Key Insights

The European Controlled-Release Fertilizer (CRF) market, valued at approximately €10.64 billion in 2024, is poised for substantial expansion. Driven by escalating demand for sustainable agriculture and enhanced fertilizer use efficiency, the market is projected to achieve a compound annual growth rate (CAGR) of 6.02% from 2024 to 2033, reaching an estimated value exceeding €19.2 billion by 2033. Key growth catalysts include stringent environmental regulations aimed at minimizing nutrient runoff and the widespread adoption of precision farming methodologies. The market is segmented by coating type (polymer-coated, polymer-sulfur-coated, others), crop type (field, horticultural, turf & ornamental), and key geographical regions including Germany, France, the UK, Italy, and the Netherlands. A prominent trend is the rising preference for polymer-coated CRFs due to their superior nutrient release control and reduced environmental impact. However, substantial upfront investment for CRF production and application may present a challenge for smaller agricultural enterprises. Leading market participants, such as Haifa Group, Grupa Azoty, and ICL Group, are actively influencing market dynamics through product advancements and strategic collaborations. The growing emphasis on improving soil health and optimizing nutrient uptake further propels market growth.

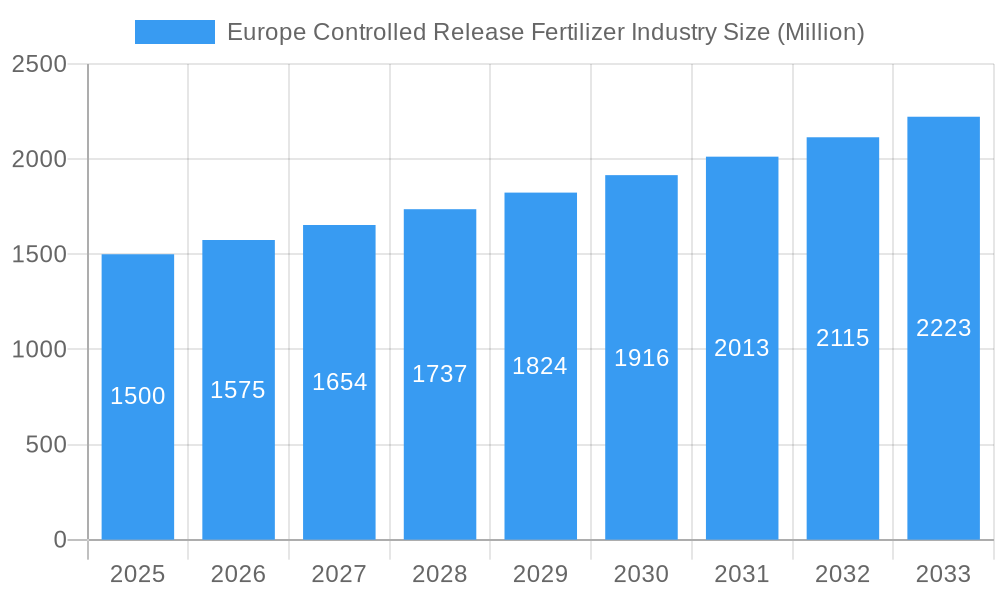

Europe Controlled Release Fertilizer Industry Market Size (In Billion)

The competitive arena features a blend of established global corporations and specialized regional entities. Innovation in CRF formulations and delivery mechanisms is crucial for sustained competitive advantage. Future market expansion will be contingent upon the development of more efficient and cost-effective CRF technologies, increased farmer awareness of environmental sustainability, and supportive government policies promoting sustainable agricultural practices. Anticipated market segmentation will likely focus on specialized CRFs tailored for specific crop requirements and environmental conditions. The ongoing proliferation of precision agriculture techniques will also generate significant opportunities for CRF manufacturers within the European landscape. Overall, the European CRF market is on an upward trajectory, propelled by converging environmental imperatives and agricultural efficiency enhancements.

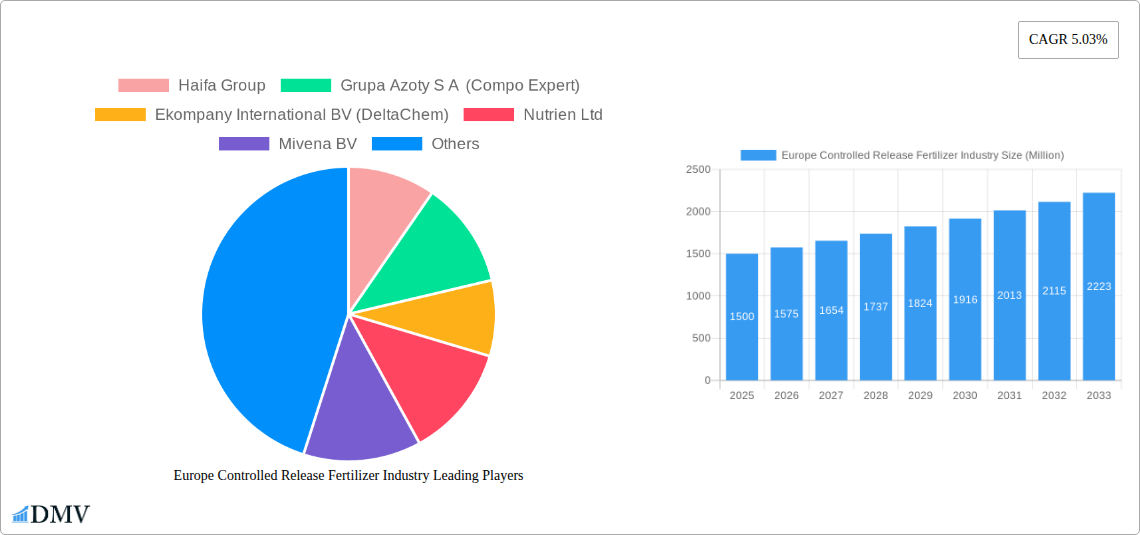

Europe Controlled Release Fertilizer Industry Company Market Share

Europe Controlled Release Fertilizer Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the Europe Controlled Release Fertilizer (CRF) industry, offering a comprehensive overview of market trends, leading players, and future growth prospects. Spanning the period from 2019 to 2033, with a focus on 2025 as the base and estimated year, this study is an essential resource for stakeholders seeking to navigate this dynamic market. The report delves into market segmentation by coating type (Polymer Coated, Polymer-Sulfur Coated, Others), crop type (Field Crops, Horticultural Crops, Turf & Ornamental), and key European countries (France, Germany, Italy, Netherlands, Russia, Spain, Ukraine, United Kingdom, and Rest of Europe), providing granular insights for strategic decision-making. The total market size in 2025 is estimated at xx Million.

Europe Controlled Release Fertilizer Industry Market Composition & Trends

The European CRF market presents a complex interplay of factors influencing its growth trajectory. Market concentration is moderate, with several key players holding significant shares, but a fragmented landscape also exists, particularly amongst smaller niche players. Innovation is driven by the need for sustainable agricultural practices and improved crop yields, prompting ongoing research into new polymer coatings and nutrient delivery systems. Stringent environmental regulations across Europe, aimed at reducing agricultural runoff and promoting sustainable farming, significantly impact market dynamics. Substitute products, such as conventional fertilizers, compete on price but often lack the efficiency and environmental benefits of CRFs. End-users consist primarily of large agricultural businesses, horticultural operations, and landscaping firms. Mergers and acquisitions (M&A) activity has been moderate, with deal values averaging xx Million per transaction in the historical period (2019-2024). Notable examples include Haifa Group's acquisition of Horticoop Andina in March 2022. Market share distribution is as follows:

- Haifa Group: xx%

- Grupa Azoty S A (Compo Expert): xx%

- Ekompany International BV (DeltaChem): xx%

- Nutrien Ltd: xx%

- Mivena BV: xx%

- ICL Group Ltd: xx%

- Others: xx%

Europe Controlled Release Fertilizer Industry Industry Evolution

The European CRF market has witnessed consistent growth from 2019 to 2024, driven by several factors. Technological advancements in polymer coating technology have led to more efficient nutrient release profiles, optimizing plant uptake and minimizing environmental impact. This, coupled with increasing awareness among farmers about the benefits of sustainable agriculture, has fueled adoption rates. The market witnessed a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024). The forecast period (2025-2033) projects a slightly moderated CAGR of xx%, largely due to economic factors and potential supply chain constraints. Consumer demand for high-quality, sustainably produced crops is a key driver of market expansion. The shift towards precision agriculture and data-driven farming practices also contributes to the increased adoption of CRFs, as their controlled release characteristics align well with optimized nutrient management strategies.

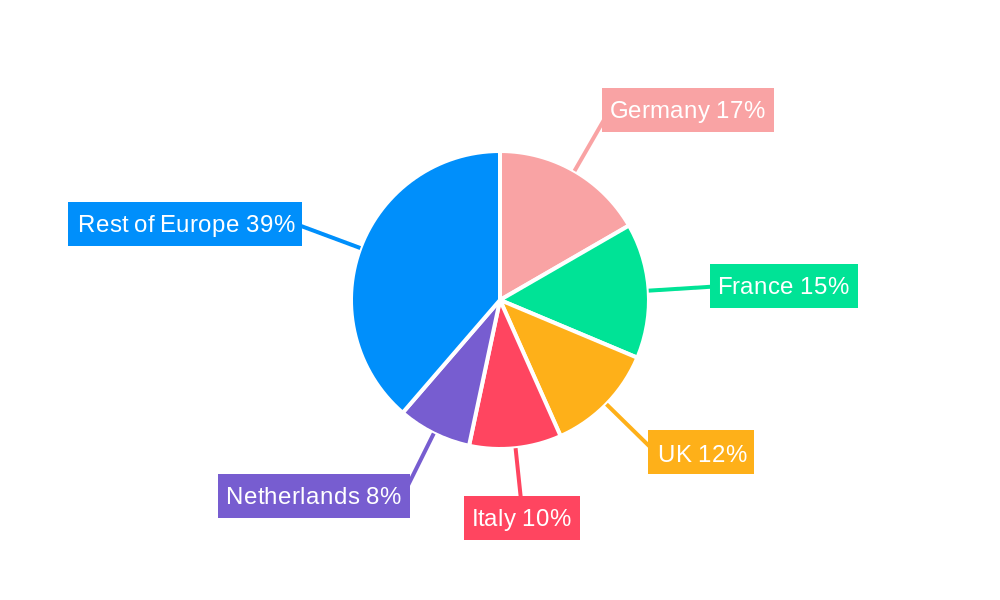

Leading Regions, Countries, or Segments in Europe Controlled Release Fertilizer Industry

Western European countries, particularly France, Germany, and the Netherlands, dominate the European CRF market. The UK also holds a significant share despite Brexit's implications.

Key Drivers:

- High agricultural output: These regions have large agricultural sectors with a high demand for efficient fertilization solutions.

- Stringent environmental regulations: Progressive environmental policies incentivize the adoption of CRFs to minimize pollution.

- High farmer incomes: High profitability enables investment in premium fertilizers like CRFs.

Dominance Factors: The dominance of Western European countries is primarily attributed to higher agricultural productivity, greater awareness of sustainable farming practices, and the availability of advanced technologies. Within the segment breakdown, Polymer Coated fertilizers represent the largest market share, followed by Polymer-Sulfur Coated and Others. Similarly, Field Crops constitutes the largest application segment, owing to its significant acreage compared to Horticultural Crops and Turf & Ornamental.

Europe Controlled Release Fertilizer Industry Product Innovations

Recent product innovations focus on enhancing nutrient release profiles, improving the efficiency of specific nutrients, and creating formulations tailored to different crop types. The introduction of advanced polymer coatings that respond to specific soil conditions or plant growth stages is a major area of development. These innovations offer unique selling propositions such as improved nutrient use efficiency, reduced environmental impact, and enhanced crop yields. Companies like ICL’s launch of new Solinure formulations demonstrates this focus on precision and optimization.

Propelling Factors for Europe Controlled Release Fertilizer Industry Growth

Several factors are driving the growth of the European CRF market. Technological advancements, such as the development of novel polymer coatings and smart release mechanisms, improve fertilizer efficiency. Economic factors, including increasing crop prices and the need for optimized input costs, incentivize adoption. Favorable regulatory environments, supporting sustainable agricultural practices, further propel growth. The ongoing trend towards precision agriculture and the increasing demand for high-quality, sustainable produce also contribute significantly.

Obstacles in the Europe Controlled Release Fertilizer Industry Market

The European CRF market faces challenges such as fluctuations in raw material prices, which impact production costs. Supply chain disruptions, particularly related to polymer resins and other key components, can limit production capacity. Intense competition from conventional fertilizers, often at lower prices, remains a significant obstacle. Regulatory uncertainty and changes in environmental policies can create challenges for manufacturers. These factors can cumulatively reduce overall market growth.

Future Opportunities in Europe Controlled Release Fertilizer Industry

Future opportunities lie in developing specialized CRF formulations for specific crops and soil types. Exploring new polymer materials with enhanced performance and environmental benefits is another key area. Expanding into emerging markets within Europe, especially in Eastern European countries with growing agricultural sectors, presents significant potential. The development of smart agriculture technologies that integrate with CRF systems could unlock new efficiencies and create significant growth opportunities.

Major Players in the Europe Controlled Release Fertilizer Industry Ecosystem

- Haifa Group

- Grupa Azoty S A (Compo Expert)

- Ekompany International BV (DeltaChem)

- Nutrien Ltd

- Mivena BV

- ICL Group Ltd

Key Developments in Europe Controlled Release Fertilizer Industry Industry

- May 2022: ICL launched three new NPK formulations of Solinure, enhancing yield optimization through increased trace elements. This demonstrates ICL’s focus on innovation to meet evolving agricultural demands.

- May 2022: ICL signed agreements to supply 600,000 and 700,000 metric tons of potash to India and China, respectively, highlighting the growing global demand for their products. This large-scale supply deal significantly impacts ICL's revenue and market position.

- March 2022: The Haifa Group acquired Horticoop Andina, expanding its Latin American market presence and strengthening its global brand position. This acquisition expands Haifa’s geographical reach and customer base, leading to potential revenue growth and market share increase.

Strategic Europe Controlled Release Fertilizer Industry Market Forecast

The European CRF market is poised for continued growth, driven by technological advancements, increasing demand for sustainable agricultural practices, and the growing adoption of precision agriculture techniques. The market's expansion will likely be influenced by the interplay of economic conditions, environmental regulations, and technological breakthroughs in polymer coating technologies and nutrient management systems. The forecast period (2025-2033) is expected to witness significant expansion, particularly in regions with robust agricultural sectors and supportive regulatory landscapes. Continued innovation and strategic partnerships will play a crucial role in shaping the future of this dynamic market.

Europe Controlled Release Fertilizer Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Europe Controlled Release Fertilizer Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Controlled Release Fertilizer Industry Regional Market Share

Geographic Coverage of Europe Controlled Release Fertilizer Industry

Europe Controlled Release Fertilizer Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.02% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Low Availability of Skilled Labor; Technological Advancements

- 3.3. Market Restrains

- 3.3.1. Increasing Farm Expenditure; Security Concerns in Modern Farming Machinery

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Controlled Release Fertilizer Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Haifa Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Grupa Azoty S A (Compo Expert)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ekompany International BV (DeltaChem)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Nutrien Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Mivena BV

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ICL Group Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 Haifa Group

List of Figures

- Figure 1: Europe Controlled Release Fertilizer Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Controlled Release Fertilizer Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Controlled Release Fertilizer Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: Europe Controlled Release Fertilizer Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Europe Controlled Release Fertilizer Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Europe Controlled Release Fertilizer Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Europe Controlled Release Fertilizer Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Europe Controlled Release Fertilizer Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 7: Europe Controlled Release Fertilizer Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 8: Europe Controlled Release Fertilizer Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Europe Controlled Release Fertilizer Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Europe Controlled Release Fertilizer Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Europe Controlled Release Fertilizer Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Europe Controlled Release Fertilizer Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: United Kingdom Europe Controlled Release Fertilizer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Germany Europe Controlled Release Fertilizer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: France Europe Controlled Release Fertilizer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Italy Europe Controlled Release Fertilizer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Spain Europe Controlled Release Fertilizer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Netherlands Europe Controlled Release Fertilizer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Belgium Europe Controlled Release Fertilizer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Sweden Europe Controlled Release Fertilizer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Norway Europe Controlled Release Fertilizer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Poland Europe Controlled Release Fertilizer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Denmark Europe Controlled Release Fertilizer Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Controlled Release Fertilizer Industry?

The projected CAGR is approximately 6.02%.

2. Which companies are prominent players in the Europe Controlled Release Fertilizer Industry?

Key companies in the market include Haifa Group, Grupa Azoty S A (Compo Expert), Ekompany International BV (DeltaChem), Nutrien Ltd, Mivena BV, ICL Group Ltd.

3. What are the main segments of the Europe Controlled Release Fertilizer Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.64 billion as of 2022.

5. What are some drivers contributing to market growth?

Low Availability of Skilled Labor; Technological Advancements.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Increasing Farm Expenditure; Security Concerns in Modern Farming Machinery.

8. Can you provide examples of recent developments in the market?

May 2022: ICL launched three new NPK formulations of Solinure, a product with increased trace elements to optimize yields.May 2022: ICL signed an agreement with customers in India and China to supply 600,000 and 700,000 metric ton of potash, respectively in 2022 at 590 USD per ton.March 2022: The Haifa Group entered into a purchase agreement with HORTICOOP BV to acquire Horticoop Andina, the distributor of nutritional products for agriculture. Through this acquisition of the brand, Haifa intends to expand its market presence in the latin market and strengthen its position as a global superbrand in advanced plant nutrition.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Controlled Release Fertilizer Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Controlled Release Fertilizer Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Controlled Release Fertilizer Industry?

To stay informed about further developments, trends, and reports in the Europe Controlled Release Fertilizer Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence