Key Insights

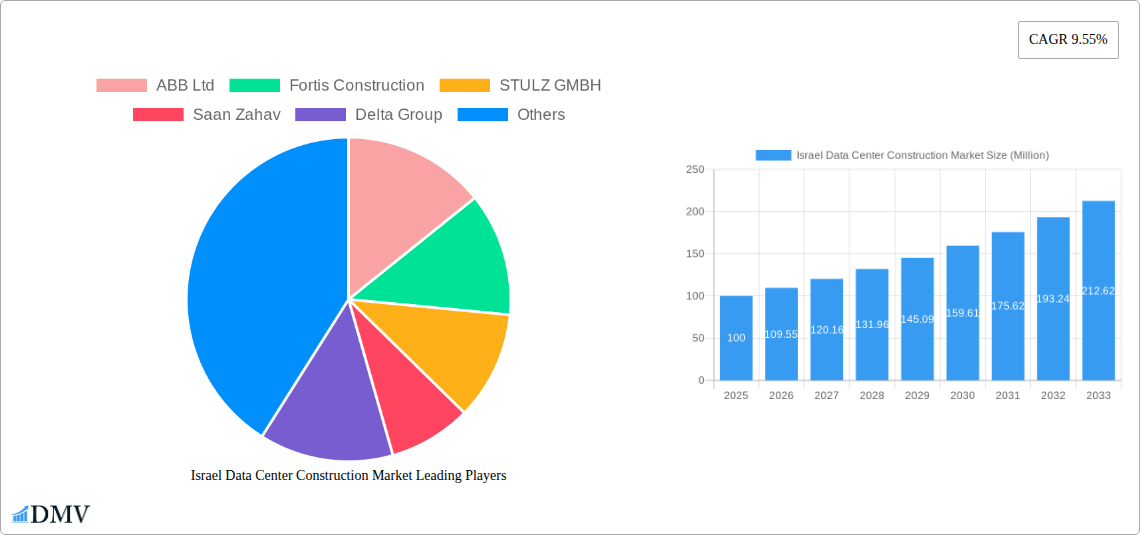

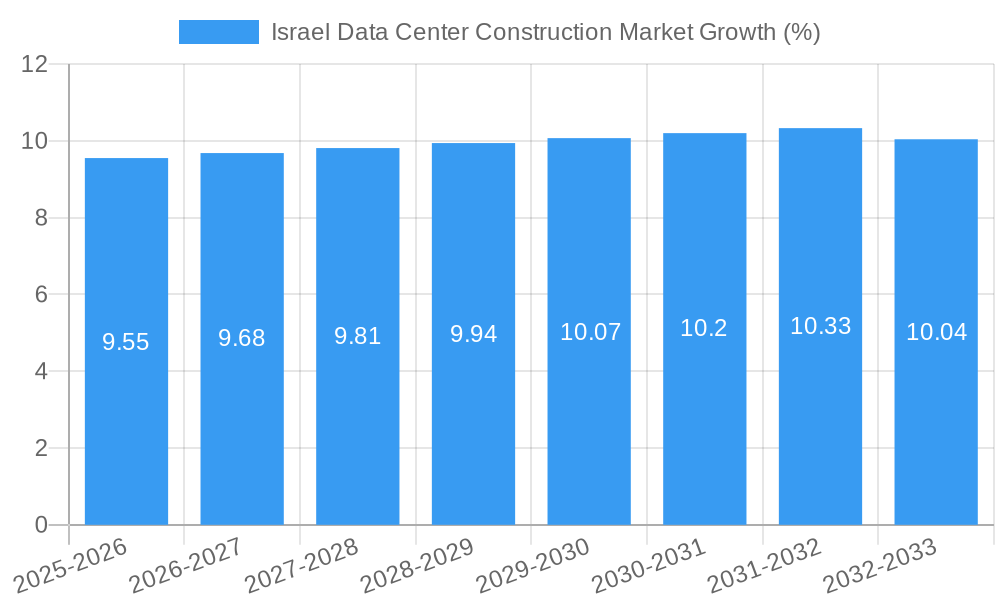

The Israel data center construction market is experiencing robust growth, driven by a surge in digital transformation initiatives across various sectors. The market, estimated at $XX million in 2025, is projected to maintain a Compound Annual Growth Rate (CAGR) of 9.55% from 2025 to 2033, indicating significant expansion opportunities. Key drivers include the increasing adoption of cloud computing, big data analytics, and the expanding e-commerce sector, all demanding robust data center infrastructure. Furthermore, government initiatives promoting digitalization and technological advancement are fueling investments in data center construction. The IT & Telecommunication sector is the leading end-user segment, followed by the BFSI and government sectors, with healthcare and other end-users contributing to overall market growth. The market is segmented by infrastructure type, with electrical infrastructure representing a significant share due to high power requirements of data centers. The competitive landscape is dynamic, encompassing both international players like ABB Ltd., Schneider Electric SE, and Caterpillar Inc., and local companies. However, challenges such as high land costs, regulatory hurdles, and potential power grid limitations could potentially restrain market growth. Strategic partnerships, technological innovations, and efficient project management will be crucial for companies to thrive in this competitive yet promising market.

The forecast period of 2025-2033 presents substantial opportunities for data center construction companies in Israel. The ongoing expansion of hyperscale data centers to cater to growing cloud services and the increasing need for edge computing infrastructure will significantly contribute to the market's growth trajectory. Moreover, the focus on cybersecurity and data sovereignty is likely to push organizations to invest in locally based data centers, further strengthening market demand. While challenges remain, the long-term outlook for the Israel data center construction market remains positive, promising substantial returns for companies able to navigate the market's complexities effectively.

Israel Data Center Construction Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Israel Data Center Construction Market, offering a comprehensive overview of its current state and future projections from 2019 to 2033. With a focus on market size, key players, technological advancements, and growth drivers, this report is an invaluable resource for investors, industry professionals, and anyone seeking to understand the dynamics of this rapidly expanding sector. The base year for this analysis is 2025, with estimations for 2025 and a forecast period covering 2025-2033, building upon historical data from 2019-2024. The market is segmented by infrastructure (electrical, mechanical, and others), end-user (IT & Telecommunication, BFSI, Government, Healthcare, and others), and other key aspects. Total market value is projected to reach xx Million by 2033.

Israel Data Center Construction Market Composition & Trends

This section delves into the intricate landscape of the Israel Data Center Construction Market, examining market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and significant mergers and acquisitions (M&A) activities. We analyze market share distribution among key players and quantify the financial impact of notable M&A deals.

- Market Concentration: The Israeli Data Center Construction market exhibits a [Insert Degree of Concentration, e.g., moderately concentrated] structure, with [Insert Number] major players holding a significant market share. [Insert Percentage]% of the market is controlled by the top 5 players.

- Innovation Catalysts: Government initiatives promoting digital infrastructure development, coupled with the burgeoning technological advancements in cloud computing and AI, are key drivers of innovation.

- Regulatory Landscape: The regulatory environment is [Insert Description, e.g., supportive] of data center construction, with [mention specific regulations or laws if available]. This fosters a conducive environment for investment and growth.

- Substitute Products: While direct substitutes are limited, the market faces indirect competition from cloud-based services that may reduce demand for on-premise data centers.

- End-User Profiles: The IT & Telecommunication sector dominates end-user demand, followed by BFSI and Government. Healthcare and other sectors are also emerging as significant contributors.

- M&A Activities: Significant M&A activity reflects the market's dynamism. Notable deals include the USD 430 Million valuation of MedOne in July 2022 (Berkshire Partners acquisition) and EdgeConneX's acquisition of Global Data Center (GDC) in August 2021, demonstrating substantial investment in the sector. The total value of M&A deals within the studied period is estimated at xx Million.

Israel Data Center Construction Market Industry Evolution

This section provides an in-depth analysis of the Israel Data Center Construction Market's evolutionary trajectory. We examine market growth trajectories, technological advancements, and shifts in consumer demands, supported by detailed data points such as growth rates and adoption metrics. The market has experienced significant growth in the historical period (2019-2024) at a CAGR of xx%, fueled by increasing demand for data storage and processing capacity. This growth trend is projected to continue into the forecast period (2025-2033), with a projected CAGR of xx%. Technological advancements like the adoption of hyperscale data centers and edge computing solutions are transforming the industry landscape. Consumer demand is driven by an increasing reliance on digital services and the growing adoption of cloud computing across various sectors. Specific examples of technological advancements include [Insert specific examples of technological advancements impacting the market, e.g., increasing adoption of liquid cooling systems, improved power efficiency technologies].

Leading Regions, Countries, or Segments in Israel Data Center Construction Market

This section identifies the dominant regions, countries, or segments within the Israel Data Center Construction Market. We explore the key factors driving their dominance through in-depth analysis and bullet points highlighting investment trends and regulatory support.

Dominant Segment: The IT & Telecommunication sector is the leading end-user segment, driving the majority of market demand. This is followed by the BFSI and Government sectors.

Key Drivers for Dominance (IT & Telecommunication):

- High Investment in Digital Infrastructure: Significant investments by major telecommunication companies and cloud providers fuel growth.

- Stringent Data Security Requirements: The need for robust data security infrastructure supports higher levels of investment.

- Technological Advancements: Growing adoption of cloud computing and AI requires significant data center capacity.

Key Drivers for Dominance (BFSI):

- Regulatory Compliance: Stringent regulations related to data security and compliance drive investment in secure and compliant data centers.

- Digital Transformation: BFSI institutions are investing heavily in digital transformation initiatives, requiring increased data center capacity.

Key Drivers for Dominance (Government):

- National Infrastructure Development: Government initiatives for developing national digital infrastructure propel market growth.

- E-Governance Initiatives: Government's push towards e-governance and digital public services increases demand.

Israel Data Center Construction Market Product Innovations

Recent innovations in the Israel Data Center Construction Market focus on enhancing energy efficiency, improving modularity and scalability, and enhancing security features. New data center designs incorporate advanced cooling systems, such as liquid cooling, to reduce energy consumption and operational costs. Modular construction techniques allow for faster deployment and greater flexibility, while improved security measures, including biometric access control and advanced threat detection systems, enhance data security. These innovations offer unique selling propositions focused on cost efficiency, speed of deployment, and heightened security.

Propelling Factors for Israel Data Center Construction Market Growth

Several factors drive the growth of the Israel Data Center Construction Market. Firstly, the rapid growth of the digital economy in Israel fuels the demand for robust data storage and processing capacity. Secondly, government initiatives supporting digital transformation and the development of advanced technologies incentivize investment in modern data center infrastructure. Thirdly, increasing data security concerns and the rise of cloud computing solutions are further bolstering the market's growth trajectory.

Obstacles in the Israel Data Center Construction Market

The Israel Data Center Construction Market faces challenges such as land scarcity and high construction costs in prime locations. Competition from international players can also impact profitability. Potential disruptions to global supply chains could impact project timelines and budgets. Regulatory hurdles related to environmental compliance and data privacy may also pose challenges.

Future Opportunities in Israel Data Center Construction Market

Future opportunities lie in the growing demand for edge computing and hyperscale data centers. The increasing adoption of AI and machine learning will create further demand for high-performance computing infrastructure. Investments in sustainable and energy-efficient data center technologies will be crucial for future growth. Expansion into new geographical areas and partnerships with technology providers are also expected to generate significant opportunities.

Major Players in the Israel Data Center Construction Market Ecosystem

- ABB Ltd

- Fortis Construction

- STULZ GMBH

- Saan Zahav

- Delta Group

- Schneider Electric SE (Schneider Electric SE)

- Turner Construction Co

- DPR Construction Inc

- Caterpillar Inc (Caterpillar Inc)

- Rittal GmbH & Co KG

- Delta Electronics (Delta Electronics)

- STULZ GMB

- Mercury Engineering

- AECOM Limited (AECOM Limited)

- Legrand (Legrand)

- CyrusOne Inc (CyrusOne Inc)

- AECOM

- Canovate Group

- EAE Group

- Alfa Laval AB (Alfa Laval AB)

- M+W Group (Exyte) (M+W Group (Exyte))

Key Developments in Israel Data Center Construction Market Industry

- July 2022: Berkshire Partners' acquisition of a 49% stake in MedOne for over USD 215 Million (MedOne valued at USD 430 Million) signifies significant investment in the Israeli data center sector.

- August 2021: EdgeConneX's acquisition of Global Data Center (GDC) expanded its presence in Israel, adding two secure facilities to its global network. This highlights the consolidation trend within the market.

Strategic Israel Data Center Construction Market Forecast

The Israel Data Center Construction Market is poised for robust growth driven by sustained demand for digital infrastructure, technological advancements, and supportive government policies. The market's future potential is significant, with continued expansion expected across various segments and regions. Opportunities in edge computing, hyperscale data centers, and sustainable technologies will further drive growth in the coming years. The market is projected to experience substantial growth, reaching xx Million by 2033, fueled by these key factors.

Israel Data Center Construction Market Segmentation

-

1. Infrastructure

-

1.1. Market Segmentation - By Electrical Infrastructure

-

1.1.1. Power Distribution Solution

- 1.1.1.1. PDU - Ba

-

1.1.1.2. Transfer Switches

- 1.1.1.2.1. Static

- 1.1.1.2.2. Automatic (ATS)

-

1.1.1.3. Switchgear

- 1.1.1.3.1. Low-voltage

- 1.1.1.3.2. Medium-voltage

- 1.1.1.4. Power Panels and Components

- 1.1.1.5. Other Power Panels and Components

-

1.1.2. Power Backup Solutions

- 1.1.2.1. UPS

- 1.1.2.2. Generators

- 1.1.3. Service

-

1.1.1. Power Distribution Solution

-

1.2. Market Segmentation - By Mechanical Infrastructure

-

1.2.1. Cooling Systems

- 1.2.1.1. Immersion Cooling

- 1.2.1.2. Direct-to-chip Cooling

- 1.2.1.3. Rear Door Heat Exchanger

- 1.2.1.4. In-row and In-rack Cooling

- 1.2.2. Racks

- 1.2.3. Other Mechanical Infrastructure

-

1.2.1. Cooling Systems

- 1.3. General Construction

-

1.1. Market Segmentation - By Electrical Infrastructure

-

2. Electrical Infrastructure

-

2.1. Power Distribution Solution

- 2.1.1. PDU - Ba

-

2.1.2. Transfer Switches

- 2.1.2.1. Static

- 2.1.2.2. Automatic (ATS)

-

2.1.3. Switchgear

- 2.1.3.1. Low-voltage

- 2.1.3.2. Medium-voltage

- 2.1.4. Power Panels and Components

- 2.1.5. Other Power Panels and Components

-

2.2. Power Backup Solutions

- 2.2.1. UPS

- 2.2.2. Generators

- 2.3. Service

-

2.1. Power Distribution Solution

-

3. Power Distribution Solution

- 3.1. PDU - Ba

-

3.2. Transfer Switches

- 3.2.1. Static

- 3.2.2. Automatic (ATS)

-

3.3. Switchgear

- 3.3.1. Low-voltage

- 3.3.2. Medium-voltage

- 3.4. Power Panels and Components

- 3.5. Other Power Panels and Components

-

4. Power Backup Solutions

- 4.1. UPS

- 4.2. Generators

- 5. Service

-

6. Mechanical Infrastructure

-

6.1. Cooling Systems

- 6.1.1. Immersion Cooling

- 6.1.2. Direct-to-chip Cooling

- 6.1.3. Rear Door Heat Exchanger

- 6.1.4. In-row and In-rack Cooling

- 6.2. Racks

- 6.3. Other Mechanical Infrastructure

-

6.1. Cooling Systems

-

7. Cooling Systems

- 7.1. Immersion Cooling

- 7.2. Direct-to-chip Cooling

- 7.3. Rear Door Heat Exchanger

- 7.4. In-row and In-rack Cooling

- 8. Racks

- 9. Other Mechanical Infrastructure

- 10. General Construction

-

11. Tier Type

- 11.1. Tier 1 and 2

- 11.2. Tier 3

- 11.3. Tier 4

- 12. Tier 1 and 2

- 13. Tier 3

- 14. Tier 4

-

15. End User

- 15.1. Banking, Financial Services, and Insurance

- 15.2. IT and Telecommunications

- 15.3. Government and Defense

- 15.4. Healthcare

- 15.5. Other End Users

- 16. Banking, Financial Services, and Insurance

- 17. IT and Telecommunications

- 18. Government and Defense

- 19. Healthcare

- 20. Other End Users

Israel Data Center Construction Market Segmentation By Geography

- 1. Israel

Israel Data Center Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.55% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 9.1 Rising Adoption of Renewable Energy Sources9.2 Increase in 5G Deployments Fueling Edge Data Center Investments9.3 Smart City Initiatives Driving Data Center Investments

- 3.3. Market Restrains

- 3.3.1. 10.1 Security Challenges in Data Centers10.2 Location Constraints on the Development of Data Centers

- 3.4. Market Trends

- 3.4.1. IT and Telecom to have significant market share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Israel Data Center Construction Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Infrastructure

- 5.1.1. Market Segmentation - By Electrical Infrastructure

- 5.1.1.1. Power Distribution Solution

- 5.1.1.1.1. PDU - Ba

- 5.1.1.1.2. Transfer Switches

- 5.1.1.1.2.1. Static

- 5.1.1.1.2.2. Automatic (ATS)

- 5.1.1.1.3. Switchgear

- 5.1.1.1.3.1. Low-voltage

- 5.1.1.1.3.2. Medium-voltage

- 5.1.1.1.4. Power Panels and Components

- 5.1.1.1.5. Other Power Panels and Components

- 5.1.1.2. Power Backup Solutions

- 5.1.1.2.1. UPS

- 5.1.1.2.2. Generators

- 5.1.1.3. Service

- 5.1.1.1. Power Distribution Solution

- 5.1.2. Market Segmentation - By Mechanical Infrastructure

- 5.1.2.1. Cooling Systems

- 5.1.2.1.1. Immersion Cooling

- 5.1.2.1.2. Direct-to-chip Cooling

- 5.1.2.1.3. Rear Door Heat Exchanger

- 5.1.2.1.4. In-row and In-rack Cooling

- 5.1.2.2. Racks

- 5.1.2.3. Other Mechanical Infrastructure

- 5.1.2.1. Cooling Systems

- 5.1.3. General Construction

- 5.1.1. Market Segmentation - By Electrical Infrastructure

- 5.2. Market Analysis, Insights and Forecast - by Electrical Infrastructure

- 5.2.1. Power Distribution Solution

- 5.2.1.1. PDU - Ba

- 5.2.1.2. Transfer Switches

- 5.2.1.2.1. Static

- 5.2.1.2.2. Automatic (ATS)

- 5.2.1.3. Switchgear

- 5.2.1.3.1. Low-voltage

- 5.2.1.3.2. Medium-voltage

- 5.2.1.4. Power Panels and Components

- 5.2.1.5. Other Power Panels and Components

- 5.2.2. Power Backup Solutions

- 5.2.2.1. UPS

- 5.2.2.2. Generators

- 5.2.3. Service

- 5.2.1. Power Distribution Solution

- 5.3. Market Analysis, Insights and Forecast - by Power Distribution Solution

- 5.3.1. PDU - Ba

- 5.3.2. Transfer Switches

- 5.3.2.1. Static

- 5.3.2.2. Automatic (ATS)

- 5.3.3. Switchgear

- 5.3.3.1. Low-voltage

- 5.3.3.2. Medium-voltage

- 5.3.4. Power Panels and Components

- 5.3.5. Other Power Panels and Components

- 5.4. Market Analysis, Insights and Forecast - by Power Backup Solutions

- 5.4.1. UPS

- 5.4.2. Generators

- 5.5. Market Analysis, Insights and Forecast - by Service

- 5.6. Market Analysis, Insights and Forecast - by Mechanical Infrastructure

- 5.6.1. Cooling Systems

- 5.6.1.1. Immersion Cooling

- 5.6.1.2. Direct-to-chip Cooling

- 5.6.1.3. Rear Door Heat Exchanger

- 5.6.1.4. In-row and In-rack Cooling

- 5.6.2. Racks

- 5.6.3. Other Mechanical Infrastructure

- 5.6.1. Cooling Systems

- 5.7. Market Analysis, Insights and Forecast - by Cooling Systems

- 5.7.1. Immersion Cooling

- 5.7.2. Direct-to-chip Cooling

- 5.7.3. Rear Door Heat Exchanger

- 5.7.4. In-row and In-rack Cooling

- 5.8. Market Analysis, Insights and Forecast - by Racks

- 5.9. Market Analysis, Insights and Forecast - by Other Mechanical Infrastructure

- 5.10. Market Analysis, Insights and Forecast - by General Construction

- 5.11. Market Analysis, Insights and Forecast - by Tier Type

- 5.11.1. Tier 1 and 2

- 5.11.2. Tier 3

- 5.11.3. Tier 4

- 5.12. Market Analysis, Insights and Forecast - by Tier 1 and 2

- 5.13. Market Analysis, Insights and Forecast - by Tier 3

- 5.14. Market Analysis, Insights and Forecast - by Tier 4

- 5.15. Market Analysis, Insights and Forecast - by End User

- 5.15.1. Banking, Financial Services, and Insurance

- 5.15.2. IT and Telecommunications

- 5.15.3. Government and Defense

- 5.15.4. Healthcare

- 5.15.5. Other End Users

- 5.16. Market Analysis, Insights and Forecast - by Banking, Financial Services, and Insurance

- 5.17. Market Analysis, Insights and Forecast - by IT and Telecommunications

- 5.18. Market Analysis, Insights and Forecast - by Government and Defense

- 5.19. Market Analysis, Insights and Forecast - by Healthcare

- 5.20. Market Analysis, Insights and Forecast - by Other End Users

- 5.21. Market Analysis, Insights and Forecast - by Region

- 5.21.1. Israel

- 5.1. Market Analysis, Insights and Forecast - by Infrastructure

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 ABB Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Fortis Construction

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 STULZ GMBH

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Saan Zahav

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Delta Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Schneider Electric SE

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Turner Construction Co

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 DPR Construction Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Caterpillar Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Rittal GmbH & Co KG

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Delta Electronics

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 STULZ GMB

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Mercury Engineering

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 AECOM Limited

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Legrand

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 CyrusOne Inc

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 AECOM

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 Canovate Group

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.19 EAE Group

- 6.2.19.1. Overview

- 6.2.19.2. Products

- 6.2.19.3. SWOT Analysis

- 6.2.19.4. Recent Developments

- 6.2.19.5. Financials (Based on Availability)

- 6.2.20 Alfa Laval AB

- 6.2.20.1. Overview

- 6.2.20.2. Products

- 6.2.20.3. SWOT Analysis

- 6.2.20.4. Recent Developments

- 6.2.20.5. Financials (Based on Availability)

- 6.2.21 M+W Group (Exyte)

- 6.2.21.1. Overview

- 6.2.21.2. Products

- 6.2.21.3. SWOT Analysis

- 6.2.21.4. Recent Developments

- 6.2.21.5. Financials (Based on Availability)

- 6.2.1 ABB Ltd

List of Figures

- Figure 1: Israel Data Center Construction Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Israel Data Center Construction Market Share (%) by Company 2024

List of Tables

- Table 1: Israel Data Center Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Israel Data Center Construction Market Revenue Million Forecast, by Infrastructure 2019 & 2032

- Table 3: Israel Data Center Construction Market Revenue Million Forecast, by Electrical Infrastructure 2019 & 2032

- Table 4: Israel Data Center Construction Market Revenue Million Forecast, by Power Distribution Solution 2019 & 2032

- Table 5: Israel Data Center Construction Market Revenue Million Forecast, by Power Backup Solutions 2019 & 2032

- Table 6: Israel Data Center Construction Market Revenue Million Forecast, by Service 2019 & 2032

- Table 7: Israel Data Center Construction Market Revenue Million Forecast, by Mechanical Infrastructure 2019 & 2032

- Table 8: Israel Data Center Construction Market Revenue Million Forecast, by Cooling Systems 2019 & 2032

- Table 9: Israel Data Center Construction Market Revenue Million Forecast, by Racks 2019 & 2032

- Table 10: Israel Data Center Construction Market Revenue Million Forecast, by Other Mechanical Infrastructure 2019 & 2032

- Table 11: Israel Data Center Construction Market Revenue Million Forecast, by General Construction 2019 & 2032

- Table 12: Israel Data Center Construction Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 13: Israel Data Center Construction Market Revenue Million Forecast, by Tier 1 and 2 2019 & 2032

- Table 14: Israel Data Center Construction Market Revenue Million Forecast, by Tier 3 2019 & 2032

- Table 15: Israel Data Center Construction Market Revenue Million Forecast, by Tier 4 2019 & 2032

- Table 16: Israel Data Center Construction Market Revenue Million Forecast, by End User 2019 & 2032

- Table 17: Israel Data Center Construction Market Revenue Million Forecast, by Banking, Financial Services, and Insurance 2019 & 2032

- Table 18: Israel Data Center Construction Market Revenue Million Forecast, by IT and Telecommunications 2019 & 2032

- Table 19: Israel Data Center Construction Market Revenue Million Forecast, by Government and Defense 2019 & 2032

- Table 20: Israel Data Center Construction Market Revenue Million Forecast, by Healthcare 2019 & 2032

- Table 21: Israel Data Center Construction Market Revenue Million Forecast, by Other End Users 2019 & 2032

- Table 22: Israel Data Center Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 23: Israel Data Center Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Israel Data Center Construction Market Revenue Million Forecast, by Infrastructure 2019 & 2032

- Table 25: Israel Data Center Construction Market Revenue Million Forecast, by Electrical Infrastructure 2019 & 2032

- Table 26: Israel Data Center Construction Market Revenue Million Forecast, by Power Distribution Solution 2019 & 2032

- Table 27: Israel Data Center Construction Market Revenue Million Forecast, by Power Backup Solutions 2019 & 2032

- Table 28: Israel Data Center Construction Market Revenue Million Forecast, by Service 2019 & 2032

- Table 29: Israel Data Center Construction Market Revenue Million Forecast, by Mechanical Infrastructure 2019 & 2032

- Table 30: Israel Data Center Construction Market Revenue Million Forecast, by Cooling Systems 2019 & 2032

- Table 31: Israel Data Center Construction Market Revenue Million Forecast, by Racks 2019 & 2032

- Table 32: Israel Data Center Construction Market Revenue Million Forecast, by Other Mechanical Infrastructure 2019 & 2032

- Table 33: Israel Data Center Construction Market Revenue Million Forecast, by General Construction 2019 & 2032

- Table 34: Israel Data Center Construction Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 35: Israel Data Center Construction Market Revenue Million Forecast, by Tier 1 and 2 2019 & 2032

- Table 36: Israel Data Center Construction Market Revenue Million Forecast, by Tier 3 2019 & 2032

- Table 37: Israel Data Center Construction Market Revenue Million Forecast, by Tier 4 2019 & 2032

- Table 38: Israel Data Center Construction Market Revenue Million Forecast, by End User 2019 & 2032

- Table 39: Israel Data Center Construction Market Revenue Million Forecast, by Banking, Financial Services, and Insurance 2019 & 2032

- Table 40: Israel Data Center Construction Market Revenue Million Forecast, by IT and Telecommunications 2019 & 2032

- Table 41: Israel Data Center Construction Market Revenue Million Forecast, by Government and Defense 2019 & 2032

- Table 42: Israel Data Center Construction Market Revenue Million Forecast, by Healthcare 2019 & 2032

- Table 43: Israel Data Center Construction Market Revenue Million Forecast, by Other End Users 2019 & 2032

- Table 44: Israel Data Center Construction Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Israel Data Center Construction Market?

The projected CAGR is approximately 9.55%.

2. Which companies are prominent players in the Israel Data Center Construction Market?

Key companies in the market include ABB Ltd, Fortis Construction, STULZ GMBH, Saan Zahav, Delta Group, Schneider Electric SE, Turner Construction Co, DPR Construction Inc, Caterpillar Inc, Rittal GmbH & Co KG, Delta Electronics, STULZ GMB, Mercury Engineering, AECOM Limited, Legrand, CyrusOne Inc, AECOM, Canovate Group, EAE Group, Alfa Laval AB, M+W Group (Exyte).

3. What are the main segments of the Israel Data Center Construction Market?

The market segments include Infrastructure, Electrical Infrastructure, Power Distribution Solution, Power Backup Solutions, Service , Mechanical Infrastructure, Cooling Systems, Racks, Other Mechanical Infrastructure, General Construction, Tier Type, Tier 1 and 2, Tier 3, Tier 4, End User, Banking, Financial Services, and Insurance, IT and Telecommunications, Government and Defense, Healthcare, Other End Users.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

9.1 Rising Adoption of Renewable Energy Sources9.2 Increase in 5G Deployments Fueling Edge Data Center Investments9.3 Smart City Initiatives Driving Data Center Investments.

6. What are the notable trends driving market growth?

IT and Telecom to have significant market share.

7. Are there any restraints impacting market growth?

10.1 Security Challenges in Data Centers10.2 Location Constraints on the Development of Data Centers.

8. Can you provide examples of recent developments in the market?

July 2022: Berkshire Partners announced to pay more than USD 215 million to acquire a 49% stake in MedOne. The company was evaluated at NIS 1.5 billion (USD 430 Million).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Israel Data Center Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Israel Data Center Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Israel Data Center Construction Market?

To stay informed about further developments, trends, and reports in the Israel Data Center Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence