Key Insights

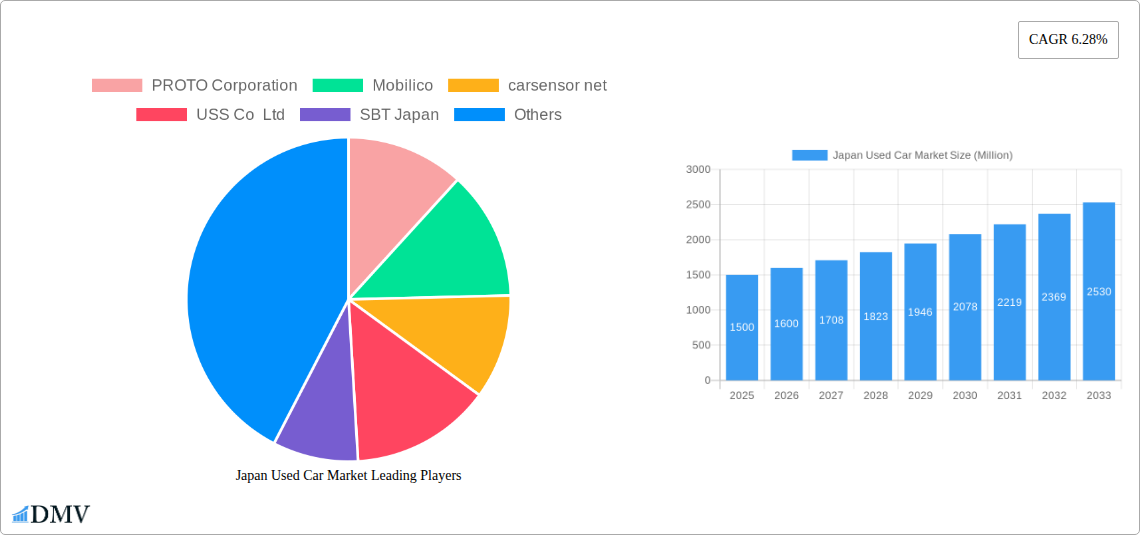

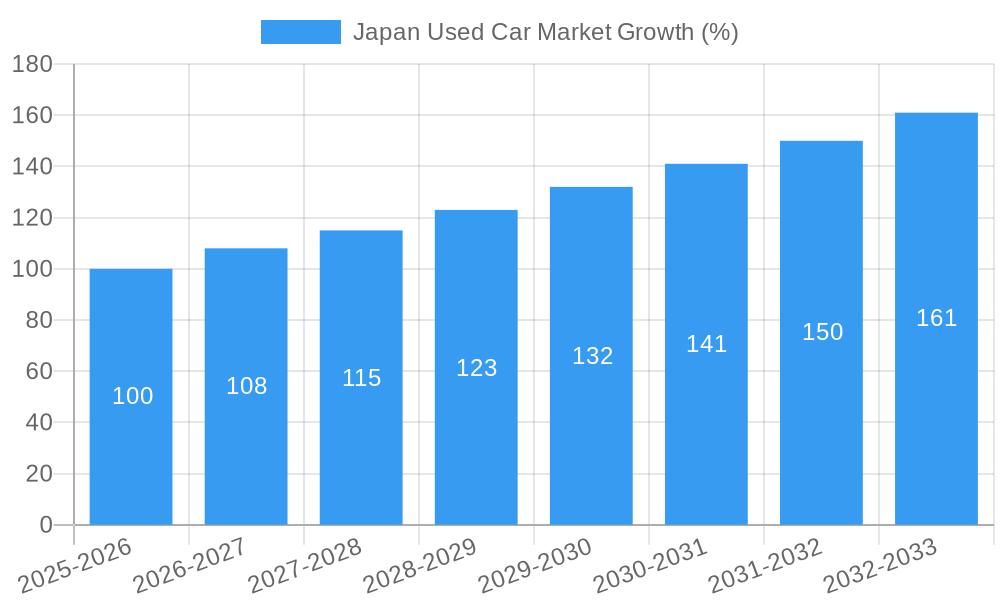

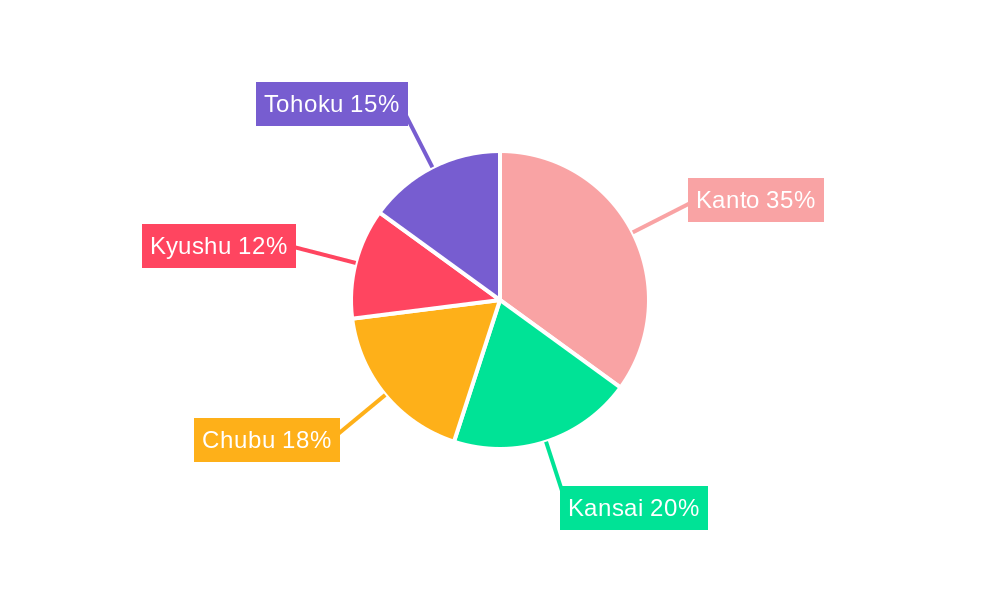

The Japan used car market, valued at approximately ¥1.5 trillion (assuming a reasonable market size based on available data and global used car market trends) in 2025, exhibits robust growth potential, projected to expand at a compound annual growth rate (CAGR) of 6.28% from 2025 to 2033. This growth is fueled by several key factors. Increasing vehicle ownership rates, particularly among younger demographics embracing more affordable used car options, contribute significantly. Furthermore, the rising cost of new vehicles and a growing preference for shorter ownership cycles are bolstering demand. The diverse segments within the market, encompassing various vehicle types (hatchbacks, sedans, SUVs, MPVs), booking channels (online platforms, dealerships), and transaction types (full payment, financing), provide ample opportunities for market players. The geographical spread across regions like Kanto, Kansai, Chubu, Kyushu, and Tohoku further diversifies the market landscape. However, potential restraints include fluctuating used car prices influenced by the new car market, government regulations regarding vehicle emissions and safety standards, and the increasing popularity of electric vehicles which may impact the resale value of older models.

Leading players like PROTO Corporation, Mobilico, carsensor.net, and others are actively shaping market dynamics through innovative online platforms and extensive dealership networks. The growth of online sales channels offers transparency and convenience to buyers, while authorized dealerships maintain strong influence due to their established trust and service offerings. The evolving financing options available to consumers are also instrumental in driving sales. Looking ahead, market participants need to focus on adapting to evolving consumer preferences and technological advancements in the automotive sector to maintain their competitive edge. Strategies encompassing data-driven insights, enhanced customer service, and a commitment to sustainability will be critical for long-term success within this dynamic market.

Japan Used Car Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Japan used car market, covering market size, segmentation, key players, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers valuable insights for stakeholders seeking to understand and capitalize on the dynamic Japanese used car market. The report analyzes a market valued at ¥XX Million in 2024, projecting a ¥XXX Million valuation by 2033.

Japan Used Car Market Composition & Trends

This section delves into the competitive landscape of the Japanese used car market, examining market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and merger & acquisition (M&A) activities. The market is characterized by a mix of large established players and smaller, specialized dealerships.

- Market Share Distribution: While precise market share data for each player requires further proprietary research, carsensor.net, USS Co Ltd, and SBT Japan are estimated to hold significant market shares. PROTO Corporation and ORIX Auto Corporation also command substantial portions of the market. The remaining market is fragmented amongst numerous smaller players, including multi-brand dealerships and independent sellers.

- Innovation Catalysts: Technological advancements, including online platforms and enhanced vehicle inspection technologies, are driving market innovation. The increasing adoption of certified pre-owned programs adds another layer of trust and transparency.

- Regulatory Landscape: Japanese regulations pertaining to used car sales, emissions standards, and vehicle inspections play a significant role in shaping market dynamics. Changes in these regulations will have direct effects on market growth and players' strategies.

- Substitute Products: While the primary focus is on used cars, the market indirectly competes with public transportation and newly manufactured vehicles, particularly in the entry-level segments.

- End-User Profiles: The Japanese used car market caters to a diverse range of buyers, from individual consumers to businesses and rental car companies. Understanding these different segments is crucial for effective market segmentation.

- M&A Activities: The used car market has witnessed several M&A activities in recent years, with deal values ranging from ¥XX Million to ¥XXX Million. Consolidation is expected to continue, driven by the need for scale and access to new technologies. Specific deal values are subject to further analysis.

Japan Used Car Market Industry Evolution

The Japan used car market has experienced significant evolution since 2019, characterized by fluctuating growth trajectories, technological advancements, and shifting consumer demands. The market has shown resilience in the face of economic headwinds and global disruptions, aided by a strong domestic demand. The historical period (2019-2024) witnessed a compound annual growth rate (CAGR) of X%, while the forecast period (2025-2033) is projected to see a CAGR of Y%. This variance reflects market maturity and evolving consumer preferences. The increasing adoption of online platforms has transformed the buying experience, offering greater convenience and transparency. Simultaneously, a growing emphasis on vehicle certification and pre-owned vehicle quality assurance programs has improved buyer confidence. Technological advancements in vehicle inspection and appraisal systems improve efficiency, minimize risks and are crucial for gaining market trust. The demand for specific vehicle types (e.g., compact cars, SUVs) fluctuates in response to economic and social trends.

Leading Regions, Countries, or Segments in Japan Used Car Market

The Japanese used car market displays regional variations in demand and pricing. While a detailed regional breakdown requires further analysis, certain segments demonstrate clear dominance:

By Vehicle Type:

- SUVs (Sports Utility Vehicles): The SUV segment has seen substantial growth, driven by increasing popularity among urban and suburban consumers seeking versatility and practicality. Key factors include growing urban populations, demand for practicality and spaciousness, and a rise in recreational activities.

- Sedans: Sedans remain a popular choice, particularly in the more urban areas, though their share might be slowly declining due to the rising popularity of SUVs and minivans.

- Hatchbacks: Compact and fuel-efficient hatchbacks continue to hold a steady share of the market, particularly among budget-conscious buyers and city dwellers.

- MPVs (Multi-purpose Vehicles): MPVs retain a strong market position, reflecting a demand for family-oriented vehicles with ample passenger and cargo space, especially in the rural sector.

By Booking Channel:

- Online Platforms: Online platforms are gaining significant traction, offering convenience and broader reach. Key drivers include increased internet penetration, preference for remote transactions and improved consumer digital literacy.

By Transaction Type:

- Full Payment: This remains the predominant transaction type, reflecting the preference for outright ownership among many Japanese consumers.

- Finance: The finance option provides a more accessible pathway to ownership, particularly among younger buyers. Growth in this sector is driven by favorable financing terms and increasingly competitive offers from various financial institutions.

Japan Used Car Market Product Innovations

Recent innovations in the Japanese used car market include the integration of online platforms with sophisticated vehicle history reporting systems and enhanced digital marketing and customer relationship management tools. These features offer customers increased transparency and reliability in the transaction, influencing buying decisions and fostering trust in the used car sector. Advanced vehicle inspection technologies also add value by providing detailed reports on vehicle condition. This increased transparency mitigates risk, enhances customer confidence and improves the overall quality of the used car market.

Propelling Factors for Japan Used Market Growth

Several factors drive the growth of the Japan used car market. These include:

- Increasing affordability: Used cars represent a cost-effective alternative to new vehicles, particularly during periods of economic uncertainty.

- Technological advancements: Online platforms and improved vehicle inspection technologies are enhancing transparency and customer experience.

- Favorable government policies: Government initiatives supporting the used car market through financing schemes or tax breaks could indirectly influence the growth of the market.

Obstacles in the Japan Used Car Market

Challenges facing the Japan used car market include:

- Supply chain disruptions: Global supply chain issues can impact the availability of certain used car models.

- Competitive pressures: Intense competition among dealerships and online platforms necessitates continuous innovation and competitive pricing strategies.

- Regulatory changes: Evolving regulations related to vehicle emissions and safety standards require adaptation from market participants.

Future Opportunities in Japan Used Car Market

Future opportunities include:

- Expansion of online marketplaces: Continued growth in the adoption of online platforms, with features like virtual inspections, AI-powered appraisal tools, and enhanced customer service.

- Growth of subscription-based services: Subscription models for used vehicles could become increasingly popular.

- Focus on sustainability: The increased focus on eco-friendly vehicles and sustainable practices could create new opportunities for used hybrid and electric car sales.

Major Players in the Japan Used Car Market Ecosystem

- PROTO Corporation

- Mobilico

- carsensor.net

- USS Co Ltd

- SBT Japan

- Crown Japan

- Yokohama Toyopet

- ORIX Auto Corporation

- Autocom Japan Inc

- Trust Co Ltd

Key Developments in Japan Used Car Market Industry

- August 2022: Lexus launched its Certified Program, enhancing trust and value in pre-owned Lexus vehicles. This initiative directly impacts the luxury used car segment.

- January 2022: Carused.jp introduced a new partner program, expanding its reach and providing increased access to imported vehicles. This development broadens the market’s reach, influencing both import and domestic supply chains.

Strategic Japan Used Car Market Forecast

The Japanese used car market is poised for continued growth, driven by technological innovation, evolving consumer preferences, and ongoing market consolidation. The increasing demand for used SUVs, the expansion of online marketplaces, and the rise of subscription services suggest strong growth potential over the forecast period (2025-2033). The market's ability to adapt to regulatory changes and navigate potential supply chain disruptions will significantly influence its future trajectory. The projected ¥XXX Million valuation by 2033 reflects this optimistic outlook, although it's crucial to monitor macroeconomic factors and evolving consumer behavior for an accurate forecast.

Japan Used Car Market Segmentation

-

1. Vehicle Type

- 1.1. Hatchbacks

- 1.2. Sedan

- 1.3. Sports Utility Vehicle

- 1.4. Multi-purpose Vehicle (MPV)

-

2. Booking Channel

- 2.1. Online

- 2.2. OEM Certified/Authorized Dealerships

- 2.3. Multi-Brand Dealerships

-

3. Transaction Type

- 3.1. Full Payment

- 3.2. Finance

Japan Used Car Market Segmentation By Geography

- 1. Japan

Japan Used Car Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.28% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 The Growing Economy

- 3.2.2 Coupled with Rising Disposal Incomes and Urbanization

- 3.2.3 Fuels Demand for the Market

- 3.3. Market Restrains

- 3.3.1 Various Regulatory Changes

- 3.3.2 Safety Standards

- 3.3.3 and Taxation Policies by the Government may Hamper the Market

- 3.4. Market Trends

- 3.4.1. Growing Online Used Car Sales Aiding the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Used Car Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Hatchbacks

- 5.1.2. Sedan

- 5.1.3. Sports Utility Vehicle

- 5.1.4. Multi-purpose Vehicle (MPV)

- 5.2. Market Analysis, Insights and Forecast - by Booking Channel

- 5.2.1. Online

- 5.2.2. OEM Certified/Authorized Dealerships

- 5.2.3. Multi-Brand Dealerships

- 5.3. Market Analysis, Insights and Forecast - by Transaction Type

- 5.3.1. Full Payment

- 5.3.2. Finance

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Kanto Japan Used Car Market Analysis, Insights and Forecast, 2019-2031

- 7. Kansai Japan Used Car Market Analysis, Insights and Forecast, 2019-2031

- 8. Chubu Japan Used Car Market Analysis, Insights and Forecast, 2019-2031

- 9. Kyushu Japan Used Car Market Analysis, Insights and Forecast, 2019-2031

- 10. Tohoku Japan Used Car Market Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 PROTO Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Mobilico

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 carsensor net

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 USS Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 SBT Japan

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Crown Japan*List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Yokohama Toyopet

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 ORIX Auto Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Autocom Japan Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Trust Co Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 PROTO Corporation

List of Figures

- Figure 1: Japan Used Car Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Japan Used Car Market Share (%) by Company 2024

List of Tables

- Table 1: Japan Used Car Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Japan Used Car Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: Japan Used Car Market Revenue Million Forecast, by Booking Channel 2019 & 2032

- Table 4: Japan Used Car Market Revenue Million Forecast, by Transaction Type 2019 & 2032

- Table 5: Japan Used Car Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Japan Used Car Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Kanto Japan Used Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Kansai Japan Used Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Chubu Japan Used Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Kyushu Japan Used Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Tohoku Japan Used Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Japan Used Car Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 13: Japan Used Car Market Revenue Million Forecast, by Booking Channel 2019 & 2032

- Table 14: Japan Used Car Market Revenue Million Forecast, by Transaction Type 2019 & 2032

- Table 15: Japan Used Car Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Used Car Market?

The projected CAGR is approximately 6.28%.

2. Which companies are prominent players in the Japan Used Car Market?

Key companies in the market include PROTO Corporation, Mobilico, carsensor net, USS Co Ltd, SBT Japan, Crown Japan*List Not Exhaustive, Yokohama Toyopet, ORIX Auto Corporation, Autocom Japan Inc, Trust Co Ltd.

3. What are the main segments of the Japan Used Car Market?

The market segments include Vehicle Type, Booking Channel, Transaction Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

The Growing Economy. Coupled with Rising Disposal Incomes and Urbanization. Fuels Demand for the Market.

6. What are the notable trends driving market growth?

Growing Online Used Car Sales Aiding the Market.

7. Are there any restraints impacting market growth?

Various Regulatory Changes. Safety Standards. and Taxation Policies by the Government may Hamper the Market.

8. Can you provide examples of recent developments in the market?

August 2022: Lexus, the Japanese luxury carmaker, announced a new initiative for the sale and purchase of used Lexus vehicles. The new Lexus Certified Program will allow the existing Lexus owners to sell their vehicles and new buyers to obtain pre-owned vehicles that have passed a rigorous inspection.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Used Car Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Used Car Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Used Car Market?

To stay informed about further developments, trends, and reports in the Japan Used Car Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence