Key Insights

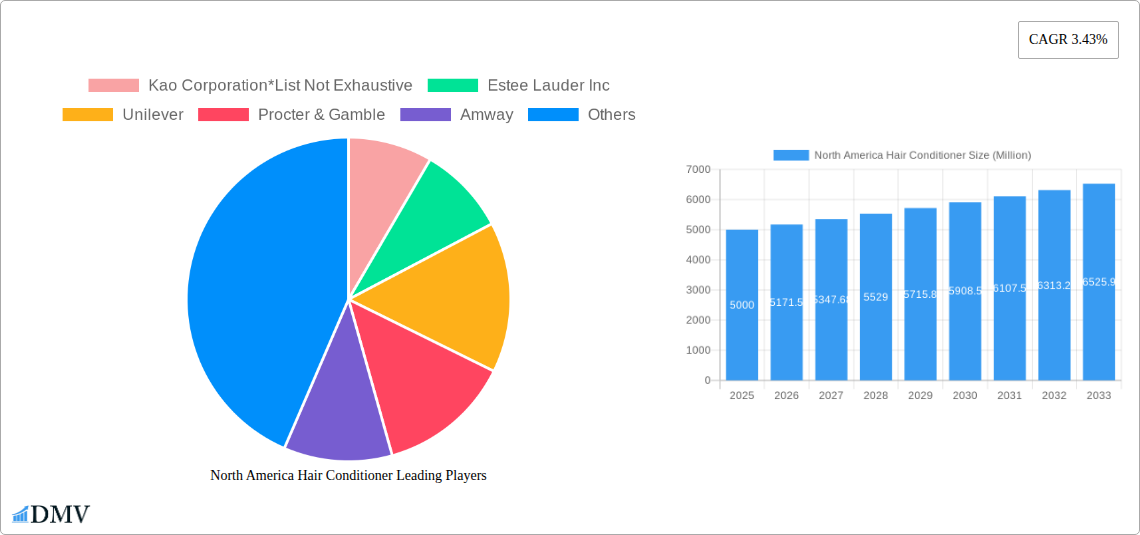

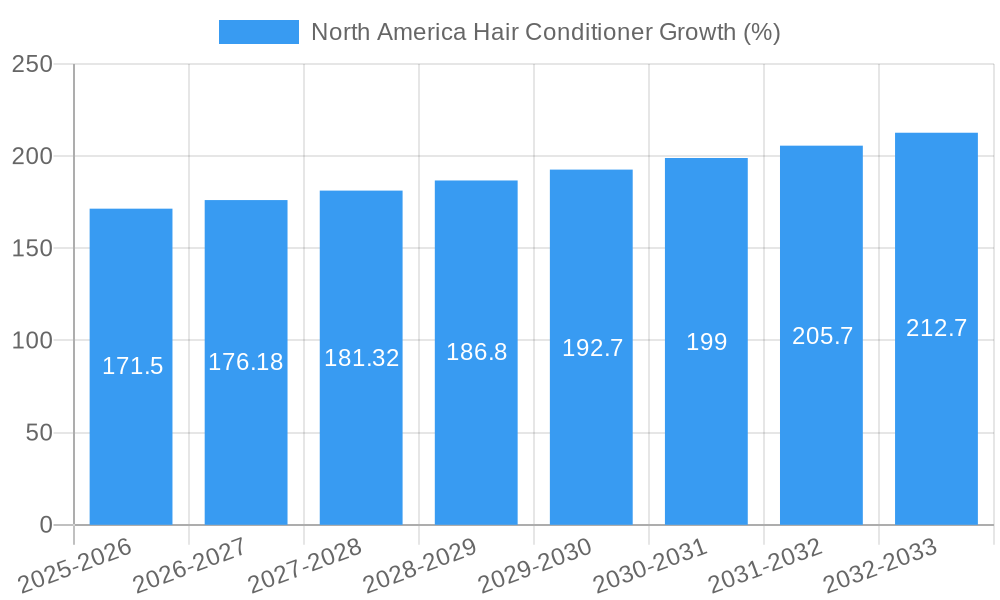

The North American hair conditioner market, valued at approximately $X billion in 2025 (estimated based on the provided global CAGR and assuming a reasonable North American market share), is projected to experience steady growth throughout the forecast period (2025-2033). A compound annual growth rate (CAGR) of 3.43% indicates a market expected to reach approximately $Y billion by 2033. This growth is driven by several key factors. Increasing consumer awareness of hair health and the rising popularity of premium and specialized conditioners, such as deep conditioners catering to specific hair types and concerns (e.g., color-treated, damaged, or dry hair), fuel demand. Furthermore, the expanding e-commerce sector provides convenient access to a wider range of products, contributing to market expansion. The market segmentation reveals a strong presence across various retail channels, with supermarkets and hypermarkets holding a significant share, followed by online retail stores and specialist retailers. The consistent demand for regular conditioners remains substantial, while the segment for deep conditioners is experiencing accelerated growth due to consumer preference for intensive hair care solutions.

However, certain restraints may influence the market's trajectory. Fluctuations in raw material prices and intense competition among established players like Kao Corporation, Unilever, Procter & Gamble, and L'Oreal S.A., could impact profitability and growth rates. Nevertheless, the continued focus on product innovation, including natural and organic formulations, and the incorporation of advanced technologies to enhance product efficacy will likely mitigate these challenges. The market's future hinges on the successful adaptation to evolving consumer preferences, a trend that favors sustainably sourced and ethically produced conditioners. Understanding and meeting the diverse needs of consumers across various age groups and hair types will be crucial for maintaining a competitive edge within this dynamic market.

North America Hair Conditioner Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America hair conditioner market, projecting a value of $XX Million by 2033. It offers invaluable insights for stakeholders, encompassing market trends, competitive landscapes, and future growth potential. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period spans 2025-2033, while the historical period encompasses 2019-2024.

North America Hair Conditioner Market Composition & Trends

This section delves into the intricacies of the North American hair conditioner market, evaluating its concentration, innovation drivers, regulatory environment, substitute products, end-user profiles, and merger & acquisition (M&A) activities. The market exhibits a moderately concentrated landscape, with key players like Kao Corporation, Unilever, Procter & Gamble, L'Oréal S.A., and Estée Lauder Inc. holding significant market share. The combined market share of these leading players is estimated at xx%.

Market Share Distribution (2024):

- Unilever: xx%

- Procter & Gamble: xx%

- L'Oréal S.A.: xx%

- Kao Corporation: xx%

- Estée Lauder Inc.: xx%

- Others: xx%

M&A Activity: The market has witnessed a moderate level of M&A activity in recent years, primarily focused on expanding product portfolios and geographical reach. Total M&A deal value between 2019 and 2024 is estimated at $XX Million. These transactions have primarily involved smaller niche players being acquired by larger corporations.

Innovation Catalysts: Growing consumer demand for natural and organic hair conditioners, along with advancements in formulations and packaging, are driving innovation. Stringent regulations regarding harmful chemicals are also pushing companies towards sustainable and eco-friendly products. Substitute products like homemade conditioners pose a minor threat but haven't significantly impacted market growth.

North America Hair Conditioner Industry Evolution

The North American hair conditioner market has experienced consistent growth over the past five years, driven by rising disposable incomes, increasing awareness of hair care, and expanding product offerings. The market size has grown from $XX Million in 2019 to an estimated $XX Million in 2024, representing a CAGR of xx%. This growth is expected to continue, with a projected market value of $XX Million by 2033, fuelled by factors such as the increasing adoption of premium conditioners, the growing popularity of online retail channels, and the rising demand for specialized conditioners catering to specific hair types and concerns (e.g., color-treated hair, damaged hair). Technological advancements in formulation, such as the incorporation of natural ingredients and advanced conditioning agents, have played a key role in driving market growth. Further, consumer preferences are shifting towards conditioners with natural ingredients and sustainable packaging, opening avenues for eco-conscious brands.

Leading Regions, Countries, or Segments in North America Hair Conditioner

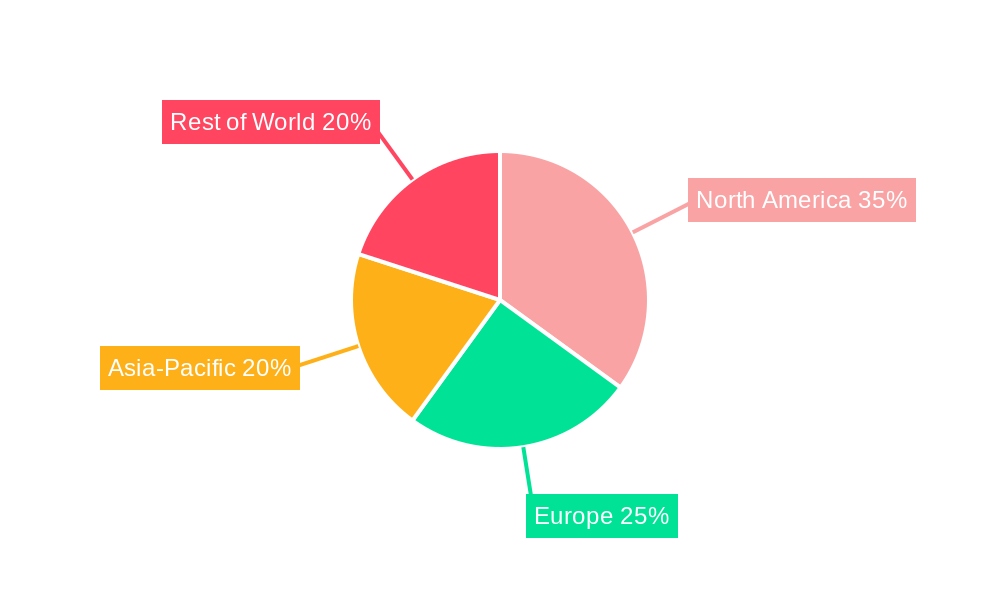

The United States dominates the North American hair conditioner market, accounting for approximately xx% of the total market value in 2024. This dominance is attributed to factors such as high per capita consumption, established retail infrastructure, and a strong presence of major players. Canada follows as a significant market, contributing xx% of the market value.

Dominant Segments:

- Product Type: The regular conditioner segment currently holds the largest market share, driven by its affordability and widespread availability. However, the deep conditioner segment is witnessing significant growth due to its effectiveness in repairing damaged hair.

- Application: Supermarkets and hypermarkets remain the leading distribution channels, but online retail stores are experiencing rapid growth, driven by convenience and increasing online shopping.

Key Drivers:

- High Disposable Incomes: Rising disposable incomes in North America, especially in the US, fuel spending on premium hair care products.

- Growing Awareness: Increasing awareness of hair care and its impact on overall appearance drives higher demand for conditioners.

- Product Innovation: Continuous innovation in formulations and packaging keeps the market dynamic and attractive to consumers.

- Retail Expansion: Expansion of e-commerce and specialized retail channels widens market access.

North America Hair Conditioner Product Innovations

Recent innovations in the hair conditioner market include the introduction of conditioners with natural ingredients like argan oil, coconut oil, and shea butter, catering to the growing demand for natural and organic products. Formulations incorporating advanced conditioning agents deliver enhanced hair repair and improved manageability. The introduction of leave-in conditioners and hair masks further expands product choices. These innovations cater to specific hair concerns and result in improved product performance and customer satisfaction. Unique selling propositions (USPs) often leverage these natural ingredients or scientifically proven results.

Propelling Factors for North America Hair Conditioner Growth

The North American hair conditioner market is propelled by several key factors. Technological advancements leading to innovative formulations, such as incorporating natural ingredients and advanced conditioning agents, are enhancing product effectiveness. A thriving economy in certain regions fuels higher spending on premium hair care. Favorable regulatory environments support market growth.

Obstacles in the North America Hair Conditioner Market

Challenges faced by the market include supply chain disruptions caused by global events, impacting the availability of raw materials and increasing production costs. Intense competition among established players and emerging brands necessitates continuous product innovation and aggressive marketing strategies. Stricter regulations on certain ingredients could also restrict product development and increase costs. These factors are impacting market expansion and potentially reducing overall profit margins.

Future Opportunities in North America Hair Conditioner

Future opportunities include expansion into niche markets catering to specific hair types and concerns (e.g., curly hair, color-treated hair). Developing sustainable and eco-friendly products, using recyclable packaging and ethically sourced ingredients, meets growing consumer preferences. Leveraging technological advancements like AI-powered personalized hair care recommendations can enhance customer engagement and product sales.

Major Players in the North America Hair Conditioner Ecosystem

- Kao Corporation

- Estée Lauder Inc.

- Unilever

- Procter & Gamble

- Amway

- L'Oréal S.A.

- Johnson & Johnson

Key Developments in North America Hair Conditioner Industry

- 2022 Q4: Unilever launches a new range of sustainable hair conditioners.

- 2023 Q1: Procter & Gamble invests in advanced hair conditioning technology.

- 2024 Q2: L'Oréal S.A. acquires a smaller hair care brand specializing in natural ingredients.

- (Further developments to be added as they occur)

Strategic North America Hair Conditioner Market Forecast

The North America hair conditioner market is poised for robust growth over the forecast period (2025-2033), driven by innovation, changing consumer preferences, and the expansion of e-commerce. The increasing demand for natural and specialized conditioners, coupled with strategic investments by major players, will significantly contribute to market expansion. The focus on sustainable practices and the introduction of technologically advanced products will further shape market dynamics. Overall, the market presents significant opportunities for growth and profitability.

North America Hair Conditioner Segmentation

-

1. Product Type

- 1.1. Regular Conditioner

- 1.2. Deep Conditioner

-

2. Application

- 2.1. Supermarkets and Hypermarkets

- 2.2. Convenience Stores

- 2.3. Online Retail Stores

- 2.4. Specialist Retailers

- 2.5. Pharmacies/Drug Stores

- 2.6. Others

North America Hair Conditioner Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Hair Conditioner REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.43% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Awareness About the Importance of Skin Care & Personal Care; Growing Influence of Social Media and Digital Technology

- 3.3. Market Restrains

- 3.3.1. Penetration of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Inculcation of Natural Products for Hair Care

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Hair Conditioner Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Regular Conditioner

- 5.1.2. Deep Conditioner

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Supermarkets and Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Online Retail Stores

- 5.2.4. Specialist Retailers

- 5.2.5. Pharmacies/Drug Stores

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United States North America Hair Conditioner Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Hair Conditioner Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Hair Conditioner Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Hair Conditioner Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Kao Corporation*List Not Exhaustive

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Estee Lauder Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Unilever

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Procter & Gamble

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Amway

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 L'Oreal S A

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Johnson & Johnson

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.1 Kao Corporation*List Not Exhaustive

List of Figures

- Figure 1: North America Hair Conditioner Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Hair Conditioner Share (%) by Company 2024

List of Tables

- Table 1: North America Hair Conditioner Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Hair Conditioner Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: North America Hair Conditioner Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: North America Hair Conditioner Volume K Tons Forecast, by Product Type 2019 & 2032

- Table 5: North America Hair Conditioner Revenue Million Forecast, by Application 2019 & 2032

- Table 6: North America Hair Conditioner Volume K Tons Forecast, by Application 2019 & 2032

- Table 7: North America Hair Conditioner Revenue Million Forecast, by Region 2019 & 2032

- Table 8: North America Hair Conditioner Volume K Tons Forecast, by Region 2019 & 2032

- Table 9: North America Hair Conditioner Revenue Million Forecast, by Country 2019 & 2032

- Table 10: North America Hair Conditioner Volume K Tons Forecast, by Country 2019 & 2032

- Table 11: United States North America Hair Conditioner Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United States North America Hair Conditioner Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 13: Canada North America Hair Conditioner Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada North America Hair Conditioner Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 15: Mexico North America Hair Conditioner Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Mexico North America Hair Conditioner Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 17: Rest of North America North America Hair Conditioner Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of North America North America Hair Conditioner Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 19: North America Hair Conditioner Revenue Million Forecast, by Product Type 2019 & 2032

- Table 20: North America Hair Conditioner Volume K Tons Forecast, by Product Type 2019 & 2032

- Table 21: North America Hair Conditioner Revenue Million Forecast, by Application 2019 & 2032

- Table 22: North America Hair Conditioner Volume K Tons Forecast, by Application 2019 & 2032

- Table 23: North America Hair Conditioner Revenue Million Forecast, by Country 2019 & 2032

- Table 24: North America Hair Conditioner Volume K Tons Forecast, by Country 2019 & 2032

- Table 25: United States North America Hair Conditioner Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: United States North America Hair Conditioner Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 27: Canada North America Hair Conditioner Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Canada North America Hair Conditioner Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 29: Mexico North America Hair Conditioner Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Mexico North America Hair Conditioner Volume (K Tons) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Hair Conditioner?

The projected CAGR is approximately 3.43%.

2. Which companies are prominent players in the North America Hair Conditioner?

Key companies in the market include Kao Corporation*List Not Exhaustive, Estee Lauder Inc, Unilever, Procter & Gamble, Amway, L'Oreal S A, Johnson & Johnson.

3. What are the main segments of the North America Hair Conditioner?

The market segments include Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Awareness About the Importance of Skin Care & Personal Care; Growing Influence of Social Media and Digital Technology.

6. What are the notable trends driving market growth?

Inculcation of Natural Products for Hair Care.

7. Are there any restraints impacting market growth?

Penetration of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Hair Conditioner," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Hair Conditioner report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Hair Conditioner?

To stay informed about further developments, trends, and reports in the North America Hair Conditioner, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence