Key Insights

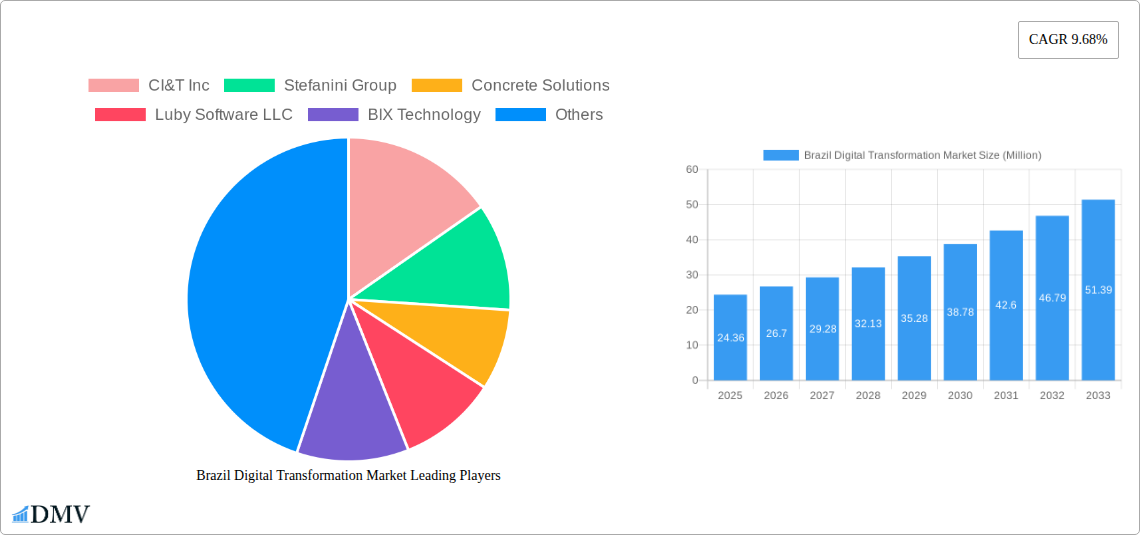

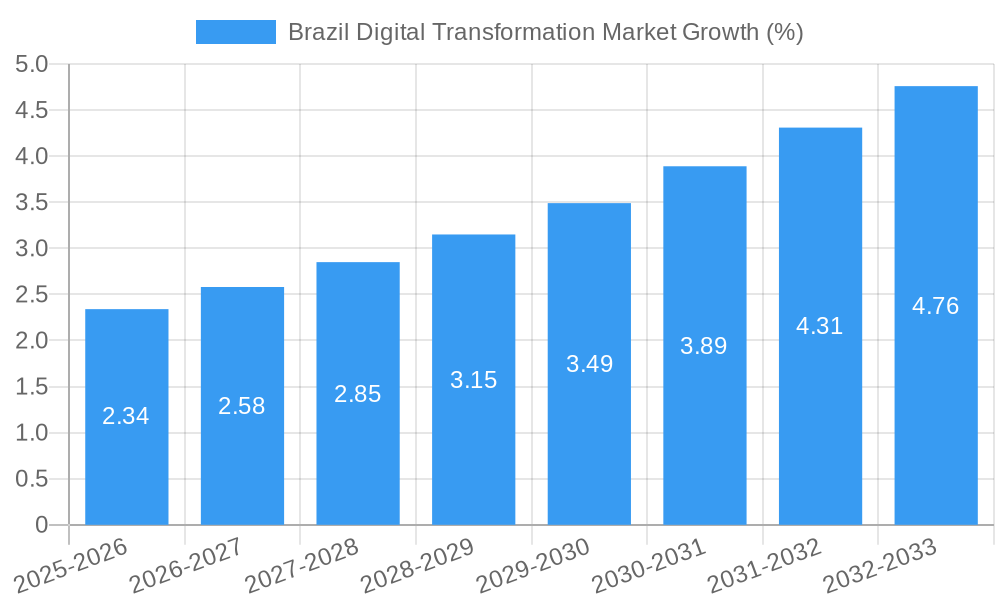

The Brazil Digital Transformation Market is experiencing robust growth, projected to reach \$24.36 million in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 9.68% from 2025 to 2033. This expansion is fueled by several key drivers. Firstly, increasing government initiatives promoting digitalization across various sectors, including healthcare, finance, and education, are creating significant demand for digital solutions. Secondly, the rising adoption of cloud computing, big data analytics, and artificial intelligence (AI) is transforming business operations and improving efficiency, further accelerating market growth. The burgeoning e-commerce sector and a growing digitally-savvy population also contribute significantly to this expansion. While challenges such as cybersecurity concerns and a potential skills gap in the IT workforce exist, the overall market outlook remains positive. Companies like CI&T Inc., Stefanini Group, and others are capitalizing on this growth by offering a diverse range of digital transformation services tailored to the specific needs of Brazilian businesses. The market is segmented based on factors such as service type (consulting, implementation, etc.), industry vertical (finance, healthcare, etc.), and deployment model (cloud, on-premise, etc.), allowing companies to target specific niches. The competitive landscape is characterized by a mix of global players and local service providers, fostering innovation and competitive pricing.

The forecast period (2025-2033) promises even stronger growth as Brazilian businesses increasingly prioritize digital strategies for competitiveness and resilience. The continued expansion of high-speed internet access and mobile penetration across the country will only serve to enhance the market's potential. However, sustained investments in digital infrastructure and talent development are crucial to mitigate potential risks and unlock the full transformative potential of this burgeoning market. Further analysis into specific segments and regional variations within Brazil will provide even more granular insights for strategic planning and investment decisions.

Brazil Digital Transformation Market: A Comprehensive Report (2019-2033)

This insightful report provides a deep dive into the dynamic Brazil digital transformation market, offering a comprehensive analysis of its current state, future trajectory, and key players. With a study period spanning 2019-2033, a base year of 2025, and an estimated year of 2025, this report is an indispensable resource for stakeholders seeking to understand and capitalize on opportunities within this rapidly evolving market. The forecast period covers 2025-2033, while the historical period analyzed is 2019-2024. The market is expected to reach xx Million by 2033.

Brazil Digital Transformation Market Composition & Trends

This section analyzes the competitive landscape, innovation drivers, regulatory environment, substitute products, end-user profiles, and mergers and acquisitions (M&A) activity within the Brazilian digital transformation market. The market exhibits a moderately concentrated structure, with a few dominant players holding significant market share. However, a number of smaller, specialized firms are also contributing to innovation and competition. The total market size in 2024 was estimated at xx Million.

- Market Share Distribution (2024): CI&T Inc. (xx%), Stefanini Group (xx%), Concrete Solutions (xx%), Other players (xx%). These figures are estimates based on available data and industry reports. Further research may be needed to refine these percentages.

- Innovation Catalysts: Strong government initiatives supporting digital adoption, a growing entrepreneurial ecosystem, and increasing demand for digital solutions across various sectors are driving innovation.

- Regulatory Landscape: The regulatory environment is evolving, with new laws and policies aimed at promoting digitalization and data privacy. Compliance with these regulations is crucial for market participants.

- Substitute Products: While digital transformation solutions are unique, some overlaps exist with traditional IT services and consulting offerings. However, the integrated nature and value proposition of digital transformation are key differentiators.

- End-User Profiles: The market caters to a broad range of end-users across various industries, including finance, healthcare, retail, and manufacturing. Each sector presents unique digital transformation needs.

- M&A Activity: The market witnessed significant M&A activity in recent years, with deal values reaching xx Million in 2024 (estimated). Key examples include Accenture’s acquisition of SOKO (June 2024) and the Bounteous-Accolite Digital merger (February 2024).

Brazil Digital Transformation Market Industry Evolution

The Brazilian digital transformation market has witnessed robust growth over the past few years, driven by factors such as increasing internet and smartphone penetration, rising digital literacy, and government initiatives promoting digitalization. The market's evolution is characterized by a shift from basic IT services to more complex and integrated solutions that address specific business needs. This transition is driven by technological advancements such as cloud computing, artificial intelligence (AI), and the Internet of Things (IoT). The market experienced a Compound Annual Growth Rate (CAGR) of xx% during the period 2019-2024 and is projected to maintain a CAGR of xx% during the forecast period (2025-2033). Adoption rates for cloud technologies, AI solutions, and digital marketing strategies are rapidly increasing across various sectors. The increasing preference for personalized customer experiences is also driving the demand for advanced digital transformation solutions.

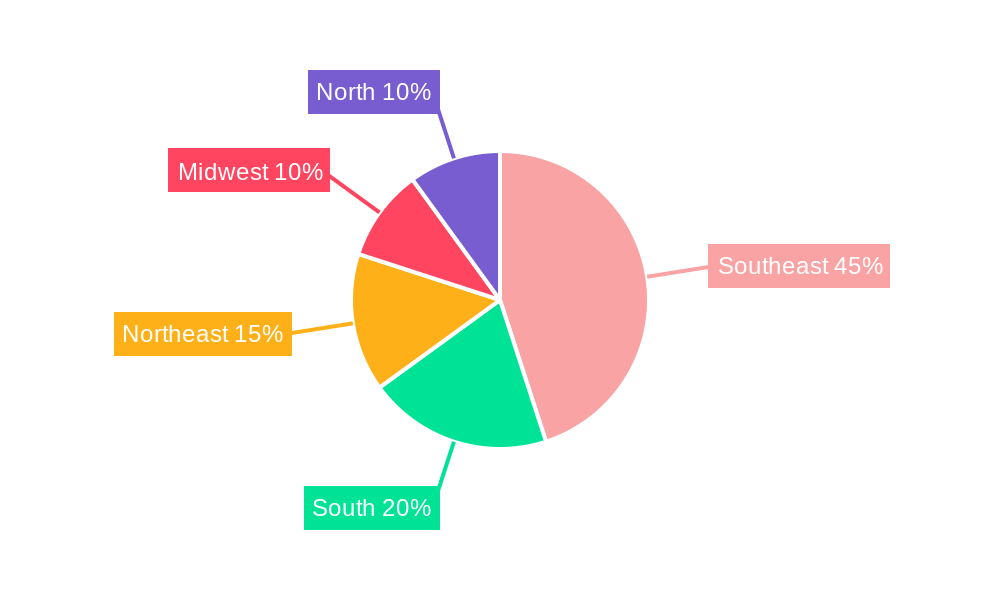

Leading Regions, Countries, or Segments in Brazil Digital Transformation Market

São Paulo, as the country's economic and technological hub, is the leading region for digital transformation adoption. This is followed by Rio de Janeiro and other major metropolitan areas. The financial services and retail segments are currently the leading adopters, due to the high potential for digital innovation, increased competition, and regulatory push.

- Key Drivers for São Paulo's Dominance:

- High Concentration of Businesses: A large number of companies are based in São Paulo, creating high demand for digital solutions.

- Significant Investment in IT Infrastructure: Major investments in infrastructure and talent acquisition are further supporting the region's dominance.

- Pro-Digital Government Policies: São Paulo's government actively promotes digitalization through various initiatives and funding programs.

São Paulo's dominance is further consolidated by its advanced infrastructure, skilled workforce, and supportive regulatory environment. This creates a positive feedback loop, attracting more investment and fostering innovation, solidifying its position as a leader in the Brazilian digital transformation market.

Brazil Digital Transformation Market Product Innovations

The market is witnessing continuous innovation in areas like AI-powered solutions for customer service, blockchain technology for supply chain management, and advanced analytics for business decision-making. These innovations are enhancing efficiency, optimizing processes, and enabling businesses to create new revenue streams. Unique selling propositions include customization, integration capabilities, and measurable return on investment (ROI). Furthermore, advancements in cloud infrastructure are facilitating scalability and reducing infrastructure costs for businesses.

Propelling Factors for Brazil Digital Transformation Market Growth

The market's growth is fueled by a confluence of factors, including:

- Technological advancements: The rapid evolution of technologies like AI, IoT, and cloud computing fuels the adoption of digital transformation solutions.

- Economic growth: Brazil's economic growth, despite recent fluctuations, continues to drive demand for efficiency and productivity improvements, making digital solutions essential.

- Government initiatives: Government programs aimed at fostering digitalization and technological adoption play a significant role in stimulating market growth.

Obstacles in the Brazil Digital Transformation Market

Significant obstacles include:

- Cybersecurity concerns: The increasing reliance on digital technologies also increases vulnerability to cyberattacks, requiring significant investments in security infrastructure.

- Digital literacy gaps: A lack of digital literacy among some segments of the population presents a barrier to complete adoption of digital solutions.

- High cost of implementation: Digital transformation initiatives can be costly, especially for smaller businesses, potentially hindering broader adoption.

Future Opportunities in Brazil Digital Transformation Market

The future holds exciting opportunities, including:

- Expansion into underserved markets: Significant potential exists for expanding digital transformation solutions into smaller cities and rural areas.

- Adoption of new technologies: Emerging technologies such as extended reality (XR) and edge computing are expected to drive significant growth.

- Focus on sustainability: Growing environmental concerns are pushing businesses to adopt sustainable digital transformation solutions.

Major Players in the Brazil Digital Transformation Market Ecosystem

- CI&T Inc

- Stefanini Group

- Concrete Solutions

- Luby Software LLC

- BIX Technology

- Tempest Security Intelligence

- Neurotech Information Technology

- Siena Company

- KIS Solutions

- Exadel Inc

Key Developments in Brazil Digital Transformation Market Industry

- June 2024: Accenture's acquisition of SOKO strengthened the market's creative and brand capabilities.

- February 2024: The Bounteous-Accolite Digital merger created a major new end-to-end digital transformation services provider.

Strategic Brazil Digital Transformation Market Forecast

The Brazilian digital transformation market is poised for significant growth over the next decade, driven by technological advancements, supportive government policies, and increasing digital adoption across various sectors. The expanding digital economy, coupled with a young and tech-savvy population, presents substantial opportunities for market players to capitalize on. The market's continued growth is expected to be fueled by increasing investments in digital infrastructure, the expansion of high-speed internet access, and a growing focus on innovation.

Brazil Digital Transformation Market Segmentation

-

1. Type

-

1.1. Analytic

- 1.1.1. Current

- 1.1.2. Key Grow

- 1.1.3. Use Case Analysis

- 1.1.4. Market Outlook

- 1.2. Extended Reality (XR)

- 1.3. IoT

- 1.4. Industrial Robotics

- 1.5. Blockchain

- 1.6. Additive Manufacturing/3D Printing

- 1.7. Cyber security

- 1.8. Cloud and Edge Computing

- 1.9. Others

-

1.1. Analytic

-

2. End-User Industry

- 2.1. Manufacturing

- 2.2. Oil, Gas and Utilities

- 2.3. Retail & e-commerce

- 2.4. Transportation and Logistics

- 2.5. Healthcare

- 2.6. BFSI

- 2.7. Telecom and IT

- 2.8. Government and Public Sector

- 2.9. Others

Brazil Digital Transformation Market Segmentation By Geography

- 1. Brazil

Brazil Digital Transformation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.68% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in the adoption of big data analytics and other technologies in the region; The rapid proliferation of mobile devices and apps

- 3.3. Market Restrains

- 3.3.1. Increase in the adoption of big data analytics and other technologies in the region; The rapid proliferation of mobile devices and apps

- 3.4. Market Trends

- 3.4.1. Telecom and IT Industry Spur the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Digital Transformation Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Analytic

- 5.1.1.1. Current

- 5.1.1.2. Key Grow

- 5.1.1.3. Use Case Analysis

- 5.1.1.4. Market Outlook

- 5.1.2. Extended Reality (XR)

- 5.1.3. IoT

- 5.1.4. Industrial Robotics

- 5.1.5. Blockchain

- 5.1.6. Additive Manufacturing/3D Printing

- 5.1.7. Cyber security

- 5.1.8. Cloud and Edge Computing

- 5.1.9. Others

- 5.1.1. Analytic

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Manufacturing

- 5.2.2. Oil, Gas and Utilities

- 5.2.3. Retail & e-commerce

- 5.2.4. Transportation and Logistics

- 5.2.5. Healthcare

- 5.2.6. BFSI

- 5.2.7. Telecom and IT

- 5.2.8. Government and Public Sector

- 5.2.9. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 CI&T Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Stefanini Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Concrete Solutions

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Luby Software LLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 BIX Technology

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Tempest Security Intelligence

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Neurotech Information Technology

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Siena Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 KIS Solutions

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Exadel Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 CI&T Inc

List of Figures

- Figure 1: Brazil Digital Transformation Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Brazil Digital Transformation Market Share (%) by Company 2024

List of Tables

- Table 1: Brazil Digital Transformation Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Brazil Digital Transformation Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Brazil Digital Transformation Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Brazil Digital Transformation Market Volume Billion Forecast, by Type 2019 & 2032

- Table 5: Brazil Digital Transformation Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 6: Brazil Digital Transformation Market Volume Billion Forecast, by End-User Industry 2019 & 2032

- Table 7: Brazil Digital Transformation Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Brazil Digital Transformation Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: Brazil Digital Transformation Market Revenue Million Forecast, by Type 2019 & 2032

- Table 10: Brazil Digital Transformation Market Volume Billion Forecast, by Type 2019 & 2032

- Table 11: Brazil Digital Transformation Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 12: Brazil Digital Transformation Market Volume Billion Forecast, by End-User Industry 2019 & 2032

- Table 13: Brazil Digital Transformation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Brazil Digital Transformation Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Digital Transformation Market?

The projected CAGR is approximately 9.68%.

2. Which companies are prominent players in the Brazil Digital Transformation Market?

Key companies in the market include CI&T Inc, Stefanini Group, Concrete Solutions, Luby Software LLC, BIX Technology, Tempest Security Intelligence, Neurotech Information Technology, Siena Company, KIS Solutions, Exadel Inc.

3. What are the main segments of the Brazil Digital Transformation Market?

The market segments include Type, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 24.36 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in the adoption of big data analytics and other technologies in the region; The rapid proliferation of mobile devices and apps.

6. What are the notable trends driving market growth?

Telecom and IT Industry Spur the Market Growth.

7. Are there any restraints impacting market growth?

Increase in the adoption of big data analytics and other technologies in the region; The rapid proliferation of mobile devices and apps.

8. Can you provide examples of recent developments in the market?

June 2024 - Accenture completed the acquisition of SOKO, an independent Brazilian creative agency that develops brand stories with deep impact in society by blending creativity, data and a comprehensive understanding of culture. The acquisition of SOKO adds approximately 300 employees to Droga5 São Paulo, deepening the agency’s influence and relevance in Brazil and Latin America, while strengthening the market’s creative and brand capabilities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Digital Transformation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Digital Transformation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Digital Transformation Market?

To stay informed about further developments, trends, and reports in the Brazil Digital Transformation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence