Key Insights

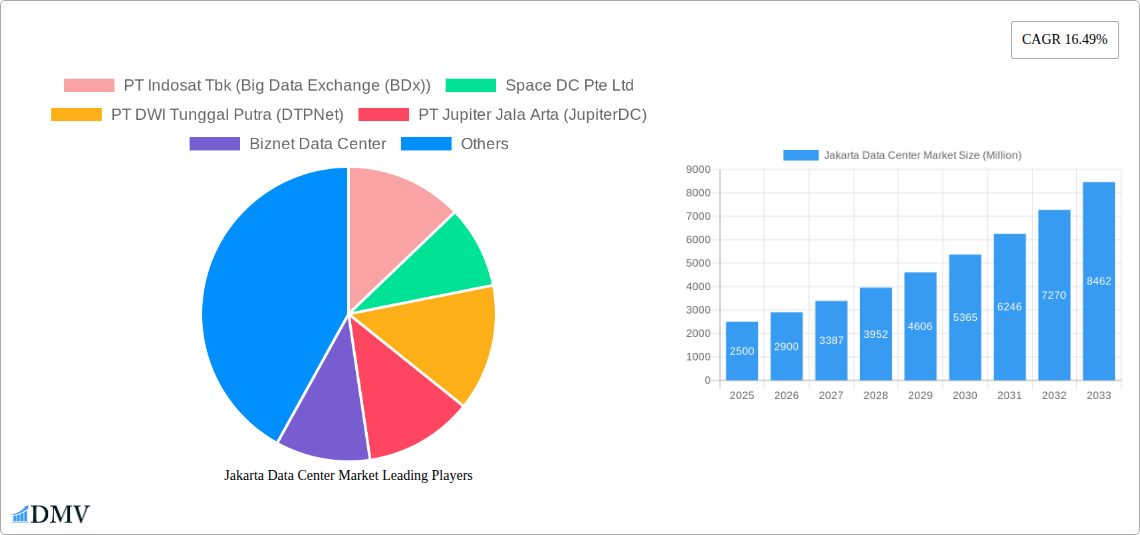

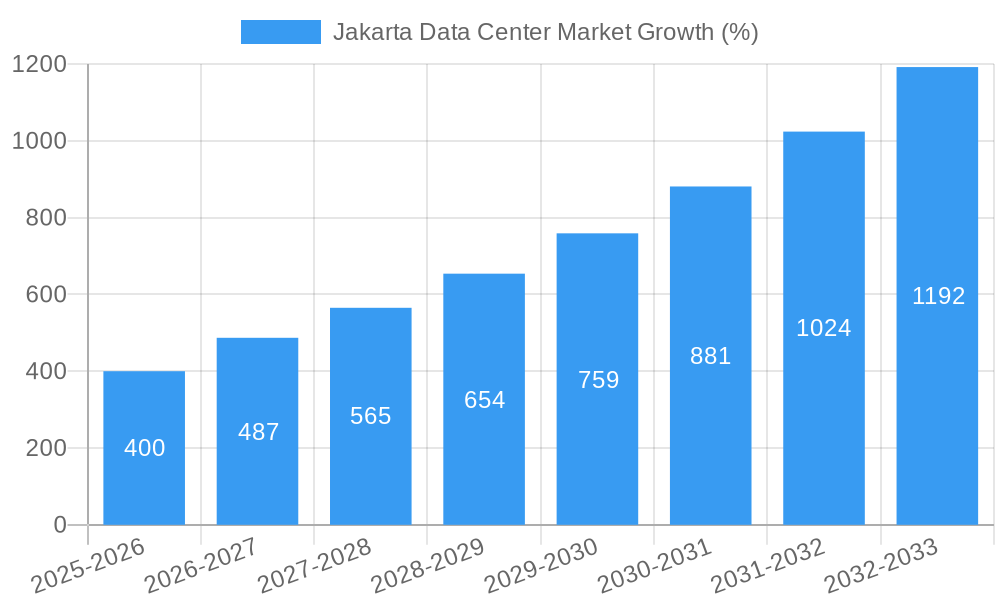

The Jakarta data center market exhibits robust growth, driven by Indonesia's burgeoning digital economy and increasing cloud adoption across various sectors. With a Compound Annual Growth Rate (CAGR) of 16.49% from 2019-2024, and considering continued expansion of e-commerce, BFSI (Banking, Financial Services, and Insurance), and government digital initiatives, the market is poised for significant expansion. The large and mega data center segments are likely to experience the most substantial growth, fueled by hyperscale cloud providers and the demand for robust infrastructure to support Indonesia's rapidly increasing data traffic. The retail colocation market also presents a substantial opportunity, catering to smaller businesses and enterprises needing scalable solutions. Geographic concentration within Jakarta is expected, though future expansion into surrounding areas is probable to meet escalating demand. While infrastructure limitations and regulatory complexities could pose some challenges, the overall positive economic outlook and strong government support for digital transformation will continue to act as key drivers for market expansion, making Jakarta a strategically attractive location for data center investment.

The competitive landscape is dynamic, featuring both local and international players. Established players like PT Indosat Tbk (BDx), PT DCI Indonesia Tbk, and XL Axiata (Princeton Digital Group) are expected to maintain significant market share, while new entrants and smaller players will likely compete based on niche offerings, pricing strategies, and geographic reach. The market is segmented by DC size (small to mega), tier type (Tier 1-4), absorption (utilized/non-utilized), colocation type (retail, wholesale, hyperscale), and end-user sector (cloud & IT, telecom, media & entertainment, etc.). The varying needs of each segment will necessitate a differentiated approach from data center providers, emphasizing flexibility, scalability, and resilience. Understanding these segments and adapting to their specific demands will be critical for success in this rapidly evolving market.

Jakarta Data Center Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Jakarta data center market, offering crucial insights for stakeholders seeking to navigate this dynamic landscape. The study period covers 2019-2033, with 2025 serving as the base and estimated year. The forecast period spans 2025-2033, while the historical period encompasses 2019-2024. This comprehensive analysis incorporates key market segments, leading players, and significant industry developments, offering a robust foundation for strategic decision-making. The report forecasts a market valued at xx Million by 2033, driven by robust growth in cloud adoption and digital transformation across various sectors.

Jakarta Data Center Market Composition & Trends

This section evaluates the competitive intensity, innovation drivers, regulatory environment, substitute offerings, end-user profiles, and merger & acquisition (M&A) activities within the Jakarta data center market. The report delves into the market share distribution amongst key players, revealing a moderately concentrated market with a few dominant players capturing a significant portion of the market share. For instance, PT DCI Indonesia Tbk and PT Indosat Tbk (Big Data Exchange (BDx)) hold a combined xx Million market share in 2025. Several factors contribute to this concentration, including significant capital investments required for data center infrastructure, extensive experience in the sector and early market entry.

- Market Concentration: High, with a few dominant players.

- Innovation Catalysts: Growing cloud adoption, increasing digitalization of businesses and government.

- Regulatory Landscape: Government initiatives supporting digital infrastructure development.

- Substitute Products: Limited direct substitutes, with cloud services offering some level of substitution.

- End-User Profiles: Strong demand from Cloud & IT, Telecom, and BFSI sectors.

- M&A Activities: Significant M&A activity observed in recent years, with deal values totaling xx Million in the past five years. This reflects increasing consolidation within the market and foreign investment interest.

Jakarta Data Center Market Industry Evolution

The Jakarta data center market has witnessed robust growth driven by factors such as the increasing adoption of cloud computing, digital transformation, and the rise of big data. From 2019 to 2024, the market exhibited a Compound Annual Growth Rate (CAGR) of xx%, and this upward trajectory is expected to persist throughout the forecast period, with a projected CAGR of xx% from 2025 to 2033. Technological advancements, such as the deployment of higher-tier data centers and improved energy efficiency, have significantly contributed to this growth. Furthermore, evolving consumer demands, specifically increased reliance on data-intensive applications and services, have further fueled this expansion. The shift towards hyperscale data centers is another significant trend, demanding increased capacity and leading to major investments in infrastructure and technology.

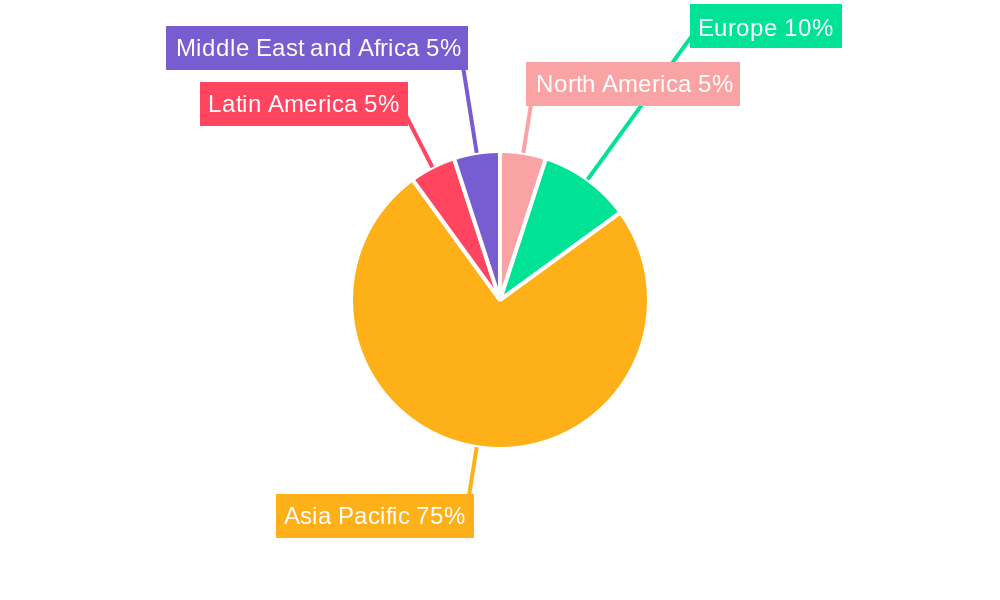

Leading Regions, Countries, or Segments in Jakarta Data Center Market

The Jakarta metropolitan area dominates the Indonesian data center market, driven by its robust digital infrastructure, high population density, and the concentration of major businesses. Within the Jakarta market, several segments are driving growth:

- Key Drivers for Dominance:

- High Demand: Significant demand from end-users across multiple sectors, particularly Cloud & IT, Telecom, and BFSI.

- Investment Trends: Substantial capital investment in new data center construction and expansion.

- Government Support: Favorable regulatory environment and government initiatives to develop digital infrastructure.

- Dominant Segments:

- DC Size: Large and Mega data centers are experiencing the most significant growth due to demands from hyperscalers.

- Tier Type: Tier III and Tier IV data centers are in high demand because of their higher reliability and redundancy.

- Absorption: Utilized capacity is high, reflecting strong demand and limited supply.

- Colocation Type: Wholesale and Hyperscale colocation are witnessing significant growth fueled by hyperscale cloud providers.

- End User: Cloud & IT, Telecom, and BFSI sectors are the key drivers of growth.

Jakarta Data Center Market Product Innovations

The Jakarta data center market is witnessing significant product innovations, with a strong focus on energy efficiency, security, and scalability. Data centers are increasingly adopting sustainable technologies, including renewable energy sources and improved cooling systems, to reduce their carbon footprint and power usage effectiveness (PUE). Advanced security measures, including biometric access control and intrusion detection systems, are being implemented to protect sensitive data. Furthermore, modular and scalable designs allow for flexible capacity expansion to meet the evolving needs of clients. These innovative solutions deliver superior performance, reduced operational costs, and increased sustainability.

Propelling Factors for Jakarta Data Center Market Growth

Several factors contribute to the projected growth of the Jakarta data center market. Firstly, the rapid expansion of the digital economy in Indonesia is driving substantial demand for data center capacity. Secondly, the government's supportive policies and investments in digital infrastructure further accelerate growth. Technological advancements, such as the introduction of 5G networks and edge computing, are also contributing to the increasing demand for data centers closer to end-users. Finally, the increasing adoption of cloud services across various industries requires substantial data center capacity to support growing computational needs.

Obstacles in the Jakarta Data Center Market

Despite significant growth potential, challenges remain. Land acquisition costs in Jakarta are high, impacting the pace of data center development. Power supply reliability is also a critical concern, requiring robust power infrastructure to ensure continuous operation. The competitive landscape is intense, creating pressure on pricing and profitability. Lastly, skilled labor shortages pose a challenge for data center operations and maintenance.

Future Opportunities in Jakarta Data Center Market

Significant growth opportunities exist in the Jakarta data center market. The expansion of 5G networks and edge computing creates new demand for data centers in strategic locations across the city. Further investment in renewable energy infrastructure will support the growth of sustainable data centers. Increased demand for hybrid and multi-cloud solutions creates opportunities for providers offering diverse services.

Major Players in the Jakarta Data Center Market Ecosystem

- PT Indosat Tbk (Big Data Exchange (BDx))

- Space DC Pte Ltd

- PT DWI Tunggal Putra (DTPNet)

- PT Jupiter Jala Arta (JupiterDC)

- Biznet Data Center

- PT Sigma Cipta Caraka (Telkomsigma)

- Digital Edge DC

- EdgeConneX Inc (GTN Data Centers)

- PT DCI Indonesia Tbk

- NEX Data Center Indonesia

- PT XL Axiata Tbk (Princeton Digital Group)

- NTT Ltd

- Nusantara Data Center

Key Developments in Jakarta Data Center Market Industry

- April 2023: BDxIndonesia launched CGK3A, a 15 MW Tier 3 data center in TB Simatupang, showcasing advanced security and a PUE of 1.4. This signifies a commitment to sustainable and high-performance data center solutions in the Jakarta market.

- December 2022: ST Telemedia Global Data Centres (Indonesia) completed the construction of STT Jakarta 1, a 19.5 MW facility, part of a planned 72 MW campus. This highlights significant foreign investment in the Indonesian data center sector and signifies a large-scale commitment to serving the growing demand.

Strategic Jakarta Data Center Market Forecast

The Jakarta data center market is poised for continued strong growth, driven by the increasing adoption of digital technologies, robust economic expansion, and supportive government policies. The forecast indicates a sustained CAGR, fueled by the expansion of cloud services, 5G, and edge computing. This will lead to a significant rise in demand for colocation services, creating substantial opportunities for data center providers. The focus on sustainable and efficient data center solutions presents further growth avenues for companies adopting innovative technologies.

Jakarta Data Center Market Segmentation

-

1. DC Size

- 1.1. Small

- 1.2. Medium

- 1.3. Large

- 1.4. Massive

- 1.5. Mega

-

2. Tier Type

- 2.1. Tier 1 & 2

- 2.2. Tier 3

- 2.3. Tier 4

-

3. Absorption

-

3.1. Utilized

-

3.1.1. Colocation Type

- 3.1.1.1. Retail

- 3.1.1.2. Wholesale

- 3.1.1.3. Hyperscale

-

3.1.2. End User

- 3.1.2.1. Cloud & IT

- 3.1.2.2. Telecom

- 3.1.2.3. Media & Entertainment

- 3.1.2.4. Government

- 3.1.2.5. BFSI

- 3.1.2.6. Manufacturing

- 3.1.2.7. E-Commerce

- 3.1.2.8. Other End User

-

3.1.1. Colocation Type

- 3.2. Non-Utilized

-

3.1. Utilized

Jakarta Data Center Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Jakarta Data Center Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 16.49% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Regulations Promoting Proper Lighting for Worker Safety in Hazardous Locations; Rising Demand for Cost-effective and Energy-efficient LED Lighting Solutions

- 3.3. Market Restrains

- 3.3.1. High Costs of Equipment

- 3.4. Market Trends

- 3.4.1. Tier 4 is Expected to Hold Significant Share of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Jakarta Data Center Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by DC Size

- 5.1.1. Small

- 5.1.2. Medium

- 5.1.3. Large

- 5.1.4. Massive

- 5.1.5. Mega

- 5.2. Market Analysis, Insights and Forecast - by Tier Type

- 5.2.1. Tier 1 & 2

- 5.2.2. Tier 3

- 5.2.3. Tier 4

- 5.3. Market Analysis, Insights and Forecast - by Absorption

- 5.3.1. Utilized

- 5.3.1.1. Colocation Type

- 5.3.1.1.1. Retail

- 5.3.1.1.2. Wholesale

- 5.3.1.1.3. Hyperscale

- 5.3.1.2. End User

- 5.3.1.2.1. Cloud & IT

- 5.3.1.2.2. Telecom

- 5.3.1.2.3. Media & Entertainment

- 5.3.1.2.4. Government

- 5.3.1.2.5. BFSI

- 5.3.1.2.6. Manufacturing

- 5.3.1.2.7. E-Commerce

- 5.3.1.2.8. Other End User

- 5.3.1.1. Colocation Type

- 5.3.2. Non-Utilized

- 5.3.1. Utilized

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by DC Size

- 6. North America Jakarta Data Center Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by DC Size

- 6.1.1. Small

- 6.1.2. Medium

- 6.1.3. Large

- 6.1.4. Massive

- 6.1.5. Mega

- 6.2. Market Analysis, Insights and Forecast - by Tier Type

- 6.2.1. Tier 1 & 2

- 6.2.2. Tier 3

- 6.2.3. Tier 4

- 6.3. Market Analysis, Insights and Forecast - by Absorption

- 6.3.1. Utilized

- 6.3.1.1. Colocation Type

- 6.3.1.1.1. Retail

- 6.3.1.1.2. Wholesale

- 6.3.1.1.3. Hyperscale

- 6.3.1.2. End User

- 6.3.1.2.1. Cloud & IT

- 6.3.1.2.2. Telecom

- 6.3.1.2.3. Media & Entertainment

- 6.3.1.2.4. Government

- 6.3.1.2.5. BFSI

- 6.3.1.2.6. Manufacturing

- 6.3.1.2.7. E-Commerce

- 6.3.1.2.8. Other End User

- 6.3.1.1. Colocation Type

- 6.3.2. Non-Utilized

- 6.3.1. Utilized

- 6.1. Market Analysis, Insights and Forecast - by DC Size

- 7. South America Jakarta Data Center Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by DC Size

- 7.1.1. Small

- 7.1.2. Medium

- 7.1.3. Large

- 7.1.4. Massive

- 7.1.5. Mega

- 7.2. Market Analysis, Insights and Forecast - by Tier Type

- 7.2.1. Tier 1 & 2

- 7.2.2. Tier 3

- 7.2.3. Tier 4

- 7.3. Market Analysis, Insights and Forecast - by Absorption

- 7.3.1. Utilized

- 7.3.1.1. Colocation Type

- 7.3.1.1.1. Retail

- 7.3.1.1.2. Wholesale

- 7.3.1.1.3. Hyperscale

- 7.3.1.2. End User

- 7.3.1.2.1. Cloud & IT

- 7.3.1.2.2. Telecom

- 7.3.1.2.3. Media & Entertainment

- 7.3.1.2.4. Government

- 7.3.1.2.5. BFSI

- 7.3.1.2.6. Manufacturing

- 7.3.1.2.7. E-Commerce

- 7.3.1.2.8. Other End User

- 7.3.1.1. Colocation Type

- 7.3.2. Non-Utilized

- 7.3.1. Utilized

- 7.1. Market Analysis, Insights and Forecast - by DC Size

- 8. Europe Jakarta Data Center Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by DC Size

- 8.1.1. Small

- 8.1.2. Medium

- 8.1.3. Large

- 8.1.4. Massive

- 8.1.5. Mega

- 8.2. Market Analysis, Insights and Forecast - by Tier Type

- 8.2.1. Tier 1 & 2

- 8.2.2. Tier 3

- 8.2.3. Tier 4

- 8.3. Market Analysis, Insights and Forecast - by Absorption

- 8.3.1. Utilized

- 8.3.1.1. Colocation Type

- 8.3.1.1.1. Retail

- 8.3.1.1.2. Wholesale

- 8.3.1.1.3. Hyperscale

- 8.3.1.2. End User

- 8.3.1.2.1. Cloud & IT

- 8.3.1.2.2. Telecom

- 8.3.1.2.3. Media & Entertainment

- 8.3.1.2.4. Government

- 8.3.1.2.5. BFSI

- 8.3.1.2.6. Manufacturing

- 8.3.1.2.7. E-Commerce

- 8.3.1.2.8. Other End User

- 8.3.1.1. Colocation Type

- 8.3.2. Non-Utilized

- 8.3.1. Utilized

- 8.1. Market Analysis, Insights and Forecast - by DC Size

- 9. Middle East & Africa Jakarta Data Center Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by DC Size

- 9.1.1. Small

- 9.1.2. Medium

- 9.1.3. Large

- 9.1.4. Massive

- 9.1.5. Mega

- 9.2. Market Analysis, Insights and Forecast - by Tier Type

- 9.2.1. Tier 1 & 2

- 9.2.2. Tier 3

- 9.2.3. Tier 4

- 9.3. Market Analysis, Insights and Forecast - by Absorption

- 9.3.1. Utilized

- 9.3.1.1. Colocation Type

- 9.3.1.1.1. Retail

- 9.3.1.1.2. Wholesale

- 9.3.1.1.3. Hyperscale

- 9.3.1.2. End User

- 9.3.1.2.1. Cloud & IT

- 9.3.1.2.2. Telecom

- 9.3.1.2.3. Media & Entertainment

- 9.3.1.2.4. Government

- 9.3.1.2.5. BFSI

- 9.3.1.2.6. Manufacturing

- 9.3.1.2.7. E-Commerce

- 9.3.1.2.8. Other End User

- 9.3.1.1. Colocation Type

- 9.3.2. Non-Utilized

- 9.3.1. Utilized

- 9.1. Market Analysis, Insights and Forecast - by DC Size

- 10. Asia Pacific Jakarta Data Center Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by DC Size

- 10.1.1. Small

- 10.1.2. Medium

- 10.1.3. Large

- 10.1.4. Massive

- 10.1.5. Mega

- 10.2. Market Analysis, Insights and Forecast - by Tier Type

- 10.2.1. Tier 1 & 2

- 10.2.2. Tier 3

- 10.2.3. Tier 4

- 10.3. Market Analysis, Insights and Forecast - by Absorption

- 10.3.1. Utilized

- 10.3.1.1. Colocation Type

- 10.3.1.1.1. Retail

- 10.3.1.1.2. Wholesale

- 10.3.1.1.3. Hyperscale

- 10.3.1.2. End User

- 10.3.1.2.1. Cloud & IT

- 10.3.1.2.2. Telecom

- 10.3.1.2.3. Media & Entertainment

- 10.3.1.2.4. Government

- 10.3.1.2.5. BFSI

- 10.3.1.2.6. Manufacturing

- 10.3.1.2.7. E-Commerce

- 10.3.1.2.8. Other End User

- 10.3.1.1. Colocation Type

- 10.3.2. Non-Utilized

- 10.3.1. Utilized

- 10.1. Market Analysis, Insights and Forecast - by DC Size

- 11. North America Jakarta Data Center Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Jakarta Data Center Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific Jakarta Data Center Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America Jakarta Data Center Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East and Africa Jakarta Data Center Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 PT Indosat Tbk (Big Data Exchange (BDx))

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Space DC Pte Ltd

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 PT DWI Tunggal Putra (DTPNet)

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 PT Jupiter Jala Arta (JupiterDC)

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Biznet Data Center

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 PT Sigma Cipta Caraka (Telkomsigma)

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Digital Edge DC

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 EdgeConneX Inc (GTN Data Centers)

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 PT DCI Indonesia Tbk

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 NEX Data Center Indonesia

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 PT XL Axiata Tbk (Princeton Digital Group)

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 NTT Ltd

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 Nusantara Data Center

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.1 PT Indosat Tbk (Big Data Exchange (BDx))

List of Figures

- Figure 1: Global Jakarta Data Center Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Jakarta Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Jakarta Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Jakarta Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Jakarta Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Jakarta Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Jakarta Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Jakarta Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Jakarta Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Jakarta Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Jakarta Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Jakarta Data Center Market Revenue (Million), by DC Size 2024 & 2032

- Figure 13: North America Jakarta Data Center Market Revenue Share (%), by DC Size 2024 & 2032

- Figure 14: North America Jakarta Data Center Market Revenue (Million), by Tier Type 2024 & 2032

- Figure 15: North America Jakarta Data Center Market Revenue Share (%), by Tier Type 2024 & 2032

- Figure 16: North America Jakarta Data Center Market Revenue (Million), by Absorption 2024 & 2032

- Figure 17: North America Jakarta Data Center Market Revenue Share (%), by Absorption 2024 & 2032

- Figure 18: North America Jakarta Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Jakarta Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: South America Jakarta Data Center Market Revenue (Million), by DC Size 2024 & 2032

- Figure 21: South America Jakarta Data Center Market Revenue Share (%), by DC Size 2024 & 2032

- Figure 22: South America Jakarta Data Center Market Revenue (Million), by Tier Type 2024 & 2032

- Figure 23: South America Jakarta Data Center Market Revenue Share (%), by Tier Type 2024 & 2032

- Figure 24: South America Jakarta Data Center Market Revenue (Million), by Absorption 2024 & 2032

- Figure 25: South America Jakarta Data Center Market Revenue Share (%), by Absorption 2024 & 2032

- Figure 26: South America Jakarta Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 27: South America Jakarta Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Europe Jakarta Data Center Market Revenue (Million), by DC Size 2024 & 2032

- Figure 29: Europe Jakarta Data Center Market Revenue Share (%), by DC Size 2024 & 2032

- Figure 30: Europe Jakarta Data Center Market Revenue (Million), by Tier Type 2024 & 2032

- Figure 31: Europe Jakarta Data Center Market Revenue Share (%), by Tier Type 2024 & 2032

- Figure 32: Europe Jakarta Data Center Market Revenue (Million), by Absorption 2024 & 2032

- Figure 33: Europe Jakarta Data Center Market Revenue Share (%), by Absorption 2024 & 2032

- Figure 34: Europe Jakarta Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Europe Jakarta Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East & Africa Jakarta Data Center Market Revenue (Million), by DC Size 2024 & 2032

- Figure 37: Middle East & Africa Jakarta Data Center Market Revenue Share (%), by DC Size 2024 & 2032

- Figure 38: Middle East & Africa Jakarta Data Center Market Revenue (Million), by Tier Type 2024 & 2032

- Figure 39: Middle East & Africa Jakarta Data Center Market Revenue Share (%), by Tier Type 2024 & 2032

- Figure 40: Middle East & Africa Jakarta Data Center Market Revenue (Million), by Absorption 2024 & 2032

- Figure 41: Middle East & Africa Jakarta Data Center Market Revenue Share (%), by Absorption 2024 & 2032

- Figure 42: Middle East & Africa Jakarta Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 43: Middle East & Africa Jakarta Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 44: Asia Pacific Jakarta Data Center Market Revenue (Million), by DC Size 2024 & 2032

- Figure 45: Asia Pacific Jakarta Data Center Market Revenue Share (%), by DC Size 2024 & 2032

- Figure 46: Asia Pacific Jakarta Data Center Market Revenue (Million), by Tier Type 2024 & 2032

- Figure 47: Asia Pacific Jakarta Data Center Market Revenue Share (%), by Tier Type 2024 & 2032

- Figure 48: Asia Pacific Jakarta Data Center Market Revenue (Million), by Absorption 2024 & 2032

- Figure 49: Asia Pacific Jakarta Data Center Market Revenue Share (%), by Absorption 2024 & 2032

- Figure 50: Asia Pacific Jakarta Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 51: Asia Pacific Jakarta Data Center Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Jakarta Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Jakarta Data Center Market Revenue Million Forecast, by DC Size 2019 & 2032

- Table 3: Global Jakarta Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 4: Global Jakarta Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 5: Global Jakarta Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Jakarta Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Jakarta Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Jakarta Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Jakarta Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Jakarta Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Jakarta Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Jakarta Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Jakarta Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Jakarta Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Jakarta Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Jakarta Data Center Market Revenue Million Forecast, by DC Size 2019 & 2032

- Table 17: Global Jakarta Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 18: Global Jakarta Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 19: Global Jakarta Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: United States Jakarta Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Canada Jakarta Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Mexico Jakarta Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global Jakarta Data Center Market Revenue Million Forecast, by DC Size 2019 & 2032

- Table 24: Global Jakarta Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 25: Global Jakarta Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 26: Global Jakarta Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Brazil Jakarta Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Argentina Jakarta Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Rest of South America Jakarta Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Global Jakarta Data Center Market Revenue Million Forecast, by DC Size 2019 & 2032

- Table 31: Global Jakarta Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 32: Global Jakarta Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 33: Global Jakarta Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: United Kingdom Jakarta Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Germany Jakarta Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: France Jakarta Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Italy Jakarta Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Spain Jakarta Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Russia Jakarta Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Benelux Jakarta Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Nordics Jakarta Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Rest of Europe Jakarta Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Global Jakarta Data Center Market Revenue Million Forecast, by DC Size 2019 & 2032

- Table 44: Global Jakarta Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 45: Global Jakarta Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 46: Global Jakarta Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 47: Turkey Jakarta Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Israel Jakarta Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: GCC Jakarta Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: North Africa Jakarta Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: South Africa Jakarta Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Rest of Middle East & Africa Jakarta Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Global Jakarta Data Center Market Revenue Million Forecast, by DC Size 2019 & 2032

- Table 54: Global Jakarta Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 55: Global Jakarta Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 56: Global Jakarta Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 57: China Jakarta Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: India Jakarta Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Japan Jakarta Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: South Korea Jakarta Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: ASEAN Jakarta Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Oceania Jakarta Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 63: Rest of Asia Pacific Jakarta Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Jakarta Data Center Market?

The projected CAGR is approximately 16.49%.

2. Which companies are prominent players in the Jakarta Data Center Market?

Key companies in the market include PT Indosat Tbk (Big Data Exchange (BDx)), Space DC Pte Ltd, PT DWI Tunggal Putra (DTPNet), PT Jupiter Jala Arta (JupiterDC), Biznet Data Center, PT Sigma Cipta Caraka (Telkomsigma), Digital Edge DC, EdgeConneX Inc (GTN Data Centers), PT DCI Indonesia Tbk, NEX Data Center Indonesia, PT XL Axiata Tbk (Princeton Digital Group), NTT Ltd, Nusantara Data Center.

3. What are the main segments of the Jakarta Data Center Market?

The market segments include DC Size, Tier Type, Absorption.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Regulations Promoting Proper Lighting for Worker Safety in Hazardous Locations; Rising Demand for Cost-effective and Energy-efficient LED Lighting Solutions.

6. What are the notable trends driving market growth?

Tier 4 is Expected to Hold Significant Share of the Market.

7. Are there any restraints impacting market growth?

High Costs of Equipment.

8. Can you provide examples of recent developments in the market?

Apr 2023: BDxIndonesia, a BDxaffiliate, began constructing a new greenfield data center, CGK3A, in TB Simatupang, South Jakarta. The data center, which has a capacity of 15 MW, seeks to deliver top data center services to Indonesian businesses and hyperscalers. The new 14,127-square-meter data center is outfitted with Tier 3 data center facilities, advanced security systems, automation technology, and high network uptime, as well as a below-average power usage effectiveness (PUE) of 1.4, which provides operational excellence and a sustainable solution without sacrificing productivity and scalability.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Jakarta Data Center Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Jakarta Data Center Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Jakarta Data Center Market?

To stay informed about further developments, trends, and reports in the Jakarta Data Center Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence