry Volume K Units Forecast, by Region 2019 & 2032

- Table 3: Sweden Beauty Products Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: Sweden Beauty Products Industry Volume K Units Forecast, by Product Type 2019 & 2032

- Table 5: Sweden Beauty Products Industry Revenue Million Forecast, by Category 2019 & 2032

- Table 6: Sweden Beauty Products Industry Volume K Units Forecast, by Category 2019 & 2032

- Table 7: Sweden Beauty Products Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 8: Sweden Beauty Products Industry Volume K Units Forecast, by Distribution Channel 2019 & 2032

- Table 9: Sweden Beauty Products Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Sweden Beauty Products Industry Volume K Units Forecast, by Region 2019 & 2032

- Table 11: Sweden Beauty Products Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Sweden Beauty Products Industry Volume K Units Forecast, by Country 2019 & 2032

- Table 13: Sweden Beauty Products Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 14: Sweden Beauty Products Industry Volume K Units Forecast, by Product Type 2019 & 2032

- Table 15: Sweden Beauty Products Industry Revenue Million Forecast, by Category 2019 & 2032

- Table 16: Sweden Beauty Products Industry Volume K Units Forecast, by Category 2019 & 2032

- Table 17: Sweden Beauty Products Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 18: Sweden Beauty Products Industry Volume K Units Forecast, by Distribution Channel 2019 & 2032

- Table 19: Sweden Beauty Products Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Sweden Beauty Products Industry Volume K Units Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sweden Beauty Products Industry?

The projected CAGR is approximately 6.68%.

2. Which companies are prominent players in the Sweden Beauty Products Industry?

Key companies in the market include Unilevr PLC, Oriflame Holding AG, Revlon Inc*List Not Exhaustive, Estee Lauder Companies Inc, Yves Rocher International, L'Oreal S A, Shiseido Co Ltd, Kao Corporation, Solstice Holdings Inc, Kose Coporation.

3. What are the main segments of the Sweden Beauty Products Industry?

The market segments include Product Type, Category, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Aging Population drives the Market Growth; Technological Advancement and Product Innovation.

6. What are the notable trends driving market growth?

Rising Beauty Consciousness to Support Market Demand.

7. Are there any restraints impacting market growth?

Product Misrepresentation and Counterfeit Concerns.

8. Can you provide examples of recent developments in the market?

July 2021: L'Oreal group launched its first-ever TikTok beauty channel driven by a progressive vision of the beauty industry's future. The channel uncovers the group's science, innovations, and technologies beyond the world's favorite beauty products. Working in collaboration with experts from L'Oreal, this new channel delivers content that combines science, innovation, and technology behind beauty products.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sweden Beauty Products Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sweden Beauty Products Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sweden Beauty Products Industry?

To stay informed about further developments, trends, and reports in the Sweden Beauty Products Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence