Key Insights

The North American e-commerce watch market is projected for significant expansion, with an estimated market size of 75.8 billion in 2024, growing at a CAGR of 4.5% through 2032. This robust growth is primarily driven by the increasing adoption of smartwatches for their advanced fitness tracking and smartphone integration capabilities. The convenience, extensive product selection, and competitive pricing offered by online retailers further accelerate consumer preference for e-commerce watch purchases. Diverse styles, readily available brands online, and effective digital marketing campaigns also contribute to this upward trend.

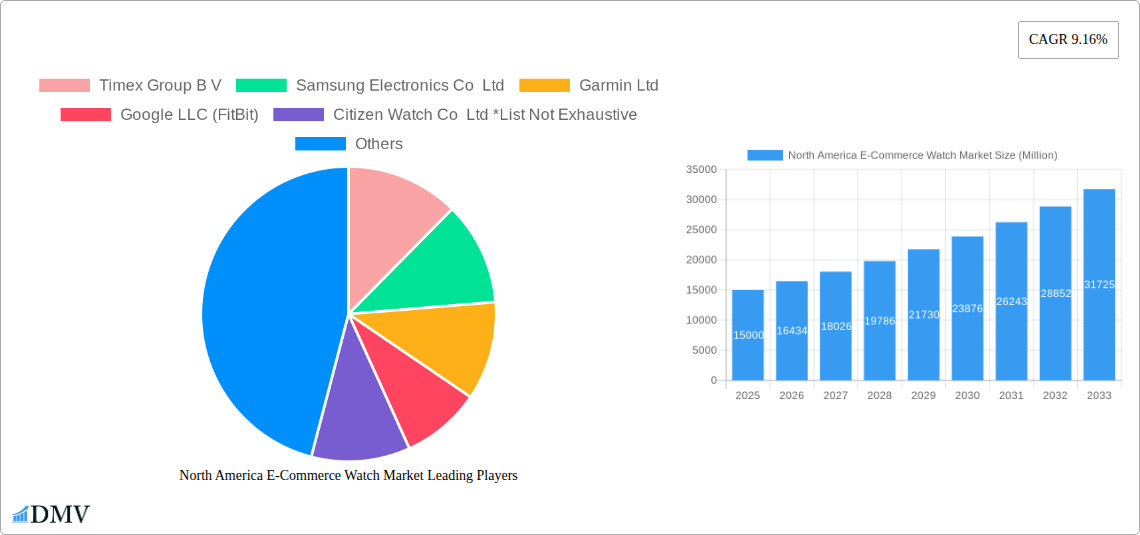

North America E-Commerce Watch Market Market Size (In Billion)

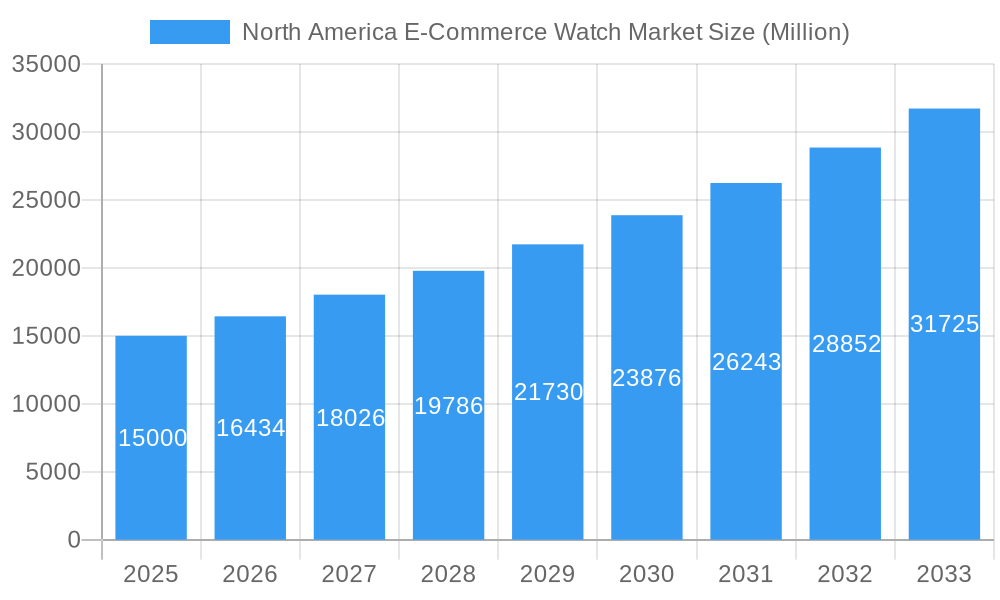

Despite strong growth, challenges such as counterfeit products and online security concerns may hinder market expansion. Additionally, the preference for in-person try-ons before purchase presents a constraint to full e-commerce dominance. Segmentation indicates demand for both traditional and smartwatches, with significant sales through third-party retailers. Key industry players include Timex, Samsung, Garmin, Fitbit, Citizen, Rolex, Casio, Fossil, Apple, and Sony, highlighting a competitive landscape. The U.S. is expected to lead the North American market due to its large consumer base and high e-commerce penetration.

North America E-Commerce Watch Market Company Market Share

The future of the North American e-commerce watch market looks promising, supported by expanding e-commerce infrastructure and evolving consumer shopping habits. Addressing authenticity and security concerns is crucial for enhancing consumer trust. Personalized marketing strategies leveraging data analytics will be vital for brands to succeed in this competitive arena. Innovative product development, incorporating advanced technology into traditional watch designs, will further stimulate growth. Company success hinges on adapting to consumer demands, optimizing e-commerce platforms, and building a reputation for quality and trustworthiness.

North America E-Commerce Watch Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the North America e-commerce watch market, offering a comprehensive overview of its current state, future trajectory, and key players. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033, this report is an invaluable resource for stakeholders seeking to understand and capitalize on opportunities within this dynamic market. The market size in 2025 is estimated at xx Million, with a projected value of xx Million by 2033.

North America E-Commerce Watch Market Market Composition & Trends

This section provides a comprehensive analysis of the competitive dynamics within the North American e-commerce watch market. We explore market concentration, the key drivers of innovation, prevailing regulatory frameworks, the influence of substitute products, and the characteristics of dominant consumer demographics. Our examination includes the impact of mergers and acquisitions (M&A) activity, detailing deal values and their subsequent influence on market share distribution. The landscape is characterized by a vibrant interplay between well-established watch brands and agile emerging players, fostering a highly competitive and evolving market environment.

- Market Concentration: The North American e-commerce watch market exhibits moderate concentration. While a few leading players command significant market share, a substantial number of smaller and niche brands actively contribute to market diversity. The precise distribution of market share is dynamic and varies considerably across different product segments, such as traditional Quartz/Mechanical watches versus feature-rich Smartwatches, and across various sales platforms, including direct-to-consumer (DTC) company websites and established third-party e-commerce retailers.

- Innovation Catalysts: Continuous technological advancements serve as primary catalysts for product innovation. Key areas include sophisticated health and wellness tracking (e.g., ECG, blood oxygen monitoring), advanced communication features (e.g., LTE connectivity, improved notifications), novel materials science (e.g., durable and lightweight alloys, sustainable components), and enhanced user interface design. These innovations are crucial for maintaining competitive advantage and meeting evolving consumer expectations.

- Regulatory Landscape: The market operates within a complex web of regulations, encompassing stringent data privacy laws (e.g., GDPR, CCPA), product safety standards, and evolving advertising guidelines. Navigating these regulations, ensuring compliance, and adapting to potential changes present both significant challenges and strategic opportunities for market participants.

- Substitute Products: The market faces competition from a growing array of substitute products, most notably fitness trackers and a broader category of wearable technology. These devices often offer overlapping functionalities, influencing consumer purchasing decisions and potentially impacting the overall growth trajectory of the traditional watch and smartwatch segments.

- End-User Profiles: The North American e-commerce watch market caters to a highly diverse consumer base. This includes tech-savvy individuals seeking the latest smart features, fitness enthusiasts prioritizing health metrics, fashion-conscious consumers looking for stylish timepieces, and individuals valuing the heritage and craftsmanship of traditional watches. Purchasing decisions are influenced by a confluence of factors including age, gender, income levels, lifestyle preferences, and brand affinity.

- M&A Activities: Over the past five years, the North American e-commerce watch market has seen significant M&A activity, with deals valued in the aggregate at approximately [Placeholder for specific M&A deal value - e.g., hundreds of millions]. These strategic consolidations and acquisitions have played a crucial role in shaping the market structure, enabling expansion into new product categories or geographical regions, and accelerating the integration of advanced technological capabilities. A more granular analysis of pivotal M&A transactions and their specific ramifications on market dynamics is detailed further within this report.

North America E-Commerce Watch Market Industry Evolution

This section examines the historical and projected growth of the North American e-commerce watch market. We analyze evolving market trends, technological advancements driving market expansion, and shifting consumer preferences that shape the industry's future. This analysis integrates growth rate data and adoption metrics across various watch segments and sales platforms, offering a dynamic perspective on industry evolution. The market experienced robust growth from 2019 to 2024, driven by increased consumer adoption of smartwatches and technological advancements. The forecast period (2025-2033) anticipates a continued, albeit potentially moderated, growth rate influenced by economic conditions and competitive pressures. Specific data points regarding growth rates and adoption metrics are detailed in the full report, including a detailed breakdown of sales growth across different product categories (Quartz/Mechanical, Smart) and distribution platforms (Company Websites, Third-Party Retailers).

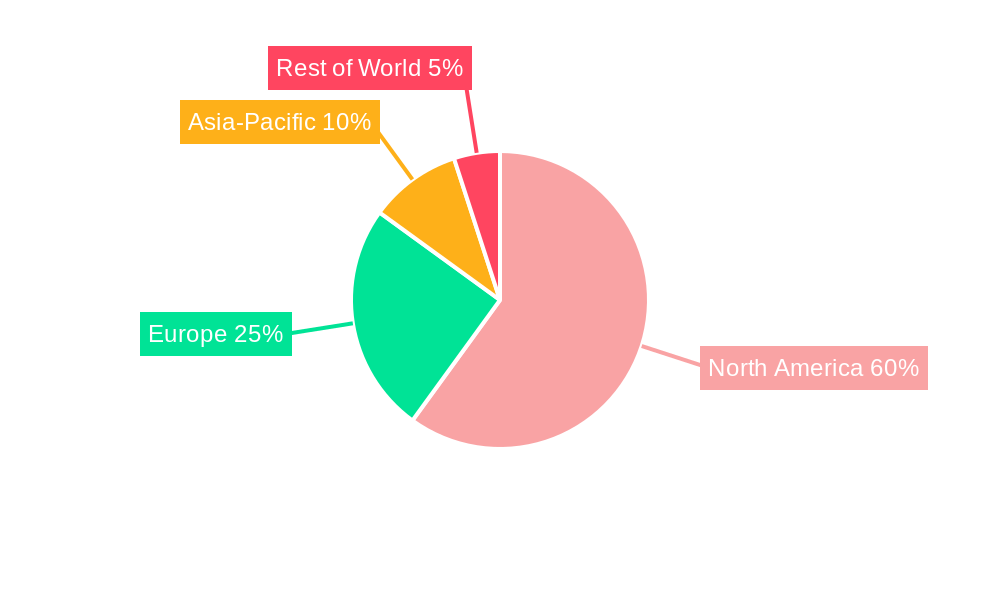

Leading Regions, Countries, or Segments in North America E-Commerce Watch Market

This section pinpoints the dominant regions, countries, and segments within the North American e-commerce watch market. Detailed analysis of the factors underpinning this dominance are examined, including economic factors, consumer preferences and technological adoption rates.

- Dominant Segment: The Smartwatch segment is projected to dominate the market throughout the forecast period (2025-2033), fueled by technological advancements and growing consumer demand for health and fitness tracking capabilities. The Quartz/Mechanical segment maintains a significant presence among consumers valuing traditional craftsmanship and design.

- Dominant Platform: Third-party retailers currently hold a larger market share, benefiting from extensive reach and established distribution networks. However, companies' own websites are steadily increasing their market share, leveraging direct customer relationships and enhanced control over pricing and branding.

- Key Drivers:

- Investment Trends: Significant investments in R&D have driven technological advancements in smartwatches, leading to improved features and user experiences.

- Regulatory Support: While regulatory frameworks around data privacy remain dynamic, government initiatives promoting technology and innovation continue to positively influence market expansion.

- Consumer Preferences: A growing preference for functional and stylish wearables, alongside rising health consciousness, plays a critical role in increasing smartwatch adoption.

North America E-Commerce Watch Market Product Innovations

Recent years have witnessed a profound acceleration in product innovation within the North American e-commerce watch market, particularly driven by advancements in smartwatch technology. Modern smartwatches now feature sophisticated health monitoring systems, including but not limited to, advanced heart rate tracking, blood oxygen saturation (SpO2) monitoring, and even temperature sensing for cycle tracking. Contactless payment solutions have become ubiquitous, and seamless smartphone integration, offering enhanced notification management and app ecosystems, continues to evolve. Concurrently, significant strides have been made in improving battery life, allowing for longer usage periods between charges, and in the utilization of premium and sustainable materials for both casings and straps. These innovations are not only broadening the appeal of smartwatches across a wider spectrum of demographics but are also driving demand. In parallel, the classic watch segment continues to innovate, with traditional designs increasingly incorporating modern, high-performance materials and advanced, precise manufacturing techniques. Unique selling propositions are emerging through the integration of specialized wellness applications, exemplified by Citizen Watch's CZ Smart with its IBM Watson-powered wellness app. Enhanced safety features, such as Garmin's innovative Bounce LTE smartwatch with its robust communication and tracking capabilities, and sophisticated health tracking functionalities, like the temperature sensor introduced in Apple's Series 8 watches, are becoming key differentiators and significant drivers of market growth.

Propelling Factors for North America E-Commerce Watch Market Growth

Several key factors contribute to the projected growth of the North American e-commerce watch market. Technological advancements, particularly in areas of health monitoring and seamless connectivity, are primary drivers. The increasing affordability of smartwatches expands market accessibility, while rising consumer disposable incomes further fuel demand. Government initiatives promoting technology and innovation also contribute to positive market dynamics.

Obstacles in the North America E-Commerce Watch Market Market

The North American e-commerce watch market navigates a complex terrain of obstacles that can impede its growth trajectory. Intense competition remains a persistent challenge, stemming from both the entrenched market presence of established global watch brands and the agile disruption posed by numerous emerging direct-to-consumer (DTC) players and tech companies. Supply chain disruptions, exacerbated by global events and geopolitical factors, continue to impact product availability, leading to potential stockouts and price volatility for both components and finished goods. The ever-evolving landscape of data privacy regulations necessitates continuous investment in compliance infrastructure and strategic adjustments to data handling practices, which can increase operational costs. Furthermore, fluctuations in consumer spending, often driven by macroeconomic uncertainties such as inflation, interest rate hikes, and recessionary fears, can significantly dampen discretionary purchases of watches, impacting overall market growth and sales volumes.

Future Opportunities in North America E-Commerce Watch Market

The North American e-commerce watch market is ripe with future opportunities for growth and innovation. Significant potential lies in the strategic expansion into underserved or emerging consumer segments and geographical markets, particularly those with a growing middle class and increasing adoption of digital commerce. Continued innovation in advanced materials, such as the use of recycled or bio-based components, and the implementation of sustainable manufacturing processes, are becoming increasingly important to environmentally conscious consumers and represent a key differentiator. The development of highly personalized user experiences, tailored to individual health goals, lifestyle needs, and aesthetic preferences, will be crucial for customer retention and loyalty. Furthermore, the deep integration of cutting-edge technologies like Artificial Intelligence (AI) for predictive health insights and personalized coaching, and the Internet of Things (IoT) for enhanced connectivity and smart home integration, promises to unlock new functionalities and create compelling value propositions, driving substantial market expansion in the coming years.

Major Players in the North America E-Commerce Watch Market Ecosystem

Key Developments in North America E-Commerce Watch Market Industry

- September 2022: Apple significantly bolstered the smartwatch segment with the launch of its Series 8 watches. This iteration introduced advanced health features, including a highly anticipated temperature sensor for cycle tracking and a crucial Crash Detection feature, enhancing user safety and broadening the device's utility.

- November 2022: Garmin strategically expanded its product portfolio and targeted a new market segment by launching the Bounce LTE smartwatch specifically designed for children. This innovative device emphasizes robust communication capabilities and reliable location tracking, addressing parental concerns for safety and connectivity.

- January 2023: Citizen Watch Canada showcased a significant integration of artificial intelligence into wearable technology by introducing the CZ Smart smartwatch. This model features a unique IBM Watson-powered wellness app, offering personalized health insights and coaching, thereby highlighting the growing trend of data-driven, intelligent wellness solutions in the market.

Strategic North America E-Commerce Watch Market Market Forecast

The North American e-commerce watch market is poised for continued growth, driven by technological innovations, expanding consumer adoption of smartwatches, and rising disposable incomes. New product features, including enhanced health monitoring, communication, and sustainability efforts, are key growth drivers. The market's future is bright, with potential for expansion across multiple segments and platforms.

North America E-Commerce Watch Market Segmentation

-

1. Product Type

- 1.1. Quartz/Mechanical

- 1.2. Smart

-

2. Platform Type

- 2.1. Third Party Retailer

- 2.2. Company's Own Website

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

- 3.4. Rest of North America

North America E-Commerce Watch Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North America E-Commerce Watch Market Regional Market Share

Geographic Coverage of North America E-Commerce Watch Market

North America E-Commerce Watch Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Inclination Toward Premium Watches; Product Innovation to Drive the Market

- 3.3. Market Restrains

- 3.3.1. Availability of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Product Innovation to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America E-Commerce Watch Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Quartz/Mechanical

- 5.1.2. Smart

- 5.2. Market Analysis, Insights and Forecast - by Platform Type

- 5.2.1. Third Party Retailer

- 5.2.2. Company's Own Website

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.3.4. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United States North America E-Commerce Watch Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Quartz/Mechanical

- 6.1.2. Smart

- 6.2. Market Analysis, Insights and Forecast - by Platform Type

- 6.2.1. Third Party Retailer

- 6.2.2. Company's Own Website

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Canada North America E-Commerce Watch Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Quartz/Mechanical

- 7.1.2. Smart

- 7.2. Market Analysis, Insights and Forecast - by Platform Type

- 7.2.1. Third Party Retailer

- 7.2.2. Company's Own Website

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.3.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Mexico North America E-Commerce Watch Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Quartz/Mechanical

- 8.1.2. Smart

- 8.2. Market Analysis, Insights and Forecast - by Platform Type

- 8.2.1. Third Party Retailer

- 8.2.2. Company's Own Website

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.3.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of North America North America E-Commerce Watch Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Quartz/Mechanical

- 9.1.2. Smart

- 9.2. Market Analysis, Insights and Forecast - by Platform Type

- 9.2.1. Third Party Retailer

- 9.2.2. Company's Own Website

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United States

- 9.3.2. Canada

- 9.3.3. Mexico

- 9.3.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Timex Group B V

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Samsung Electronics Co Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Garmin Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Google LLC (FitBit)

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Citizen Watch Co Ltd *List Not Exhaustive

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Rolex SA

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Casio Computer Co Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Fossil Group Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Apple Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Sony Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Timex Group B V

List of Figures

- Figure 1: North America E-Commerce Watch Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America E-Commerce Watch Market Share (%) by Company 2025

List of Tables

- Table 1: North America E-Commerce Watch Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: North America E-Commerce Watch Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 3: North America E-Commerce Watch Market Revenue billion Forecast, by Platform Type 2020 & 2033

- Table 4: North America E-Commerce Watch Market Volume K Units Forecast, by Platform Type 2020 & 2033

- Table 5: North America E-Commerce Watch Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: North America E-Commerce Watch Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 7: North America E-Commerce Watch Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: North America E-Commerce Watch Market Volume K Units Forecast, by Region 2020 & 2033

- Table 9: North America E-Commerce Watch Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 10: North America E-Commerce Watch Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 11: North America E-Commerce Watch Market Revenue billion Forecast, by Platform Type 2020 & 2033

- Table 12: North America E-Commerce Watch Market Volume K Units Forecast, by Platform Type 2020 & 2033

- Table 13: North America E-Commerce Watch Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 14: North America E-Commerce Watch Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 15: North America E-Commerce Watch Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: North America E-Commerce Watch Market Volume K Units Forecast, by Country 2020 & 2033

- Table 17: North America E-Commerce Watch Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 18: North America E-Commerce Watch Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 19: North America E-Commerce Watch Market Revenue billion Forecast, by Platform Type 2020 & 2033

- Table 20: North America E-Commerce Watch Market Volume K Units Forecast, by Platform Type 2020 & 2033

- Table 21: North America E-Commerce Watch Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 22: North America E-Commerce Watch Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 23: North America E-Commerce Watch Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: North America E-Commerce Watch Market Volume K Units Forecast, by Country 2020 & 2033

- Table 25: North America E-Commerce Watch Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 26: North America E-Commerce Watch Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 27: North America E-Commerce Watch Market Revenue billion Forecast, by Platform Type 2020 & 2033

- Table 28: North America E-Commerce Watch Market Volume K Units Forecast, by Platform Type 2020 & 2033

- Table 29: North America E-Commerce Watch Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 30: North America E-Commerce Watch Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 31: North America E-Commerce Watch Market Revenue billion Forecast, by Country 2020 & 2033

- Table 32: North America E-Commerce Watch Market Volume K Units Forecast, by Country 2020 & 2033

- Table 33: North America E-Commerce Watch Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 34: North America E-Commerce Watch Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 35: North America E-Commerce Watch Market Revenue billion Forecast, by Platform Type 2020 & 2033

- Table 36: North America E-Commerce Watch Market Volume K Units Forecast, by Platform Type 2020 & 2033

- Table 37: North America E-Commerce Watch Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 38: North America E-Commerce Watch Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 39: North America E-Commerce Watch Market Revenue billion Forecast, by Country 2020 & 2033

- Table 40: North America E-Commerce Watch Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America E-Commerce Watch Market?

The projected CAGR is approximately 4.5%.

2. Which companies are prominent players in the North America E-Commerce Watch Market?

Key companies in the market include Timex Group B V, Samsung Electronics Co Ltd, Garmin Ltd, Google LLC (FitBit), Citizen Watch Co Ltd *List Not Exhaustive, Rolex SA, Casio Computer Co Ltd, Fossil Group Inc, Apple Inc, Sony Corporation.

3. What are the main segments of the North America E-Commerce Watch Market?

The market segments include Product Type, Platform Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 75.8 billion as of 2022.

5. What are some drivers contributing to market growth?

Inclination Toward Premium Watches; Product Innovation to Drive the Market.

6. What are the notable trends driving market growth?

Product Innovation to Drive the Market.

7. Are there any restraints impacting market growth?

Availability of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

January 2023: Citizen Watch Canada launched its next-generation smartwatch at CES 2023. The all-new CZ Smart was claimed to feature an advanced, IBM Watson-powered wellness app through which the device can be connected to a mobile for easy access. The app uses personal data points accumulated by the watch to boost personalization by tracking the wearer's unique characterization, rhythms, and habits. The company made this product available on its official e-commerce website.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units .

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America E-Commerce Watch Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America E-Commerce Watch Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America E-Commerce Watch Market?

To stay informed about further developments, trends, and reports in the North America E-Commerce Watch Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence