Key Insights

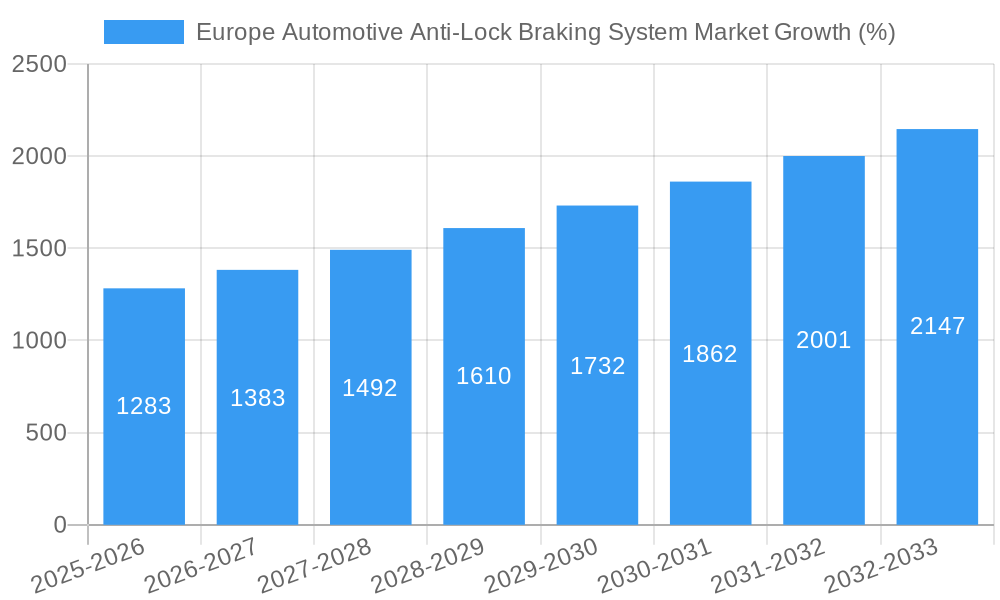

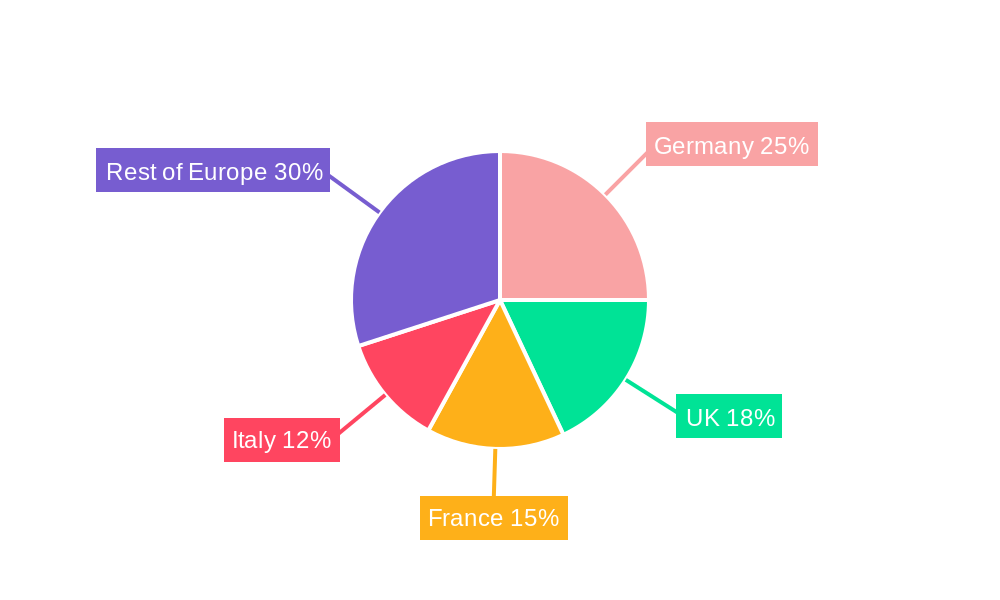

The European Automotive Anti-Lock Braking System (ABS) market is experiencing robust growth, projected to reach €20.35 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 6.30% from 2025 to 2033. This expansion is fueled by several key factors. Stringent safety regulations across European nations are mandating ABS in an increasing number of vehicle types, driving significant demand, particularly within the passenger car and commercial vehicle segments. Furthermore, the rising adoption of advanced driver-assistance systems (ADAS) featuring integrated ABS functionalities is boosting market growth. Technological advancements, such as the integration of sensors and sophisticated electronic control units (ECUs) offering improved braking performance and efficiency, are also contributing to market expansion. The aftermarket segment is witnessing growth due to the increasing age of vehicles and the rising demand for aftermarket replacements and upgrades. Germany, the United Kingdom, Italy, and France represent major markets within Europe, reflecting their substantial automotive production and robust vehicle parc. Competition is fierce, with key players like Bosch, Continental, and ZF Friedrichshafen dominating the market through their established technological prowess and extensive distribution networks.

However, potential restraints exist. Economic fluctuations can influence the demand for new vehicles, impacting the OEM segment. The increasing adoption of electric and autonomous vehicles might present both opportunities and challenges, as these technologies require unique ABS adaptations. The market’s growth is also contingent upon ongoing technological innovation and the successful integration of advanced braking systems within evolving vehicle architectures. Despite these challenges, the long-term outlook for the European ABS market remains positive, driven by sustained regulatory pressure, technological progress, and the inherent demand for enhanced vehicle safety features. The consistent growth indicates a sustained commitment to vehicle safety across Europe, a trend expected to continue for the foreseeable future.

Europe Automotive Anti-Lock Braking System (ABS) Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Europe Automotive Anti-Lock Braking System (ABS) market, offering a comprehensive overview of market trends, competitive dynamics, and future growth prospects. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report covers key segments including vehicle type (motorcycles, passenger cars, commercial vehicles), technology type (sensors, hydraulic unit, electronic control unit), sales channel (OEM, aftermarket), and key European countries (Germany, United Kingdom, Italy, France, and Rest of Europe). The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). Leading players like Robert Bosch GmbH, Continental AG, DENSO Corporation, and others shape the competitive landscape.

Europe Automotive Anti-Lock Braking System Market Composition & Trends

The European automotive ABS market is characterized by moderate concentration, with several key players holding significant market share. The market share distribution in 2025 is estimated as follows: Robert Bosch GmbH (xx%), Continental AG (xx%), DENSO Corporation (xx%), and others (xx%). Innovation is driven by advancements in sensor technology, electronic control units, and the integration of ABS with other advanced driver-assistance systems (ADAS). Stringent safety regulations across Europe are a major growth catalyst, pushing manufacturers towards enhanced braking performance. Substitute products are limited due to the critical safety function of ABS. End-users comprise OEMs (original equipment manufacturers) and aftermarket players catering to vehicle repair and replacement needs. The market has witnessed several mergers and acquisitions (M&A) activities, with deal values totaling xx Million in the last five years. Examples include:

- June 2023: FSUE NAMI's acquisition of Robert Bosch Samara LLC, expanding its ABS production capacity.

- June 2023: Autoliv Inc.'s announcement to launch motorcycle ABS in Sweden.

- November 2022: Continental AG’s launch of a new generation of compact 2-channel ABS for motorcycles.

Europe Automotive Anti-Lock Braking System Market Industry Evolution

The European automotive ABS market has witnessed significant growth over the historical period (2019-2024), fueled by increasing vehicle production, rising safety standards, and growing consumer preference for advanced safety features. The market experienced a CAGR of xx% from 2019 to 2024. Technological advancements, particularly in sensor technology and electronic control units, have led to improved ABS performance, enhanced integration with other ADAS, and reduced costs. Shifting consumer demands towards enhanced vehicle safety and autonomous driving capabilities further contribute to market growth. The adoption rate of ABS in new vehicles is nearing 100% in many European countries, while the aftermarket segment presents substantial growth potential, driven by the aging vehicle fleet. The forecast period (2025-2033) projects sustained growth, driven by factors such as the increasing adoption of electric and hybrid vehicles and the continued focus on safety regulations. Advancements such as integrated braking systems and the development of more sophisticated algorithms for better braking performance under varying conditions will further propel market expansion. The increasing focus on connected car technology is expected to drive the demand for advanced ABS systems capable of communicating with other vehicles and infrastructure.

Leading Regions, Countries, or Segments in Europe Automotive Anti-Lock Braking System Market

- By Vehicle Type: Passenger cars dominate the market due to high vehicle production volumes and stringent safety regulations. Commercial vehicles show strong growth potential due to increasing adoption of advanced safety features in fleets. The motorcycle segment is also witnessing growth due to new product launches and rising safety awareness.

- By Technology Type: Electronic control units are the most dominant technology type, owing to their enhanced functionalities. Sensor technology represents another important part, with advancements in radar and camera-based sensors expected to drive significant growth. The hydraulic unit market is comparatively mature, experiencing stable growth.

- By Sales Channel: OEM sales continue to be the primary driver of market growth, although the aftermarket segment is expanding significantly, benefiting from the aging vehicle fleet and rising demand for vehicle repairs.

- By Country: Germany, United Kingdom, and France are the leading markets in Europe, owing to high vehicle production, substantial vehicle fleets, and stringent safety regulations. These regions benefit from robust economies and advanced automotive industries.

Key Drivers:

- High vehicle production and sales in major European countries.

- Stringent safety regulations and standards.

- Increasing consumer preference for advanced safety features.

- Technological advancements leading to improved performance and reduced costs.

- Growth of the aftermarket segment.

Europe Automotive Anti-Lock Braking System Market Product Innovations

Recent innovations in the European automotive ABS market include compact designs, improved sensor technology (e.g., radar and camera-based sensors), and advanced algorithms for optimal braking performance in various conditions. These innovations focus on reducing system costs, enhancing performance under extreme conditions, and facilitating seamless integration with other ADAS features. Unique selling propositions emphasize improved safety, enhanced efficiency, and compatibility with advanced vehicle architectures.

Propelling Factors for Europe Automotive Anti-Lock Braking System Market Growth

Technological advancements in sensor technology and electronic control units are key drivers of market growth, leading to improved performance, reduced cost, and enhanced safety. The increasingly stringent safety regulations in Europe mandate the inclusion of ABS in new vehicles, further boosting market demand. The growing preference among consumers for safer vehicles and the increasing adoption of advanced driver-assistance systems are also significant growth drivers.

Obstacles in the Europe Automotive Anti-Lock Braking System Market Market

Challenges include supply chain disruptions affecting component availability and increasing manufacturing costs. Intense competition among established players and the emergence of new market entrants puts pressure on pricing and profitability. Regulatory changes and compliance requirements can also introduce uncertainty and added costs for manufacturers. The economic climate and consumer purchasing power can impact the overall market demand for new vehicles.

Future Opportunities in Europe Automotive Anti-Lock Braking System Market

Future opportunities lie in the development of integrated braking systems combining ABS with other ADAS functions. The growing adoption of electric and autonomous vehicles will create further demand for advanced ABS systems capable of handling the unique braking challenges of these vehicle types. Expansion into emerging markets within Europe and exploring new applications beyond passenger cars (e.g., two-wheelers, heavy-duty vehicles) offer further growth potential.

Major Players in the Europe Automotive Anti-Lock Braking System Market Ecosystem

- Hyundai Mobis Co Ltd

- Nissin Kogyo Co

- WABCO Holdings Inc

- Continental AG

- Hitachi Automotive Systems Ltd

- Autoliv Inc

- Robert Bosch GmbH

- DENSO Corporation

- Haldex A

- ZF Friedrichshafen AG

Key Developments in Europe Automotive Anti-Lock Braking System Market Industry

- June 2023: FSUE NAMI acquired a 100% stake in Robert Bosch Samara LLC, expanding its production of ABS and other safety systems. This significantly increases the market presence of FSUE NAMI and enhances their ability to supply the Russian market.

- June 2023: Autoliv Inc. announced the launch of a new ABS system specifically designed for motorcycles in the Swedish market. This expands Autoliv's product portfolio into the motorcycle segment.

- November 2022: Continental AG introduced a new generation of compact 2-channel ABS for motorcycles in Germany, improving performance and reducing costs. This move strengthens Continental AG's position in the motorcycle ABS market.

Strategic Europe Automotive Anti-Lock Braking System Market Forecast

The European automotive ABS market is poised for continued growth over the forecast period (2025-2033), driven by technological advancements, stringent safety regulations, and the increasing adoption of ADAS. The market will benefit from the expansion of the electric vehicle segment and the rising demand for advanced safety features in both new and used vehicles. The integration of ABS with other ADAS functionalities and the continuous development of more efficient and cost-effective systems will further fuel market expansion. The aftermarket segment holds immense growth potential due to the substantial number of existing vehicles in need of ABS repair or replacement.

Europe Automotive Anti-Lock Braking System Market Segmentation

-

1. Vehicle Type

- 1.1. Motorcycles

- 1.2. Passenger Cars

- 1.3. Commercial Vehicles

-

2. Technology Type

- 2.1. Sensors

- 2.2. Hydraulic Unit

- 2.3. Electronic Control Unit

-

3. Sales Channel

- 3.1. OEM

- 3.2. Aftermarket

Europe Automotive Anti-Lock Braking System Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Automotive Anti-Lock Braking System Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.30% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing demand for safety Features in Vehicles; Others

- 3.3. Market Restrains

- 3.3.1. Vulnerability to Cyber Attacks

- 3.4. Market Trends

- 3.4.1. Government Regulations Likely to Drive Adoption of ABS in Passenger Cars

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Automotive Anti-Lock Braking System Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Motorcycles

- 5.1.2. Passenger Cars

- 5.1.3. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Technology Type

- 5.2.1. Sensors

- 5.2.2. Hydraulic Unit

- 5.2.3. Electronic Control Unit

- 5.3. Market Analysis, Insights and Forecast - by Sales Channel

- 5.3.1. OEM

- 5.3.2. Aftermarket

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Germany Europe Automotive Anti-Lock Braking System Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Automotive Anti-Lock Braking System Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Automotive Anti-Lock Braking System Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Automotive Anti-Lock Braking System Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Automotive Anti-Lock Braking System Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Automotive Anti-Lock Braking System Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Automotive Anti-Lock Braking System Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Hyundai Mobis Co Ltd

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Nissin Kogyo Co

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 WABCO Holdings Inc

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Continental AG

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Hitachi Automotive Systems Ltd

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Autoliv Inc

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Robert Bosch GmbH

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 DENSO Corporation

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Haldex A

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 ZF Friedrichshafen AG

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Hyundai Mobis Co Ltd

List of Figures

- Figure 1: Europe Automotive Anti-Lock Braking System Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Automotive Anti-Lock Braking System Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Automotive Anti-Lock Braking System Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Automotive Anti-Lock Braking System Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: Europe Automotive Anti-Lock Braking System Market Revenue Million Forecast, by Technology Type 2019 & 2032

- Table 4: Europe Automotive Anti-Lock Braking System Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 5: Europe Automotive Anti-Lock Braking System Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Europe Automotive Anti-Lock Braking System Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Germany Europe Automotive Anti-Lock Braking System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: France Europe Automotive Anti-Lock Braking System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Italy Europe Automotive Anti-Lock Braking System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Europe Automotive Anti-Lock Braking System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Netherlands Europe Automotive Anti-Lock Braking System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Sweden Europe Automotive Anti-Lock Braking System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe Europe Automotive Anti-Lock Braking System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Europe Automotive Anti-Lock Braking System Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 15: Europe Automotive Anti-Lock Braking System Market Revenue Million Forecast, by Technology Type 2019 & 2032

- Table 16: Europe Automotive Anti-Lock Braking System Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 17: Europe Automotive Anti-Lock Braking System Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: United Kingdom Europe Automotive Anti-Lock Braking System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Germany Europe Automotive Anti-Lock Braking System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: France Europe Automotive Anti-Lock Braking System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Italy Europe Automotive Anti-Lock Braking System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Spain Europe Automotive Anti-Lock Braking System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Netherlands Europe Automotive Anti-Lock Braking System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Belgium Europe Automotive Anti-Lock Braking System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Sweden Europe Automotive Anti-Lock Braking System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Norway Europe Automotive Anti-Lock Braking System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Poland Europe Automotive Anti-Lock Braking System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Denmark Europe Automotive Anti-Lock Braking System Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Automotive Anti-Lock Braking System Market?

The projected CAGR is approximately 6.30%.

2. Which companies are prominent players in the Europe Automotive Anti-Lock Braking System Market?

Key companies in the market include Hyundai Mobis Co Ltd, Nissin Kogyo Co, WABCO Holdings Inc, Continental AG, Hitachi Automotive Systems Ltd, Autoliv Inc, Robert Bosch GmbH, DENSO Corporation, Haldex A, ZF Friedrichshafen AG.

3. What are the main segments of the Europe Automotive Anti-Lock Braking System Market?

The market segments include Vehicle Type, Technology Type, Sales Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 20.35 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing demand for safety Features in Vehicles; Others.

6. What are the notable trends driving market growth?

Government Regulations Likely to Drive Adoption of ABS in Passenger Cars.

7. Are there any restraints impacting market growth?

Vulnerability to Cyber Attacks.

8. Can you provide examples of recent developments in the market?

June 2023: FSUE NAMI (State Scientific Center of the Russian Federation) acquired a 100% stake in Robert Bosch Samara LLC. The company produces steering systems, anti-lock braking systems ABS and dynamic stabilization systems ESP. Through this acquisition, the company will expand its product portfolio.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Automotive Anti-Lock Braking System Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Automotive Anti-Lock Braking System Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Automotive Anti-Lock Braking System Market?

To stay informed about further developments, trends, and reports in the Europe Automotive Anti-Lock Braking System Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence