Key Insights

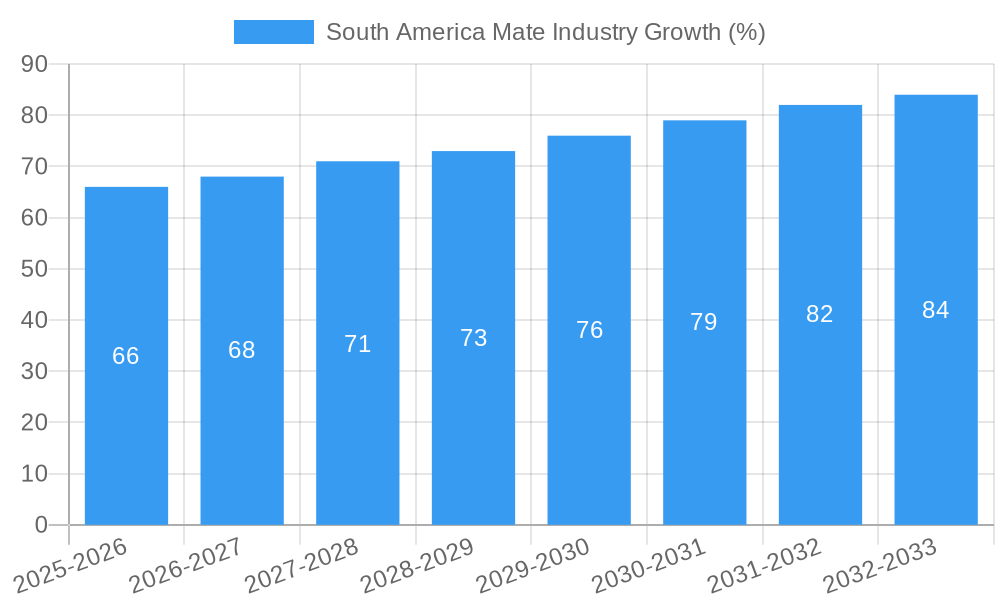

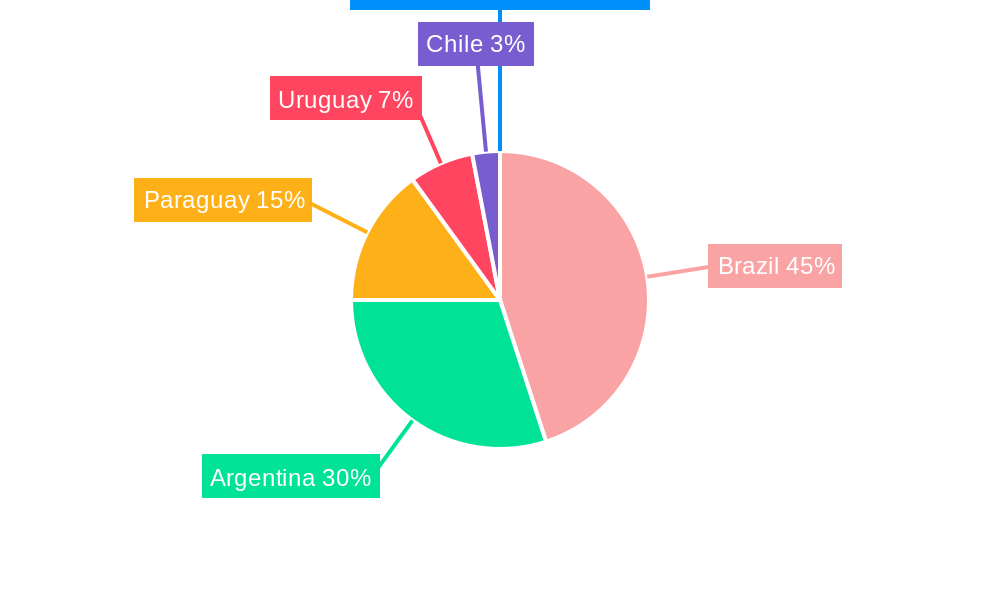

The South American mate industry, currently valued at approximately $X million (estimated based on provided CAGR and market size information – a specific number cannot be provided without the missing market size data), is experiencing robust growth, projected to maintain a 4.40% Compound Annual Growth Rate (CAGR) from 2025 to 2033. This expansion is driven by several factors, including increasing consumer awareness of mate's health benefits – its rich antioxidant properties and stimulating effects – and a rising preference for natural and functional beverages. Growing tourism in the region also contributes to the market's expansion, as mate consumption becomes a cultural experience for visitors. Key players like Lauro Raatz SA (La Hoja) and Industrias de Mision S.A. (Rosamonte) are strategically investing in product innovation and distribution networks to capitalize on these trends. Brazil, Argentina, and Paraguay, being major producers and consumers, significantly shape the market dynamics. However, challenges such as fluctuating raw material prices and potential environmental concerns regarding sustainable harvesting of yerba mate could influence future growth trajectory.

Despite these challenges, the market shows considerable potential for continued growth, particularly through diversification of product offerings. This includes ready-to-drink mate beverages, flavored mate infusions, and mate-based energy drinks catering to a wider range of consumer preferences. Further penetration into international markets, particularly among health-conscious consumers in developed nations, represents a significant opportunity for expansion. The segmentation analysis by country (Brazil, Argentina, Paraguay, Uruguay, and Chile) provides a granular understanding of regional consumption patterns, production capabilities, and import-export dynamics, facilitating targeted growth strategies for companies operating within this dynamic sector. This detailed understanding of regional variations, along with the identified market drivers and restraints, provides valuable insights for investors and stakeholders seeking to navigate the South American mate market effectively.

South America Mate Industry: A Comprehensive Market Analysis (2019-2033)

This insightful report provides a detailed analysis of the South America Mate industry, offering a comprehensive overview of market dynamics, key players, and future growth prospects. Spanning the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this study meticulously examines the historical period (2019-2024) and projects future trends. The report uses a combination of quantitative data and qualitative insights to provide a holistic understanding of this vibrant market, valued at xx Million in 2025 and projected to reach xx Million by 2033. Key players such as Lauro Raatz SA (La Hoja), Cooperativa Agrícola de la Colonia Liebig Ltda. (Playadito), Amanda, Cooperativa Agrícola Mixta de Monte Carlo Ltda., La Cachuera SA (Taragüi), Establecimiento Las Marías, and Industrias de Mision S.A. (Rosamonte) are analyzed in detail. The report covers key segments including Paraguay, Chile, Uruguay, Argentina, and Brazil, examining production, consumption, import/export, and price trends for each.

South America Mate Industry Market Composition & Trends

This section delves into the competitive landscape of the South American Mate market, assessing market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and merger & acquisition (M&A) activities. The report provides a granular analysis of market share distribution amongst key players. For instance, Industrias de Mision S.A. (Rosamonte) holds an estimated xx% market share in Argentina, while Lauro Raatz SA (La Hoja) commands approximately xx% in Paraguay. The impact of regulatory changes on market access and pricing is also explored.

- Market Concentration: High concentration in Argentina and Brazil, with fragmented markets in other countries.

- Innovation Catalysts: Focus on premiumization, functionalization (e.g., mate with added vitamins), and sustainable packaging.

- Regulatory Landscape: Analysis of tariffs, labeling regulations, and food safety standards across different countries.

- Substitute Products: Examination of the competitive pressure from other beverages, such as coffee and tea.

- End-User Profiles: Segmentation based on demographics, consumption patterns, and preferences.

- M&A Activities: Assessment of recent mergers and acquisitions, including deal values (e.g., a xx Million acquisition in 2022), and their impact on market structure. The report identifies an increase in M&A activity driven by efforts to secure supply chains and expand market share.

South America Mate Industry Industry Evolution

This section provides a detailed analysis of the South American Mate industry's evolution over the study period (2019-2033). The report examines market growth trajectories, focusing on factors that have driven growth and shifts in consumer demand. Technological advancements like improved processing and packaging techniques are analyzed in detail. The report identifies a compound annual growth rate (CAGR) of xx% for the overall market during the forecast period. Specific data points regarding the adoption of new technologies and changes in consumption patterns are included. The rise of e-commerce and the growing popularity of ready-to-drink (RTD) mate beverages are key factors shaping the industry's evolution. The impact of changing consumer preferences towards healthier beverages is also carefully considered.

Leading Regions, Countries, or Segments in South America Mate Industry

This section identifies the leading regions and countries within the South American Mate industry, providing a deep dive into their respective market dynamics. Argentina and Brazil are identified as the most significant contributors to overall production and consumption.

Argentina:

- Production Analysis: xx Million tons in 2025, projected to reach xx Million tons by 2033.

- Consumption Analysis: xx Million tons in 2025, projected to reach xx Million tons by 2033.

- Market Size: xx Million in 2025, projected to reach xx Million in 2033.

- Import/Export Analysis: Details on volume and value of imports and exports.

- Price Trend Analysis: Analysis of price fluctuations and contributing factors.

Brazil: Similar detailed analysis as for Argentina, with specific data on production, consumption, import/export, and price trends.

Paraguay, Chile, Uruguay: Similar detailed analysis as for Argentina and Brazil.

- Key Drivers: Strong cultural attachment to mate, government support for the industry, and increasing investment in processing and distribution infrastructure.

South America Mate Industry Product Innovations

This section highlights product innovations within the Mate industry, including advancements in processing, packaging, and formulation. The emergence of flavored and functional mate drinks, along with eco-friendly packaging options, is discussed. Key innovations include the introduction of RTD mate drinks in various formats (cans, bottles, etc.), and the development of mate-based energy drinks. These innovations cater to evolving consumer preferences and preferences for convenience.

Propelling Factors for South America Mate Industry Growth

Several factors contribute to the South American Mate industry's growth. These include rising consumer demand driven by health consciousness and the growing popularity of natural and functional beverages. Economic growth, particularly in emerging markets, fuels increased disposable income, facilitating higher spending on premium beverages. Government regulations supporting local Mate production and export also positively influence market expansion.

Obstacles in the South America Mate Industry Market

Despite the growth potential, the South American Mate industry faces challenges. Climate change poses a significant risk to crop yields, leading to supply chain disruptions and price volatility. Competition from other beverages, particularly carbonated soft drinks and energy drinks, presents a considerable obstacle. Stricter regulatory frameworks concerning labeling and food safety can also impact profitability.

Future Opportunities in South America Mate Industry

The South American Mate industry is poised for substantial growth, fueled by expanding global demand. Opportunities exist in exploring new markets, particularly in Asia and Europe, where Mate consumption is growing. Innovations in product formulations, such as the development of unique blends and functional mate drinks, can attract new consumers. Sustainable practices, focused on reducing environmental impact, will offer a significant competitive advantage.

Major Players in the South America Mate Industry Ecosystem

- Lauro Raatz SA (La Hoja)

- Cooperativa Agrícola de la Colonia Liebig Ltda. (Playadito)

- Amanda

- Cooperativa Agrícola Mixta de Monte Carlo Ltda.

- La Cachuera SA (Taragüi)

- Establecimiento Las Marías

- Industrias de Mision S.A. (Rosamonte)

Key Developments in South America Mate Industry Industry

- 2022 Q3: Launch of a new RTD mate drink by Industrias de Mision S.A. (Rosamonte).

- 2023 Q1: Acquisition of a smaller Mate producer by Lauro Raatz SA (La Hoja).

- 2024 Q2: Introduction of a sustainable packaging solution by Cooperativa Agrícola de la Colonia Liebig Ltda. (Playadito). (Further developments to be added as per data)

Strategic South America Mate Industry Market Forecast

The South American Mate market is projected to witness sustained growth over the forecast period (2025-2033), driven by several factors. Expanding consumer preference for healthier beverages, innovation in product offerings, and targeted marketing initiatives will propel market expansion. Increased investment in sustainable farming practices and supply chain optimization will ensure long-term stability and growth. The increasing global awareness of Mate's health benefits will also create new market opportunities in both established and emerging markets.

South America Mate Industry Segmentation

-

1. Argentina

- 1.1. Production Analysis

- 1.2. Consumption Analysis & Market Size

- 1.3. Import Market Analysis (Volume & Value)

- 1.4. Export Market Analysis (Volume & Value)

- 1.5. Price Trend Analysis

-

2. Brazil

- 2.1. Production Analysis

- 2.2. Consumption Analysis & Market Size

- 2.3. Import Market Analysis (Volume & Value)

- 2.4. Export Market Analysis (Volume & Value)

- 2.5. Price Trend Analysis

-

3. Paraguay

- 3.1. Production Analysis

- 3.2. Consumption Analysis & Market Size

- 3.3. Import Market Analysis (Volume & Value)

- 3.4. Export Market Analysis (Volume & Value)

- 3.5. Price Trend Analysis

-

4. Chile

- 4.1. Production Analysis

- 4.2. Consumption Analysis & Market Size

- 4.3. Import Market Analysis (Volume & Value)

- 4.4. Export Market Analysis (Volume & Value)

- 4.5. Price Trend Analysis

-

5. Uruguay

- 5.1. Production Analysis

- 5.2. Consumption Analysis & Market Size

- 5.3. Import Market Analysis (Volume & Value)

- 5.4. Export Market Analysis (Volume & Value)

- 5.5. Price Trend Analysis

-

6. Argentina

- 6.1. Production Analysis

- 6.2. Consumption Analysis & Market Size

- 6.3. Import Market Analysis (Volume & Value)

- 6.4. Export Market Analysis (Volume & Value)

- 6.5. Price Trend Analysis

-

7. Brazil

- 7.1. Production Analysis

- 7.2. Consumption Analysis & Market Size

- 7.3. Import Market Analysis (Volume & Value)

- 7.4. Export Market Analysis (Volume & Value)

- 7.5. Price Trend Analysis

-

8. Paraguay

- 8.1. Production Analysis

- 8.2. Consumption Analysis & Market Size

- 8.3. Import Market Analysis (Volume & Value)

- 8.4. Export Market Analysis (Volume & Value)

- 8.5. Price Trend Analysis

-

9. Chile

- 9.1. Production Analysis

- 9.2. Consumption Analysis & Market Size

- 9.3. Import Market Analysis (Volume & Value)

- 9.4. Export Market Analysis (Volume & Value)

- 9.5. Price Trend Analysis

-

10. Uruguay

- 10.1. Production Analysis

- 10.2. Consumption Analysis & Market Size

- 10.3. Import Market Analysis (Volume & Value)

- 10.4. Export Market Analysis (Volume & Value)

- 10.5. Price Trend Analysis

South America Mate Industry Segmentation By Geography

-

1. South America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Peru

- 1.6. Venezuela

- 1.7. Ecuador

- 1.8. Bolivia

- 1.9. Paraguay

- 1.10. Uruguay

South America Mate Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Awareness About Health Benefits Associated With Pecan Consumption; Wide Application of Pecan

- 3.3. Market Restrains

- 3.3.1. ; Volatility in the Prices; Adverse Weather Conditions Affecting Yield

- 3.4. Market Trends

- 3.4.1. Emerging Export Potential Driving Production

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Mate Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Argentina

- 5.1.1. Production Analysis

- 5.1.2. Consumption Analysis & Market Size

- 5.1.3. Import Market Analysis (Volume & Value)

- 5.1.4. Export Market Analysis (Volume & Value)

- 5.1.5. Price Trend Analysis

- 5.2. Market Analysis, Insights and Forecast - by Brazil

- 5.2.1. Production Analysis

- 5.2.2. Consumption Analysis & Market Size

- 5.2.3. Import Market Analysis (Volume & Value)

- 5.2.4. Export Market Analysis (Volume & Value)

- 5.2.5. Price Trend Analysis

- 5.3. Market Analysis, Insights and Forecast - by Paraguay

- 5.3.1. Production Analysis

- 5.3.2. Consumption Analysis & Market Size

- 5.3.3. Import Market Analysis (Volume & Value)

- 5.3.4. Export Market Analysis (Volume & Value)

- 5.3.5. Price Trend Analysis

- 5.4. Market Analysis, Insights and Forecast - by Chile

- 5.4.1. Production Analysis

- 5.4.2. Consumption Analysis & Market Size

- 5.4.3. Import Market Analysis (Volume & Value)

- 5.4.4. Export Market Analysis (Volume & Value)

- 5.4.5. Price Trend Analysis

- 5.5. Market Analysis, Insights and Forecast - by Uruguay

- 5.5.1. Production Analysis

- 5.5.2. Consumption Analysis & Market Size

- 5.5.3. Import Market Analysis (Volume & Value)

- 5.5.4. Export Market Analysis (Volume & Value)

- 5.5.5. Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Argentina

- 5.6.1. Production Analysis

- 5.6.2. Consumption Analysis & Market Size

- 5.6.3. Import Market Analysis (Volume & Value)

- 5.6.4. Export Market Analysis (Volume & Value)

- 5.6.5. Price Trend Analysis

- 5.7. Market Analysis, Insights and Forecast - by Brazil

- 5.7.1. Production Analysis

- 5.7.2. Consumption Analysis & Market Size

- 5.7.3. Import Market Analysis (Volume & Value)

- 5.7.4. Export Market Analysis (Volume & Value)

- 5.7.5. Price Trend Analysis

- 5.8. Market Analysis, Insights and Forecast - by Paraguay

- 5.8.1. Production Analysis

- 5.8.2. Consumption Analysis & Market Size

- 5.8.3. Import Market Analysis (Volume & Value)

- 5.8.4. Export Market Analysis (Volume & Value)

- 5.8.5. Price Trend Analysis

- 5.9. Market Analysis, Insights and Forecast - by Chile

- 5.9.1. Production Analysis

- 5.9.2. Consumption Analysis & Market Size

- 5.9.3. Import Market Analysis (Volume & Value)

- 5.9.4. Export Market Analysis (Volume & Value)

- 5.9.5. Price Trend Analysis

- 5.10. Market Analysis, Insights and Forecast - by Uruguay

- 5.10.1. Production Analysis

- 5.10.2. Consumption Analysis & Market Size

- 5.10.3. Import Market Analysis (Volume & Value)

- 5.10.4. Export Market Analysis (Volume & Value)

- 5.10.5. Price Trend Analysis

- 5.11. Market Analysis, Insights and Forecast - by Region

- 5.11.1. South America

- 5.1. Market Analysis, Insights and Forecast - by Argentina

- 6. Brazil South America Mate Industry Analysis, Insights and Forecast, 2019-2031

- 7. Argentina South America Mate Industry Analysis, Insights and Forecast, 2019-2031

- 8. Rest of South America South America Mate Industry Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Lauro Raatz SA (La Hoja)

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Cooperativa Agrícola de la Colonia Liebig Ltda. (Playadito)

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Amanda

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Cooperativa Agrícola Mixta de Monte Carlo Ltda.

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 La Cachuera SA (Taragüi)

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Establecimiento Las Marías

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Industrias de Mision S.A. (Rosamonte)

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.1 Lauro Raatz SA (La Hoja)

List of Figures

- Figure 1: South America Mate Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South America Mate Industry Share (%) by Company 2024

List of Tables

- Table 1: South America Mate Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South America Mate Industry Revenue Million Forecast, by Argentina 2019 & 2032

- Table 3: South America Mate Industry Revenue Million Forecast, by Brazil 2019 & 2032

- Table 4: South America Mate Industry Revenue Million Forecast, by Paraguay 2019 & 2032

- Table 5: South America Mate Industry Revenue Million Forecast, by Chile 2019 & 2032

- Table 6: South America Mate Industry Revenue Million Forecast, by Uruguay 2019 & 2032

- Table 7: South America Mate Industry Revenue Million Forecast, by Argentina 2019 & 2032

- Table 8: South America Mate Industry Revenue Million Forecast, by Brazil 2019 & 2032

- Table 9: South America Mate Industry Revenue Million Forecast, by Paraguay 2019 & 2032

- Table 10: South America Mate Industry Revenue Million Forecast, by Chile 2019 & 2032

- Table 11: South America Mate Industry Revenue Million Forecast, by Uruguay 2019 & 2032

- Table 12: South America Mate Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 13: South America Mate Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Brazil South America Mate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Argentina South America Mate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America South America Mate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: South America Mate Industry Revenue Million Forecast, by Argentina 2019 & 2032

- Table 18: South America Mate Industry Revenue Million Forecast, by Brazil 2019 & 2032

- Table 19: South America Mate Industry Revenue Million Forecast, by Paraguay 2019 & 2032

- Table 20: South America Mate Industry Revenue Million Forecast, by Chile 2019 & 2032

- Table 21: South America Mate Industry Revenue Million Forecast, by Uruguay 2019 & 2032

- Table 22: South America Mate Industry Revenue Million Forecast, by Argentina 2019 & 2032

- Table 23: South America Mate Industry Revenue Million Forecast, by Brazil 2019 & 2032

- Table 24: South America Mate Industry Revenue Million Forecast, by Paraguay 2019 & 2032

- Table 25: South America Mate Industry Revenue Million Forecast, by Chile 2019 & 2032

- Table 26: South America Mate Industry Revenue Million Forecast, by Uruguay 2019 & 2032

- Table 27: South America Mate Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Brazil South America Mate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Argentina South America Mate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Chile South America Mate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Colombia South America Mate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Peru South America Mate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Venezuela South America Mate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Ecuador South America Mate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Bolivia South America Mate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Paraguay South America Mate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Uruguay South America Mate Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Mate Industry?

The projected CAGR is approximately 4.40%.

2. Which companies are prominent players in the South America Mate Industry?

Key companies in the market include Lauro Raatz SA (La Hoja) , Cooperativa Agrícola de la Colonia Liebig Ltda. (Playadito) , Amanda, Cooperativa Agrícola Mixta de Monte Carlo Ltda. , La Cachuera SA (Taragüi), Establecimiento Las Marías, Industrias de Mision S.A. (Rosamonte).

3. What are the main segments of the South America Mate Industry?

The market segments include Argentina, Brazil , Paraguay , Chile , Uruguay, Argentina, Brazil , Paraguay , Chile , Uruguay.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX Million as of 2022.

5. What are some drivers contributing to market growth?

; Awareness About Health Benefits Associated With Pecan Consumption; Wide Application of Pecan.

6. What are the notable trends driving market growth?

Emerging Export Potential Driving Production.

7. Are there any restraints impacting market growth?

; Volatility in the Prices; Adverse Weather Conditions Affecting Yield.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Mate Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Mate Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Mate Industry?

To stay informed about further developments, trends, and reports in the South America Mate Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence