Key Insights

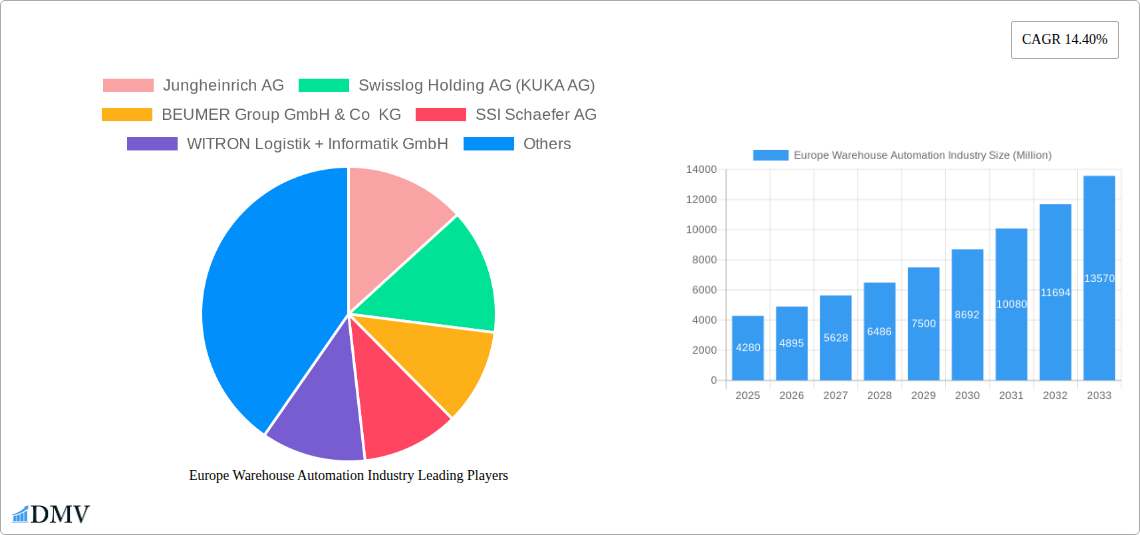

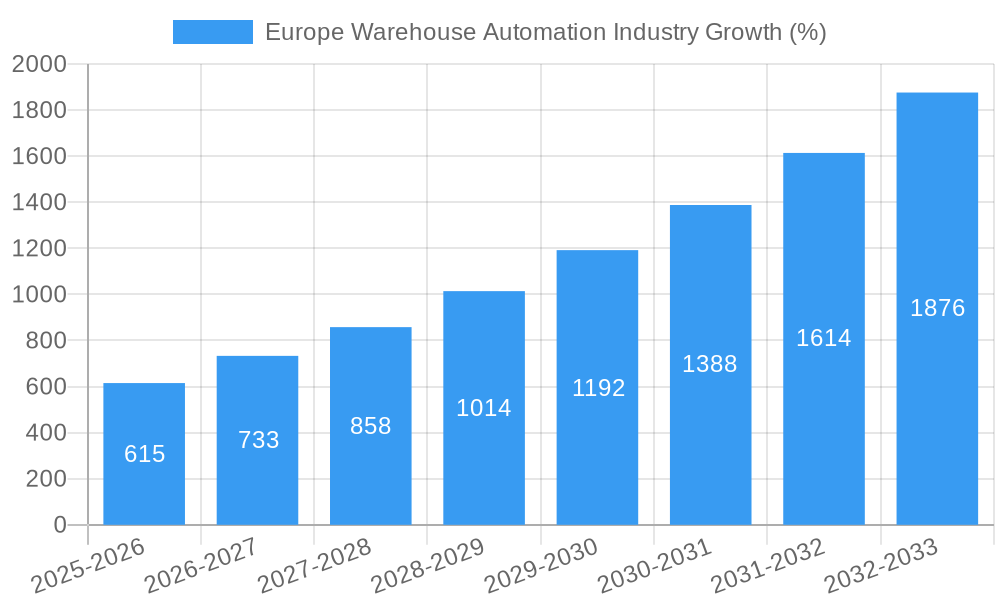

The European warehouse automation market, valued at €4.28 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 14.40% from 2025 to 2033. This surge is driven by several key factors. The e-commerce boom necessitates efficient order fulfillment, pushing businesses to adopt automated solutions for improved speed, accuracy, and scalability. Furthermore, labor shortages across Europe are compelling companies to invest in automation to mitigate workforce gaps and maintain operational efficiency. Rising labor costs and the increasing demand for faster delivery times further fuel this adoption. Technological advancements, such as the development of sophisticated warehouse management systems (WMS) and advanced robotics like piece-picking robots, are enhancing automation capabilities and driving market expansion. Germany, France, and the United Kingdom are major contributors to the market, driven by their robust e-commerce sectors and advanced logistics infrastructure. The market is segmented by end-user industry (food and beverage, post and parcel, groceries, etc.), components (hardware, software, services), and country, with significant opportunities across all segments.

The market's growth is not without challenges. High initial investment costs associated with warehouse automation can be a deterrent for smaller businesses. Integration complexities with existing systems and the need for skilled personnel to operate and maintain these advanced technologies pose additional hurdles. However, ongoing technological innovation, coupled with the availability of financing options and government incentives promoting automation, is gradually addressing these concerns. The continuous development of user-friendly software solutions and the increasing affordability of automated systems are expected to further accelerate market penetration in the coming years. The long-term outlook remains exceptionally positive, with continued expansion fueled by the sustained growth of e-commerce and the ongoing need for efficient and cost-effective warehouse operations across Europe.

Europe Warehouse Automation Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the European warehouse automation industry, offering valuable insights for stakeholders across the value chain. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages extensive historical data (2019-2024) to project future market trends accurately. The European warehouse automation market is poised for significant growth, driven by e-commerce expansion, supply chain optimization needs, and technological advancements. The market size is estimated at €XX Billion in 2025 and is projected to reach €XX Billion by 2033.

Europe Warehouse Automation Industry Market Composition & Trends

The European warehouse automation market exhibits a moderately concentrated landscape with several key players holding significant market share. Leading companies include Jungheinrich AG, Swisslog Holding AG (KUKA AG), BEUMER Group GmbH & Co KG, SSI Schaefer AG, WITRON Logistik + Informatik GmbH, TGW Logistics Group GmbH, Mecalux SA, Vanderlande Industries BV, Kion Group AG (Dematic Group), and Knapp AG. However, the market also accommodates numerous smaller, specialized firms. Innovation is driven by advancements in robotics, AI, and software solutions, leading to the development of autonomous mobile robots (AMRs), automated guided vehicles (AGVs), and sophisticated warehouse management systems (WMS). Regulatory landscapes vary across European countries, with some promoting automation through incentives while others focus on worker safety regulations. Substitute products include manual labor and less sophisticated automation technologies, but the trend leans towards full automation due to efficiency gains. Mergers and acquisitions (M&A) are frequent, reflecting the industry's dynamic nature. Recent deals, while their exact values are not publicly available in all cases, show a trend towards consolidation in this space.

- Market Share Distribution: The top 5 players account for approximately XX% of the market share in 2025.

- M&A Deal Values: Significant M&A activity was observed between 2019 and 2024, with estimated total deal value exceeding €XX Billion. This includes a notable amount of strategic acquisitions focused on expanding software capabilities and automated solutions.

- End-User Profiles: The market is characterized by diverse end-user industries, including food and beverage, post and parcel, groceries, general merchandise, apparel, and manufacturing (durable and non-durable goods).

Europe Warehouse Automation Industry Industry Evolution

The European warehouse automation industry has witnessed rapid growth over the past decade, propelled by the burgeoning e-commerce sector and the need for enhanced supply chain efficiency. Technological advancements, particularly in robotics and AI, have significantly enhanced automation capabilities, boosting productivity and reducing operational costs. The shift towards automated solutions is driven by the increasing demand for faster delivery times, improved inventory management, and reduced labor costs. This is further spurred by the growing prevalence of omnichannel distribution strategies and demand for efficient order fulfillment in increasingly competitive markets. Adoption rates for warehouse automation solutions vary across different end-user industries, with sectors like e-commerce and food & beverage exhibiting higher adoption compared to others. The market shows a Compound Annual Growth Rate (CAGR) of XX% during the historical period (2019-2024) and is projected to maintain a CAGR of XX% during the forecast period (2025-2033).

Leading Regions, Countries, or Segments in Europe Warehouse Automation Industry

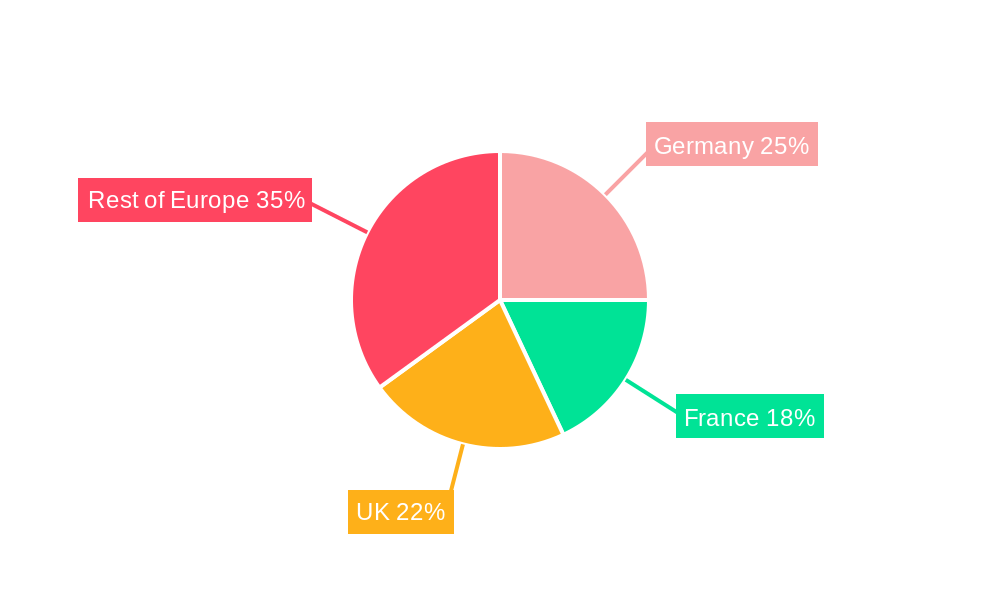

The UK, Germany, and France represent the largest markets within Europe, accounting for a combined XX% of the total market revenue in 2025. However, growth is also anticipated in the "Rest of Europe" segment, driven by increasing adoption in various sectors and countries.

Key Drivers by Region:

- United Kingdom: High e-commerce penetration, robust logistics infrastructure, and government support for technological adoption.

- Germany: Strong manufacturing sector, high automation adoption rates, and a sophisticated technology ecosystem.

- France: Growing e-commerce market, increasing focus on supply chain optimization, and government incentives for automation.

- Rest of Europe: Emerging markets with high growth potential, driven by factors similar to those listed above, though at varying paces depending on individual countries.

Dominant End-User Segments: The Food & Beverage and E-commerce (Post and Parcel, Groceries, General Merchandise) sectors are leading adopters of automation solutions, owing to their high-volume operations and demand for rapid order fulfillment. This is reflected in their high revenue contributions to the market.

Component-wise Segmentation: The hardware segment dominates the market, given the significant investment in automated systems. However, there is a steady increase in demand for software solutions (WMS, WES), and services, such as system integration and maintenance, are also important components.

Europe Warehouse Automation Industry Product Innovations

Recent innovations focus on enhancing the capabilities of AMRs and AGVs, improving their navigation, payload capacity, and integration with WMS. The development of advanced picking robots is a key trend, addressing the need for efficient and flexible order fulfillment. Artificial Intelligence (AI) and machine learning (ML) are being integrated into automation systems to enhance decision-making, optimize workflows, and predict maintenance needs. These innovations are supported by the development of cloud-based platforms, offering scalable and flexible automation solutions. Unique selling propositions often focus on improved efficiency, reduced operational costs, increased throughput, and enhanced order accuracy.

Propelling Factors for Europe Warehouse Automation Industry Growth

Several factors are propelling the growth of the European warehouse automation industry. These include:

- E-commerce boom: The rapid growth of e-commerce is significantly increasing demand for efficient warehouse operations and faster delivery times.

- Labor shortages: The scarcity of skilled labor in certain regions is driving the adoption of automation solutions to address operational challenges.

- Supply chain optimization: Companies are adopting automation to enhance supply chain visibility, reduce delays, and improve overall efficiency.

- Technological advancements: Continuous innovations in robotics, AI, and software solutions are expanding the capabilities and applications of warehouse automation systems.

- Government support: Several European governments are offering incentives and subsidies to encourage automation adoption.

Obstacles in the Europe Warehouse Automation Industry Market

Despite significant growth potential, the European warehouse automation market faces several obstacles:

- High initial investment costs: The implementation of automation systems requires substantial upfront investments, which may deter smaller businesses.

- Integration complexities: Integrating automation systems with existing warehouse infrastructure can be challenging and time-consuming.

- Lack of skilled workforce: A shortage of skilled personnel to operate and maintain automation systems can hinder efficient operation.

- Cybersecurity concerns: Automated systems are vulnerable to cyberattacks, which can disrupt operations and compromise sensitive data.

Future Opportunities in Europe Warehouse Automation Industry

Future opportunities in the European warehouse automation industry include the expansion into new markets (e.g., smaller and medium-sized enterprises), the adoption of more advanced technologies (e.g., AI-powered predictive maintenance), and the development of innovative automation solutions tailored to specific industry needs. The development and application of sustainable solutions will also open doors to new possibilities.

Major Players in the Europe Warehouse Automation Industry Ecosystem

- Jungheinrich AG

- Swisslog Holding AG (KUKA AG)

- BEUMER Group GmbH & Co KG

- SSI Schaefer AG

- WITRON Logistik + Informatik GmbH

- TGW Logistics Group GmbH

- Mecalux SA

- Vanderlande Industries BV

- Kion Group AG (Dematic Group)

- Knapp AG

Key Developments in Europe Warehouse Automation Industry Industry

- July 2021: ABB acquired ASTI Mobile Robotics Group, expanding its AMR portfolio and strengthening its position in the flexible automation market.

- May 2022: Lineage Logistics expanded its automated warehouse in Peterborough, UK, significantly increasing its storage capacity and solidifying its Southeast Superhub.

Strategic Europe Warehouse Automation Industry Market Forecast

The European warehouse automation market is expected to witness sustained growth over the forecast period, driven by continued e-commerce expansion, increasing adoption of advanced technologies, and ongoing government support. The market's evolution will be characterized by increasing sophistication in automation solutions, a rise in the adoption of cloud-based platforms, and a greater emphasis on sustainability. This growth will create significant opportunities for established players and new entrants alike. Specific growth figures are detailed within the full report.

Europe Warehouse Automation Industry Segmentation

-

1. Component

-

1.1. Hardware

- 1.1.1. Mobile Robots (AGV, AMR)

- 1.1.2. Automated Storage and Retrieval Systems (AS/RS)

- 1.1.3. Automated Conveyor & Sorting Systems

- 1.1.4. De-palletizing/Palletizing Systems

- 1.1.5. Automati

- 1.1.6. Piece Picking Robots

- 1.2. Software

- 1.3. Services (Value Added Services, Maintenance, etc.)

-

1.1. Hardware

-

2. End-User

- 2.1. Food and

- 2.2. Post and Parcel

- 2.3. Groceries

- 2.4. General Merchandise

- 2.5. Apparel

- 2.6. Manufacturing (Durable and Non-Durable)

- 2.7. Other End-user Industries

Europe Warehouse Automation Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Warehouse Automation Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 14.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Exponential Growth of the E-commerce Industry and Customer Expectation; Increasing Manufacturing Complexity and Technology Availability; Industry 4.0 Investments Driving The Demand For Automation & Material Handling

- 3.3. Market Restrains

- 3.3.1. High Cost of Infrastructure set up

- 3.4. Market Trends

- 3.4.1. Autonomous Mobile Robots (AMRs) are Gaining Popularity Throughout Europe

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Warehouse Automation Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Hardware

- 5.1.1.1. Mobile Robots (AGV, AMR)

- 5.1.1.2. Automated Storage and Retrieval Systems (AS/RS)

- 5.1.1.3. Automated Conveyor & Sorting Systems

- 5.1.1.4. De-palletizing/Palletizing Systems

- 5.1.1.5. Automati

- 5.1.1.6. Piece Picking Robots

- 5.1.2. Software

- 5.1.3. Services (Value Added Services, Maintenance, etc.)

- 5.1.1. Hardware

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Food and

- 5.2.2. Post and Parcel

- 5.2.3. Groceries

- 5.2.4. General Merchandise

- 5.2.5. Apparel

- 5.2.6. Manufacturing (Durable and Non-Durable)

- 5.2.7. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. Germany Europe Warehouse Automation Industry Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Warehouse Automation Industry Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Warehouse Automation Industry Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Warehouse Automation Industry Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Warehouse Automation Industry Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Warehouse Automation Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Warehouse Automation Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Jungheinrich AG

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Swisslog Holding AG (KUKA AG)

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 BEUMER Group GmbH & Co KG

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 SSI Schaefer AG

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 WITRON Logistik + Informatik GmbH

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 TGW Logistics Group GmbH

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Mecalux SA*List Not Exhaustive

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Vanderlande Industries BV

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Kion Group AG (Dematic Group)

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Knapp AG

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Jungheinrich AG

List of Figures

- Figure 1: Europe Warehouse Automation Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Warehouse Automation Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe Warehouse Automation Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Warehouse Automation Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 3: Europe Warehouse Automation Industry Revenue Million Forecast, by End-User 2019 & 2032

- Table 4: Europe Warehouse Automation Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Europe Warehouse Automation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Europe Warehouse Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Europe Warehouse Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Europe Warehouse Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Europe Warehouse Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Europe Warehouse Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Europe Warehouse Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Europe Warehouse Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Europe Warehouse Automation Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 14: Europe Warehouse Automation Industry Revenue Million Forecast, by End-User 2019 & 2032

- Table 15: Europe Warehouse Automation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United Kingdom Europe Warehouse Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Germany Europe Warehouse Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: France Europe Warehouse Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Italy Europe Warehouse Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Spain Europe Warehouse Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Netherlands Europe Warehouse Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Belgium Europe Warehouse Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Sweden Europe Warehouse Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Norway Europe Warehouse Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Poland Europe Warehouse Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Denmark Europe Warehouse Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Warehouse Automation Industry?

The projected CAGR is approximately 14.40%.

2. Which companies are prominent players in the Europe Warehouse Automation Industry?

Key companies in the market include Jungheinrich AG, Swisslog Holding AG (KUKA AG), BEUMER Group GmbH & Co KG, SSI Schaefer AG, WITRON Logistik + Informatik GmbH, TGW Logistics Group GmbH, Mecalux SA*List Not Exhaustive, Vanderlande Industries BV, Kion Group AG (Dematic Group), Knapp AG.

3. What are the main segments of the Europe Warehouse Automation Industry?

The market segments include Component, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.28 Million as of 2022.

5. What are some drivers contributing to market growth?

Exponential Growth of the E-commerce Industry and Customer Expectation; Increasing Manufacturing Complexity and Technology Availability; Industry 4.0 Investments Driving The Demand For Automation & Material Handling.

6. What are the notable trends driving market growth?

Autonomous Mobile Robots (AMRs) are Gaining Popularity Throughout Europe.

7. Are there any restraints impacting market growth?

High Cost of Infrastructure set up.

8. Can you provide examples of recent developments in the market?

May 2022 - Lineage expanded its fully automated warehouse in Peterborough by adding 45,000 pallet spots, bringing its total capacity to roughly 71,000 pallets. The additional warehouse creates a critical Southeast Superhub that will support retail and foodservice customers with specific supply chain needs.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Warehouse Automation Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Warehouse Automation Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Warehouse Automation Industry?

To stay informed about further developments, trends, and reports in the Europe Warehouse Automation Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence