Key Insights

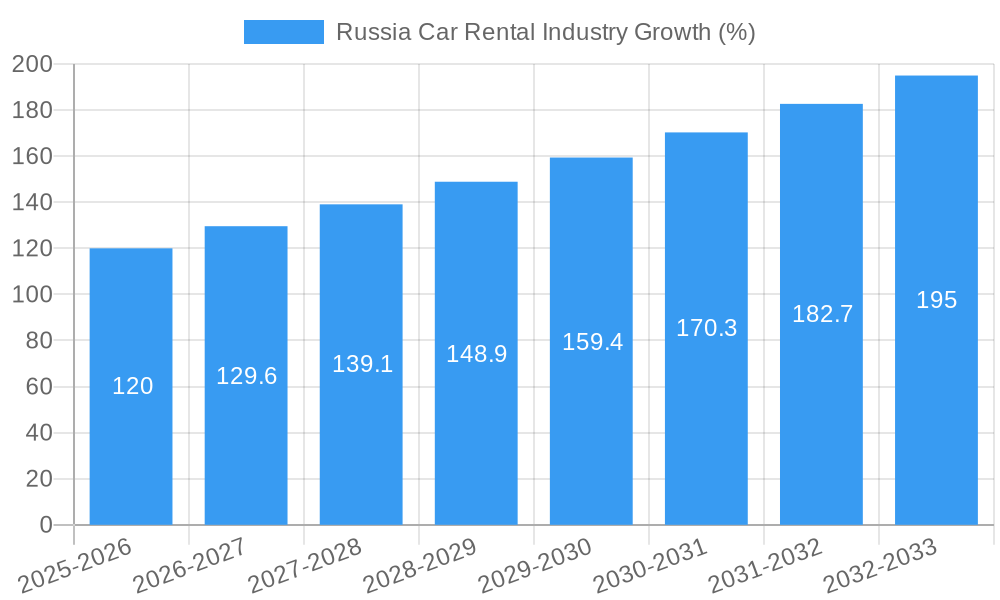

The Russian car rental market, valued at approximately [Estimate based on available data and market trends – e.g., $X billion] in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 8.00% from 2025 to 2033. This expansion is fueled by several key drivers. The burgeoning tourism sector, particularly inbound tourism to major cities like Moscow and St. Petersburg, is a significant contributor. Increasing business travel and the rising disposable incomes of the middle class are further boosting demand for convenient and flexible transportation options. The increasing popularity of online booking platforms is streamlining the rental process, enhancing accessibility and driving market growth. Moreover, the diversification of car types offered, ranging from economical hatchbacks to luxury SUVs, caters to a broader spectrum of customer needs and preferences. The growth of ride-hailing services, however, presents some degree of competition, although these often complement rather than directly substitute car rentals for longer durations or specific travel requirements.

However, the market faces certain restraints. Economic fluctuations and geopolitical uncertainties can impact consumer spending and investment in the car rental sector. The availability of public transportation in major cities, while sometimes limited in certain regions, provides alternative transportation options. Furthermore, the existing regulatory environment and infrastructure limitations, particularly in less developed regions of Russia, pose challenges to the growth of the car rental industry. Market segmentation, with a focus on short-term leisure rentals in urban areas and longer-term rentals for business purposes in both urban and regional settings, allows rental companies to strategically cater to diverse customer demands and maximize profitability. This segmentation also indicates opportunity for expansion into underserved regions and niche markets. The competitive landscape, encompassing both international players like Hertz and Europcar, and domestic providers like Delimobil and Yandex Drive, is characterized by intense competition, demanding effective strategies for market share acquisition and retention.

Russia Car Rental Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the Russia car rental market, covering its evolution, key players, growth drivers, and future prospects from 2019 to 2033. The report leverages extensive data analysis, incorporating both historical (2019-2024) and forecast data (2025-2033), with 2025 serving as the base and estimated year. The study meticulously examines various market segments, including booking types, car types, rental lengths, and applications, offering a granular understanding of this dynamic sector. The total market value is expected to reach XX Million by 2033.

Russia Car Rental Industry Market Composition & Trends

This section delves into the competitive landscape of the Russia car rental market, evaluating market concentration, key innovation drivers, the regulatory environment, substitute products, end-user profiles, and significant merger and acquisition (M&A) activities. The market is characterized by a mix of international players and rapidly growing domestic companies.

Market Concentration: The market exhibits moderate concentration, with a few major players like Yandex Drive and Delimobil holding significant market share, but a large number of smaller players also contributing significantly. Market share distribution amongst the top 5 players is estimated at approximately XX%.

Innovation Catalysts: The sector is witnessing rapid innovation, driven by technological advancements such as smartphone apps for booking and management, and the introduction of subscription services. The rise of car-sharing services also significantly contributes to market dynamics.

Regulatory Landscape: The regulatory landscape significantly influences operations, particularly concerning licensing, insurance, and environmental regulations. Changes in these areas can directly impact market growth and profitability.

Substitute Products: Public transport and ride-hailing services present the primary substitute products, impacting demand, particularly for shorter rental durations.

End-User Profiles: The market caters to both leisure/tourism and business travelers, with a growing segment of users utilizing car rental for short-term personal needs.

M&A Activities: The industry has seen considerable M&A activity, although exact deal values remain largely undisclosed (estimated at XX Million in total value from 2019-2024). These activities often involve strategic partnerships or acquisitions to expand market reach and service offerings.

Russia Car Rental Industry Industry Evolution

This section analyzes the Russia car rental market's growth trajectory, influenced by technological advancements and shifting consumer preferences from 2019 to 2033. The market experienced significant growth during the historical period (2019-2024), with an average annual growth rate (AAGR) of approximately XX%. This growth is expected to continue, although at a slightly moderated pace, during the forecast period (2025-2033), with a projected AAGR of XX%.

Technological advancements, including the widespread adoption of mobile booking apps and the integration of innovative features like in-car technology and digital key systems, are driving the market's transformation. The increasing preference for online bookings and self-service options underscores the shift towards customer-centric solutions. The emergence of subscription models, offering flexible rental options, is further reshaping the industry. Consumer demand is also driven by factors like improved infrastructure, increased disposable income, and the evolving travel preferences of a younger generation.

Leading Regions, Countries, or Segments in Russia Car Rental Industry

This section identifies the dominant segments within the Russian car rental market.

By Booking Type: Online bookings are rapidly gaining prominence due to convenience and accessibility, representing a larger market share compared to offline bookings. The online segment's growth is fueled by increasing internet penetration and smartphone usage.

By Car Type: SUVs and sedans dominate the market, driven by family travel and business requirements. Hatchbacks also constitute a significant segment, catering to individual travelers and budget-conscious customers.

By Rental Length: Short-term rentals are currently the most prevalent, aligning with the needs of tourists and business travelers. However, the long-term rental segment is witnessing gradual growth, driven by the rise of subscription models and the demand for more flexible car usage options.

By Application: Leisure/tourism and business travel are the primary application segments, with leisure tourism holding a slightly larger market share. The increasing popularity of domestic tourism is bolstering this segment.

Key Drivers:

Investment Trends: Significant investments in technology and fleet expansion are crucial drivers in several segments, especially online booking platforms and the expansion of SUV fleets.

Regulatory Support: Supportive regulatory frameworks that encourage market competition and innovation contribute to overall market growth.

The dominance of these segments is influenced by a number of factors, including affordability, convenience, and suitability for specific needs. For instance, the prevalence of short-term rentals reflects the nature of travel in Russia, whereas the dominance of SUVs reflects a preference for vehicles suitable for varied road conditions.

Russia Car Rental Industry Product Innovations

The Russian car rental market is witnessing continuous product innovation, driven by technological advancements and evolving consumer preferences. New features such as mobile apps with integrated navigation, real-time tracking, and digital key systems enhance user experience. Subscription-based models are gaining traction, providing flexible rental options that cater to diverse needs. Premium services offering high-end vehicles with additional features like chauffeur services are also emerging. These innovations contribute to improved convenience, affordability, and overall customer satisfaction.

Propelling Factors for Russia Car Rental Industry Growth

Several factors contribute to the growth of the Russia car rental industry. Technological advancements, particularly the development and adoption of user-friendly mobile applications, have streamlined the booking and rental process. Economic factors, such as rising disposable incomes and increased tourism, further fuel demand. Government initiatives to improve infrastructure and support the tourism sector create a conducive environment for industry growth. Finally, favorable regulatory frameworks that promote competition and innovation are essential to market expansion.

Obstacles in the Russia Car Rental Industry Market

The Russia car rental market faces certain challenges. Regulatory hurdles, including licensing requirements and insurance regulations, can impact operational efficiency and expansion plans. Supply chain disruptions, particularly concerning vehicle availability and maintenance, can limit fleet sizes and service capabilities. Intense competition from established players and new entrants also puts pressure on profit margins. These factors necessitate strategic adaptations for market players.

Future Opportunities in Russia Car Rental Industry

Future opportunities abound in the Russia car rental industry. Expanding into underserved regions and targeting new customer segments presents significant potential. The integration of advanced technologies such as autonomous driving features and electric vehicle fleets will reshape the market. Capitalizing on emerging consumer trends, such as eco-friendly travel and personalized rental experiences, will drive future growth. Exploring innovative business models, like subscription-based services or car-sharing platforms, further enhances market potential.

Major Players in the Russia Car Rental Industry Ecosystem

- Delimobil

- Europcar International (Europcar International)

- The Hertz Corporation (The Hertz Corporation)

- Naprokat R

- YouDrive

- Yandex Drive (Yandex)

- Belka Car

- Budget Rent a Car System Inc (Budget Rent a Car)

- Avis (Avis)

- Enterprise Holding Inc (Enterprise)

Key Developments in Russia Car Rental Industry Industry

- June 2021: Yandex Drive launched a platform for managing vehicle fleets, enhancing operational efficiency.

- March 2021: Audi Russia introduced a premium subscription service, Audi Drive, expanding market segmentation.

- October 2021: MINI Russia launched EASY2DRIVE, a fully digital car rental service via a mobile app.

- May 2022: Mercedes Benz and BMW AG introduced a joint minute-based car rental service, demonstrating innovation in rental models.

Strategic Russia Car Rental Industry Market Forecast

The Russia car rental market is poised for sustained growth, driven by technological advancements, evolving consumer preferences, and increased investment. The expanding tourism sector and the rise of subscription-based models promise significant market potential. However, successful navigation of regulatory complexities and supply chain vulnerabilities remains crucial for long-term success. Focusing on innovation, customer experience, and strategic partnerships will be key for companies aiming to capture market share in this dynamic sector.

Russia Car Rental Industry Segmentation

-

1. Booking Type

- 1.1. Online Booking

- 1.2. Offline Booking

-

2. Car Type

- 2.1. Hatchback

- 2.2. Sedan

- 2.3. SUV

-

3. Rental Length

- 3.1. Short Term

- 3.2. Long Term

-

4. Application

- 4.1. Leisure/Tourism

- 4.2. Business

Russia Car Rental Industry Segmentation By Geography

- 1. Russia

Russia Car Rental Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of 2-wheelers across the Globe

- 3.3. Market Restrains

- 3.3.1. Rise in demand of Electric Vehicles

- 3.4. Market Trends

- 3.4.1. Online Booking Segment Likely to Drive Demand in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russia Car Rental Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Booking Type

- 5.1.1. Online Booking

- 5.1.2. Offline Booking

- 5.2. Market Analysis, Insights and Forecast - by Car Type

- 5.2.1. Hatchback

- 5.2.2. Sedan

- 5.2.3. SUV

- 5.3. Market Analysis, Insights and Forecast - by Rental Length

- 5.3.1. Short Term

- 5.3.2. Long Term

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Leisure/Tourism

- 5.4.2. Business

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by Booking Type

- 6. Western Russia Russia Car Rental Industry Analysis, Insights and Forecast, 2019-2031

- 7. Eastern Russia Russia Car Rental Industry Analysis, Insights and Forecast, 2019-2031

- 8. Southern Russia Russia Car Rental Industry Analysis, Insights and Forecast, 2019-2031

- 9. Northern Russia Russia Car Rental Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Delimobil

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Europcar International

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 The Hertz Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Naprokat R

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 YouDrive

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Yandex Drive

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Belka Car

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Budget Rent a Car System Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Avis

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Enterprise Holding Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Delimobil

List of Figures

- Figure 1: Russia Car Rental Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Russia Car Rental Industry Share (%) by Company 2024

List of Tables

- Table 1: Russia Car Rental Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Russia Car Rental Industry Revenue Million Forecast, by Booking Type 2019 & 2032

- Table 3: Russia Car Rental Industry Revenue Million Forecast, by Car Type 2019 & 2032

- Table 4: Russia Car Rental Industry Revenue Million Forecast, by Rental Length 2019 & 2032

- Table 5: Russia Car Rental Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Russia Car Rental Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Russia Car Rental Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Western Russia Russia Car Rental Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Eastern Russia Russia Car Rental Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Southern Russia Russia Car Rental Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Northern Russia Russia Car Rental Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Russia Car Rental Industry Revenue Million Forecast, by Booking Type 2019 & 2032

- Table 13: Russia Car Rental Industry Revenue Million Forecast, by Car Type 2019 & 2032

- Table 14: Russia Car Rental Industry Revenue Million Forecast, by Rental Length 2019 & 2032

- Table 15: Russia Car Rental Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 16: Russia Car Rental Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russia Car Rental Industry?

The projected CAGR is approximately 8.00%.

2. Which companies are prominent players in the Russia Car Rental Industry?

Key companies in the market include Delimobil, Europcar International, The Hertz Corporation, Naprokat R, YouDrive, Yandex Drive, Belka Car, Budget Rent a Car System Inc, Avis, Enterprise Holding Inc.

3. What are the main segments of the Russia Car Rental Industry?

The market segments include Booking Type, Car Type, Rental Length, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of 2-wheelers across the Globe.

6. What are the notable trends driving market growth?

Online Booking Segment Likely to Drive Demand in the Market.

7. Are there any restraints impacting market growth?

Rise in demand of Electric Vehicles.

8. Can you provide examples of recent developments in the market?

In May 2022, Mercedes Benz and BMW AG jointly introduced a car rental service in Russia. The service allows the user to rent a car by the minute. The vehicles were booked over a smartphone application and can be returned anywhere in the business area.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russia Car Rental Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russia Car Rental Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russia Car Rental Industry?

To stay informed about further developments, trends, and reports in the Russia Car Rental Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence