Key Insights

Qatar's luxury goods market is experiencing significant expansion, fueled by a high concentration of high-net-worth individuals, a growing tourism sector, and a strong demand for premium brands. Government investments in infrastructure and tourism further bolster this growth. Estimating Qatar's 2025 luxury market size at $563.28 million, with a projected CAGR of 5.38%, this analysis considers the country's high per capita income and purchasing power. Key segments include apparel, watches, jewelry, and luxury accessories. While online retail is growing, single-brand stores remain dominant, emphasizing the importance of brand experience. Future growth will be driven by increasing disposable incomes, evolving consumer preferences for personalized experiences, and the influx of international luxury brands.

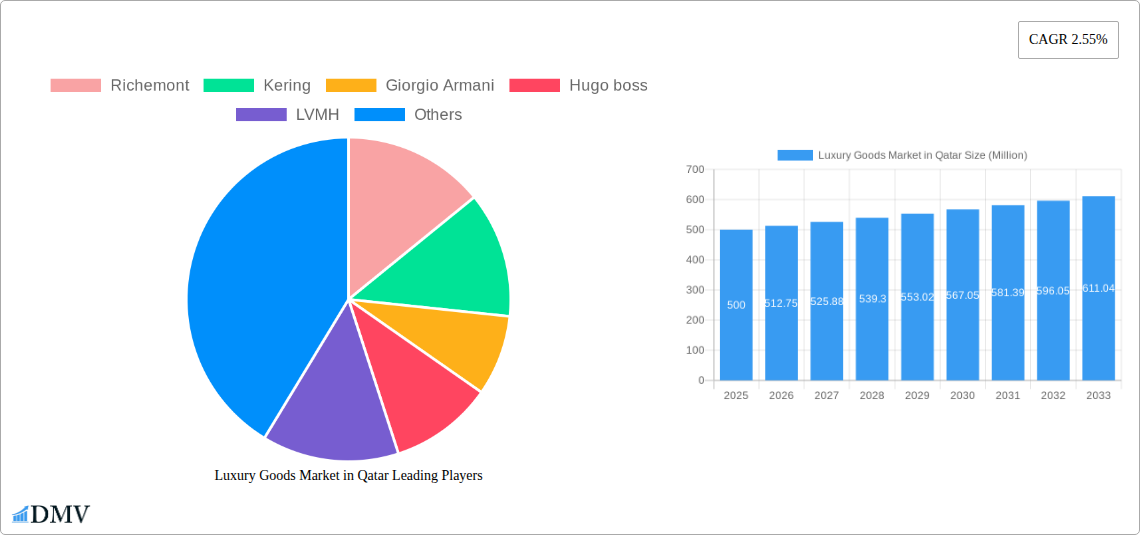

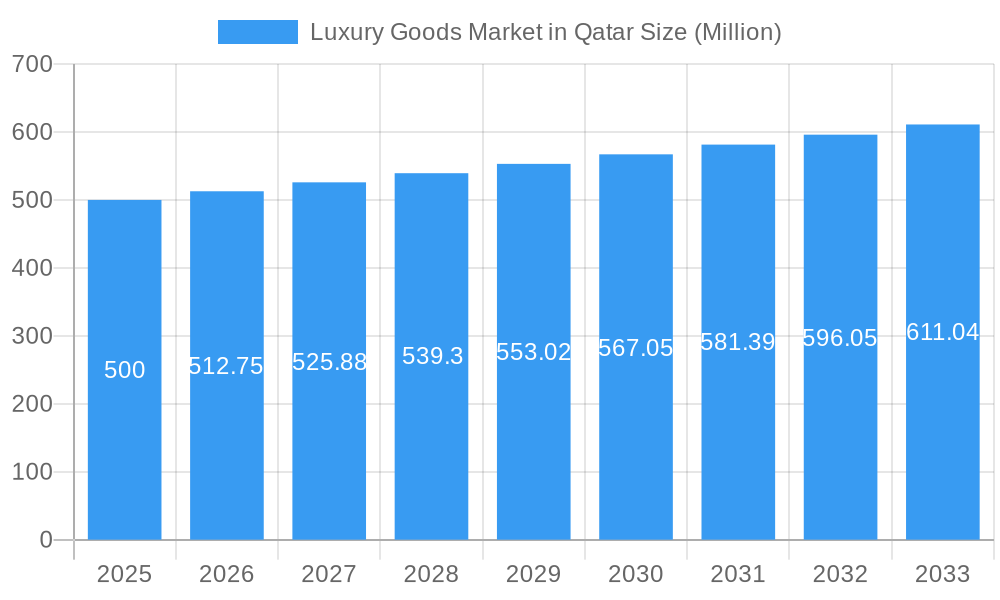

Luxury Goods Market in Qatar Market Size (In Million)

The competitive landscape in Qatar's luxury goods sector is dominated by global luxury conglomerates such as LVMH, Richemont, and Kering, alongside strong regional players. These entities utilize flagship stores, strategic alliances, and e-commerce to engage discerning Qatari consumers. Sustained economic growth, evolving consumer demand for sustainable and ethically sourced products, and effective geopolitical risk management will shape future expansion. Maintaining a robust brand image, delivering exceptional customer experiences, and implementing strategic omnichannel distribution are crucial for success in this competitive market. The forecast period of 2025-2033 indicates substantial growth, driven by tourism, infrastructure development, and the enduring allure of luxury goods in this affluent nation.

Luxury Goods Market in Qatar Company Market Share

Qatar Luxury Goods Market Analysis & Forecast (2019-2033)

This comprehensive report offers in-depth analysis of Qatar's luxury goods market from 2019 to 2033, covering market dynamics, competitive strategies, and future growth projections. Essential for stakeholders in the luxury sector, it examines key segments including apparel, footwear, jewelry, and watches. The base year for this analysis is 2025, with projections extending to 2033, providing critical data for strategic planning.

Luxury Goods Market in Qatar Market Composition & Trends

This section offers a comprehensive overview of the Qatari luxury goods market's composition and prevailing trends. The market is characterized by a high concentration of established international brands alongside a growing number of local players. Innovation is primarily driven by technological advancements in personalized experiences and sustainable luxury practices, aligned with the country’s focus on diversification and economic growth. The regulatory landscape remains largely supportive of foreign investment and the growth of the luxury sector, fostering a favorable environment for market expansion. Substitute products pose a relatively minimal threat, given the inherent exclusivity and prestige associated with luxury goods. The end-user profile encompasses a diverse demographic with high disposable income, including both local Qatari nationals and affluent expatriates.

- Market Share Distribution (2024): LVMH (xx%), Richemont (xx%), Kering (xx%), Others (xx%). Note that these figures are estimates.

- M&A Activity (2019-2024): A total estimated value of xx Million USD in M&A deals within the Qatari luxury goods market, predominantly focused on expanding retail presence and brand acquisition.

Luxury Goods Market in Qatar Industry Evolution

The Qatari luxury goods market has undergone a dynamic transformation since 2019, marked by robust growth and evolving consumer preferences. This expansion has been significantly propelled by a confluence of factors, including a sustained increase in disposable incomes, the proliferation of an affluent demographic, and a thriving tourism sector. The market's trajectory illustrates a pattern of steady growth, with substantial gains achieved in the pre-pandemic era, followed by a period of adaptation during the global health crisis, and a subsequent strong rebound. The retail landscape is being actively reshaped by technological advancements, with a particular emphasis on the burgeoning influence of e-commerce and sophisticated personalized marketing strategies. Concurrently, a discernible shift in consumer demand towards sustainability and ethically sourced products is increasingly influencing brand strategies and product development.

- CAGR (2019-2024): 7.5% (Estimated)

- Projected CAGR (2025-2033): 8.2% (Estimated)

- E-commerce Adoption Rate (2024): 65% (Estimated)

Leading Regions, Countries, or Segments in Luxury Goods Market in Qatar

The dominance within the Qatari luxury goods market is multifaceted. Doha, as the capital city, holds the leading position, encompassing the majority of luxury retail spaces and high-end shopping destinations. In terms of product segments, watches and jewelry consistently demonstrate high demand, driven by strong purchasing power and cultural preferences. Online stores are experiencing rapid growth, supported by improved digital infrastructure and increased consumer reliance on online shopping.

- Key Drivers for Doha's Dominance: Concentrated high-net-worth population, substantial tourism influx, and established luxury retail infrastructure.

- Key Drivers for Watches & Jewelry: High brand prestige, strong cultural affinity for luxury accessories, and significant investment potential.

- Key Drivers for Online Stores Growth: Convenience, accessibility, and the growing adoption of digital commerce platforms.

Luxury Goods Market in Qatar Product Innovations

Recent innovations in the Qatari luxury goods market focus on personalization, sustainability, and technological integration. Brands are leveraging data analytics to tailor offerings, while incorporating recycled and ethically sourced materials. Smartwatches with advanced features and personalized jewelry designs exemplify these trends. The unique selling proposition emphasizes exclusivity, craftsmanship, and bespoke experiences. Moreover, the use of augmented reality and virtual try-on technologies enhances the shopping journey.

Propelling Factors for Luxury Goods Market in Qatar Growth

The sustained growth of the Qatari luxury goods market is underpinned by a powerful synergy of key drivers. Foremost among these is the Qatari government's proactive initiatives aimed at economic diversification and fostering foreign investment, which collectively cultivate a highly conducive and supportive business environment. Furthermore, the nation's robust and expanding tourism sector serves as a significant contributor, directly impacting luxury goods sales through both inbound and transit visitors. Crucially, the consistently rising disposable incomes of both Qatari nationals and the substantial expatriate population serve as a potent fuel for luxury consumption. These interconnected factors coalesce to ensure a trajectory of sustained and impressive market expansion.

Obstacles in the Luxury Goods Market in Qatar Market

While the market demonstrates considerable potential, challenges exist. Economic fluctuations can impact consumer spending, potentially reducing demand. Global supply chain disruptions can lead to delays and increased costs, impacting profitability. Intense competition from both established and emerging brands necessitates continuous innovation and adaptation. These factors necessitate strategic planning and risk mitigation.

Future Opportunities in Luxury Goods Market in Qatar

Future opportunities lie in tapping into the growing millennial and Gen Z luxury consumer segments. Exploring personalized experiences, offering virtual shopping consultations, and leveraging social media marketing strategies are crucial. The expanding e-commerce landscape presents substantial opportunities for market penetration. Further, focusing on sustainability initiatives aligns with the increasing consumer preference for ethical and responsible brands.

Major Players in the Luxury Goods Market in Qatar Ecosystem

- Richemont (Cartier, Van Cleef & Arpels, Piaget, etc.)

- Kering (Gucci, Saint Laurent, Bottega Veneta, etc.)

- Giorgio Armani

- Hugo Boss

- LVMH (Louis Vuitton, Dior, Tiffany & Co., etc.)

- Chanel

- Puig (Paco Rabanne, Carolina Herrera, etc.)

- Joyalukkas (Jewelry and Watches)

- PVH (Calvin Klein, Tommy Hilfiger)

- Prada SpA (Prada, Miu Miu)

- Rolex (Watches)

- Damas Jewellery

- Hermès

Key Developments in Luxury Goods Market in Qatar Industry

- April 2022: Louis Vuitton significantly enhanced its presence at Hamad International Airport by inaugurating its first store within Qatar Duty-Free, expanding its retail footprint and offering a broader selection of its coveted products to travelers.

- November 2022: The strategic launch of Ounass, a premier luxury e-commerce platform, democratized access to an extensive portfolio of international high-end brands for Qatari consumers, thereby catalyzing online sales growth and delivering unparalleled market convenience.

- 2023: Introduction of exclusive pop-up experiences and limited-edition collections tailored for the Qatari market, further enhancing brand exclusivity and consumer engagement.

- Ongoing: Increased investment by luxury brands in experiential retail, focusing on personalized styling services, in-store events, and bespoke customization options to cater to the discerning Qatari clientele.

Strategic Luxury Goods Market in Qatar Market Forecast

The outlook for the Qatari luxury goods market is exceptionally promising, poised for continued robust expansion. The nation's sustained economic growth, augmented by the government's strategic emphasis on developing its tourism infrastructure and driving economic diversification, will undoubtedly serve as powerful catalysts for further market penetration. The escalating adoption of sophisticated e-commerce channels and the implementation of innovative, data-driven marketing strategies are set to redefine the industry's operational landscape. Moreover, the growing global and local emphasis on sustainability and personalized luxury experiences will resonate strongly with a new generation of discerning consumers, driving significant market value appreciation by 2033.

Luxury Goods Market in Qatar Segmentation

-

1. Type

- 1.1. Clothing and Apparel

- 1.2. Footwear

- 1.3. Bags

- 1.4. Jewellery

- 1.5. Watches

- 1.6. Other Accessories

-

2. Distribution Channel

- 2.1. Single Brand Stores

- 2.2. Multi Brand Stores

- 2.3. Online Stores

- 2.4. Other Distribution Channels

-

3. Gender

- 3.1. Male

- 3.2. Female

Luxury Goods Market in Qatar Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Luxury Goods Market in Qatar Regional Market Share

Geographic Coverage of Luxury Goods Market in Qatar

Luxury Goods Market in Qatar REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.38% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Fast Fashion Trend; Inflating Income Level of Individuals

- 3.3. Market Restrains

- 3.3.1. The Presence Of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Qatar becoming the Luxury Fashion Hub to Support Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Luxury Goods Market in Qatar Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Clothing and Apparel

- 5.1.2. Footwear

- 5.1.3. Bags

- 5.1.4. Jewellery

- 5.1.5. Watches

- 5.1.6. Other Accessories

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Single Brand Stores

- 5.2.2. Multi Brand Stores

- 5.2.3. Online Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Gender

- 5.3.1. Male

- 5.3.2. Female

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Luxury Goods Market in Qatar Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Clothing and Apparel

- 6.1.2. Footwear

- 6.1.3. Bags

- 6.1.4. Jewellery

- 6.1.5. Watches

- 6.1.6. Other Accessories

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Single Brand Stores

- 6.2.2. Multi Brand Stores

- 6.2.3. Online Stores

- 6.2.4. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Gender

- 6.3.1. Male

- 6.3.2. Female

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Luxury Goods Market in Qatar Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Clothing and Apparel

- 7.1.2. Footwear

- 7.1.3. Bags

- 7.1.4. Jewellery

- 7.1.5. Watches

- 7.1.6. Other Accessories

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Single Brand Stores

- 7.2.2. Multi Brand Stores

- 7.2.3. Online Stores

- 7.2.4. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Gender

- 7.3.1. Male

- 7.3.2. Female

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Luxury Goods Market in Qatar Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Clothing and Apparel

- 8.1.2. Footwear

- 8.1.3. Bags

- 8.1.4. Jewellery

- 8.1.5. Watches

- 8.1.6. Other Accessories

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Single Brand Stores

- 8.2.2. Multi Brand Stores

- 8.2.3. Online Stores

- 8.2.4. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Gender

- 8.3.1. Male

- 8.3.2. Female

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Luxury Goods Market in Qatar Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Clothing and Apparel

- 9.1.2. Footwear

- 9.1.3. Bags

- 9.1.4. Jewellery

- 9.1.5. Watches

- 9.1.6. Other Accessories

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Single Brand Stores

- 9.2.2. Multi Brand Stores

- 9.2.3. Online Stores

- 9.2.4. Other Distribution Channels

- 9.3. Market Analysis, Insights and Forecast - by Gender

- 9.3.1. Male

- 9.3.2. Female

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Luxury Goods Market in Qatar Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Clothing and Apparel

- 10.1.2. Footwear

- 10.1.3. Bags

- 10.1.4. Jewellery

- 10.1.5. Watches

- 10.1.6. Other Accessories

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Single Brand Stores

- 10.2.2. Multi Brand Stores

- 10.2.3. Online Stores

- 10.2.4. Other Distribution Channels

- 10.3. Market Analysis, Insights and Forecast - by Gender

- 10.3.1. Male

- 10.3.2. Female

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Richemont

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Kering

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Giorgio Armani

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Hugo boss

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 LVMH

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Chanel

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Puig

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Joyalukkas

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 PVH

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Prada SpA*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Rolex

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Richemont

List of Figures

- Figure 1: Global Luxury Goods Market in Qatar Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Luxury Goods Market in Qatar Revenue (million), by Type 2025 & 2033

- Figure 3: North America Luxury Goods Market in Qatar Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Luxury Goods Market in Qatar Revenue (million), by Distribution Channel 2025 & 2033

- Figure 5: North America Luxury Goods Market in Qatar Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Luxury Goods Market in Qatar Revenue (million), by Gender 2025 & 2033

- Figure 7: North America Luxury Goods Market in Qatar Revenue Share (%), by Gender 2025 & 2033

- Figure 8: North America Luxury Goods Market in Qatar Revenue (million), by Country 2025 & 2033

- Figure 9: North America Luxury Goods Market in Qatar Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America Luxury Goods Market in Qatar Revenue (million), by Type 2025 & 2033

- Figure 11: South America Luxury Goods Market in Qatar Revenue Share (%), by Type 2025 & 2033

- Figure 12: South America Luxury Goods Market in Qatar Revenue (million), by Distribution Channel 2025 & 2033

- Figure 13: South America Luxury Goods Market in Qatar Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 14: South America Luxury Goods Market in Qatar Revenue (million), by Gender 2025 & 2033

- Figure 15: South America Luxury Goods Market in Qatar Revenue Share (%), by Gender 2025 & 2033

- Figure 16: South America Luxury Goods Market in Qatar Revenue (million), by Country 2025 & 2033

- Figure 17: South America Luxury Goods Market in Qatar Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Luxury Goods Market in Qatar Revenue (million), by Type 2025 & 2033

- Figure 19: Europe Luxury Goods Market in Qatar Revenue Share (%), by Type 2025 & 2033

- Figure 20: Europe Luxury Goods Market in Qatar Revenue (million), by Distribution Channel 2025 & 2033

- Figure 21: Europe Luxury Goods Market in Qatar Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 22: Europe Luxury Goods Market in Qatar Revenue (million), by Gender 2025 & 2033

- Figure 23: Europe Luxury Goods Market in Qatar Revenue Share (%), by Gender 2025 & 2033

- Figure 24: Europe Luxury Goods Market in Qatar Revenue (million), by Country 2025 & 2033

- Figure 25: Europe Luxury Goods Market in Qatar Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa Luxury Goods Market in Qatar Revenue (million), by Type 2025 & 2033

- Figure 27: Middle East & Africa Luxury Goods Market in Qatar Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East & Africa Luxury Goods Market in Qatar Revenue (million), by Distribution Channel 2025 & 2033

- Figure 29: Middle East & Africa Luxury Goods Market in Qatar Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Middle East & Africa Luxury Goods Market in Qatar Revenue (million), by Gender 2025 & 2033

- Figure 31: Middle East & Africa Luxury Goods Market in Qatar Revenue Share (%), by Gender 2025 & 2033

- Figure 32: Middle East & Africa Luxury Goods Market in Qatar Revenue (million), by Country 2025 & 2033

- Figure 33: Middle East & Africa Luxury Goods Market in Qatar Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific Luxury Goods Market in Qatar Revenue (million), by Type 2025 & 2033

- Figure 35: Asia Pacific Luxury Goods Market in Qatar Revenue Share (%), by Type 2025 & 2033

- Figure 36: Asia Pacific Luxury Goods Market in Qatar Revenue (million), by Distribution Channel 2025 & 2033

- Figure 37: Asia Pacific Luxury Goods Market in Qatar Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 38: Asia Pacific Luxury Goods Market in Qatar Revenue (million), by Gender 2025 & 2033

- Figure 39: Asia Pacific Luxury Goods Market in Qatar Revenue Share (%), by Gender 2025 & 2033

- Figure 40: Asia Pacific Luxury Goods Market in Qatar Revenue (million), by Country 2025 & 2033

- Figure 41: Asia Pacific Luxury Goods Market in Qatar Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Luxury Goods Market in Qatar Revenue million Forecast, by Type 2020 & 2033

- Table 2: Global Luxury Goods Market in Qatar Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Luxury Goods Market in Qatar Revenue million Forecast, by Gender 2020 & 2033

- Table 4: Global Luxury Goods Market in Qatar Revenue million Forecast, by Region 2020 & 2033

- Table 5: Global Luxury Goods Market in Qatar Revenue million Forecast, by Type 2020 & 2033

- Table 6: Global Luxury Goods Market in Qatar Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 7: Global Luxury Goods Market in Qatar Revenue million Forecast, by Gender 2020 & 2033

- Table 8: Global Luxury Goods Market in Qatar Revenue million Forecast, by Country 2020 & 2033

- Table 9: United States Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Canada Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Global Luxury Goods Market in Qatar Revenue million Forecast, by Type 2020 & 2033

- Table 13: Global Luxury Goods Market in Qatar Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 14: Global Luxury Goods Market in Qatar Revenue million Forecast, by Gender 2020 & 2033

- Table 15: Global Luxury Goods Market in Qatar Revenue million Forecast, by Country 2020 & 2033

- Table 16: Brazil Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Argentina Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Global Luxury Goods Market in Qatar Revenue million Forecast, by Type 2020 & 2033

- Table 20: Global Luxury Goods Market in Qatar Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 21: Global Luxury Goods Market in Qatar Revenue million Forecast, by Gender 2020 & 2033

- Table 22: Global Luxury Goods Market in Qatar Revenue million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Germany Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: France Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Italy Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Spain Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Russia Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 29: Benelux Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: Nordics Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Global Luxury Goods Market in Qatar Revenue million Forecast, by Type 2020 & 2033

- Table 33: Global Luxury Goods Market in Qatar Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 34: Global Luxury Goods Market in Qatar Revenue million Forecast, by Gender 2020 & 2033

- Table 35: Global Luxury Goods Market in Qatar Revenue million Forecast, by Country 2020 & 2033

- Table 36: Turkey Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: Israel Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 38: GCC Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 39: North Africa Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 40: South Africa Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 42: Global Luxury Goods Market in Qatar Revenue million Forecast, by Type 2020 & 2033

- Table 43: Global Luxury Goods Market in Qatar Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 44: Global Luxury Goods Market in Qatar Revenue million Forecast, by Gender 2020 & 2033

- Table 45: Global Luxury Goods Market in Qatar Revenue million Forecast, by Country 2020 & 2033

- Table 46: China Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 47: India Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 48: Japan Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 49: South Korea Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 51: Oceania Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Luxury Goods Market in Qatar?

The projected CAGR is approximately 5.38%.

2. Which companies are prominent players in the Luxury Goods Market in Qatar?

Key companies in the market include Richemont, Kering, Giorgio Armani, Hugo boss, LVMH, Chanel, Puig, Joyalukkas, PVH, Prada SpA*List Not Exhaustive, Rolex.

3. What are the main segments of the Luxury Goods Market in Qatar?

The market segments include Type, Distribution Channel, Gender.

4. Can you provide details about the market size?

The market size is estimated to be USD 563.28 million as of 2022.

5. What are some drivers contributing to market growth?

Fast Fashion Trend; Inflating Income Level of Individuals.

6. What are the notable trends driving market growth?

Qatar becoming the Luxury Fashion Hub to Support Market Growth.

7. Are there any restraints impacting market growth?

The Presence Of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

November 2022: A luxury e-commerce website, Ounass, was launched in Qatar, where consumers can shop for luxury brands, including Gucci, Saint Laurent, Balenciaga, etc. Consumers can shop for men's, women's, and children's ready-to-wear clothing, handbags, footwear, cosmetics, fine jewelry, and home goods.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Luxury Goods Market in Qatar," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Luxury Goods Market in Qatar report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Luxury Goods Market in Qatar?

To stay informed about further developments, trends, and reports in the Luxury Goods Market in Qatar, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence