Key Insights

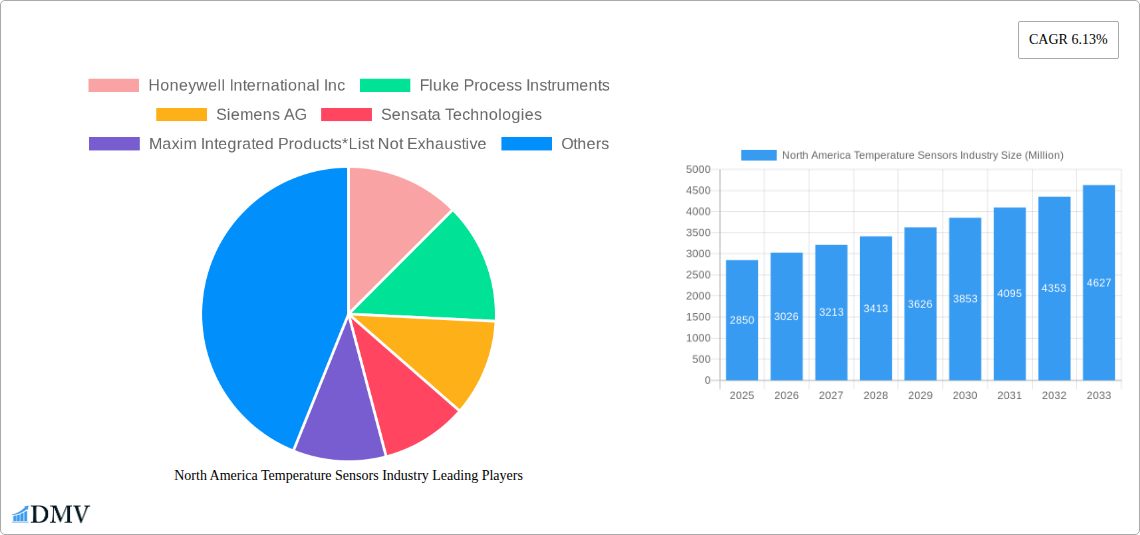

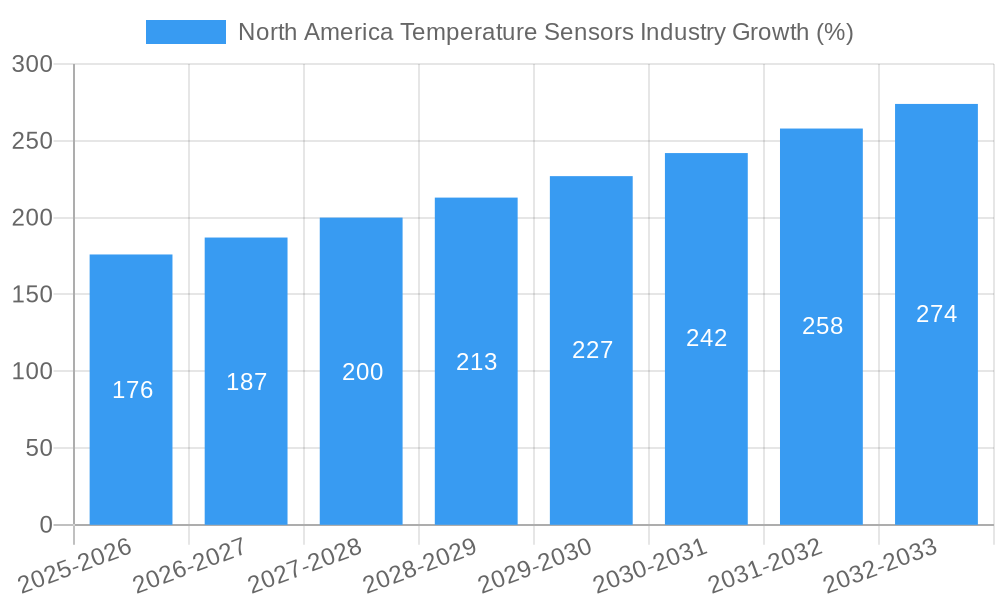

The North American temperature sensor market, valued at $2.85 billion in 2025, is projected to experience robust growth, driven by increasing automation across various end-user industries and the rising demand for precise temperature monitoring in applications ranging from industrial processes to consumer electronics. The market's Compound Annual Growth Rate (CAGR) of 6.13% from 2019 to 2024 suggests a continued upward trajectory. Key growth drivers include the expanding adoption of smart technologies, the Internet of Things (IoT), and Industry 4.0 initiatives, all of which require precise and reliable temperature sensing for optimal performance and safety. The chemical & petrochemical, oil & gas, and automotive sectors are significant contributors to market demand, driven by stringent safety regulations and the need for process optimization. Wireless temperature sensors are gaining traction over wired counterparts, due to their ease of installation and data transmission capabilities, contributing to market expansion. Technological advancements in areas such as infrared and fiber optic sensors further enhance the accuracy and reliability of temperature measurement, fueling market growth.

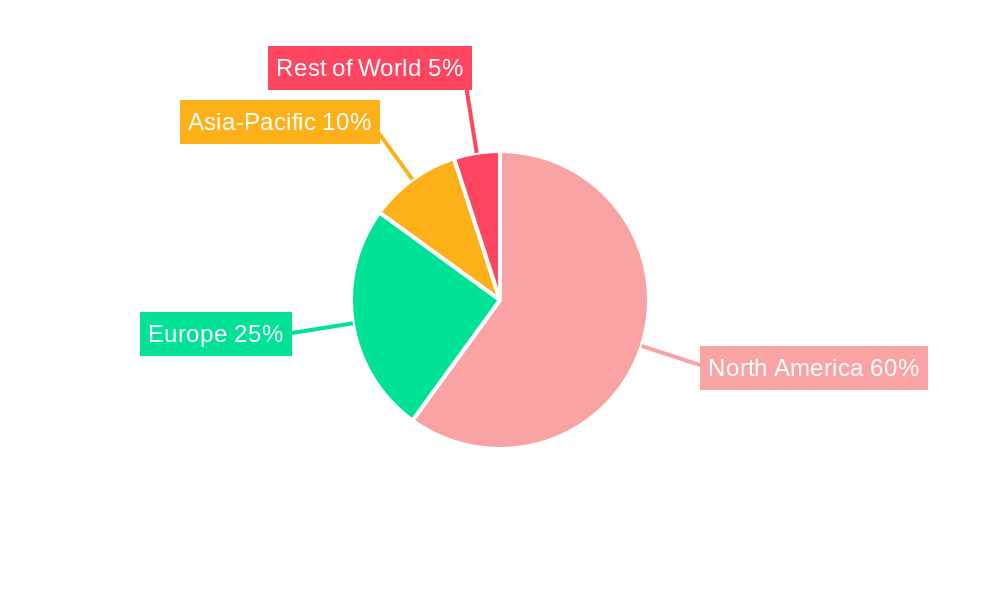

While the market enjoys strong growth, certain restraints exist, primarily associated with the high initial investment cost of implementing advanced temperature sensing systems and the potential for sensor inaccuracies due to environmental factors. However, these challenges are being addressed by the continuous development of more cost-effective and robust sensor technologies. The North American market, specifically the United States and Canada, dominates the regional landscape, owing to strong industrial development and technological advancements. The presence of major players like Honeywell, Fluke, Siemens, and others further consolidates North America's leading position in the global temperature sensor market. Continued growth is expected in the forecast period (2025-2033), with significant contributions anticipated from emerging applications in areas such as medical devices, aerospace, and renewable energy.

North America Temperature Sensors Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America temperature sensors industry, covering the period from 2019 to 2033. With a focus on market size, growth drivers, and key players, this report is an invaluable resource for stakeholders seeking to understand and capitalize on opportunities within this dynamic sector. The report uses 2025 as its base year and provides forecasts through 2033, leveraging historical data from 2019-2024. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033.

North America Temperature Sensors Industry Market Composition & Trends

The North American temperature sensors market exhibits a moderately concentrated landscape, with several major players holding significant market share. The market is characterized by continuous innovation driven by advancements in semiconductor technology, miniaturization, and the rising demand for accurate and reliable temperature measurement across diverse applications. Stringent regulatory frameworks, particularly concerning safety and environmental compliance, influence market dynamics. Substitute products, such as thermocouples and thermistors, compete with advanced technologies like infrared sensors. End-user profiles vary widely, ranging from industrial giants in chemical processing and oil & gas to smaller players in the consumer electronics sector. Mergers and acquisitions (M&A) activity has been moderate in recent years, with deal values averaging xx Million.

- Market Share Distribution: Honeywell International Inc., Fluke Process Instruments, and Siemens AG collectively hold an estimated xx% market share.

- M&A Activity: The past five years have witnessed xx M&A deals, with an average deal value of xx Million, primarily focused on technological expansion and market consolidation.

- Innovation Catalysts: Advancements in semiconductor technology, wireless communication, and miniaturization are driving innovation.

- Regulatory Landscape: Stringent safety and environmental regulations influence product design and manufacturing processes.

North America Temperature Sensors Industry Industry Evolution

The North American temperature sensors market has experienced steady growth over the past five years (2019-2024), expanding at a Compound Annual Growth Rate (CAGR) of xx%. This growth is attributed to several factors, including the increasing adoption of smart devices, the growth of automation in various industries, and the rising demand for precise temperature control in critical applications. Technological advancements, such as the development of more accurate and reliable sensors, smaller form factors, and wireless capabilities, have significantly contributed to market expansion. Shifting consumer demands, such as increased preference for energy-efficient products and heightened awareness of safety standards, have further shaped industry evolution. The market is expected to maintain a CAGR of xx% during the forecast period (2025-2033). Key advancements include the development of high-precision infrared sensors, the integration of advanced signal processing algorithms, and the widespread adoption of wireless technologies for remote monitoring and control. The increasing integration of sensors into Internet of Things (IoT) applications is expected to be a key driver of future growth. The adoption rate of wireless sensors, for example, is projected to increase from xx% in 2025 to xx% by 2033.

Leading Regions, Countries, or Segments in North America Temperature Sensors Industry

The United States is the dominant market for temperature sensors in North America, accounting for approximately xx% of the total market revenue in 2025. The chemical & petrochemical and oil & gas sectors are the leading end-user industries, driven by stringent process control requirements and safety regulations. The wired sensor type currently holds the largest market share, but wireless sensors are gaining traction due to their flexibility and ease of installation. Resistance Temperature Detectors (RTDs) and Thermocouples dominate the technology segment.

- Key Drivers (United States): Robust industrial sector, significant investments in automation, stringent safety regulations.

- Key Drivers (Canada): Growing energy sector, increased adoption of smart technologies in various sectors.

- Dominant End-User Industry: Chemical & Petrochemical, driven by strict process control needs and high safety standards. The Oil & Gas sector is a close second.

- Dominant Sensor Type: Wired sensors currently hold the largest market share due to reliability and established infrastructure.

- Dominant Technology: RTDs and Thermocouples due to their cost-effectiveness and reliability in harsh environments.

North America Temperature Sensors Industry Product Innovations

Recent innovations in temperature sensors focus on enhanced accuracy, miniaturization, and improved wireless capabilities. The development of highly sensitive infrared sensors for non-contact temperature measurement and the integration of advanced signal processing for improved data analysis are notable advancements. Unique selling propositions include increased durability, improved energy efficiency, and real-time data transmission capabilities. Technological advancements such as MEMS technology and advanced materials are driving the development of more robust and reliable sensors with improved performance metrics.

Propelling Factors for North America Temperature Sensors Industry Growth

Several factors contribute to the growth of the North American temperature sensors market. Technological advancements, particularly in miniaturization, wireless communication, and improved accuracy, are driving demand. The rising adoption of automation across various industries, particularly in chemical processing, oil & gas, and manufacturing, necessitates reliable temperature monitoring. Government regulations promoting energy efficiency and safety are also contributing factors. For instance, the growing demand for precise temperature control in industrial processes and the increasing use of temperature sensors in smart building applications are propelling market growth.

Obstacles in the North America Temperature Sensors Industry Market

The North American temperature sensors market faces challenges such as supply chain disruptions, increasing material costs, and intense competition from both established and emerging players. Regulatory compliance can also be complex and costly, particularly for manufacturers of specialized sensors. The global chip shortage experienced in recent years has also constrained sensor production and availability. These factors influence pricing and availability, impacting the market's overall growth trajectory.

Future Opportunities in North America Temperature Sensors Industry

Emerging opportunities lie in the growing demand for temperature sensors in the Internet of Things (IoT), particularly in smart homes, smart cities, and industrial automation. The development of new materials and sensor technologies, along with the increasing integration of artificial intelligence (AI) for data analysis, presents significant potential for market expansion. The adoption of advanced wireless communication protocols and the integration of temperature sensors into other sensor systems are also expected to fuel future growth.

Major Players in the North America Temperature Sensors Industry Ecosystem

- Honeywell International Inc

- Fluke Process Instruments

- Siemens AG

- Sensata Technologies

- Maxim Integrated Products

- Texas Instruments Incorporated

- Microchip Technology Incorporated

- Analog Devices Inc

- FLIR Systems

- Emerson Electric Company

Key Developments in North America Temperature Sensors Industry Industry

- November 2020: FLIR Systems launched the FLIR SV87 Kit, enabling real-time monitoring of vibration and heat variations for predictive maintenance. This significantly improves efficiency and safety within industrial settings.

- May 2021: Honeywell implemented its Honeywell Thermo Rebellion advanced skin temperature screening systems at JFK Airport, showcasing the application of temperature sensors in health and safety applications. This highlights a growing need for non-contact temperature measurement solutions in public spaces.

Strategic North America Temperature Sensors Industry Market Forecast

The North American temperature sensors market is poised for robust growth in the coming years. Driven by technological advancements, increasing automation across sectors, and a rising focus on energy efficiency and safety, the market is expected to witness significant expansion. Opportunities in emerging applications such as the Internet of Things (IoT) and smart infrastructure will further propel market growth, with wireless sensors and advanced technologies gaining significant traction. The continued investment in research and development, coupled with strategic partnerships and collaborations, will pave the way for innovative sensor solutions and increased market penetration.

North America Temperature Sensors Industry Segmentation

-

1. Type

- 1.1. Wired

- 1.2. Wireless

-

2. Technology

- 2.1. Infrared

- 2.2. Thermocouple

- 2.3. Resistance Temperature Detector

- 2.4. Thermistor

- 2.5. Temperature Transmitter

- 2.6. Fiber Optic

- 2.7. Others

-

3. End-user Industry

- 3.1. Chemical & Petrochemical

- 3.2. Oil and Gas

- 3.3. Metal and Mining

- 3.4. Power Generation

- 3.5. Food and Beverage

- 3.6. Automotive

- 3.7. Medical

- 3.8. Aerospace and Military

- 3.9. Consumer Electronics

- 3.10. Other End-user Industries

North America Temperature Sensors Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Temperature Sensors Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.13% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Growth in Industry 4.0 & Rapid Factory Automation; Increasing Adoption of Wireless Technologies

- 3.2.2 especially in Harsh Environments

- 3.3. Market Restrains

- 3.3.1. Higher Security Needs and Infrastructure Updating Costs

- 3.4. Market Trends

- 3.4.1. Infrared Temperature Sensors to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Temperature Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Wired

- 5.1.2. Wireless

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Infrared

- 5.2.2. Thermocouple

- 5.2.3. Resistance Temperature Detector

- 5.2.4. Thermistor

- 5.2.5. Temperature Transmitter

- 5.2.6. Fiber Optic

- 5.2.7. Others

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Chemical & Petrochemical

- 5.3.2. Oil and Gas

- 5.3.3. Metal and Mining

- 5.3.4. Power Generation

- 5.3.5. Food and Beverage

- 5.3.6. Automotive

- 5.3.7. Medical

- 5.3.8. Aerospace and Military

- 5.3.9. Consumer Electronics

- 5.3.10. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Temperature Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Temperature Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Temperature Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Temperature Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Honeywell International Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Fluke Process Instruments

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Siemens AG

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Sensata Technologies

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Maxim Integrated Products*List Not Exhaustive

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Texas Instruments Incorporated

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Microchip Technology Incorporated

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Analog Devices Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 FLIR Systems

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Emerson Electric Company

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Honeywell International Inc

List of Figures

- Figure 1: North America Temperature Sensors Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Temperature Sensors Industry Share (%) by Company 2024

List of Tables

- Table 1: North America Temperature Sensors Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Temperature Sensors Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: North America Temperature Sensors Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 4: North America Temperature Sensors Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 5: North America Temperature Sensors Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: North America Temperature Sensors Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States North America Temperature Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada North America Temperature Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico North America Temperature Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America North America Temperature Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: North America Temperature Sensors Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 12: North America Temperature Sensors Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 13: North America Temperature Sensors Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 14: North America Temperature Sensors Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 15: United States North America Temperature Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada North America Temperature Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Mexico North America Temperature Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Temperature Sensors Industry?

The projected CAGR is approximately 6.13%.

2. Which companies are prominent players in the North America Temperature Sensors Industry?

Key companies in the market include Honeywell International Inc, Fluke Process Instruments, Siemens AG, Sensata Technologies, Maxim Integrated Products*List Not Exhaustive, Texas Instruments Incorporated, Microchip Technology Incorporated, Analog Devices Inc, FLIR Systems, Emerson Electric Company.

3. What are the main segments of the North America Temperature Sensors Industry?

The market segments include Type, Technology, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.85 Million as of 2022.

5. What are some drivers contributing to market growth?

Growth in Industry 4.0 & Rapid Factory Automation; Increasing Adoption of Wireless Technologies. especially in Harsh Environments.

6. What are the notable trends driving market growth?

Infrared Temperature Sensors to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Higher Security Needs and Infrastructure Updating Costs.

8. Can you provide examples of recent developments in the market?

Nov 2020 - The company launched a new FLIR SV87 Kit, which can be installed on any surface with Wi-Fi access. The kit allows maintenance personnel to track variations in vibration and heat in real-time, allowing them to predict potentially severe problems before they occur.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Temperature Sensors Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Temperature Sensors Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Temperature Sensors Industry?

To stay informed about further developments, trends, and reports in the North America Temperature Sensors Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence