Key Insights

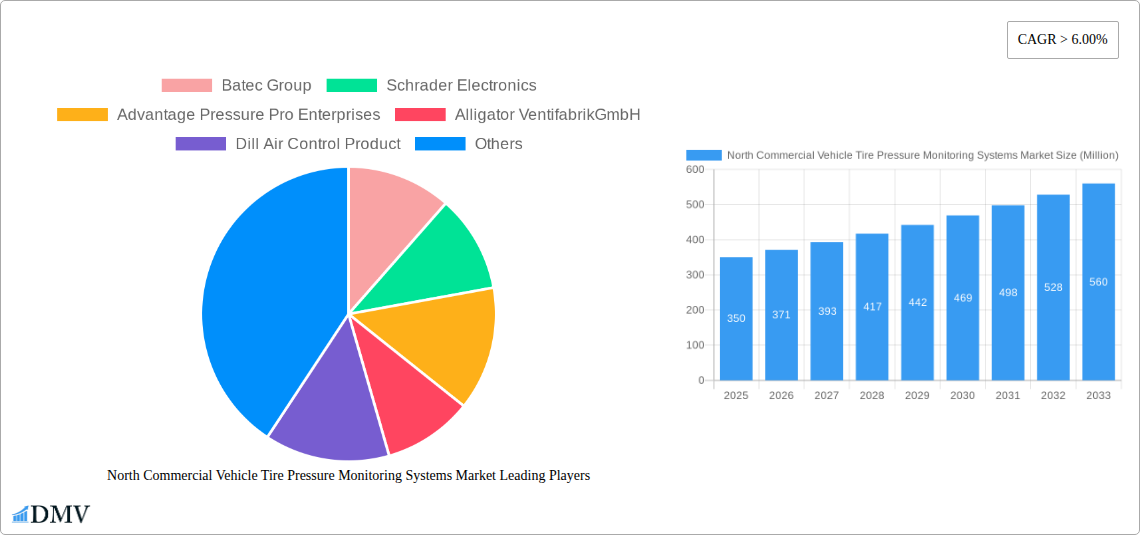

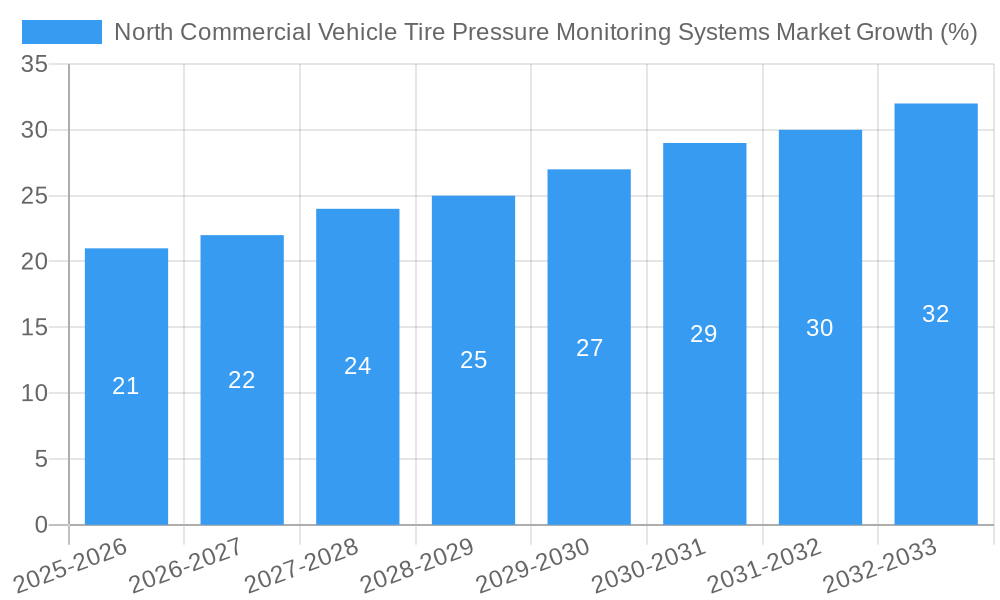

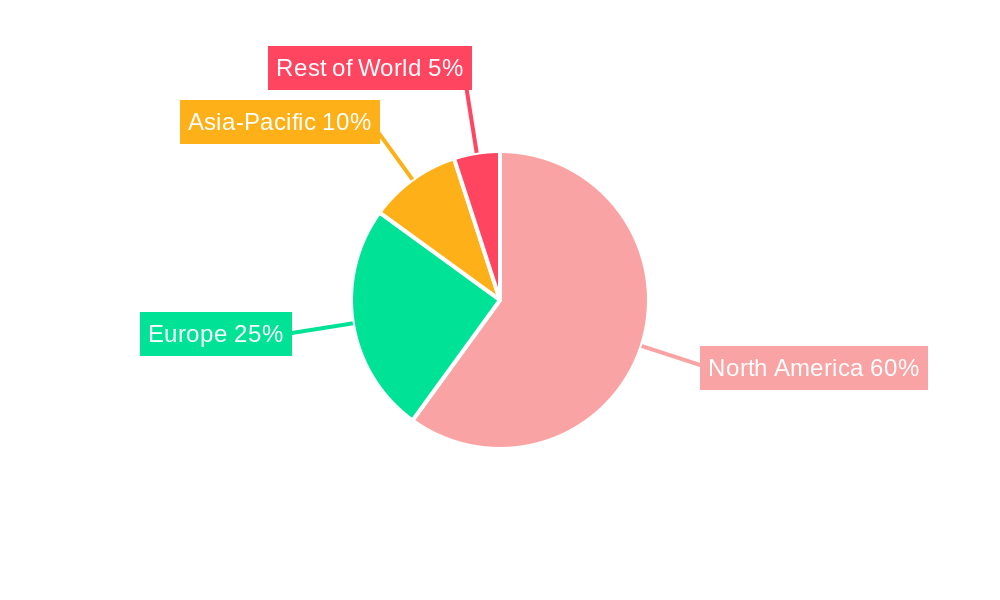

The North American commercial vehicle tire pressure monitoring system (TPMS) market is experiencing robust growth, driven by increasing regulations mandating TPMS installation in commercial vehicles to enhance safety and fuel efficiency. The market's Compound Annual Growth Rate (CAGR) exceeding 6% from 2019 to 2024 indicates a strong upward trajectory. This growth is fueled by several key factors, including the rising adoption of advanced TPMS technologies offering real-time monitoring and data analytics, improving fleet management and reducing operational costs. The increasing awareness of the economic benefits associated with preventing tire-related breakdowns and maximizing tire lifespan further contributes to market expansion. The market segmentation reveals a significant presence of both OEM (Original Equipment Manufacturer) and aftermarket sales channels, with a growing preference for indirect TPMS solutions offering cost-effective and easily integrable systems. Leading players like Schrader Electronics, Continental AG, and Denso are investing heavily in research and development to introduce innovative TPMS technologies, fostering competition and driving market innovation. The significant market size in the United States, coupled with considerable growth in Canada and the Rest of North America, underscores the region's importance within the global commercial vehicle TPMS landscape. Looking ahead, the forecast period (2025-2033) anticipates continued expansion driven by technological advancements, stringent safety regulations, and an increasing emphasis on optimizing fleet operations.

The North American commercial vehicle TPMS market is characterized by a competitive landscape with both established international players and regional manufacturers. While precise market sizing data is not provided, a reasonable estimate for 2025, considering the CAGR and market trends, would place the North American market value in the hundreds of millions of dollars. The OEM segment is expected to maintain a substantial share due to the growing trend of pre-installation in new commercial vehicles. However, the aftermarket segment is also demonstrating significant growth fueled by retrofitting needs in older fleets. Further research into specific regional data within North America (United States, Canada, and Rest of North America) would allow for a more granular analysis of market dynamics and regional variations in market penetration. The ongoing trend toward connected vehicles and the integration of TPMS data into broader fleet management systems will continue shaping the future of this market, driving demand for sophisticated and integrated solutions.

North Commercial Vehicle Tire Pressure Monitoring Systems Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the North American Commercial Vehicle Tire Pressure Monitoring Systems (TPMS) market, offering invaluable insights for stakeholders seeking to navigate this dynamic landscape. The study period covers 2019-2033, with 2025 serving as the base and estimated year. The forecast period spans 2025-2033, building upon historical data from 2019-2024. This report meticulously examines market trends, technological advancements, competitive dynamics, and future growth opportunities, providing a 360-degree view of this crucial market segment. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

North Commercial Vehicle Tire Pressure Monitoring Systems Market Market Composition & Trends

The North American commercial vehicle TPMS market is characterized by a moderately concentrated landscape, with key players such as Continental AG, Denso, and Bendix Commercial Vehicle Systems LLC holding significant market share. Market concentration is estimated at xx%, with the top five players accounting for approximately xx% of the total revenue in 2024. Innovation in TPMS technology, driven by advancements in sensor technology and data analytics, is a major catalyst for market growth. Stringent fuel efficiency regulations and safety standards are further shaping the market landscape, pushing adoption of advanced TPMS systems. Substitute products, such as traditional tire pressure gauges, pose minimal threat given the superior performance and convenience offered by TPMS. The end-user profile predominantly includes fleet operators, trucking companies, and logistics providers. M&A activities have been relatively moderate in recent years, with deal values averaging approximately xx Million per transaction.

- Market Share Distribution (2024): Continental AG (xx%), Denso (xx%), Bendix (xx%), Schrader Electronics (xx%), Others (xx%)

- Average M&A Deal Value (2019-2024): xx Million

- Key Innovation Catalysts: Advanced sensor technology, IoT integration, data analytics platforms.

- Regulatory Landscape: Focus on fuel efficiency and safety standards (e.g., FMVSS 121).

North Commercial Vehicle Tire Pressure Monitoring Systems Market Industry Evolution

The North American commercial vehicle TPMS market has witnessed significant growth over the past five years, fueled by increasing adoption rates among fleet operators and stricter regulatory mandates. The market expanded from xx Million in 2019 to xx Million in 2024, representing a CAGR of xx%. Technological advancements, such as the integration of TPMS with telematics systems and the development of more robust and reliable sensors, have been key drivers of this growth. The shift towards connected vehicles and the rising demand for real-time monitoring capabilities have also significantly influenced market expansion. Adoption rates have increased steadily, with xx% of commercial vehicles equipped with TPMS in 2024, up from xx% in 2019. Further growth is anticipated as the industry moves towards more sophisticated systems capable of predictive maintenance and optimized tire management. This trend is expected to accelerate with the increasing integration of artificial intelligence and machine learning algorithms in TPMS solutions. The market is also witnessing a rise in demand for indirect TPMS systems due to their cost-effectiveness compared to direct TPMS systems.

Leading Regions, Countries, or Segments in North Commercial Vehicle Tire Pressure Monitoring Systems Market

The OEM sales channel currently dominates the North American commercial vehicle TPMS market, driven by the increasing integration of TPMS as a standard feature in new vehicles. The direct TPMS segment also holds a significant market share due to its superior accuracy and reliability. However, the aftermarket segment is exhibiting strong growth potential, fueled by the increasing number of older vehicles requiring TPMS retrofitting.

Key Drivers for OEM Dominance:

- High integration rates in new commercial vehicles.

- OEM partnerships and bundled offerings.

- Strong focus on vehicle safety and fuel efficiency.

Key Drivers for Direct TPMS Dominance:

- Superior accuracy and reliability compared to indirect TPMS.

- Growing demand for real-time tire pressure monitoring.

Key Drivers for Aftermarket Growth:

- Increasing number of older vehicles requiring TPMS retrofitting.

- Cost-effective solutions for improving fleet safety and efficiency.

North Commercial Vehicle Tire Pressure Monitoring Systems Market Product Innovations

Recent innovations in commercial vehicle TPMS include the development of more durable and longer-lasting sensors, enhanced data analytics capabilities for predictive maintenance, and improved integration with telematics platforms. These advancements provide fleet operators with valuable insights into tire performance, allowing for proactive maintenance scheduling and reduced downtime. Unique selling propositions often center around extended sensor lifespan, real-time data accessibility via mobile apps, and integration with fleet management software.

Propelling Factors for North Commercial Vehicle Tire Pressure Monitoring Systems Market Growth

Several factors are driving the growth of the North American commercial vehicle TPMS market. Stringent government regulations on fuel efficiency and vehicle safety are pushing adoption. Technological advancements, such as the development of more accurate and reliable sensors and improved data analytics capabilities, are also contributing to market expansion. Furthermore, increasing awareness among fleet operators of the cost savings associated with proper tire pressure management is fueling demand.

Obstacles in the North Commercial Vehicle Tire Pressure Monitoring Systems Market Market

The market faces challenges including the high initial investment costs associated with TPMS installation, potential supply chain disruptions affecting sensor availability, and intense competition among established and emerging players. These factors can affect market growth and profitability. The complexity of TPMS systems and the need for specialized installation expertise can also impede wider adoption.

Future Opportunities in North Commercial Vehicle Tire Pressure Monitoring Systems Market

Future growth opportunities exist in expanding into new market segments, such as light commercial vehicles and specialized trucking fleets. Technological advancements, such as AI-powered predictive maintenance capabilities and integration with autonomous driving systems, offer significant potential for innovation. Exploring new business models, such as subscription-based TPMS services, can also drive market growth.

Major Players in the North Commercial Vehicle Tire Pressure Monitoring Systems Market Ecosystem

- Batec Group

- Schrader Electronics

- Advantage Pressure Pro Enterprises

- Alligator Ventifabrik GmbH

- Dill Air Control Product

- Delphi Automotive

- Continental AG

- Denso

- Bendix Commercial Vehicle Systems LLC

- Pacific Industrial

Key Developments in North Commercial Vehicle Tire Pressure Monitoring Systems Market Industry

- Q1 2023: Continental AG launched its new generation of TPMS sensors with enhanced durability and extended lifespan.

- Q3 2022: Bendix Commercial Vehicle Systems LLC partnered with a leading telematics provider to integrate TPMS data into its fleet management platform.

- Q4 2021: A significant merger occurred in the industry consolidating two major players.

Strategic North Commercial Vehicle Tire Pressure Monitoring Systems Market Market Forecast

The North American commercial vehicle TPMS market is poised for robust growth over the next decade, driven by the aforementioned technological advancements, regulatory pressures, and increasing demand for improved fleet efficiency and safety. New opportunities in areas like predictive maintenance and integration with advanced driver-assistance systems (ADAS) will further fuel this growth, creating a significant market potential. The market is expected to reach xx Million by 2033, presenting substantial opportunities for both established and emerging players.

North Commercial Vehicle Tire Pressure Monitoring Systems Market Segmentation

-

1. Sales Channel

- 1.1. OEM

- 1.2. Aftermarket

-

2. Type

- 2.1. Direct TPMS

- 2.2. Indirect TPMS

North Commercial Vehicle Tire Pressure Monitoring Systems Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest of North America

North Commercial Vehicle Tire Pressure Monitoring Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 6.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Enhanced Ride Comfort

- 3.3. Market Restrains

- 3.3.1. High Upfront Cost of Advanced Suspension Systems

- 3.4. Market Trends

- 3.4.1. Commercial Vehicle Sales Driving Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North Commercial Vehicle Tire Pressure Monitoring Systems Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Sales Channel

- 5.1.1. OEM

- 5.1.2. Aftermarket

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Direct TPMS

- 5.2.2. Indirect TPMS

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Sales Channel

- 6. United States North Commercial Vehicle Tire Pressure Monitoring Systems Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Sales Channel

- 6.1.1. OEM

- 6.1.2. Aftermarket

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Direct TPMS

- 6.2.2. Indirect TPMS

- 6.1. Market Analysis, Insights and Forecast - by Sales Channel

- 7. Canada North Commercial Vehicle Tire Pressure Monitoring Systems Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Sales Channel

- 7.1.1. OEM

- 7.1.2. Aftermarket

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Direct TPMS

- 7.2.2. Indirect TPMS

- 7.1. Market Analysis, Insights and Forecast - by Sales Channel

- 8. Rest of North America North Commercial Vehicle Tire Pressure Monitoring Systems Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Sales Channel

- 8.1.1. OEM

- 8.1.2. Aftermarket

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Direct TPMS

- 8.2.2. Indirect TPMS

- 8.1. Market Analysis, Insights and Forecast - by Sales Channel

- 9. United States North Commercial Vehicle Tire Pressure Monitoring Systems Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Canada North Commercial Vehicle Tire Pressure Monitoring Systems Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Rest of North America North Commercial Vehicle Tire Pressure Monitoring Systems Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Batec Group

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Schrader Electronics

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Advantage Pressure Pro Enterprises

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Alligator VentifabrikGmbH

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Dill Air Control Product

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Delphi Automotive

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Continental AG

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Denso

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Bendix Commercial Vehicle Systems LLC

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Pacific Industrial

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Batec Group

List of Figures

- Figure 1: North Commercial Vehicle Tire Pressure Monitoring Systems Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North Commercial Vehicle Tire Pressure Monitoring Systems Market Share (%) by Company 2024

List of Tables

- Table 1: North Commercial Vehicle Tire Pressure Monitoring Systems Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North Commercial Vehicle Tire Pressure Monitoring Systems Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 3: North Commercial Vehicle Tire Pressure Monitoring Systems Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: North Commercial Vehicle Tire Pressure Monitoring Systems Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: North Commercial Vehicle Tire Pressure Monitoring Systems Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: North Commercial Vehicle Tire Pressure Monitoring Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: North Commercial Vehicle Tire Pressure Monitoring Systems Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: North Commercial Vehicle Tire Pressure Monitoring Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: North Commercial Vehicle Tire Pressure Monitoring Systems Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: North Commercial Vehicle Tire Pressure Monitoring Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: North Commercial Vehicle Tire Pressure Monitoring Systems Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 12: North Commercial Vehicle Tire Pressure Monitoring Systems Market Revenue Million Forecast, by Type 2019 & 2032

- Table 13: North Commercial Vehicle Tire Pressure Monitoring Systems Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: North Commercial Vehicle Tire Pressure Monitoring Systems Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 15: North Commercial Vehicle Tire Pressure Monitoring Systems Market Revenue Million Forecast, by Type 2019 & 2032

- Table 16: North Commercial Vehicle Tire Pressure Monitoring Systems Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: North Commercial Vehicle Tire Pressure Monitoring Systems Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 18: North Commercial Vehicle Tire Pressure Monitoring Systems Market Revenue Million Forecast, by Type 2019 & 2032

- Table 19: North Commercial Vehicle Tire Pressure Monitoring Systems Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North Commercial Vehicle Tire Pressure Monitoring Systems Market?

The projected CAGR is approximately > 6.00%.

2. Which companies are prominent players in the North Commercial Vehicle Tire Pressure Monitoring Systems Market?

Key companies in the market include Batec Group, Schrader Electronics, Advantage Pressure Pro Enterprises, Alligator VentifabrikGmbH, Dill Air Control Product, Delphi Automotive, Continental AG, Denso, Bendix Commercial Vehicle Systems LLC, Pacific Industrial.

3. What are the main segments of the North Commercial Vehicle Tire Pressure Monitoring Systems Market?

The market segments include Sales Channel, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Enhanced Ride Comfort.

6. What are the notable trends driving market growth?

Commercial Vehicle Sales Driving Growth.

7. Are there any restraints impacting market growth?

High Upfront Cost of Advanced Suspension Systems.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North Commercial Vehicle Tire Pressure Monitoring Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North Commercial Vehicle Tire Pressure Monitoring Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North Commercial Vehicle Tire Pressure Monitoring Systems Market?

To stay informed about further developments, trends, and reports in the North Commercial Vehicle Tire Pressure Monitoring Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence