Key Insights

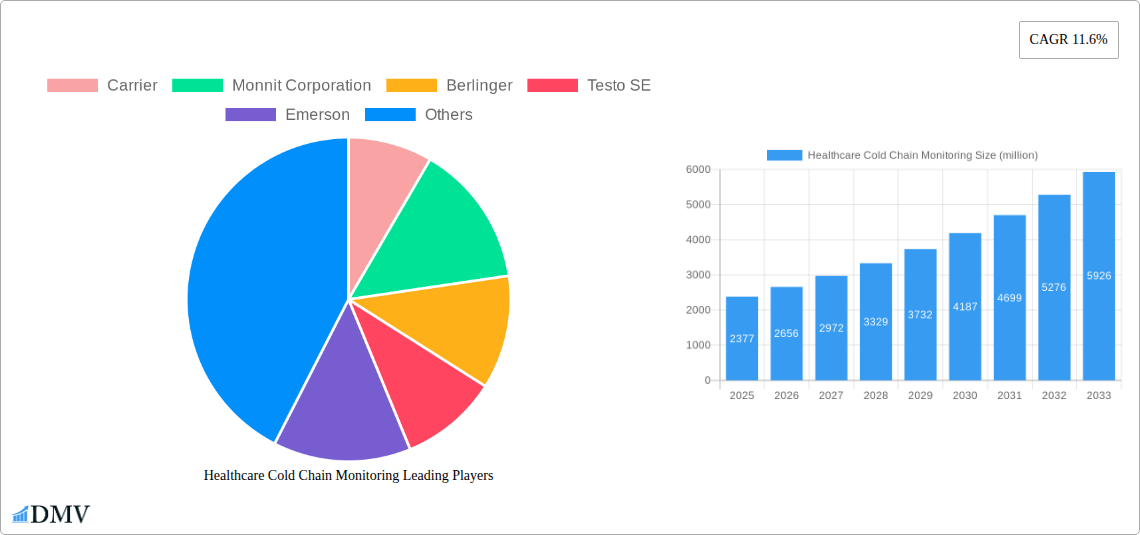

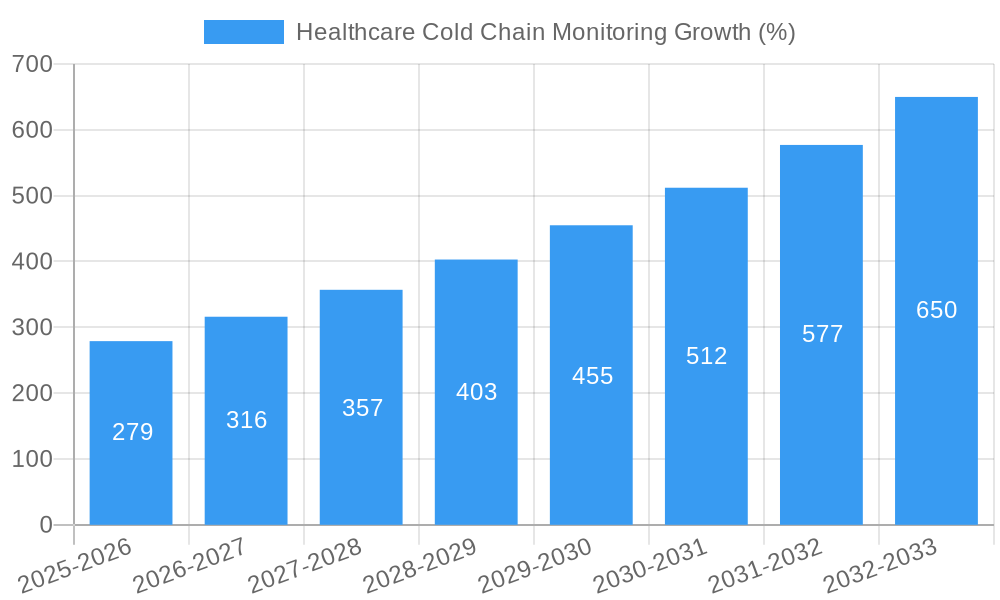

The global healthcare cold chain monitoring market, valued at $2377 million in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 11.6% from 2025 to 2033. This expansion is fueled by several key factors. The increasing prevalence of temperature-sensitive pharmaceuticals, including vaccines, biologics, and specialized medications, necessitates reliable monitoring systems to maintain product efficacy and patient safety. Stringent regulatory requirements concerning the transportation and storage of these products are also driving market growth. Furthermore, technological advancements in sensor technology, data analytics, and connectivity are leading to the development of more sophisticated and efficient monitoring solutions. The adoption of cloud-based platforms and real-time tracking capabilities enhances visibility throughout the cold chain, reducing waste and improving operational efficiency. Competitive pressures within the pharmaceutical and logistics sectors are also incentivizing the adoption of advanced cold chain monitoring technologies to improve supply chain transparency and enhance overall competitiveness.

The market is segmented by technology (e.g., wireless sensors, GPS tracking, RFID), application (e.g., pharmaceutical transportation, storage), and end-user (e.g., hospitals, pharmaceutical companies, logistics providers). Key players such as Carrier, Monnit Corporation, and others are actively involved in developing innovative solutions and expanding their market presence. While challenges remain, such as the high initial investment costs associated with implementing comprehensive monitoring systems and the need for reliable infrastructure in remote areas, the overall market outlook remains highly positive, driven by the critical need to ensure the integrity and safety of temperature-sensitive healthcare products. The continued focus on improving patient outcomes and reducing medication waste is expected to fuel considerable growth in the years to come.

Healthcare Cold Chain Monitoring Market Report: A Comprehensive Analysis (2019-2033)

This insightful report delivers a comprehensive analysis of the global Healthcare Cold Chain Monitoring market, projecting a market value of $XX million by 2033. The study period spans from 2019 to 2033, with 2025 serving as both the base and estimated year. The forecast period covers 2025-2033, and the historical period encompasses 2019-2024. This report provides critical insights for stakeholders, including manufacturers, investors, and regulatory bodies, enabling informed strategic decisions within this rapidly evolving market.

Healthcare Cold Chain Monitoring Market Composition & Trends

This section meticulously dissects the Healthcare Cold Chain Monitoring market landscape, offering a granular view of its structure and dynamics. The market's concentration is analyzed, revealing the market share distribution among key players such as Carrier, Monnit Corporation, Berlinger, and others. We delve into the impact of innovation catalysts, including advancements in sensor technology and data analytics, and assess the influence of regulatory landscapes on market growth. Substitute products and their competitive pressures are also evaluated, while comprehensive end-user profiles provide detailed insights into the diverse needs and preferences of pharmaceutical companies, hospitals, and logistics providers. Furthermore, the report explores M&A activities within the industry, analyzing the values of significant deals and their impact on market consolidation. We estimate that M&A activities in this sector have reached a total value of $XX million over the past five years. A detailed analysis of the factors driving market share changes is also included, accompanied by specific data points illustrating the competitive landscape. For example, we found that the top three players control approximately XX% of the market.

Healthcare Cold Chain Monitoring Industry Evolution

This section offers a deep dive into the evolutionary trajectory of the Healthcare Cold Chain Monitoring market. It examines the market's historical growth rates from 2019 to 2024, forecasting a compound annual growth rate (CAGR) of XX% from 2025 to 2033. This growth is driven by several factors including the increasing adoption of IoT technologies, stricter regulations related to drug efficacy and safety, and the rising prevalence of temperature-sensitive pharmaceuticals. Technological advancements, such as the integration of AI and machine learning for predictive maintenance and real-time monitoring, are explored in detail. The study also examines the impact of changing consumer demands, including a rising preference for real-time data visibility and increased traceability throughout the cold chain. Specific data points on the adoption of various monitoring technologies and the associated market penetration are provided to offer stakeholders a clear picture of the industry’s evolution.

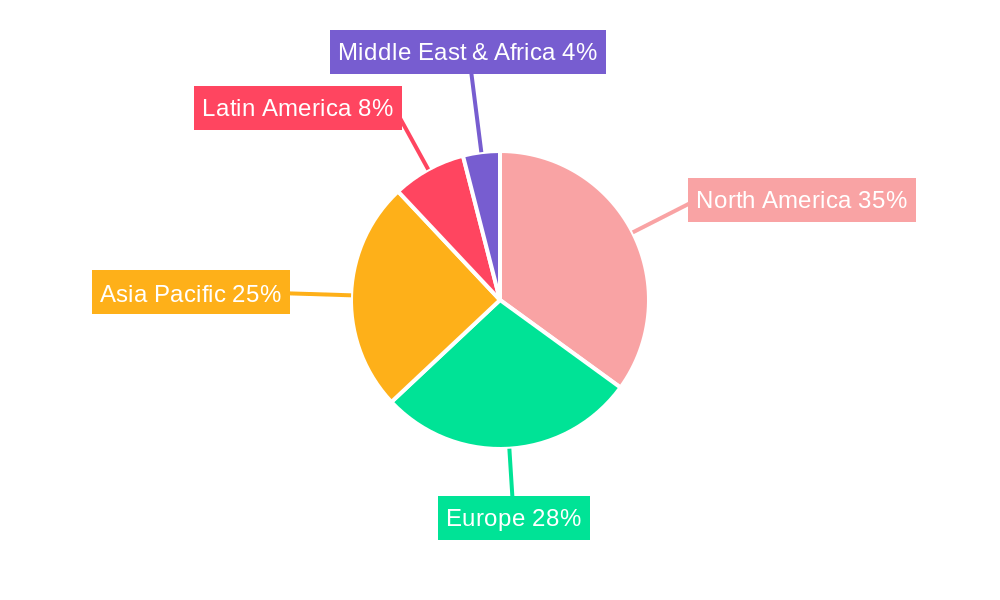

Leading Regions, Countries, or Segments in Healthcare Cold Chain Monitoring

This section pinpoints the leading regions and segments within the Healthcare Cold Chain Monitoring market. We found that North America currently holds the largest market share due to factors outlined below:

- Robust Regulatory Framework: Stringent regulations regarding drug storage and transportation drive adoption of advanced monitoring solutions.

- High Investment in Healthcare Infrastructure: Significant investments in healthcare infrastructure and technology foster market growth.

- Early Adoption of Innovative Technologies: North America demonstrates early adoption of cutting-edge technologies like IoT and AI in cold chain management.

A detailed analysis is provided, exploring the dominant factors contributing to the region's leadership position and contrasting it with other regions. Similar analysis is provided for key segments within the market, identifying factors that drive their growth and dominance.

Healthcare Cold Chain Monitoring Product Innovations

The Healthcare Cold Chain Monitoring market is characterized by continuous product innovation, with the emergence of sophisticated solutions incorporating advanced sensor technologies, data analytics, and cloud connectivity. These innovations offer enhanced real-time visibility, improved data accuracy, and greater operational efficiency. Unique selling propositions, including features such as predictive alerts, automated reporting, and seamless integration with existing logistics systems, are highlighted. Furthermore, the advancements in battery technology, leading to longer sensor lifespans, are discussed. The superior performance metrics of these new products, such as enhanced accuracy and reliability, contribute significantly to market growth.

Propelling Factors for Healthcare Cold Chain Monitoring Growth

Several key factors contribute to the expanding Healthcare Cold Chain Monitoring market. Technological advancements, such as the miniaturization of sensors and the development of low-power, long-range communication technologies, are driving innovation and adoption. Economic incentives, such as reduced waste due to improved temperature control and enhanced product lifespan, also stimulate growth. Furthermore, regulatory pressures, including increasing compliance requirements related to drug safety and efficacy, mandate the use of robust monitoring systems. For example, the implementation of new guidelines by regulatory bodies in several countries is directly driving demand for advanced monitoring technologies.

Obstacles in the Healthcare Cold Chain Monitoring Market

Despite the significant growth potential, several barriers hinder the widespread adoption of Healthcare Cold Chain Monitoring solutions. Regulatory challenges, including varying standards across different regions, create complexities for manufacturers and users alike. Supply chain disruptions, such as delays in the delivery of components or logistical challenges, impact the timely deployment of monitoring systems. Moreover, intense competition among established and emerging players exerts downward pressure on pricing, reducing profit margins for some companies. These factors, collectively, are estimated to negatively impact market growth by approximately XX% annually.

Future Opportunities in Healthcare Cold Chain Monitoring

The Healthcare Cold Chain Monitoring market presents several compelling future opportunities. The expansion into emerging markets with growing healthcare sectors offers significant potential for growth. Technological advancements, such as the integration of blockchain technology for enhanced traceability and security, are expected to drive further innovation. Furthermore, evolving consumer demands, including a greater focus on sustainability and environmentally friendly solutions, represent opportunities for manufacturers to develop and deploy more eco-conscious monitoring systems.

Major Players in the Healthcare Cold Chain Monitoring Ecosystem

- Carrier

- Monnit Corporation

- Berlinger

- Testo SE

- Emerson

- Signatrol

- Haier Biomedical

- Temptime Corporation

- Cold Chain Technologies

- Dickson

- Spotsee

- Elpro

- Controlant

- Roambee Corporation

- OnAsset Intelligence

Key Developments in Healthcare Cold Chain Monitoring Industry

- Jan 2023: Carrier launched a new line of cold chain monitoring devices with improved connectivity and data analytics capabilities. This launch significantly impacted market competition.

- Jul 2022: Monnit Corporation acquired a smaller competitor, expanding its product portfolio and market reach. This M&A activity significantly increased the company’s market share.

- Oct 2021: Berlinger introduced a new software platform for data visualization and reporting, enhancing the usability of its monitoring systems. This development improved user experience and increased adoption.

- (Further developments will be detailed in the full report.)

Strategic Healthcare Cold Chain Monitoring Market Forecast

The Healthcare Cold Chain Monitoring market is poised for substantial growth, driven by technological innovation, increased regulatory scrutiny, and expanding healthcare infrastructure globally. The market is anticipated to benefit from advancements in IoT, AI, and blockchain technologies, leading to improved monitoring capabilities, enhanced data security, and greater supply chain efficiency. The emerging markets in Asia and Africa present significant untapped potential, contributing substantially to the overall market growth over the forecast period. The continued focus on ensuring the integrity and safety of temperature-sensitive pharmaceuticals will further fuel the demand for advanced cold chain monitoring solutions.

Healthcare Cold Chain Monitoring Segmentation

-

1. Application

- 1.1. Biopharmaceutical Companies

- 1.2. Hospital and Clinics

- 1.3. Research Institutes

- 1.4. Others

-

2. Types

- 2.1. Chilled

- 2.2. Frozen

Healthcare Cold Chain Monitoring Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Healthcare Cold Chain Monitoring REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.6% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Healthcare Cold Chain Monitoring Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Biopharmaceutical Companies

- 5.1.2. Hospital and Clinics

- 5.1.3. Research Institutes

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Chilled

- 5.2.2. Frozen

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Healthcare Cold Chain Monitoring Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Biopharmaceutical Companies

- 6.1.2. Hospital and Clinics

- 6.1.3. Research Institutes

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Chilled

- 6.2.2. Frozen

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Healthcare Cold Chain Monitoring Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Biopharmaceutical Companies

- 7.1.2. Hospital and Clinics

- 7.1.3. Research Institutes

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Chilled

- 7.2.2. Frozen

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Healthcare Cold Chain Monitoring Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Biopharmaceutical Companies

- 8.1.2. Hospital and Clinics

- 8.1.3. Research Institutes

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Chilled

- 8.2.2. Frozen

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Healthcare Cold Chain Monitoring Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Biopharmaceutical Companies

- 9.1.2. Hospital and Clinics

- 9.1.3. Research Institutes

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Chilled

- 9.2.2. Frozen

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Healthcare Cold Chain Monitoring Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Biopharmaceutical Companies

- 10.1.2. Hospital and Clinics

- 10.1.3. Research Institutes

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Chilled

- 10.2.2. Frozen

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Carrier

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Monnit Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Berlinger

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Testo SE

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Emerson

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Signatrol

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Haier Biomedical

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Temptime Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Cold Chain Technologies

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Dickson

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Spotsee

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Elpro

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Controlant

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Roambee Corporation

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 OnAsset Intelligence

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Carrier

List of Figures

- Figure 1: Global Healthcare Cold Chain Monitoring Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Healthcare Cold Chain Monitoring Revenue (million), by Application 2024 & 2032

- Figure 3: North America Healthcare Cold Chain Monitoring Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Healthcare Cold Chain Monitoring Revenue (million), by Types 2024 & 2032

- Figure 5: North America Healthcare Cold Chain Monitoring Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Healthcare Cold Chain Monitoring Revenue (million), by Country 2024 & 2032

- Figure 7: North America Healthcare Cold Chain Monitoring Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Healthcare Cold Chain Monitoring Revenue (million), by Application 2024 & 2032

- Figure 9: South America Healthcare Cold Chain Monitoring Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Healthcare Cold Chain Monitoring Revenue (million), by Types 2024 & 2032

- Figure 11: South America Healthcare Cold Chain Monitoring Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Healthcare Cold Chain Monitoring Revenue (million), by Country 2024 & 2032

- Figure 13: South America Healthcare Cold Chain Monitoring Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Healthcare Cold Chain Monitoring Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Healthcare Cold Chain Monitoring Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Healthcare Cold Chain Monitoring Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Healthcare Cold Chain Monitoring Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Healthcare Cold Chain Monitoring Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Healthcare Cold Chain Monitoring Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Healthcare Cold Chain Monitoring Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Healthcare Cold Chain Monitoring Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Healthcare Cold Chain Monitoring Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Healthcare Cold Chain Monitoring Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Healthcare Cold Chain Monitoring Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Healthcare Cold Chain Monitoring Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Healthcare Cold Chain Monitoring Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Healthcare Cold Chain Monitoring Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Healthcare Cold Chain Monitoring Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Healthcare Cold Chain Monitoring Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Healthcare Cold Chain Monitoring Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Healthcare Cold Chain Monitoring Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Healthcare Cold Chain Monitoring Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Healthcare Cold Chain Monitoring Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Healthcare Cold Chain Monitoring Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Healthcare Cold Chain Monitoring Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Healthcare Cold Chain Monitoring Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Healthcare Cold Chain Monitoring Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Healthcare Cold Chain Monitoring Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Healthcare Cold Chain Monitoring Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Healthcare Cold Chain Monitoring Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Healthcare Cold Chain Monitoring Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Healthcare Cold Chain Monitoring Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Healthcare Cold Chain Monitoring Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Healthcare Cold Chain Monitoring Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Healthcare Cold Chain Monitoring Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Healthcare Cold Chain Monitoring Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Healthcare Cold Chain Monitoring Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Healthcare Cold Chain Monitoring Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Healthcare Cold Chain Monitoring Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Healthcare Cold Chain Monitoring Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Healthcare Cold Chain Monitoring Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Healthcare Cold Chain Monitoring Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Healthcare Cold Chain Monitoring Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Healthcare Cold Chain Monitoring Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Healthcare Cold Chain Monitoring Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Healthcare Cold Chain Monitoring Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Healthcare Cold Chain Monitoring Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Healthcare Cold Chain Monitoring Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Healthcare Cold Chain Monitoring Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Healthcare Cold Chain Monitoring Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Healthcare Cold Chain Monitoring Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Healthcare Cold Chain Monitoring Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Healthcare Cold Chain Monitoring Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Healthcare Cold Chain Monitoring Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Healthcare Cold Chain Monitoring Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Healthcare Cold Chain Monitoring Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Healthcare Cold Chain Monitoring Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Healthcare Cold Chain Monitoring Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Healthcare Cold Chain Monitoring Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Healthcare Cold Chain Monitoring Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Healthcare Cold Chain Monitoring Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Healthcare Cold Chain Monitoring Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Healthcare Cold Chain Monitoring Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Healthcare Cold Chain Monitoring Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Healthcare Cold Chain Monitoring Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Healthcare Cold Chain Monitoring Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Healthcare Cold Chain Monitoring Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Healthcare Cold Chain Monitoring Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Healthcare Cold Chain Monitoring?

The projected CAGR is approximately 11.6%.

2. Which companies are prominent players in the Healthcare Cold Chain Monitoring?

Key companies in the market include Carrier, Monnit Corporation, Berlinger, Testo SE, Emerson, Signatrol, Haier Biomedical, Temptime Corporation, Cold Chain Technologies, Dickson, Spotsee, Elpro, Controlant, Roambee Corporation, OnAsset Intelligence.

3. What are the main segments of the Healthcare Cold Chain Monitoring?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 2377 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Healthcare Cold Chain Monitoring," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Healthcare Cold Chain Monitoring report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Healthcare Cold Chain Monitoring?

To stay informed about further developments, trends, and reports in the Healthcare Cold Chain Monitoring, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence