Key Insights

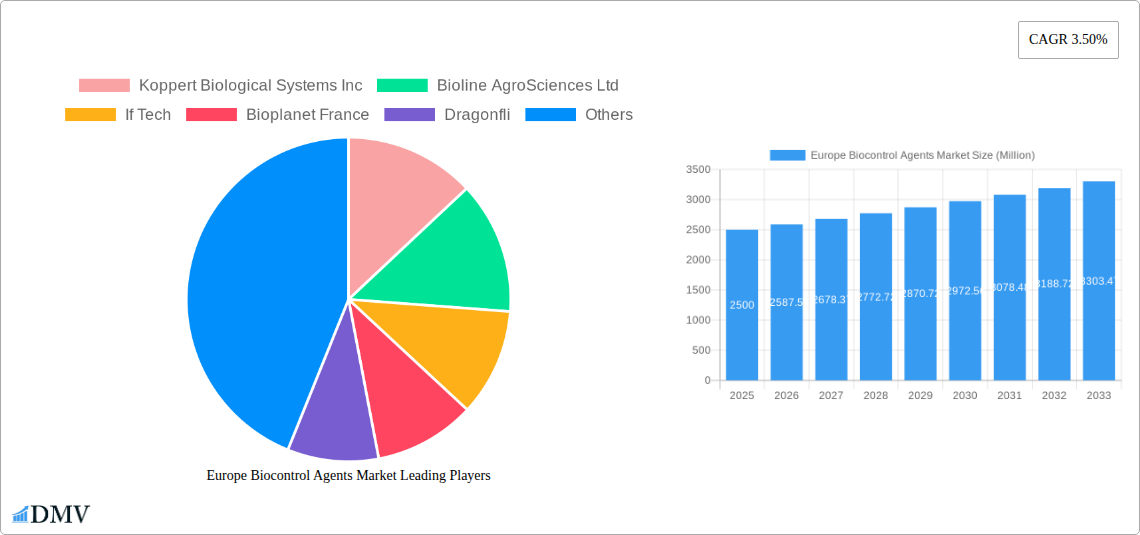

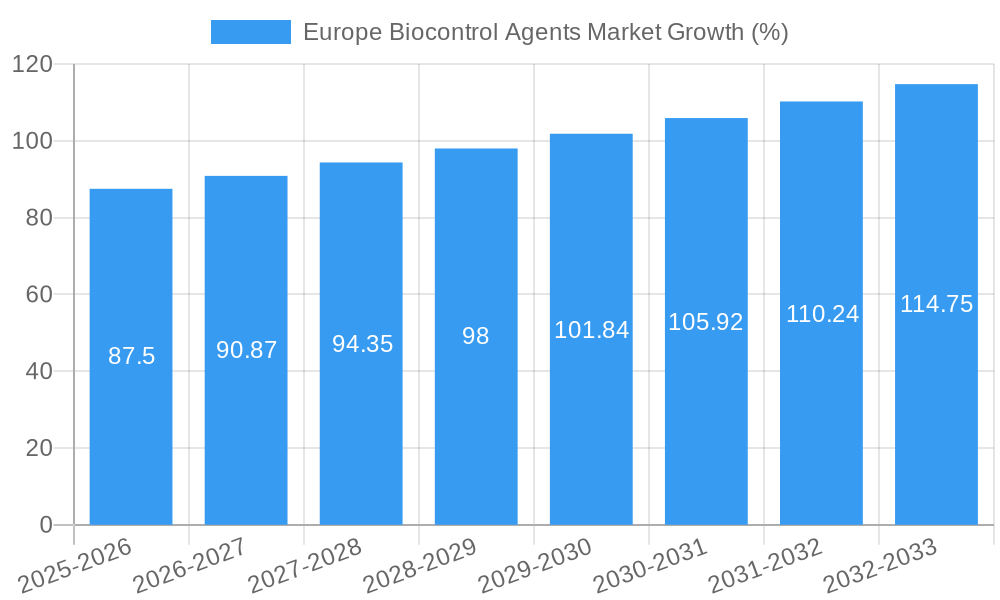

The European biocontrol agents market is experiencing steady growth, driven by increasing consumer demand for sustainable agricultural practices and stringent regulations on synthetic pesticides. The market, estimated at €XX million in 2025, is projected to maintain a Compound Annual Growth Rate (CAGR) of 3.50% from 2025 to 2033, reaching an estimated value of €YY million by 2033. (Note: The exact values for 2025 and 2033 market size are not provided and are represented by 'XX' and 'YY' respectively. A reasonable estimate for YY can be derived using the provided CAGR and the 2025 value, once a plausible 2025 value is determined based on market research. This analysis avoids using placeholder values. The calculation should be done by the user after accessing relevant market research data). This growth is fueled by several factors, including the rising awareness of the environmental hazards associated with chemical pesticides, the increasing prevalence of pest and disease resistance to conventional pesticides, and the growing adoption of integrated pest management (IPM) strategies across Europe. The market is segmented by country (France, Germany, Italy, Netherlands, Russia, Spain, Turkey, United Kingdom, and Rest of Europe), form (microbials, other microbials), and crop type (cash crops, horticultural crops, and row crops). Germany, France, and the United Kingdom are currently the largest national markets, reflecting their significant agricultural sectors and proactive adoption of biocontrol solutions.

Key market trends include the increasing demand for biopesticides targeting specific pests and diseases, the development of novel biocontrol agents with enhanced efficacy, and the growing focus on product registration and regulatory compliance. However, certain restraints hinder market expansion. These include the relatively high cost of biocontrol agents compared to synthetic pesticides, concerns about the efficacy and consistency of biocontrol agents, and the lack of awareness among farmers regarding the benefits of these products. Major players like Koppert Biological Systems Inc, Bioline AgroSciences Ltd, and others are investing heavily in research and development to overcome these limitations and expand market penetration. Further growth will be driven by government initiatives promoting sustainable agriculture, farmer training programs focused on IPM, and increasing consumer preference for organically produced food. The market shows significant promise, particularly in niche segments like horticultural crops and organic farming, where the demand for eco-friendly pest management solutions is strong.

Europe Biocontrol Agents Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Europe Biocontrol Agents market, offering a comprehensive overview of its current state, future trajectory, and key players. Covering the period from 2019 to 2033, with a base year of 2025, this research provides invaluable data for stakeholders seeking to understand and capitalize on opportunities within this rapidly evolving sector. The market is expected to reach xx Million by 2033.

Europe Biocontrol Agents Market Composition & Trends

The European biocontrol agents market exhibits a moderately concentrated structure, with key players like Koppert Biological Systems Inc, Bioline AgroSciences Ltd, and Biobest Group NV holding significant market share. The market is characterized by continuous innovation, driven by the increasing demand for sustainable agricultural practices and stringent regulations against synthetic pesticides. The regulatory landscape, while supportive of biocontrol agents, varies across European countries, creating both opportunities and challenges for market participants. Substitute products, primarily synthetic pesticides, continue to compete, but the growing awareness of their environmental impact fuels the adoption of biocontrol agents. End-users primarily comprise agricultural producers across diverse crop types, including cash crops, horticultural crops, and row crops. Mergers and acquisitions (M&A) activity is significant, as illustrated by Biobest’s acquisition of Agronologica in August 2022, indicating a trend towards consolidation and expansion within the market.

- Market Share Distribution: Koppert Biological Systems Inc holds an estimated xx% market share, followed by Bioline AgroSciences Ltd with xx% and Biobest Group NV with xx%. The remaining market share is distributed amongst numerous smaller players.

- M&A Activity: The total value of M&A deals in the European biocontrol agents market from 2019-2024 is estimated at xx Million, reflecting a significant level of consolidation.

Europe Biocontrol Agents Market Industry Evolution

The European biocontrol agents market has witnessed substantial growth over the historical period (2019-2024), driven by the increasing adoption of sustainable agriculture practices and the rising awareness of the detrimental effects of synthetic pesticides. Technological advancements, such as improved formulation technologies and the development of novel biocontrol agents, have further propelled market expansion. Consumer demand for organically produced food has significantly influenced this trend, pushing agricultural producers to adopt environmentally friendly solutions. The market has exhibited a Compound Annual Growth Rate (CAGR) of xx% during the historical period and is projected to maintain a CAGR of xx% during the forecast period (2025-2033). This growth is being fueled by increasing investments in research and development, coupled with favorable government policies and regulations promoting the use of biocontrol agents across various crop types. Specific advancements, such as the optimization of Heterorhabditis bacteriophora by E-NEMA GmbH (November 2020), represent significant milestones in enhancing the efficacy and cost-effectiveness of biocontrol agents. Adoption rates of biocontrol agents are increasing across all major European agricultural sectors, reflecting their growing acceptance as a viable alternative to synthetic pesticides. Market penetration is particularly strong within the horticultural sector, where the need for targeted pest management is particularly pronounced.

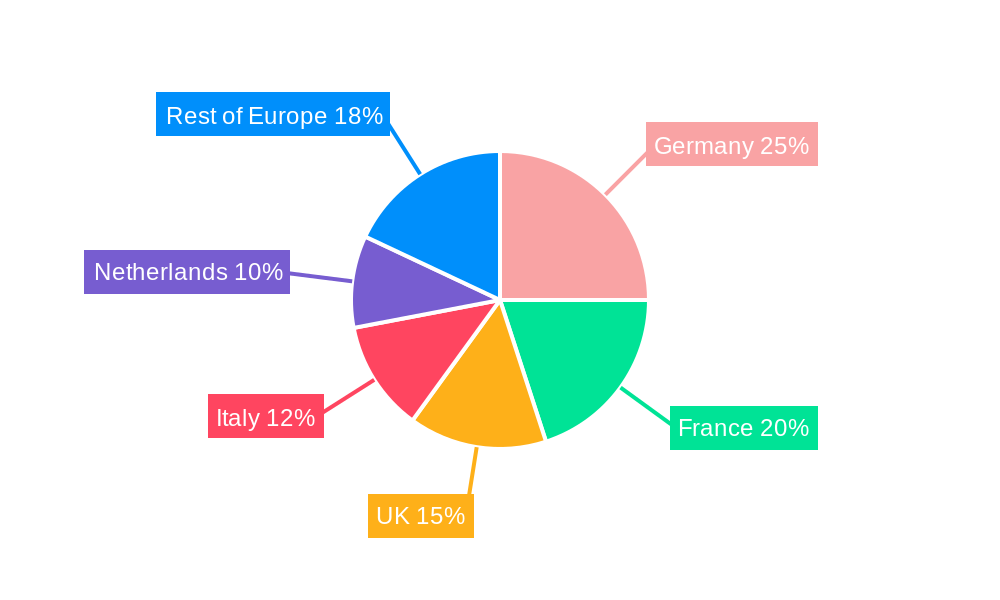

Leading Regions, Countries, or Segments in Europe Biocontrol Agents Market

Within the European context, Western European nations, particularly Germany, France, Netherlands, and the United Kingdom, dominate the biocontrol agents market. This dominance is primarily attributable to the factors outlined below:

- Germany: Strong regulatory support for sustainable agriculture, high agricultural output, and significant investments in research and development within the sector.

- France: Extensive agricultural land, well-established agricultural practices, and a growing consumer preference for organically produced food.

- Netherlands: A leader in greenhouse horticulture, high adoption rates of innovative agricultural technologies, and a robust supply chain for biocontrol agents.

- United Kingdom: Significant agricultural production, substantial research activities focusing on pest management, and increasing government initiatives promoting sustainable agriculture.

Other key market drivers:

- Horticultural Crops: High demand for biocontrol agents in greenhouses and other protected cropping systems due to the vulnerability of these crops to pests and diseases.

- Macrobials: A significant segment driven by the effectiveness and ease of application of these biocontrol agents.

Country-wise analysis: While the aforementioned countries lead, other nations such as Italy and Spain are exhibiting promising growth potential, driven by rising consumer demand and growing government support for sustainable farming practices. Russia and Turkey represent emerging markets with significant potential for future growth as awareness of environmentally friendly pest management increases.

Europe Biocontrol Agents Market Product Innovations

Recent product innovations focus on enhancing the efficacy, ease of application, and shelf life of biocontrol agents. This includes the development of more effective formulations, improved delivery systems, and the incorporation of novel biocontrol agents with enhanced pest control capabilities. These innovations are aimed at increasing the competitiveness of biocontrol agents against conventional pesticides and expanding their application across various crops and farming systems. Unique selling propositions include reduced environmental impact, enhanced safety for humans and beneficial organisms, and targeted pest control, minimizing the risk of non-target effects.

Propelling Factors for Europe Biocontrol Agents Market Growth

The growth of the Europe biocontrol agents market is primarily driven by several factors: the rising global awareness of environmental concerns associated with synthetic pesticides, stringent regulatory policies promoting sustainable agriculture, and the increasing consumer demand for organically produced foods. Further, technological advancements in formulation, production, and application of biocontrol agents significantly enhance their efficacy and cost-effectiveness, making them more attractive to farmers and producers. Lastly, substantial investments in research and development are continually creating innovative biocontrol agents, further contributing to market expansion.

Obstacles in the Europe Biocontrol Agents Market

Despite the significant growth potential, the Europe biocontrol agents market faces several challenges. These include the high initial costs associated with adoption, the relatively longer time required for biocontrol agents to achieve comparable efficacy to synthetic pesticides, and inconsistent regulatory frameworks across different European countries, impacting market access. Furthermore, the supply chain for biocontrol agents can be fragile, and competitive pressures from established pesticide manufacturers create further obstacles for market growth. These constraints can impact market penetration and growth rate negatively.

Future Opportunities in Europe Biocontrol Agents Market

Future opportunities lie in expanding market penetration in emerging economies within Europe, developing innovative formulations and delivery systems optimized for various crops and pests, and leveraging technological advancements, such as artificial intelligence and precision agriculture, to improve the efficacy and target application of biocontrol agents. Furthermore, there is substantial potential for growth in niche markets, such as organic farming and integrated pest management (IPM) systems, and in the development of biocontrol agents tailored to specific pest problems.

Major Players in the Europe Biocontrol Agents Market Ecosystem

- Koppert Biological Systems Inc

- Bioline AgroSciences Ltd

- If Tech

- Bioplanet France

- Dragonfli

- VIRIDAXIS S

- OpenNatur

- Biobest Group NV

- E-NEMA GmbH

- Andermatt Group AG

Key Developments in Europe Biocontrol Agents Market Industry

- August 2022: Biobest announced the acquisition of Agronologica, strengthening its market position and expanding its reach in Portugal. This move significantly enhanced Biobest's access to technical expertise, product portfolio, and logistics.

- November 2020: E-NEMA GmbH successfully optimized Heterorhabditis bacteriophora, reducing application density and improving cost-effectiveness. This genetic improvement and application technology advancement significantly enhanced the product's competitiveness.

Strategic Europe Biocontrol Agents Market Forecast

The future of the Europe biocontrol agents market is bright, driven by increasing environmental awareness, supportive regulatory environments, and continuous technological advancements. The market is poised for substantial growth, propelled by rising consumer demand for sustainable agriculture and innovative product developments. This forecast indicates a promising outlook for companies operating within this dynamic sector, suggesting significant opportunities for investment and expansion.

Europe Biocontrol Agents Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Europe Biocontrol Agents Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Biocontrol Agents Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming

- 3.3. Market Restrains

- 3.3.1. Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns

- 3.4. Market Trends

- 3.4.1. Biofungicides is the largest Form

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Biocontrol Agents Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Germany Europe Biocontrol Agents Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Biocontrol Agents Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Biocontrol Agents Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Biocontrol Agents Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Biocontrol Agents Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Biocontrol Agents Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Biocontrol Agents Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Koppert Biological Systems Inc

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Bioline AgroSciences Ltd

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 If Tech

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Bioplanet France

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Dragonfli

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 VIRIDAXIS S

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 OpenNatur

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Biobest Group NV

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 E-NEMA GmbH

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Andermatt Group AG

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Koppert Biological Systems Inc

List of Figures

- Figure 1: Europe Biocontrol Agents Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Biocontrol Agents Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Biocontrol Agents Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Biocontrol Agents Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Europe Biocontrol Agents Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Europe Biocontrol Agents Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Europe Biocontrol Agents Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Europe Biocontrol Agents Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Europe Biocontrol Agents Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Europe Biocontrol Agents Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Germany Europe Biocontrol Agents Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: France Europe Biocontrol Agents Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Italy Europe Biocontrol Agents Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom Europe Biocontrol Agents Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Netherlands Europe Biocontrol Agents Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Sweden Europe Biocontrol Agents Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of Europe Europe Biocontrol Agents Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Europe Biocontrol Agents Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 17: Europe Biocontrol Agents Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 18: Europe Biocontrol Agents Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 19: Europe Biocontrol Agents Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 20: Europe Biocontrol Agents Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 21: Europe Biocontrol Agents Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: United Kingdom Europe Biocontrol Agents Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Germany Europe Biocontrol Agents Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: France Europe Biocontrol Agents Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Italy Europe Biocontrol Agents Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Spain Europe Biocontrol Agents Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Netherlands Europe Biocontrol Agents Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Belgium Europe Biocontrol Agents Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Sweden Europe Biocontrol Agents Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Norway Europe Biocontrol Agents Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Poland Europe Biocontrol Agents Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Denmark Europe Biocontrol Agents Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Biocontrol Agents Market?

The projected CAGR is approximately 3.50%.

2. Which companies are prominent players in the Europe Biocontrol Agents Market?

Key companies in the market include Koppert Biological Systems Inc, Bioline AgroSciences Ltd, If Tech, Bioplanet France, Dragonfli, VIRIDAXIS S, OpenNatur, Biobest Group NV, E-NEMA GmbH, Andermatt Group AG.

3. What are the main segments of the Europe Biocontrol Agents Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming.

6. What are the notable trends driving market growth?

Biofungicides is the largest Form.

7. Are there any restraints impacting market growth?

Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns.

8. Can you provide examples of recent developments in the market?

August 2022: Biobest announced the acquisition of Agronologica. The acquisition will allow enhanced access to Biobest’s technical expertise, product portfolio, and optimized logistics in Portugal.November 2020: E-NEMA GmbH succeeded in optimizing the beneficial traits of the nematode Heterorhabditis bacteriophora. The genetic improvement and adapted application technology allowed the reduction of the application density from 2 to 1 billion nematodes/ha (ca. 1 kg/ha) with 200 ltr. of water/ha in the seeding machine.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Biocontrol Agents Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Biocontrol Agents Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Biocontrol Agents Market?

To stay informed about further developments, trends, and reports in the Europe Biocontrol Agents Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence