Key Insights

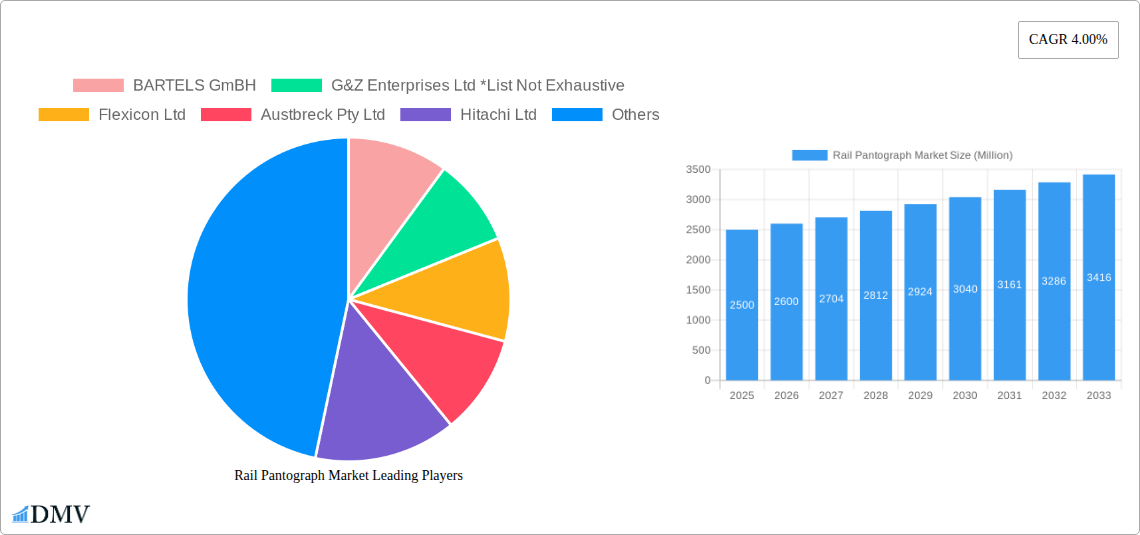

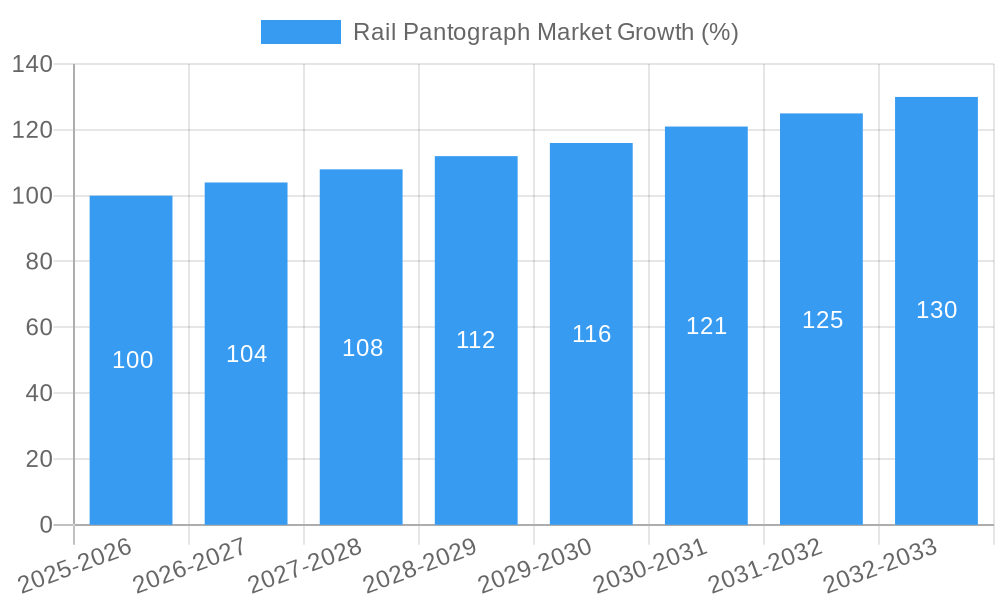

The global rail pantograph market, valued at approximately $XX million in 2025, is projected to experience steady growth with a compound annual growth rate (CAGR) of 4.00% from 2025 to 2033. This growth is fueled by several key factors. The increasing demand for high-speed rail networks globally, particularly in developing economies in Asia-Pacific and other regions, is a major driver. Modernization and expansion of existing railway infrastructure in mature markets like Europe and North America also contributes significantly. Furthermore, the shift towards electric trains, driven by environmental concerns and the need for sustainable transportation, is further bolstering market expansion. Technological advancements, such as the development of more efficient and durable pantograph designs (like diamond-shaped and bow-type designs suitable for diverse train types), are enhancing performance and longevity, contributing to market growth.

However, the market faces certain restraints. High initial investment costs associated with the procurement and installation of advanced pantograph systems can pose a challenge for smaller railway operators. Furthermore, stringent safety regulations and rigorous testing requirements can impact the speed of market penetration for new technologies. Nevertheless, the long-term prospects for the rail pantograph market remain positive, driven by sustained investment in railway infrastructure globally and ongoing technological innovation to improve energy efficiency and reliability. The market segmentation by arm type (single vs. double arm), pantograph type (diamond vs. bow), and train type (high-speed, mainline, freight, metro) reflects the diverse applications and specific requirements of the rail industry, leading to varied growth trajectories across these segments. Major players like Siemens Mobility, Alstom SA, and Hitachi Ltd are actively involved in driving innovation and market competition.

Rail Pantograph Market: A Comprehensive Analysis (2019-2033)

This insightful report provides a detailed analysis of the global Rail Pantograph Market, offering a comprehensive overview of market dynamics, technological advancements, and future growth prospects. The study covers the period from 2019 to 2033, with 2025 as the base and estimated year, and forecasts extending to 2033. The report is essential for stakeholders seeking to understand the market's competitive landscape, key players, and future growth trajectory. The global Rail Pantograph Market is estimated to be valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Rail Pantograph Market Composition & Trends

This section delves into the intricate structure of the rail pantograph market, examining its concentration levels, innovation drivers, regulatory frameworks, and competitive activities. The market is characterized by a moderately concentrated landscape with several key players holding significant market share. The distribution of market share among these players is as follows: Hitachi Ltd. (xx%), Siemens Mobility (xx%), Alstom SA (xx%), and others (xx%). However, the market is witnessing an influx of smaller players, particularly those specializing in niche applications or innovative designs.

Key Market Drivers:

- Technological Advancements: Continuous innovations in pantograph design, materials, and monitoring systems are improving efficiency and reliability.

- Stringent Safety Regulations: Governments worldwide are implementing stricter safety standards for rail infrastructure, pushing the demand for advanced pantographs.

- Infrastructure Development: Ongoing investments in rail infrastructure expansion and modernization are driving market growth.

- Rising Electrification of Rail Networks: A global trend towards electric traction is significantly fueling the demand for efficient and reliable pantographs.

Market Dynamics:

- Mergers & Acquisitions (M&A): The rail pantograph market has witnessed several M&A activities in recent years, primarily driven by strategic expansion and technology acquisition. The total value of M&A deals within the past five years is estimated to be xx Million. Examples include [Insert specific examples if available, otherwise remove this bullet point].

- Substitute Products: While limited, alternative power collection methods are emerging, posing a potential, yet currently minor, threat to market growth.

- End-User Profiles: The major end-users include high-speed rail operators, mainline railway companies, freight rail operators, and metro systems.

Rail Pantograph Market Industry Evolution

The rail pantograph market has undergone a significant transformation over the past decade, driven by technological advancements, evolving regulatory landscapes, and shifting consumer demands. From the historical period (2019-2024), the market exhibited a CAGR of xx%, primarily fueled by increasing investments in high-speed rail projects globally. The introduction of lightweight, high-performance materials and advanced monitoring systems has greatly enhanced pantograph efficiency and reliability. Furthermore, the growing focus on sustainable transportation solutions is influencing the development of environmentally friendly pantograph designs. The forecast period (2025-2033) anticipates a CAGR of xx%, driven by continuous infrastructure development in emerging economies and the ongoing electrification of rail networks. The increasing adoption of predictive maintenance strategies, leveraging IoT and data analytics, is also expected to accelerate market growth.

Leading Regions, Countries, or Segments in Rail Pantograph Market

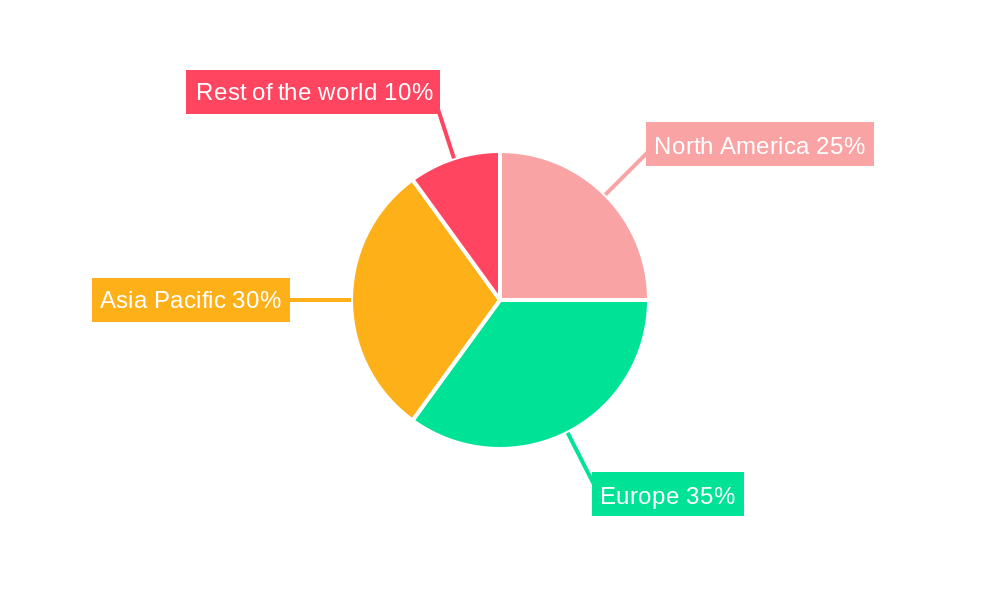

The European region currently dominates the rail pantograph market, driven by substantial investments in high-speed rail projects and a well-established rail network. Asia-Pacific is projected to experience the fastest growth during the forecast period, propelled by the rapid expansion of rail infrastructure in countries like India and China.

Leading Segments:

- By Arm Type: The double-arm pantograph segment holds a larger market share due to its higher current collection capacity and stability at high speeds.

- By Pantograph Type: Diamond-shaped pantographs are more prevalent due to their superior performance and reliability compared to bow-type pantographs.

- By Train Type: High-speed trains and mainline trains constitute a substantial portion of the market due to their extensive use of advanced pantograph systems.

Key Drivers by Region/Segment:

- Europe: Strong government support for rail infrastructure development, high adoption of advanced technologies, and stringent safety regulations.

- Asia-Pacific: Rapid urbanization, increasing investments in high-speed rail networks, and government initiatives promoting sustainable transportation.

- North America: Growing focus on upgrading existing rail infrastructure and expanding electric rail networks.

Rail Pantograph Market Product Innovations

Recent product innovations include the development of lightweight, aerodynamic pantographs that minimize energy loss and improve efficiency at high speeds. Integration of advanced monitoring systems using sensors and data analytics enables predictive maintenance, reducing downtime and operational costs. Furthermore, the incorporation of smart materials and self-adjusting mechanisms enhance the overall performance and lifespan of pantographs. These innovations provide unique selling propositions such as improved energy efficiency, reduced maintenance costs, and enhanced operational safety.

Propelling Factors for Rail Pantograph Market Growth

Technological advancements in materials science and electronic systems, coupled with the increasing demand for high-speed and efficient rail transportation, are primary growth catalysts. Government initiatives promoting sustainable transportation and the electrification of rail networks provide further impetus. Economic growth in several regions, particularly in developing economies, drives infrastructure investment and fuels market expansion. Stringent safety regulations, requiring advanced pantograph systems, also contribute significantly to market growth.

Obstacles in the Rail Pantograph Market

Significant barriers include the high initial investment costs associated with advanced pantograph systems, potential supply chain disruptions due to global events, and intense competition from established and emerging players. Regulatory hurdles, varying across different regions, can also create challenges for market entry and expansion. These factors, while not insurmountable, pose considerable challenges to sustained and rapid market growth, potentially affecting profitability and market share.

Future Opportunities in Rail Pantograph Market

Emerging opportunities lie in the development of next-generation pantographs incorporating advanced materials like carbon fiber composites, further enhancing performance and efficiency. Expansion into new markets, especially in developing regions with significant rail infrastructure projects, offers substantial growth potential. Integration of advanced monitoring and predictive maintenance capabilities using IoT and AI technologies presents another major avenue for expansion. Furthermore, the growing demand for sustainable transportation solutions opens opportunities for eco-friendly pantograph designs.

Major Players in the Rail Pantograph Market Ecosystem

- BARTELS GmBH

- G&Z Enterprises Ltd

- Flexicon Ltd

- Austbreck Pty Ltd

- Hitachi Ltd

- Siemens Mobility

- SCHUNK GmbH & Co KG

- Alstom SA

- KONI BV

- Wabtec Corporation

Key Developments in Rail Pantograph Market Industry

- March 2022: The Indian government announced a plan to manufacture 400 new Vande Bharat express trains, boosting demand for pantographs.

- November 2021: Ricardo completed the rollout of its Pan Mon pantograph condition monitoring system in Scotland, showcasing technological advancements in the field.

Strategic Rail Pantograph Market Forecast

The rail pantograph market is poised for significant growth over the next decade, driven by the increasing adoption of electric trains and the expansion of high-speed rail networks globally. Technological advancements, coupled with supportive government policies, are expected to further accelerate market expansion. The focus on sustainability and the development of efficient, low-maintenance pantograph systems will play a crucial role in shaping the future of this dynamic market. Emerging markets present significant opportunities for growth, and strategic partnerships and collaborations will be instrumental in driving innovation and market penetration.

Rail Pantograph Market Segmentation

-

1. Arm Type

- 1.1. Single arm Pantograph

- 1.2. Double arm Pantograph

-

2. Pantograph Type

- 2.1. Diamond Shape

- 2.2. Bow type

-

3. Train Type

- 3.1. High Speed train

- 3.2. Mainline Train

- 3.3. Freight Train

- 3.4. Metro Train

Rail Pantograph Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the world

- 4.1. South America

- 4.2. Middle East and Africa

Rail Pantograph Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Used Car Financing To Continue Solving Consumer Challenges In Indonesia

- 3.3. Market Restrains

- 3.3.1. Trust And Transparency In Used Car Remained A Key Challenge For Consumers

- 3.4. Market Trends

- 3.4.1. Growing Rail Electrification to Drive Demand in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Rail Pantograph Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Arm Type

- 5.1.1. Single arm Pantograph

- 5.1.2. Double arm Pantograph

- 5.2. Market Analysis, Insights and Forecast - by Pantograph Type

- 5.2.1. Diamond Shape

- 5.2.2. Bow type

- 5.3. Market Analysis, Insights and Forecast - by Train Type

- 5.3.1. High Speed train

- 5.3.2. Mainline Train

- 5.3.3. Freight Train

- 5.3.4. Metro Train

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the world

- 5.1. Market Analysis, Insights and Forecast - by Arm Type

- 6. North America Rail Pantograph Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Arm Type

- 6.1.1. Single arm Pantograph

- 6.1.2. Double arm Pantograph

- 6.2. Market Analysis, Insights and Forecast - by Pantograph Type

- 6.2.1. Diamond Shape

- 6.2.2. Bow type

- 6.3. Market Analysis, Insights and Forecast - by Train Type

- 6.3.1. High Speed train

- 6.3.2. Mainline Train

- 6.3.3. Freight Train

- 6.3.4. Metro Train

- 6.1. Market Analysis, Insights and Forecast - by Arm Type

- 7. Europe Rail Pantograph Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Arm Type

- 7.1.1. Single arm Pantograph

- 7.1.2. Double arm Pantograph

- 7.2. Market Analysis, Insights and Forecast - by Pantograph Type

- 7.2.1. Diamond Shape

- 7.2.2. Bow type

- 7.3. Market Analysis, Insights and Forecast - by Train Type

- 7.3.1. High Speed train

- 7.3.2. Mainline Train

- 7.3.3. Freight Train

- 7.3.4. Metro Train

- 7.1. Market Analysis, Insights and Forecast - by Arm Type

- 8. Asia Pacific Rail Pantograph Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Arm Type

- 8.1.1. Single arm Pantograph

- 8.1.2. Double arm Pantograph

- 8.2. Market Analysis, Insights and Forecast - by Pantograph Type

- 8.2.1. Diamond Shape

- 8.2.2. Bow type

- 8.3. Market Analysis, Insights and Forecast - by Train Type

- 8.3.1. High Speed train

- 8.3.2. Mainline Train

- 8.3.3. Freight Train

- 8.3.4. Metro Train

- 8.1. Market Analysis, Insights and Forecast - by Arm Type

- 9. Rest of the world Rail Pantograph Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Arm Type

- 9.1.1. Single arm Pantograph

- 9.1.2. Double arm Pantograph

- 9.2. Market Analysis, Insights and Forecast - by Pantograph Type

- 9.2.1. Diamond Shape

- 9.2.2. Bow type

- 9.3. Market Analysis, Insights and Forecast - by Train Type

- 9.3.1. High Speed train

- 9.3.2. Mainline Train

- 9.3.3. Freight Train

- 9.3.4. Metro Train

- 9.1. Market Analysis, Insights and Forecast - by Arm Type

- 10. North America Rail Pantograph Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 United States

- 10.1.2 Canada

- 10.1.3 Rest of North America

- 11. Europe Rail Pantograph Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 Germany

- 11.1.2 United Kingdom

- 11.1.3 France

- 11.1.4 Italy

- 11.1.5 Rest of Europe

- 12. Asia Pacific Rail Pantograph Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 China

- 12.1.2 India

- 12.1.3 Japan

- 12.1.4 South Korea

- 12.1.5 Rest of Asia Pacific

- 13. Rest of the world Rail Pantograph Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 South America

- 13.1.2 Middle East and Africa

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 BARTELS GmBH

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 G&Z Enterprises Ltd *List Not Exhaustive

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Flexicon Ltd

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Austbreck Pty Ltd

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Hitachi Ltd

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Siemens Mobility

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 SCHUNK GmbH & Co KG

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Alstom SA

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 KONI BV

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Wabtec Corporation

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 BARTELS GmBH

List of Figures

- Figure 1: Global Rail Pantograph Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Rail Pantograph Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Rail Pantograph Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Rail Pantograph Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Rail Pantograph Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Rail Pantograph Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Rail Pantograph Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the world Rail Pantograph Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the world Rail Pantograph Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Rail Pantograph Market Revenue (Million), by Arm Type 2024 & 2032

- Figure 11: North America Rail Pantograph Market Revenue Share (%), by Arm Type 2024 & 2032

- Figure 12: North America Rail Pantograph Market Revenue (Million), by Pantograph Type 2024 & 2032

- Figure 13: North America Rail Pantograph Market Revenue Share (%), by Pantograph Type 2024 & 2032

- Figure 14: North America Rail Pantograph Market Revenue (Million), by Train Type 2024 & 2032

- Figure 15: North America Rail Pantograph Market Revenue Share (%), by Train Type 2024 & 2032

- Figure 16: North America Rail Pantograph Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Rail Pantograph Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Rail Pantograph Market Revenue (Million), by Arm Type 2024 & 2032

- Figure 19: Europe Rail Pantograph Market Revenue Share (%), by Arm Type 2024 & 2032

- Figure 20: Europe Rail Pantograph Market Revenue (Million), by Pantograph Type 2024 & 2032

- Figure 21: Europe Rail Pantograph Market Revenue Share (%), by Pantograph Type 2024 & 2032

- Figure 22: Europe Rail Pantograph Market Revenue (Million), by Train Type 2024 & 2032

- Figure 23: Europe Rail Pantograph Market Revenue Share (%), by Train Type 2024 & 2032

- Figure 24: Europe Rail Pantograph Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe Rail Pantograph Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Rail Pantograph Market Revenue (Million), by Arm Type 2024 & 2032

- Figure 27: Asia Pacific Rail Pantograph Market Revenue Share (%), by Arm Type 2024 & 2032

- Figure 28: Asia Pacific Rail Pantograph Market Revenue (Million), by Pantograph Type 2024 & 2032

- Figure 29: Asia Pacific Rail Pantograph Market Revenue Share (%), by Pantograph Type 2024 & 2032

- Figure 30: Asia Pacific Rail Pantograph Market Revenue (Million), by Train Type 2024 & 2032

- Figure 31: Asia Pacific Rail Pantograph Market Revenue Share (%), by Train Type 2024 & 2032

- Figure 32: Asia Pacific Rail Pantograph Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific Rail Pantograph Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: Rest of the world Rail Pantograph Market Revenue (Million), by Arm Type 2024 & 2032

- Figure 35: Rest of the world Rail Pantograph Market Revenue Share (%), by Arm Type 2024 & 2032

- Figure 36: Rest of the world Rail Pantograph Market Revenue (Million), by Pantograph Type 2024 & 2032

- Figure 37: Rest of the world Rail Pantograph Market Revenue Share (%), by Pantograph Type 2024 & 2032

- Figure 38: Rest of the world Rail Pantograph Market Revenue (Million), by Train Type 2024 & 2032

- Figure 39: Rest of the world Rail Pantograph Market Revenue Share (%), by Train Type 2024 & 2032

- Figure 40: Rest of the world Rail Pantograph Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Rest of the world Rail Pantograph Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Rail Pantograph Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Rail Pantograph Market Revenue Million Forecast, by Arm Type 2019 & 2032

- Table 3: Global Rail Pantograph Market Revenue Million Forecast, by Pantograph Type 2019 & 2032

- Table 4: Global Rail Pantograph Market Revenue Million Forecast, by Train Type 2019 & 2032

- Table 5: Global Rail Pantograph Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Rail Pantograph Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Rail Pantograph Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Rail Pantograph Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America Rail Pantograph Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Rail Pantograph Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Germany Rail Pantograph Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom Rail Pantograph Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: France Rail Pantograph Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Italy Rail Pantograph Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of Europe Rail Pantograph Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Rail Pantograph Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: China Rail Pantograph Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: India Rail Pantograph Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Japan Rail Pantograph Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: South Korea Rail Pantograph Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Rest of Asia Pacific Rail Pantograph Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Global Rail Pantograph Market Revenue Million Forecast, by Country 2019 & 2032

- Table 23: South America Rail Pantograph Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Middle East and Africa Rail Pantograph Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Global Rail Pantograph Market Revenue Million Forecast, by Arm Type 2019 & 2032

- Table 26: Global Rail Pantograph Market Revenue Million Forecast, by Pantograph Type 2019 & 2032

- Table 27: Global Rail Pantograph Market Revenue Million Forecast, by Train Type 2019 & 2032

- Table 28: Global Rail Pantograph Market Revenue Million Forecast, by Country 2019 & 2032

- Table 29: United States Rail Pantograph Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Canada Rail Pantograph Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Rest of North America Rail Pantograph Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Global Rail Pantograph Market Revenue Million Forecast, by Arm Type 2019 & 2032

- Table 33: Global Rail Pantograph Market Revenue Million Forecast, by Pantograph Type 2019 & 2032

- Table 34: Global Rail Pantograph Market Revenue Million Forecast, by Train Type 2019 & 2032

- Table 35: Global Rail Pantograph Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: Germany Rail Pantograph Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: United Kingdom Rail Pantograph Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: France Rail Pantograph Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Italy Rail Pantograph Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Rest of Europe Rail Pantograph Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Global Rail Pantograph Market Revenue Million Forecast, by Arm Type 2019 & 2032

- Table 42: Global Rail Pantograph Market Revenue Million Forecast, by Pantograph Type 2019 & 2032

- Table 43: Global Rail Pantograph Market Revenue Million Forecast, by Train Type 2019 & 2032

- Table 44: Global Rail Pantograph Market Revenue Million Forecast, by Country 2019 & 2032

- Table 45: China Rail Pantograph Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: India Rail Pantograph Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Japan Rail Pantograph Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: South Korea Rail Pantograph Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Rest of Asia Pacific Rail Pantograph Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Global Rail Pantograph Market Revenue Million Forecast, by Arm Type 2019 & 2032

- Table 51: Global Rail Pantograph Market Revenue Million Forecast, by Pantograph Type 2019 & 2032

- Table 52: Global Rail Pantograph Market Revenue Million Forecast, by Train Type 2019 & 2032

- Table 53: Global Rail Pantograph Market Revenue Million Forecast, by Country 2019 & 2032

- Table 54: South America Rail Pantograph Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Middle East and Africa Rail Pantograph Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Rail Pantograph Market?

The projected CAGR is approximately 4.00%.

2. Which companies are prominent players in the Rail Pantograph Market?

Key companies in the market include BARTELS GmBH, G&Z Enterprises Ltd *List Not Exhaustive, Flexicon Ltd, Austbreck Pty Ltd, Hitachi Ltd, Siemens Mobility, SCHUNK GmbH & Co KG, Alstom SA, KONI BV, Wabtec Corporation.

3. What are the main segments of the Rail Pantograph Market?

The market segments include Arm Type, Pantograph Type, Train Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Used Car Financing To Continue Solving Consumer Challenges In Indonesia.

6. What are the notable trends driving market growth?

Growing Rail Electrification to Drive Demand in the Market.

7. Are there any restraints impacting market growth?

Trust And Transparency In Used Car Remained A Key Challenge For Consumers.

8. Can you provide examples of recent developments in the market?

In March 2022, Indian Government has announced the declaration plan to undertake indigenous manufacture of 400 new generation Vande Bharat express trains by allocating INR 130 crores in the recent budget for year 2022 -2023. Unlike a normal express train which is hauled by a detachable locomotive provided at one end of the train, the Vande Bharat series is provided by electric gear and trains draws it energy from over-head equipment through pantograph mounted on coaches.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Rail Pantograph Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Rail Pantograph Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Rail Pantograph Market?

To stay informed about further developments, trends, and reports in the Rail Pantograph Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence