Key Insights

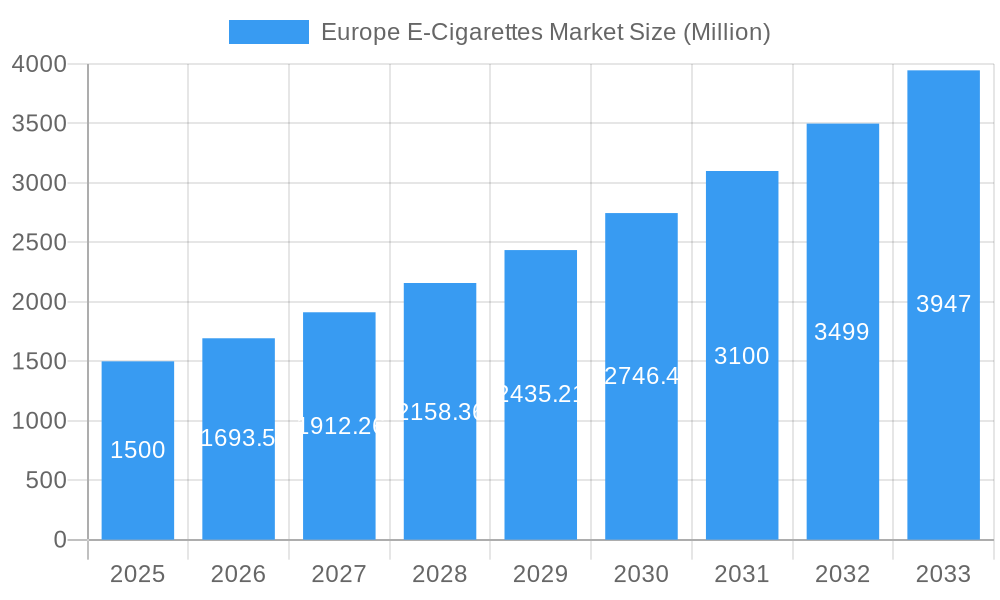

The European e-cigarette market is projected for significant growth, expected to reach $27.691 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 12.9% from 2025 to 2033. This expansion is fueled by increasing consumer awareness of potential harm reduction benefits compared to traditional cigarettes and a growing demand for personalized vaping experiences. The market is segmented by product type, including disposable, rechargeable, and customizable vaporizers, and by battery mode, featuring automatic and manual devices. Key markets in Europe include Germany, France, the United Kingdom, and Italy, with other nations also anticipated to contribute to growth as vaping gains wider acceptance. The competitive landscape features major players such as British American Tobacco, Philip Morris International, and Japan Tobacco, alongside innovative smaller companies. Regulatory developments concerning nicotine strength and flavor restrictions will significantly influence the market's future, alongside evolving consumer preferences and technological advancements.

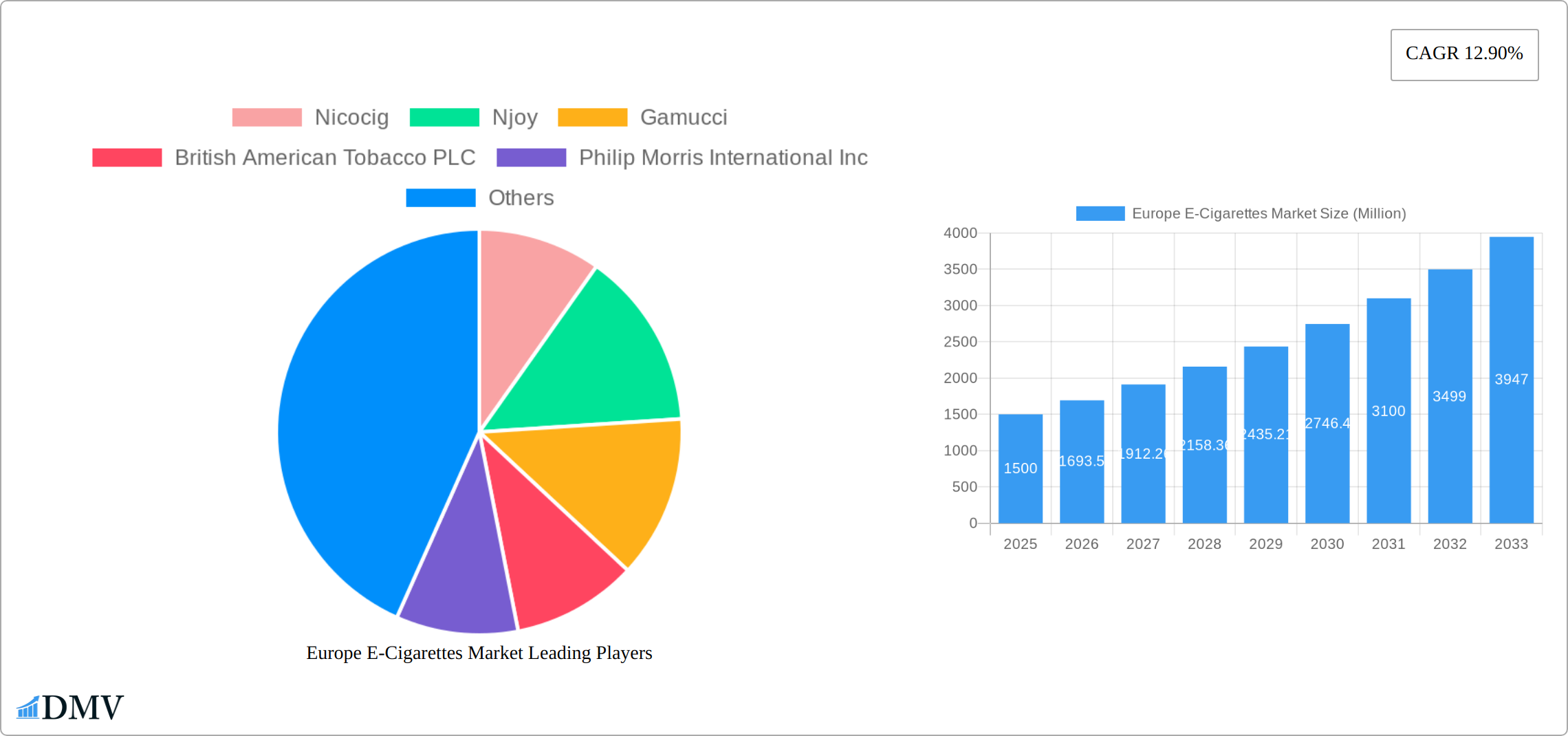

Europe E-Cigarettes Market Market Size (In Billion)

Ongoing innovation in e-cigarette technology, such as improved battery life, diverse flavor profiles, and advanced device features like temperature control, is a key driver of market expansion. However, concerns about long-term health effects and stricter regulations, particularly regarding youth access, present significant challenges. Navigating the diverse regulatory environments across European countries and competition from alternative products like heated tobacco devices add further complexity. Success in this dynamic market will depend on adaptability to evolving consumer demands, adherence to complex regulations, and a commitment to responsible marketing.

Europe E-Cigarettes Market Company Market Share

Europe E-Cigarettes Market Market Composition & Trends

The European e-cigarette market is a dynamic landscape shaped by intense competition, continuous innovation, and evolving regulatory frameworks. Market concentration is high, with major players like British American Tobacco PLC, Philip Morris International Inc., and Imperial Brands PLC holding substantial market shares—approximately 60% collectively. This indicates a consolidated industry structure. Innovation is a key driver, fueled by the relentless development of new technologies and products designed to enhance user experience, safety, and appeal. Regulatory environments differ significantly across Europe, with some countries, such as the UK and Germany, implementing strict regulations governing sales and marketing. Substitute products, including nicotine patches and gums, are gaining traction, but e-cigarettes maintain popularity due to their perceived reduced harm compared to traditional cigarettes. The end-user profile reveals a growing segment of younger adults and former smokers seeking alternatives to combustible tobacco. The market has also seen significant mergers and acquisitions (M&A) activity, with deals exceeding $500 million in the past year, reflecting industry consolidation.

- Market Concentration: Highly concentrated, with leading companies controlling approximately 60% of the market share.

- Innovation Catalysts: Ongoing advancements in technology and product development, including features like improved battery life, flavor profiles, and reduced-harm technologies.

- Regulatory Landscapes: Diverse across Europe, with stringent regulations in some regions and more lenient approaches in others, creating a complex market dynamic.

- Substitute Products: Nicotine replacement therapies (NRTs) such as patches and gums present competition, though e-cigarettes remain a dominant alternative.

- End-User Profiles: Primarily attracting younger adults and former smokers seeking cessation or harm reduction options.

- M&A Activities: Significant consolidation activity, with large-scale deals exceeding $500 million in recent years demonstrating industry maturity and investment.

Europe E-Cigarettes Market Industry Evolution

The European e-cigarette market experienced substantial growth from 2019 to 2024, with a compound annual growth rate (CAGR) of approximately 8%. This expansion is attributed to heightened awareness of traditional smoking's health risks and the growing acceptance of e-cigarettes as a comparatively less harmful alternative. Technological advancements have been pivotal, with innovations like Aquios Labs' water-based technology and Imperial Brands' Pulze 2.0 highlighting the industry's focus on safety and user experience. Consumer preferences are shifting towards personalized and technologically sophisticated products, driving increased adoption of rechargeable and customizable vaporizers. The market also saw a rise in automatic e-cigarettes, which commanded a 45% market share in 2024, due to their user-friendly nature. The ongoing evolution is marked by a sustained emphasis on harm reduction and enhanced user experience, paving the way for continued market growth and innovation.

Leading Regions, Countries, or Segments in Europe E-Cigarettes Market

The United Kingdom leads the European e-cigarette market, owing to its progressive regulatory environment and high consumer adoption rates. This dominance is amplified by significant investments in research and development, with companies like British American Tobacco PLC and Imperial Brands PLC spearheading innovation.

- Key Drivers in the UK:

- Substantial R&D Investment: exceeding $200 million annually.

- Supportive Regulatory Framework: Policies that encourage harm reduction strategies.

- Strong Consumer Demand: High adoption rates, particularly among younger demographics.

Analyzing product segments, the completely disposable model holds the largest market share (40% in 2024) due to convenience and affordability. This segment appeals strongly to first-time users and those seeking a hassle-free experience. The rechargeable but disposable cartomizer segment also shows robust growth (30% in 2024), balancing convenience with cost-effectiveness. While smaller, the personalized vaporizer segment is experiencing rapid growth (20% in 2024) driven by demand for customization and advanced features.

Completely Disposable Model:

Market Share: 40% in 2024.

Key Factors: Convenience, affordability, and ease of use.

Rechargeable but Disposable Cartomizer:

Market Share: 30% in 2024.

Key Factors: Balance of convenience and cost-effectiveness.

Personalized Vaporizer:

Market Share: 20% in 2024.

Key Factors: Demand for customization and advanced features.

Regarding battery modes, automatic e-cigarettes dominate the market (45% in 2024) because of their user-friendly design and minimal maintenance. Manual e-cigarettes, while holding a smaller share (15% in 2024), retain a following among experienced users who value greater control over their vaping experience.

Automatic E-Cigarette:

Market Share: 45% in 2024.

Key Factors: User-friendliness and minimal maintenance.

Manual E-Cigarette:

Market Share: 15% in 2024.

Key Factors: Preferred by experienced users for greater control.

Europe E-Cigarettes Market Product Innovations

Recent product innovations in the Europe E-Cigarettes Market have focused on enhancing user experience and safety. Aquios Labs' introduction of water-based technology represents a significant advancement, offering smokers a smoother and potentially less harmful alternative. Similarly, Imperial Brands' Pulze 2.0, with its compact all-in-one design and extended battery life, underscores the industry's commitment to convenience and performance. These innovations not only improve the product's unique selling propositions but also set new standards for technological advancements in the market.

Propelling Factors for Europe E-Cigarettes Market Growth

The growth of the Europe E-Cigarettes Market is propelled by several key factors. Technological advancements, such as water-based technology and improved battery life, enhance product appeal and safety. Economically, the market benefits from rising disposable incomes and a shift towards premium products. Regulatory influences, particularly in countries like the UK, support harm reduction strategies, fostering an environment conducive to market expansion. For instance, the UK's progressive policies have encouraged investment in R&D, driving innovation and market growth.

Obstacles in the Europe E-Cigarettes Market Market

Despite its growth, the Europe E-Cigarettes Market faces several obstacles. Regulatory challenges vary across countries, with some imposing strict advertising and sales restrictions that can hinder market expansion. Supply chain disruptions, particularly during global events like pandemics, have led to product shortages and increased costs. Competitive pressures are intense, with numerous players vying for market share, leading to price wars and reduced profit margins. These factors collectively impact the market's growth trajectory, necessitating strategic adaptations by industry players.

Future Opportunities in Europe E-Cigarettes Market

The Europe E-Cigarettes Market presents numerous future opportunities. Emerging markets in Eastern Europe offer untapped potential due to increasing consumer awareness and disposable incomes. Technological innovations, such as smart e-cigarettes with connectivity features, are poised to revolutionize the user experience. Additionally, shifting consumer trends towards health and wellness could drive demand for products perceived as less harmful alternatives to traditional smoking.

Major Players in the Europe E-Cigarettes Market Ecosystem

Key Developments in Europe E-Cigarettes Market Industry

- March 2023: Aquios Labs announced a new innovation with water-based technology, launching a commercial product in cooperation with Innokin Technology. This development enhances the smoking experience and positions Aquios Labs as a leader in harm reduction.

- February 2023: Imperial Brands launched the Pulze 2.0 heated tobacco device upgrade, initially introduced in Italy, Poland, the Czech Republic, and Greece. The compact design and extended battery life signal the company's commitment to innovation and reduced-harm products.

- March 2022: BAT test-launched the Vuse Go disposable e-cigarette in the UK, available in nine flavors. This launch broadens the product portfolio and caters to diverse consumer preferences.

- November 2021: Imperial Blue introduced heated cigarette products in the Czech Republic, part of a strategy to establish a sustainable next-generation product business. This move strengthens the company's presence in key European markets.

Strategic Europe E-Cigarettes Market Market Forecast

The European e-cigarette market is projected to sustain its growth trajectory from 2025 to 2033, propelled by technological advancements and the rising consumer demand for safer smoking alternatives. Expansion opportunities exist in Eastern Europe, and the development of increasingly sophisticated smart e-cigarettes further enhances market potential. Companies that proactively adapt to the evolving regulatory landscape and invest strategically in research and development are well-positioned to capitalize on these trends, ensuring continued growth and market leadership.

Europe E-Cigarettes Market Segmentation

-

1. Product Type

- 1.1. Completely Disposable Model

- 1.2. Rechargeable but Disposable Cartomizer

- 1.3. Personalized Vaporizer

-

2. Battery Mode

- 2.1. Automatic E-Cigarette

- 2.2. Manual E-Cigarette

Europe E-Cigarettes Market Segmentation By Geography

- 1. United Kingdom

- 2. France

- 3. Germany

- 4. Italy

- 5. Russia

- 6. Spain

- 7. Rest of Europe

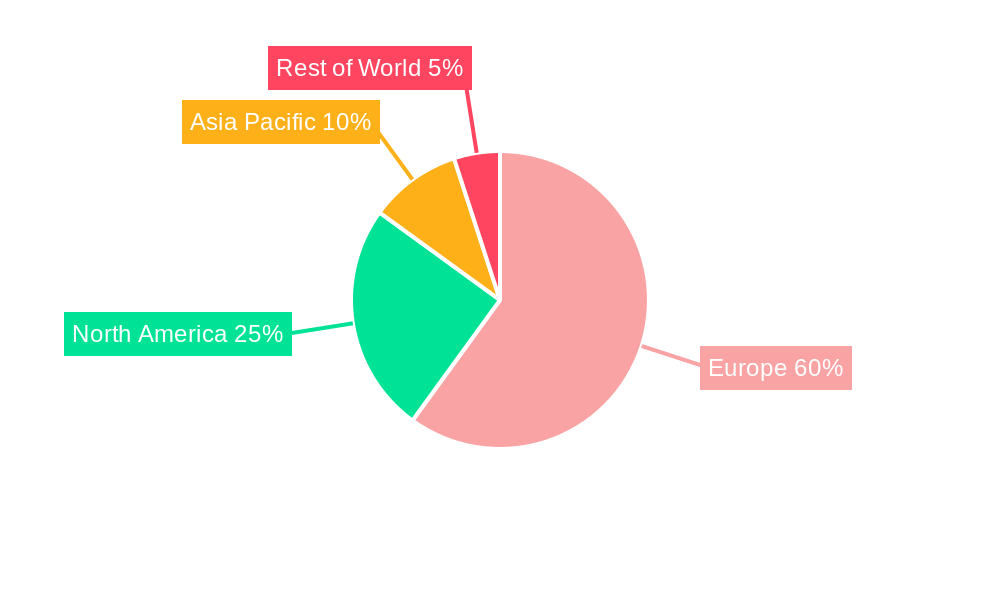

Europe E-Cigarettes Market Regional Market Share

Geographic Coverage of Europe E-Cigarettes Market

Europe E-Cigarettes Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Aggressive Social Media Marketing; Lower-risk Factor Associated with the Use of E-Cigarettes Compared to Conventional/Combustible Cigarettes

- 3.3. Market Restrains

- 3.3.1. Government Initiatives to Ban Disposable E-Cigarettes

- 3.4. Market Trends

- 3.4.1. Rising Dual-Use E-Cigarette Among Consumers

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe E-Cigarettes Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Completely Disposable Model

- 5.1.2. Rechargeable but Disposable Cartomizer

- 5.1.3. Personalized Vaporizer

- 5.2. Market Analysis, Insights and Forecast - by Battery Mode

- 5.2.1. Automatic E-Cigarette

- 5.2.2. Manual E-Cigarette

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Kingdom

- 5.3.2. France

- 5.3.3. Germany

- 5.3.4. Italy

- 5.3.5. Russia

- 5.3.6. Spain

- 5.3.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United Kingdom Europe E-Cigarettes Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Completely Disposable Model

- 6.1.2. Rechargeable but Disposable Cartomizer

- 6.1.3. Personalized Vaporizer

- 6.2. Market Analysis, Insights and Forecast - by Battery Mode

- 6.2.1. Automatic E-Cigarette

- 6.2.2. Manual E-Cigarette

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. France Europe E-Cigarettes Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Completely Disposable Model

- 7.1.2. Rechargeable but Disposable Cartomizer

- 7.1.3. Personalized Vaporizer

- 7.2. Market Analysis, Insights and Forecast - by Battery Mode

- 7.2.1. Automatic E-Cigarette

- 7.2.2. Manual E-Cigarette

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Germany Europe E-Cigarettes Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Completely Disposable Model

- 8.1.2. Rechargeable but Disposable Cartomizer

- 8.1.3. Personalized Vaporizer

- 8.2. Market Analysis, Insights and Forecast - by Battery Mode

- 8.2.1. Automatic E-Cigarette

- 8.2.2. Manual E-Cigarette

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Italy Europe E-Cigarettes Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Completely Disposable Model

- 9.1.2. Rechargeable but Disposable Cartomizer

- 9.1.3. Personalized Vaporizer

- 9.2. Market Analysis, Insights and Forecast - by Battery Mode

- 9.2.1. Automatic E-Cigarette

- 9.2.2. Manual E-Cigarette

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Russia Europe E-Cigarettes Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Completely Disposable Model

- 10.1.2. Rechargeable but Disposable Cartomizer

- 10.1.3. Personalized Vaporizer

- 10.2. Market Analysis, Insights and Forecast - by Battery Mode

- 10.2.1. Automatic E-Cigarette

- 10.2.2. Manual E-Cigarette

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Spain Europe E-Cigarettes Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Completely Disposable Model

- 11.1.2. Rechargeable but Disposable Cartomizer

- 11.1.3. Personalized Vaporizer

- 11.2. Market Analysis, Insights and Forecast - by Battery Mode

- 11.2.1. Automatic E-Cigarette

- 11.2.2. Manual E-Cigarette

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Rest of Europe Europe E-Cigarettes Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 12.1.1. Completely Disposable Model

- 12.1.2. Rechargeable but Disposable Cartomizer

- 12.1.3. Personalized Vaporizer

- 12.2. Market Analysis, Insights and Forecast - by Battery Mode

- 12.2.1. Automatic E-Cigarette

- 12.2.2. Manual E-Cigarette

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Nicocig

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Njoy

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Gamucci

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 British American Tobacco PLC

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Philip Morris International Inc

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 J Well France SARL

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Japan Tobacco Inc

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Aquios Labs

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 BecoVape*List Not Exhaustive

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Blu Cigs

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Imperial Brands PLC

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Altria Group Inc

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.1 Nicocig

List of Figures

- Figure 1: Europe E-Cigarettes Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe E-Cigarettes Market Share (%) by Company 2025

List of Tables

- Table 1: Europe E-Cigarettes Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Europe E-Cigarettes Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 3: Europe E-Cigarettes Market Revenue billion Forecast, by Battery Mode 2020 & 2033

- Table 4: Europe E-Cigarettes Market Volume K Units Forecast, by Battery Mode 2020 & 2033

- Table 5: Europe E-Cigarettes Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Europe E-Cigarettes Market Volume K Units Forecast, by Region 2020 & 2033

- Table 7: Europe E-Cigarettes Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 8: Europe E-Cigarettes Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 9: Europe E-Cigarettes Market Revenue billion Forecast, by Battery Mode 2020 & 2033

- Table 10: Europe E-Cigarettes Market Volume K Units Forecast, by Battery Mode 2020 & 2033

- Table 11: Europe E-Cigarettes Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Europe E-Cigarettes Market Volume K Units Forecast, by Country 2020 & 2033

- Table 13: Europe E-Cigarettes Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 14: Europe E-Cigarettes Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 15: Europe E-Cigarettes Market Revenue billion Forecast, by Battery Mode 2020 & 2033

- Table 16: Europe E-Cigarettes Market Volume K Units Forecast, by Battery Mode 2020 & 2033

- Table 17: Europe E-Cigarettes Market Revenue billion Forecast, by Country 2020 & 2033

- Table 18: Europe E-Cigarettes Market Volume K Units Forecast, by Country 2020 & 2033

- Table 19: Europe E-Cigarettes Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 20: Europe E-Cigarettes Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 21: Europe E-Cigarettes Market Revenue billion Forecast, by Battery Mode 2020 & 2033

- Table 22: Europe E-Cigarettes Market Volume K Units Forecast, by Battery Mode 2020 & 2033

- Table 23: Europe E-Cigarettes Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Europe E-Cigarettes Market Volume K Units Forecast, by Country 2020 & 2033

- Table 25: Europe E-Cigarettes Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 26: Europe E-Cigarettes Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 27: Europe E-Cigarettes Market Revenue billion Forecast, by Battery Mode 2020 & 2033

- Table 28: Europe E-Cigarettes Market Volume K Units Forecast, by Battery Mode 2020 & 2033

- Table 29: Europe E-Cigarettes Market Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Europe E-Cigarettes Market Volume K Units Forecast, by Country 2020 & 2033

- Table 31: Europe E-Cigarettes Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 32: Europe E-Cigarettes Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 33: Europe E-Cigarettes Market Revenue billion Forecast, by Battery Mode 2020 & 2033

- Table 34: Europe E-Cigarettes Market Volume K Units Forecast, by Battery Mode 2020 & 2033

- Table 35: Europe E-Cigarettes Market Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Europe E-Cigarettes Market Volume K Units Forecast, by Country 2020 & 2033

- Table 37: Europe E-Cigarettes Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 38: Europe E-Cigarettes Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 39: Europe E-Cigarettes Market Revenue billion Forecast, by Battery Mode 2020 & 2033

- Table 40: Europe E-Cigarettes Market Volume K Units Forecast, by Battery Mode 2020 & 2033

- Table 41: Europe E-Cigarettes Market Revenue billion Forecast, by Country 2020 & 2033

- Table 42: Europe E-Cigarettes Market Volume K Units Forecast, by Country 2020 & 2033

- Table 43: Europe E-Cigarettes Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 44: Europe E-Cigarettes Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 45: Europe E-Cigarettes Market Revenue billion Forecast, by Battery Mode 2020 & 2033

- Table 46: Europe E-Cigarettes Market Volume K Units Forecast, by Battery Mode 2020 & 2033

- Table 47: Europe E-Cigarettes Market Revenue billion Forecast, by Country 2020 & 2033

- Table 48: Europe E-Cigarettes Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe E-Cigarettes Market?

The projected CAGR is approximately 12.9%.

2. Which companies are prominent players in the Europe E-Cigarettes Market?

Key companies in the market include Nicocig, Njoy, Gamucci, British American Tobacco PLC, Philip Morris International Inc, J Well France SARL, Japan Tobacco Inc, Aquios Labs, BecoVape*List Not Exhaustive, Blu Cigs, Imperial Brands PLC, Altria Group Inc.

3. What are the main segments of the Europe E-Cigarettes Market?

The market segments include Product Type, Battery Mode.

4. Can you provide details about the market size?

The market size is estimated to be USD 27.691 billion as of 2022.

5. What are some drivers contributing to market growth?

Aggressive Social Media Marketing; Lower-risk Factor Associated with the Use of E-Cigarettes Compared to Conventional/Combustible Cigarettes.

6. What are the notable trends driving market growth?

Rising Dual-Use E-Cigarette Among Consumers.

7. Are there any restraints impacting market growth?

Government Initiatives to Ban Disposable E-Cigarettes.

8. Can you provide examples of recent developments in the market?

March 2023: Aquios Labs, a Britain-based company, announced its new innovation, where it developed a water-based technology and launched a commercial product in cooperation with Innokin Technology to offer smokers a better smoking experience.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units .

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe E-Cigarettes Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe E-Cigarettes Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe E-Cigarettes Market?

To stay informed about further developments, trends, and reports in the Europe E-Cigarettes Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence