Key Insights

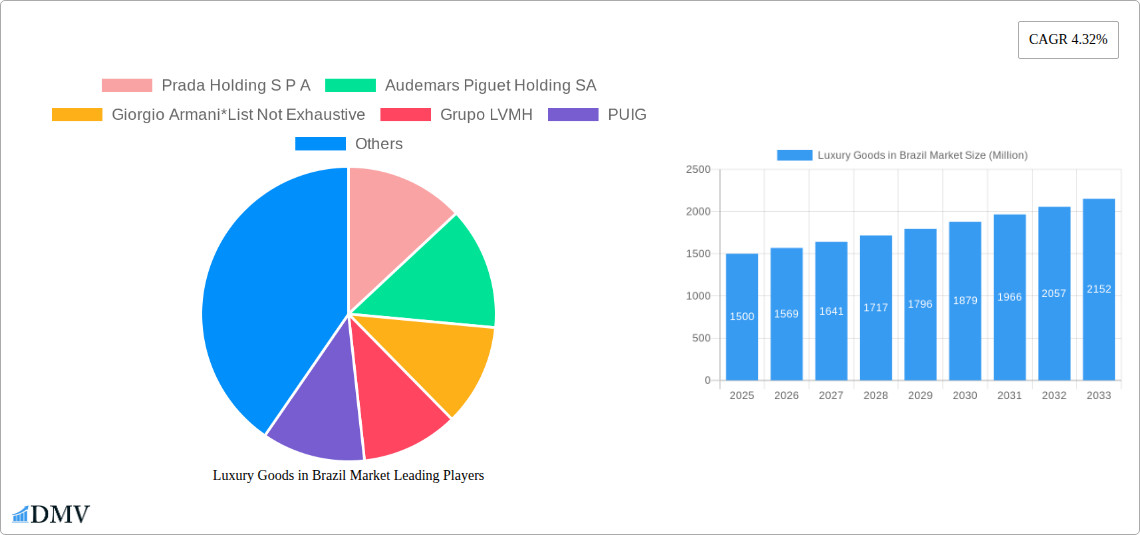

The Brazilian luxury goods market, valued at approximately $XX million in 2025 (assuming a reasonable market size based on global luxury market trends and Brazil's economic indicators), is projected to experience robust growth with a Compound Annual Growth Rate (CAGR) of 4.32% from 2025 to 2033. This expansion is driven by several key factors. A burgeoning affluent consumer class with increasing disposable income is fueling demand for high-end products, particularly in segments like clothing and apparel, jewelry, and watches. Furthermore, the growing popularity of e-commerce platforms and a rise in luxury online retail are reshaping the distribution landscape, offering broader access to international brands and enhancing customer convenience. The increasing influence of social media and celebrity endorsements further contributes to the market's dynamism. Despite these positive trends, certain challenges persist. Economic volatility in Brazil, currency fluctuations, and potential inflationary pressures could pose restraints to market growth. Moreover, the competitive landscape remains intense, with both established global luxury conglomerates like LVMH, Kering, and Richemont, and local players vying for market share. The market is segmented by distribution channel (single-brand stores, multi-brand stores, online stores, and others) and product type (clothing and apparel, footwear, jewelry, watches, bags, and others).

Luxury Goods in Brazil Market Market Size (In Billion)

This growth trajectory signifies significant opportunities for luxury brands in Brazil. Strategic investments in e-commerce infrastructure, targeted marketing campaigns that resonate with the unique preferences of Brazilian consumers, and robust supply chain management are crucial for capitalizing on the market's potential. Brands that effectively adapt to the local context, addressing both the demands of the affluent consumer and the unique aspects of the Brazilian market, are positioned to achieve sustained success in this lucrative sector. Careful attention to managing risks associated with economic instability and competitive pressures will be essential for long-term profitability.

Luxury Goods in Brazil Market Company Market Share

Luxury Goods in Brazil Market: A Comprehensive Report (2019-2033)

This insightful report provides a deep dive into the dynamic Brazilian luxury goods market, offering a comprehensive analysis of its current state and future trajectory. Spanning the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this study is essential for stakeholders seeking to understand and capitalize on the opportunities within this lucrative sector. The report encompasses detailed market sizing, competitive landscape analysis, and future growth projections, presenting valuable insights for strategic decision-making. The market value is predicted to reach xx Million by 2033.

Luxury Goods in Brazil Market Market Composition & Trends

This section analyzes the Brazilian luxury goods market's structure, key trends, and influential factors. We evaluate market concentration, highlighting the share held by major players like Grupo LVMH, Kering Group, and Prada Holding S P A, among others. Innovation catalysts, including sustainable practices and technological advancements (e.g., personalized online experiences), are examined, alongside the regulatory landscape and its impact. The role of substitute products and the evolving profiles of Brazilian luxury consumers are also explored.

- Market Concentration: Grupo LVMH holds an estimated xx% market share, followed by Kering Group with xx% and Prada Holding S P A at xx%. The remaining share is distributed among numerous other players, indicating a moderately concentrated market.

- M&A Activity: While specific deal values are not publicly available for all transactions, the report estimates a total M&A value of xx Million within the observed period (2019-2024), primarily driven by expansion strategies and brand consolidation.

- Innovation Catalysts: The growing demand for sustainable luxury and personalized experiences fuels innovation in materials, production processes, and digital marketing strategies.

- Regulatory Landscape: The report assesses the impact of Brazilian regulations on imports, taxation, and consumer protection on market dynamics.

- Substitute Products: The availability of more affordable, high-quality alternatives poses a challenge to the luxury segment, influencing consumer purchasing decisions.

- End-User Profiles: The report segments the Brazilian luxury consumer base based on demographics, income levels, and purchasing habits, providing insights into their preferences and buying behaviors.

Luxury Goods in Brazil Market Industry Evolution

This section details the evolutionary trajectory of the Brazilian luxury goods market, examining growth rates, technological adoption, and evolving consumer demands. The historical period (2019-2024) saw a Compound Annual Growth Rate (CAGR) of xx%, driven by factors such as rising disposable incomes and increasing brand awareness. The forecast period (2025-2033) projects a CAGR of xx%, fueled by the expanding middle class, the growth of e-commerce, and continuous product innovation. Technological advancements, such as the integration of augmented reality in online shopping and personalized customer relationship management (CRM) systems, are impacting market growth. The increasing demand for sustainable and ethically sourced luxury goods also significantly shapes industry developments.

Leading Regions, Countries, or Segments in Luxury Goods in Brazil Market

This section identifies the leading segments within the Brazilian luxury market by distribution channel and product type. São Paulo remains the dominant region, while online sales are experiencing rapid growth.

By Distribution Channel:

- Single-brand Stores: These stores maintain high brand control and offer a premium shopping experience, making them a leading segment. Key drivers include targeted marketing campaigns and exclusive product launches.

- Multi-brand Stores: These stores offer diverse options and attract a broader customer base. Drivers include convenient location and wider product selections.

- Online Stores: This segment is growing rapidly driven by increasing internet penetration and consumer preference for convenient online shopping.

- Other Distribution Channels: This category includes department stores, duty-free shops, and pop-up stores, making a significant contribution to the total market.

By Product Type:

- Watches & Jewelry: High demand for luxury watches and jewelry, fuelled by affluent consumer preferences, makes this a leading segment.

- Bags: Luxury handbags and accessories represent a significant portion of the market due to their status as highly desired items.

- Clothing and Apparel: This segment is consistently strong, catering to different styles and preferences within the luxury market.

- Footwear: High-end footwear complements other luxury purchases.

Luxury Goods in Brazil Market Product Innovations

The Brazilian luxury goods market is experiencing a dynamic evolution, with a strong emphasis on groundbreaking innovations in materials, design, and functionality. Brands are increasingly prioritizing sustainability, integrating recycled fabrics and pioneering production techniques to minimize their environmental footprint without compromising on exquisite quality. Technological advancements are also at the forefront, with hyper-personalization becoming a key differentiator. This includes intricate custom embroidery on apparel and bespoke modifications for timepieces, significantly enhancing their exclusivity and perceived value. To elevate the digital retail experience, leading brands are leveraging augmented reality (AR) to enable consumers to virtually interact with products, allowing for a more immersive and confident online purchasing journey.

Propelling Factors for Luxury Goods in Brazil Market Growth

Several factors contribute to the growth of the Brazilian luxury goods market. The expansion of the affluent middle class, with increasing disposable incomes and a growing interest in luxury brands, serves as a major driver. Technological advancements, including e-commerce platforms and personalized shopping experiences, are enhancing accessibility and convenience for luxury consumers. Government initiatives promoting tourism and encouraging foreign investment also positively impact market growth.

Obstacles in the Luxury Goods in Brazil Market Market

Despite its considerable potential, the Brazilian luxury goods sector navigates a landscape marked by notable challenges. Persistent economic volatility and fluctuating currency exchange rates can significantly impact discretionary consumer spending and elevate import costs for premium products. Supply chain disruptions, particularly amplified during periods of global uncertainty, can lead to unforeseen delays and escalated production expenses. The market is also characterized by intense competition, stemming from a dual force of well-established international luxury houses and a burgeoning cohort of sophisticated local brands, creating a highly contested commercial environment. Furthermore, the pervasive issue of counterfeit products continues to pose a substantial threat, undermining brand reputation and negatively affecting sales figures.

Future Opportunities in Luxury Goods in Brazil Market

The future holds significant opportunities for the Brazilian luxury goods market. The rising popularity of sustainable and ethical luxury presents a major opportunity for brands to align with environmentally and socially conscious consumers. Technological innovations, such as virtual try-on tools and personalized shopping experiences, offer avenues for enhanced consumer engagement. Expansion into untapped markets within Brazil, coupled with strategic partnerships and collaborations, can further fuel market growth.

Major Players in the Luxury Goods in Brazil Market Ecosystem

- Prada Holding S P A

- Audemars Piguet Holding SA

- Giorgio Armani

- Grupo LVMH

- PUIG

- Chanel limited

- Rolex SA

- Kering Group

- Patek Philippe

- Hermès International S A

Key Developments in Luxury Goods in Brazil Market Industry

- October 2021: Grupo Axo and thredUP's strategic investment in Vopero underscores the growing momentum and consumer interest in the circular economy and sustainable fashion resale within Brazil.

- April 2021: The inaugural South American flagship store opening by Balenciaga in São Paulo signifies a major expansion and commitment to the Brazilian luxury market.

- July 2020: Prada's enhanced online store launch demonstrates a focused effort to bolster its digital presence and solidify its e-commerce capabilities in Brazil.

- October 2019: Osklen's introduction of its Black Edition Collection highlights the increasing prominence and market appeal of sustainable luxury offerings from Brazilian designers.

Strategic Luxury Goods in Brazil Market Market Forecast

The Brazilian luxury goods market is strategically positioned for sustained and robust growth, propelled by a combination of resilient economic fundamentals and a discernible shift in evolving consumer preferences. The accelerating adoption of e-commerce channels, coupled with a heightened demand for highly personalized and exclusive experiences, are anticipated to be significant drivers of market expansion. For brands aiming to maintain a competitive edge and successfully meet the dynamic expectations of the contemporary luxury consumer, strategic investments in sustainable practices and cutting-edge technological innovations will be paramount. The future trajectory of this vibrant market will critically depend on the ability of stakeholders to adeptly navigate economic uncertainties and proactively adapt to shifting consumer desires, thereby capitalizing on the emerging opportunities.

Luxury Goods in Brazil Market Segmentation

-

1. Product Type

- 1.1. Clothing and Apparel

- 1.2. Footwear

- 1.3. Jewelry

- 1.4. Watches

- 1.5. Bags

- 1.6. Other Types

-

2. Distribution Channel

- 2.1. Single-brand stores

- 2.2. Multi-brand stores

- 2.3. Online Stores

- 2.4. Other Distribution Channels

Luxury Goods in Brazil Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Luxury Goods in Brazil Market Regional Market Share

Geographic Coverage of Luxury Goods in Brazil Market

Luxury Goods in Brazil Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.23% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Prevalence of Obesity Among Consumers; Demand for Online and Hybrid Models with Customization and Personalization

- 3.3. Market Restrains

- 3.3.1. High Operational Costs and Competitive Pricing of Memberships

- 3.4. Market Trends

- 3.4.1. Expansion of Online Retailing

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Luxury Goods in Brazil Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Clothing and Apparel

- 5.1.2. Footwear

- 5.1.3. Jewelry

- 5.1.4. Watches

- 5.1.5. Bags

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Single-brand stores

- 5.2.2. Multi-brand stores

- 5.2.3. Online Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Luxury Goods in Brazil Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Clothing and Apparel

- 6.1.2. Footwear

- 6.1.3. Jewelry

- 6.1.4. Watches

- 6.1.5. Bags

- 6.1.6. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Single-brand stores

- 6.2.2. Multi-brand stores

- 6.2.3. Online Stores

- 6.2.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South America Luxury Goods in Brazil Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Clothing and Apparel

- 7.1.2. Footwear

- 7.1.3. Jewelry

- 7.1.4. Watches

- 7.1.5. Bags

- 7.1.6. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Single-brand stores

- 7.2.2. Multi-brand stores

- 7.2.3. Online Stores

- 7.2.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe Luxury Goods in Brazil Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Clothing and Apparel

- 8.1.2. Footwear

- 8.1.3. Jewelry

- 8.1.4. Watches

- 8.1.5. Bags

- 8.1.6. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Single-brand stores

- 8.2.2. Multi-brand stores

- 8.2.3. Online Stores

- 8.2.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East & Africa Luxury Goods in Brazil Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Clothing and Apparel

- 9.1.2. Footwear

- 9.1.3. Jewelry

- 9.1.4. Watches

- 9.1.5. Bags

- 9.1.6. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Single-brand stores

- 9.2.2. Multi-brand stores

- 9.2.3. Online Stores

- 9.2.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Asia Pacific Luxury Goods in Brazil Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Clothing and Apparel

- 10.1.2. Footwear

- 10.1.3. Jewelry

- 10.1.4. Watches

- 10.1.5. Bags

- 10.1.6. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Single-brand stores

- 10.2.2. Multi-brand stores

- 10.2.3. Online Stores

- 10.2.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Prada Holding S P A

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Audemars Piguet Holding SA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Giorgio Armani*List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Grupo LVMH

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 PUIG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Chanel limited

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Rolex SA

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Kering Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Patek Philippe

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Hermès International S A

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Prada Holding S P A

List of Figures

- Figure 1: Global Luxury Goods in Brazil Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Luxury Goods in Brazil Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 3: North America Luxury Goods in Brazil Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Luxury Goods in Brazil Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 5: North America Luxury Goods in Brazil Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Luxury Goods in Brazil Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Luxury Goods in Brazil Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Luxury Goods in Brazil Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 9: South America Luxury Goods in Brazil Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: South America Luxury Goods in Brazil Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 11: South America Luxury Goods in Brazil Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: South America Luxury Goods in Brazil Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: South America Luxury Goods in Brazil Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Luxury Goods in Brazil Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 15: Europe Luxury Goods in Brazil Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Europe Luxury Goods in Brazil Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 17: Europe Luxury Goods in Brazil Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Europe Luxury Goods in Brazil Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe Luxury Goods in Brazil Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Luxury Goods in Brazil Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 21: Middle East & Africa Luxury Goods in Brazil Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Middle East & Africa Luxury Goods in Brazil Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 23: Middle East & Africa Luxury Goods in Brazil Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Middle East & Africa Luxury Goods in Brazil Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East & Africa Luxury Goods in Brazil Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Luxury Goods in Brazil Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 27: Asia Pacific Luxury Goods in Brazil Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Asia Pacific Luxury Goods in Brazil Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 29: Asia Pacific Luxury Goods in Brazil Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Asia Pacific Luxury Goods in Brazil Market Revenue (undefined), by Country 2025 & 2033

- Figure 31: Asia Pacific Luxury Goods in Brazil Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Luxury Goods in Brazil Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Global Luxury Goods in Brazil Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Luxury Goods in Brazil Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Luxury Goods in Brazil Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 5: Global Luxury Goods in Brazil Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Luxury Goods in Brazil Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Luxury Goods in Brazil Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Luxury Goods in Brazil Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico Luxury Goods in Brazil Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global Luxury Goods in Brazil Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 11: Global Luxury Goods in Brazil Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 12: Global Luxury Goods in Brazil Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Brazil Luxury Goods in Brazil Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Argentina Luxury Goods in Brazil Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Luxury Goods in Brazil Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global Luxury Goods in Brazil Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 17: Global Luxury Goods in Brazil Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 18: Global Luxury Goods in Brazil Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Luxury Goods in Brazil Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Germany Luxury Goods in Brazil Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: France Luxury Goods in Brazil Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Italy Luxury Goods in Brazil Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Spain Luxury Goods in Brazil Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Russia Luxury Goods in Brazil Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Benelux Luxury Goods in Brazil Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Nordics Luxury Goods in Brazil Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Luxury Goods in Brazil Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Global Luxury Goods in Brazil Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 29: Global Luxury Goods in Brazil Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 30: Global Luxury Goods in Brazil Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: Turkey Luxury Goods in Brazil Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Israel Luxury Goods in Brazil Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: GCC Luxury Goods in Brazil Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: North Africa Luxury Goods in Brazil Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: South Africa Luxury Goods in Brazil Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Luxury Goods in Brazil Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Global Luxury Goods in Brazil Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 38: Global Luxury Goods in Brazil Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 39: Global Luxury Goods in Brazil Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: China Luxury Goods in Brazil Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: India Luxury Goods in Brazil Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Japan Luxury Goods in Brazil Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: South Korea Luxury Goods in Brazil Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Luxury Goods in Brazil Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: Oceania Luxury Goods in Brazil Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Luxury Goods in Brazil Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Luxury Goods in Brazil Market?

The projected CAGR is approximately 5.23%.

2. Which companies are prominent players in the Luxury Goods in Brazil Market?

Key companies in the market include Prada Holding S P A, Audemars Piguet Holding SA, Giorgio Armani*List Not Exhaustive, Grupo LVMH, PUIG, Chanel limited, Rolex SA, Kering Group, Patek Philippe, Hermès International S A.

3. What are the main segments of the Luxury Goods in Brazil Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Prevalence of Obesity Among Consumers; Demand for Online and Hybrid Models with Customization and Personalization.

6. What are the notable trends driving market growth?

Expansion of Online Retailing.

7. Are there any restraints impacting market growth?

High Operational Costs and Competitive Pricing of Memberships.

8. Can you provide examples of recent developments in the market?

In October 2021, Grupo Axo and thredUP announced Strategic Investment in Vopero to capture emerging opportunities in Latin America's Sustainable Fashion Resale Marketplace. The collaboration is expanding to Brazil.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Luxury Goods in Brazil Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Luxury Goods in Brazil Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Luxury Goods in Brazil Market?

To stay informed about further developments, trends, and reports in the Luxury Goods in Brazil Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence