Key Insights

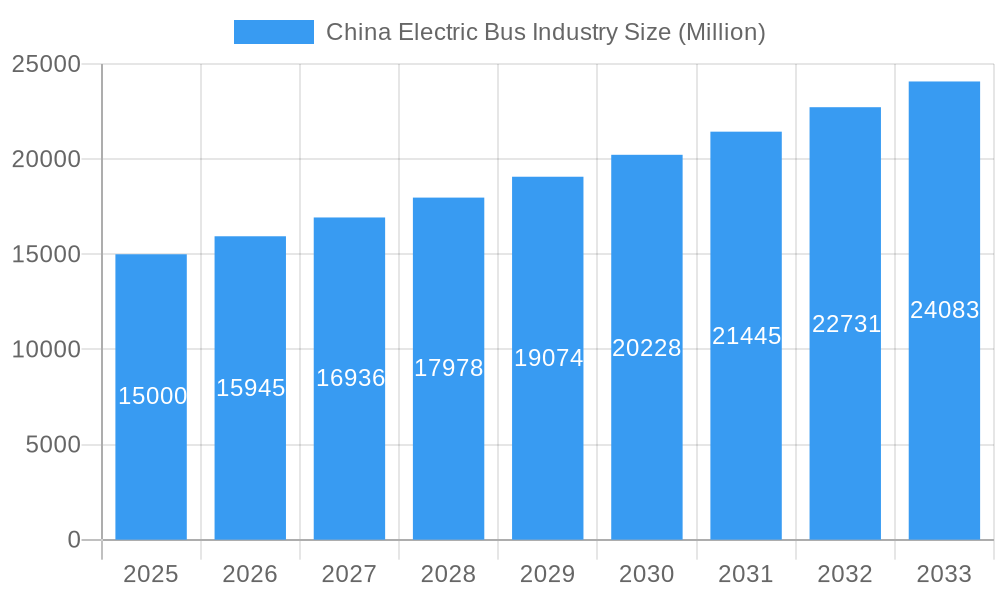

The China electric bus market is projected to reach $23.8 billion by 2025, with a projected Compound Annual Growth Rate (CAGR) of 14% from 2025 to 2033. This significant expansion is fueled by government mandates for sustainable transport, stringent emission standards, and heightened environmental consciousness. The adoption of Battery Electric Vehicles (BEVs) is leading this surge, with Plug-in Hybrid Electric Vehicles (PHEVs) also playing a vital role. Leading manufacturers such as BYD Auto, CRRC Electric Vehicle, and Yutong Bus are pioneering advancements in battery technology, extended range capabilities, and charging infrastructure. Addressing charging infrastructure limitations and reducing battery costs are critical for sustained market growth. Intense competition drives manufacturers to innovate technologically and optimize costs. The market, segmented by fuel type, clearly shows BEVs as the dominant segment, though PHEVs remain significant, particularly in areas with developing charging networks.

China Electric Bus Industry Market Size (In Billion)

Continued growth in China's electric bus sector will be underpinned by supportive government subsidies and policies. Technological breakthroughs in battery efficiency and rapid charging solutions are essential to alleviate range concerns and lower total ownership costs. The expansion of charging infrastructure across urban centers and key transit points is paramount to support the escalating fleet of electric buses. Despite obstacles like high upfront investments and the necessity for robust grid infrastructure, the market's outlook is highly positive. Factors such as ongoing urbanization, rising passenger transit needs, and a steadfast commitment to environmental sustainability will propel considerable growth. The 2025-2033 forecast period indicates substantial market expansion, driven by consistent adoption and ongoing technological advancements.

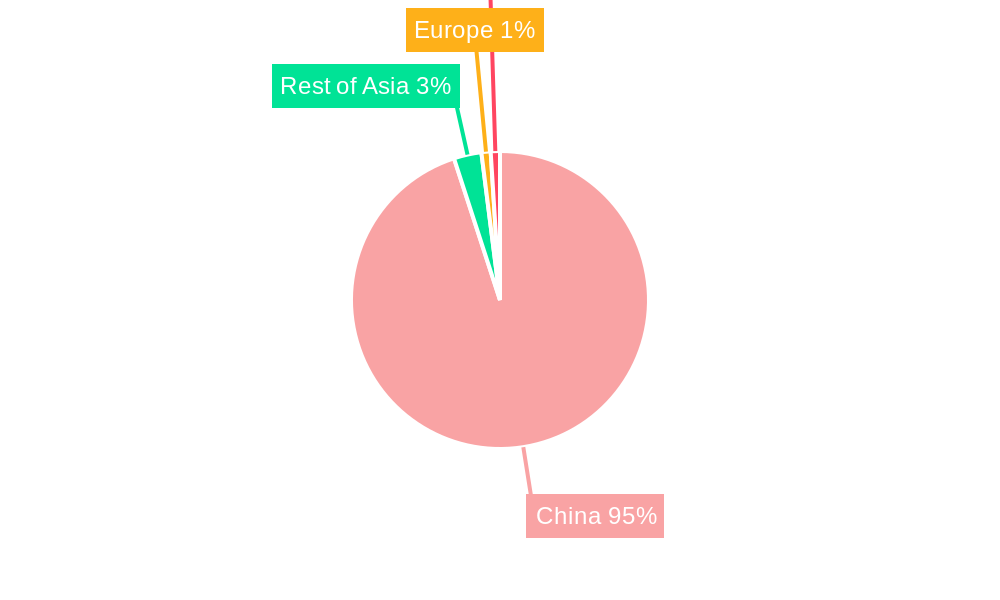

China Electric Bus Industry Company Market Share

China Electric Bus Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the burgeoning China electric bus industry, offering invaluable insights for stakeholders across the value chain. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report leverages meticulous data analysis to paint a clear picture of market trends, technological advancements, and future opportunities. The report dives deep into the competitive landscape, identifying key players and analyzing their strategic moves, ultimately empowering businesses to make data-driven decisions and capitalize on emerging market trends within the multi-billion dollar electric bus sector.

China Electric Bus Industry Market Composition & Trends

This section dissects the intricate composition of the China electric bus market, evaluating its concentration, innovation drivers, regulatory framework, and competitive dynamics. We analyze market share distribution among key players, uncovering the competitive landscape and identifying potential future shifts. The analysis includes a deep dive into the impact of mergers and acquisitions (M&A) activity, providing insights into deal values and their influence on market structure. The report examines the influence of substitute products, evolving end-user profiles, and the broader macroeconomic environment shaping the industry. We explore how government regulations, technological innovation, and evolving consumer preferences are impacting the market's trajectory. Key metrics such as market share distribution and M&A deal values (estimated at $XX Million in the historical period) are incorporated, offering a granular understanding of the industry's competitive dynamics and growth potential.

China Electric Bus Industry Industry Evolution

This section meticulously charts the evolutionary path of the China electric bus industry, analyzing its growth trajectories, technological advancements, and the changing preferences of consumers. We present detailed data points, including specific growth rates and adoption metrics, to illustrate the industry's evolution. The analysis spans the historical period (2019-2024) and extends into the future, projecting growth based on current trends and anticipated technological advancements. The report will delve into the factors driving the increasing adoption of electric buses, including government incentives, environmental concerns, and technological improvements leading to greater affordability and efficiency. We will examine the shift in consumer demands, focusing on factors like range anxiety, charging infrastructure, and the overall cost of ownership. The report will also cover the impact of technological advancements, such as battery technology, charging infrastructure, and autonomous driving capabilities.

Leading Regions, Countries, or Segments in China Electric Bus Industry

This section identifies the dominant regions, countries, and segments within the China electric bus market, focusing specifically on the fuel categories: BEV, FCEV, HEV, and PHEV. We delve into the factors driving the dominance of specific segments, exploring key drivers such as investment trends and regulatory support.

- Key Drivers for Dominant Segments:

- Robust government subsidies and incentives for electric vehicle adoption.

- Stringent emission regulations pushing the transition from traditional buses.

- Expanding charging infrastructure supporting increased adoption rates.

- Technological advancements, such as improved battery technology and reduced costs.

- Increasing consumer demand for eco-friendly transportation solutions.

The analysis provides a detailed examination of the factors contributing to market leadership within each segment, offering a clear understanding of the industry's regional and technological landscape. We will further identify and analyze the factors that contribute to the dominance of specific regions or segments.

China Electric Bus Industry Product Innovations

This section highlights the groundbreaking product innovations driving the China electric bus industry. We explore advancements in battery technology, charging systems, autonomous driving capabilities, and other key performance indicators. The discussion will include the unique selling propositions (USPs) of various electric bus models and the technological advancements responsible for improvements in efficiency, range, and safety. These innovations are significantly impacting the industry’s growth and market dynamics.

Propelling Factors for China Electric Bus Industry Growth

Several key factors propel the growth of the China electric bus industry. Technological advancements, such as improved battery technology and charging infrastructure, are crucial. Government policies supporting electric vehicle adoption and stringent emission regulations also play a significant role. Furthermore, economic factors, including the decreasing cost of electric buses and increasing fuel prices, further stimulate market expansion. The growing environmental awareness among consumers and the desire for sustainable transportation options provide further impetus for industry growth.

Obstacles in the China Electric Bus Industry Market

Despite the promising growth trajectory, the China electric bus industry faces challenges. Regulatory hurdles, including the complexity of obtaining permits and navigating bureaucratic processes, create obstacles. Supply chain disruptions, particularly concerning raw materials for battery production, can negatively impact production and cost. Intense competition among numerous domestic and international players also presents a challenge. These factors collectively impact the industry's growth and require careful consideration for strategic planning.

Future Opportunities in China Electric Bus Industry

The future holds significant opportunities for the China electric bus industry. Expanding into new markets, both domestically and internationally, presents considerable potential. Advancements in technologies like autonomous driving and smart charging systems offer further avenues for growth. The increasing demand for sustainable transportation solutions within and beyond the city limits presents a strong demand outlook.

Major Players in the China Electric Bus Industry Ecosystem

- Nanjing Golden Dragon Bus Co Ltd

- FAW Toyota Motor Co Ltd

- Zhengzhou Yutong Bus Co Ltd

- Chongqing Changan Automobile Company Limited

- Anhui Ankai Automobile Co Ltd

- Zhejiang Geely Holding Group Co Ltd

- CRRC Electric Vehicle Co Ltd

- Shanghai Sunwin Bus Corporation Ltd

- King Long United Automotive Industry Co Ltd

- BYD Auto Co Ltd

- Higer Bus Company Ltd

- Zhongtong Bus Holding Co Ltd

- Chery Automobile Co Ltd

Key Developments in China Electric Bus Industry Industry

September 2023: Yutong announced the export of 87 apron buses to Saudi Arabia, representing the largest single export of apron buses from China. This signifies a significant expansion into international markets and highlights the increasing global demand for Chinese-made electric buses.

July 2023: Yutong Group celebrated a bus delivery ceremony in Astana, Kazakhstan, demonstrating the company's successful expansion into international markets and indicating the growing adoption of electric buses in Central Asia.

July 2023: Yutong Group partnered with Langfang Transportation to jointly promote new energy logistics transportation. This collaboration expands the application of electric buses beyond passenger transport and highlights the growing role of electric vehicles in the logistics sector. These partnerships are crucial for developing further infrastructure support.

Strategic China Electric Bus Industry Market Forecast

The China electric bus industry is poised for substantial growth, driven by continued government support, technological innovation, and increasing consumer demand for sustainable transportation. The forecast period (2025-2033) is expected to witness significant expansion, with the market size projected to reach XX Million by 2033. Continued investment in charging infrastructure and technological advancements, particularly in battery technology and autonomous driving, are expected to fuel this growth, further solidifying China’s position as a global leader in the electric bus sector.

China Electric Bus Industry Segmentation

-

1. Fuel Category

- 1.1. BEV

- 1.2. FCEV

- 1.3. HEV

- 1.4. PHEV

China Electric Bus Industry Segmentation By Geography

- 1. China

China Electric Bus Industry Regional Market Share

Geographic Coverage of China Electric Bus Industry

China Electric Bus Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasingly Focused On Reducing Vehicle Weight To Improve Fuel Efficiency; Cost-effectiveness

- 3.3. Market Restrains

- 3.3.1. Competitiveness Of Alternative Materials

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Electric Bus Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Fuel Category

- 5.1.1. BEV

- 5.1.2. FCEV

- 5.1.3. HEV

- 5.1.4. PHEV

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. China

- 5.1. Market Analysis, Insights and Forecast - by Fuel Category

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Nanjing Golden Dragon Bus Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 FAW Toyota Motor Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Zhengzhou Yutong Bus Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Chongqing Changan Automobile Company Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Anhui Ankai Automobile Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Zhejiang Geely Holding Group Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 CRRC Electric Vehicle Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Shanghai Sunwin Bus Corporation Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 King Long United Automotive Industry Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 BYD Auto Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Higer Bus Company Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Zhongtong Bus Holding Co Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Chery Automobile Co Ltd

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Nanjing Golden Dragon Bus Co Ltd

List of Figures

- Figure 1: China Electric Bus Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: China Electric Bus Industry Share (%) by Company 2025

List of Tables

- Table 1: China Electric Bus Industry Revenue billion Forecast, by Fuel Category 2020 & 2033

- Table 2: China Electric Bus Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: China Electric Bus Industry Revenue billion Forecast, by Fuel Category 2020 & 2033

- Table 4: China Electric Bus Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Electric Bus Industry?

The projected CAGR is approximately 14%.

2. Which companies are prominent players in the China Electric Bus Industry?

Key companies in the market include Nanjing Golden Dragon Bus Co Ltd, FAW Toyota Motor Co Ltd, Zhengzhou Yutong Bus Co Ltd, Chongqing Changan Automobile Company Limited, Anhui Ankai Automobile Co Ltd, Zhejiang Geely Holding Group Co Ltd, CRRC Electric Vehicle Co Ltd, Shanghai Sunwin Bus Corporation Ltd, King Long United Automotive Industry Co Ltd, BYD Auto Co Ltd, Higer Bus Company Ltd, Zhongtong Bus Holding Co Ltd, Chery Automobile Co Ltd.

3. What are the main segments of the China Electric Bus Industry?

The market segments include Fuel Category.

4. Can you provide details about the market size?

The market size is estimated to be USD 23.8 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasingly Focused On Reducing Vehicle Weight To Improve Fuel Efficiency; Cost-effectiveness.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Competitiveness Of Alternative Materials.

8. Can you provide examples of recent developments in the market?

September 2023: Yutong announced that it held a shipping ceremony for 87 apron buses exported from China to Saudi Arabia in the Yutong New Energy Plant. It is the largest batch of apron buses exported from China.July 2023: Yutong Group commemorated bus delivery ceremony which took place in Astana, Kazakhstan.July 2023: Yutong Group forms a partnership with Langfang Transportation to jointly promote the development of New Energy logistics transportation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Electric Bus Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Electric Bus Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Electric Bus Industry?

To stay informed about further developments, trends, and reports in the China Electric Bus Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence