Key Insights

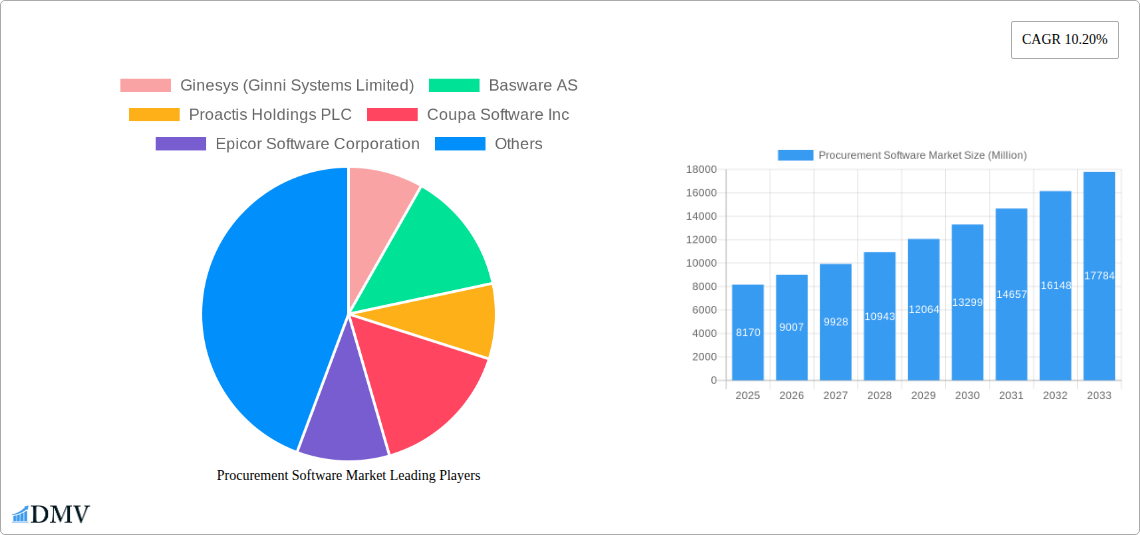

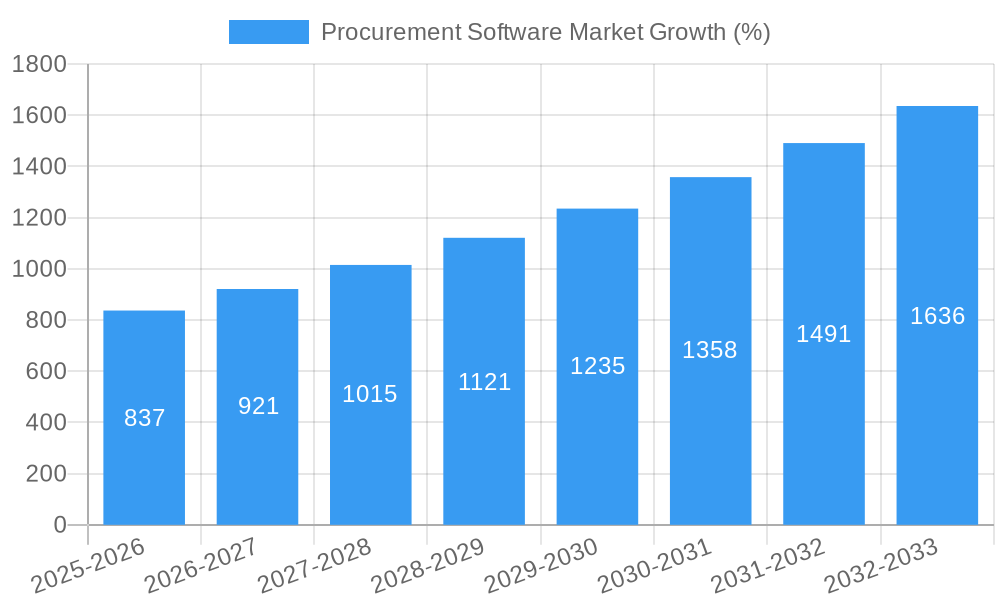

The global Procurement Software market, valued at $8.17 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 10.20% from 2025 to 2033. This expansion is driven by several key factors. The increasing need for enhanced efficiency and cost reduction in procurement processes across diverse industries, including retail, manufacturing, and healthcare, is a major catalyst. Businesses are increasingly adopting cloud-based solutions for improved accessibility, scalability, and collaboration, fueling market growth. Furthermore, the rising adoption of advanced technologies such as artificial intelligence (AI) and machine learning (ML) within procurement software is streamlining operations and improving decision-making, contributing significantly to market expansion. Strong competition amongst established players like Coupa, SAP, and Oracle, alongside emerging innovative companies, further intensifies market activity and fosters innovation.

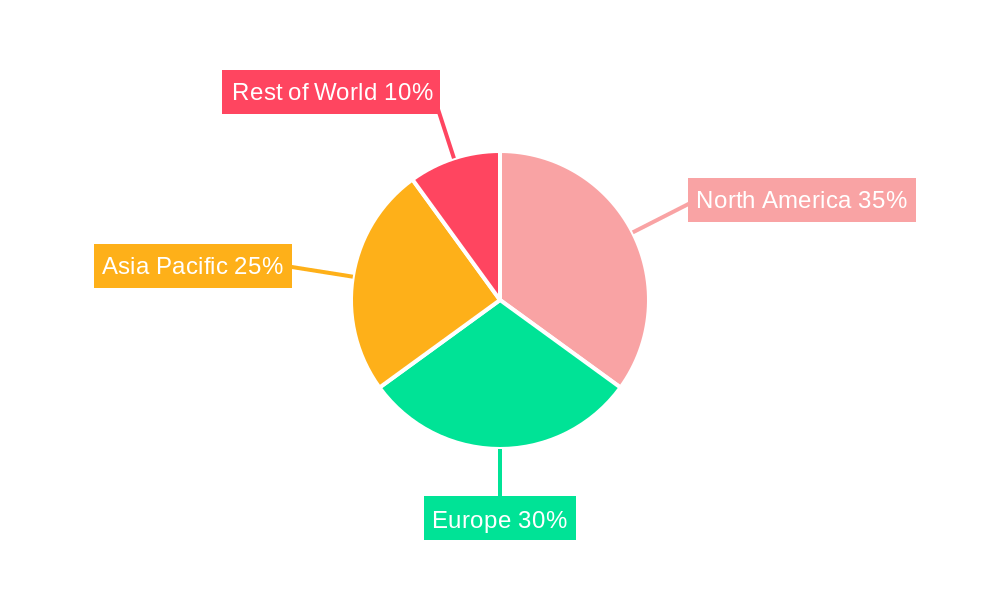

The market segmentation reveals a strong preference for cloud-based deployment models, reflecting the advantages of accessibility and scalability. While on-premise solutions still hold a segment of the market, the cloud’s dominance is expected to continue throughout the forecast period. Industry-wise, retail, manufacturing, and transportation and logistics sectors currently drive significant demand. However, the healthcare sector is poised for substantial growth, driven by increasing focus on cost containment and supply chain optimization within the healthcare industry. Geographical distribution indicates a significant presence across North America and Europe, with the Asia-Pacific region exhibiting strong growth potential due to increasing digitalization and technological adoption. Restraints to market growth include the initial investment costs associated with software implementation and integration, as well as the need for robust cybersecurity measures to protect sensitive procurement data. However, the overall growth trajectory is expected to remain positive, driven by the compelling benefits of improved efficiency and cost savings offered by procurement software.

Procurement Software Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Procurement Software Market, offering a comprehensive overview of its current state, future trajectory, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for stakeholders seeking to understand and capitalize on the market's growth potential. The market is expected to reach xx Million by 2033.

Procurement Software Market Composition & Trends

This section delves into the intricate dynamics of the Procurement Software Market, examining its competitive landscape, innovative drivers, regulatory environment, and market evolution. We analyze market concentration, revealing the market share distribution among key players like Coupa Software Inc, Oracle Corporation, and SAP SE. The report further explores the impact of mergers and acquisitions (M&A), analyzing deal values and their influence on market consolidation. Innovation within the procurement software space, driven by AI, automation, and cloud technologies, is also assessed, along with the regulatory landscape’s effect on market growth. Finally, the report profiles end-users across various industries, including retail, manufacturing, healthcare, and transportation & logistics, highlighting their unique needs and procurement software adoption rates. Substitute products and their competitive impact are also carefully considered.

- Market Concentration: Coupa Software and SAP SE hold a significant share, with Oracle and others vying for market dominance. The market exhibits moderate concentration with a xx% market share held by the top 5 players in 2024.

- M&A Activity: The report analyzes xx major M&A deals from 2019-2024, with a total value of approximately xx Million, highlighting the strategic implications for market players.

- Innovation Catalysts: Artificial Intelligence (AI), machine learning, and robotic process automation are driving significant innovation.

- Regulatory Landscape: GDPR and other data privacy regulations are shaping the development and deployment of procurement software.

Procurement Software Market Industry Evolution

This section provides a comprehensive analysis of the Procurement Software Market's evolution from 2019 to 2024 and its projected trajectory until 2033. The report examines the market's growth trajectories, charting the Compound Annual Growth Rate (CAGR) and pinpointing periods of accelerated growth and potential plateaus. We analyze the pivotal role of technological advancements, from cloud-based solutions to AI-powered features, and detail how these innovations influence market adoption rates and consumer preferences. The shifting demands of end-users across various industries are also explored, highlighting their influence on product development and market segmentation. Specific data points such as growth rates by segment, adoption metrics by region, and consumer spending on procurement software are included. The market experienced a CAGR of xx% during 2019-2024 and is projected to grow at a CAGR of xx% between 2025 and 2033.

Leading Regions, Countries, or Segments in Procurement Software Market

This section identifies the leading regions, countries, and segments within the Procurement Software Market. We analyze both By Deployment (On-Premise, Cloud) and By End-user Industry (Retail, Manufacturing, Transportation and Logistics, Healthcare, Other End-user Industries), pinpointing the dominant players and factors contributing to their success.

Dominant Segment: The Cloud-based deployment segment is projected to dominate the market due to its scalability and cost-effectiveness. The Manufacturing end-user industry shows strong growth due to its increased adoption of digital transformation strategies.

- Key Drivers for Cloud Deployment:

- Increased cost-effectiveness and scalability.

- Enhanced accessibility and remote collaboration.

- Improved data security and compliance.

- Key Drivers for Manufacturing Industry:

- Need for improved supply chain efficiency and transparency.

- Growing demand for real-time data analysis and insights.

- Stringent regulatory compliance requirements.

The North American region is expected to maintain its leadership position due to its robust technological infrastructure and high adoption rate of advanced procurement software. Europe and Asia-Pacific are projected to experience substantial growth, driven by increasing digitalization and government initiatives.

Procurement Software Market Product Innovations

Recent innovations in procurement software emphasize user-friendly interfaces, advanced analytics, and seamless integration with enterprise resource planning (ERP) systems. AI-powered features, including predictive analytics for spend optimization and automated invoice processing, are becoming increasingly prevalent. This leads to improved efficiency, reduced costs, and enhanced risk management for organizations. The focus on cloud-based solutions further boosts accessibility and scalability, catering to the needs of businesses of all sizes. Unique selling propositions now include real-time visibility into the procurement process, machine learning-driven insights, and robust compliance functionalities.

Propelling Factors for Procurement Software Market Growth

Several key factors fuel the growth of the Procurement Software Market. Technological advancements, particularly the rise of cloud computing and AI, are significantly improving efficiency and transparency in procurement processes. Economic factors, such as the need for cost optimization and improved supply chain resilience, are driving adoption among businesses. Furthermore, regulatory mandates emphasizing transparency and compliance are pushing organizations to adopt sophisticated procurement software solutions. The growing awareness of the benefits of digital transformation is also impacting the market positively.

Obstacles in the Procurement Software Market

Despite its growth potential, the Procurement Software Market faces several challenges. High implementation costs and the complexity of integrating software with existing systems can act as deterrents for smaller organizations. Supply chain disruptions can impact software development and deployment, leading to project delays and cost overruns. Moreover, intense competition among established and emerging vendors creates pricing pressures and necessitates constant innovation to maintain market share. The resistance to change within organizations can also hamper the adoption of new procurement software.

Future Opportunities in Procurement Software Market

The Procurement Software Market presents several promising opportunities. Expanding into new geographical markets, particularly in developing economies with growing digitalization efforts, offers considerable potential. The integration of advanced technologies, such as blockchain for improved transparency and security, presents further opportunities for innovation. Tailoring solutions to specific industry needs and offering specialized features will also drive market expansion. Moreover, the increasing focus on sustainability and ethical sourcing presents opportunities for software developers to build solutions supporting these goals.

Major Players in the Procurement Software Market Ecosystem

- Ginesys (Ginni Systems Limited)

- Basware AS

- Proactis Holdings PLC

- Coupa Software Inc

- Epicor Software Corporation

- Jaggaer Inc

- Microsoft Corporation

- Zycus Inc

- GEP Corporation

- Oracle Corporation

- Ivalua Inc

- Mercateo AG

- GT Nexus (Infor Inc)

- SAP SE

Key Developments in Procurement Software Market Industry

- December 2022: GEP's software implementation by bpost group highlights the growing adoption of comprehensive source-to-contract (S2C) solutions for enhanced efficiency and compliance.

- September 2022: Oro's launch of Smart Procurement Workflows underscores the market's focus on simplifying procurement processes to meet compliance needs and accelerate business operations.

Strategic Procurement Software Market Forecast

The Procurement Software Market is poised for robust growth, driven by continued technological innovation, increasing demand for efficiency, and the rising need for supply chain optimization. The market's future potential is considerable, particularly in emerging economies and sectors embracing digital transformation. Continued investment in AI, machine learning, and blockchain integration will further enhance the capabilities of procurement software, creating new opportunities for market expansion and shaping the future of procurement.

Procurement Software Market Segmentation

-

1. Deployment

- 1.1. On-premise

- 1.2. Cloud

-

2. End-user Industry

- 2.1. Retail

- 2.2. Manufacturing

- 2.3. Transportation and Logistics

- 2.4. Healthcare

- 2.5. Other End-user Industries

Procurement Software Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Procurement Software Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing demand to automate the procurement processes; Integration between E Procurement applications and ERP solutions; Retail Industry is Expected to Hold Significant Market Share

- 3.3. Market Restrains

- 3.3.1. Absence of Secure Cloud

- 3.4. Market Trends

- 3.4.1. Retail Industry is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Procurement Software Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 5.1.1. On-premise

- 5.1.2. Cloud

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Retail

- 5.2.2. Manufacturing

- 5.2.3. Transportation and Logistics

- 5.2.4. Healthcare

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 6. North America Procurement Software Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 6.1.1. On-premise

- 6.1.2. Cloud

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Retail

- 6.2.2. Manufacturing

- 6.2.3. Transportation and Logistics

- 6.2.4. Healthcare

- 6.2.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 7. Europe Procurement Software Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 7.1.1. On-premise

- 7.1.2. Cloud

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Retail

- 7.2.2. Manufacturing

- 7.2.3. Transportation and Logistics

- 7.2.4. Healthcare

- 7.2.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 8. Asia Procurement Software Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 8.1.1. On-premise

- 8.1.2. Cloud

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Retail

- 8.2.2. Manufacturing

- 8.2.3. Transportation and Logistics

- 8.2.4. Healthcare

- 8.2.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 9. Australia and New Zealand Procurement Software Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 9.1.1. On-premise

- 9.1.2. Cloud

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Retail

- 9.2.2. Manufacturing

- 9.2.3. Transportation and Logistics

- 9.2.4. Healthcare

- 9.2.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 10. Latin America Procurement Software Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Deployment

- 10.1.1. On-premise

- 10.1.2. Cloud

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Retail

- 10.2.2. Manufacturing

- 10.2.3. Transportation and Logistics

- 10.2.4. Healthcare

- 10.2.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Deployment

- 11. Middle East and Africa Procurement Software Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Deployment

- 11.1.1. On-premise

- 11.1.2. Cloud

- 11.2. Market Analysis, Insights and Forecast - by End-user Industry

- 11.2.1. Retail

- 11.2.2. Manufacturing

- 11.2.3. Transportation and Logistics

- 11.2.4. Healthcare

- 11.2.5. Other End-user Industries

- 11.1. Market Analysis, Insights and Forecast - by Deployment

- 12. North America Procurement Software Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Europe Procurement Software Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Asia Pacific Procurement Software Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Rest of the World Procurement Software Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Ginesys (Ginni Systems Limited)

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Basware AS

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Proactis Holdings PLC

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Coupa Software Inc

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Epicor Software Corporation

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Jaggaer Inc *List Not Exhaustive

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Microsoft Corporation

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Zycus Inc

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 GEP Corporation

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Oracle Corporation

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Ivalua Inc

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Mercateo AG

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 GT Nexus (Infor Inc )

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.14 SAP SE

- 16.2.14.1. Overview

- 16.2.14.2. Products

- 16.2.14.3. SWOT Analysis

- 16.2.14.4. Recent Developments

- 16.2.14.5. Financials (Based on Availability)

- 16.2.1 Ginesys (Ginni Systems Limited)

List of Figures

- Figure 1: Global Procurement Software Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Procurement Software Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Procurement Software Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Procurement Software Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Procurement Software Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Procurement Software Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Procurement Software Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Procurement Software Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Procurement Software Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Procurement Software Market Revenue (Million), by Deployment 2024 & 2032

- Figure 11: North America Procurement Software Market Revenue Share (%), by Deployment 2024 & 2032

- Figure 12: North America Procurement Software Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 13: North America Procurement Software Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 14: North America Procurement Software Market Revenue (Million), by Country 2024 & 2032

- Figure 15: North America Procurement Software Market Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Procurement Software Market Revenue (Million), by Deployment 2024 & 2032

- Figure 17: Europe Procurement Software Market Revenue Share (%), by Deployment 2024 & 2032

- Figure 18: Europe Procurement Software Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 19: Europe Procurement Software Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 20: Europe Procurement Software Market Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe Procurement Software Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Asia Procurement Software Market Revenue (Million), by Deployment 2024 & 2032

- Figure 23: Asia Procurement Software Market Revenue Share (%), by Deployment 2024 & 2032

- Figure 24: Asia Procurement Software Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 25: Asia Procurement Software Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 26: Asia Procurement Software Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Asia Procurement Software Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Australia and New Zealand Procurement Software Market Revenue (Million), by Deployment 2024 & 2032

- Figure 29: Australia and New Zealand Procurement Software Market Revenue Share (%), by Deployment 2024 & 2032

- Figure 30: Australia and New Zealand Procurement Software Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 31: Australia and New Zealand Procurement Software Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 32: Australia and New Zealand Procurement Software Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Australia and New Zealand Procurement Software Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: Latin America Procurement Software Market Revenue (Million), by Deployment 2024 & 2032

- Figure 35: Latin America Procurement Software Market Revenue Share (%), by Deployment 2024 & 2032

- Figure 36: Latin America Procurement Software Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 37: Latin America Procurement Software Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 38: Latin America Procurement Software Market Revenue (Million), by Country 2024 & 2032

- Figure 39: Latin America Procurement Software Market Revenue Share (%), by Country 2024 & 2032

- Figure 40: Middle East and Africa Procurement Software Market Revenue (Million), by Deployment 2024 & 2032

- Figure 41: Middle East and Africa Procurement Software Market Revenue Share (%), by Deployment 2024 & 2032

- Figure 42: Middle East and Africa Procurement Software Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 43: Middle East and Africa Procurement Software Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 44: Middle East and Africa Procurement Software Market Revenue (Million), by Country 2024 & 2032

- Figure 45: Middle East and Africa Procurement Software Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Procurement Software Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Procurement Software Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 3: Global Procurement Software Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: Global Procurement Software Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Procurement Software Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Procurement Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Procurement Software Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Procurement Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Procurement Software Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Procurement Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Procurement Software Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Procurement Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Procurement Software Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 14: Global Procurement Software Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 15: Global Procurement Software Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global Procurement Software Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 17: Global Procurement Software Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 18: Global Procurement Software Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Global Procurement Software Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 20: Global Procurement Software Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 21: Global Procurement Software Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global Procurement Software Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 23: Global Procurement Software Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 24: Global Procurement Software Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Global Procurement Software Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 26: Global Procurement Software Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 27: Global Procurement Software Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Global Procurement Software Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 29: Global Procurement Software Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 30: Global Procurement Software Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Procurement Software Market?

The projected CAGR is approximately 10.20%.

2. Which companies are prominent players in the Procurement Software Market?

Key companies in the market include Ginesys (Ginni Systems Limited), Basware AS, Proactis Holdings PLC, Coupa Software Inc, Epicor Software Corporation, Jaggaer Inc *List Not Exhaustive, Microsoft Corporation, Zycus Inc, GEP Corporation, Oracle Corporation, Ivalua Inc, Mercateo AG, GT Nexus (Infor Inc ), SAP SE.

3. What are the main segments of the Procurement Software Market?

The market segments include Deployment, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.17 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing demand to automate the procurement processes; Integration between E Procurement applications and ERP solutions; Retail Industry is Expected to Hold Significant Market Share.

6. What are the notable trends driving market growth?

Retail Industry is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Absence of Secure Cloud.

8. Can you provide examples of recent developments in the market?

December 2022 - GEP, a procurement and supply chain services company, announced that Belgium's leading postal and e-commerce logistics provider, bpost group, had implemented the usage of GEP Software for digital transformation across the source-to-contract (S2C) process encompassing sourcing management, project management, contracts, and supplier management to improve efficiencies and compliance throughout the tendering and contracting process.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Procurement Software Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Procurement Software Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Procurement Software Market?

To stay informed about further developments, trends, and reports in the Procurement Software Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence