Key Insights

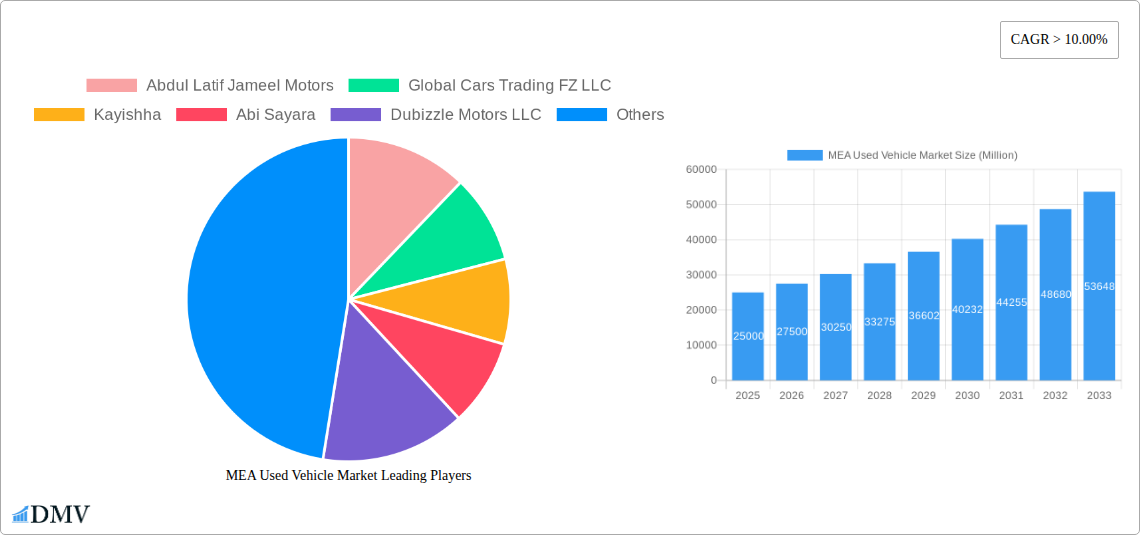

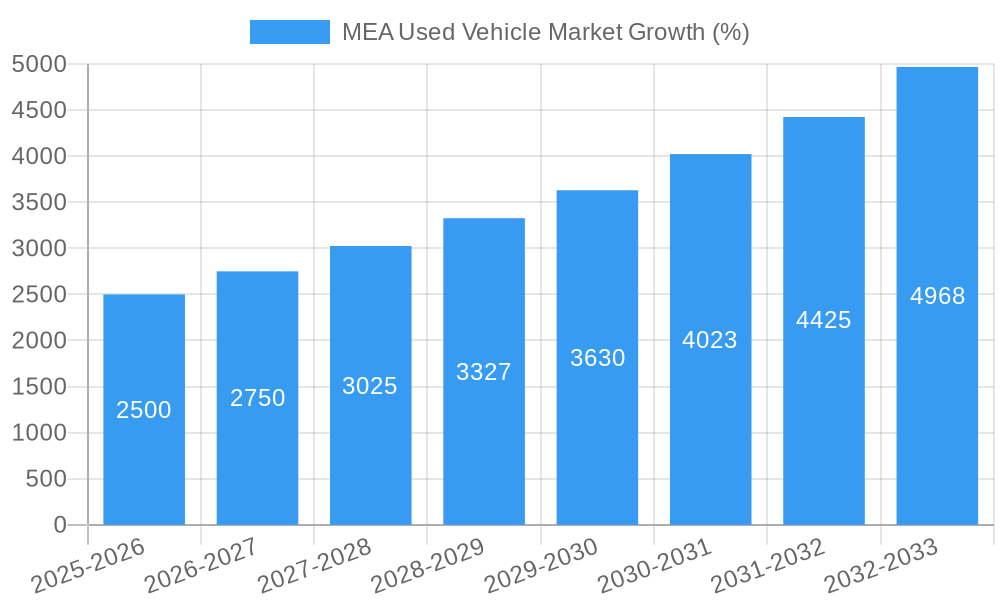

The Middle East and Africa (MEA) used vehicle market is experiencing robust growth, fueled by several key factors. The market's substantial size, coupled with a Compound Annual Growth Rate (CAGR) exceeding 10%, signifies significant investment potential. Rising disposable incomes across several MEA nations, particularly in the UAE, Saudi Arabia, and Egypt, are driving increased demand for personal vehicles. Furthermore, the pre-owned vehicle market offers more affordable options compared to new vehicles, making it attractive to a wider consumer base. The segment is diverse, encompassing various vehicle types like hatchbacks, sedans, and SUVs, catering to diverse preferences and budgets. While organized vendors like Abdul Latif Jameel Motors and Al-Futtaim Group dominate the market, the substantial presence of unorganized vendors indicates a dynamic, competitive landscape. Challenges include fluctuating fuel prices, economic volatility in certain regions, and varying levels of vehicle maintenance and regulation across the MEA. However, the ongoing expansion of online marketplaces like Dubizzle Motors LLC and Yallamotor is streamlining the buying and selling processes, boosting market accessibility and transparency. Future growth will likely be shaped by government regulations on used car imports, evolving consumer preferences towards fuel-efficient vehicles, and the increasing adoption of digital technologies in the automotive sector. The forecast period (2025-2033) promises continued expansion driven by sustained economic growth and increasing urbanization within the region.

The continued growth trajectory of the MEA used vehicle market is projected to be influenced by several factors. Government initiatives promoting sustainable transportation and stricter emission regulations will likely accelerate the shift towards more fuel-efficient used vehicles. This transition will present both opportunities and challenges for market players. The emergence of innovative financing options and insurance products specifically tailored to the used vehicle market will also play a crucial role in driving market penetration. Moreover, increasing awareness regarding vehicle history reports and certification programs can enhance consumer confidence and market transparency. The competitive landscape will continue to evolve, with both established players and new entrants vying for market share. Strategic partnerships, technological advancements, and improved customer service will be essential for success in this dynamic market. The ongoing expansion of the region's economy and population will continue to fuel demand, making the MEA used vehicle market an attractive investment prospect for both local and international players.

MEA Used Vehicle Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Middle East and Africa (MEA) used vehicle market, covering the period from 2019 to 2033. It offers a comprehensive overview of market dynamics, key players, growth drivers, and future opportunities, equipping stakeholders with the knowledge to make informed decisions in this dynamic sector. The report leverages extensive data analysis to provide accurate forecasts and in-depth insights into market trends. The total market value is estimated at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting significant growth potential.

MEA Used Vehicle Market Composition & Trends

This section delves into the intricate structure of the MEA used vehicle market, evaluating market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and mergers & acquisitions (M&A) activities. The market is characterized by a diverse range of players, with a notable presence of both organized and unorganized vendors. Market share distribution is analyzed across key players like Abdul Latif Jameel Motors, Global Cars Trading FZ LLC, Kayishha, Abi Sayara, Dubizzle Motors LLC, Al-Futtaim Group, Yallamotor, and Bavaria Motors. However, the market is fragmented, with several smaller players contributing significantly.

- Market Concentration: The MEA used vehicle market exhibits a moderately fragmented structure, with no single dominant player commanding a significant majority of the market share.

- Innovation Catalysts: Technological advancements, particularly in online marketplaces and vehicle inspection technologies, are driving innovation.

- Regulatory Landscape: Varying regulations across MEA countries influence market dynamics, impacting vehicle import/export, pricing, and safety standards.

- Substitute Products: Public transportation and ride-sharing services pose a competitive threat to the used vehicle market.

- End-User Profiles: The demand for used vehicles is driven by a diverse range of end-users, including individual buyers, rental companies, and fleet operators.

- M&A Activities: The report analyzes significant M&A deals in the MEA used vehicle market, providing insights into deal values and their impact on market consolidation. Total M&A deal value from 2019-2024 is estimated at xx Million.

MEA Used Vehicle Market Industry Evolution

This section analyzes the evolution of the MEA used vehicle market, examining market growth trajectories, technological advancements, and shifting consumer preferences. The market has witnessed substantial growth during the historical period (2019-2024) fueled by rising disposable incomes, increasing urbanization, and growing demand for personal transportation. Technological advancements like online marketplaces have significantly enhanced accessibility and transparency. Consumer preferences are also shifting towards fuel-efficient and technologically advanced vehicles. The Compound Annual Growth Rate (CAGR) during 2019-2024 was xx%, and the forecast period (2025-2033) projects a CAGR of xx%. This growth is influenced by factors such as rising population, improving infrastructure, and government initiatives promoting vehicle ownership (with regional variations).

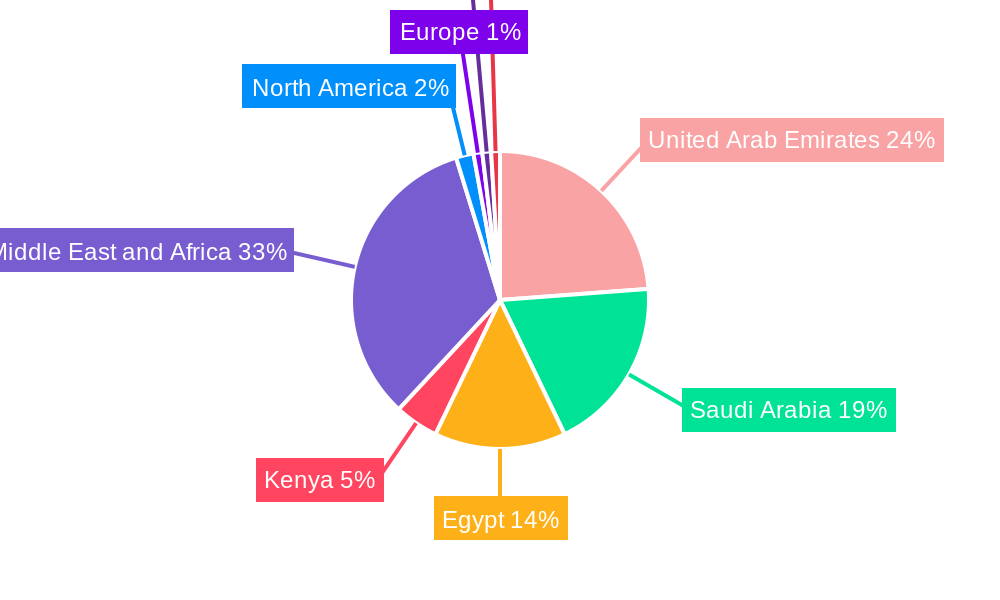

Leading Regions, Countries, or Segments in MEA Used Vehicle Market

The United Arab Emirates (UAE) and Saudi Arabia currently dominate the MEA used vehicle market. The strong economies of these countries, coupled with supportive government policies, are driving higher demand. The SUV segment is the leading vehicle type, followed by sedans and hatchbacks. The organized vendor segment holds a larger market share compared to the unorganized sector.

- Key Drivers for UAE Dominance:

- High disposable incomes and a large expatriate population.

- Well-developed infrastructure and robust automotive sector.

- Supportive government policies towards the automotive industry.

- Key Drivers for Saudi Arabia Dominance:

- Rapid economic growth and a rising middle class.

- Government initiatives promoting infrastructure development.

- Expanding transportation sector.

- SUV Segment Dominance:

- Growing preference for spacious and versatile vehicles.

- Increasing popularity of SUVs among families and young professionals.

- Organized Vendor Dominance:

- Growing consumer preference for organized dealerships, offering greater transparency, warranty, and financing options.

MEA Used Vehicle Market Product Innovations

Recent product innovations focus on enhancing the online vehicle buying experience, improving vehicle inspection processes, and offering extended warranties. Platforms offering virtual test drives and digital financing options are gaining traction. The introduction of sophisticated vehicle history reports helps build consumer trust and provides accurate information on vehicle condition, creating a transparent market.

Propelling Factors for MEA Used Vehicle Market Growth

Several factors are driving the growth of the MEA used vehicle market: Rising disposable incomes in several MEA countries are empowering more consumers to purchase vehicles, leading to increased demand. The expansion of online marketplaces offering diverse selection, competitive pricing, and convenient transactions fosters market growth. Moreover, favorable government policies and infrastructure improvements in various regions contribute to this upward trend.

Obstacles in the MEA Used Vehicle Market

The MEA used vehicle market faces several challenges, including inconsistent vehicle quality control, impacting consumer trust. The lack of standardized vehicle inspection processes across all markets hinders transparent transactions. Furthermore, supply chain disruptions stemming from global events and economic fluctuations negatively impact vehicle availability and pricing. The informal sector continues to present issues in terms of accurate market tracking.

Future Opportunities in MEA Used Vehicle Market

The MEA used vehicle market presents promising growth opportunities. Expanding into underserved regions within MEA offers significant untapped potential. Innovations such as blockchain technology for transparent transactions and AI-powered vehicle valuation tools offer new avenues for growth. Moreover, incorporating sustainable practices into the market, like promoting fuel-efficient vehicles, can capitalize on the growing environmental consciousness among consumers.

Major Players in the MEA Used Vehicle Market Ecosystem

- Abdul Latif Jameel Motors

- Global Cars Trading FZ LLC

- Kayishha

- Abi Sayara

- Dubizzle Motors LLC

- Al-Futtaim Group

- Yallamotor

- Bavaria Motors

- List Not Exhaustive

Key Developments in MEA Used Vehicle Market Industry

- March 2022: ADIB (Abu Dhabi Islamic Bank) launched the UAE's largest digital car marketplace, significantly enhancing the online vehicle buying experience and boosting market transparency. This initiative streamlined the car buying process, enabling consumers to search for cars, schedule test drives, obtain insurance quotes, and apply for financing all within a single platform. This impacted the market by increasing consumer confidence and driving online sales.

Strategic MEA Used Vehicle Market Forecast

The MEA used vehicle market is poised for continued growth driven by several factors such as the rising middle class, increased urbanization, improving infrastructure, and the increasing adoption of online platforms. New technologies and services, such as digital marketplaces and innovative financing solutions, will continue to shape the market landscape. The market's sustained growth trajectory promises significant opportunities for existing and new players, creating a dynamic and competitive environment.

MEA Used Vehicle Market Segmentation

-

1. Vehicle Type

- 1.1. Hachbacks

- 1.2. Sedan

- 1.3. Sports Utility vehicles (SUV)

-

2. Vendor Type

- 2.1. Organized

- 2.2. Unorganized

MEA Used Vehicle Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

MEA Used Vehicle Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 10.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Increasing Demand for Luxury Cars is Anticipated to Boost the Market

- 3.3. Market Restrains

- 3.3.1. Comparatively Limited Market Transparency May Hinder the Market

- 3.4. Market Trends

- 3.4.1. Shift towards Unorganized Vendor to Elevate Used Cars Sales In Middle-East and Africa

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global MEA Used Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Hachbacks

- 5.1.2. Sedan

- 5.1.3. Sports Utility vehicles (SUV)

- 5.2. Market Analysis, Insights and Forecast - by Vendor Type

- 5.2.1. Organized

- 5.2.2. Unorganized

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North America MEA Used Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Hachbacks

- 6.1.2. Sedan

- 6.1.3. Sports Utility vehicles (SUV)

- 6.2. Market Analysis, Insights and Forecast - by Vendor Type

- 6.2.1. Organized

- 6.2.2. Unorganized

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. South America MEA Used Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Hachbacks

- 7.1.2. Sedan

- 7.1.3. Sports Utility vehicles (SUV)

- 7.2. Market Analysis, Insights and Forecast - by Vendor Type

- 7.2.1. Organized

- 7.2.2. Unorganized

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Europe MEA Used Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Hachbacks

- 8.1.2. Sedan

- 8.1.3. Sports Utility vehicles (SUV)

- 8.2. Market Analysis, Insights and Forecast - by Vendor Type

- 8.2.1. Organized

- 8.2.2. Unorganized

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Middle East & Africa MEA Used Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Hachbacks

- 9.1.2. Sedan

- 9.1.3. Sports Utility vehicles (SUV)

- 9.2. Market Analysis, Insights and Forecast - by Vendor Type

- 9.2.1. Organized

- 9.2.2. Unorganized

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. Asia Pacific MEA Used Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.1.1. Hachbacks

- 10.1.2. Sedan

- 10.1.3. Sports Utility vehicles (SUV)

- 10.2. Market Analysis, Insights and Forecast - by Vendor Type

- 10.2.1. Organized

- 10.2.2. Unorganized

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 11. North America MEA Used Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Rest of North America

- 12. Europe MEA Used Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Spain

- 12.1.5 Rest of Europe

- 13. Asia Pacific MEA Used Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 India

- 13.1.2 China

- 13.1.3 Japan

- 13.1.4 Rest of Asia Pacific

- 14. Latin America MEA Used Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Mexico

- 14.1.2 Brazil

- 14.1.3 Argentina

- 15. Middle East and Africa MEA Used Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 United Arab Emirates

- 15.1.2 Saudi Arabia

- 15.1.3 Rest of Middle East and Africa

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Abdul Latif Jameel Motors

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Global Cars Trading FZ LLC

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Kayishha

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Abi Sayara

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Dubizzle Motors LLC

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Al-Futtaim Group

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Yallamotor

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Bavaria Motors*List Not Exhaustive

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.1 Abdul Latif Jameel Motors

List of Figures

- Figure 1: Global MEA Used Vehicle Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America MEA Used Vehicle Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America MEA Used Vehicle Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe MEA Used Vehicle Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe MEA Used Vehicle Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific MEA Used Vehicle Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific MEA Used Vehicle Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America MEA Used Vehicle Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America MEA Used Vehicle Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa MEA Used Vehicle Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa MEA Used Vehicle Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America MEA Used Vehicle Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 13: North America MEA Used Vehicle Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 14: North America MEA Used Vehicle Market Revenue (Million), by Vendor Type 2024 & 2032

- Figure 15: North America MEA Used Vehicle Market Revenue Share (%), by Vendor Type 2024 & 2032

- Figure 16: North America MEA Used Vehicle Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America MEA Used Vehicle Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: South America MEA Used Vehicle Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 19: South America MEA Used Vehicle Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 20: South America MEA Used Vehicle Market Revenue (Million), by Vendor Type 2024 & 2032

- Figure 21: South America MEA Used Vehicle Market Revenue Share (%), by Vendor Type 2024 & 2032

- Figure 22: South America MEA Used Vehicle Market Revenue (Million), by Country 2024 & 2032

- Figure 23: South America MEA Used Vehicle Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: Europe MEA Used Vehicle Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 25: Europe MEA Used Vehicle Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 26: Europe MEA Used Vehicle Market Revenue (Million), by Vendor Type 2024 & 2032

- Figure 27: Europe MEA Used Vehicle Market Revenue Share (%), by Vendor Type 2024 & 2032

- Figure 28: Europe MEA Used Vehicle Market Revenue (Million), by Country 2024 & 2032

- Figure 29: Europe MEA Used Vehicle Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: Middle East & Africa MEA Used Vehicle Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 31: Middle East & Africa MEA Used Vehicle Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 32: Middle East & Africa MEA Used Vehicle Market Revenue (Million), by Vendor Type 2024 & 2032

- Figure 33: Middle East & Africa MEA Used Vehicle Market Revenue Share (%), by Vendor Type 2024 & 2032

- Figure 34: Middle East & Africa MEA Used Vehicle Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Middle East & Africa MEA Used Vehicle Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Asia Pacific MEA Used Vehicle Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 37: Asia Pacific MEA Used Vehicle Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 38: Asia Pacific MEA Used Vehicle Market Revenue (Million), by Vendor Type 2024 & 2032

- Figure 39: Asia Pacific MEA Used Vehicle Market Revenue Share (%), by Vendor Type 2024 & 2032

- Figure 40: Asia Pacific MEA Used Vehicle Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Asia Pacific MEA Used Vehicle Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global MEA Used Vehicle Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global MEA Used Vehicle Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: Global MEA Used Vehicle Market Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 4: Global MEA Used Vehicle Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global MEA Used Vehicle Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States MEA Used Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada MEA Used Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Rest of North America MEA Used Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global MEA Used Vehicle Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Germany MEA Used Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United Kingdom MEA Used Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: France MEA Used Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Spain MEA Used Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of Europe MEA Used Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global MEA Used Vehicle Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: India MEA Used Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: China MEA Used Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Japan MEA Used Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Rest of Asia Pacific MEA Used Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Global MEA Used Vehicle Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Mexico MEA Used Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Brazil MEA Used Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Argentina MEA Used Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Global MEA Used Vehicle Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: United Arab Emirates MEA Used Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Saudi Arabia MEA Used Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Rest of Middle East and Africa MEA Used Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Global MEA Used Vehicle Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 29: Global MEA Used Vehicle Market Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 30: Global MEA Used Vehicle Market Revenue Million Forecast, by Country 2019 & 2032

- Table 31: United States MEA Used Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Canada MEA Used Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Mexico MEA Used Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Global MEA Used Vehicle Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 35: Global MEA Used Vehicle Market Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 36: Global MEA Used Vehicle Market Revenue Million Forecast, by Country 2019 & 2032

- Table 37: Brazil MEA Used Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Argentina MEA Used Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Rest of South America MEA Used Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Global MEA Used Vehicle Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 41: Global MEA Used Vehicle Market Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 42: Global MEA Used Vehicle Market Revenue Million Forecast, by Country 2019 & 2032

- Table 43: United Kingdom MEA Used Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Germany MEA Used Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: France MEA Used Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Italy MEA Used Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Spain MEA Used Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Russia MEA Used Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Benelux MEA Used Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Nordics MEA Used Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Rest of Europe MEA Used Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Global MEA Used Vehicle Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 53: Global MEA Used Vehicle Market Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 54: Global MEA Used Vehicle Market Revenue Million Forecast, by Country 2019 & 2032

- Table 55: Turkey MEA Used Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Israel MEA Used Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: GCC MEA Used Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: North Africa MEA Used Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: South Africa MEA Used Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Rest of Middle East & Africa MEA Used Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: Global MEA Used Vehicle Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 62: Global MEA Used Vehicle Market Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 63: Global MEA Used Vehicle Market Revenue Million Forecast, by Country 2019 & 2032

- Table 64: China MEA Used Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 65: India MEA Used Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: Japan MEA Used Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 67: South Korea MEA Used Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 68: ASEAN MEA Used Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 69: Oceania MEA Used Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 70: Rest of Asia Pacific MEA Used Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the MEA Used Vehicle Market?

The projected CAGR is approximately > 10.00%.

2. Which companies are prominent players in the MEA Used Vehicle Market?

Key companies in the market include Abdul Latif Jameel Motors, Global Cars Trading FZ LLC, Kayishha, Abi Sayara, Dubizzle Motors LLC, Al-Futtaim Group, Yallamotor, Bavaria Motors*List Not Exhaustive.

3. What are the main segments of the MEA Used Vehicle Market?

The market segments include Vehicle Type, Vendor Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

The Increasing Demand for Luxury Cars is Anticipated to Boost the Market.

6. What are the notable trends driving market growth?

Shift towards Unorganized Vendor to Elevate Used Cars Sales In Middle-East and Africa.

7. Are there any restraints impacting market growth?

Comparatively Limited Market Transparency May Hinder the Market.

8. Can you provide examples of recent developments in the market?

In March 2022, ADIB (Abu Dhabi Islamic Bank) launched the emirates' largest digital car marketplace. Using this digital marketplace, on a single view, consumers can easily search for cars from a wide network of dealers and distributors, schedule a test drive, obtain an insurance quote for the car, and apply for financing for the same. The company discussed the issue with all 775 car dealers in UAE and finally made this digital portal for ease for buyers so that they can have their car from home itself.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "MEA Used Vehicle Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the MEA Used Vehicle Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the MEA Used Vehicle Market?

To stay informed about further developments, trends, and reports in the MEA Used Vehicle Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence