Key Insights

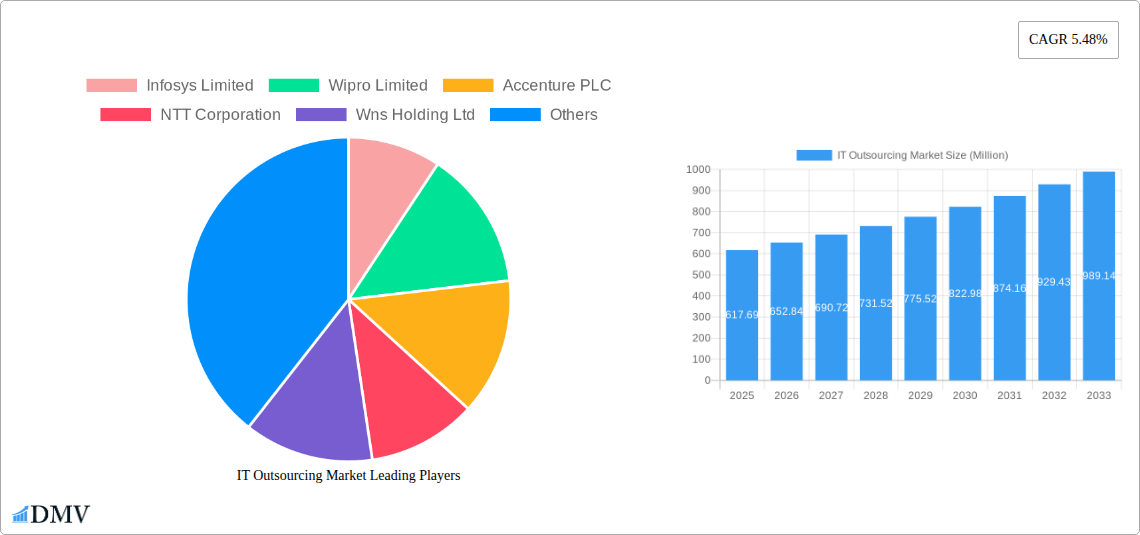

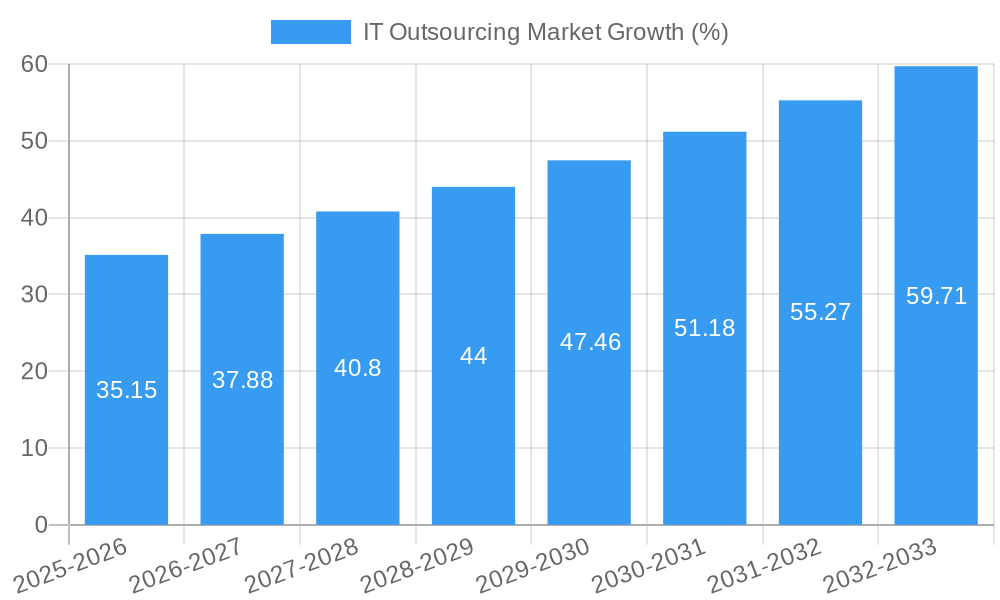

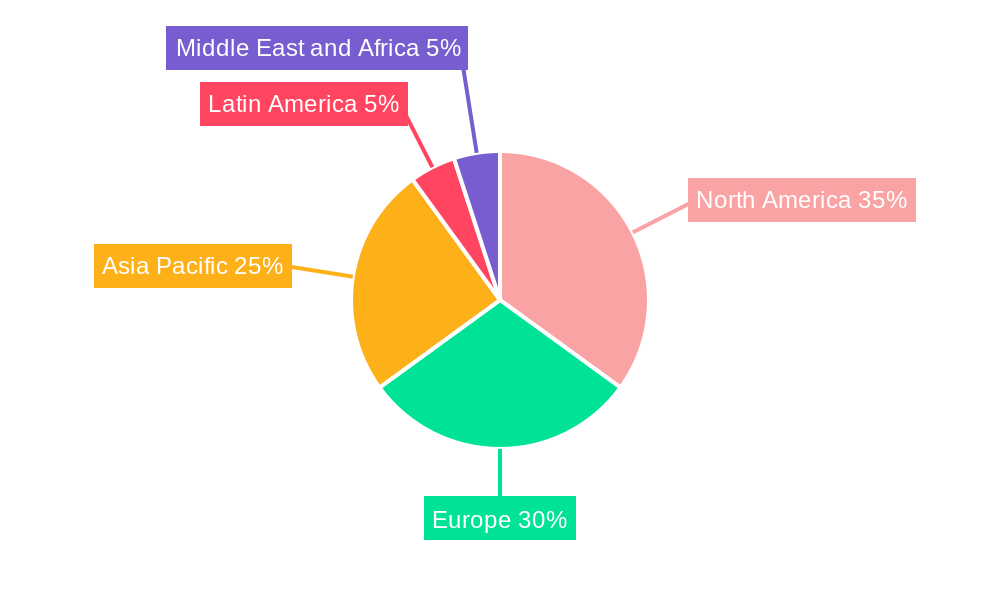

The IT Outsourcing market, valued at $617.69 million in 2025, is projected to experience robust growth, driven by the increasing adoption of cloud computing, digital transformation initiatives across various industries, and the escalating demand for specialized IT skills. The market's Compound Annual Growth Rate (CAGR) of 5.48% from 2025 to 2033 indicates a significant expansion over the forecast period. Key drivers include the need for cost optimization, enhanced operational efficiency, and access to a global talent pool. Significant growth is expected from segments like BFSI (Banking, Financial Services, and Insurance), Healthcare, and Retail & E-commerce, as these sectors increasingly rely on IT for core operations and innovation. Large enterprises are anticipated to dominate the market due to their higher IT budgets and complex technological needs, although the SME segment is also experiencing considerable growth fueled by the accessibility of cloud-based solutions and flexible outsourcing models. Geographical distribution shows strong presence in North America and Europe, but Asia-Pacific is also a significant and rapidly growing market due to the concentration of IT talent and increasing digital adoption in countries like India and China. Competitive landscape is characterized by a mix of large multinational corporations like Accenture and Infosys, and smaller specialized firms, indicating a diverse ecosystem with opportunities for both established players and emerging entrants.

The forecast period (2025-2033) presents several opportunities and challenges. While the demand for IT outsourcing services continues to rise, companies face potential restraints such as data security concerns, vendor lock-in risks, and the need for robust governance frameworks to manage offshore partnerships effectively. The successful players will be those that can adeptly manage these challenges, invest in advanced technologies like AI and automation, and foster strong client relationships based on trust and transparency. The market's continued evolution necessitates proactive adaptation and strategic positioning from both service providers and clients alike. Growth will likely be uneven across regions, influenced by factors such as economic conditions, government regulations, and the availability of skilled IT professionals. The market’s evolution will be marked by continuous innovation in areas like AI-powered solutions, cybersecurity services and managed cloud offerings, driving the next stage of growth.

IT Outsourcing Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the IT Outsourcing market, projecting a market value of XX Million by 2033. It delves into market dynamics, competitive landscapes, technological advancements, and future growth opportunities, offering invaluable insights for stakeholders across the IT sector. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report encompasses historical data (2019-2024) and forecasts (2025-2033), equipping you with a comprehensive understanding of this rapidly evolving market.

IT Outsourcing Market Composition & Trends

This section analyzes the competitive intensity, innovation drivers, regulatory environment, substitute offerings, end-user characteristics, and merger & acquisition (M&A) activity within the IT outsourcing market. We examine the market share distribution among key players, including Infosys Limited, Wipro Limited, Accenture PLC, and others, revealing the dynamics of market concentration. The report quantifies M&A deal values over the study period to illustrate the level of consolidation and strategic investment within the sector. Key findings include:

- Market Concentration: The market exhibits a moderately concentrated structure, with a few major players holding significant market share. However, the presence of numerous smaller specialized firms indicates a dynamic competitive landscape. The report provides a detailed breakdown of market share distribution among leading companies, revealing the competitive intensity.

- Innovation Catalysts: The rapid advancement of cloud computing, AI, and automation technologies are significant catalysts driving innovation within the market. These technologies are enabling the delivery of more efficient, cost-effective, and scalable IT solutions.

- Regulatory Landscape: Varying data privacy regulations across different geographies impact the operations of IT outsourcing firms. The report assesses the implications of these regulations on market growth and investment strategies.

- Substitute Products: Internal IT development and open-source solutions present limited alternatives to IT outsourcing, though the appeal of these alternatives is often dependent on the scale and complexity of the business.

- End-User Profiles: The analysis examines the characteristics of end-users across different industry verticals and organization sizes, emphasizing the key drivers of outsourcing decisions.

- M&A Activities: The report documents significant M&A activities in the IT outsourcing industry during the study period, analyzing the financial impact and strategic implications of these transactions. The total value of M&A deals is estimated at XX Million during the period 2019-2024.

IT Outsourcing Market Industry Evolution

This section charts the trajectory of the IT outsourcing market, detailing its growth trends, technological developments, and evolving customer demands. The report utilizes extensive data points to analyze growth rates and adoption metrics of various technologies. Growth is influenced by factors such as increasing digital transformation initiatives across sectors, cost optimization strategies by businesses, and the rising demand for specialized IT skills. The average annual growth rate (AAGR) from 2019 to 2024 was approximately XX%, driven by increasing adoption of cloud-based services, big data analytics, and cybersecurity solutions.

The market is witnessing significant shifts driven by:

- The exponential growth of cloud computing has propelled the adoption of cloud-based outsourcing models, with a projected XX% increase in cloud-based services utilization by 2033.

- The increasing sophistication of AI and machine learning technologies is enabling more intelligent and automated IT services, resulting in greater efficiency and cost savings for organizations.

- The increasing prevalence of cybersecurity threats has driven demand for robust and outsourced security solutions, with expenditure in this domain expected to reach XX Million by 2033.

- The rise of the gig economy is impacting the workforce dynamics of IT outsourcing, with an estimated XX% of IT professionals working as independent contractors by 2033.

Leading Regions, Countries, or Segments in IT Outsourcing Market

This section identifies the leading regions, countries, and segments within the IT outsourcing market. Key drivers, such as investment trends and regulatory support, are highlighted using bullet points. Dominance factors are analyzed in-depth through paragraphs.

By Organization Size: Large Enterprises dominate the market currently, accounting for approximately XX% of the total market revenue. This is driven by their higher budgets and more complex IT needs. However, the SME segment is also experiencing significant growth, fueled by increasing adoption of cloud-based solutions and SaaS offerings.

By End-user Vertical: The BFSI (Banking, Financial Services, and Insurance) sector constitutes the largest segment, accounting for approximately XX% of the market, due to its stringent regulatory compliance needs and heavy reliance on technology. However, other sectors like Healthcare, Retail & E-commerce, and Manufacturing are showing substantial growth potential.

Key Drivers:

- India and other Asian countries: These countries attract significant outsourcing projects due to favorable cost structures and a large pool of skilled IT professionals. Government initiatives to improve infrastructure and enhance digital literacy further boost the attractiveness of these locations.

- North America: The region remains a major market for IT outsourcing, driven by high technological adoption, the presence of significant enterprises, and robust regulatory frameworks.

- Western Europe: The presence of established IT industries and high levels of technological sophistication supports the European market’s sustained growth.

IT Outsourcing Market Product Innovations

The IT outsourcing market witnesses continuous innovation in service offerings. The integration of AI, machine learning, and automation technologies is transforming the delivery and efficiency of IT services. New product offerings are focusing on specialized solutions for specific industry verticals, offering tailored services, performance guarantees, and improved security measures. This has led to the emergence of cloud-based solutions and managed services, significantly impacting traditional outsourcing models. The focus on predictive analytics and data-driven insights enhances service delivery capabilities, enabling more efficient and proactive problem-solving.

Propelling Factors for IT Outsourcing Market Growth

Several factors drive the growth of the IT outsourcing market. The increasing complexity of IT infrastructure and the rising demand for specialized skills lead businesses to outsource their IT operations. Cost optimization is another key driver, as outsourcing often proves more cost-effective than maintaining an in-house IT department. Government initiatives to promote digital transformation across various sectors further accelerate market growth. Furthermore, the global adoption of cloud computing and the increasing need for robust cybersecurity solutions fuel this expansion.

Obstacles in the IT Outsourcing Market

The IT outsourcing market faces challenges such as data security concerns, regulatory compliance requirements, and the risk of vendor lock-in. Supply chain disruptions, particularly concerning the availability of skilled IT professionals, also hinder growth. Increased competition and the pricing pressures from emerging markets pose ongoing challenges for established providers. These factors necessitate strategic adaptations and a focus on innovation to navigate these obstacles.

Future Opportunities in IT Outsourcing Market

Emerging technologies like blockchain, IoT, and quantum computing offer significant opportunities for IT outsourcing providers. Expansion into new geographic markets, particularly developing economies with growing IT demands, presents attractive avenues for growth. The convergence of IT services with other areas, such as digital marketing and customer experience management, opens new avenues for growth. Moreover, niche specializations within sectors like healthcare and finance create significant opportunities for specialized service offerings.

Major Players in the IT Outsourcing Market Ecosystem

- Infosys Limited

- Wipro Limited

- Accenture PLC

- NTT Corporation

- Wns Holding Ltd

- IBM Corporation

- ATOS SE

- Capgemini SE

- Andela Inc

- Pointwest Technologies

- Amadeus IT Group

- Tata Consultancy Services

- HCL Technologies Lt

- DXC Technologies

- Specialist Computer Centres (SCC)

- Cognizant Technology Solutions Corporation

Key Developments in IT Outsourcing Market Industry

- May 2023: TDCX expands its facility in Sao Paulo, Brazil, reflecting the growing demand for digital customer experience (CX) solutions in the region and leveraging AI for enhanced service capabilities.

- April 2023: Atos SE establishes three state-of-the-art cloud centers in India and Poland, supporting customer cloud journeys across various sectors with a strong cybersecurity framework.

Strategic IT Outsourcing Market Forecast

The IT outsourcing market is poised for sustained growth, driven by continuous technological advancements, increased digitization across industries, and the growing need for specialized IT skills. The market's future potential is substantial, driven by the increasing adoption of cloud computing, AI, and other emerging technologies. This creates opportunities for both established players and new entrants to capitalize on the market's expansive growth. The projected compound annual growth rate (CAGR) for the forecast period (2025-2033) is estimated at XX%, promising substantial market expansion.

IT Outsourcing Market Segmentation

-

1. Organization Size

- 1.1. Small and Medium Enterprises

- 1.2. Large Enterprises

-

2. End-user Vertical

- 2.1. BFSI

- 2.2. Healthcare

- 2.3. Media and Telecommunications

- 2.4. Retail and E-commerce

- 2.5. Manufacturing

- 2.6. Other End-user verticals

IT Outsourcing Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Poland

- 2.7. Belgium

- 2.8. Netherlands

- 2.9. Luxembourg

- 2.10. Sweden

- 2.11. Denmark

- 2.12. Norway

- 2.13. Finland

- 2.14. Iceland

-

3. Asia

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Indonesia

- 3.5. Vietnam

- 3.6. Malaysia

- 3.7. South Korea

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Colombia

-

5. Middle East and Africa

- 5.1. GCC

- 5.2. South Africa

- 5.3. Turkey

IT Outsourcing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.48% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Efficiency and Scalable IT Infrastructure; Organization are Increasingly Focusing on IT as a means to Gain Differentiation by Relying on Outsourced Vendors; Ongoing Migration Toward the Cloud and Adoption of Virtualized Infrastructure

- 3.3. Market Restrains

- 3.3.1. Use of Physical Vault

- 3.4. Market Trends

- 3.4.1. BFSI to be the Largest End-user Vertical

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. IT Outsourcing Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Organization Size

- 5.1.1. Small and Medium Enterprises

- 5.1.2. Large Enterprises

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. BFSI

- 5.2.2. Healthcare

- 5.2.3. Media and Telecommunications

- 5.2.4. Retail and E-commerce

- 5.2.5. Manufacturing

- 5.2.6. Other End-user verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Organization Size

- 6. North America IT Outsourcing Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Organization Size

- 6.1.1. Small and Medium Enterprises

- 6.1.2. Large Enterprises

- 6.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.2.1. BFSI

- 6.2.2. Healthcare

- 6.2.3. Media and Telecommunications

- 6.2.4. Retail and E-commerce

- 6.2.5. Manufacturing

- 6.2.6. Other End-user verticals

- 6.1. Market Analysis, Insights and Forecast - by Organization Size

- 7. Europe IT Outsourcing Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Organization Size

- 7.1.1. Small and Medium Enterprises

- 7.1.2. Large Enterprises

- 7.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.2.1. BFSI

- 7.2.2. Healthcare

- 7.2.3. Media and Telecommunications

- 7.2.4. Retail and E-commerce

- 7.2.5. Manufacturing

- 7.2.6. Other End-user verticals

- 7.1. Market Analysis, Insights and Forecast - by Organization Size

- 8. Asia IT Outsourcing Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Organization Size

- 8.1.1. Small and Medium Enterprises

- 8.1.2. Large Enterprises

- 8.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 8.2.1. BFSI

- 8.2.2. Healthcare

- 8.2.3. Media and Telecommunications

- 8.2.4. Retail and E-commerce

- 8.2.5. Manufacturing

- 8.2.6. Other End-user verticals

- 8.1. Market Analysis, Insights and Forecast - by Organization Size

- 9. Latin America IT Outsourcing Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Organization Size

- 9.1.1. Small and Medium Enterprises

- 9.1.2. Large Enterprises

- 9.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 9.2.1. BFSI

- 9.2.2. Healthcare

- 9.2.3. Media and Telecommunications

- 9.2.4. Retail and E-commerce

- 9.2.5. Manufacturing

- 9.2.6. Other End-user verticals

- 9.1. Market Analysis, Insights and Forecast - by Organization Size

- 10. Middle East and Africa IT Outsourcing Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Organization Size

- 10.1.1. Small and Medium Enterprises

- 10.1.2. Large Enterprises

- 10.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 10.2.1. BFSI

- 10.2.2. Healthcare

- 10.2.3. Media and Telecommunications

- 10.2.4. Retail and E-commerce

- 10.2.5. Manufacturing

- 10.2.6. Other End-user verticals

- 10.1. Market Analysis, Insights and Forecast - by Organization Size

- 11. North America IT Outsourcing Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 12. Europe IT Outsourcing Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United Kingdom

- 12.1.2 Germany

- 12.1.3 France

- 12.1.4 Italy

- 12.1.5 Spain

- 12.1.6 The Nordics

- 12.1.7 Benelux

- 12.1.8 Poland

- 12.1.9 Rest of Europe

- 13. Asia Pacific IT Outsourcing Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 India

- 13.1.3 Japan

- 13.1.4 Indonesia

- 13.1.5 Vietnam

- 13.1.6 Malaysia

- 13.1.7 South Korea

- 13.1.8 Rest of Asia Pacific

- 14. Latin America IT Outsourcing Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Mexico

- 14.1.3 Colombia

- 14.1.4 Rest of Latin America

- 15. Middle East and Africa IT Outsourcing Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 GCC

- 15.1.2 South Africa

- 15.1.3 Turkey

- 15.1.4 Rest of Middle East and Africa

- 16. Competitive Analysis

- 16.1. Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Infosys Limited

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Wipro Limited

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Accenture PLC

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 NTT Corporation

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Wns Holding Ltd

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 IBM Corporation

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 ATOS SE

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Capgemini SE

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Andela Inc

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Pointwest Technologies

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Amadeus IT Group

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Tata Consultancy Services

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 HCL Technologies Lt

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.14 DXC Technologies

- 16.2.14.1. Overview

- 16.2.14.2. Products

- 16.2.14.3. SWOT Analysis

- 16.2.14.4. Recent Developments

- 16.2.14.5. Financials (Based on Availability)

- 16.2.15 Specialist Computer Centres (SCC)

- 16.2.15.1. Overview

- 16.2.15.2. Products

- 16.2.15.3. SWOT Analysis

- 16.2.15.4. Recent Developments

- 16.2.15.5. Financials (Based on Availability)

- 16.2.16 Cognizant Technology Solutions Corporation

- 16.2.16.1. Overview

- 16.2.16.2. Products

- 16.2.16.3. SWOT Analysis

- 16.2.16.4. Recent Developments

- 16.2.16.5. Financials (Based on Availability)

- 16.2.1 Infosys Limited

List of Figures

- Figure 1: IT Outsourcing Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: IT Outsourcing Market Share (%) by Company 2024

List of Tables

- Table 1: IT Outsourcing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: IT Outsourcing Market Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 3: IT Outsourcing Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 4: IT Outsourcing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: IT Outsourcing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States IT Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada IT Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: IT Outsourcing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United Kingdom IT Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Germany IT Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: France IT Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Italy IT Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Spain IT Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: The Nordics IT Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Benelux IT Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Poland IT Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Rest of Europe IT Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: IT Outsourcing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: China IT Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: India IT Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Japan IT Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Indonesia IT Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Vietnam IT Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Malaysia IT Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: South Korea IT Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Rest of Asia Pacific IT Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: IT Outsourcing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Brazil IT Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Mexico IT Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Colombia IT Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Rest of Latin America IT Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: IT Outsourcing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 33: GCC IT Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: South Africa IT Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Turkey IT Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Rest of Middle East and Africa IT Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: IT Outsourcing Market Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 38: IT Outsourcing Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 39: IT Outsourcing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 40: United States IT Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Canada IT Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: IT Outsourcing Market Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 43: IT Outsourcing Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 44: IT Outsourcing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 45: United Kingdom IT Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Germany IT Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: France IT Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Italy IT Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Spain IT Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Poland IT Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Belgium IT Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Netherlands IT Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Luxembourg IT Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Sweden IT Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Denmark IT Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Norway IT Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: Finland IT Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Iceland IT Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: IT Outsourcing Market Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 60: IT Outsourcing Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 61: IT Outsourcing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 62: China IT Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 63: India IT Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: Japan IT Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 65: Indonesia IT Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: Vietnam IT Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 67: Malaysia IT Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 68: South Korea IT Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 69: IT Outsourcing Market Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 70: IT Outsourcing Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 71: IT Outsourcing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 72: Brazil IT Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 73: Mexico IT Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 74: Colombia IT Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 75: IT Outsourcing Market Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 76: IT Outsourcing Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 77: IT Outsourcing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 78: GCC IT Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 79: South Africa IT Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 80: Turkey IT Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the IT Outsourcing Market?

The projected CAGR is approximately 5.48%.

2. Which companies are prominent players in the IT Outsourcing Market?

Key companies in the market include Infosys Limited, Wipro Limited, Accenture PLC, NTT Corporation, Wns Holding Ltd, IBM Corporation, ATOS SE, Capgemini SE, Andela Inc, Pointwest Technologies, Amadeus IT Group, Tata Consultancy Services, HCL Technologies Lt, DXC Technologies, Specialist Computer Centres (SCC), Cognizant Technology Solutions Corporation.

3. What are the main segments of the IT Outsourcing Market?

The market segments include Organization Size, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 617.69 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Efficiency and Scalable IT Infrastructure; Organization are Increasingly Focusing on IT as a means to Gain Differentiation by Relying on Outsourced Vendors; Ongoing Migration Toward the Cloud and Adoption of Virtualized Infrastructure.

6. What are the notable trends driving market growth?

BFSI to be the Largest End-user Vertical.

7. Are there any restraints impacting market growth?

Use of Physical Vault.

8. Can you provide examples of recent developments in the market?

May 2023: TDCX officially unveiled its plans for the expansion of its facility in Sao Paulo, Brazil. The company is a leading provider of digital customer experience (CX) solutions for technology and blue-chip enterprises. With the advent of cutting-edge technologies, including generative artificial intelligence (AI), TDCX is poised to revolutionize the CX landscape in various domains. These advancements empower service providers like TDCX to further automate their operations, offer enhanced predictive capabilities through data analysis, and optimize procedures for their valued clients. The decision to expand into Brazil underscores the country's growing appeal as a prime destination for digital customer experience solutions and IT services.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "IT Outsourcing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the IT Outsourcing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the IT Outsourcing Market?

To stay informed about further developments, trends, and reports in the IT Outsourcing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence