Key Insights

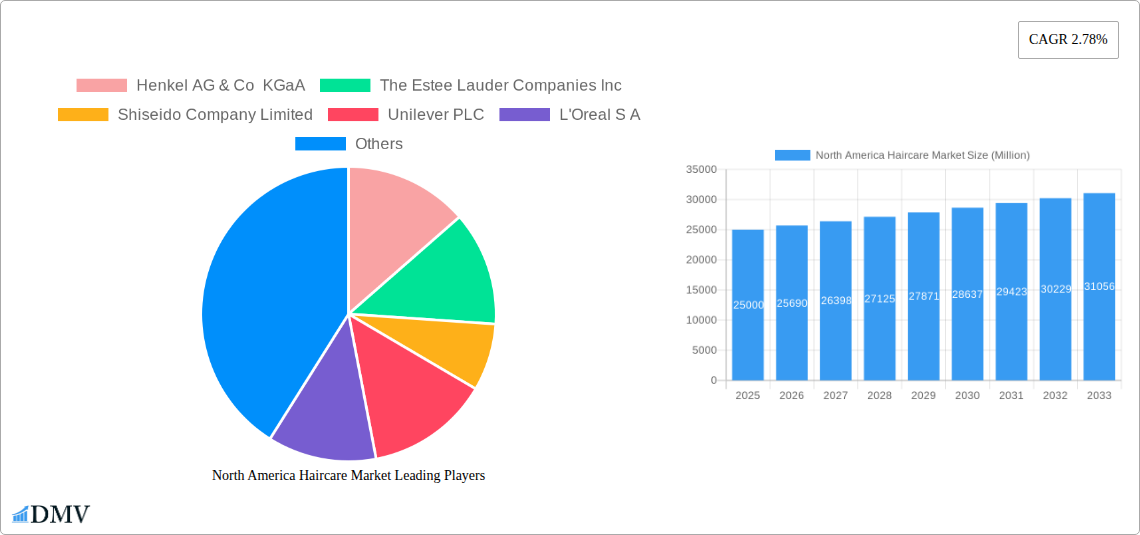

The North American haircare market, valued at approximately $XX million in 2025, is projected to experience steady growth, driven by several key factors. The rising demand for premium and specialized haircare products, fueled by increased consumer awareness of hair health and styling trends, is a significant contributor. The burgeoning popularity of natural and organic haircare options, alongside the growing adoption of personalized haircare routines, further bolsters market expansion. E-commerce channels are playing a crucial role, providing convenient access to a wider range of products and fostering direct-to-consumer brands. While the market faces potential restraints such as price fluctuations in raw materials and increased competition, the consistent CAGR of 2.78% suggests sustained growth throughout the forecast period (2025-2033). Specific segments like hair loss treatment products and hair styling products are anticipated to witness above-average growth due to heightened consumer interest in hair health and aesthetic enhancement. Major players like L'Oréal, Unilever, and Procter & Gamble are leveraging their established brand equity and innovation capabilities to maintain market leadership, while smaller, niche brands are gaining traction through targeted marketing and online presence. The continued expansion of the market is expected to be fueled by increased disposable incomes in North America, the rising influence of social media beauty trends, and a surge in product innovation within the hair care segment.

This growth trajectory, however, is not uniform across all distribution channels. While online retail stores are experiencing rapid growth, supermarkets/hypermarkets remain dominant due to their widespread accessibility and established customer base. The competitive landscape is characterized by both established giants and emerging players, resulting in a dynamic market characterized by continuous innovation and strategic positioning. Product diversification, particularly in specialized areas like natural and organic products, and personalized haircare solutions will play a critical role in determining future market success. Focus on sustainable and ethically sourced ingredients is also gaining importance among environmentally conscious consumers, presenting a significant opportunity for businesses to adopt eco-friendly practices. The forecast period (2025-2033) will likely witness a consolidation of market share among leading players, but also room for innovative brands to carve out significant niches.

North America Haircare Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the North America haircare market, encompassing historical data (2019-2024), the base year (2025), and a forecast period extending to 2033. Valued at xx Million in 2025, the market is poised for significant growth, driven by factors detailed within this insightful document. This report is essential for stakeholders seeking to understand market dynamics, identify key players, and strategize for future success in this dynamic sector.

North America Haircare Market Composition & Trends

The North American haircare market is characterized by a moderately concentrated landscape, with key players such as L'Oreal S.A., Procter & Gamble Company, Unilever PLC, and Henkel AG & Co KGaA holding significant market share. The market share distribution fluctuates based on product innovation, marketing campaigns, and acquisitions. Estimates suggest that the top 5 players collectively command approximately xx% of the market share in 2025, while smaller players and niche brands account for the remaining xx%. Innovation is a significant catalyst for growth, with companies continuously introducing new products tailored to specific hair types and consumer preferences. The regulatory landscape, encompassing ingredient safety and labeling requirements, impacts product formulations and marketing strategies. Substitute products, such as homemade hair masks or natural remedies, pose a minor competitive threat. The end-user profile is diverse, encompassing men and women of all ages and ethnicities, each with unique haircare needs. Mergers and acquisitions (M&A) activity is moderate, with deal values averaging xx Million annually in the historical period. Major deals often involve strategic acquisitions of smaller, innovative brands or those with strong presence in specific niches.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% of market share in 2025.

- Innovation: A primary driver, focused on natural ingredients, specialized formulations, and sustainable packaging.

- Regulatory Landscape: Influences ingredient choices and labeling requirements.

- Substitute Products: Limited competitive threat from homemade alternatives.

- M&A Activity: Moderate, with average deal values of xx Million annually (2019-2024).

North America Haircare Market Industry Evolution

The North American haircare market has experienced steady growth from 2019 to 2024, with a Compound Annual Growth Rate (CAGR) of approximately xx%. This growth is primarily attributed to increasing disposable incomes, rising awareness of hair health, and the growing popularity of personalized haircare routines. Technological advancements in formulation and packaging have also played a key role. The introduction of innovative ingredients, such as naturally derived extracts and advanced conditioning agents, has enhanced product efficacy and consumer appeal. Furthermore, a shift in consumer demand towards natural, organic, and sustainable products is reshaping the market. Consumers are increasingly seeking products free from harsh chemicals and prioritizing environmentally friendly packaging. This trend is fueling the growth of organic and sustainably sourced haircare products. Market adoption of these products shows a CAGR of xx% between 2019 and 2024, reflecting the considerable market interest. The market is projected to continue its growth trajectory during the forecast period (2025-2033), with a projected CAGR of xx%, driven by ongoing technological innovation, shifting consumer preferences, and the expansion of e-commerce channels. The focus will remain on catering to diverse hair types and offering tailored solutions.

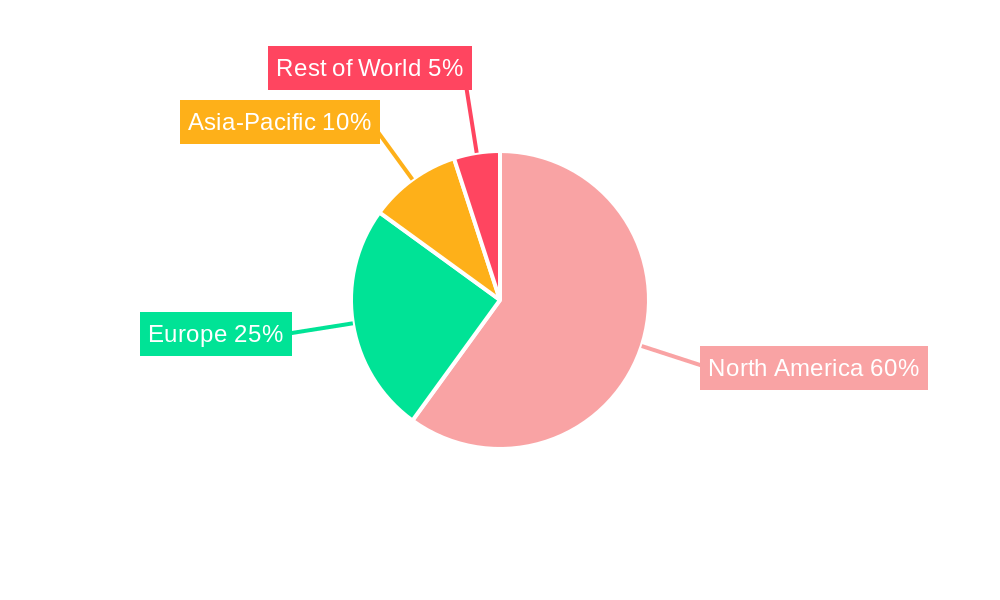

Leading Regions, Countries, or Segments in North America Haircare Market

The United States dominates the North American haircare market, representing the largest share of revenue across all product types and distribution channels. This dominance is attributed to a large and affluent consumer base, advanced retail infrastructure, and high levels of disposable income. Canada follows as a significant market, with consistent growth driven by similar factors, albeit on a smaller scale.

Key Drivers for US Market Dominance:

- High Disposable Incomes: Fueling higher spending on premium and specialized haircare products.

- Developed Retail Infrastructure: Providing extensive access to products across various channels.

- High Consumer Awareness: of hair health and beauty, driving demand for innovative products.

- Strong E-commerce Penetration: Enabling convenient purchasing options.

Dominant Product Types:

Shampoo: Remains the largest segment due to consistent demand and frequent purchase cycles.

Conditioner: High demand, often linked to shampoo purchases, contributes significantly to market revenue.

Hair Styling Products: Growth fueled by increasing consumer interest in diverse hairstyles.

Hair Colorants: Significant market share, supported by continuous innovation in color technology and trends. Dominant Distribution Channels:

Supermarkets/Hypermarkets: Large market share due to wide reach and high foot traffic.

Online Retail Stores: Rapidly expanding segment, driven by convenience and increased e-commerce adoption.

Specialty Stores: Cater to specific consumer needs and offer personalized services.

North America Haircare Market Product Innovations

Recent innovations in the North American haircare market are focused on delivering customized solutions that address specific hair concerns, such as dryness, damage, hair loss, and scalp issues. Companies are increasingly incorporating natural ingredients, emphasizing sustainability, and leveraging technological advancements in formulation and packaging. Examples include the rise of personalized haircare kits, advanced conditioning technologies, and the development of solid shampoo bars to reduce plastic waste. Unique selling propositions increasingly focus on natural ingredients, ethical sourcing, and personalized solutions. Technological advancements involve incorporating advanced ingredients, such as peptides, ceramides, and stem cells, to deliver superior performance.

Propelling Factors for North America Haircare Market Growth

The North American haircare market's growth is fueled by several key factors. Technological advancements in formulation and packaging deliver superior performance and enhanced sustainability. Economic factors, such as increasing disposable incomes, allow consumers to spend more on premium haircare products. Regulatory developments, such as stricter regulations on ingredient safety and environmentally friendly packaging, create opportunities for companies to differentiate themselves. For example, the growing interest in natural and sustainable products drives innovation in this space.

Obstacles in the North America Haircare Market

The North American haircare market faces challenges such as stringent regulatory compliance requirements which can increase costs and complexity of product development and launch. Supply chain disruptions, particularly those caused by geopolitical instability or extreme weather events, can impact the availability of raw materials and packaging. Intense competition from numerous established brands and new entrants necessitates continuous innovation and strategic marketing to maintain market share.

Future Opportunities in North America Haircare Market

Future opportunities include tapping into niche markets with specialized haircare needs (e.g., curly hair, ethnic hair). Leveraging new technologies such as AI-powered personalization tools to offer tailored haircare solutions creates a unique selling proposition. Meeting consumer demand for sustainable and ethical products drives demand in eco-friendly formulations and packaging.

Major Players in the North America Haircare Market Ecosystem

- Henkel AG & Co KGaA

- The Estée Lauder Companies Inc

- Shiseido Company Limited

- Unilever PLC

- L'Oréal S.A

- Natura & Co

- John Paul Mitchell Systems

- Procter & Gamble Company

- Kao Corporation

- Alticor (Amway Corporation)

- List Not Exhaustive

Key Developments in North America Haircare Market Industry

- August 2021: Garnier (L'Oréal) launched Whole Blends Shampoo Bars, emphasizing sustainability and reduced environmental impact.

- September 2022: Estée Lauder's The Ordinary introduced a haircare line focused on "skinification of hair," highlighting specific ingredient benefits.

- December 2022: P&G's Ouai launched an anti-dandruff shampoo containing FDA-approved salicylic acid, targeting a specific consumer need.

Strategic North America Haircare Market Forecast

The North America haircare market is projected to experience robust growth throughout the forecast period (2025-2033), driven by increasing consumer spending, technological innovation, and a growing focus on sustainability and personalization. This growth will be underpinned by the ongoing development of specialized products and a greater understanding of diverse hair needs, leading to an expanded market potential. The rise of e-commerce will continue to shape distribution strategies, further bolstering market expansion.

North America Haircare Market Segmentation

-

1. Product Type

- 1.1. Shampoo

- 1.2. Conditioner

- 1.3. Hair Loss Treatment Products

- 1.4. Hair Styling Products

- 1.5. Perms and Relaxants

- 1.6. Hair Colorants

- 1.7. Other Product Types

-

2. Distribution channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Specialty Stores

- 2.4. Pharmacies/Drug Stores

- 2.5. Online Retail Stores

- 2.6. Other Distribution Channels

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

- 3.4. Rest of North America

North America Haircare Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North America Haircare Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.78% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Influence of Social Media and Impact of Digital Technology; Rising Demand for Natural and Organic Skincare Products

- 3.3. Market Restrains

- 3.3.1. Enhanced Presence of Counterfeit Skin Care Products

- 3.4. Market Trends

- 3.4.1. Growing Influence of Social Media and Impact of Digital Technology on the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Haircare Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Shampoo

- 5.1.2. Conditioner

- 5.1.3. Hair Loss Treatment Products

- 5.1.4. Hair Styling Products

- 5.1.5. Perms and Relaxants

- 5.1.6. Hair Colorants

- 5.1.7. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Specialty Stores

- 5.2.4. Pharmacies/Drug Stores

- 5.2.5. Online Retail Stores

- 5.2.6. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.3.4. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United States North America Haircare Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Shampoo

- 6.1.2. Conditioner

- 6.1.3. Hair Loss Treatment Products

- 6.1.4. Hair Styling Products

- 6.1.5. Perms and Relaxants

- 6.1.6. Hair Colorants

- 6.1.7. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Convenience Stores

- 6.2.3. Specialty Stores

- 6.2.4. Pharmacies/Drug Stores

- 6.2.5. Online Retail Stores

- 6.2.6. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Canada North America Haircare Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Shampoo

- 7.1.2. Conditioner

- 7.1.3. Hair Loss Treatment Products

- 7.1.4. Hair Styling Products

- 7.1.5. Perms and Relaxants

- 7.1.6. Hair Colorants

- 7.1.7. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Convenience Stores

- 7.2.3. Specialty Stores

- 7.2.4. Pharmacies/Drug Stores

- 7.2.5. Online Retail Stores

- 7.2.6. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.3.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Mexico North America Haircare Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Shampoo

- 8.1.2. Conditioner

- 8.1.3. Hair Loss Treatment Products

- 8.1.4. Hair Styling Products

- 8.1.5. Perms and Relaxants

- 8.1.6. Hair Colorants

- 8.1.7. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Convenience Stores

- 8.2.3. Specialty Stores

- 8.2.4. Pharmacies/Drug Stores

- 8.2.5. Online Retail Stores

- 8.2.6. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.3.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of North America North America Haircare Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Shampoo

- 9.1.2. Conditioner

- 9.1.3. Hair Loss Treatment Products

- 9.1.4. Hair Styling Products

- 9.1.5. Perms and Relaxants

- 9.1.6. Hair Colorants

- 9.1.7. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution channel

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Convenience Stores

- 9.2.3. Specialty Stores

- 9.2.4. Pharmacies/Drug Stores

- 9.2.5. Online Retail Stores

- 9.2.6. Other Distribution Channels

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United States

- 9.3.2. Canada

- 9.3.3. Mexico

- 9.3.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. United States North America Haircare Market Analysis, Insights and Forecast, 2019-2031

- 11. Canada North America Haircare Market Analysis, Insights and Forecast, 2019-2031

- 12. Mexico North America Haircare Market Analysis, Insights and Forecast, 2019-2031

- 13. Rest of North America North America Haircare Market Analysis, Insights and Forecast, 2019-2031

- 14. Competitive Analysis

- 14.1. Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Henkel AG & Co KGaA

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 The Estee Lauder Companies Inc

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Shiseido Company Limited

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Unilever PLC

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 L'Oreal S A

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Natura & Co

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 John Paul Mitchell Systems

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Procter & Gamble Company

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Kao Corporation

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Alticor (Amway Corporation)*List Not Exhaustive

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 Henkel AG & Co KGaA

List of Figures

- Figure 1: North America Haircare Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Haircare Market Share (%) by Company 2024

List of Tables

- Table 1: North America Haircare Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Haircare Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: North America Haircare Market Revenue Million Forecast, by Distribution channel 2019 & 2032

- Table 4: North America Haircare Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: North America Haircare Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: North America Haircare Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States North America Haircare Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada North America Haircare Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico North America Haircare Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America North America Haircare Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: North America Haircare Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 12: North America Haircare Market Revenue Million Forecast, by Distribution channel 2019 & 2032

- Table 13: North America Haircare Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 14: North America Haircare Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: North America Haircare Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 16: North America Haircare Market Revenue Million Forecast, by Distribution channel 2019 & 2032

- Table 17: North America Haircare Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 18: North America Haircare Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: North America Haircare Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 20: North America Haircare Market Revenue Million Forecast, by Distribution channel 2019 & 2032

- Table 21: North America Haircare Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 22: North America Haircare Market Revenue Million Forecast, by Country 2019 & 2032

- Table 23: North America Haircare Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 24: North America Haircare Market Revenue Million Forecast, by Distribution channel 2019 & 2032

- Table 25: North America Haircare Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 26: North America Haircare Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Haircare Market?

The projected CAGR is approximately 2.78%.

2. Which companies are prominent players in the North America Haircare Market?

Key companies in the market include Henkel AG & Co KGaA, The Estee Lauder Companies Inc, Shiseido Company Limited, Unilever PLC, L'Oreal S A, Natura & Co, John Paul Mitchell Systems, Procter & Gamble Company, Kao Corporation, Alticor (Amway Corporation)*List Not Exhaustive.

3. What are the main segments of the North America Haircare Market?

The market segments include Product Type, Distribution channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Influence of Social Media and Impact of Digital Technology; Rising Demand for Natural and Organic Skincare Products.

6. What are the notable trends driving market growth?

Growing Influence of Social Media and Impact of Digital Technology on the Market.

7. Are there any restraints impacting market growth?

Enhanced Presence of Counterfeit Skin Care Products.

8. Can you provide examples of recent developments in the market?

Dec 2022: P&G's Ouai improved its anti-dandruff shampoo category with the new launch, Ouai's Anti-Dandruff Shampoo, which contains an FDA-approved ingredient such as 2% salicylic acid formulated to relieve dandruff symptoms and break down dandruff-causing bacteria to soothe the scalp. It debuted on the Sephora App and will appear on Sephora's and Ouai's websites.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Haircare Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Haircare Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Haircare Market?

To stay informed about further developments, trends, and reports in the North America Haircare Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence