Key Insights

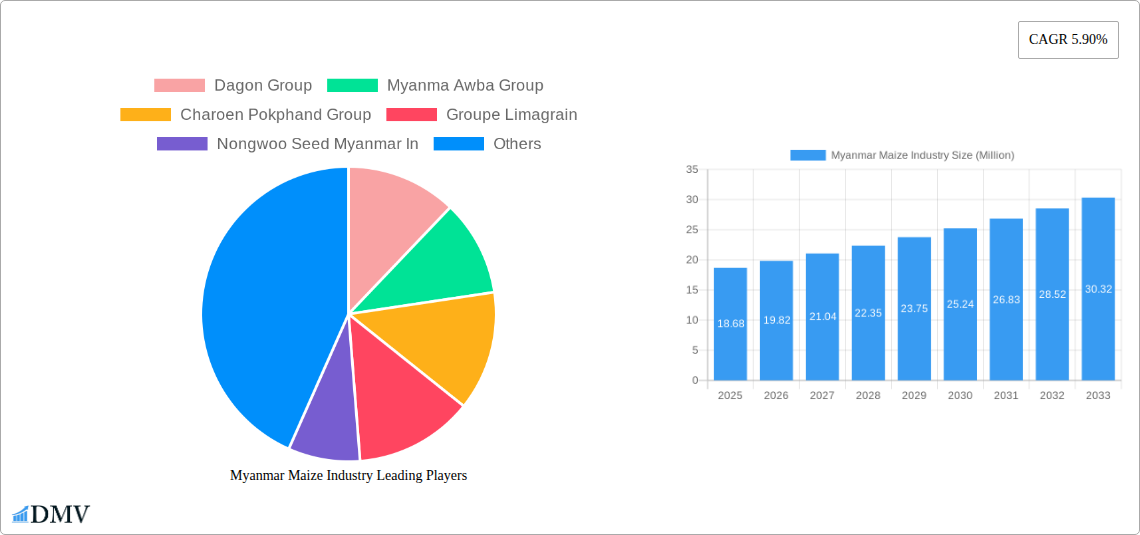

The Myanmar maize industry, valued at $18.68 million in 2025, is projected to experience robust growth, driven by increasing domestic demand for maize as a staple food and feed ingredient. The Compound Annual Growth Rate (CAGR) of 5.90% from 2025 to 2033 indicates a significant expansion in market size over the forecast period. This growth is fueled by several factors. Firstly, rising incomes and a growing population are boosting consumption. Secondly, the increasing adoption of improved maize varieties, such as hybrids, contributes to higher yields and improved quality, further stimulating market expansion. Government initiatives promoting agricultural modernization and investments in irrigation infrastructure are also playing a pivotal role in boosting production. The market is segmented into hybrids and non-transgenic open-pollinated varieties, with hybrids likely commanding a larger share due to their superior yield potential. Key players like Dagon Group, Myanma Awba Group, and international companies like Charoen Pokphand Group and Corteva Agriscience are shaping market competition and driving innovation. Challenges, however, remain, including limited access to advanced agricultural technologies in certain regions and potential vulnerabilities to climate change impacting yields.

Myanmar Maize Industry Market Size (In Million)

Despite these challenges, the long-term outlook for the Myanmar maize industry remains positive. Continued investments in research and development, coupled with supportive government policies aimed at improving agricultural infrastructure and promoting sustainable farming practices, are expected to mitigate risks and ensure consistent growth. The increasing integration of the Myanmar maize industry into regional and global supply chains further strengthens its potential for expansion. The shift towards higher-yielding hybrid varieties will likely continue to dominate market trends, alongside efforts to improve post-harvest handling and storage to reduce losses. The competitive landscape, characterized by both domestic and international players, indicates ongoing innovation and diversification within the sector.

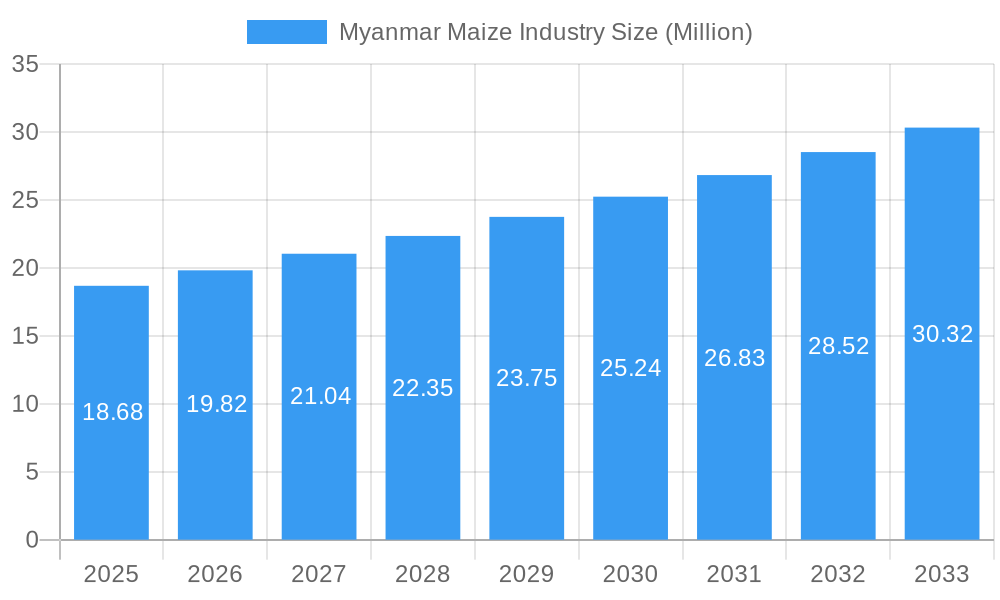

Myanmar Maize Industry Company Market Share

Myanmar Maize Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the Myanmar maize industry, encompassing market trends, key players, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for stakeholders seeking to understand and capitalize on opportunities within this dynamic sector. The report leverages extensive data analysis from the historical period (2019-2024) and utilizes predicted values where necessary. The total market size in 2025 is estimated at xx Million.

Myanmar Maize Industry Market Composition & Trends

This section evaluates the Myanmar maize market's competitive landscape, highlighting market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and merger and acquisition (M&A) activities. The report delves into the market share distribution amongst key players, including Dagon Group, Myanma Awba Group, Charoen Pokphand Group, Groupe Limagrain, Nongwoo Seed Myanmar In, KNOWN-YOU SEED CO LTD, East West Seed Myanmar Co Ltd, and Corteva Agriscience. Market concentration is analyzed using metrics such as the Herfindahl-Hirschman Index (HHI), while M&A activities are assessed based on deal values (in Millions) and their impact on market dynamics. The report further examines the influence of regulatory changes on market access and competition, the role of substitute products (e.g., other grains) and end-user demand from various sectors (e.g., food processing, animal feed).

- Market Share Distribution (2025): Dagon Group (xx%), Myanma Awba Group (xx%), Charoen Pokphand Group (xx%), Others (xx%). (Note: xx represents estimated market share percentages)

- M&A Activity (2019-2024): Total deal value estimated at xx Million. Specific deal details and analysis will be included within the full report.

- Innovation Catalysts: Focus on technological advancements in seed technology and farming techniques.

- Regulatory Landscape: Analysis of existing regulations and potential future policy changes affecting the maize industry.

Myanmar Maize Industry Industry Evolution

This section analyzes the evolution of the Myanmar maize industry from 2019 to 2033. It details market growth trajectories, technological advancements, and shifts in consumer demands, supported by specific data points such as compound annual growth rates (CAGR) and adoption rates of new technologies. The report explores the impact of factors like climate change, government policies, and changes in agricultural practices on market growth and development. Key areas of focus include yield improvements, advancements in seed technology (hybrids and open-pollinated varieties), and evolving consumer preferences within the food and feed sectors. The analysis will also cover the challenges and opportunities presented by the changing economic and political landscape of Myanmar.

- Historical Growth Rate (2019-2024): xx% CAGR

- Projected Growth Rate (2025-2033): xx% CAGR

Leading Regions, Countries, or Segments in Myanmar Maize Industry

This section identifies the dominant regions, countries, or segments within the Myanmar maize industry. Focusing on the distinction between Hybrids and Non-Transgenic: Open Pollinated Varieties, this section highlights the key drivers for each segment's prominence. Analysis will cover investment trends, government support, climatic suitability and other factors. The dominant segment (e.g., Hybrids or Open Pollinated Varieties) will be clearly identified, with a detailed explanation of its dominance within the market.

- Key Drivers for Dominant Segment:

- Investment in research and development for improved seed varieties.

- Government incentives and support programs targeting maize production.

- Suitable climate conditions and arable land for maize cultivation.

Myanmar Maize Industry Product Innovations

This section details recent product innovations, applications, and performance metrics for maize products in Myanmar. It emphasizes unique selling propositions (USPs) such as drought tolerance and higher yields, and highlights technological advancements in seed development and farming practices that drive improvements in productivity and efficiency. Examples of specific new maize varieties and their performance characteristics will be discussed.

Propelling Factors for Myanmar Maize Industry Growth

Several factors are driving the growth of Myanmar's maize industry. Technological advancements like improved seed varieties and mechanized farming techniques boost yields and efficiency. Favorable economic conditions, including increasing domestic demand and export opportunities, stimulate production. Supportive government policies, such as agricultural subsidies and infrastructure development, further contribute to industry expansion.

Obstacles in the Myanmar Maize Industry Market

The Myanmar maize industry faces various challenges. Regulatory hurdles, including licensing and import/export restrictions, can complicate operations. Supply chain disruptions, due to infrastructure limitations or political instability, can affect production and distribution. Intense competition from both domestic and international players creates pressure on pricing and profitability. These factors, along with others, may impact overall growth and require detailed consideration.

Future Opportunities in Myanmar Maize Industry

The Myanmar maize industry presents several promising opportunities. Growing domestic demand and potential for increased exports create significant market expansion. Technological advancements in seed genetics, precision farming, and post-harvest technologies offer avenues for improved efficiency and higher yields. New market segments, such as value-added maize products, provide diversification opportunities.

Major Players in the Myanmar Maize Industry Ecosystem

- Dagon Group

- Myanma Awba Group

- Charoen Pokphand Group

- Groupe Limagrain

- Nongwoo Seed Myanmar In

- KNOWN-YOU SEED CO LTD

- East West Seed Myanmar Co Ltd

- Corteva Agriscience

Key Developments in Myanmar Maize Industry Industry

- June 2021: The International Maize and Wheat Improvement Center (CIMMYT) and Syngenta jointly developed a drought-tolerant hybrid maize variety, TA5085, commercially registered as ASC 108 by Ayeyarwady Seed in Myanmar. This development significantly improves crop resilience in drought-prone areas, boosting overall yields and farmer incomes.

- June 2022: Myanmar Awba Industry Company Limited (MAIC) relocated its operations to a new industrial zone, enhancing its capacity to provide affordable, high-quality maize seeds and other agri-products to Myanmar farmers. This improves distribution efficiency and strengthens the company's market presence.

- December 2022: The Myanmar Rice Federation constructed 10-ton maize dryer machines in Shan State, improving post-harvest handling and reducing losses, which enhances the quality and market value of maize.

Strategic Myanmar Maize Industry Market Forecast

The Myanmar maize industry is poised for significant growth over the forecast period (2025-2033), driven by increasing domestic demand, supportive government policies, and technological advancements in seed development and farming practices. The focus on improved varieties, especially drought-resistant hybrids, will enhance productivity and mitigate the impact of climate change. Continued investment in infrastructure and supply chain improvements will further stimulate market expansion, creating attractive opportunities for investors and stakeholders.

Myanmar Maize Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Myanmar Maize Industry Segmentation By Geography

- 1. Myanmar

Myanmar Maize Industry Regional Market Share

Geographic Coverage of Myanmar Maize Industry

Myanmar Maize Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.90% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Shortage of Skilled Labor; Government Support to Enhance Farm Mechanization

- 3.3. Market Restrains

- 3.3.1. Heavy Initial Procurement Cost and High Expenditure on Maintenance

- 3.4. Market Trends

- 3.4.1 Rising Domestic Production

- 3.4.2 and Multiple Industry Application of Maize

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Myanmar Maize Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Myanmar

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Dagon Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Myanma Awba Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Charoen Pokphand Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Groupe Limagrain

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Nongwoo Seed Myanmar In

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 KNOWN-YOU SEED CO LTD

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 East West Seed Myanmar Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Corteva Agriscience

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Dagon Group

List of Figures

- Figure 1: Myanmar Maize Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Myanmar Maize Industry Share (%) by Company 2025

List of Tables

- Table 1: Myanmar Maize Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Myanmar Maize Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Myanmar Maize Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Myanmar Maize Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Myanmar Maize Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Myanmar Maize Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Myanmar Maize Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Myanmar Maize Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Myanmar Maize Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Myanmar Maize Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Myanmar Maize Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Myanmar Maize Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Myanmar Maize Industry?

The projected CAGR is approximately 5.90%.

2. Which companies are prominent players in the Myanmar Maize Industry?

Key companies in the market include Dagon Group, Myanma Awba Group, Charoen Pokphand Group, Groupe Limagrain, Nongwoo Seed Myanmar In, KNOWN-YOU SEED CO LTD, East West Seed Myanmar Co Ltd, Corteva Agriscience.

3. What are the main segments of the Myanmar Maize Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 18.68 Million as of 2022.

5. What are some drivers contributing to market growth?

Shortage of Skilled Labor; Government Support to Enhance Farm Mechanization.

6. What are the notable trends driving market growth?

Rising Domestic Production. and Multiple Industry Application of Maize.

7. Are there any restraints impacting market growth?

Heavy Initial Procurement Cost and High Expenditure on Maintenance.

8. Can you provide examples of recent developments in the market?

December 2022: The Myanmar Rice Federation constructed 10-ton maize dryer machines at YaKyo village in Nyaung Shwe township of Shan State, which will operate the process of drying corn seed.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Myanmar Maize Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Myanmar Maize Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Myanmar Maize Industry?

To stay informed about further developments, trends, and reports in the Myanmar Maize Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence