Key Insights

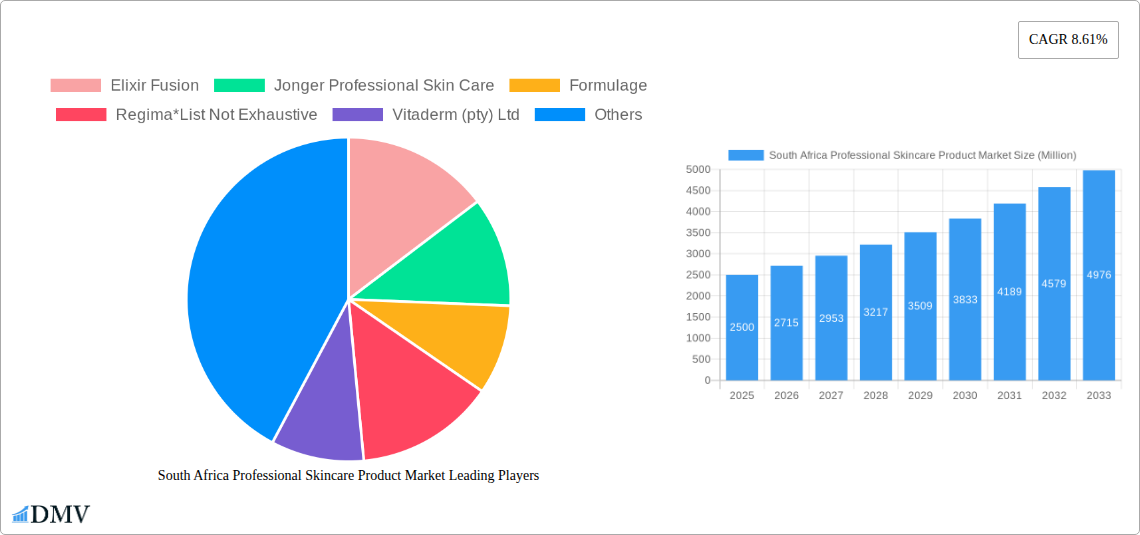

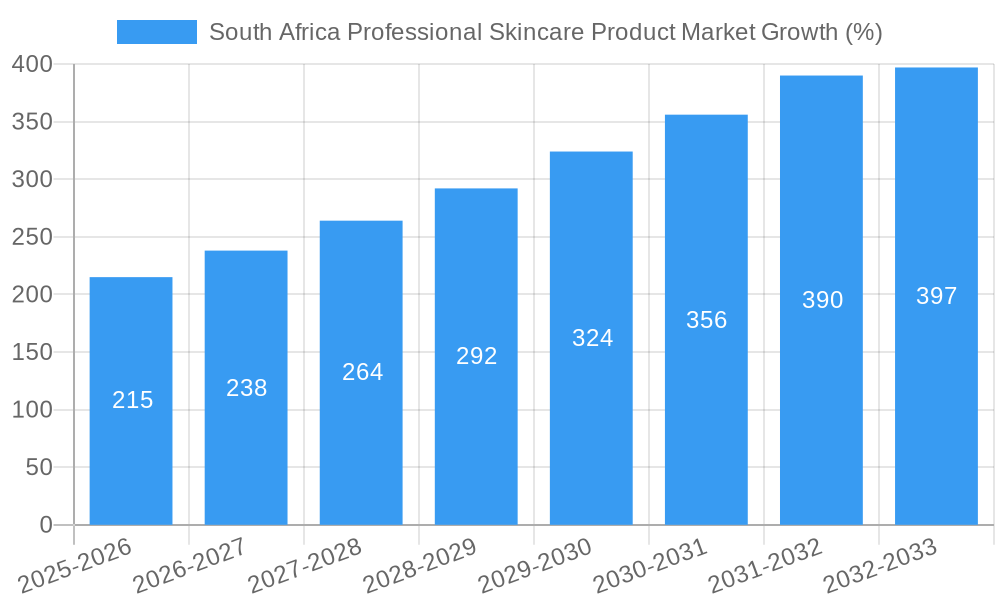

The South African professional skincare market, valued at approximately ZAR 2.5 billion (assuming a conversion rate and market size based on the provided MEA regional data and CAGR) in 2025, is poised for robust growth, projected to reach approximately ZAR 4.2 billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 8.61%. This expansion is fueled by several key market drivers. Rising disposable incomes within the South African middle class are empowering consumers to invest more in premium skincare products promising visible results. A growing awareness of skin health and the increasing prevalence of skin conditions like acne and hyperpigmentation are further driving demand for professional treatments and products. The popularity of social media influencers and beauty bloggers showcasing professional skincare routines also significantly impacts consumer choices, pushing the demand higher. Furthermore, the South African market witnesses a noticeable preference for specialized skincare addressing specific needs, like anti-aging or acne-prone skin. This is driving innovation and diversification within the industry, leading to the introduction of targeted product ranges. The market segmentation is crucial for understanding this growth: the "Face Care" segment leads, while convenient packaging types like tubes and bottles dominate sales channels. Online retail channels are experiencing rapid expansion, complementing the traditionally dominant offline retail stores.

The competitive landscape is dynamic, with established players such as Elixir Fusion, Jonger Professional Skin Care, Formulage, and Environ Skin Care competing alongside newer entrants. The market's future growth will be influenced by continued economic stability, evolving consumer preferences, and the increasing availability of innovative products and treatment options. Sustained marketing efforts focusing on product efficacy and the benefits of professional skincare will be key to maintaining the current trajectory. Addressing challenges such as fluctuating exchange rates and potential economic uncertainties will be critical for consistent market expansion. The focus on sustainability and ethical sourcing is also likely to play a more significant role in influencing consumer choices and impacting industry practices.

South Africa Professional Skincare Product Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the South Africa professional skincare product market, offering valuable insights for stakeholders seeking to understand market dynamics, growth opportunities, and competitive landscapes. The report covers the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033. The market is segmented by product type (face care, body care, and other), packaging type (tubes, bottles, jars), and distribution channel (offline and online retail stores). Key players such as Elixir Fusion, Jonger Professional Skin Care, Formulage, Regima, Vitaderm (pty) Ltd, Saloncare, Dr Gobac, Lamelle, Essel Products, and Environ Skin Care (pty) Ltd are analyzed in detail. The market is projected to reach xx Million by 2033.

South Africa Professional Skincare Product Market Composition & Trends

This section evaluates the South African professional skincare market's concentration, innovation drivers, regulatory environment, substitute products, end-user profiles, and mergers and acquisitions (M&A) activity. The market exhibits a moderately concentrated structure, with the top five players holding an estimated xx% market share in 2025.

- Market Share Distribution (2025): Top 5 players: xx%; Others: xx%.

- Innovation Catalysts: Increasing consumer awareness of skincare benefits, demand for natural and organic products, and technological advancements in formulation and delivery systems.

- Regulatory Landscape: The South African regulatory framework governing cosmetics and skincare products is relatively robust, ensuring product safety and quality. However, navigating regulations can be complex for new entrants.

- Substitute Products: The market faces competition from mass-market skincare brands and home remedies, impacting the premium segment's growth.

- End-User Profiles: The target audience includes professionals (dermatologists, estheticians) and consumers seeking advanced skincare solutions.

- M&A Activities: While specific M&A deal values aren't publicly available for all transactions, the market has witnessed several strategic acquisitions and partnerships in recent years, driven by consolidation efforts and access to new technologies or distribution channels. Estimated total M&A value during 2019-2024 is xx Million.

South Africa Professional Skincare Product Market Industry Evolution

This section analyzes the market's growth trajectories, technological advancements, and evolving consumer preferences from 2019 to 2025. The market witnessed a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024). This growth is primarily fueled by increased disposable incomes, changing lifestyles, and heightened awareness regarding skin health among consumers. The forecast period (2025-2033) projects a CAGR of xx%, driven by the increasing adoption of advanced skincare technologies and the expansion of e-commerce channels. Technological advancements, such as the incorporation of advanced ingredients (e.g., peptides, stem cells) and innovative delivery systems (e.g., nanotechnology), have played a vital role in market growth. Simultaneously, shifting consumer preferences towards natural, organic, and sustainable products are reshaping the market landscape, compelling manufacturers to adapt their offerings. The growing demand for specialized skincare solutions catering to specific skin concerns (e.g., acne, aging, hyperpigmentation) also fuels market growth.

Leading Regions, Countries, or Segments in South Africa Professional Skincare Product Market

This section identifies the dominant segments within the South African professional skincare market.

- Dominant Segment: The face care segment is currently the largest and fastest-growing segment, accounting for xx% of the market in 2025.

- Key Drivers:

- High Investment Trends: Significant investments in research and development are driving innovation in the face care segment.

- Regulatory Support: Stringent regulations regarding product safety and efficacy bolster consumer confidence.

- Growing Awareness: Increasing consumer awareness of the importance of sun protection and anti-aging solutions.

- Other Significant Segments: The body care segment represents a substantial market share (xx% in 2025) and shows potential for future growth. Offline retail stores are currently the most prominent distribution channel, holding xx% market share in 2025, but online channels are rapidly gaining traction. Bottles are the most preferred packaging type.

The dominance of the face care segment is due to the high demand for anti-aging, brightening, and acne-treatment products. The increasing number of beauty salons and spas offering professional skincare treatments further contributes to its dominance. The preference for bottles as the preferred packaging stems from consumers' comfort and the perception of better product preservation. However, the online retail channel is steadily gaining market share, driven by enhanced internet penetration and the convenience it offers.

South Africa Professional Skincare Product Market Product Innovations

Recent product launches showcase innovation, with a focus on addressing specific skin concerns using advanced formulations and ingredients. Brands are incorporating natural and sustainable ingredients, highlighting their commitment to environmental responsibility and consumer demand for cleaner beauty. The emphasis on personalized skincare solutions, tailored to individual needs, is a prominent trend. Technological advancements such as nanotechnology for enhanced delivery systems and advanced ingredient formulations are also contributing to product innovation, enabling superior performance and efficacy.

Propelling Factors for South Africa Professional Skincare Product Market Growth

Several factors drive the South African professional skincare market's growth. The rising disposable incomes of the middle class are a significant driver, leading to increased spending on premium skincare products. Government support for the cosmetics industry, including investment in research and development, promotes innovation and growth. The increasing prevalence of skin conditions and the rising awareness of skincare’s importance also fuel market expansion.

Obstacles in the South Africa Professional Skincare Product Market

The South African professional skincare market faces some challenges. High import duties on raw materials and finished goods increase production costs. The volatile economic climate impacts consumer spending, influencing demand for premium skincare products. Intense competition from both domestic and international brands creates challenges for market entry and expansion.

Future Opportunities in South Africa Professional Skincare Product Market

The market presents significant opportunities. The rising popularity of natural and organic skincare products creates a niche for eco-conscious brands. The growing adoption of online retail channels opens up new avenues for distribution and market penetration. Increased consumer awareness of advanced skincare technology and the rising demand for personalized solutions will further drive market growth.

Major Players in the South Africa Professional Skincare Product Market Ecosystem

- Elixir Fusion

- Jonger Professional Skin Care

- Formulage

- Regima

- Vitaderm (pty) Ltd

- Saloncare

- Dr Gobac

- Lamelle

- Essel Products

- Environ Skin Care (pty) Ltd

Key Developments in South Africa Professional Skincare Product Market Industry

- February 2022: Environ Skin Care (Pty) Ltd launched Focus Care Youth+ 3DSynerge filler creme, targeting aging concerns.

- February 2023: Benefit Cosmetics launched six pore-erasing skincare products.

- March 2023: Tatcha launched The Silk Serum, a wrinkle-smoothing formula with a retinol alternative.

- March 2023: Byoma announced plans to launch a moisturizing gel cream with SPF 30.

These launches highlight the industry's focus on addressing specific skin concerns and incorporating advanced ingredients and technologies.

Strategic South Africa Professional Skincare Product Market Forecast

The South African professional skincare market is poised for significant growth over the forecast period (2025-2033). Increasing consumer awareness, rising disposable incomes, and the expansion of e-commerce channels will contribute to market expansion. Innovation in product formulations and delivery systems will create new opportunities for growth. The market is expected to reach xx Million by 2033, driven by a combination of factors. The ongoing focus on natural and sustainable products and the increasing demand for personalized skincare solutions further supports a positive growth outlook.

South Africa Professional Skincare Product Market Segmentation

-

1. Type

-

1.1. Face Care

- 1.1.1. Cleansers & Exfoliators

- 1.1.2. Face Masks

- 1.1.3. Face Moisturizers

- 1.1.4. Other Face Care Products

-

1.2. Body Care

- 1.2.1. Body Lotions/Moisturizers

- 1.2.2. Body Wash and Shower Gel

- 1.2.3. Other Body Care Products

-

1.1. Face Care

-

2. Packaging Type

- 2.1. Tube

- 2.2. Bottles

- 2.3. Jars

-

3. Distribution Channel

- 3.1. Offline Retail Stores

-

3.2. Online Retail Stores

- 3.2.1. Specialist Retail Stores

- 3.2.2. Supermarkets/Hypermarkets

- 3.2.3. Convenience/Grocery Stores

- 3.2.4. Pharmacies/Drug Stores

- 3.2.5. Online Retail Channels

- 3.2.6. Other Distribution Channels

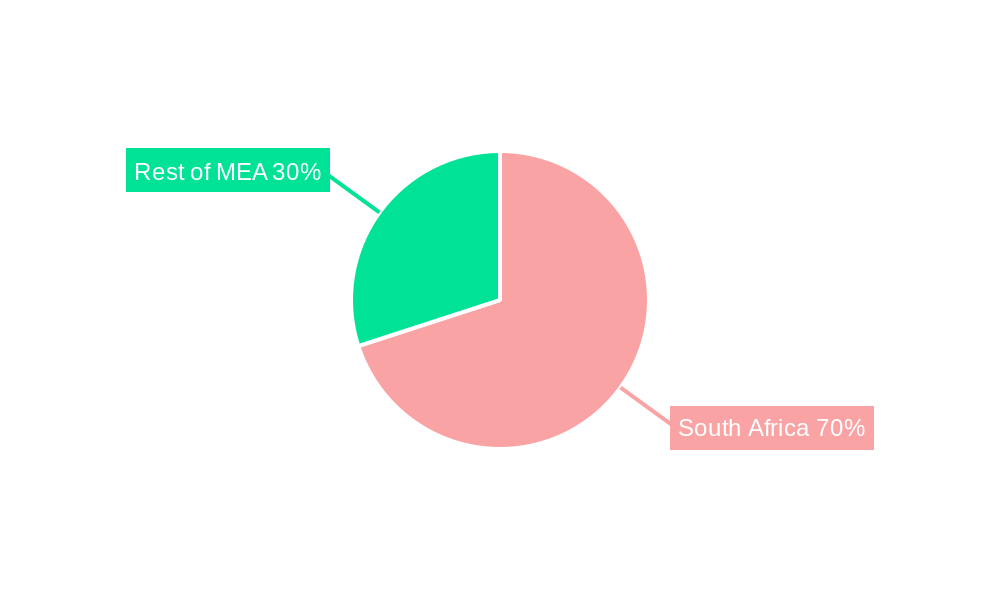

South Africa Professional Skincare Product Market Segmentation By Geography

- 1. South Africa

South Africa Professional Skincare Product Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.61% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Consumption of Tobacco is Rising as Cigarette Segment is Growing at a Significant Pace; Strong Penetration of Retail Distribution Network

- 3.3. Market Restrains

- 3.3.1. Growing Awareness about the Harmful effects of Tobacco Products to Hamper Market Growth

- 3.4. Market Trends

- 3.4.1. Growing Aging Population is Accelerating the Growth of Professional Skin Care Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Professional Skincare Product Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Face Care

- 5.1.1.1. Cleansers & Exfoliators

- 5.1.1.2. Face Masks

- 5.1.1.3. Face Moisturizers

- 5.1.1.4. Other Face Care Products

- 5.1.2. Body Care

- 5.1.2.1. Body Lotions/Moisturizers

- 5.1.2.2. Body Wash and Shower Gel

- 5.1.2.3. Other Body Care Products

- 5.1.1. Face Care

- 5.2. Market Analysis, Insights and Forecast - by Packaging Type

- 5.2.1. Tube

- 5.2.2. Bottles

- 5.2.3. Jars

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Offline Retail Stores

- 5.3.2. Online Retail Stores

- 5.3.2.1. Specialist Retail Stores

- 5.3.2.2. Supermarkets/Hypermarkets

- 5.3.2.3. Convenience/Grocery Stores

- 5.3.2.4. Pharmacies/Drug Stores

- 5.3.2.5. Online Retail Channels

- 5.3.2.6. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. UAE South Africa Professional Skincare Product Market Analysis, Insights and Forecast, 2019-2031

- 7. South Africa South Africa Professional Skincare Product Market Analysis, Insights and Forecast, 2019-2031

- 8. Saudi Arabia South Africa Professional Skincare Product Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of MEA South Africa Professional Skincare Product Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Elixir Fusion

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Jonger Professional Skin Care

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Formulage

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Regima*List Not Exhaustive

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Vitaderm (pty) Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Saloncare

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Dr Gobac

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Lamelle

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Essel Products

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Environ Skin Care (pty) Ltd

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Elixir Fusion

List of Figures

- Figure 1: South Africa Professional Skincare Product Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South Africa Professional Skincare Product Market Share (%) by Company 2024

List of Tables

- Table 1: South Africa Professional Skincare Product Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South Africa Professional Skincare Product Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: South Africa Professional Skincare Product Market Revenue Million Forecast, by Packaging Type 2019 & 2032

- Table 4: South Africa Professional Skincare Product Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 5: South Africa Professional Skincare Product Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: South Africa Professional Skincare Product Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: UAE South Africa Professional Skincare Product Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: South Africa South Africa Professional Skincare Product Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Saudi Arabia South Africa Professional Skincare Product Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of MEA South Africa Professional Skincare Product Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: South Africa Professional Skincare Product Market Revenue Million Forecast, by Type 2019 & 2032

- Table 12: South Africa Professional Skincare Product Market Revenue Million Forecast, by Packaging Type 2019 & 2032

- Table 13: South Africa Professional Skincare Product Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 14: South Africa Professional Skincare Product Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Professional Skincare Product Market?

The projected CAGR is approximately 8.61%.

2. Which companies are prominent players in the South Africa Professional Skincare Product Market?

Key companies in the market include Elixir Fusion, Jonger Professional Skin Care, Formulage, Regima*List Not Exhaustive, Vitaderm (pty) Ltd, Saloncare, Dr Gobac, Lamelle, Essel Products, Environ Skin Care (pty) Ltd.

3. What are the main segments of the South Africa Professional Skincare Product Market?

The market segments include Type, Packaging Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Consumption of Tobacco is Rising as Cigarette Segment is Growing at a Significant Pace; Strong Penetration of Retail Distribution Network.

6. What are the notable trends driving market growth?

Growing Aging Population is Accelerating the Growth of Professional Skin Care Products.

7. Are there any restraints impacting market growth?

Growing Awareness about the Harmful effects of Tobacco Products to Hamper Market Growth.

8. Can you provide examples of recent developments in the market?

March 2023: Byoma announced its plans to launch Moisturising Gel Cream SPF 30. According to the brand's website, this product is ultra-effective as it is claimed to be a deeply hydrating and non-greasy SPF 30 daily moisturizer. Further, this product is claimed to be the ultimate blend of sun care, barrier care, and skincare.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Professional Skincare Product Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Professional Skincare Product Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Professional Skincare Product Market?

To stay informed about further developments, trends, and reports in the South Africa Professional Skincare Product Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence