Key Insights

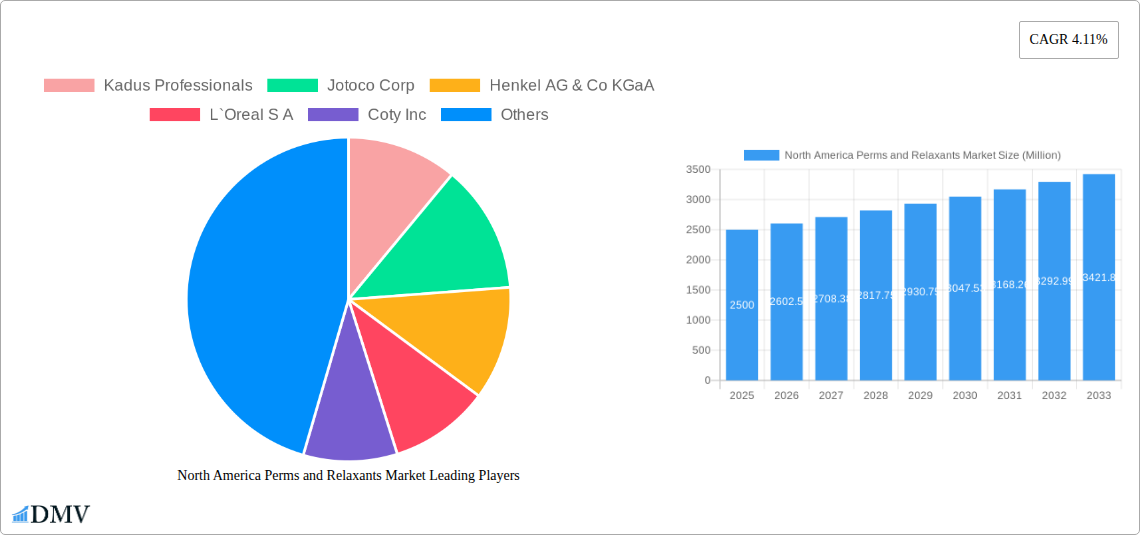

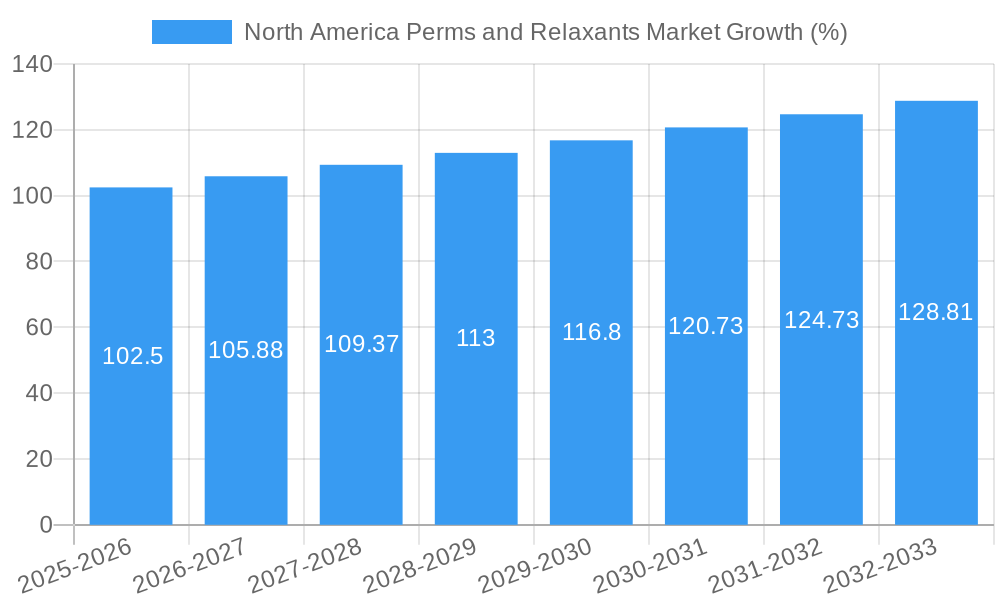

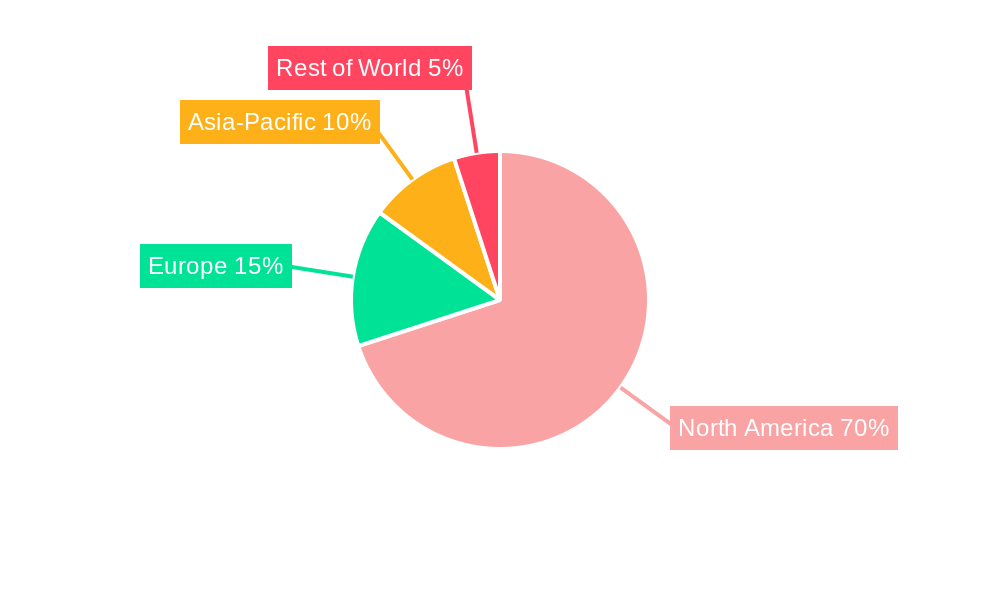

The North American perms and relaxants market, valued at approximately $XX million in 2025, is projected to experience steady growth at a Compound Annual Growth Rate (CAGR) of 4.11% from 2025 to 2033. This growth is fueled by several key factors. The increasing demand for convenient and effective hair styling solutions among younger demographics contributes significantly. The rise of at-home hair treatments, driven by the ease and affordability provided by online retail channels, further propels market expansion. Furthermore, innovation within the industry, with the development of gentler, less damaging formulations, is attracting a wider consumer base concerned about hair health. However, the market faces some challenges. Growing awareness of the potential long-term damage associated with chemical hair treatments, coupled with the rising popularity of natural and organic hair care products, acts as a restraint. The market is segmented by product type (perms and relaxants) and distribution channel (supermarkets/hypermarkets, convenience stores, specialist retailers, online stores, and others). The online channel is experiencing the fastest growth, driven by e-commerce penetration and targeted digital marketing campaigns. Major players like L'Oréal S.A., Procter & Gamble, and Henkel AG & Co. KGaA hold significant market share, competing through product diversification and strategic brand positioning. The United States, as the largest market within North America, dominates the region's sales, followed by Canada and Mexico.

The projected growth trajectory indicates a promising outlook for the North American perms and relaxants market over the forecast period. Continued innovation focusing on gentler formulations and improved user experience will be crucial for sustained growth. Market participants will need to leverage digital marketing and e-commerce platforms to effectively engage consumers. Furthermore, addressing consumer concerns regarding the potential negative impacts of chemical hair treatments through transparent labeling and education will be essential in maintaining market share and fostering long-term growth. Competitive strategies focusing on premium product offerings and brand building are expected to shape the market landscape in the coming years. Successful navigation of regulatory landscapes and evolving consumer preferences will be crucial for manufacturers to capitalize on the growth opportunities in this segment.

North America Perms and Relaxants Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America perms and relaxants market, offering invaluable insights for stakeholders seeking to understand market dynamics, growth trajectories, and future opportunities. Covering the period from 2019 to 2033, with a base year of 2025 and an estimated year of 2025, this report meticulously examines market trends, competitive landscapes, and key factors influencing market growth. The market is valued at XX Million in 2025 and is projected to reach XX Million by 2033, exhibiting a CAGR of XX%.

North America Perms and Relaxants Market Composition & Trends

This section delves into the intricate structure of the North America perms and relaxants market, analyzing market concentration, innovation drivers, regulatory landscapes, substitute products, end-user profiles, and mergers and acquisitions (M&A) activities. The market exhibits a moderately fragmented structure, with key players like Henkel AG & Co KGaA, L'Oreal S A, Coty Inc, and Procter & Gamble Co. holding significant, yet not dominant, market share. The exact market share distribution is detailed within the full report. Innovation is primarily driven by consumer demand for gentler, more effective, and damage-reducing formulations, as well as environmentally conscious options. Regulatory landscapes, varying by state and province, significantly impact product formulations and labeling requirements. Substitute products, such as hair straightening treatments and extensions, pose a competitive challenge. The end-user profile is diverse, encompassing salons, individual consumers, and online retailers. M&A activity in the sector has been moderate in recent years, with deal values averaging around XX Million. Specific deal details and their impact on market dynamics are extensively analyzed within.

- Market Concentration: Moderately fragmented.

- Key Players: Henkel AG & Co KGaA, L'Oreal S A, Coty Inc, Procter & Gamble Co, Kadus Professionals, Jotoco Corp, Makarizo International (and others).

- Innovation Drivers: Consumer demand for gentler formulas, environmentally conscious products.

- Regulatory Landscape: Varies by region, impacting formulations and labeling.

- Substitute Products: Hair straightening treatments, hair extensions.

- Average M&A Deal Value: XX Million (2019-2024).

North America Perms and Relaxants Market Industry Evolution

This section analyzes the historical and projected growth trajectory of the North America perms and relaxants market. The market experienced a period of steady growth from 2019-2024, influenced by factors such as evolving consumer preferences, technological advancements in product formulation, and increased accessibility through diverse distribution channels. The market experienced a slight downturn in 2020 due to the pandemic, however, a robust recovery is observed in the following years. The introduction of innovative technologies in the formulation of these products has led to the development of gentler and more effective solutions, stimulating market growth. Consumer demand has shifted towards natural and organic options, forcing companies to adapt their product lines. This shift, coupled with changing hair styling trends, are crucial factors shaping market evolution. The projected growth rate from 2025-2033 shows a promising future for the market, fueled by advancements in technology and evolving consumer preferences.

Leading Regions, Countries, or Segments in North America Perms and Relaxants Market

This section identifies the dominant regions, countries, and segments within the North America perms and relaxants market. Analysis reveals that the United States holds the largest market share, driven by high consumer spending and a well-established beauty industry. Within product types, perms currently holds a larger market share than relaxants, although both segments are expected to experience growth. In terms of distribution channels, specialist retailers and online stores are experiencing the fastest growth, fueled by consumer convenience and targeted marketing.

Key Drivers by Segment:

- United States: High consumer spending on beauty products, well-established salons and retail networks.

- Perms: Continued popularity of permed hairstyles among certain demographics.

- Specialist Retailers: Expertise in hair care, personalized consultations, and product recommendations.

- Online Stores: Convenience, broader product selection, competitive pricing.

North America Perms and Relaxants Market Product Innovations

Recent years have witnessed significant innovation in perms and relaxants, focusing on minimizing hair damage and improving overall hair health. Formulations now incorporate advanced technologies, such as keratin-based ingredients and amino acids, to strengthen hair and reduce breakage. The emphasis on natural and organic ingredients is also driving innovation, with companies introducing products free of harsh chemicals and parabens. These improvements cater to the growing demand for safer and more effective hair care solutions. The unique selling propositions of these products often revolve around their ability to provide long-lasting results while minimizing damage and improving overall hair quality.

Propelling Factors for North America Perms and Relaxants Market Growth

Several factors contribute to the positive growth outlook for the North America perms and relaxants market. Technological advancements in formulations leading to less damaging products are a primary driver. The growing popularity of varied hairstyles across demographics stimulates market expansion. Furthermore, the increased accessibility through online and retail channels contributes to this growth.

Obstacles in the North America Perms and Relaxants Market

Despite the positive growth forecast, challenges exist. Stricter regulatory requirements regarding chemical composition and labeling impose production costs and can limit product offerings. Supply chain disruptions, experienced in recent years, significantly impact raw material availability and manufacturing. Increased competition from substitute hair styling methods and products also presents a challenge.

Future Opportunities in North America Perms and Relaxants Market

The market presents considerable untapped potential. Expanding into niche markets, such as eco-conscious and personalized hair care solutions, presents significant opportunities. Leveraging advanced technologies, such as AI-powered hair analysis tools and personalized product recommendations, offers a competitive advantage.

Major Players in the North America Perms and Relaxants Market Ecosystem

- Kadus Professionals

- Jotoco Corp

- Henkel AG & Co KGaA

- L'Oreal S A

- Coty Inc

- Makarizo International

- Procter & Gamble Co

Key Developments in North America Perms and Relaxants Market Industry

- 2022 Q3: L'Oreal launches a new line of ammonia-free perms.

- 2023 Q1: Henkel introduces a sustainable packaging for its relaxant products.

- 2024 Q2: Coty acquires a smaller hair care brand specializing in natural ingredients.

Strategic North America Perms and Relaxants Market Forecast

The North America perms and relaxants market is poised for continued growth, driven by technological advancements, evolving consumer preferences, and increased product accessibility. The market's future depends heavily on the ability of key players to innovate, adapt to shifting consumer demands, and navigate regulatory landscapes effectively. The focus on safer, more effective, and sustainable products will be crucial to capture market share and drive profitability in the years to come.

North America Perms and Relaxants Market Segmentation

-

1. Product Type

- 1.1. Perms

- 1.2. Relaxants

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Specialist Retailers

- 2.4. Online Stores

- 2.5. Other Distribution Channels

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

- 3.4. Rest of North America

North America Perms and Relaxants Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North America Perms and Relaxants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.11% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Natural/Organic Products; Increased Focus on Facial Care Regimes

- 3.3. Market Restrains

- 3.3.1. Presence of Counterfeit Products Restraints Growth

- 3.4. Market Trends

- 3.4.1. Relaxants dominate the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Perms and Relaxants Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Perms

- 5.1.2. Relaxants

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Specialist Retailers

- 5.2.4. Online Stores

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.3.4. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United States North America Perms and Relaxants Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Perms

- 6.1.2. Relaxants

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Convenience Stores

- 6.2.3. Specialist Retailers

- 6.2.4. Online Stores

- 6.2.5. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Canada North America Perms and Relaxants Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Perms

- 7.1.2. Relaxants

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Convenience Stores

- 7.2.3. Specialist Retailers

- 7.2.4. Online Stores

- 7.2.5. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.3.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Mexico North America Perms and Relaxants Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Perms

- 8.1.2. Relaxants

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Convenience Stores

- 8.2.3. Specialist Retailers

- 8.2.4. Online Stores

- 8.2.5. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.3.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of North America North America Perms and Relaxants Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Perms

- 9.1.2. Relaxants

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Convenience Stores

- 9.2.3. Specialist Retailers

- 9.2.4. Online Stores

- 9.2.5. Other Distribution Channels

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United States

- 9.3.2. Canada

- 9.3.3. Mexico

- 9.3.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. United States North America Perms and Relaxants Market Analysis, Insights and Forecast, 2019-2031

- 11. Canada North America Perms and Relaxants Market Analysis, Insights and Forecast, 2019-2031

- 12. Mexico North America Perms and Relaxants Market Analysis, Insights and Forecast, 2019-2031

- 13. Rest of North America North America Perms and Relaxants Market Analysis, Insights and Forecast, 2019-2031

- 14. Competitive Analysis

- 14.1. Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Kadus Professionals

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Jotoco Corp

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Henkel AG & Co KGaA

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 L`Oreal S A

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Coty Inc

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Makarizo International

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Procter & Gamble Co*List Not Exhaustive

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.1 Kadus Professionals

List of Figures

- Figure 1: North America Perms and Relaxants Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Perms and Relaxants Market Share (%) by Company 2024

List of Tables

- Table 1: North America Perms and Relaxants Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Perms and Relaxants Market Volume K Units Forecast, by Region 2019 & 2032

- Table 3: North America Perms and Relaxants Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: North America Perms and Relaxants Market Volume K Units Forecast, by Product Type 2019 & 2032

- Table 5: North America Perms and Relaxants Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 6: North America Perms and Relaxants Market Volume K Units Forecast, by Distribution Channel 2019 & 2032

- Table 7: North America Perms and Relaxants Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 8: North America Perms and Relaxants Market Volume K Units Forecast, by Geography 2019 & 2032

- Table 9: North America Perms and Relaxants Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: North America Perms and Relaxants Market Volume K Units Forecast, by Region 2019 & 2032

- Table 11: North America Perms and Relaxants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: North America Perms and Relaxants Market Volume K Units Forecast, by Country 2019 & 2032

- Table 13: United States North America Perms and Relaxants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: United States North America Perms and Relaxants Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 15: Canada North America Perms and Relaxants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada North America Perms and Relaxants Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 17: Mexico North America Perms and Relaxants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Mexico North America Perms and Relaxants Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 19: Rest of North America North America Perms and Relaxants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of North America North America Perms and Relaxants Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 21: North America Perms and Relaxants Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 22: North America Perms and Relaxants Market Volume K Units Forecast, by Product Type 2019 & 2032

- Table 23: North America Perms and Relaxants Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 24: North America Perms and Relaxants Market Volume K Units Forecast, by Distribution Channel 2019 & 2032

- Table 25: North America Perms and Relaxants Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 26: North America Perms and Relaxants Market Volume K Units Forecast, by Geography 2019 & 2032

- Table 27: North America Perms and Relaxants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: North America Perms and Relaxants Market Volume K Units Forecast, by Country 2019 & 2032

- Table 29: North America Perms and Relaxants Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 30: North America Perms and Relaxants Market Volume K Units Forecast, by Product Type 2019 & 2032

- Table 31: North America Perms and Relaxants Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 32: North America Perms and Relaxants Market Volume K Units Forecast, by Distribution Channel 2019 & 2032

- Table 33: North America Perms and Relaxants Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 34: North America Perms and Relaxants Market Volume K Units Forecast, by Geography 2019 & 2032

- Table 35: North America Perms and Relaxants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: North America Perms and Relaxants Market Volume K Units Forecast, by Country 2019 & 2032

- Table 37: North America Perms and Relaxants Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 38: North America Perms and Relaxants Market Volume K Units Forecast, by Product Type 2019 & 2032

- Table 39: North America Perms and Relaxants Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 40: North America Perms and Relaxants Market Volume K Units Forecast, by Distribution Channel 2019 & 2032

- Table 41: North America Perms and Relaxants Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 42: North America Perms and Relaxants Market Volume K Units Forecast, by Geography 2019 & 2032

- Table 43: North America Perms and Relaxants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 44: North America Perms and Relaxants Market Volume K Units Forecast, by Country 2019 & 2032

- Table 45: North America Perms and Relaxants Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 46: North America Perms and Relaxants Market Volume K Units Forecast, by Product Type 2019 & 2032

- Table 47: North America Perms and Relaxants Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 48: North America Perms and Relaxants Market Volume K Units Forecast, by Distribution Channel 2019 & 2032

- Table 49: North America Perms and Relaxants Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 50: North America Perms and Relaxants Market Volume K Units Forecast, by Geography 2019 & 2032

- Table 51: North America Perms and Relaxants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 52: North America Perms and Relaxants Market Volume K Units Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Perms and Relaxants Market?

The projected CAGR is approximately 4.11%.

2. Which companies are prominent players in the North America Perms and Relaxants Market?

Key companies in the market include Kadus Professionals, Jotoco Corp, Henkel AG & Co KGaA, L`Oreal S A, Coty Inc, Makarizo International, Procter & Gamble Co*List Not Exhaustive.

3. What are the main segments of the North America Perms and Relaxants Market?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Natural/Organic Products; Increased Focus on Facial Care Regimes.

6. What are the notable trends driving market growth?

Relaxants dominate the market.

7. Are there any restraints impacting market growth?

Presence of Counterfeit Products Restraints Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Perms and Relaxants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Perms and Relaxants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Perms and Relaxants Market?

To stay informed about further developments, trends, and reports in the North America Perms and Relaxants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence