Key Insights

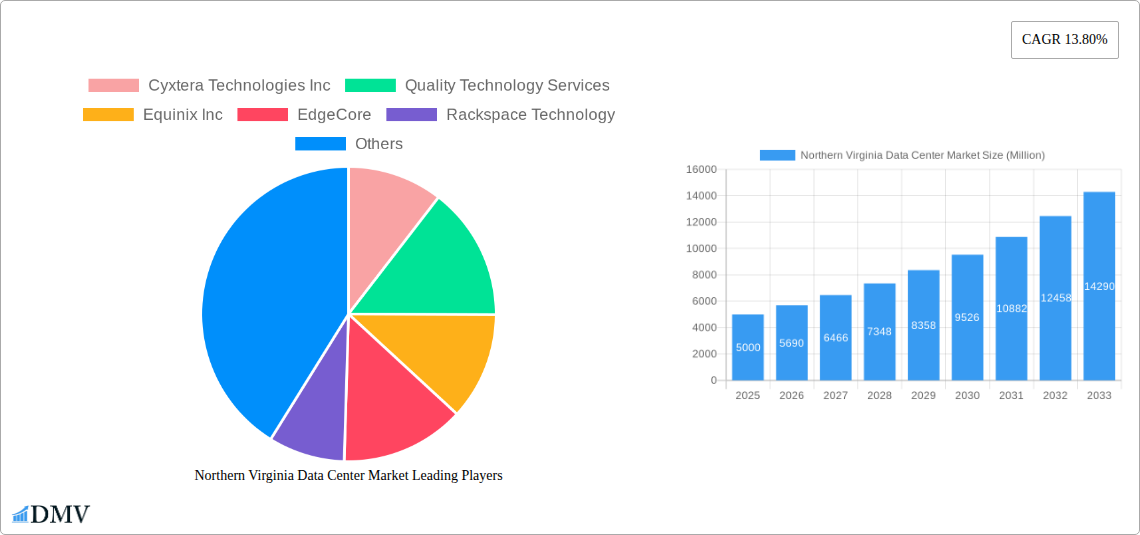

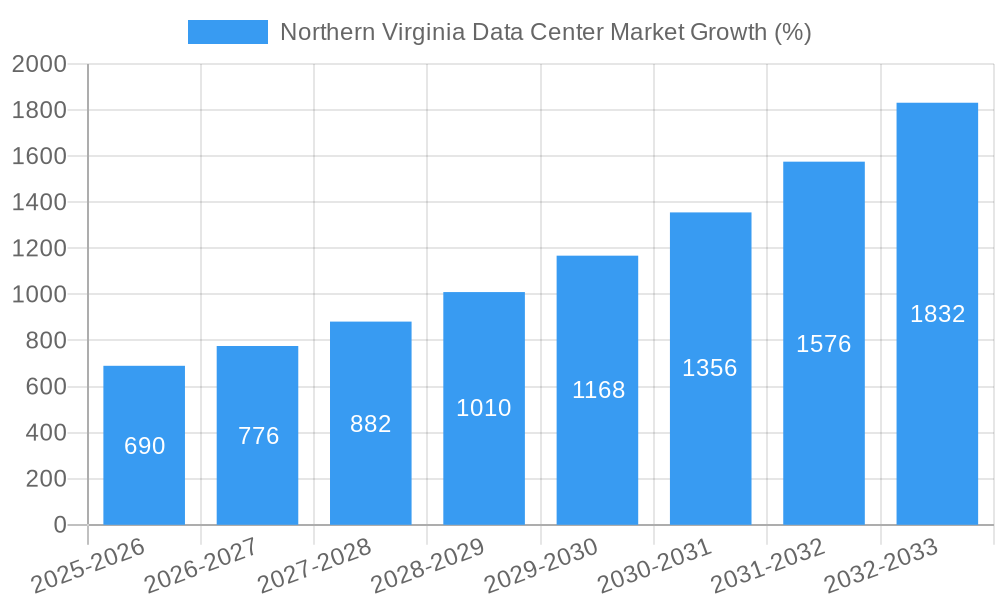

The Northern Virginia data center market is experiencing robust growth, driven by factors such as the high concentration of major cloud providers, robust internet infrastructure, and access to a skilled workforce. The region's strategic location, coupled with its extensive fiber optic network, makes it an ideal hub for data processing and storage. The market is segmented by data center size (small, medium, large, massive, mega), tier type (Tier 1, Tier 2, Tier 3, Tier 4), absorption rate (utilized, co-located), colocation type (retail, wholesale, hyperscale), and end-user industry (cloud & IT, telecom, media & entertainment, government, BFSI, manufacturing, e-commerce, others). While a precise market size for Northern Virginia in 2025 isn't provided, considering a global CAGR of 13.80% and the region's prominence, a reasonable estimate would place the market value at several billion dollars. This estimate incorporates the significant investments made by major players like Equinix, Digital Realty, and others, constantly expanding their capacity to meet the growing demand. The market's continued expansion is projected to be fueled by increasing cloud adoption, the rise of edge computing, and the growing need for low-latency data processing.

The competitive landscape is highly concentrated, with major players like Equinix, Digital Realty, Cyxtera, and others vying for market share. These companies are continuously investing in expanding their facilities and service offerings to accommodate the surging demand. While factors like land availability and power constraints pose potential restraints, the substantial investment in infrastructure development and the ongoing demand from hyperscale cloud providers are likely to mitigate these challenges. Future growth will likely be shaped by advancements in technology, such as AI and 5G, further fueling the demand for advanced data center capabilities. This will lead to increased competition and innovation within the Northern Virginia data center market, pushing service providers to constantly refine their offerings and infrastructure to maintain their competitive edge. The projected CAGR suggests significant growth potential in the coming years, making Northern Virginia a key strategic location within the global data center landscape.

Northern Virginia Data Center Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Northern Virginia data center market, encompassing its current state, future trajectory, and key players. We examine market composition, technological advancements, investment trends, and regulatory influences shaping this dynamic sector. The report covers the period 2019-2033, with a focus on 2025, offering invaluable data for stakeholders seeking to understand and capitalize on this booming market. The report is meticulously researched and provides data-driven insights, devoid of placeholders, to ensure immediate usability.

Northern Virginia Data Center Market Composition & Trends

This section delves into the competitive landscape of the Northern Virginia data center market, assessing market concentration, innovation drivers, regulatory frameworks, substitute technologies, end-user segmentation, and merger & acquisition (M&A) activity. We analyze market share distribution among key players, including Equinix Inc, CyrusOne, Digital Realty Trust Inc, and others, and quantify M&A deal values to gauge market dynamics. The impact of regulatory changes on market access and expansion is also evaluated. We examine the prevalence of retail, wholesale, and hyperscale colocation models and identify dominant end-user sectors such as Cloud & IT, Telecom, and Government. We explore the impact of substitute products and the overall market concentration.

- Market Share Distribution (2025 Estimate): Equinix: xx%, Digital Realty: xx%, CyrusOne: xx%, Others: xx%

- Total M&A Deal Value (2019-2024): $xx Million

- Average Deal Size (2019-2024): $xx Million

- Key Regulatory Impacts: Analysis of relevant state and federal regulations influencing market access and expansion.

Northern Virginia Data Center Market Industry Evolution

This section examines the historical (2019-2024) and projected (2025-2033) growth of the Northern Virginia data center market, exploring the interplay between technological advancements, evolving consumer demands, and overall market expansion. We analyze growth trajectories for different data center segments based on size (Small, Medium, Large, Massive, Mega), tier type (Tier 1, Tier 2, Tier 3), and colocation type (Retail, Wholesale, Hyperscale). The adoption rates of new technologies such as AI-powered infrastructure management and enhanced security protocols are investigated. The shift in end-user preferences towards specific services (e.g., cloud-based solutions) is also analyzed. We present quantifiable data points, including growth rates (CAGR) and adoption metrics for various technologies. The impact of economic cycles and their influence on market growth will be carefully analyzed.

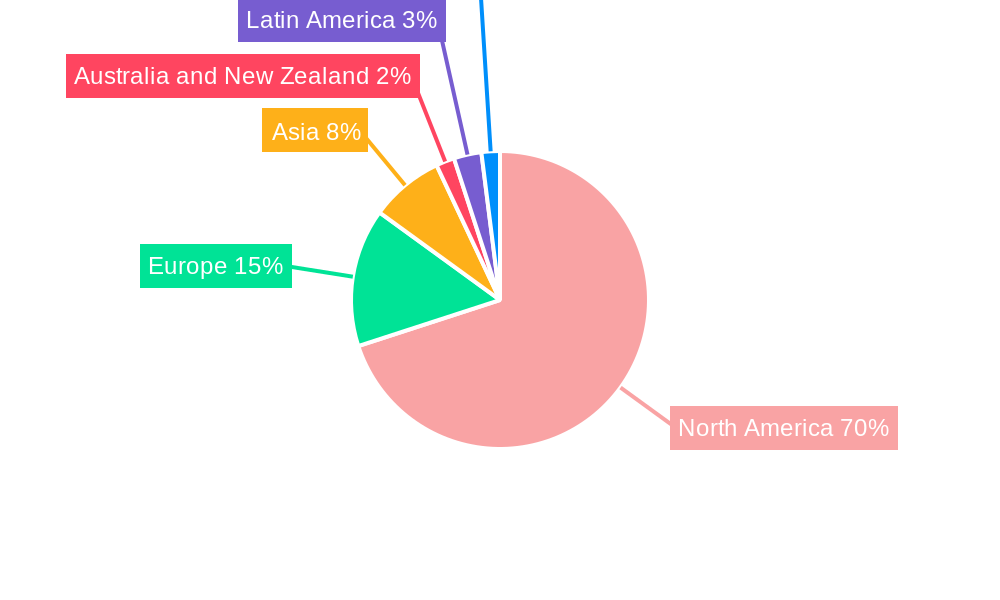

Leading Regions, Countries, or Segments in Northern Virginia Data Center Market

This section identifies the dominant regions, countries, and segments within the Northern Virginia data center market. Ashburn, Loudoun County, and Prince William County are identified as key locations. The analysis will detail the factors contributing to the dominance of specific segments, using data from the historical and forecast periods.

- Dominant Segment (2025): Large and Mega Data Centers

- Key Drivers for Dominance:

- High Demand: Driven by the growth of Cloud & IT, Telecom, and Government sectors.

- Investment Trends: Significant investments in infrastructure and technological upgrades.

- Regulatory Support: Favorable policies promoting data center development.

- Detailed Analysis of Dominant Factors: This section will provide a deeper dive into the reasons behind the dominance of specified segments, with quantitative data to substantiate the claims.

Northern Virginia Data Center Market Product Innovations

This section explores recent advancements in data center technologies within the Northern Virginia market, focusing on unique selling propositions and performance enhancements. This includes advancements in cooling technologies, energy efficiency, and security features. Examples include increased use of liquid cooling and AI-driven predictive maintenance.

Propelling Factors for Northern Virginia Data Center Market Growth

The rapid growth of the Northern Virginia data center market is propelled by several key factors. These include substantial investments in cloud infrastructure, the increasing demand for digital services, and the region's robust fiber optic network. Government initiatives promoting technological advancement and the presence of a skilled workforce also contribute significantly.

Obstacles in the Northern Virginia Data Center Market

While the market presents significant opportunities, challenges exist. These include the high cost of land and construction, potential power supply limitations, and competition from other data center hubs. Supply chain disruptions and labor shortages also pose considerable obstacles.

Future Opportunities in Northern Virginia Data Center Market

The future of the Northern Virginia data center market looks promising. The expanding adoption of edge computing, the growth of the Internet of Things (IoT), and the increasing demand for high-performance computing are expected to fuel further growth. New market entry from innovative technology providers and supportive government policies will continue to shape the market.

Major Players in the Northern Virginia Data Center Market Ecosystem

- Cyxtera Technologies Inc

- Quality Technology Services

- Equinix Inc

- EdgeCore

- Rackspace Technology

- PhoenixNAP

- Iron Mountain

- 365 data centers

- DataBank

- Evocative

- CyrusOne

- EdgeConneX Inc

- Flexential

- Cogent

- Cologix

- Evoque

- Vantage Data Center

- CoreSite

- H5 Data centers

- Digital Realty Trust Inc

- Stack Infrastructure

- NTT Ltd

Key Developments in Northern Virginia Data Center Market Industry

- May 2023: Culpeper County approves rezoning for over 4 Million square feet of new data center construction. This signals significant expansion outside the traditional data center hubs.

- April 2023: GI Partners acquires a 98-acre data center campus in Ashburn, indicating continued strong investor interest in the region's data center market.

Strategic Northern Virginia Data Center Market Forecast

The Northern Virginia data center market is poised for continued robust growth over the forecast period (2025-2033), driven by sustained demand from major cloud providers, expanding digital services consumption, and ongoing infrastructure investments. The market's strategic location, robust connectivity, and supportive regulatory environment further underpin its positive outlook. The projected growth rate for the next decade will exceed xx%, ensuring this market remains a key focus for both investors and technology providers.

Northern Virginia Data Center Market Segmentation

-

1. DC Size

- 1.1. Small

- 1.2. Medium

- 1.3. Large

- 1.4. Massive

- 1.5. Mega

-

2. Tier Type

- 2.1. Tier 1 & 2

- 2.2. Tier 3

- 2.3. Tier 4

-

3. Absorption

-

3.1. Utilized

-

3.1.1. Colocation Type

- 3.1.1.1. Retail

- 3.1.1.2. Wholesale

- 3.1.1.3. Hyperscale

-

3.1.2. End User

- 3.1.2.1. Cloud & IT

- 3.1.2.2. Telecom

- 3.1.2.3. Media & Entertainment

- 3.1.2.4. Government

- 3.1.2.5. BFSI

- 3.1.2.6. Manufacturing

- 3.1.2.7. E-Commerce

- 3.1.2.8. Other End User

-

3.1.1. Colocation Type

- 3.2. Non-Utilized

-

3.1. Utilized

Northern Virginia Data Center Market Segmentation By Geography

- 1. Virginia

Northern Virginia Data Center Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 13.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Adoption of Cloud Services is expected to flourish the market; Increasing Growth in Wholesale Datacenter Multi-tenant Spaces to propel demand (albeit from a lower base); Increased Emphasis on Compliance with Data Regulations and Cost-Effective Nature of Multi-tenant Facilities to Drive Adoption among SME's

- 3.3. Market Restrains

- 3.3.1. Dependence on Regulatory Landscape & Stringent Security Requirements

- 3.4. Market Trends

- 3.4.1. Tier 4 is Expected to Hold Significant Share of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Northern Virginia Data Center Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by DC Size

- 5.1.1. Small

- 5.1.2. Medium

- 5.1.3. Large

- 5.1.4. Massive

- 5.1.5. Mega

- 5.2. Market Analysis, Insights and Forecast - by Tier Type

- 5.2.1. Tier 1 & 2

- 5.2.2. Tier 3

- 5.2.3. Tier 4

- 5.3. Market Analysis, Insights and Forecast - by Absorption

- 5.3.1. Utilized

- 5.3.1.1. Colocation Type

- 5.3.1.1.1. Retail

- 5.3.1.1.2. Wholesale

- 5.3.1.1.3. Hyperscale

- 5.3.1.2. End User

- 5.3.1.2.1. Cloud & IT

- 5.3.1.2.2. Telecom

- 5.3.1.2.3. Media & Entertainment

- 5.3.1.2.4. Government

- 5.3.1.2.5. BFSI

- 5.3.1.2.6. Manufacturing

- 5.3.1.2.7. E-Commerce

- 5.3.1.2.8. Other End User

- 5.3.1.1. Colocation Type

- 5.3.2. Non-Utilized

- 5.3.1. Utilized

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Virginia

- 5.1. Market Analysis, Insights and Forecast - by DC Size

- 6. North America Northern Virginia Data Center Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. Europe Northern Virginia Data Center Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. Asia Northern Virginia Data Center Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. Australia and New Zealand Northern Virginia Data Center Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Latin America Northern Virginia Data Center Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Middle East and Africa Northern Virginia Data Center Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Cyxtera Technologies Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Quality Technology Services

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Equinix Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 EdgeCore

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Rackspace Technology

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 PhoenixNAP

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Iron Mountain

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 365 data centers

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 DataBank

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Evocative

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 CyrusOne

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 EdgeConneX Inc

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Flexential

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.14 Cogent

- 12.2.14.1. Overview

- 12.2.14.2. Products

- 12.2.14.3. SWOT Analysis

- 12.2.14.4. Recent Developments

- 12.2.14.5. Financials (Based on Availability)

- 12.2.15 Cologix

- 12.2.15.1. Overview

- 12.2.15.2. Products

- 12.2.15.3. SWOT Analysis

- 12.2.15.4. Recent Developments

- 12.2.15.5. Financials (Based on Availability)

- 12.2.16 Evoque

- 12.2.16.1. Overview

- 12.2.16.2. Products

- 12.2.16.3. SWOT Analysis

- 12.2.16.4. Recent Developments

- 12.2.16.5. Financials (Based on Availability)

- 12.2.17 Vantage Data Center

- 12.2.17.1. Overview

- 12.2.17.2. Products

- 12.2.17.3. SWOT Analysis

- 12.2.17.4. Recent Developments

- 12.2.17.5. Financials (Based on Availability)

- 12.2.18 CoreSite

- 12.2.18.1. Overview

- 12.2.18.2. Products

- 12.2.18.3. SWOT Analysis

- 12.2.18.4. Recent Developments

- 12.2.18.5. Financials (Based on Availability)

- 12.2.19 H5 Data centers

- 12.2.19.1. Overview

- 12.2.19.2. Products

- 12.2.19.3. SWOT Analysis

- 12.2.19.4. Recent Developments

- 12.2.19.5. Financials (Based on Availability)

- 12.2.20 Digital Realty Trust Inc

- 12.2.20.1. Overview

- 12.2.20.2. Products

- 12.2.20.3. SWOT Analysis

- 12.2.20.4. Recent Developments

- 12.2.20.5. Financials (Based on Availability)

- 12.2.21 Stack Infrastructure

- 12.2.21.1. Overview

- 12.2.21.2. Products

- 12.2.21.3. SWOT Analysis

- 12.2.21.4. Recent Developments

- 12.2.21.5. Financials (Based on Availability)

- 12.2.22 NTT Ltd

- 12.2.22.1. Overview

- 12.2.22.2. Products

- 12.2.22.3. SWOT Analysis

- 12.2.22.4. Recent Developments

- 12.2.22.5. Financials (Based on Availability)

- 12.2.1 Cyxtera Technologies Inc

List of Figures

- Figure 1: Northern Virginia Data Center Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Northern Virginia Data Center Market Share (%) by Company 2024

List of Tables

- Table 1: Northern Virginia Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Northern Virginia Data Center Market Revenue Million Forecast, by DC Size 2019 & 2032

- Table 3: Northern Virginia Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 4: Northern Virginia Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 5: Northern Virginia Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Northern Virginia Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Northern Virginia Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Northern Virginia Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Northern Virginia Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Northern Virginia Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Northern Virginia Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Northern Virginia Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Northern Virginia Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Northern Virginia Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Northern Virginia Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Northern Virginia Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Northern Virginia Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Northern Virginia Data Center Market Revenue Million Forecast, by DC Size 2019 & 2032

- Table 19: Northern Virginia Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 20: Northern Virginia Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 21: Northern Virginia Data Center Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Northern Virginia Data Center Market?

The projected CAGR is approximately 13.80%.

2. Which companies are prominent players in the Northern Virginia Data Center Market?

Key companies in the market include Cyxtera Technologies Inc, Quality Technology Services, Equinix Inc, EdgeCore, Rackspace Technology, PhoenixNAP, Iron Mountain, 365 data centers, DataBank, Evocative, CyrusOne, EdgeConneX Inc , Flexential, Cogent, Cologix, Evoque, Vantage Data Center, CoreSite, H5 Data centers, Digital Realty Trust Inc, Stack Infrastructure, NTT Ltd.

3. What are the main segments of the Northern Virginia Data Center Market?

The market segments include DC Size, Tier Type, Absorption.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Adoption of Cloud Services is expected to flourish the market; Increasing Growth in Wholesale Datacenter Multi-tenant Spaces to propel demand (albeit from a lower base); Increased Emphasis on Compliance with Data Regulations and Cost-Effective Nature of Multi-tenant Facilities to Drive Adoption among SME's.

6. What are the notable trends driving market growth?

Tier 4 is Expected to Hold Significant Share of the Market.

7. Are there any restraints impacting market growth?

Dependence on Regulatory Landscape & Stringent Security Requirements.

8. Can you provide examples of recent developments in the market?

May 2023: Culpeper County, Virginia, may soon see the building of more than four million square feet of data centers. The Culpeper Town and County Councils have received rezoning proposals allowing the construction of about 17 structures on two campuses on the town's border alongside McDevitt Drive. According to the Culpeper Star-Exponent, the Culpeper County Planning Commission voted 7-1 last week to approve an application to rezone approximately 34.4 acres from RA (Rural Areas) to LI (Light Industrial) over Route 799 (McDevitt Drive) and Route 699 (East Chandler Street) in the StevensburgMagisterial area.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Northern Virginia Data Center Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Northern Virginia Data Center Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Northern Virginia Data Center Market?

To stay informed about further developments, trends, and reports in the Northern Virginia Data Center Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence