Key Insights

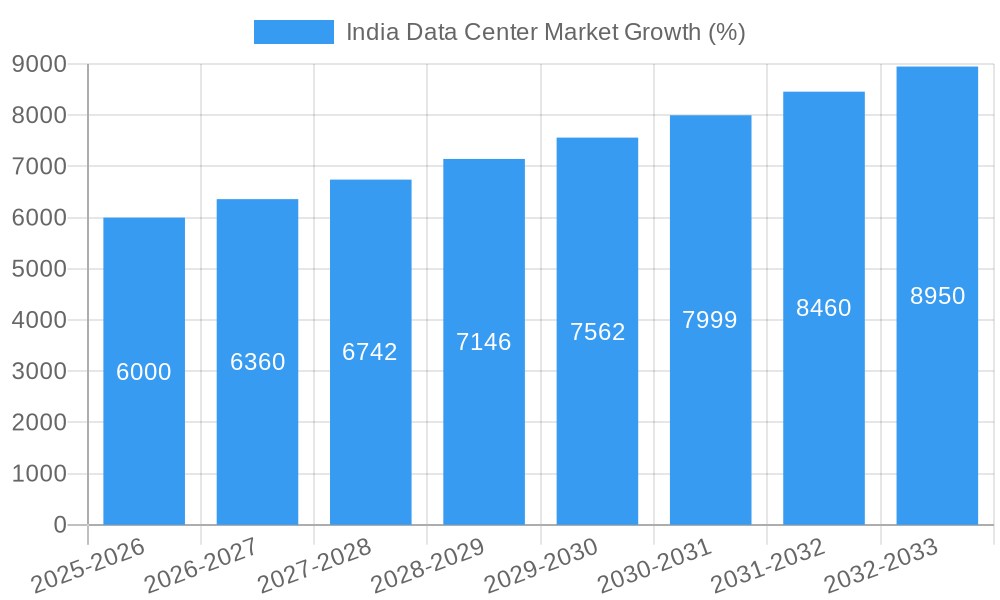

The India data center market is experiencing robust growth, driven by the burgeoning digital economy, increasing cloud adoption, and government initiatives promoting digital infrastructure. With a Compound Annual Growth Rate (CAGR) of 6% and a 2025 market size exceeding (estimated) ₹100 billion (assuming a logical extrapolation from unspecified XX million), the market is poised for significant expansion through 2033. Key growth drivers include the rise of e-commerce, the proliferation of data-intensive applications (like AI and IoT), and the increasing need for robust data security and disaster recovery solutions. The major metropolitan areas—Bangalore, Chennai, Hyderabad, Mumbai, NCR (National Capital Region), and Pune—are leading the market expansion, attracting significant investment in large-scale data center facilities. Tier-1 and Tier-III facilities are preferred due to their superior infrastructure and connectivity, while the demand for both utilized and non-utilized absorption space indicates a healthy market dynamic reflective of ongoing development and expansion. The competition is fierce, with major players like CtrlS Datacenters, WebWerks, Reliance Jio, Sify Technologies, and global giants like Equinix vying for market share.

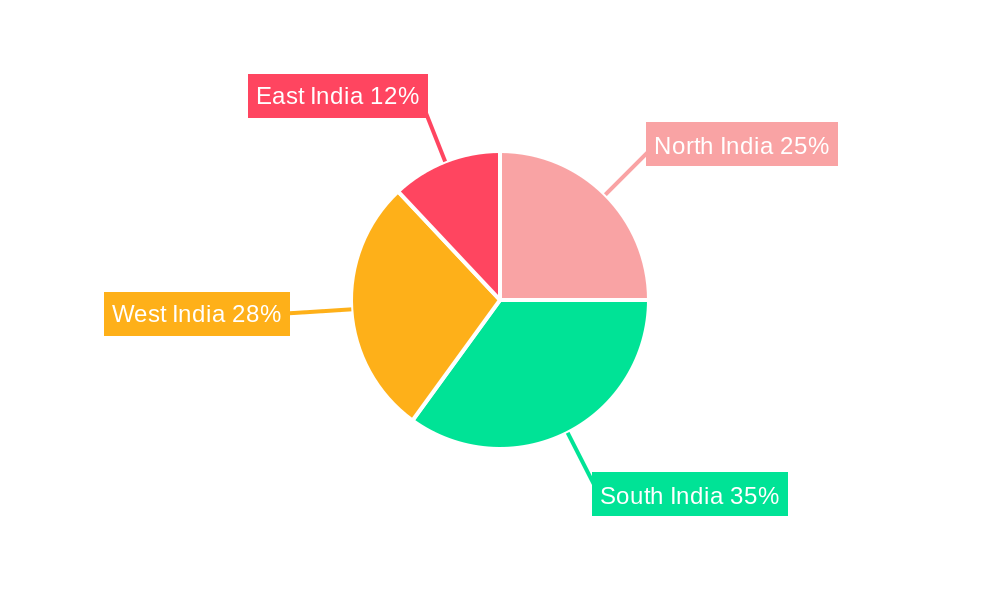

The segmentation of the market reveals several key trends. The "Massive" and "Mega" data center size categories are experiencing high demand, driven by hyperscale cloud providers and large enterprises. Furthermore, the significant presence of companies across different regions (North, South, East, and West India) highlights a decentralized growth pattern, although southern and western regions likely maintain a slight lead in development. This distributed approach reflects the diverse needs of different industries and regions, signaling opportunities for specialized data center providers to cater to specific market needs. While regulatory hurdles and infrastructure challenges remain potential restraints, the overall growth outlook remains extremely positive, promising lucrative opportunities for investors and service providers alike in the coming years.

This insightful report provides a detailed analysis of the burgeoning India data center market, projecting robust growth from 2025 to 2033. It offers a comprehensive overview of market trends, key players, technological advancements, and future opportunities, equipping stakeholders with critical insights for strategic decision-making. The study period spans 2019-2033, with 2025 as the base year and the forecast period extending to 2033. The report leverages data from the historical period of 2019-2024 and incorporates detailed analysis across various segments and regions.

India Data Center Market Composition & Trends

This section delves into the competitive landscape of the Indian data center market, analyzing market concentration, innovation drivers, regulatory frameworks, substitute technologies, end-user profiles, and mergers & acquisitions (M&A) activities. The report examines the market share distribution among key players like CtrlS Datacenters Ltd, WebWerks, Reliance Jio, Sify Technologies Ltd, and others, providing a granular view of the market's competitive intensity. An analysis of M&A activities, including deal values (estimated at xx Million), sheds light on strategic consolidation within the sector. The impact of regulatory changes and government initiatives on market dynamics is also thoroughly evaluated. The report further explores the influence of substitute technologies and the evolving demands of various end-user segments including BFSI, IT/ITES, government, and other sectors, analyzing their impact on market growth and shaping future strategies.

- Market Concentration: A detailed analysis of market share held by top players, identifying dominant players and emerging competitors.

- Innovation Catalysts: Examination of technological advancements driving market expansion, including cloud computing, edge computing, and 5G.

- Regulatory Landscape: Assessment of government policies, licensing requirements, and their impact on market growth.

- Substitute Products: Analysis of alternative solutions and their competitive threat.

- End-User Profiles: Detailed segmentation of end-users based on their data center requirements and spending patterns.

- M&A Activities: Review of significant M&A transactions in the market, including deal values and strategic implications. Estimated total M&A deal value for the period 2019-2024 is xx Million.

India Data Center Market Industry Evolution

This section meticulously charts the evolution of the India data center market, examining growth trajectories, technological advancements, and shifting consumer demands during the historical period (2019-2024) and projecting future trends up to 2033. The report provides specific data points such as compound annual growth rate (CAGR) for the period and adoption rates of various technologies. The analysis also addresses the impact of factors like digital transformation, increasing data volumes, and the rise of cloud computing on market growth. Furthermore, the influence of evolving consumer preferences and the emergence of new business models will be analyzed, offering insights into future market dynamics. The projected market size for 2033 is estimated at xx Million.

Leading Regions, Countries, or Segments in India Data Center Market

This section identifies the leading regions and segments within the Indian data center market. Hotspots like Bangalore, Mumbai, Chennai, Hyderabad, NCR (National Capital Region), and Pune are analyzed in detail, considering factors influencing their dominance. The analysis considers data center size (Large, Massive, Medium, Mega, Small), Tier type (Tier I, Tier II, Tier III, Tier IV), and absorption rates (Utilized, Non-Utilized). The influence of investment trends, regulatory support, and infrastructure availability on regional growth is also highlighted.

Key Drivers for Dominant Regions:

- Bangalore: Strong IT infrastructure, skilled workforce, and favorable government policies.

- Mumbai: Major financial hub with high demand for data centers.

- Chennai: Growing IT sector and supportive government initiatives.

- Hyderabad: Emerging as a significant technology center.

- NCR: High concentration of government and private sector organizations.

- Pune: Rapid growth in IT and manufacturing sectors.

Data Center Size Segmentation: Analysis of the market share of various data center sizes. The Large and Mega data center segments are projected to hold the largest share by 2033, estimated at xx Million and xx Million, respectively.

Tier Type Segmentation: Analysis of the market share of different tier types. The majority of the market is projected to be made up of Tier III and Tier IV data centers by 2033.

Absorption Rates: Detailed analysis of utilized and non-utilized capacity.

India Data Center Market Product Innovations

This section explores recent product innovations, applications, and performance metrics within the Indian data center market. The report highlights unique selling propositions (USPs) and technological advancements in areas such as hyperscale data centers, modular data centers, and energy-efficient cooling solutions. The adoption of these innovative technologies is expected to significantly impact market dynamics. Examples include the increasing adoption of liquid cooling and AI-powered management systems.

Propelling Factors for India Data Center Market Growth

The growth of the Indian data center market is driven by several key factors: the rapid digitalization of the Indian economy, increasing data generation, and the growing adoption of cloud computing and big data analytics. Government initiatives to improve digital infrastructure and attract investments in the sector are also significant contributors. The expansion of 5G networks and the rising demand for edge computing further fuel market growth. These factors collectively contribute to a significant increase in the demand for data center capacity.

Obstacles in the India Data Center Market

Despite the significant growth potential, the Indian data center market faces certain challenges. These include the high cost of land and power, regulatory complexities, and infrastructure limitations in certain regions. Supply chain disruptions and intense competition among existing and new market entrants also pose significant hurdles. The estimated impact of these constraints on market growth is xx% by 2033.

Future Opportunities in India Data Center Market

The Indian data center market presents numerous future opportunities. The rising demand for edge computing and IoT devices will drive growth in regional data centers. The government's initiatives to promote digital India and improve digital infrastructure provide further opportunities. The adoption of sustainable and energy-efficient technologies is also a key area for future growth. Expansion into tier II and tier III cities, coupled with an increasing focus on hyperscale data centers, is anticipated to open up new avenues for expansion.

Major Players in the India Data Center Market Ecosystem

- CtrlS Datacenters Ltd

- WebWerks

- Reliance Jio

- Sify Technologies Ltd

- Go4hosting

- Equinix Inc

- ESDS Software Solution Ltd

- Yotta Infrastructure Solutions

- Nxtra Data Ltd

- Pi Datacenters Pvt Ltd

- STT GDC Pte Ltd

- NTT Ltd

Key Developments in India Data Center Market Industry

- November 2022: STT Telemedia signed a Memorandum of Understanding with the Indian Government to expand its data center facilities in Karnataka over ten years. This signifies a significant boost to the Karnataka data center market.

- October 2022: Pi Datacenters partnered with Sequretek to enhance data security, addressing a critical market need and improving consumer confidence.

- September 2022: Nxtra Data implemented hydrogen fuel cells in its Karnataka facility, demonstrating a commitment to sustainability and potentially attracting environmentally conscious clients.

Strategic India Data Center Market Forecast

The Indian data center market is poised for sustained growth, driven by strong economic fundamentals, favorable government policies, and technological advancements. The increasing adoption of cloud computing, big data, and the IoT will fuel demand for data center capacity. The focus on sustainability and energy efficiency will shape future investments and technological innovation. The market is expected to witness significant expansion in the coming years, presenting considerable opportunities for both established players and new entrants. The long-term outlook remains highly positive, with xx Million projected as the market size by 2033.

India Data Center Market Segmentation

-

1. Hotspot

- 1.1. Bangalore

- 1.2. Chennai

- 1.3. Hyderabad

- 1.4. Mumbai

- 1.5. NCR

- 1.6. Pune

- 1.7. Rest of India

-

2. Data Center Size

- 2.1. Large

- 2.2. Massive

- 2.3. Medium

- 2.4. Mega

- 2.5. Small

-

3. Tier Type

- 3.1. Tier 1 and 2

- 3.2. Tier 3

- 3.3. Tier 4

-

4. Absorption

- 4.1. Non-Utilized

-

5. Colocation Type

- 5.1. Hyperscale

- 5.2. Retail

- 5.3. Wholesale

-

6. End User

- 6.1. BFSI

- 6.2. Cloud

- 6.3. E-Commerce

- 6.4. Government

- 6.5. Manufacturing

- 6.6. Media & Entertainment

- 6.7. Telecom

- 6.8. Other End User

India Data Center Market Segmentation By Geography

- 1. India

India Data Center Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 ; High Mobile penetration

- 3.2.2 Low Tariff

- 3.2.3 and Mature Regulatory Authority; Successful Privatization and Liberalization Initiatives

- 3.3. Market Restrains

- 3.3.1. ; Difficulties in Customization According to Business Needs

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Data Center Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Hotspot

- 5.1.1. Bangalore

- 5.1.2. Chennai

- 5.1.3. Hyderabad

- 5.1.4. Mumbai

- 5.1.5. NCR

- 5.1.6. Pune

- 5.1.7. Rest of India

- 5.2. Market Analysis, Insights and Forecast - by Data Center Size

- 5.2.1. Large

- 5.2.2. Massive

- 5.2.3. Medium

- 5.2.4. Mega

- 5.2.5. Small

- 5.3. Market Analysis, Insights and Forecast - by Tier Type

- 5.3.1. Tier 1 and 2

- 5.3.2. Tier 3

- 5.3.3. Tier 4

- 5.4. Market Analysis, Insights and Forecast - by Absorption

- 5.4.1. Non-Utilized

- 5.5. Market Analysis, Insights and Forecast - by Colocation Type

- 5.5.1. Hyperscale

- 5.5.2. Retail

- 5.5.3. Wholesale

- 5.6. Market Analysis, Insights and Forecast - by End User

- 5.6.1. BFSI

- 5.6.2. Cloud

- 5.6.3. E-Commerce

- 5.6.4. Government

- 5.6.5. Manufacturing

- 5.6.6. Media & Entertainment

- 5.6.7. Telecom

- 5.6.8. Other End User

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. India

- 5.1. Market Analysis, Insights and Forecast - by Hotspot

- 6. North India India Data Center Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Data Center Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Data Center Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Data Center Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 CtrlS Datacenters Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 WebWerks

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Reliance

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Sify Technologies Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Go4hosting

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Equinix Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 ESDS Software Solution Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Yotta Infrastructure Solutions5 4

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Nxtra Data Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Pi Datacenters Pvt Ltd

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 STT GDC Pte Ltd

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 NTT Ltd

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 CtrlS Datacenters Ltd

List of Figures

- Figure 1: India Data Center Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Data Center Market Share (%) by Company 2024

List of Tables

- Table 1: India Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Data Center Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: India Data Center Market Revenue Million Forecast, by Hotspot 2019 & 2032

- Table 4: India Data Center Market Volume K Unit Forecast, by Hotspot 2019 & 2032

- Table 5: India Data Center Market Revenue Million Forecast, by Data Center Size 2019 & 2032

- Table 6: India Data Center Market Volume K Unit Forecast, by Data Center Size 2019 & 2032

- Table 7: India Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 8: India Data Center Market Volume K Unit Forecast, by Tier Type 2019 & 2032

- Table 9: India Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 10: India Data Center Market Volume K Unit Forecast, by Absorption 2019 & 2032

- Table 11: India Data Center Market Revenue Million Forecast, by Colocation Type 2019 & 2032

- Table 12: India Data Center Market Volume K Unit Forecast, by Colocation Type 2019 & 2032

- Table 13: India Data Center Market Revenue Million Forecast, by End User 2019 & 2032

- Table 14: India Data Center Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 15: India Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 16: India Data Center Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 17: India Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: India Data Center Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 19: North India India Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: North India India Data Center Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: South India India Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: South India India Data Center Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: East India India Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: East India India Data Center Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 25: West India India Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: West India India Data Center Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 27: India Data Center Market Revenue Million Forecast, by Hotspot 2019 & 2032

- Table 28: India Data Center Market Volume K Unit Forecast, by Hotspot 2019 & 2032

- Table 29: India Data Center Market Revenue Million Forecast, by Data Center Size 2019 & 2032

- Table 30: India Data Center Market Volume K Unit Forecast, by Data Center Size 2019 & 2032

- Table 31: India Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 32: India Data Center Market Volume K Unit Forecast, by Tier Type 2019 & 2032

- Table 33: India Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 34: India Data Center Market Volume K Unit Forecast, by Absorption 2019 & 2032

- Table 35: India Data Center Market Revenue Million Forecast, by Colocation Type 2019 & 2032

- Table 36: India Data Center Market Volume K Unit Forecast, by Colocation Type 2019 & 2032

- Table 37: India Data Center Market Revenue Million Forecast, by End User 2019 & 2032

- Table 38: India Data Center Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 39: India Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 40: India Data Center Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Data Center Market?

The projected CAGR is approximately 6.00%.

2. Which companies are prominent players in the India Data Center Market?

Key companies in the market include CtrlS Datacenters Ltd, WebWerks, Reliance, Sify Technologies Ltd, Go4hosting, Equinix Inc, ESDS Software Solution Ltd, Yotta Infrastructure Solutions5 4 , Nxtra Data Ltd, Pi Datacenters Pvt Ltd, STT GDC Pte Ltd, NTT Ltd.

3. What are the main segments of the India Data Center Market?

The market segments include Hotspot, Data Center Size, Tier Type, Absorption, Colocation Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; High Mobile penetration. Low Tariff. and Mature Regulatory Authority; Successful Privatization and Liberalization Initiatives.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

; Difficulties in Customization According to Business Needs.

8. Can you provide examples of recent developments in the market?

November 2022: STT Telemedia has signed a Memorandum of Understanding with the Indian Government, wherein they plan to expand further by opening new data center facilities in Karnataka withing the span of ten years.October 2022: Pi Datcenters has entered into a joint venture with Sequretek, a company which offers cybersecurity solutions. The partnership is aimed at providing data security for Pi data centers cloud and other service offerings.September 2022: Nxtra data has announced hydrogen fuel cell implementation in their Karnataka data center facility which would help reduce carbon emissions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Data Center Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Data Center Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Data Center Market?

To stay informed about further developments, trends, and reports in the India Data Center Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence