Key Insights

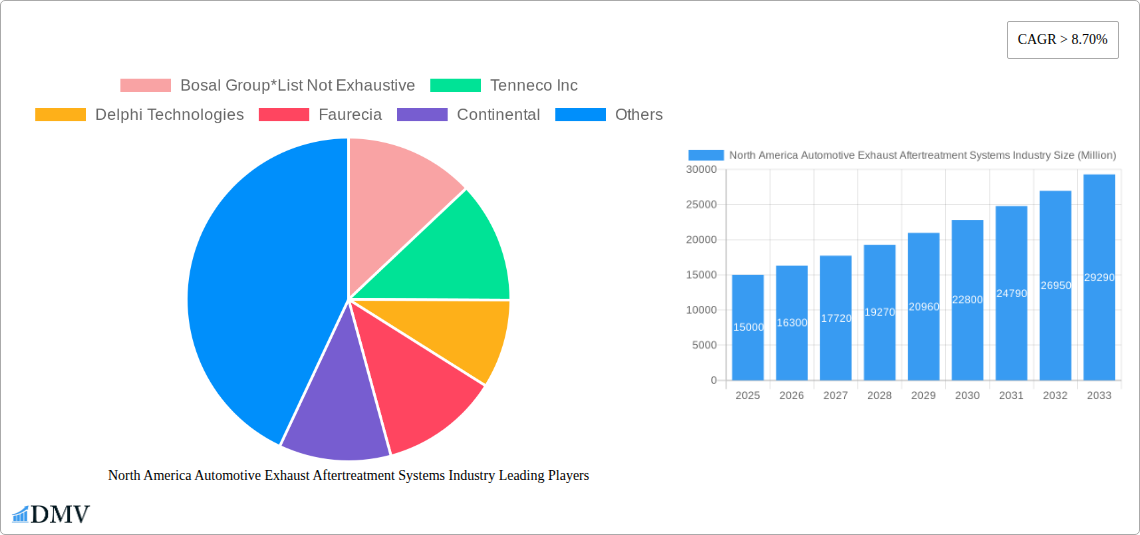

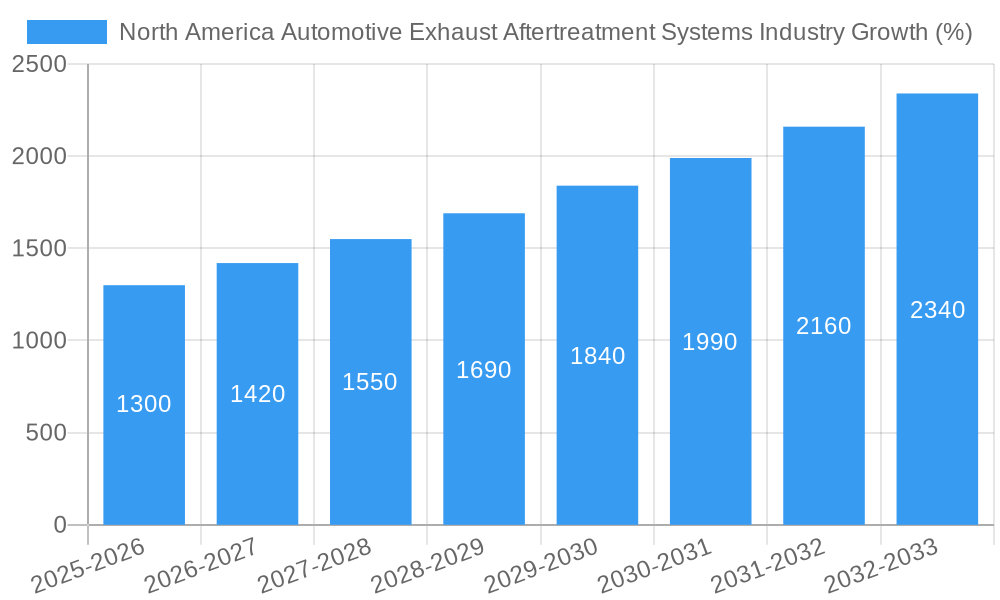

The North American automotive exhaust aftertreatment systems market is experiencing robust growth, driven by increasingly stringent emission regulations and the rising adoption of gasoline and diesel vehicles. The market, valued at approximately $15 billion in 2025, is projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 8.70% from 2025 to 2033. This expansion is fueled by several key factors. The increasing prevalence of particulate matter control systems and carbon compound control systems in both passenger cars and commercial vehicles is a major contributor. Government mandates aimed at reducing greenhouse gas emissions and improving air quality are significantly influencing market growth, particularly in the United States and Canada. Furthermore, technological advancements leading to more efficient and cost-effective aftertreatment solutions are making them more accessible to automakers, further propelling market expansion. The market segmentation reveals a strong demand across all fuel types, with gasoline and diesel vehicles driving the majority of demand. Major players like Bosal Group, Tenneco Inc, Delphi Technologies, Faurecia, Continental, and Donaldson Company are actively shaping market dynamics through innovation and strategic partnerships.

However, certain restraints are likely to impact growth. The high initial cost of implementing advanced exhaust aftertreatment technologies might hinder adoption in some segments, particularly in the commercial vehicle market. Fluctuations in raw material prices, particularly precious metals used in catalytic converters, can also impact profitability and overall market expansion. Despite these challenges, the long-term outlook for the North American automotive exhaust aftertreatment systems market remains positive, driven by sustained regulatory pressure and the continuous need for cleaner vehicles. The market's diverse segments offer opportunities for growth across various vehicle types and geographical areas within North America. Ongoing technological innovations within the sector will likely address the challenges of cost and material prices, leading to sustainable growth throughout the forecast period.

North America Automotive Exhaust Aftertreatment Systems Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a comprehensive analysis of the North America automotive exhaust aftertreatment systems market, covering the period from 2019 to 2033. It delves into market dynamics, competitive landscapes, technological advancements, and future growth projections, offering crucial insights for stakeholders across the automotive value chain. The market is segmented by vehicle type (passenger cars, commercial vehicles), fuel type (gasoline, diesel), filter type (particulate matter control system, carbon compounds control system, others), and country (United States, Canada, Rest of North America). The report forecasts a market valued at xx Million by 2033, with a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). The base year for this analysis is 2025.

North America Automotive Exhaust Aftertreatment Systems Industry Market Composition & Trends

This section evaluates the North American automotive exhaust aftertreatment systems market's competitive intensity, innovation drivers, regulatory environment, substitute product analysis, end-user profiles, and mergers & acquisitions (M&A) activity. The market exhibits a moderately concentrated landscape, with key players like Bosal Group, Tenneco Inc, Delphi Technologies, Faurecia, Continental, and Donaldson Company holding significant market share. However, the presence of several smaller, specialized players fosters innovation.

- Market Share Distribution: The top 5 players collectively control approximately xx% of the market in 2025, with Bosal Group holding an estimated xx% share.

- M&A Activity: Significant M&A activity in the past five years, with deal values totaling approximately xx Million, reflects consolidation efforts and expansion into new technologies.

- Innovation Catalysts: Stringent emission regulations and the rising demand for fuel-efficient vehicles drive innovation in catalytic converter technology and particulate filter designs.

- Regulatory Landscape: The increasingly stringent emission standards in North America (e.g., EPA regulations) are a key factor shaping market growth and technological advancements.

- Substitute Products: While currently limited, alternative technologies like electric vehicles pose a long-term threat, influencing the market's evolution.

North America Automotive Exhaust Aftertreatment Systems Industry Evolution

The North American automotive exhaust aftertreatment systems market has witnessed significant growth from 2019 to 2024, driven by factors such as increasing vehicle production, stricter emission norms, and growing consumer awareness of environmental concerns. The market size expanded from xx Million in 2019 to xx Million in 2024, representing a CAGR of xx%. Technological advancements, particularly in selective catalytic reduction (SCR) and diesel particulate filter (DPF) systems, have been instrumental in meeting increasingly stringent emission regulations. Furthermore, the shift towards more fuel-efficient vehicles has driven demand for advanced aftertreatment systems capable of maximizing fuel economy while minimizing emissions. The rising adoption of gasoline direct injection (GDI) engines has also influenced market trends, with specific filter types better suited for GDI emission profiles gaining popularity. Consumer demand for cleaner vehicles is indirectly impacting the market by encouraging automakers to adopt advanced aftertreatment technologies to meet environmental standards. The forecast period (2025-2033) anticipates continued market expansion, fueled by new vehicle sales and technological upgrades in existing vehicles.

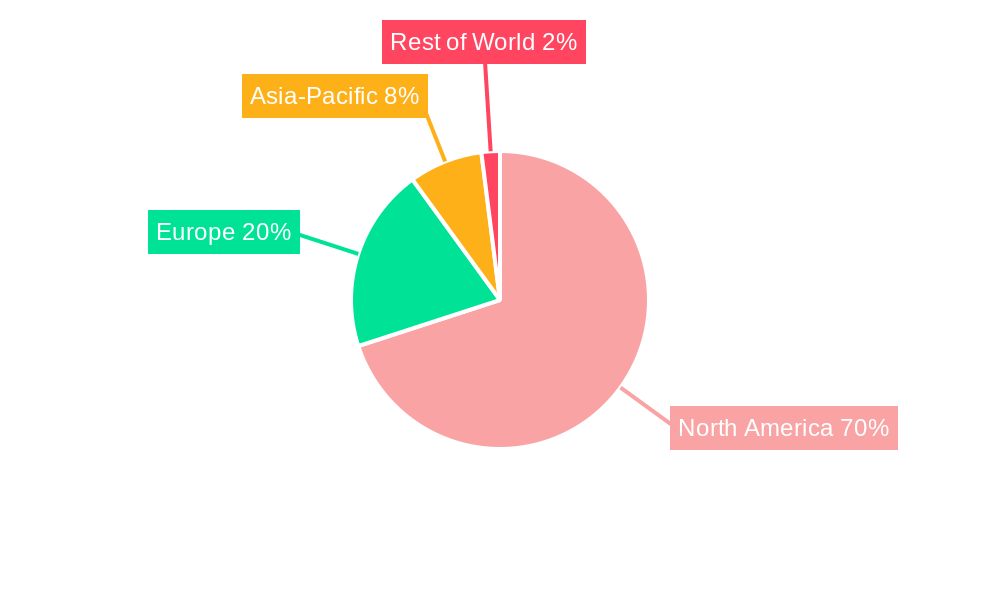

Leading Regions, Countries, or Segments in North America Automotive Exhaust Aftertreatment Systems Industry

The United States dominates the North American automotive exhaust aftertreatment systems market, accounting for approximately xx% of the total market value in 2025. This dominance is largely due to:

- High Vehicle Production: The U.S. is a major automobile manufacturing hub, driving significant demand for aftertreatment systems.

- Stringent Emission Regulations: Stricter emission standards in the U.S. compared to Canada and the rest of North America necessitate the use of advanced aftertreatment technologies.

- Higher Investment in R&D: The presence of major automotive manufacturers and suppliers in the U.S. results in higher investments in research and development of advanced aftertreatment systems.

Within the segments, the passenger car segment holds a larger market share than the commercial vehicle segment due to higher passenger car production volumes. Similarly, the diesel fuel type segment showcases higher demand due to the prevalence of diesel-powered commercial vehicles. Particulate matter control systems represent the largest share of the filter type segment due to their importance in reducing particulate emissions.

North America Automotive Exhaust Aftertreatment Systems Industry Product Innovations

Recent innovations focus on enhancing the efficiency and durability of existing aftertreatment technologies, such as developing more efficient catalysts and improved DPF designs with longer service life. Furthermore, the integration of advanced sensors and control systems allows for real-time optimization of aftertreatment system performance, leading to reduced emissions and improved fuel economy. These advancements are driven by a need to comply with increasingly stringent emission regulations while mitigating the cost impacts for both manufacturers and consumers. Unique selling propositions revolve around improved efficiency, extended service life, reduced emissions, and optimized fuel economy.

Propelling Factors for North America Automotive Exhaust Aftertreatment Systems Industry Growth

Several factors drive the growth of the North American automotive exhaust aftertreatment systems market. Stringent emission regulations mandated by governments like the EPA continue to be the primary driver, pushing automakers to adopt advanced technologies. The growing demand for fuel-efficient vehicles also necessitates the adoption of optimized aftertreatment systems that reduce emissions without compromising fuel economy. Furthermore, technological advancements leading to improved efficiency, durability, and cost-effectiveness of aftertreatment systems are positively impacting market growth.

Obstacles in the North America Automotive Exhaust Aftertreatment Systems Industry Market

The market faces challenges, including the high cost of advanced aftertreatment systems, potentially impacting adoption rates, especially for lower-priced vehicles. Supply chain disruptions can also cause delays and increase production costs. The increasing competitiveness within the market and the emergence of alternative vehicle technologies, like electric vehicles, present significant long-term challenges. Furthermore, the complexity of integrating new technologies into existing vehicle designs and maintaining compliance with evolving regulatory standards add to the challenges faced by industry players.

Future Opportunities in North America Automotive Exhaust Aftertreatment Systems Industry

Emerging opportunities include the development and adoption of more sustainable and cost-effective aftertreatment technologies, such as systems capable of reducing greenhouse gas emissions beyond current regulatory requirements. Expanding into new markets (e.g., heavy-duty vehicles) and leveraging advancements in materials science to create lighter, more durable, and longer-lasting systems offer considerable potential. Further market growth is anticipated through ongoing technological innovation and the development of systems that improve efficiency and address the long-term sustainability challenges faced by the automotive industry.

Major Players in the North America Automotive Exhaust Aftertreatment Systems Industry Ecosystem

- Bosal Group

- Tenneco Inc

- Delphi Technologies

- Faurecia

- Continental

- Donaldson Company

Key Developments in North America Automotive Exhaust Aftertreatment Systems Industry Industry

- January 2023: Company X launches a new generation of DPF technology with improved efficiency and durability.

- June 2022: Company Y announces a strategic partnership with Company Z to develop advanced SCR systems for commercial vehicles.

- October 2021: New emission regulations come into effect in California, driving demand for advanced aftertreatment technologies.

Strategic North America Automotive Exhaust Aftertreatment Systems Industry Market Forecast

The North American automotive exhaust aftertreatment systems market is poised for continued growth driven by stringent emission regulations, technological innovation, and the increasing demand for fuel-efficient vehicles. The market is projected to expand significantly over the forecast period (2025-2033), creating substantial opportunities for existing and new players. The focus on sustainable solutions, coupled with ongoing advancements in technology, will shape future market dynamics, paving the way for a more environmentally responsible automotive industry.

North America Automotive Exhaust Aftertreatment Systems Industry Segmentation

-

1. Vehicle Type

- 1.1. Passenger Cars

- 1.2. Commercial Vehicles

-

2. Fuel Type

- 2.1. Gasoline

- 2.2. Diesel

-

3. Filter Type

- 3.1. Particulate matter control system

- 3.2. Carbon compounds control system

- 3.3. Others

North America Automotive Exhaust Aftertreatment Systems Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Automotive Exhaust Aftertreatment Systems Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 8.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Strict Rules and Regulations in Vehicle Safety

- 3.3. Market Restrains

- 3.3.1. Integration Complexity

- 3.4. Market Trends

- 3.4.1. Diesel Particulate Filters (DPFs) is the Fastest Growing Technology by Filter Type

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Automotive Exhaust Aftertreatment Systems Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Cars

- 5.1.2. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Fuel Type

- 5.2.1. Gasoline

- 5.2.2. Diesel

- 5.3. Market Analysis, Insights and Forecast - by Filter Type

- 5.3.1. Particulate matter control system

- 5.3.2. Carbon compounds control system

- 5.3.3. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. United States North America Automotive Exhaust Aftertreatment Systems Industry Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Automotive Exhaust Aftertreatment Systems Industry Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Automotive Exhaust Aftertreatment Systems Industry Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Automotive Exhaust Aftertreatment Systems Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Bosal Group*List Not Exhaustive

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Tenneco Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Delphi Technologies

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Faurecia

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Continental

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Donaldson Company

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.1 Bosal Group*List Not Exhaustive

List of Figures

- Figure 1: North America Automotive Exhaust Aftertreatment Systems Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Automotive Exhaust Aftertreatment Systems Industry Share (%) by Company 2024

List of Tables

- Table 1: North America Automotive Exhaust Aftertreatment Systems Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Automotive Exhaust Aftertreatment Systems Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: North America Automotive Exhaust Aftertreatment Systems Industry Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 4: North America Automotive Exhaust Aftertreatment Systems Industry Revenue Million Forecast, by Filter Type 2019 & 2032

- Table 5: North America Automotive Exhaust Aftertreatment Systems Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: North America Automotive Exhaust Aftertreatment Systems Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States North America Automotive Exhaust Aftertreatment Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada North America Automotive Exhaust Aftertreatment Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico North America Automotive Exhaust Aftertreatment Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America North America Automotive Exhaust Aftertreatment Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: North America Automotive Exhaust Aftertreatment Systems Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 12: North America Automotive Exhaust Aftertreatment Systems Industry Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 13: North America Automotive Exhaust Aftertreatment Systems Industry Revenue Million Forecast, by Filter Type 2019 & 2032

- Table 14: North America Automotive Exhaust Aftertreatment Systems Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 15: United States North America Automotive Exhaust Aftertreatment Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada North America Automotive Exhaust Aftertreatment Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Mexico North America Automotive Exhaust Aftertreatment Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Automotive Exhaust Aftertreatment Systems Industry?

The projected CAGR is approximately > 8.70%.

2. Which companies are prominent players in the North America Automotive Exhaust Aftertreatment Systems Industry?

Key companies in the market include Bosal Group*List Not Exhaustive, Tenneco Inc, Delphi Technologies, Faurecia, Continental, Donaldson Company.

3. What are the main segments of the North America Automotive Exhaust Aftertreatment Systems Industry?

The market segments include Vehicle Type, Fuel Type, Filter Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Strict Rules and Regulations in Vehicle Safety.

6. What are the notable trends driving market growth?

Diesel Particulate Filters (DPFs) is the Fastest Growing Technology by Filter Type.

7. Are there any restraints impacting market growth?

Integration Complexity.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Automotive Exhaust Aftertreatment Systems Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Automotive Exhaust Aftertreatment Systems Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Automotive Exhaust Aftertreatment Systems Industry?

To stay informed about further developments, trends, and reports in the North America Automotive Exhaust Aftertreatment Systems Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence