Key Insights

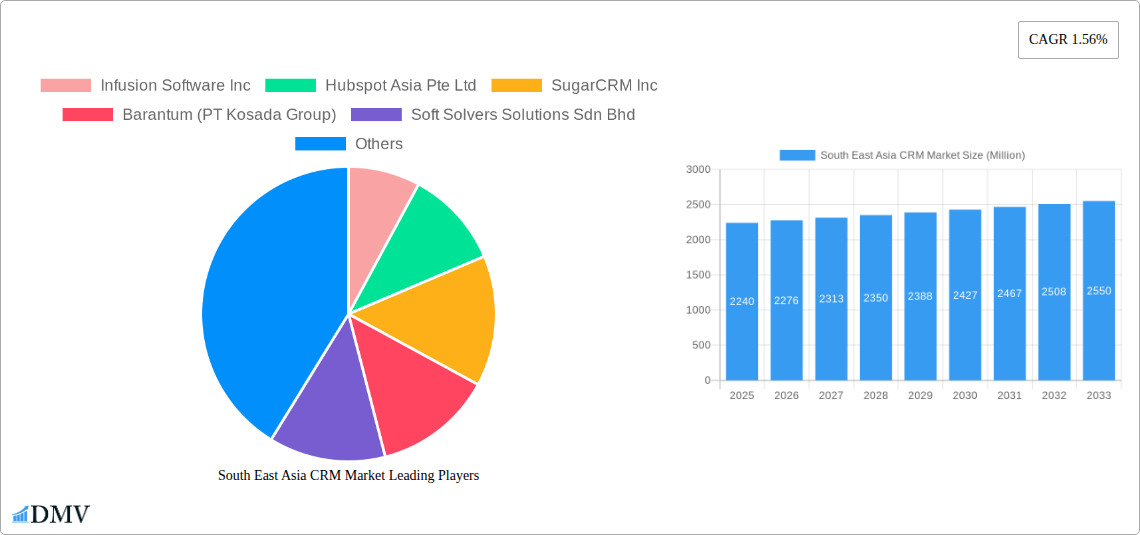

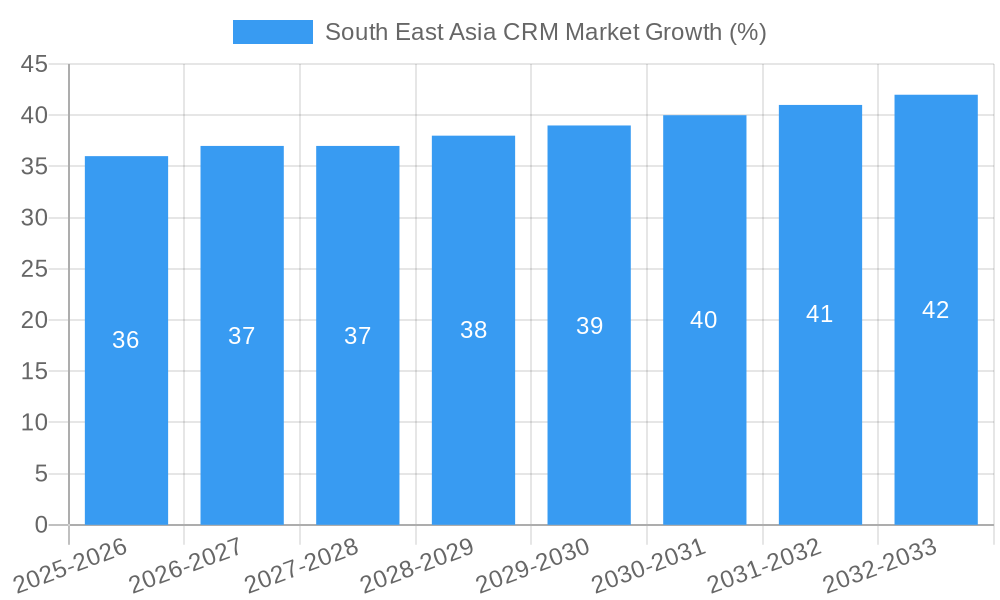

The Southeast Asia CRM market, valued at $2.24 billion in 2025, is projected to experience steady growth, driven by increasing digitalization across various sectors and the rising adoption of cloud-based CRM solutions. The 1.56% CAGR indicates a consistent, albeit moderate, expansion over the forecast period (2025-2033). Key growth drivers include the expanding SME sector in countries like Indonesia and the Philippines, demanding efficient customer relationship management tools. Furthermore, the increasing need for data-driven insights across industries like BFSI (Banking, Financial Services, and Insurance), retail, and manufacturing fuels the demand for sophisticated CRM systems capable of handling large volumes of customer data and providing actionable analytics. While on-premise solutions still hold a segment of the market, the trend is strongly towards cloud-based deployments due to their scalability, cost-effectiveness, and accessibility. However, factors such as data security concerns and the digital literacy gap in certain regions could pose challenges to market growth. The competitive landscape is diverse, with both global giants like Salesforce and Microsoft, alongside regional players like Hubspot Asia and local providers, vying for market share. This necessitates a nuanced approach for companies aiming to penetrate this market, requiring localization strategies and understanding of unique regional requirements.

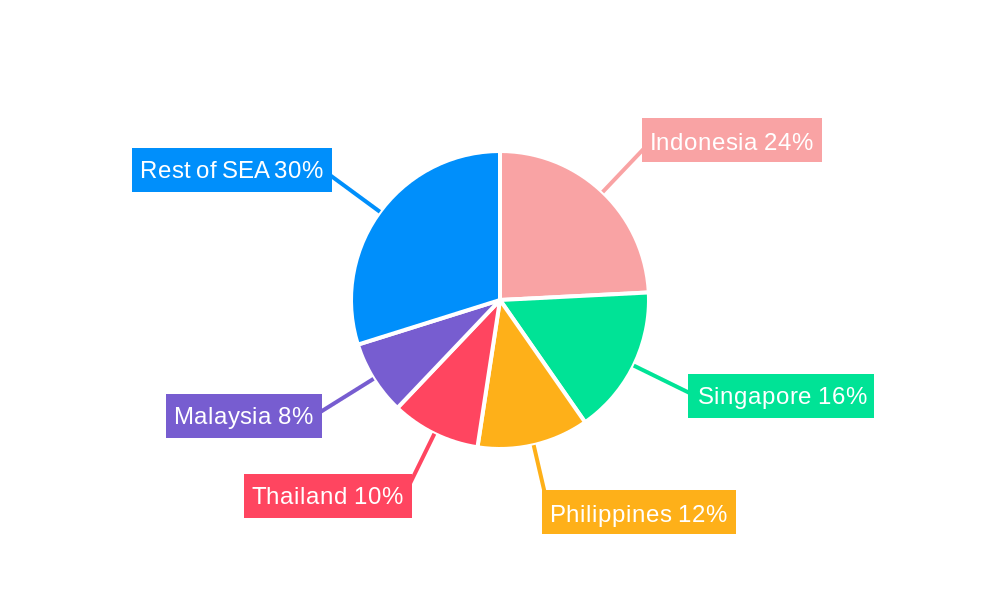

The market segmentation reveals significant opportunities across various verticals. The BFSI sector, with its emphasis on customer retention and personalized services, presents a lucrative market segment. Similarly, the rapidly evolving retail and logistics sector, requiring efficient order management and supply chain optimization, drives CRM adoption. Government and public sector organizations are also increasingly embracing CRM solutions for improved citizen engagement and service delivery. Analyzing individual country performances within Southeast Asia - such as Indonesia's large and growing market or Singapore's high adoption rate of advanced technologies - provides further insights for strategic market entry and investment decisions. The continued expansion of digital infrastructure and increasing internet penetration in the region further strengthens the outlook for the CRM market's sustained growth.

South East Asia CRM Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the South East Asia CRM market, offering a comprehensive overview of its current state, future trajectory, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period extending to 2033, this report is an invaluable resource for stakeholders seeking to understand and capitalize on the opportunities within this dynamic market. The market is projected to reach xx Million by 2033, exhibiting robust growth driven by technological advancements and increasing digital adoption across various sectors.

South East Asia CRM Market Composition & Trends

This section delves into the intricate composition of the South East Asia CRM market, examining its concentration, innovation drivers, regulatory environment, substitute products, and end-user profiles. The analysis incorporates a thorough evaluation of M&A activities, including market share distribution and deal values. The highly fragmented nature of the market, characterized by a multitude of both international and regional players, is a key characteristic.

- Market Concentration: The market exhibits a moderately fragmented landscape, with no single dominant player commanding a significant majority of the market share. Leading players hold approximately xx% of the market share collectively.

- Innovation Catalysts: Rapid technological advancements, including AI and cloud computing, are significant drivers of innovation, prompting the development of sophisticated CRM solutions.

- Regulatory Landscape: Varying data privacy regulations across Southeast Asian nations influence CRM adoption and implementation strategies. Compliance requirements necessitate robust data security protocols.

- Substitute Products: While CRM systems offer comprehensive solutions, alternative tools focusing on specific functions, such as marketing automation or sales management, present some degree of substitution.

- End-User Profiles: The market caters to a diverse range of end-users, including small and medium-sized enterprises (SMEs), large-scale organizations, and various industry verticals.

- M&A Activities: Recent years have witnessed notable M&A activity, reflecting the strategic importance of the CRM sector and the consolidation of market players. For example, the acquisition of Aodigy by Capgemini in 2022 demonstrates a move toward enhancing Salesforce expertise and expanding regional capabilities. Deal values have ranged from xx Million to xx Million in recent years, indicating significant investment in the sector.

South East Asia CRM Market Industry Evolution

This section analyzes the evolutionary path of the South East Asia CRM market, focusing on growth trajectories, technological advancements, and evolving consumer demands. The analysis incorporates specific data points, including growth rates and adoption metrics, to provide a comprehensive understanding of market dynamics. The market has experienced substantial growth over the historical period (2019-2024) driven by factors such as increasing digital transformation initiatives, the rising popularity of cloud-based CRM solutions, and growing recognition of the value of customer relationship management among businesses.

The shift towards cloud-based deployments is a notable trend, reflecting greater agility, scalability, and cost-effectiveness compared to on-premise solutions. The adoption of advanced technologies such as AI, machine learning, and big data analytics is further enhancing CRM functionalities, providing organizations with improved insights into customer behavior and enabling more personalized experiences. The increasing demand for integrated CRM platforms that seamlessly integrate with other business applications is also driving market expansion. Expected annual growth rates are projected to be around xx% during the forecast period (2025-2033), indicating sustained momentum in the market's evolution.

Leading Regions, Countries, or Segments in South East Asia CRM Market

This section identifies the leading regions, countries, and segments within the South East Asia CRM market, providing an in-depth analysis of dominance factors. Key drivers such as investment trends and regulatory support are highlighted using bullet points, complemented by detailed paragraph analyses.

- By Organization Size: Large-scale organizations lead in CRM adoption due to their greater resources and need for sophisticated solutions. SMEs, however, are increasingly adopting CRM to enhance efficiency and competitiveness.

- By Deployment Size: Cloud deployments are the dominant model, driven by flexibility, scalability, and reduced IT infrastructure costs. On-premise deployments remain significant in some sectors, driven by specific security or regulatory requirements. Hybrid models are also gaining traction, combining the benefits of both.

- By End-user Vertical: The BFSI (Banking, Financial Services, and Insurance) sector demonstrates high CRM adoption, followed by Retail and Logistics, and Services. Government and other verticals (including Construction, Education, and Energy & Utilities) are exhibiting increasing adoption rates.

- By Country: Singapore and Indonesia represent the largest markets, driven by advanced economies and strong technological infrastructure. Other countries like Malaysia, Thailand, and the Philippines show significant growth potential.

Key Drivers:

- Singapore: Strong government support for digital transformation initiatives, coupled with a highly developed technological infrastructure, fosters rapid CRM adoption.

- Indonesia: The large market size and expanding digital economy are major drivers, although infrastructure gaps in certain regions present some challenges.

- Malaysia & Thailand: Government investments in digital infrastructure and growing SME sector are fostering market expansion.

South East Asia CRM Market Product Innovations

Recent product innovations in the South East Asia CRM market have focused on enhancing customer engagement through AI-powered personalization and predictive analytics, improving sales team efficiency by optimizing lead management and sales forecasting, and streamlining customer service processes through chatbots and self-service portals. The integration of CRM systems with other business applications, such as marketing automation, ERP, and e-commerce platforms, has significantly enhanced operational efficiency and data-driven decision-making. This has resulted in improved customer retention rates and increased revenue generation.

Propelling Factors for South East Asia CRM Market Growth

Several factors are driving the growth of the South East Asia CRM market. Technological advancements, particularly cloud computing and AI, are facilitating the development of sophisticated and accessible CRM solutions. Economic growth, particularly in emerging markets, fuels the demand for efficient business tools. Finally, supportive government policies and initiatives promoting digital transformation are further accelerating market expansion. The rising importance of customer experience is creating a greater need for effective CRM systems to improve customer engagement and loyalty.

Obstacles in the South East Asia CRM Market

Despite its potential, the South East Asia CRM market faces certain challenges. Data security and privacy concerns influence adoption rates. Varying levels of digital literacy and infrastructure gaps across the region also create barriers. Moreover, intense competition among numerous vendors necessitates effective differentiation strategies. These challenges may constrain market growth if not appropriately addressed.

Future Opportunities in South East Asia CRM Market

The South East Asia CRM market presents exciting future opportunities. The expansion of e-commerce and digital channels creates demand for CRM systems that seamlessly integrate with online platforms. The growing importance of personalized customer experiences will fuel innovation in AI-powered CRM solutions. Moreover, untapped markets in less developed regions present significant growth potential. Addressing infrastructure gaps and digital literacy through targeted initiatives will unlock further market expansion.

Major Players in the South East Asia CRM Market Ecosystem

- Infusion Software Inc

- Hubspot Asia Pte Ltd

- SugarCRM Inc

- Barantum (PT Kosada Group)

- Soft Solvers Solutions Sdn Bhd

- Tigernix Pte Ltd

- IBM Corporation

- Vinno Software Company

- Sage Group PLC

- Microsoft Dynamics

- Insightly Inc

- Salesforce com Inc

- Capillary Technologies

- Deskera Holdings Ltd

- Zoho Corporation

- Qontak Pte Ltd

- Creatio

- Oracle Siebel

- PT VADS Indonesia

- SAP SE

Key Developments in South East Asia CRM Market Industry

- September 2022: Capgemini's acquisition of Singapore-based Aodigy significantly enhances its Salesforce capabilities and regional expertise in end-to-end digital transformation.

- June 2022: Microsoft's launch of Viva Sales integrates CRM systems with Microsoft 365 and Teams, leveraging AI to improve seller efficiency and customer engagement.

Strategic South East Asia CRM Market Forecast

The South East Asia CRM market is poised for sustained growth, driven by technological innovations, increasing digital adoption across various sectors, and expanding e-commerce activities. The ongoing trend towards cloud-based CRM solutions, coupled with the increasing demand for AI-powered personalization and predictive analytics, will further fuel market expansion. Untapped opportunities in less developed regions and the growing importance of customer experience will present significant potential for growth over the forecast period. The market is expected to witness further consolidation through M&A activity, as larger players seek to expand their market share and enhance their service offerings.

South East Asia CRM Market Segmentation

-

1. Organization Size

- 1.1. Small and Medium

- 1.2. Large Scale

-

2. Deployment Size

- 2.1. Cloud

- 2.2. On-premise

- 2.3. Hybrid

-

3. End-user Vertical

- 3.1. Services

- 3.2. Manufacturing

- 3.3. BFSI

- 3.4. Retail and Logistics

- 3.5. Government

- 3.6. Other En

South East Asia CRM Market Segmentation By Geography

-

1. South East Asia

- 1.1. Indonesia

- 1.2. Malaysia

- 1.3. Singapore

- 1.4. Thailand

- 1.5. Vietnam

- 1.6. Philippines

- 1.7. Myanmar

- 1.8. Cambodia

- 1.9. Laos

South East Asia CRM Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 1.56% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Global Cues

- 3.2.2 such as BYOD

- 3.2.3 and Use of IT tools for Driving Decision Making Expected to Provide Ample Scope for Future Growth; Emergence of Several Pure-Play CRM Solutions at a Local and Regional-Level

- 3.2.4 to Compete with the Top 5 incumbents; Increasing Adoption from SME's Aided by Flexible Pricing Strategies Provided by the Vendors

- 3.3. Market Restrains

- 3.3.1. ; Complex Analytical Processes; Existing Data Security Apprehensions

- 3.4. Market Trends

- 3.4.1 Global Cues

- 3.4.2 such as BYOD

- 3.4.3 and Use of IT tools for Driving Decision Making Expected to Provide Ample Scope for Future Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South East Asia CRM Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Organization Size

- 5.1.1. Small and Medium

- 5.1.2. Large Scale

- 5.2. Market Analysis, Insights and Forecast - by Deployment Size

- 5.2.1. Cloud

- 5.2.2. On-premise

- 5.2.3. Hybrid

- 5.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.3.1. Services

- 5.3.2. Manufacturing

- 5.3.3. BFSI

- 5.3.4. Retail and Logistics

- 5.3.5. Government

- 5.3.6. Other En

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South East Asia

- 5.1. Market Analysis, Insights and Forecast - by Organization Size

- 6. China South East Asia CRM Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan South East Asia CRM Market Analysis, Insights and Forecast, 2019-2031

- 8. India South East Asia CRM Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea South East Asia CRM Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan South East Asia CRM Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia South East Asia CRM Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific South East Asia CRM Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Infusion Software Inc

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Hubspot Asia Pte Ltd

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 SugarCRM Inc

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Barantum (PT Kosada Group)

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Soft Solvers Solutions Sdn Bhd

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Tigernix Pte Ltd

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 IBM Corporation

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Vinno Software Company

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Sage Group PLC

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Microsoft Dynamics

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Insightly Inc

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Salesforce com Inc

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 Capillary Technologies

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 Deskera Holdings Ltd

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.15 Zoho Corporation

- 13.2.15.1. Overview

- 13.2.15.2. Products

- 13.2.15.3. SWOT Analysis

- 13.2.15.4. Recent Developments

- 13.2.15.5. Financials (Based on Availability)

- 13.2.16 Qontak Pte Ltd

- 13.2.16.1. Overview

- 13.2.16.2. Products

- 13.2.16.3. SWOT Analysis

- 13.2.16.4. Recent Developments

- 13.2.16.5. Financials (Based on Availability)

- 13.2.17 Creatio

- 13.2.17.1. Overview

- 13.2.17.2. Products

- 13.2.17.3. SWOT Analysis

- 13.2.17.4. Recent Developments

- 13.2.17.5. Financials (Based on Availability)

- 13.2.18 Oracle Siebel

- 13.2.18.1. Overview

- 13.2.18.2. Products

- 13.2.18.3. SWOT Analysis

- 13.2.18.4. Recent Developments

- 13.2.18.5. Financials (Based on Availability)

- 13.2.19 PT VADS Indonesia*List Not Exhaustive

- 13.2.19.1. Overview

- 13.2.19.2. Products

- 13.2.19.3. SWOT Analysis

- 13.2.19.4. Recent Developments

- 13.2.19.5. Financials (Based on Availability)

- 13.2.20 SAP SE

- 13.2.20.1. Overview

- 13.2.20.2. Products

- 13.2.20.3. SWOT Analysis

- 13.2.20.4. Recent Developments

- 13.2.20.5. Financials (Based on Availability)

- 13.2.1 Infusion Software Inc

List of Figures

- Figure 1: South East Asia CRM Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South East Asia CRM Market Share (%) by Company 2024

List of Tables

- Table 1: South East Asia CRM Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South East Asia CRM Market Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 3: South East Asia CRM Market Revenue Million Forecast, by Deployment Size 2019 & 2032

- Table 4: South East Asia CRM Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 5: South East Asia CRM Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: South East Asia CRM Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: China South East Asia CRM Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Japan South East Asia CRM Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: India South East Asia CRM Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South Korea South East Asia CRM Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Taiwan South East Asia CRM Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Australia South East Asia CRM Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Asia-Pacific South East Asia CRM Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: South East Asia CRM Market Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 15: South East Asia CRM Market Revenue Million Forecast, by Deployment Size 2019 & 2032

- Table 16: South East Asia CRM Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 17: South East Asia CRM Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Indonesia South East Asia CRM Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Malaysia South East Asia CRM Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Singapore South East Asia CRM Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Thailand South East Asia CRM Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Vietnam South East Asia CRM Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Philippines South East Asia CRM Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Myanmar South East Asia CRM Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Cambodia South East Asia CRM Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Laos South East Asia CRM Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South East Asia CRM Market?

The projected CAGR is approximately 1.56%.

2. Which companies are prominent players in the South East Asia CRM Market?

Key companies in the market include Infusion Software Inc, Hubspot Asia Pte Ltd, SugarCRM Inc, Barantum (PT Kosada Group), Soft Solvers Solutions Sdn Bhd, Tigernix Pte Ltd, IBM Corporation, Vinno Software Company, Sage Group PLC, Microsoft Dynamics, Insightly Inc, Salesforce com Inc, Capillary Technologies, Deskera Holdings Ltd, Zoho Corporation, Qontak Pte Ltd, Creatio, Oracle Siebel, PT VADS Indonesia*List Not Exhaustive, SAP SE.

3. What are the main segments of the South East Asia CRM Market?

The market segments include Organization Size, Deployment Size, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.24 Million as of 2022.

5. What are some drivers contributing to market growth?

Global Cues. such as BYOD. and Use of IT tools for Driving Decision Making Expected to Provide Ample Scope for Future Growth; Emergence of Several Pure-Play CRM Solutions at a Local and Regional-Level. to Compete with the Top 5 incumbents; Increasing Adoption from SME's Aided by Flexible Pricing Strategies Provided by the Vendors.

6. What are the notable trends driving market growth?

Global Cues. such as BYOD. and Use of IT tools for Driving Decision Making Expected to Provide Ample Scope for Future Growth.

7. Are there any restraints impacting market growth?

; Complex Analytical Processes; Existing Data Security Apprehensions.

8. Can you provide examples of recent developments in the market?

September 2022 : Capgemini acquired Singapore-based Aodigy to expand its Salesforce expertise. The acquisition of the Singapore-based specialized partner is intended to boost Capgemini's regional capabilities to provide "end-to-end digital transformation at scale." Access to Aodigy's entire suite of Salesforce ecosystem customer engagement products, including cloud migration, customer interaction, sales optimization, and business process automation, would be central to such efforts, with offices in Singapore and Vietnam.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South East Asia CRM Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South East Asia CRM Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South East Asia CRM Market?

To stay informed about further developments, trends, and reports in the South East Asia CRM Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence