Key Insights

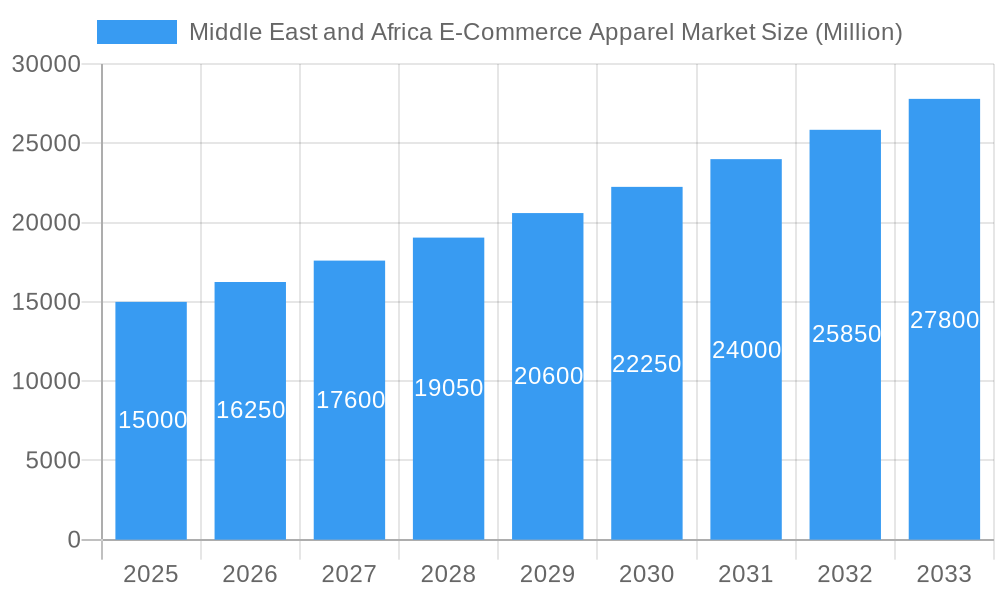

The Middle East and Africa (MEA) e-commerce apparel market is experiencing robust growth, driven by increasing internet and smartphone penetration, a burgeoning young population with a strong preference for online shopping, and a rising middle class with increased disposable income. The market's Compound Annual Growth Rate (CAGR) of 8.72% from 2019 to 2024 indicates a significant upward trajectory, projected to continue in the forecast period (2025-2033). Key segments within the MEA market include formal wear, casual wear, and sportswear, catering to both men and women, with kids/children's apparel also showing promising growth. The dominance of third-party retailers is notable, although company-owned websites are steadily gaining traction as brands invest more heavily in their direct-to-consumer strategies. Strong competition exists among major international and regional players, including Giorgio Armani, Landmark Group, Adidas, Burberry, and Inditex, reflecting the market's attractiveness and potential for further expansion. Growth is particularly strong in key markets like the UAE, South Africa, and Saudi Arabia, although opportunities exist across the broader MEA region as e-commerce infrastructure improves and consumer confidence continues to rise. Factors such as improved logistics and delivery services, wider payment gateway options, and increased trust in online platforms are further accelerating market expansion.

Middle East and Africa E-Commerce Apparel Market Market Size (In Billion)

The market's growth is, however, not without its challenges. Concerns regarding counterfeit products, inconsistent sizing and quality across online retailers, and data security remain obstacles that need addressing. Moreover, the varying levels of internet access and digital literacy across the MEA region create pockets of opportunity and constraints. To capitalize fully on the market's potential, businesses must focus on building consumer trust, streamlining the online shopping experience, and adopting localized strategies that cater to the diverse cultural and consumer preferences within the region. This includes offering multiple payment options, multilingual websites and customer service, and targeted marketing campaigns that resonate with local demographics. Successful players will be those that can effectively navigate the complexities of the region, overcome existing limitations, and adapt to the constantly evolving digital landscape.

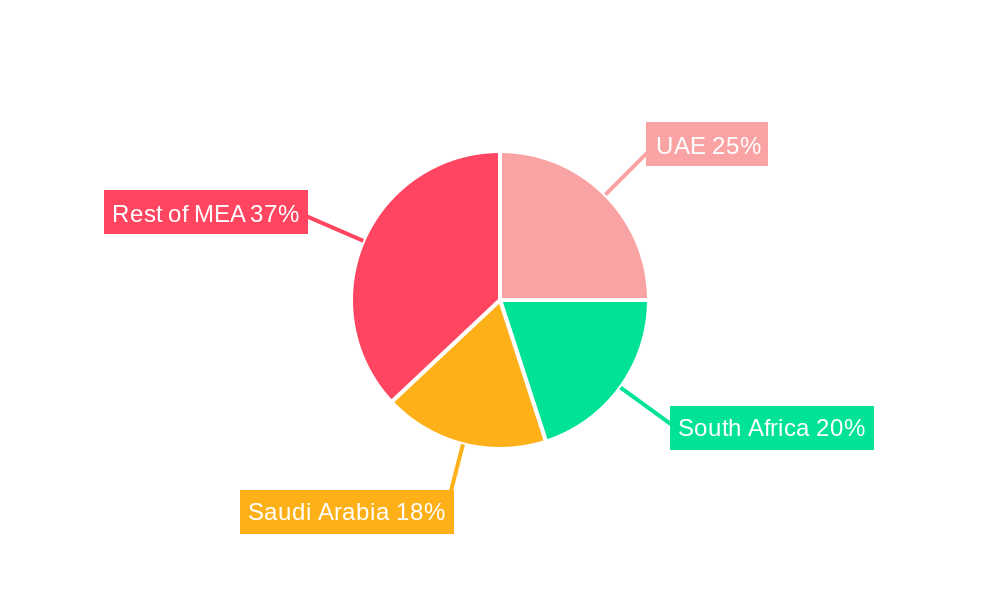

Middle East and Africa E-Commerce Apparel Market Company Market Share

Middle East and Africa E-Commerce Apparel Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Middle East and Africa e-commerce apparel market, offering a comprehensive overview of its current state, future trajectory, and key players. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. This report is essential for stakeholders seeking to understand the dynamics of this rapidly evolving market and capitalize on emerging opportunities. The total market value is predicted to reach xx Million by 2033.

Middle East and Africa E-Commerce Apparel Market Market Composition & Trends

This section evaluates the competitive landscape, innovative drivers, regulatory frameworks, substitute products, end-user demographics, and merger & acquisition (M&A) activities within the Middle East and Africa e-commerce apparel market. The market exhibits a moderately concentrated structure, with major players like H&M, Inditex, and Landmark Group holding significant market share. However, a multitude of smaller, niche players are also contributing to market dynamism.

- Market Share Distribution (2024): H&M (xx%), Inditex (xx%), Landmark Group (xx%), Others (xx%). These figures are estimates based on available data.

- Innovation Catalysts: The rise of social commerce, personalized recommendations, and augmented reality (AR) shopping experiences are driving innovation.

- Regulatory Landscape: Varying regulations across different countries within the region present both challenges and opportunities for market players.

- Substitute Products: The rise of secondhand apparel and rental services presents a notable challenge to the market.

- End-User Profiles: A young and growing population, coupled with rising disposable incomes, particularly in urban centers, fuels demand for online apparel purchases.

- M&A Activities (2019-2024): Total M&A deal value estimated at xx Million, reflecting increased consolidation within the industry. Specific deals are detailed further within the report.

Middle East and Africa E-Commerce Apparel Market Industry Evolution

This section analyzes the historical growth trajectory (2019-2024), technological advancements, and evolving consumer preferences that shape the Middle East and Africa e-commerce apparel market. The market experienced significant growth during the historical period, driven by increasing internet and smartphone penetration, along with a preference shift towards online shopping convenience. Technological advancements like improved logistics, mobile payment systems, and personalized online shopping experiences have further fueled market expansion. Shifting consumer demands towards sustainable and ethically sourced apparel are also influencing market trends. The compound annual growth rate (CAGR) during 2019-2024 is estimated at xx%, with an expected CAGR of xx% during the forecast period (2025-2033). This growth is predicted to be influenced by factors such as increased disposable incomes, a young and tech-savvy population, and the continuous improvement of e-commerce infrastructure and logistics.

Leading Regions, Countries, or Segments in Middle East and Africa E-Commerce Apparel Market

This section pinpoints the leading segments within the Middle East and Africa e-commerce apparel market across Product Type, End User, and Platform Type. Analysis highlights dominance factors and key drivers.

- Dominant Region: The UAE and South Africa are currently leading the market, benefiting from strong e-commerce infrastructure and high internet penetration rates.

- Dominant Product Type: Casual wear holds the largest market share, driven by everyday demand and affordability.

- Dominant End User: Women's apparel accounts for the largest segment, influenced by diverse fashion preferences and higher online shopping engagement.

- Dominant Platform Type: Third-party retailers currently hold a larger market share due to their established infrastructure and wider consumer reach.

Key Drivers:

- High Smartphone Penetration: Facilitates easy access to online shopping platforms.

- Growing Middle Class: Increases disposable incomes and spending power on apparel.

- Government Initiatives: Support for e-commerce development in several countries.

Middle East and Africa E-Commerce Apparel Market Product Innovations

Recent innovations in the Middle East and Africa e-commerce apparel market include the integration of AR/VR technologies for virtual try-ons, the rise of personalized recommendations through AI algorithms, and the growing popularity of sustainable and ethically produced clothing. These innovations enhance the customer experience, improve efficiency, and cater to evolving consumer preferences, providing unique selling propositions and driving market growth.

Propelling Factors for Middle East and Africa E-Commerce Apparel Market Growth

The growth of the Middle East and Africa e-commerce apparel market is being driven by several factors. Technological advancements like improved logistics, mobile payments, and AI-powered personalization enhance customer experience. The expanding middle class and rising disposable incomes lead to increased spending on apparel. Favorable government policies supporting e-commerce further accelerate market expansion. Finally, the increasing preference for online shopping convenience amongst younger demographics significantly contributes to this growth.

Obstacles in the Middle East and Africa E-Commerce Apparel Market Market

Several challenges hinder the growth of the Middle East and Africa e-commerce apparel market. Regulatory inconsistencies across different countries create complexity for businesses. Supply chain disruptions, particularly those relating to international shipping, can affect timely deliveries. Intense competition among existing players and the emergence of new entrants maintain considerable pressure on profit margins and market share.

Future Opportunities in Middle East and Africa E-Commerce Apparel Market

The Middle East and Africa e-commerce apparel market presents significant opportunities. Expanding into underserved markets within the region offers immense potential. Leveraging emerging technologies such as blockchain for improved supply chain transparency and AI for more personalized shopping experiences will be crucial. Catering to growing demand for sustainable and ethical fashion presents a further avenue for innovation and growth.

Major Players in the Middle East and Africa E-Commerce Apparel Market Ecosystem

- Giorgio Armani S p A

- Landmark Group

- Adidas AG

- Burberry Group PLC

- Valentino Fashion Group S p A

- Industria de Diseño Textil S A (INDITEX)

- Prada S p A

- Dolce & Gabbana S r l

- LVMH Moët Hennessy Louis Vuitton

- H & M Hennes & Mauritz AB

- PVH Corp

*List Not Exhaustive

Key Developments in Middle East and Africa E-Commerce Apparel Market Industry

- March 2023: H&M launched its Limited Edition 2023 Ramadan collection in three capsules, priced from DHS 139, boosting sales during a key religious period.

- February 2023: H&M South Africa partnered with Superbalist to expand its online presence across the country, increasing market reach.

- March 2022: H&M launched its 'H&M Ramadan & Eid Statements 2022' collection across select stores and e-commerce platforms, capitalizing on seasonal demand.

Strategic Middle East and Africa E-Commerce Apparel Market Market Forecast

The Middle East and Africa e-commerce apparel market is poised for substantial growth, driven by sustained technological advancements, rising disposable incomes, and favorable government support. The increasing adoption of online shopping, coupled with the expansion of e-commerce infrastructure, is expected to further propel market expansion. This growth will be particularly significant in emerging markets within the region, presenting exciting opportunities for both established and new players. The market is predicted to witness a strong upward trajectory in the coming years, with significant value creation for businesses strategically positioned within this dynamic sector.

Middle East and Africa E-Commerce Apparel Market Segmentation

-

1. Product Type

- 1.1. Formal Wear

- 1.2. Casual Wear

- 1.3. Sportswear

- 1.4. Nightwear

- 1.5. Other Types

-

2. End User

- 2.1. Men

- 2.2. Women

- 2.3. Kids/Children

-

3. Platform Type

- 3.1. Third Party Retailer

- 3.2. Company's Own Website

-

4. Geography

- 4.1. Saudi Arabia

- 4.2. South Africa

- 4.3. Rest of Middle East & Africa

Middle East and Africa E-Commerce Apparel Market Segmentation By Geography

- 1. Saudi Arabia

- 2. South Africa

- 3. Rest of Middle East

Middle East and Africa E-Commerce Apparel Market Regional Market Share

Geographic Coverage of Middle East and Africa E-Commerce Apparel Market

Middle East and Africa E-Commerce Apparel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.72% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Internet Penetration and Increased Social Media Usage Boosting the Market; Seasonal Demand Surge & Discounts in Online Stores Driving the Market

- 3.3. Market Restrains

- 3.3.1. Availability of Counterfeit Products Restricting the Market Growth

- 3.4. Market Trends

- 3.4.1. Rising Internet Penetration & Increased Social Media Usage Boosting the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa E-Commerce Apparel Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Formal Wear

- 5.1.2. Casual Wear

- 5.1.3. Sportswear

- 5.1.4. Nightwear

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Men

- 5.2.2. Women

- 5.2.3. Kids/Children

- 5.3. Market Analysis, Insights and Forecast - by Platform Type

- 5.3.1. Third Party Retailer

- 5.3.2. Company's Own Website

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Saudi Arabia

- 5.4.2. South Africa

- 5.4.3. Rest of Middle East & Africa

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Saudi Arabia

- 5.5.2. South Africa

- 5.5.3. Rest of Middle East

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Saudi Arabia Middle East and Africa E-Commerce Apparel Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Formal Wear

- 6.1.2. Casual Wear

- 6.1.3. Sportswear

- 6.1.4. Nightwear

- 6.1.5. Other Types

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Men

- 6.2.2. Women

- 6.2.3. Kids/Children

- 6.3. Market Analysis, Insights and Forecast - by Platform Type

- 6.3.1. Third Party Retailer

- 6.3.2. Company's Own Website

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Saudi Arabia

- 6.4.2. South Africa

- 6.4.3. Rest of Middle East & Africa

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South Africa Middle East and Africa E-Commerce Apparel Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Formal Wear

- 7.1.2. Casual Wear

- 7.1.3. Sportswear

- 7.1.4. Nightwear

- 7.1.5. Other Types

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Men

- 7.2.2. Women

- 7.2.3. Kids/Children

- 7.3. Market Analysis, Insights and Forecast - by Platform Type

- 7.3.1. Third Party Retailer

- 7.3.2. Company's Own Website

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Saudi Arabia

- 7.4.2. South Africa

- 7.4.3. Rest of Middle East & Africa

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Rest of Middle East Middle East and Africa E-Commerce Apparel Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Formal Wear

- 8.1.2. Casual Wear

- 8.1.3. Sportswear

- 8.1.4. Nightwear

- 8.1.5. Other Types

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Men

- 8.2.2. Women

- 8.2.3. Kids/Children

- 8.3. Market Analysis, Insights and Forecast - by Platform Type

- 8.3.1. Third Party Retailer

- 8.3.2. Company's Own Website

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. Saudi Arabia

- 8.4.2. South Africa

- 8.4.3. Rest of Middle East & Africa

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Giorgio Armani S p A

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Landmark Group

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Adidas AG

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Burberry Group PLC

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Valentino Fashion Group S p A

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Industria de Diseño Textil S A (INDITEX)

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Prada S p A

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Dolce & Gabbana S r l

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 LVMH Moët Hennessy Louis Vuitton

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 H & M Hennes & Mauritz AB

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.11 PVH Corp *List Not Exhaustive

- 9.2.11.1. Overview

- 9.2.11.2. Products

- 9.2.11.3. SWOT Analysis

- 9.2.11.4. Recent Developments

- 9.2.11.5. Financials (Based on Availability)

- 9.2.1 Giorgio Armani S p A

List of Figures

- Figure 1: Middle East and Africa E-Commerce Apparel Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Middle East and Africa E-Commerce Apparel Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East and Africa E-Commerce Apparel Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Middle East and Africa E-Commerce Apparel Market Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Middle East and Africa E-Commerce Apparel Market Revenue Million Forecast, by Platform Type 2020 & 2033

- Table 4: Middle East and Africa E-Commerce Apparel Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 5: Middle East and Africa E-Commerce Apparel Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Middle East and Africa E-Commerce Apparel Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 7: Middle East and Africa E-Commerce Apparel Market Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Middle East and Africa E-Commerce Apparel Market Revenue Million Forecast, by Platform Type 2020 & 2033

- Table 9: Middle East and Africa E-Commerce Apparel Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: Middle East and Africa E-Commerce Apparel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Middle East and Africa E-Commerce Apparel Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 12: Middle East and Africa E-Commerce Apparel Market Revenue Million Forecast, by End User 2020 & 2033

- Table 13: Middle East and Africa E-Commerce Apparel Market Revenue Million Forecast, by Platform Type 2020 & 2033

- Table 14: Middle East and Africa E-Commerce Apparel Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 15: Middle East and Africa E-Commerce Apparel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Middle East and Africa E-Commerce Apparel Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 17: Middle East and Africa E-Commerce Apparel Market Revenue Million Forecast, by End User 2020 & 2033

- Table 18: Middle East and Africa E-Commerce Apparel Market Revenue Million Forecast, by Platform Type 2020 & 2033

- Table 19: Middle East and Africa E-Commerce Apparel Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 20: Middle East and Africa E-Commerce Apparel Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa E-Commerce Apparel Market?

The projected CAGR is approximately 8.72%.

2. Which companies are prominent players in the Middle East and Africa E-Commerce Apparel Market?

Key companies in the market include Giorgio Armani S p A, Landmark Group, Adidas AG, Burberry Group PLC, Valentino Fashion Group S p A, Industria de Diseño Textil S A (INDITEX), Prada S p A, Dolce & Gabbana S r l, LVMH Moët Hennessy Louis Vuitton, H & M Hennes & Mauritz AB, PVH Corp *List Not Exhaustive.

3. What are the main segments of the Middle East and Africa E-Commerce Apparel Market?

The market segments include Product Type, End User, Platform Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Internet Penetration and Increased Social Media Usage Boosting the Market; Seasonal Demand Surge & Discounts in Online Stores Driving the Market.

6. What are the notable trends driving market growth?

Rising Internet Penetration & Increased Social Media Usage Boosting the Market.

7. Are there any restraints impacting market growth?

Availability of Counterfeit Products Restricting the Market Growth.

8. Can you provide examples of recent developments in the market?

March 2023: H&M announced the launch of its Limited Edition 2023 collection for Ramadan. The products were launched in three unique capsules. The H&M Limited Edition 2023 collection prices ranged from DHS 139 in different sizes XS-XL. The first 'Ramadan Ready capsule went on sale online and in a few select stores on March 2, 2023. The second one went on sale on March 16 of that same year, and the last one went on sale on April 6 of that same year.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa E-Commerce Apparel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa E-Commerce Apparel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa E-Commerce Apparel Market?

To stay informed about further developments, trends, and reports in the Middle East and Africa E-Commerce Apparel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence