Key Insights

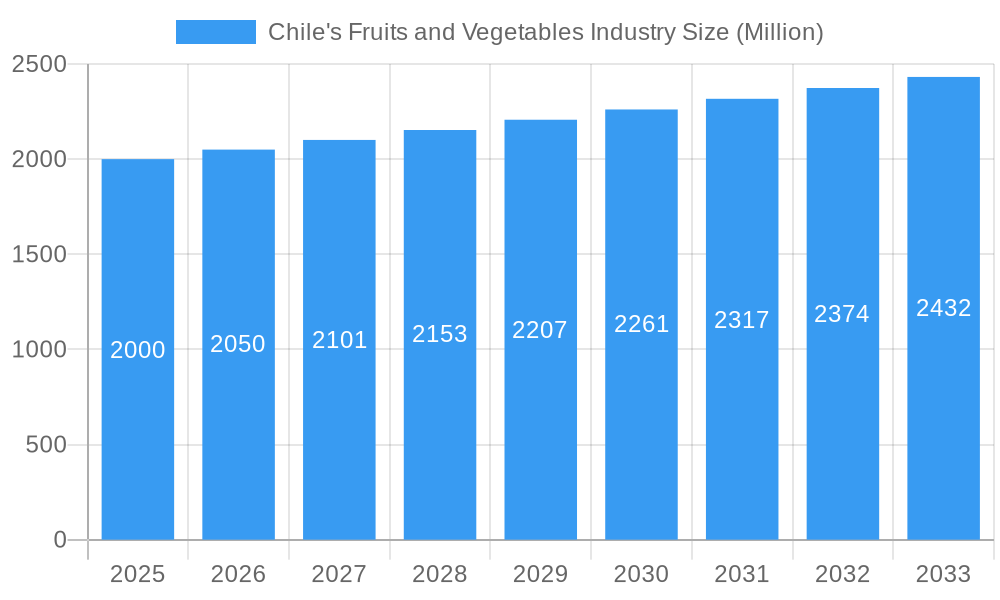

Chile's fruits and vegetables industry, valued at approximately $X million in 2025 (estimated based on the provided CAGR and market size), is projected to experience steady growth, exhibiting a compound annual growth rate (CAGR) of 2.50% from 2025 to 2033. This growth is driven by several factors, including increasing global demand for high-quality fresh produce, Chile's favorable climate and agricultural expertise, and a focus on sustainable and innovative farming practices. Key export markets, such as North America and Europe, continue to fuel this expansion. However, challenges remain, such as fluctuating international prices, logistical hurdles in transporting perishable goods, and the impact of climate change on crop yields. Major players like Hortifrut, Copec Agro Industrial, and Frutícola Santa Cruz are strategically investing in technological advancements and supply chain optimization to enhance efficiency and competitiveness. The industry's segmentation into fruits and vegetables offers opportunities for specialized production and marketing strategies, catering to diverse consumer preferences and health trends. Analysis of production volume, consumption value and volume, import and export figures, alongside price trends across these segments, reveals a dynamic landscape with potential for further growth, particularly in value-added products and niche markets.

Chile's Fruits and Vegetables Industry Market Size (In Billion)

The Chilean fruits and vegetables sector’s success hinges on effectively navigating these challenges and capitalizing on emerging opportunities. Strategies involving diversification of export markets, improved cold chain infrastructure to reduce post-harvest losses, and the exploration of higher-value product lines are crucial for sustained growth. Furthermore, increased investment in research and development focusing on climate-resilient crop varieties and sustainable farming techniques will become increasingly important in ensuring the long-term viability and competitiveness of this vital sector of the Chilean economy. The industry’s success will be measured not only by production volume but also by profitability, sustainability, and its ability to contribute to the nation's economic development.

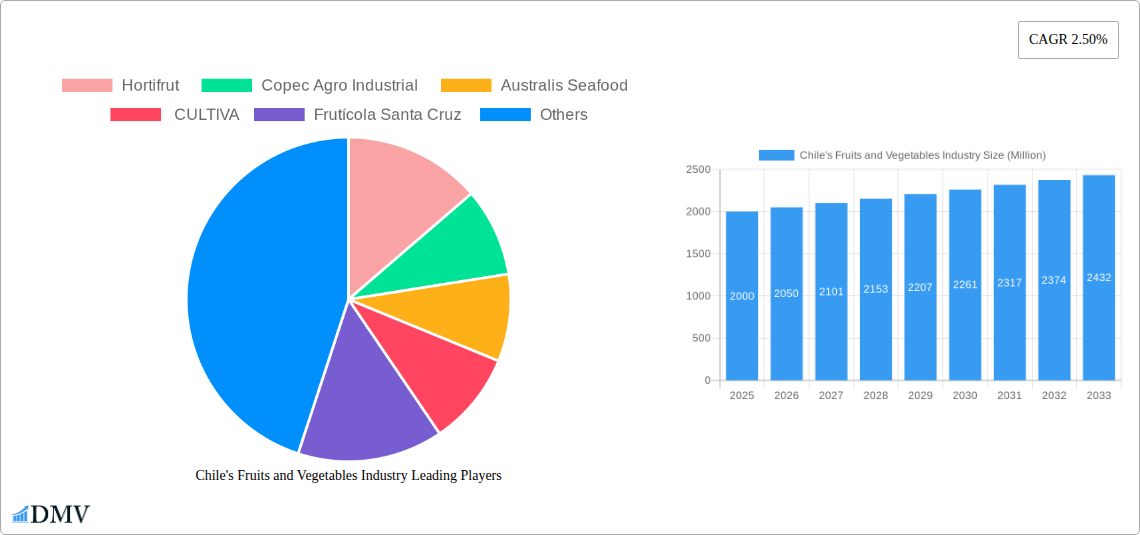

Chile's Fruits and Vegetables Industry Company Market Share

Chile's Fruits and Vegetables Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of Chile's dynamic fruits and vegetables industry, covering the period from 2019 to 2033. With a focus on production, consumption, import/export, and price trends, this study offers crucial insights for stakeholders seeking to navigate this lucrative market. The base year is 2025, with estimations for 2025 and forecasts extending to 2033, providing a comprehensive historical perspective (2019-2024) and a clear vision for future growth. The report leverages robust data and analysis to pinpoint key trends, challenges, and opportunities within the Chilean fruits and vegetables sector, valued at xx Million USD.

Chile's Fruits and Vegetables Industry Market Composition & Trends

This section delves into the intricate structure of Chile's fruits and vegetables market, analyzing market concentration, innovation, regulations, substitute products, end-user profiles, and M&A activity. Key players like Hortifrut, Copec Agro Industrial, and Frutícola Santa Cruz shape the competitive landscape.

- Market Concentration: The market exhibits a moderately concentrated structure, with the top five players holding an estimated xx% market share in 2025. This is influenced by the dominance of large-scale exporters and established farming operations.

- Innovation Catalysts: Technological advancements in vertical farming and controlled-environment agriculture (CEA) are driving innovation, exemplified by the partnership between Aerofarms and Hortifrut. This contributes to improved yields, sustainability, and year-round production.

- Regulatory Landscape: Government initiatives like the removal of methyl bromide fumigation requirements (November 2022) aim to enhance market access and competitiveness. However, evolving regulations related to sustainable practices and food safety present both challenges and opportunities.

- Substitute Products: Competition arises from imported fruits and vegetables, particularly from neighboring countries. This necessitates a focus on differentiation through quality, branding, and specialized varieties.

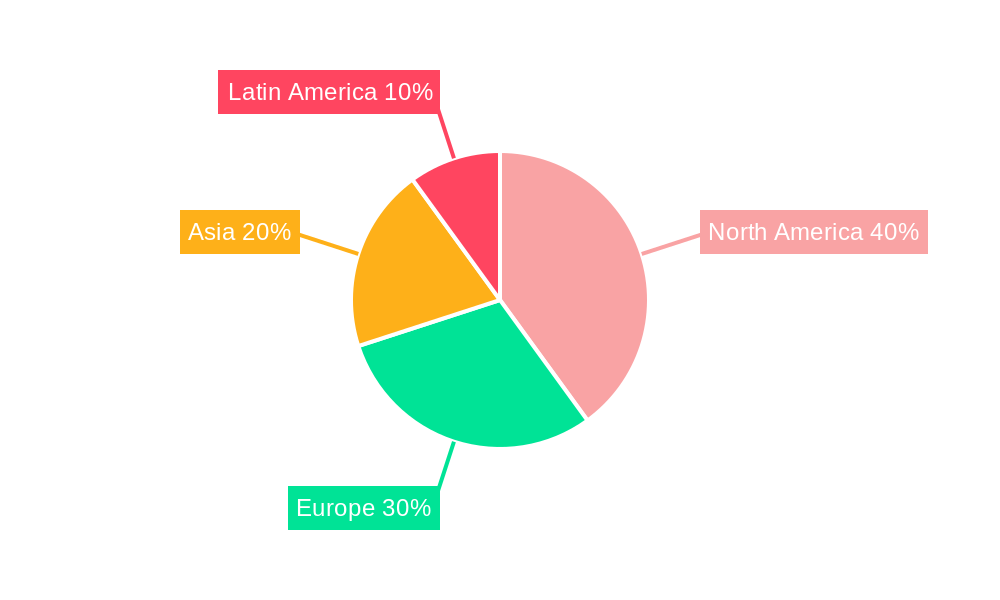

- End-User Profiles: Key end-users include domestic consumers, food processors, exporters, and retailers. Export markets, particularly in North America and Europe, are vital to the industry’s success.

- M&A Activities: Significant M&A activity, as seen in Hortifrut's acquisition of Atlantic Blue (USD 280 Million in 2021), reflects industry consolidation and expansion strategies. Total M&A deal value for the period 2019-2024 is estimated at xx Million USD.

Chile's Fruits and Vegetables Industry Industry Evolution

This section provides a detailed account of the Chilean fruits and vegetables industry’s evolution, exploring market growth trajectories, technological changes, and shifts in consumer preferences. The industry has witnessed robust growth fueled by investments in technology and sustainable farming practices. From 2019 to 2024, the market experienced a Compound Annual Growth Rate (CAGR) of xx%, driven by increasing global demand for high-quality Chilean produce. Technological advancements in post-harvest handling, cold chain logistics, and precision agriculture are crucial to maintaining quality and extending shelf life. The changing consumer preferences toward healthier eating habits and sustainably sourced food are also influencing the industry's dynamics, promoting a shift towards organic and specialty products. This trend is expected to continue, driving further innovation and investment in organic farming practices and sustainable packaging solutions. The forecast period (2025-2033) anticipates a CAGR of xx%, with growth propelled by increasing exports to new markets and rising domestic consumption, particularly for high-value fruits like blueberries and avocados.

Leading Regions, Countries, or Segments in Chile's Fruits and Vegetables Industry

This section identifies the dominant regions, countries, and segments within the Chilean fruits and vegetables sector, analyzing key drivers of their dominance.

Fruits:

- Production (Volume): The regions of O'Higgins and Maule are leading producers, owing to favorable climatic conditions and established infrastructure. Production volume of fruits was xx Million tons in 2025.

- Consumption (Value & Volume): Domestic consumption is dominated by readily available and affordable fruits like apples and grapes, while high-value berries show strong growth, driven by increasing disposable incomes and health consciousness. Consumption value of fruits is xx Million USD in 2025.

- Export (Value & Volume): Chile is a significant exporter of high-value fruits like blueberries, grapes, and avocados to markets in North America and Europe. Export value of fruits is xx Million USD in 2025.

- Import (Value & Volume): Imports consist primarily of specialized or out-of-season produce. Import value of fruits is xx Million USD in 2025.

- Price Trend Analysis: Prices vary significantly by product type and season, with high-value fruits generally commanding premium prices.

Vegetables:

- Production (Volume): Production is largely focused on key vegetables such as potatoes, onions, and tomatoes, with a significant portion allocated to export markets. Production volume of vegetables was xx Million tons in 2025.

- Consumption (Value & Volume): Domestic consumption is primarily driven by staple vegetables, with increasing demand for processed vegetable products. Consumption value of vegetables is xx Million USD in 2025.

- Export (Value & Volume): While less prominent compared to fruits, certain vegetables are exported to niche markets. Export value of vegetables is xx Million USD in 2025.

- Import (Value & Volume): Imports cater to specific demands and address seasonal shortages. Import value of vegetables is xx Million USD in 2025.

- Price Trend Analysis: Prices fluctuate due to seasonal factors and changes in global supply chains.

Key Drivers:

- Investment Trends: Significant investment in infrastructure, technology, and sustainable farming practices.

- Regulatory Support: Government initiatives promoting exports and sustainable agriculture.

Chile's Fruits and Vegetables Industry Product Innovations

The industry is witnessing innovations in varieties with enhanced shelf life, flavor profiles, and nutritional content. Technological advancements in packaging (e.g., modified atmosphere packaging) extend product freshness and reduce waste. The rise of organic and sustainably produced fruits and vegetables caters to growing consumer demand for healthier, environmentally friendly options. Unique selling propositions often focus on superior quality, traceability, and brand recognition.

Propelling Factors for Chile's Fruits and Vegetables Industry Growth

Several factors drive the growth of Chile's fruits and vegetables industry: Favorable climatic conditions create a competitive advantage for high-quality production. Government support and investment in infrastructure and technology facilitate export growth. Increasing global demand for healthy and sustainable food products enhances market opportunities. The adoption of innovative farming practices and technological advancements improves yields, reduces costs, and enhances product quality.

Obstacles in the Chile's Fruits and Vegetables Industry Market

Challenges include climate change risks affecting production yields and the need for continuous adaptation to changing consumer preferences. Fluctuations in global commodity prices and transportation costs can affect profitability. Competition from other producing countries necessitates ongoing investment in product differentiation and market development. Supply chain disruptions, particularly those caused by extreme weather or geopolitical instability can significantly impact exports.

Future Opportunities in Chile's Fruits and Vegetables Industry

Emerging opportunities lie in developing new high-value product lines, increasing focus on organic and sustainable production, expanding into new export markets, and leveraging technology to enhance efficiency and sustainability. The growth of e-commerce and direct-to-consumer channels presents exciting potential. Investments in research and development towards developing climate-resilient varieties can mitigate risks linked to climate change.

Major Players in the Chile's Fruits and Vegetables Industry Ecosystem

- Hortifrut

- Copec Agro Industrial

- Australis Seafood

- CULTIVA

- Frutícola Santa Cruz

Key Developments in Chile's Fruits and Vegetables Industry Industry

- October 2021: Hortifrut acquired Atlantic Blue for USD 280 Million, expanding its berry production capacity.

- March 2021: Aerofarms and Hortifrut partnered to advance R&D in vertical farming for blueberries and cranberries.

- November 2022: The Chilean government eliminated methyl bromide fumigation requirements for table grapes, boosting export potential.

Strategic Chile's Fruits and Vegetables Industry Market Forecast

The Chilean fruits and vegetables industry is poised for continued growth, driven by increasing global demand, technological advancements, and government support. Opportunities exist in expanding into new markets, developing innovative product offerings, and strengthening sustainable practices. The forecast period (2025-2033) suggests a promising outlook, with substantial market expansion driven by export growth and rising domestic consumption. Technological innovation will play a key role in driving efficiency, sustainability, and product quality.

Chile's Fruits and Vegetables Industry Segmentation

-

1. Type (Pr

- 1.1. Vegetables

- 1.2. Fruits

-

2. Type (Pr

- 2.1. Vegetables

- 2.2. Fruits

Chile's Fruits and Vegetables Industry Segmentation By Geography

- 1. Chile

Chile's Fruits and Vegetables Industry Regional Market Share

Geographic Coverage of Chile's Fruits and Vegetables Industry

Chile's Fruits and Vegetables Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Technology in Horticulture; Government Initiatives for Self-reliance in Vegetable and Fruit Farming

- 3.3. Market Restrains

- 3.3.1. Limited Resource Availability and Unfavourable Climatic Condition; Increasing Reliance on Imports for Domestic Supply

- 3.4. Market Trends

- 3.4.1. Increasing Exports of Fruits and Vegetables

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Chile's Fruits and Vegetables Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type (Pr

- 5.1.1. Vegetables

- 5.1.2. Fruits

- 5.2. Market Analysis, Insights and Forecast - by Type (Pr

- 5.2.1. Vegetables

- 5.2.2. Fruits

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Chile

- 5.1. Market Analysis, Insights and Forecast - by Type (Pr

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Hortifrut

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Copec Agro Industrial

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Australis Seafood

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 CULTIVA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Frutícola Santa Cruz

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Hortifrut

List of Figures

- Figure 1: Chile's Fruits and Vegetables Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Chile's Fruits and Vegetables Industry Share (%) by Company 2025

List of Tables

- Table 1: Chile's Fruits and Vegetables Industry Revenue Million Forecast, by Type (Pr 2020 & 2033

- Table 2: Chile's Fruits and Vegetables Industry Volume Kiloton Forecast, by Type (Pr 2020 & 2033

- Table 3: Chile's Fruits and Vegetables Industry Revenue Million Forecast, by Type (Pr 2020 & 2033

- Table 4: Chile's Fruits and Vegetables Industry Volume Kiloton Forecast, by Type (Pr 2020 & 2033

- Table 5: Chile's Fruits and Vegetables Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Chile's Fruits and Vegetables Industry Volume Kiloton Forecast, by Region 2020 & 2033

- Table 7: Chile's Fruits and Vegetables Industry Revenue Million Forecast, by Type (Pr 2020 & 2033

- Table 8: Chile's Fruits and Vegetables Industry Volume Kiloton Forecast, by Type (Pr 2020 & 2033

- Table 9: Chile's Fruits and Vegetables Industry Revenue Million Forecast, by Type (Pr 2020 & 2033

- Table 10: Chile's Fruits and Vegetables Industry Volume Kiloton Forecast, by Type (Pr 2020 & 2033

- Table 11: Chile's Fruits and Vegetables Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Chile's Fruits and Vegetables Industry Volume Kiloton Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Chile's Fruits and Vegetables Industry?

The projected CAGR is approximately 2.50%.

2. Which companies are prominent players in the Chile's Fruits and Vegetables Industry?

Key companies in the market include Hortifrut , Copec Agro Industrial , Australis Seafood , CULTIVA, Frutícola Santa Cruz .

3. What are the main segments of the Chile's Fruits and Vegetables Industry?

The market segments include Type (Pr, Type (Pr.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Technology in Horticulture; Government Initiatives for Self-reliance in Vegetable and Fruit Farming.

6. What are the notable trends driving market growth?

Increasing Exports of Fruits and Vegetables.

7. Are there any restraints impacting market growth?

Limited Resource Availability and Unfavourable Climatic Condition; Increasing Reliance on Imports for Domestic Supply.

8. Can you provide examples of recent developments in the market?

November 2022: The Chilean government adopted a new strategy for increasing the sales of table grapes from the country to other regions, such as North America and Europe, by removing the mandatory requirement of methyl bromide fumigation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Kiloton.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Chile's Fruits and Vegetables Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Chile's Fruits and Vegetables Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Chile's Fruits and Vegetables Industry?

To stay informed about further developments, trends, and reports in the Chile's Fruits and Vegetables Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence