Key Insights

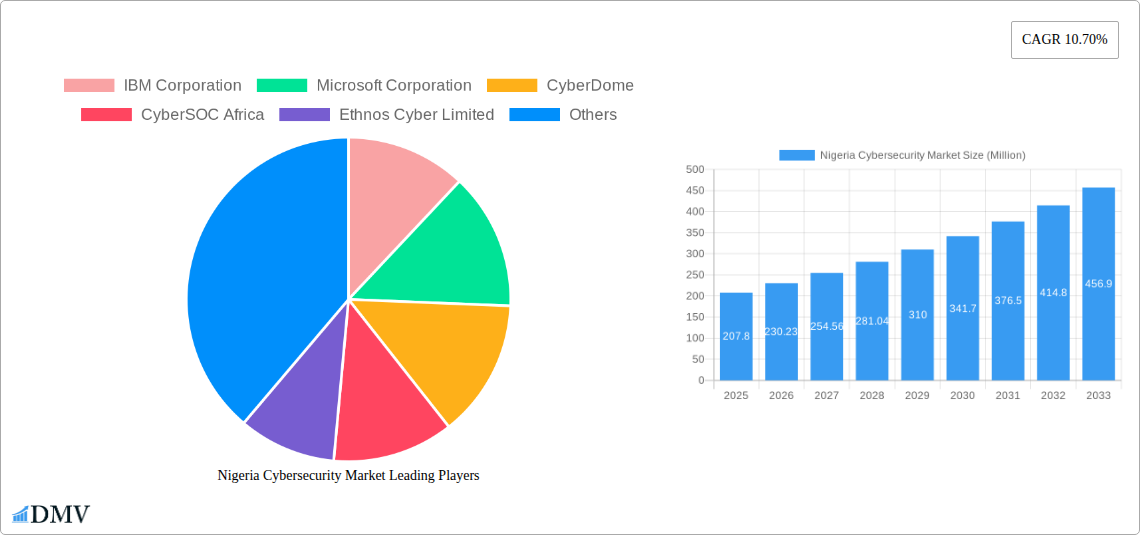

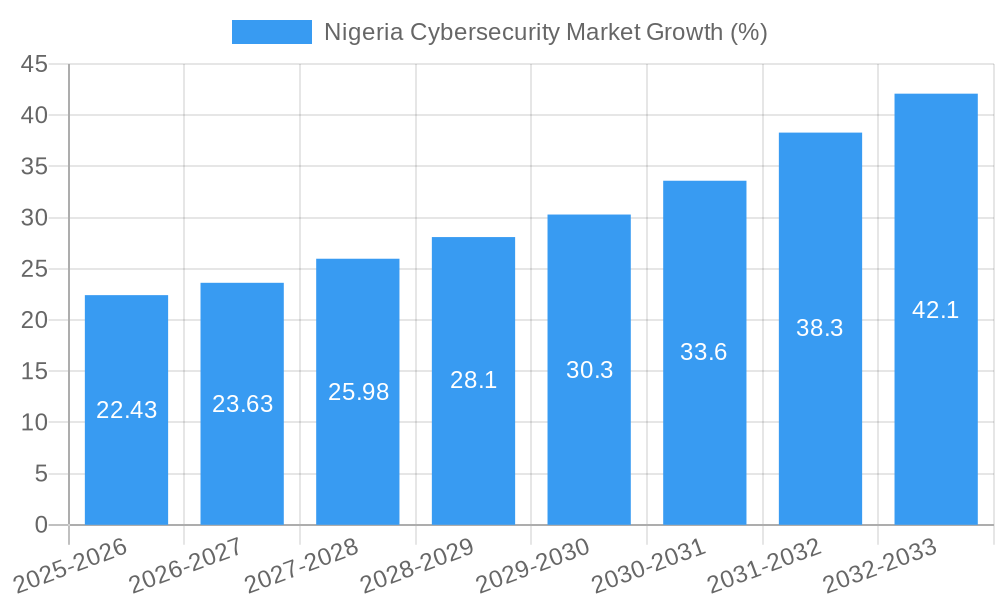

The Nigerian cybersecurity market, valued at $207.80 million in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 10.70% from 2025 to 2033. This surge is driven by several factors. The increasing adoption of digital technologies across various sectors—from finance and government to healthcare and education—is creating a larger attack surface, making robust cybersecurity essential. Furthermore, rising cybercrime rates, including phishing attacks, ransomware incidents, and data breaches, are compelling organizations to invest heavily in preventative and reactive security measures. Government initiatives promoting digital literacy and cybersecurity awareness are also contributing to market growth, while the increasing complexity of cyber threats necessitates sophisticated solutions, fueling demand for advanced cybersecurity services and technologies. Key players like IBM, Microsoft, and several local companies are actively shaping the market landscape, offering a mix of cloud-based security solutions, managed security services, and specialized cybersecurity consulting.

The market segmentation within Nigeria likely reflects the diverse needs of different industries. We can anticipate a strong demand for network security solutions, endpoint protection, data loss prevention tools, and security information and event management (SIEM) systems. The government sector will likely represent a significant portion of the market due to its critical infrastructure and the need to protect sensitive citizen data. The financial sector will also be a substantial contributor, driven by its reliance on digital transactions and its vulnerability to financial cybercrimes. While constraints such as limited cybersecurity expertise and budget limitations in some sectors might impede rapid adoption, the overall market trajectory remains positive, fuelled by increasing digitalization and a growing awareness of cybersecurity risks. The forecast period of 2025-2033 promises substantial growth for companies offering innovative and effective cybersecurity solutions in Nigeria.

Nigeria Cybersecurity Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the burgeoning Nigeria Cybersecurity Market, encompassing market trends, leading players, and future growth projections from 2019 to 2033. The study period covers the historical period (2019-2024), the base year (2025), and the forecast period (2025-2033), providing stakeholders with a comprehensive understanding of this dynamic market. The estimated market value in 2025 is projected at xx Million.

Nigeria Cybersecurity Market Composition & Trends

This section delves into the competitive landscape of the Nigerian cybersecurity market, examining market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and mergers and acquisitions (M&A) activities. The market is characterized by a mix of multinational corporations and local players, with a notable increase in M&A activity in recent years. While precise market share data for individual players is unavailable (xx%), we estimate that the top 5 players hold approximately xx% of the market share.

- Market Concentration: The market exhibits a moderately concentrated structure, with a few dominant players alongside numerous smaller, specialized firms.

- Innovation Catalysts: The increasing sophistication of cyber threats and government initiatives promoting cybersecurity awareness are key drivers of innovation.

- Regulatory Landscape: Evolving data protection regulations are shaping the market, encouraging investment in compliance solutions.

- Substitute Products: While dedicated cybersecurity solutions are preferred, alternative measures like internal IT teams offer limited substitutes.

- End-User Profiles: Key end-users include government agencies, financial institutions, telecommunications companies, and large corporations.

- M&A Activities: Consolidation is expected to continue, with M&A deal values averaging xx Million in recent years, reflecting an increasing demand for comprehensive security solutions.

Nigeria Cybersecurity Market Industry Evolution

The Nigerian cybersecurity market has witnessed substantial growth over the past five years, driven by increasing digitalization and a growing awareness of cyber threats. This section analyzes market growth trajectories, technological advancements, and shifting consumer demands. The market experienced a Compound Annual Growth Rate (CAGR) of xx% from 2019 to 2024, and projections indicate a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by the rapid adoption of cloud technologies, the rise of mobile banking, and the increasing reliance on the internet for business and personal activities. Furthermore, government initiatives such as the establishment of the Lagos State Cybersecurity Operations Centre (CSOC) are significantly accelerating market growth. Consumer demand is shifting towards more comprehensive and integrated security solutions that address multiple threats.

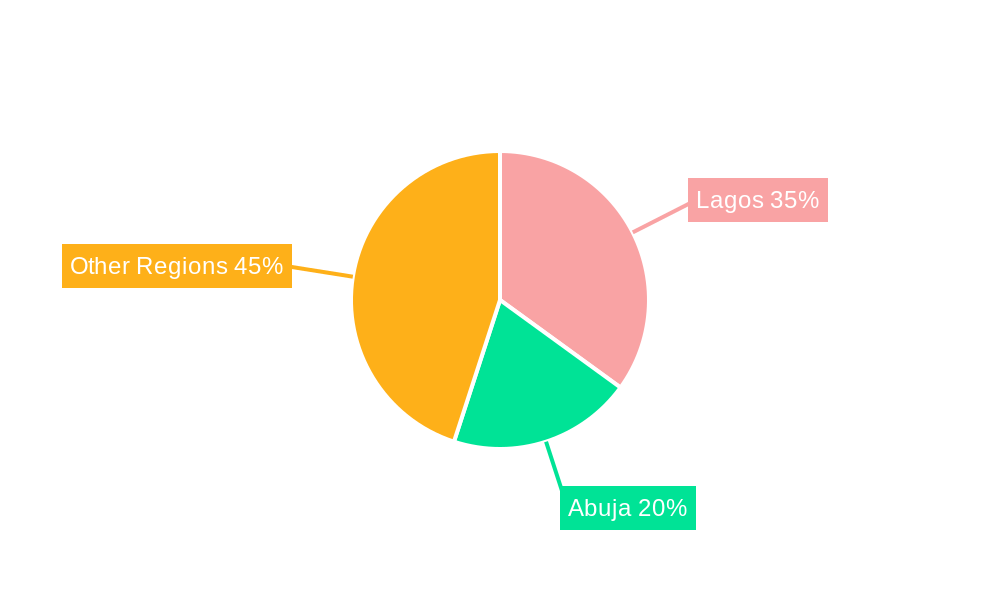

Leading Regions, Countries, or Segments in Nigeria Cybersecurity Market

Lagos and Abuja, as major economic hubs, are leading regions in the adoption of cybersecurity solutions. The financial services and government sectors represent the most significant market segments.

- Key Drivers in Lagos and Abuja:

- High concentration of businesses and financial institutions: These sectors are prime targets for cyberattacks, leading to high demand for robust security solutions.

- Government initiatives: The establishment of the Lagos State CSOC demonstrates a strong commitment to cybersecurity, stimulating market growth.

- Significant investments in IT infrastructure: Continued investments in digital infrastructure are driving the demand for advanced cybersecurity technologies.

- Dominance Factors: The concentration of key industries, government support, and substantial investment in IT infrastructure in Lagos and Abuja are major factors contributing to their leading positions within the Nigerian cybersecurity market.

Nigeria Cybersecurity Market Product Innovations

Recent innovations include advanced threat detection systems, AI-powered security solutions, and blockchain-based security protocols. These offer enhanced threat detection, faster response times, and improved data protection capabilities. The unique selling propositions often center on ease of use, scalability, and integration with existing systems.

Propelling Factors for Nigeria Cybersecurity Market Growth

Several factors fuel the growth of Nigeria's cybersecurity market. Technological advancements, including AI and machine learning, are enhancing threat detection and response capabilities. The increasing digitalization of the economy creates a greater attack surface, necessitating more robust security measures. Government regulations and initiatives such as the CSOC further stimulate demand.

Obstacles in the Nigeria Cybersecurity Market

Challenges include limited cybersecurity awareness among individuals and organizations, leading to vulnerabilities. The lack of skilled cybersecurity professionals creates a talent gap. Furthermore, budgetary constraints and the prevalence of sophisticated cyber threats pose significant hurdles.

Future Opportunities in Nigeria Cybersecurity Market

Emerging opportunities exist in areas such as cloud security, IoT security, and mobile security. The growth of fintech presents a substantial market for specialized financial cybersecurity solutions. Government initiatives and increased investment in cybersecurity infrastructure will further open doors for growth.

Major Players in the Nigeria Cybersecurity Market Ecosystem

- IBM Corporation

- Microsoft Corporation

- CyberDome

- CyberSOC Africa

- Ethnos Cyber Limited

- Cybervergent

- Jireh Technologies Limited

- Digital Encode Limited

- Reconnaissance Technologies Nigeria Limited

Key Developments in Nigeria Cybersecurity Market Industry

- May 2024: Inauguration of the Lagos State Cybersecurity Operations Centre (CSOC), significantly boosting digital security infrastructure and enhancing threat response capabilities.

- January 2024: Launch of the American Business Council’s cybersecurity hub, raising awareness and providing resources to combat cyber threats. This initiative has increased the demand for cybersecurity training and consultation services.

Strategic Nigeria Cybersecurity Market Forecast

The Nigeria Cybersecurity Market is poised for significant growth over the next decade. Continued government support, increased private sector investment, and the growing adoption of digital technologies will be key drivers. The market's potential is considerable, particularly in sectors like finance, telecommunications, and government. The focus will shift towards preventative measures, AI-driven security solutions, and skilled cybersecurity professionals.

Nigeria Cybersecurity Market Segmentation

-

1. Offering

-

1.1. Solutions

- 1.1.1. Application Security

- 1.1.2. Cloud Security

- 1.1.3. Consumer Security Software

- 1.1.4. Data Security

- 1.1.5. Identity and Access Management

- 1.1.6. Infrastructure Protection

- 1.1.7. Integrated Risk Management

- 1.1.8. Network Security Equipment

- 1.1.9. Other Solutions

-

1.2. Services

- 1.2.1. Professional Services

- 1.2.2. Managed Services

-

1.1. Solutions

-

2. Deployment

- 2.1. Cloud

- 2.2. On-premise

-

3. End User

-

3.1. IT and Telecom

- 3.1.1. Use Cases

- 3.2. BFSI

- 3.3. Retail and E-commerce

- 3.4. Oil, Gas, and Energy

- 3.5. Manufacturing

- 3.6. Government and Defense

- 3.7. Other End Users

-

3.1. IT and Telecom

Nigeria Cybersecurity Market Segmentation By Geography

- 1. Niger

Nigeria Cybersecurity Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in Digital Transformation Across Sectors; Rapidly Increasing Cybersecurity Incidents

- 3.3. Market Restrains

- 3.3.1. Growth in Digital Transformation Across Sectors; Rapidly Increasing Cybersecurity Incidents

- 3.4. Market Trends

- 3.4.1. The Solutions Segment is Analyzed to Hold a Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Nigeria Cybersecurity Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 5.1.1. Solutions

- 5.1.1.1. Application Security

- 5.1.1.2. Cloud Security

- 5.1.1.3. Consumer Security Software

- 5.1.1.4. Data Security

- 5.1.1.5. Identity and Access Management

- 5.1.1.6. Infrastructure Protection

- 5.1.1.7. Integrated Risk Management

- 5.1.1.8. Network Security Equipment

- 5.1.1.9. Other Solutions

- 5.1.2. Services

- 5.1.2.1. Professional Services

- 5.1.2.2. Managed Services

- 5.1.1. Solutions

- 5.2. Market Analysis, Insights and Forecast - by Deployment

- 5.2.1. Cloud

- 5.2.2. On-premise

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. IT and Telecom

- 5.3.1.1. Use Cases

- 5.3.2. BFSI

- 5.3.3. Retail and E-commerce

- 5.3.4. Oil, Gas, and Energy

- 5.3.5. Manufacturing

- 5.3.6. Government and Defense

- 5.3.7. Other End Users

- 5.3.1. IT and Telecom

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Niger

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 IBM Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Microsoft Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 CyberDome

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 CyberSOC Africa

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Ethnos Cyber Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Cybervergent

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Jireh Technologies Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Digital Encode Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Reconnaissance Technologies Nigeria Limite

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 IBM Corporation

List of Figures

- Figure 1: Nigeria Cybersecurity Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Nigeria Cybersecurity Market Share (%) by Company 2024

List of Tables

- Table 1: Nigeria Cybersecurity Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Nigeria Cybersecurity Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: Nigeria Cybersecurity Market Revenue Million Forecast, by Offering 2019 & 2032

- Table 4: Nigeria Cybersecurity Market Volume Million Forecast, by Offering 2019 & 2032

- Table 5: Nigeria Cybersecurity Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 6: Nigeria Cybersecurity Market Volume Million Forecast, by Deployment 2019 & 2032

- Table 7: Nigeria Cybersecurity Market Revenue Million Forecast, by End User 2019 & 2032

- Table 8: Nigeria Cybersecurity Market Volume Million Forecast, by End User 2019 & 2032

- Table 9: Nigeria Cybersecurity Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Nigeria Cybersecurity Market Volume Million Forecast, by Region 2019 & 2032

- Table 11: Nigeria Cybersecurity Market Revenue Million Forecast, by Offering 2019 & 2032

- Table 12: Nigeria Cybersecurity Market Volume Million Forecast, by Offering 2019 & 2032

- Table 13: Nigeria Cybersecurity Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 14: Nigeria Cybersecurity Market Volume Million Forecast, by Deployment 2019 & 2032

- Table 15: Nigeria Cybersecurity Market Revenue Million Forecast, by End User 2019 & 2032

- Table 16: Nigeria Cybersecurity Market Volume Million Forecast, by End User 2019 & 2032

- Table 17: Nigeria Cybersecurity Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Nigeria Cybersecurity Market Volume Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Nigeria Cybersecurity Market?

The projected CAGR is approximately 10.70%.

2. Which companies are prominent players in the Nigeria Cybersecurity Market?

Key companies in the market include IBM Corporation, Microsoft Corporation, CyberDome, CyberSOC Africa, Ethnos Cyber Limited, Cybervergent, Jireh Technologies Limited, Digital Encode Limited, Reconnaissance Technologies Nigeria Limite.

3. What are the main segments of the Nigeria Cybersecurity Market?

The market segments include Offering, Deployment, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 207.80 Million as of 2022.

5. What are some drivers contributing to market growth?

Growth in Digital Transformation Across Sectors; Rapidly Increasing Cybersecurity Incidents.

6. What are the notable trends driving market growth?

The Solutions Segment is Analyzed to Hold a Significant Market Share.

7. Are there any restraints impacting market growth?

Growth in Digital Transformation Across Sectors; Rapidly Increasing Cybersecurity Incidents.

8. Can you provide examples of recent developments in the market?

May 2024: The Lagos state government announced the inauguration of a Cybersecurity Operations Centre (CSOC). This move aimed to bolster digital safety and shield the state's critical infrastructure from cyber threats. The CSOC will actively monitor, detect, and swiftly counter cyber threats across the state. This initiative aligns with the state's goal of fortifying security and governance.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Nigeria Cybersecurity Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Nigeria Cybersecurity Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Nigeria Cybersecurity Market?

To stay informed about further developments, trends, and reports in the Nigeria Cybersecurity Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence