Key Insights

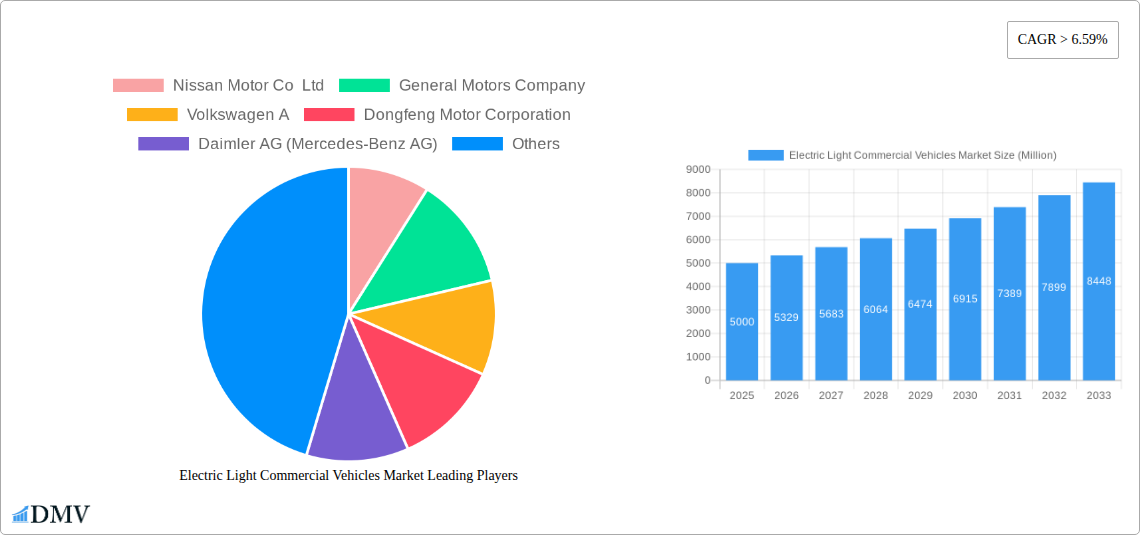

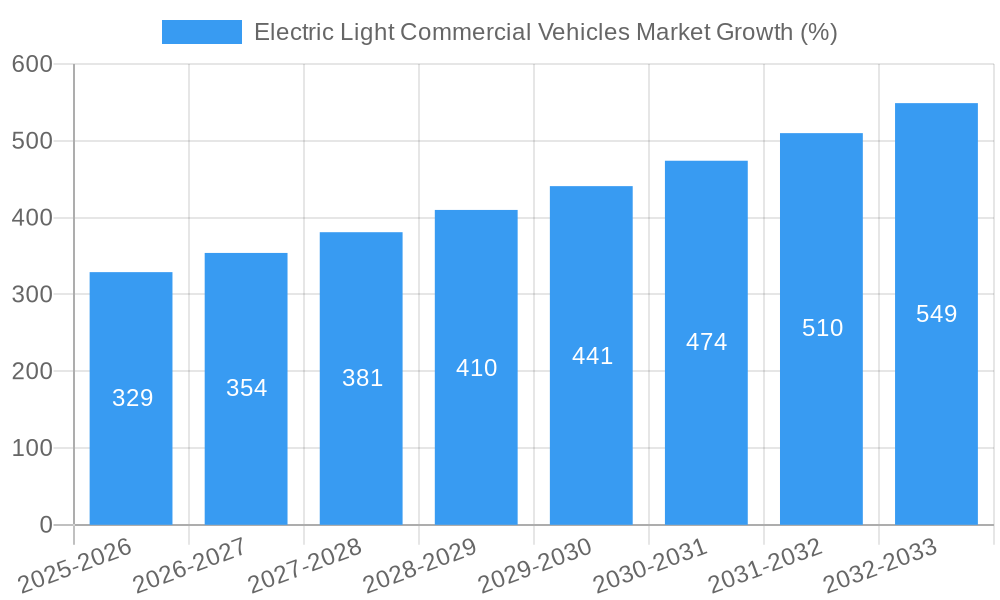

The Electric Light Commercial Vehicle (eLCV) market is experiencing robust growth, driven by stringent emission regulations, increasing fuel costs, and a growing focus on sustainability across logistics and delivery sectors. A Compound Annual Growth Rate (CAGR) exceeding 6.59% from 2019 to 2024 suggests a significant market expansion, with projections indicating continued strong performance through 2033. The market segmentation reveals a diverse landscape, encompassing various vehicle configurations (primarily focusing on light commercial vehicles) and fuel categories including Battery Electric Vehicles (BEVs), Fuel Cell Electric Vehicles (FCEVs), Hybrid Electric Vehicles (HEVs), and Plug-in Hybrid Electric Vehicles (PHEVs). Leading automotive manufacturers such as Nissan, General Motors, Volkswagen, and BYD are actively investing in R&D and production to capitalize on this burgeoning market, introducing a range of innovative eLCV models tailored to diverse consumer needs and operational requirements. The market's success is further fueled by advancements in battery technology, leading to improved range and reduced charging times, thus addressing previously significant range anxiety concerns.

Continued growth in the eLCV market hinges on several factors. Government incentives and subsidies aimed at accelerating eLCV adoption are playing a critical role. Furthermore, the development of robust charging infrastructure is proving essential in overcoming range limitations and promoting wider acceptance. However, challenges remain, including the relatively higher initial cost of eLCVs compared to their internal combustion engine counterparts and the need for greater investment in charging infrastructure, particularly in regions with limited grid capacity. Nevertheless, considering the environmental benefits, ongoing technological improvements, and supportive government policies, the eLCV market is poised for substantial expansion over the forecast period (2025-2033), presenting significant opportunities for manufacturers, investors, and supporting industries. The market size in 2025 is estimated to be substantial given the CAGR and expected market growth. A conservative estimate would place the 2025 market size in the several billion-dollar range, with continued growth projected beyond this point.

Electric Light Commercial Vehicles Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Electric Light Commercial Vehicles (LCV) market, encompassing market size, growth drivers, competitive landscape, and future outlook. Spanning the historical period (2019-2024), base year (2025), and forecast period (2025-2033), this report is an indispensable resource for stakeholders seeking to navigate this rapidly evolving sector. The market is segmented by vehicle configuration (Light Commercial Vehicles), fuel category (BEV, FCEV, HEV, PHEV), and key players including Nissan Motor Co Ltd, General Motors Company, Volkswagen AG, Dongfeng Motor Corporation, Daimler AG (Mercedes-Benz AG), BAIC Motor Corporation Ltd, BYD Auto Co Ltd, Groupe Renault, Rivian Automotive Inc, and Ford Motor Company. The total market value is projected to reach xx Million by 2033.

Electric Light Commercial Vehicles Market Composition & Trends

This section delves into the intricate dynamics of the Electric LCV market, examining market concentration, innovation drivers, regulatory landscapes, substitute products, end-user profiles, and M&A activities. We analyze market share distribution among key players, revealing the competitive intensity and dominance patterns. The report also quantifies the financial implications of M&A activities, providing insights into deal values and their impact on market consolidation. Analysis covers the influence of government policies, technological advancements (like battery technology breakthroughs and charging infrastructure development), and the emergence of substitute products (e.g., alternative fuel vehicles) on the market trajectory. Furthermore, the report profiles end-users across various sectors, shedding light on their adoption rates and preferences, influencing future demand projections.

- Market Concentration: A detailed analysis of market share distribution among key players, revealing the competitive landscape. [Include specific market share data for key players].

- Innovation Catalysts: Examination of technological advancements driving market growth, including battery technology, charging infrastructure, and vehicle design improvements.

- Regulatory Landscape: Assessment of government policies and regulations impacting market growth in various regions, focusing on incentives, emission standards, and infrastructure development.

- Substitute Products: Analysis of alternative fuel vehicles and their potential impact on the Electric LCV market.

- End-User Profiles: Profiling of key end-user segments and their adoption patterns, forecasting future demand based on sector-specific growth.

- M&A Activities: Analysis of mergers and acquisitions in the Electric LCV sector, including deal values and their strategic implications. [Include data on M&A deal values and volume].

Electric Light Commercial Vehicles Market Industry Evolution

This section charts the evolutionary path of the Electric LCV market, tracing its growth trajectories, technological advancements, and the shifting preferences of consumers. The report provides granular data on market growth rates, adoption metrics (e.g., number of vehicles sold, market penetration rates), and technological breakthroughs that have shaped the industry. It examines the influence of consumer demand, including factors such as environmental awareness, government incentives, and total cost of ownership. The analysis extends to the impact of evolving consumer preferences on vehicle features, range expectations, and charging infrastructure needs. The section highlights technological milestones achieved, showing the shift from early adoption to mass-market penetration.

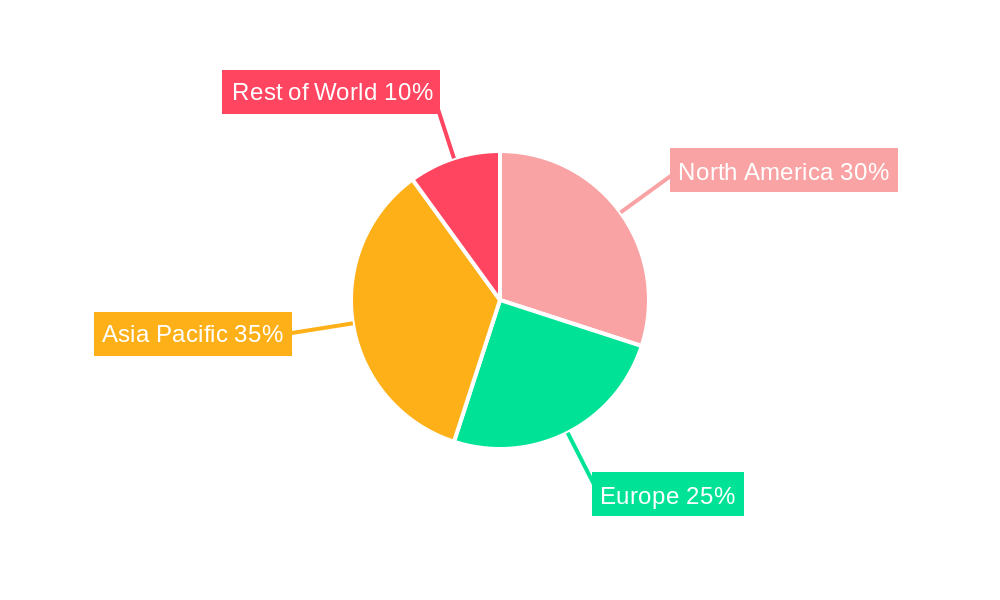

Leading Regions, Countries, or Segments in Electric Light Commercial Vehicles Market

This section identifies the leading regions, countries, and segments within the Electric LCV market. The analysis considers factors such as market size, growth rate, and key drivers across different geographical locations and fuel categories (BEV, FCEV, HEV, PHEV).

- Dominant Region/Country: [Identify the leading region/country and provide detailed justification]. Analysis of factors driving dominance, including favorable government policies, robust charging infrastructure, and strong consumer demand.

- Leading Fuel Category: [Identify the leading fuel category (e.g., BEV) and discuss its dominance]. Factors driving growth include cost-effectiveness, technology maturity, and consumer preferences.

- Key Drivers (Bullet Points):

- Investment trends in infrastructure and R&D.

- Government incentives and regulations (e.g., tax credits, emission standards).

- Consumer preferences and adoption rates.

- Technological advancements in battery technology and charging infrastructure.

Electric Light Commercial Vehicles Market Product Innovations

This section highlights recent product innovations, applications, and performance metrics for Electric LCVs. The analysis focuses on unique selling propositions (USPs), technological advancements such as improvements in battery technology, range extension, and enhanced charging capabilities. The discussion includes an evaluation of the performance characteristics of different Electric LCV models, including range, payload capacity, and charging times.

Propelling Factors for Electric Light Commercial Vehicles Market Growth

Several factors are driving the growth of the Electric LCV market. Technological advancements, such as improvements in battery technology and charging infrastructure, are reducing the cost and increasing the range of electric vehicles. Government incentives, such as tax credits and subsidies, are making electric vehicles more affordable. Growing environmental concerns are also driving demand for electric vehicles. The rising fuel costs and stringent emission norms are further pushing the adoption of Electric LCVs.

Obstacles in the Electric Light Commercial Vehicles Market Market

Despite the positive outlook, several challenges hinder the growth of the Electric LCV market. High upfront costs remain a significant barrier for many consumers and businesses. Range anxiety (fear of running out of charge) continues to be a concern for some potential buyers. A limited charging infrastructure in certain regions also constrains the adoption of Electric LCVs. Furthermore, supply chain disruptions and competition from internal combustion engine (ICE) vehicles pose significant challenges. [Quantify the impact of these barriers on market growth].

Future Opportunities in Electric Light Commercial Vehicles Market

The Electric LCV market presents significant future opportunities. The expansion of charging infrastructure in underserved regions will unlock new market segments. Technological breakthroughs, such as solid-state batteries, promise to further enhance the performance and affordability of electric vehicles. The growing adoption of electric vehicles in fleet operations presents a substantial market opportunity. Finally, new market segments like last-mile delivery and urban logistics are emerging, fueling demand for specialized Electric LCVs.

Major Players in the Electric Light Commercial Vehicles Market Ecosystem

- Nissan Motor Co Ltd

- General Motors Company

- Volkswagen AG

- Dongfeng Motor Corporation

- Daimler AG (Mercedes-Benz AG)

- BAIC Motor Corporation Ltd

- BYD Auto Co Ltd

- Groupe Renault

- Rivian Automotive Inc

- Ford Motor Company

Key Developments in Electric Light Commercial Vehicles Market Industry

- August 2023: General Motors will launch an all-electric Cadillac Escalade in late 2024. This signifies a major step towards electrifying the luxury SUV segment and could significantly influence consumer perception and market share.

- August 2023: General Motors doubles down on plans for an electric future in the Middle East. This expansion into new geographical markets demonstrates the global growth potential of the Electric LCV sector.

- June 2023: FORD NEXT launches a new pilot program creating flexible electric solutions for drivers who use the Uber platform in select U.S. markets, allowing them to lease a vehicle for more customized time periods. This initiative targets a specific niche within the market, indicating a trend towards tailored solutions.

Strategic Electric Light Commercial Vehicles Market Forecast

The Electric LCV market is poised for significant growth, driven by technological advancements, supportive government policies, and rising environmental concerns. The increasing affordability of electric vehicles, coupled with improvements in battery technology and charging infrastructure, will accelerate market penetration. New market segments, such as last-mile delivery and urban logistics, will create substantial demand for specialized Electric LCVs. The continued investment in R&D and innovation will lead to further improvements in vehicle performance and efficiency, solidifying the long-term growth prospects of the Electric LCV market.

Electric Light Commercial Vehicles Market Segmentation

-

1. Vehicle Configuration

- 1.1. Light Commercial Vehicles

-

2. Fuel Category

- 2.1. BEV

- 2.2. FCEV

- 2.3. HEV

- 2.4. PHEV

Electric Light Commercial Vehicles Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Electric Light Commercial Vehicles Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 6.59% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Air Pollution Awareness and Health Concern is Driving the Demand

- 3.3. Market Restrains

- 3.3.1. High Cost of Installation Related to Industrial Robots

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Electric Light Commercial Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Configuration

- 5.1.1. Light Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Fuel Category

- 5.2.1. BEV

- 5.2.2. FCEV

- 5.2.3. HEV

- 5.2.4. PHEV

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Configuration

- 6. North America Electric Light Commercial Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Configuration

- 6.1.1. Light Commercial Vehicles

- 6.2. Market Analysis, Insights and Forecast - by Fuel Category

- 6.2.1. BEV

- 6.2.2. FCEV

- 6.2.3. HEV

- 6.2.4. PHEV

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Configuration

- 7. South America Electric Light Commercial Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Configuration

- 7.1.1. Light Commercial Vehicles

- 7.2. Market Analysis, Insights and Forecast - by Fuel Category

- 7.2.1. BEV

- 7.2.2. FCEV

- 7.2.3. HEV

- 7.2.4. PHEV

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Configuration

- 8. Europe Electric Light Commercial Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Configuration

- 8.1.1. Light Commercial Vehicles

- 8.2. Market Analysis, Insights and Forecast - by Fuel Category

- 8.2.1. BEV

- 8.2.2. FCEV

- 8.2.3. HEV

- 8.2.4. PHEV

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Configuration

- 9. Middle East & Africa Electric Light Commercial Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Configuration

- 9.1.1. Light Commercial Vehicles

- 9.2. Market Analysis, Insights and Forecast - by Fuel Category

- 9.2.1. BEV

- 9.2.2. FCEV

- 9.2.3. HEV

- 9.2.4. PHEV

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Configuration

- 10. Asia Pacific Electric Light Commercial Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Configuration

- 10.1.1. Light Commercial Vehicles

- 10.2. Market Analysis, Insights and Forecast - by Fuel Category

- 10.2.1. BEV

- 10.2.2. FCEV

- 10.2.3. HEV

- 10.2.4. PHEV

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Configuration

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Nissan Motor Co Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 General Motors Company

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Volkswagen A

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Dongfeng Motor Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Daimler AG (Mercedes-Benz AG)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 BAIC Motor Corporation Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 BYD Auto Co Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Groupe Renault

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Rivian Automotive Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Ford Motor Company

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Nissan Motor Co Ltd

List of Figures

- Figure 1: Global Electric Light Commercial Vehicles Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Electric Light Commercial Vehicles Market Revenue (Million), by Vehicle Configuration 2024 & 2032

- Figure 3: North America Electric Light Commercial Vehicles Market Revenue Share (%), by Vehicle Configuration 2024 & 2032

- Figure 4: North America Electric Light Commercial Vehicles Market Revenue (Million), by Fuel Category 2024 & 2032

- Figure 5: North America Electric Light Commercial Vehicles Market Revenue Share (%), by Fuel Category 2024 & 2032

- Figure 6: North America Electric Light Commercial Vehicles Market Revenue (Million), by Country 2024 & 2032

- Figure 7: North America Electric Light Commercial Vehicles Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Electric Light Commercial Vehicles Market Revenue (Million), by Vehicle Configuration 2024 & 2032

- Figure 9: South America Electric Light Commercial Vehicles Market Revenue Share (%), by Vehicle Configuration 2024 & 2032

- Figure 10: South America Electric Light Commercial Vehicles Market Revenue (Million), by Fuel Category 2024 & 2032

- Figure 11: South America Electric Light Commercial Vehicles Market Revenue Share (%), by Fuel Category 2024 & 2032

- Figure 12: South America Electric Light Commercial Vehicles Market Revenue (Million), by Country 2024 & 2032

- Figure 13: South America Electric Light Commercial Vehicles Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Electric Light Commercial Vehicles Market Revenue (Million), by Vehicle Configuration 2024 & 2032

- Figure 15: Europe Electric Light Commercial Vehicles Market Revenue Share (%), by Vehicle Configuration 2024 & 2032

- Figure 16: Europe Electric Light Commercial Vehicles Market Revenue (Million), by Fuel Category 2024 & 2032

- Figure 17: Europe Electric Light Commercial Vehicles Market Revenue Share (%), by Fuel Category 2024 & 2032

- Figure 18: Europe Electric Light Commercial Vehicles Market Revenue (Million), by Country 2024 & 2032

- Figure 19: Europe Electric Light Commercial Vehicles Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Electric Light Commercial Vehicles Market Revenue (Million), by Vehicle Configuration 2024 & 2032

- Figure 21: Middle East & Africa Electric Light Commercial Vehicles Market Revenue Share (%), by Vehicle Configuration 2024 & 2032

- Figure 22: Middle East & Africa Electric Light Commercial Vehicles Market Revenue (Million), by Fuel Category 2024 & 2032

- Figure 23: Middle East & Africa Electric Light Commercial Vehicles Market Revenue Share (%), by Fuel Category 2024 & 2032

- Figure 24: Middle East & Africa Electric Light Commercial Vehicles Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Electric Light Commercial Vehicles Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Electric Light Commercial Vehicles Market Revenue (Million), by Vehicle Configuration 2024 & 2032

- Figure 27: Asia Pacific Electric Light Commercial Vehicles Market Revenue Share (%), by Vehicle Configuration 2024 & 2032

- Figure 28: Asia Pacific Electric Light Commercial Vehicles Market Revenue (Million), by Fuel Category 2024 & 2032

- Figure 29: Asia Pacific Electric Light Commercial Vehicles Market Revenue Share (%), by Fuel Category 2024 & 2032

- Figure 30: Asia Pacific Electric Light Commercial Vehicles Market Revenue (Million), by Country 2024 & 2032

- Figure 31: Asia Pacific Electric Light Commercial Vehicles Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Electric Light Commercial Vehicles Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Electric Light Commercial Vehicles Market Revenue Million Forecast, by Vehicle Configuration 2019 & 2032

- Table 3: Global Electric Light Commercial Vehicles Market Revenue Million Forecast, by Fuel Category 2019 & 2032

- Table 4: Global Electric Light Commercial Vehicles Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Electric Light Commercial Vehicles Market Revenue Million Forecast, by Vehicle Configuration 2019 & 2032

- Table 6: Global Electric Light Commercial Vehicles Market Revenue Million Forecast, by Fuel Category 2019 & 2032

- Table 7: Global Electric Light Commercial Vehicles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United States Electric Light Commercial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Canada Electric Light Commercial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Electric Light Commercial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Electric Light Commercial Vehicles Market Revenue Million Forecast, by Vehicle Configuration 2019 & 2032

- Table 12: Global Electric Light Commercial Vehicles Market Revenue Million Forecast, by Fuel Category 2019 & 2032

- Table 13: Global Electric Light Commercial Vehicles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Brazil Electric Light Commercial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Electric Light Commercial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Electric Light Commercial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global Electric Light Commercial Vehicles Market Revenue Million Forecast, by Vehicle Configuration 2019 & 2032

- Table 18: Global Electric Light Commercial Vehicles Market Revenue Million Forecast, by Fuel Category 2019 & 2032

- Table 19: Global Electric Light Commercial Vehicles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Electric Light Commercial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Germany Electric Light Commercial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: France Electric Light Commercial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Italy Electric Light Commercial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Spain Electric Light Commercial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Russia Electric Light Commercial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Electric Light Commercial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Electric Light Commercial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Electric Light Commercial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Global Electric Light Commercial Vehicles Market Revenue Million Forecast, by Vehicle Configuration 2019 & 2032

- Table 30: Global Electric Light Commercial Vehicles Market Revenue Million Forecast, by Fuel Category 2019 & 2032

- Table 31: Global Electric Light Commercial Vehicles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Turkey Electric Light Commercial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Israel Electric Light Commercial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: GCC Electric Light Commercial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Electric Light Commercial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Electric Light Commercial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Electric Light Commercial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Global Electric Light Commercial Vehicles Market Revenue Million Forecast, by Vehicle Configuration 2019 & 2032

- Table 39: Global Electric Light Commercial Vehicles Market Revenue Million Forecast, by Fuel Category 2019 & 2032

- Table 40: Global Electric Light Commercial Vehicles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 41: China Electric Light Commercial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: India Electric Light Commercial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Japan Electric Light Commercial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Electric Light Commercial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Electric Light Commercial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Electric Light Commercial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Electric Light Commercial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Electric Light Commercial Vehicles Market?

The projected CAGR is approximately > 6.59%.

2. Which companies are prominent players in the Electric Light Commercial Vehicles Market?

Key companies in the market include Nissan Motor Co Ltd, General Motors Company, Volkswagen A, Dongfeng Motor Corporation, Daimler AG (Mercedes-Benz AG), BAIC Motor Corporation Ltd, BYD Auto Co Ltd, Groupe Renault, Rivian Automotive Inc, Ford Motor Company.

3. What are the main segments of the Electric Light Commercial Vehicles Market?

The market segments include Vehicle Configuration, Fuel Category.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Air Pollution Awareness and Health Concern is Driving the Demand.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

High Cost of Installation Related to Industrial Robots.

8. Can you provide examples of recent developments in the market?

August 2023: General Motors will launch an all-electric Cadillac Escalade in late 2024August 2023: General Motors doubles down on plans for an electric future in the Middle East.June 2023: FORD NEXT launches New pilot program creates flexible electric solutions for drivers who use the Uber platform in select U.S. markets, allowing them to lease a vehicle for more customized time periods.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Electric Light Commercial Vehicles Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Electric Light Commercial Vehicles Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Electric Light Commercial Vehicles Market?

To stay informed about further developments, trends, and reports in the Electric Light Commercial Vehicles Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence