Key Insights

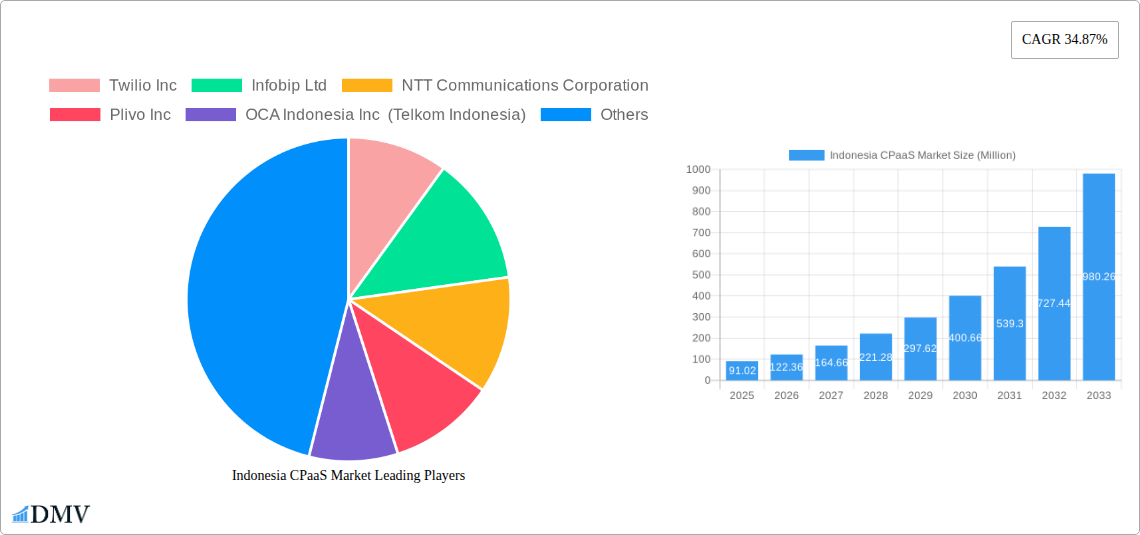

The Indonesian CPaaS (Communications Platform as a Service) market is experiencing robust growth, projected to reach a market size of US$ 91.02 million in 2025, expanding at a Compound Annual Growth Rate (CAGR) of 34.87% from 2025 to 2033. This rapid expansion is fueled by several key drivers. The increasing adoption of digital technologies across various Indonesian industries, including e-commerce, finance, and healthcare, is creating a surge in demand for seamless communication solutions. Furthermore, the rise of mobile penetration and a burgeoning young, tech-savvy population are contributing significantly to market growth. Businesses are increasingly leveraging CPaaS solutions for enhanced customer engagement, improved operational efficiency, and cost optimization. The market's segmentation likely includes various communication channels (SMS, voice, chatbots) and deployment models (cloud, on-premise), with cloud-based solutions expected to dominate due to their scalability and affordability. Competitive dynamics are intense, with both global players like Twilio and Infobip, and local providers like Qiscus and Mekari Qontak vying for market share. Challenges include ensuring data security and privacy, maintaining reliable network infrastructure, and addressing the digital literacy gap in certain segments of the population.

Looking ahead, the Indonesian CPaaS market is poised for continued expansion. The government's ongoing initiatives to promote digitalization across various sectors will further accelerate market growth. The increasing adoption of artificial intelligence (AI) and machine learning (ML) technologies within CPaaS platforms will enhance functionalities such as personalized customer interactions and proactive support, adding to market appeal. However, potential restraints could include regulatory hurdles, competition from alternative communication channels, and economic fluctuations. Successful players will need to focus on offering innovative, secure, and cost-effective solutions tailored to the specific needs of the Indonesian market, while simultaneously investing in robust customer support and strategic partnerships.

Indonesia CPaaS Market: A Comprehensive Report (2019-2033)

This insightful report provides a deep dive into the dynamic Indonesia CPaaS market, offering a comprehensive analysis of its current state, future trajectory, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for stakeholders seeking to understand and capitalize on the growth opportunities within this rapidly evolving sector. The market is projected to reach xx Million by 2033.

Indonesia CPaaS Market Composition & Trends

This section analyzes the competitive landscape, innovation drivers, regulatory environment, and market dynamics of the Indonesian CPaaS market. We examine market concentration, revealing the market share distribution among key players like Twilio Inc, Infobib Ltd, and NTT Communications Corporation. The report also details the impact of mergers and acquisitions (M&A) activities, quantifying deal values where available, and assessing their influence on market consolidation. The influence of substitute products and evolving end-user profiles are also considered.

- Market Concentration: The Indonesian CPaaS market exhibits a [Describe market concentration: e.g., moderately concentrated, fragmented] structure. Top 5 players hold an estimated xx% market share in 2025.

- Innovation Catalysts: The rising adoption of digital technologies, particularly in e-commerce and fintech, is a major driver of innovation. Government initiatives promoting digitalization further fuel market growth.

- Regulatory Landscape: The Indonesian government's regulatory framework for telecommunications and data privacy significantly impacts market operations. We analyze the impact of these regulations on market growth and competition.

- Substitute Products: The report explores the competitive pressures from alternative communication solutions and their impact on CPaaS adoption rates.

- End-User Profiles: A detailed profile of end-users across various sectors (e.g., BFSI, Healthcare, Retail) is provided, highlighting their specific CPaaS needs and adoption patterns.

- M&A Activities: The report documents recent M&A activities in the Indonesian CPaaS space, analyzing their impact on market dynamics and competitive landscape. Total M&A deal value in the historical period (2019-2024) is estimated at xx Million.

Indonesia CPaaS Market Industry Evolution

This section delves into the historical and projected growth trajectories of the Indonesian CPaaS market. We analyze technological advancements, such as the increasing adoption of RCS and AI-powered solutions, and their influence on market expansion. Furthermore, we examine the evolving consumer demands and their impact on the types of CPaaS solutions being deployed. The market witnessed a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024) and is projected to grow at a CAGR of xx% during the forecast period (2025-2033).

This section also includes data points such as adoption rates of specific CPaaS functionalities (e.g., SMS, voice, video) across different industry verticals. The impact of industry developments like Telkomsel's collaboration with Google on RCS adoption is meticulously assessed. The increasing adoption of cloud-based solutions and the demand for robust security features are also analyzed, in addition to the impact of partnerships, like the 8x8 Inc. and Coca-Cola Indonesia collaboration.

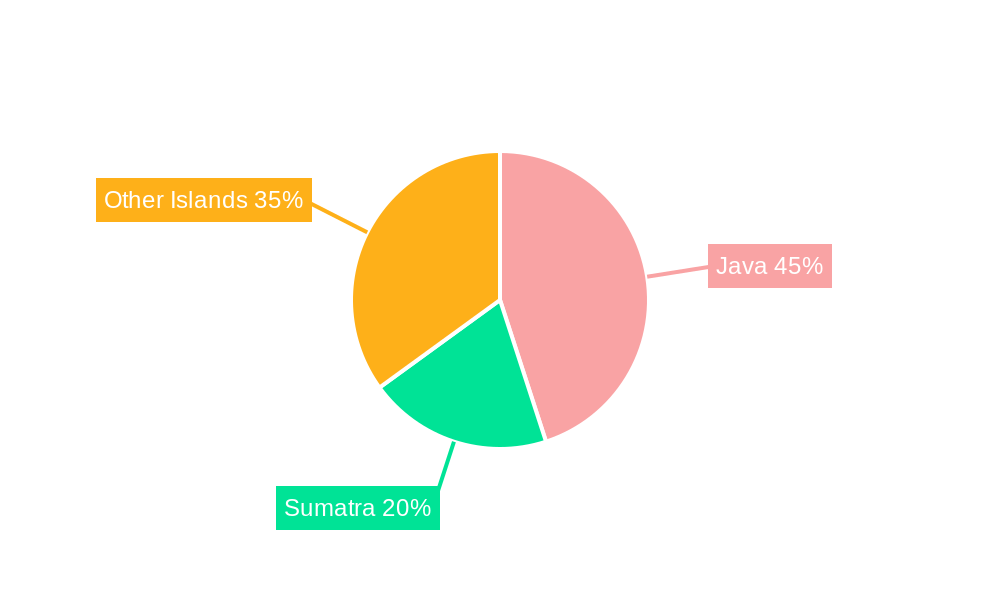

Leading Regions, Countries, or Segments in Indonesia CPaaS Market

This section identifies the dominant regions, countries, or segments within the Indonesian CPaaS market. We provide a detailed analysis of the factors contributing to their dominance, including investment trends, regulatory support, and market penetration rates.

- Key Drivers for Dominance:

- High Smartphone Penetration: The widespread adoption of smartphones across the Indonesian archipelago fuels demand for mobile-first communication solutions.

- Government Initiatives: Government support for digital transformation initiatives creates a favorable environment for CPaaS growth.

- Robust E-commerce Sector: The booming e-commerce industry drives the need for efficient and scalable customer communication channels.

Indonesia CPaaS Market Product Innovations

This section highlights recent product innovations and advancements in the Indonesian CPaaS market. We discuss the unique selling propositions (USPs) of leading CPaaS solutions, focusing on features like AI-powered chatbots, enhanced security protocols, and seamless integration with other business applications. The integration of advanced features such as real-time analytics and personalized communication experiences significantly improves the value proposition of CPaaS offerings.

Propelling Factors for Indonesia CPaaS Market Growth

Several factors drive the growth of the Indonesian CPaaS market. These include the expanding digital economy, increasing smartphone penetration, and government initiatives promoting digital transformation. The rising adoption of cloud-based solutions and the increasing demand for omnichannel communication strategies also contribute to market growth. The growth of specific industries (e.g., fintech, e-commerce) further fuels demand for sophisticated CPaaS solutions.

Obstacles in the Indonesia CPaaS Market

The Indonesian CPaaS market faces challenges including concerns about data privacy and security, the need for robust infrastructure in remote areas, and the competitive pressures from both local and international players. These factors could potentially hinder the market's growth trajectory to some extent, depending on the intensity and pace of addressing these challenges.

Future Opportunities in Indonesia CPaaS Market

Future opportunities lie in the increasing adoption of emerging technologies such as 5G, IoT, and AI in CPaaS solutions. The expansion into untapped rural markets and increasing government emphasis on digital transformation present significant growth potential. The development of innovative solutions addressing specific needs of various industry verticals promises substantial growth in the coming years.

Major Players in the Indonesia CPaaS Market Ecosystem

- Twilio Inc

- Infobip Ltd

- NTT Communications Corporation

- Plivo Inc

- OCA Indonesia Inc (Telkom Indonesia)

- Barantum

- 8x8 Inc

- Messagebird

- Route Mobile Limited

- PT Vfirst Komunikasi Indonesia

- Qiscus

- Mekari Qontak (PT Mid Solusi Nusantara)

Key Developments in Indonesia CPaaS Market Industry

- January 2024: Telkomsel partners with Google to launch RCS-based business messaging, boosting digital transformation and enhancing customer communication.

- September 2023: 8x8 Inc. partners with Coca-Cola Indonesia, integrating CPaaS solutions into its loyalty program and launching 8x8 Omni Shield to combat SMS fraud.

Strategic Indonesia CPaaS Market Forecast

The Indonesian CPaaS market is poised for significant growth driven by increasing digitalization, technological advancements, and favorable government policies. The adoption of innovative CPaaS solutions across diverse sectors and the expansion into underserved regions will continue to fuel market expansion. The market's future prospects remain highly positive, promising substantial returns for investors and significant advancements in communication technologies within Indonesia.

Indonesia CPaaS Market Segmentation

-

1. Organization Size

- 1.1. SME

- 1.2. Large-Scale Organization

-

2. End User

- 2.1. IT and Telecom

- 2.2. BFSI

- 2.3. Retail and E-commerce

- 2.4. Healthcare

- 2.5. Other End-user Verticals

Indonesia CPaaS Market Segmentation By Geography

- 1. Indonesia

Indonesia CPaaS Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 34.87% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Exponential Increase in the Uptake of CPaaS-based Solutions Over Other Adjacent Models; Growing Demand for Low-code Enablement to Make Enterprise CPaaS Highly Usable for Customer Operations

- 3.2.2 Service

- 3.2.3 and Marketing

- 3.3. Market Restrains

- 3.3.1 Exponential Increase in the Uptake of CPaaS-based Solutions Over Other Adjacent Models; Growing Demand for Low-code Enablement to Make Enterprise CPaaS Highly Usable for Customer Operations

- 3.3.2 Service

- 3.3.3 and Marketing

- 3.4. Market Trends

- 3.4.1. SME Organization Size Segment is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia CPaaS Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Organization Size

- 5.1.1. SME

- 5.1.2. Large-Scale Organization

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. IT and Telecom

- 5.2.2. BFSI

- 5.2.3. Retail and E-commerce

- 5.2.4. Healthcare

- 5.2.5. Other End-user Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Organization Size

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Twilio Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Infobip Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 NTT Communications Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Plivo Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 OCA Indonesia Inc (Telkom Indonesia)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Barantum

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 8x8 Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Messagebird

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Route Mobile Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 PT Vfirst Komunikasi Indonesia

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Qiscus

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Mekari Qontak (PT Mid Solusi Nusantara

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Twilio Inc

List of Figures

- Figure 1: Indonesia CPaaS Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Indonesia CPaaS Market Share (%) by Company 2024

List of Tables

- Table 1: Indonesia CPaaS Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Indonesia CPaaS Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: Indonesia CPaaS Market Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 4: Indonesia CPaaS Market Volume Million Forecast, by Organization Size 2019 & 2032

- Table 5: Indonesia CPaaS Market Revenue Million Forecast, by End User 2019 & 2032

- Table 6: Indonesia CPaaS Market Volume Million Forecast, by End User 2019 & 2032

- Table 7: Indonesia CPaaS Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Indonesia CPaaS Market Volume Million Forecast, by Region 2019 & 2032

- Table 9: Indonesia CPaaS Market Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 10: Indonesia CPaaS Market Volume Million Forecast, by Organization Size 2019 & 2032

- Table 11: Indonesia CPaaS Market Revenue Million Forecast, by End User 2019 & 2032

- Table 12: Indonesia CPaaS Market Volume Million Forecast, by End User 2019 & 2032

- Table 13: Indonesia CPaaS Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Indonesia CPaaS Market Volume Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia CPaaS Market?

The projected CAGR is approximately 34.87%.

2. Which companies are prominent players in the Indonesia CPaaS Market?

Key companies in the market include Twilio Inc, Infobip Ltd, NTT Communications Corporation, Plivo Inc, OCA Indonesia Inc (Telkom Indonesia), Barantum, 8x8 Inc, Messagebird, Route Mobile Limited, PT Vfirst Komunikasi Indonesia, Qiscus, Mekari Qontak (PT Mid Solusi Nusantara.

3. What are the main segments of the Indonesia CPaaS Market?

The market segments include Organization Size, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 91.02 Million as of 2022.

5. What are some drivers contributing to market growth?

Exponential Increase in the Uptake of CPaaS-based Solutions Over Other Adjacent Models; Growing Demand for Low-code Enablement to Make Enterprise CPaaS Highly Usable for Customer Operations. Service. and Marketing.

6. What are the notable trends driving market growth?

SME Organization Size Segment is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Exponential Increase in the Uptake of CPaaS-based Solutions Over Other Adjacent Models; Growing Demand for Low-code Enablement to Make Enterprise CPaaS Highly Usable for Customer Operations. Service. and Marketing.

8. Can you provide examples of recent developments in the market?

January 2024 - Telkomsel, an Indonesian telecommunications company, collaborated with Google to introduce its Rich Communication Services (RCS)--based business messaging to support digital business transformation by enhancing customer communication experiences and providing more feature-rich short messaging solutions. The RCS services with RBM would be available for Telkomsel customers in Indonesia, which shows the market's future growth potential and would support market growth during the forecast period.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia CPaaS Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia CPaaS Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia CPaaS Market?

To stay informed about further developments, trends, and reports in the Indonesia CPaaS Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence