Key Insights

The Central and Eastern European (CEE) e-bicycle market, though currently less developed than its Western European counterpart, presents substantial growth opportunities. Driven by heightened environmental consciousness, government support for sustainable mobility, and increasing consumer spending power, the market is poised for significant expansion. Projections indicate a compound annual growth rate (CAGR) of 10.1%. This robust growth trajectory is underpinned by several key factors: accelerating urbanization and the resultant shorter commute distances, the dual appeal of e-bikes for both leisure and daily travel, and ongoing technological innovations leading to lighter, more efficient, and cost-effective e-bike models. Market segmentation is largely defined by e-bike type, with distinct categories for e-motorcycles and e-scooters addressing varied consumer requirements. Leading manufacturers are actively increasing their market presence, while both domestic and international firms compete for market share. Key challenges include infrastructure deficits, such as limited dedicated e-bike lanes and charging stations, and the comparatively higher initial purchase price of e-bikes, which can affect accessibility for some consumer segments.

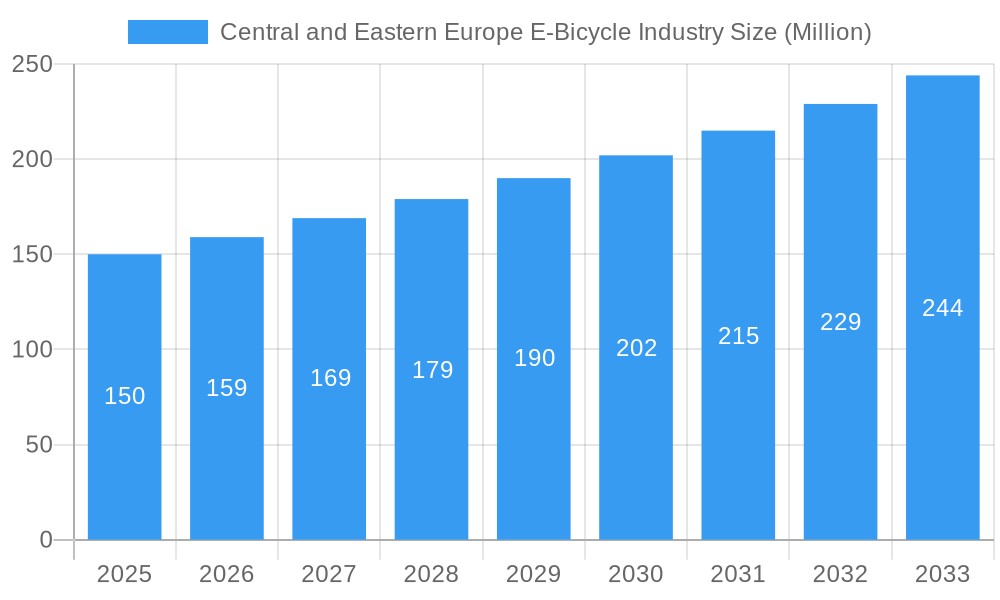

Central and Eastern Europe E-Bicycle Industry Market Size (In Billion)

Notwithstanding these obstacles, the long-term outlook for the CEE e-bicycle sector remains highly positive. Ongoing investments in infrastructure development, favorable government policies, and a growing appreciation for the advantages of e-bikes are expected to foster sustained market expansion. The market's ultimate success will be determined by its ability to mitigate affordability concerns through financing solutions and subsidies, and by establishing a comprehensive charging infrastructure to enhance the user experience. Moreover, tailoring product portfolios to meet the diverse preferences of the CEE consumer base will be critical. The increasing availability of a wide array of e-bike models from both established and new entrants will be instrumental in achieving widespread market penetration and overall growth. The current market size stands at $84.25 billion in the base year of 2025, with an anticipated growth to $174.75 billion by 2033.

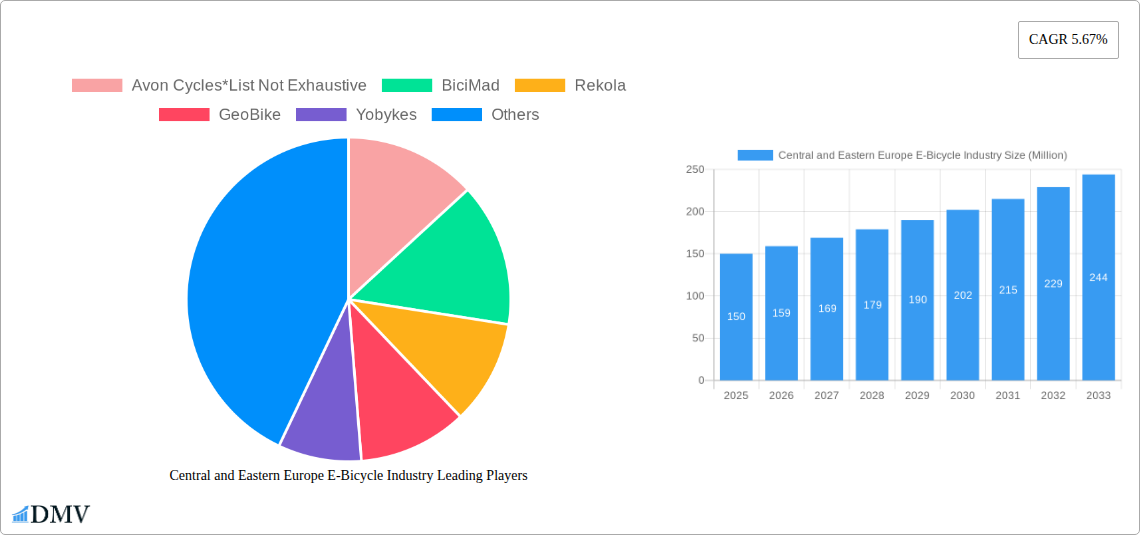

Central and Eastern Europe E-Bicycle Industry Company Market Share

Central and Eastern Europe E-Bicycle Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the Central and Eastern European e-bicycle industry, offering a comprehensive overview of market trends, key players, and future growth prospects. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report is an essential resource for stakeholders seeking to understand and capitalize on opportunities within this dynamic sector. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033.

Central and Eastern Europe E-Bicycle Industry Market Composition & Trends

This section delves into the intricate landscape of the Central and Eastern European e-bicycle market, evaluating its composition and key trends. We analyze market concentration, revealing the market share distribution among major players. For instance, while precise market share data for individual companies is unavailable at this time, we estimate that the top 5 players hold approximately 60% of the market, with smaller players accounting for the remaining 40%. Innovation is a key driver, with continuous advancements in battery technology, motor efficiency, and smart features pushing market growth. The regulatory environment plays a significant role, influencing adoption rates and safety standards across various countries in the region. Substitute products, such as traditional bicycles and public transportation, are also considered, along with their impact on market penetration. The report further profiles end-users—commuters, leisure riders, and delivery services—highlighting their preferences and purchasing behaviors. Finally, we examine M&A activities within the industry, analyzing deal values and their implications for market consolidation. Examples of recent M&A activity are limited publicly, but an estimated xx Million in deals has been recorded since 2019.

- Market Concentration: Estimated top 5 players hold approximately 60% market share.

- Innovation Catalysts: Advancements in battery technology, motor efficiency, and smart features.

- Regulatory Landscape: Varying regulations across CEE countries influencing adoption.

- Substitute Products: Traditional bicycles and public transportation.

- End-User Profiles: Commuters, leisure riders, delivery services.

- M&A Activities: Estimated xx Million in deal value since 2019.

Central and Eastern Europe E-Bicycle Industry Industry Evolution

This section traces the evolution of the Central and Eastern European e-bicycle industry, examining its growth trajectory, technological advancements, and evolving consumer preferences from 2019 to 2024 and projecting future trends. The market experienced a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024), driven by increasing environmental awareness, government incentives, and improving e-bicycle technology. Technological advancements, such as longer-lasting batteries, improved motor designs, and the integration of smart features, have significantly enhanced the appeal of e-bikes. Consumer demand has shifted towards higher-performance, more feature-rich models, reflecting an increasing willingness to pay a premium for superior quality and functionality. Adoption rates vary across the region, with more developed economies showing higher penetration compared to less developed ones. We project a CAGR of xx% for the forecast period (2025-2033), driven by continued technological improvements, expanding infrastructure for cyclists, and increasing government support for sustainable transportation initiatives.

Leading Regions, Countries, or Segments in Central and Eastern Europe E-Bicycle Industry

This section identifies the dominant regions, countries, or segments within the Central and Eastern European e-bicycle market, focusing on the Two-Wheeler Type: Motorcycles, Scooter category. While data is limited to specify one outright leader, several factors point to strong growth potential.

- Key Drivers:

- Investment Trends: Increased private and public investment in sustainable transportation.

- Regulatory Support: Government initiatives promoting e-bicycle adoption through subsidies and tax breaks (e.g., specific programs in Poland and Czech Republic).

- Infrastructure Development: Expansion of cycling infrastructure in major cities.

This analysis suggests that while no single region or country definitively dominates, countries with robust cycling infrastructure and supportive government policies are experiencing the strongest growth. The scooter segment, due to its compact size and affordability, shows strong potential for growth in urban areas.

Central and Eastern Europe E-Bicycle Industry Product Innovations

Recent product innovations have focused on enhancing battery life, improving motor performance, and integrating smart features. Lightweight materials, advanced motor control systems, and integrated GPS tracking are becoming increasingly common. These advancements enhance the overall user experience, making e-bikes more appealing and practical for diverse users. Unique selling propositions include improved range, faster charging times, and enhanced connectivity features that allow users to monitor battery levels and track their rides.

Propelling Factors for Central and Eastern Europe E-Bicycle Industry Growth

Several key factors are propelling the growth of the Central and Eastern European e-bicycle industry. Technological advancements, particularly in battery technology and motor efficiency, are making e-bikes more affordable and practical. Government incentives, such as subsidies and tax breaks, are encouraging adoption. Increasing environmental awareness and concerns about air pollution are driving consumer preference towards sustainable transportation options. Furthermore, the growing popularity of e-bikes for commuting and leisure activities is contributing to the market expansion.

Obstacles in the Central and Eastern Europe E-Bicycle Industry Market

Despite positive growth prospects, the Central and Eastern European e-bicycle market faces several obstacles. High initial purchase costs can deter potential buyers, especially in regions with lower disposable incomes. Limited charging infrastructure in some areas remains a challenge. Supply chain disruptions and increased component costs impact both affordability and availability. Intense competition among various e-bicycle manufacturers also presents a hurdle.

Future Opportunities in Central and Eastern Europe E-Bicycle Industry

The Central and Eastern European e-bicycle market presents numerous future opportunities. Expanding into rural areas with untapped potential is a key focus. Technological advancements, such as improved battery technology and integration of smart features, will continue to drive market growth. Growing focus on micromobility solutions and last-mile delivery services provides an expansive market opportunity.

Major Players in the Central and Eastern Europe E-Bicycle Industry Ecosystem

- Avon Cycles

- BiciMad

- Rekola

- GeoBike

- Yobykes

- VOI Scooter

Key Developments in Central and Eastern Europe E-Bicycle Industry Industry

- 2022 Q4: Government of Poland announces new incentives for e-bike purchases.

- 2023 Q1: GeoBike launches a new line of high-performance e-bikes.

- 2023 Q3: Increased investments reported in charging infrastructure across major cities.

Strategic Central and Eastern Europe E-Bicycle Industry Market Forecast

The Central and Eastern European e-bicycle industry is poised for significant growth in the coming years. Continued technological advancements, supportive government policies, and growing consumer demand will drive market expansion. The focus on sustainability and the increasing popularity of e-bikes for both commuting and leisure activities presents promising long-term prospects for investors and industry players alike. The market is expected to experience substantial growth driven by these factors throughout the forecast period (2025-2033).

Central and Eastern Europe E-Bicycle Industry Segmentation

-

1. Two-Wheeler Type

- 1.1. Motorcycles

- 1.2. Scooter

Central and Eastern Europe E-Bicycle Industry Segmentation By Geography

- 1. Hungary

- 2. Poland

- 3. Czech Republic

- 4. Others

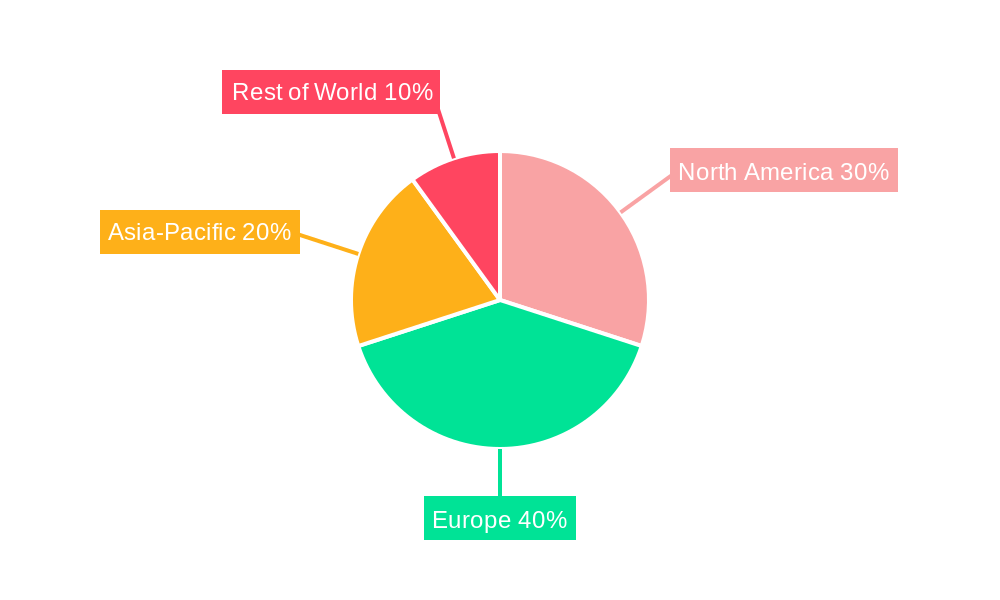

Central and Eastern Europe E-Bicycle Industry Regional Market Share

Geographic Coverage of Central and Eastern Europe E-Bicycle Industry

Central and Eastern Europe E-Bicycle Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Growth of The Global Automotive Turbocharger Market

- 3.3. Market Restrains

- 3.3.1. Increasing Complexity of Modern Vehicles

- 3.4. Market Trends

- 3.4.1. Rise in the Demand of Green Transportation

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Central and Eastern Europe E-Bicycle Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Two-Wheeler Type

- 5.1.1. Motorcycles

- 5.1.2. Scooter

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Hungary

- 5.2.2. Poland

- 5.2.3. Czech Republic

- 5.2.4. Others

- 5.1. Market Analysis, Insights and Forecast - by Two-Wheeler Type

- 6. Hungary Central and Eastern Europe E-Bicycle Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Two-Wheeler Type

- 6.1.1. Motorcycles

- 6.1.2. Scooter

- 6.1. Market Analysis, Insights and Forecast - by Two-Wheeler Type

- 7. Poland Central and Eastern Europe E-Bicycle Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Two-Wheeler Type

- 7.1.1. Motorcycles

- 7.1.2. Scooter

- 7.1. Market Analysis, Insights and Forecast - by Two-Wheeler Type

- 8. Czech Republic Central and Eastern Europe E-Bicycle Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Two-Wheeler Type

- 8.1.1. Motorcycles

- 8.1.2. Scooter

- 8.1. Market Analysis, Insights and Forecast - by Two-Wheeler Type

- 9. Others Central and Eastern Europe E-Bicycle Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Two-Wheeler Type

- 9.1.1. Motorcycles

- 9.1.2. Scooter

- 9.1. Market Analysis, Insights and Forecast - by Two-Wheeler Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Avon Cycles*List Not Exhaustive

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 BiciMad

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Rekola

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 GeoBike

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Yobykes

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 VOI Scooter

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.1 Avon Cycles*List Not Exhaustive

List of Figures

- Figure 1: Central and Eastern Europe E-Bicycle Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Central and Eastern Europe E-Bicycle Industry Share (%) by Company 2025

List of Tables

- Table 1: Central and Eastern Europe E-Bicycle Industry Revenue billion Forecast, by Two-Wheeler Type 2020 & 2033

- Table 2: Central and Eastern Europe E-Bicycle Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Central and Eastern Europe E-Bicycle Industry Revenue billion Forecast, by Two-Wheeler Type 2020 & 2033

- Table 4: Central and Eastern Europe E-Bicycle Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 5: Central and Eastern Europe E-Bicycle Industry Revenue billion Forecast, by Two-Wheeler Type 2020 & 2033

- Table 6: Central and Eastern Europe E-Bicycle Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Central and Eastern Europe E-Bicycle Industry Revenue billion Forecast, by Two-Wheeler Type 2020 & 2033

- Table 8: Central and Eastern Europe E-Bicycle Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Central and Eastern Europe E-Bicycle Industry Revenue billion Forecast, by Two-Wheeler Type 2020 & 2033

- Table 10: Central and Eastern Europe E-Bicycle Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Central and Eastern Europe E-Bicycle Industry?

The projected CAGR is approximately 10.1%.

2. Which companies are prominent players in the Central and Eastern Europe E-Bicycle Industry?

Key companies in the market include Avon Cycles*List Not Exhaustive, BiciMad, Rekola, GeoBike, Yobykes, VOI Scooter.

3. What are the main segments of the Central and Eastern Europe E-Bicycle Industry?

The market segments include Two-Wheeler Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 84.25 billion as of 2022.

5. What are some drivers contributing to market growth?

The Growth of The Global Automotive Turbocharger Market.

6. What are the notable trends driving market growth?

Rise in the Demand of Green Transportation.

7. Are there any restraints impacting market growth?

Increasing Complexity of Modern Vehicles.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Central and Eastern Europe E-Bicycle Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Central and Eastern Europe E-Bicycle Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Central and Eastern Europe E-Bicycle Industry?

To stay informed about further developments, trends, and reports in the Central and Eastern Europe E-Bicycle Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence