Key Insights

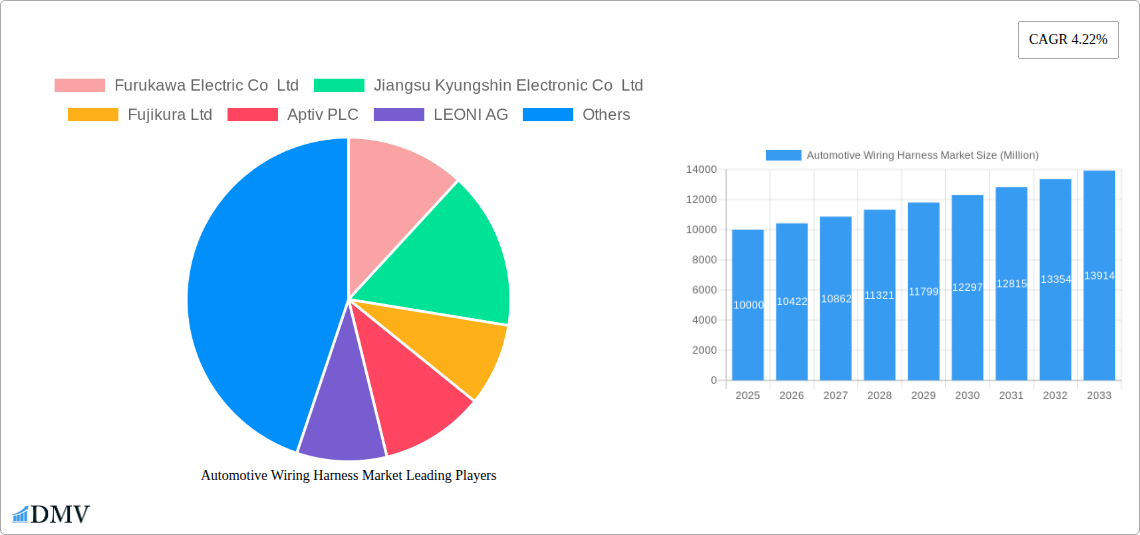

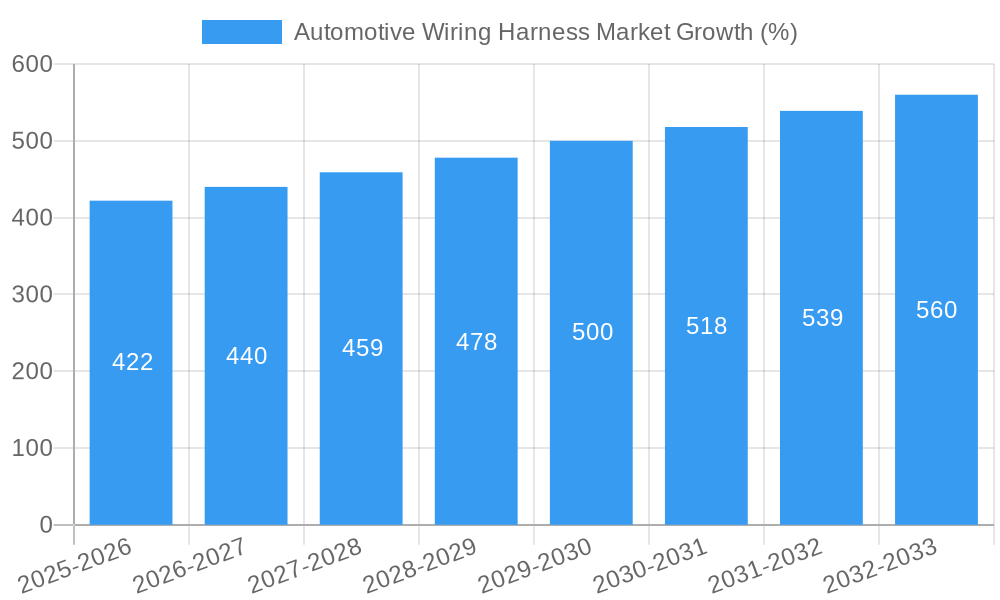

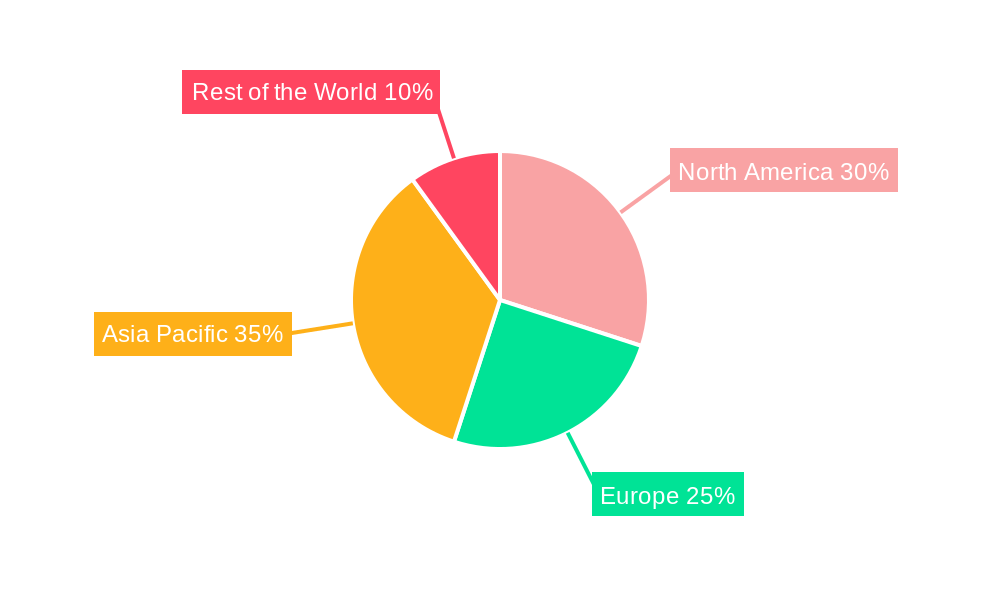

The automotive wiring harness market is experiencing robust growth, driven by the increasing adoption of advanced driver-assistance systems (ADAS), electric vehicles (EVs), and the rising demand for enhanced vehicle connectivity and safety features. The market's Compound Annual Growth Rate (CAGR) of 4.22% from 2019-2024 indicates a steady expansion, projected to continue in the forecast period (2025-2033). Several factors contribute to this growth. The shift towards electrification necessitates more complex wiring harnesses to accommodate battery management systems and electric motors. The integration of ADAS necessitates intricate wiring to support various sensors and control units, further driving demand. Furthermore, the growing preference for premium vehicles with sophisticated infotainment systems and comfortable cabins boosts the demand for high-quality, feature-rich wiring harnesses. The market is segmented by application type (ignition system, charging system, etc.), wire type (copper, aluminum), and vehicle type (passenger cars, commercial vehicles), offering diverse growth opportunities. Key players like Furukawa Electric, Lear Corporation, and Yazaki Corporation are strategically investing in research and development to enhance their product offerings and meet evolving market demands. Geographical expansion, particularly in rapidly developing economies in Asia Pacific, is also contributing significantly to the overall market growth.

The competitive landscape is characterized by both established players and emerging companies vying for market share. Established players leverage their extensive manufacturing capabilities and global presence, while newer entrants focus on innovation and cost-effective solutions. The market also faces challenges, including fluctuating raw material prices (particularly copper and aluminum), stringent regulatory compliance requirements, and the need to keep pace with rapid technological advancements. To maintain a competitive edge, companies are concentrating on developing lightweight, high-performance wiring harnesses that reduce vehicle weight and improve fuel efficiency. The focus on sustainable manufacturing practices, along with advancements in material science and production technologies, will shape the future trajectory of the automotive wiring harness market. The market's growth will likely be influenced by factors like the global economic climate, government regulations on vehicle safety and emissions, and the pace of technological innovations within the automotive sector. We can reasonably project that the market will continue its upward trajectory, driven by these underlying trends.

Automotive Wiring Harness Market: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the global Automotive Wiring Harness Market, offering a comprehensive overview of market trends, growth drivers, challenges, and future opportunities. Covering the period from 2019 to 2033, with a base year of 2025, this report is essential for stakeholders seeking to understand and capitalize on the evolving dynamics of this crucial automotive component sector. The market is projected to reach xx Million by 2033, exhibiting a robust CAGR.

Automotive Wiring Harness Market Market Composition & Trends

This section delves into the intricate structure of the automotive wiring harness market, examining its concentration, innovation landscape, regulatory environment, substitute products, and key end-user profiles. We analyze the competitive landscape, revealing market share distribution among key players and scrutinizing significant M&A activities. The report assesses the impact of these mergers and acquisitions on market dynamics, using examples such as Aptiv Plc's acquisition of Intercable Automotive Solutions for USD 600.95 Million.

- Market Concentration: The market exhibits a moderately concentrated structure, with the top 10 players holding approximately xx% of the global market share in 2024.

- Innovation Catalysts: Advancements in lightweight materials, electrification technologies, and autonomous driving systems are driving innovation within the sector.

- Regulatory Landscape: Stringent safety and emission regulations are shaping product development and influencing market growth.

- Substitute Products: While limited, alternative technologies are emerging, requiring constant adaptation and innovation within the industry.

- End-User Profiles: The report profiles key end-users, including passenger car and commercial vehicle manufacturers, providing insights into their specific needs and preferences.

- M&A Activities: The report details significant mergers and acquisitions, such as the USD 600.95 Million acquisition of Intercable Automotive Solutions by Aptiv Plc, highlighting their influence on market consolidation and technological advancements. Total M&A deal value over the study period is estimated at xx Million.

Automotive Wiring Harness Market Industry Evolution

This section provides a comprehensive analysis of the Automotive Wiring Harness Market's historical and projected growth trajectories. We examine technological advancements shaping the industry, analyzing the impact of factors like the increasing adoption of electric vehicles (EVs) and the integration of advanced driver-assistance systems (ADAS). The report further explores the evolution of consumer demands, shifting preferences towards advanced functionalities, and their implications for market evolution.

The market witnessed substantial growth during the historical period (2019-2024), with a CAGR of xx%. This growth is projected to continue during the forecast period (2025-2033), driven by the increasing demand for automobiles globally and the incorporation of advanced functionalities in vehicles. The adoption rate of lightweight wiring harnesses is expected to increase by xx% by 2033. The shift towards electric vehicles is predicted to fuel significant growth in the high-voltage wiring harness segment.

Leading Regions, Countries, or Segments in Automotive Wiring Harness Market

This section identifies the dominant regions, countries, and segments within the automotive wiring harness market. We analyze factors contributing to regional dominance and segment leadership.

- Dominant Region: [Insert Dominant Region, e.g., Asia Pacific] is projected to maintain its lead throughout the forecast period due to robust automotive production in countries like China and India.

- Dominant Segment (By Application Type): The Body and Cabin Wiring Harness segment is anticipated to dominate due to its increasing complexity and importance in modern vehicles.

- Dominant Segment (By Wire Type): The Copper wire type segment currently holds the largest market share but the Aluminum segment is expected to see significant growth fueled by the demand for lighter and more efficient vehicles.

- Dominant Segment (By Vehicle Type): The Passenger Cars segment is expected to be the primary revenue generator, driven by escalating global passenger vehicle sales.

Key Drivers:

- Investment Trends: Significant investments in automotive manufacturing facilities across leading regions are driving market expansion.

- Regulatory Support: Government initiatives promoting automotive industry growth and electric vehicle adoption are fostering market expansion.

Automotive Wiring Harness Market Product Innovations

The automotive wiring harness market is witnessing continuous innovation, focusing on enhancing performance, reducing weight, and improving efficiency. Lightweight materials like aluminum are increasingly incorporated, leading to improved fuel efficiency and reduced vehicle weight. Advanced manufacturing techniques such as automated assembly and 3D printing are driving productivity and quality improvements. Furthermore, the integration of sensors and advanced communication protocols is creating more sophisticated and interconnected wiring harnesses. These innovations are driving up the average selling price of wiring harnesses.

Propelling Factors for Automotive Wiring Harness Market Growth

The growth of the automotive wiring harness market is driven by a confluence of factors, including the booming automotive industry, escalating demand for advanced driver-assistance systems (ADAS), increasing adoption of electric vehicles (EVs), and stricter government regulations on fuel efficiency and safety. Technological advancements such as lightweight materials and improved manufacturing processes further fuel market growth. Economic growth in developing countries is also contributing significantly to increased vehicle production and sales.

Obstacles in the Automotive Wiring Harness Market Market

Despite its promising outlook, the automotive wiring harness market faces several challenges. Fluctuations in raw material prices and supply chain disruptions can impact production costs and profitability. Intense competition from established and emerging players puts pressure on margins. Stringent regulatory requirements and compliance costs also pose significant hurdles for manufacturers. These factors can collectively impact the growth rate by approximately xx% annually in the next five years.

Future Opportunities in Automotive Wiring Harness Market

The automotive wiring harness market offers several exciting future opportunities. The burgeoning demand for electric and autonomous vehicles presents significant growth potential. The development of next-generation communication technologies and the integration of advanced sensor systems create new market avenues. Furthermore, expansion into emerging markets and the exploration of innovative materials and manufacturing techniques offer further avenues for growth.

Major Players in the Automotive Wiring Harness Market Ecosystem

- Furukawa Electric Co Ltd

- Jiangsu Kyungshin Electronic Co Ltd

- Fujikura Ltd

- Aptiv PLC

- LEONI AG

- Coroplast Fritz Müller GmbH & Co

- THB Grou

- Lear Corporation

- Nexans

- Yazaki Corporation

- Motherson Sumi Systems Ltd

- Sumitomo Electric Industries Ltd

Key Developments in Automotive Wiring Harness Market Industry

- September 2022: Aptiv Plc acquired Intercable Automotive Solutions for USD 600.95 Million, strengthening its position in busbars and interconnect solutions.

- September 2022: Motherson Sumi Ltd. opened a new Serbian manufacturing facility for Daimler Trucks, creating 1,000 jobs.

- July 2022: Sumitomo Wiring Systems Ltd. inaugurated a new manufacturing facility in Cambodia.

- May 2022: Leoni AG sold its automotive cables business to Stark Corporation for an undisclosed amount (USD 1.31 Billion in 2021 revenue).

Strategic Automotive Wiring Harness Market Market Forecast

The automotive wiring harness market is poised for significant growth, driven by the global expansion of the automotive industry, the increasing complexity of vehicles, and the rising demand for electric and autonomous vehicles. Continued innovation in lightweight materials and advanced manufacturing processes will further fuel market expansion. The market's future growth trajectory will be positively influenced by these technological advancements and favorable global economic conditions. Specific forecasts detailed in the complete report.

Automotive Wiring Harness Market Segmentation

-

1. Application Type

- 1.1. Ignition System

- 1.2. Charging System

- 1.3. Drivetrain and Powertrain System

- 1.4. Infotainment System and Dashboard

- 1.5. Vehicle Control and Safety Systems

- 1.6. Body and Cabin Wiring Harness

-

2. Wire Type

- 2.1. Copper

- 2.2. Aluminum

-

3. Vehicle Type

- 3.1. Passenger Cars

- 3.2. Commercial Vehicles

Automotive Wiring Harness Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Automotive Wiring Harness Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.22% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Automotive Production; Growing Demand For Advanced Safety Features

- 3.3. Market Restrains

- 3.3.1. Fluctuating Raw Material Prices

- 3.4. Market Trends

- 3.4.1. Electric Vehicles are Expected to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Wiring Harness Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 5.1.1. Ignition System

- 5.1.2. Charging System

- 5.1.3. Drivetrain and Powertrain System

- 5.1.4. Infotainment System and Dashboard

- 5.1.5. Vehicle Control and Safety Systems

- 5.1.6. Body and Cabin Wiring Harness

- 5.2. Market Analysis, Insights and Forecast - by Wire Type

- 5.2.1. Copper

- 5.2.2. Aluminum

- 5.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.3.1. Passenger Cars

- 5.3.2. Commercial Vehicles

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 6. North America Automotive Wiring Harness Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application Type

- 6.1.1. Ignition System

- 6.1.2. Charging System

- 6.1.3. Drivetrain and Powertrain System

- 6.1.4. Infotainment System and Dashboard

- 6.1.5. Vehicle Control and Safety Systems

- 6.1.6. Body and Cabin Wiring Harness

- 6.2. Market Analysis, Insights and Forecast - by Wire Type

- 6.2.1. Copper

- 6.2.2. Aluminum

- 6.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.3.1. Passenger Cars

- 6.3.2. Commercial Vehicles

- 6.1. Market Analysis, Insights and Forecast - by Application Type

- 7. Europe Automotive Wiring Harness Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application Type

- 7.1.1. Ignition System

- 7.1.2. Charging System

- 7.1.3. Drivetrain and Powertrain System

- 7.1.4. Infotainment System and Dashboard

- 7.1.5. Vehicle Control and Safety Systems

- 7.1.6. Body and Cabin Wiring Harness

- 7.2. Market Analysis, Insights and Forecast - by Wire Type

- 7.2.1. Copper

- 7.2.2. Aluminum

- 7.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.3.1. Passenger Cars

- 7.3.2. Commercial Vehicles

- 7.1. Market Analysis, Insights and Forecast - by Application Type

- 8. Asia Pacific Automotive Wiring Harness Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application Type

- 8.1.1. Ignition System

- 8.1.2. Charging System

- 8.1.3. Drivetrain and Powertrain System

- 8.1.4. Infotainment System and Dashboard

- 8.1.5. Vehicle Control and Safety Systems

- 8.1.6. Body and Cabin Wiring Harness

- 8.2. Market Analysis, Insights and Forecast - by Wire Type

- 8.2.1. Copper

- 8.2.2. Aluminum

- 8.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.3.1. Passenger Cars

- 8.3.2. Commercial Vehicles

- 8.1. Market Analysis, Insights and Forecast - by Application Type

- 9. Rest of the World Automotive Wiring Harness Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application Type

- 9.1.1. Ignition System

- 9.1.2. Charging System

- 9.1.3. Drivetrain and Powertrain System

- 9.1.4. Infotainment System and Dashboard

- 9.1.5. Vehicle Control and Safety Systems

- 9.1.6. Body and Cabin Wiring Harness

- 9.2. Market Analysis, Insights and Forecast - by Wire Type

- 9.2.1. Copper

- 9.2.2. Aluminum

- 9.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.3.1. Passenger Cars

- 9.3.2. Commercial Vehicles

- 9.1. Market Analysis, Insights and Forecast - by Application Type

- 10. North America Automotive Wiring Harness Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 United States

- 10.1.2 Canada

- 10.1.3 Rest of North America

- 11. Europe Automotive Wiring Harness Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 Germany

- 11.1.2 United Kingdom

- 11.1.3 France

- 11.1.4 Russia

- 11.1.5 Spain

- 11.1.6 Rest of Europe

- 12. Asia Pacific Automotive Wiring Harness Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 China

- 12.1.2 Japan

- 12.1.3 India

- 12.1.4 South Korea

- 12.1.5 Rest of Asia Pacific

- 13. Rest of the World Automotive Wiring Harness Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 South America

- 13.1.2 Middle East and Africa

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Furukawa Electric Co Ltd

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Jiangsu Kyungshin Electronic Co Ltd

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Fujikura Ltd

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Aptiv PLC

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 LEONI AG

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Coroplast Fritz Müller GmbH & Co

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 THB Grou

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Lear Corporation

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Nexans

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Yazaki Corporation

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 Motherson Sumi Systems Ltd

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.12 Sumitomo Electric Industries Ltd

- 14.2.12.1. Overview

- 14.2.12.2. Products

- 14.2.12.3. SWOT Analysis

- 14.2.12.4. Recent Developments

- 14.2.12.5. Financials (Based on Availability)

- 14.2.1 Furukawa Electric Co Ltd

List of Figures

- Figure 1: Global Automotive Wiring Harness Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Automotive Wiring Harness Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Automotive Wiring Harness Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Automotive Wiring Harness Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Automotive Wiring Harness Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Automotive Wiring Harness Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Automotive Wiring Harness Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Automotive Wiring Harness Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Automotive Wiring Harness Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Automotive Wiring Harness Market Revenue (Million), by Application Type 2024 & 2032

- Figure 11: North America Automotive Wiring Harness Market Revenue Share (%), by Application Type 2024 & 2032

- Figure 12: North America Automotive Wiring Harness Market Revenue (Million), by Wire Type 2024 & 2032

- Figure 13: North America Automotive Wiring Harness Market Revenue Share (%), by Wire Type 2024 & 2032

- Figure 14: North America Automotive Wiring Harness Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 15: North America Automotive Wiring Harness Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 16: North America Automotive Wiring Harness Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Automotive Wiring Harness Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Automotive Wiring Harness Market Revenue (Million), by Application Type 2024 & 2032

- Figure 19: Europe Automotive Wiring Harness Market Revenue Share (%), by Application Type 2024 & 2032

- Figure 20: Europe Automotive Wiring Harness Market Revenue (Million), by Wire Type 2024 & 2032

- Figure 21: Europe Automotive Wiring Harness Market Revenue Share (%), by Wire Type 2024 & 2032

- Figure 22: Europe Automotive Wiring Harness Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 23: Europe Automotive Wiring Harness Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 24: Europe Automotive Wiring Harness Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe Automotive Wiring Harness Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Automotive Wiring Harness Market Revenue (Million), by Application Type 2024 & 2032

- Figure 27: Asia Pacific Automotive Wiring Harness Market Revenue Share (%), by Application Type 2024 & 2032

- Figure 28: Asia Pacific Automotive Wiring Harness Market Revenue (Million), by Wire Type 2024 & 2032

- Figure 29: Asia Pacific Automotive Wiring Harness Market Revenue Share (%), by Wire Type 2024 & 2032

- Figure 30: Asia Pacific Automotive Wiring Harness Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 31: Asia Pacific Automotive Wiring Harness Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 32: Asia Pacific Automotive Wiring Harness Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific Automotive Wiring Harness Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: Rest of the World Automotive Wiring Harness Market Revenue (Million), by Application Type 2024 & 2032

- Figure 35: Rest of the World Automotive Wiring Harness Market Revenue Share (%), by Application Type 2024 & 2032

- Figure 36: Rest of the World Automotive Wiring Harness Market Revenue (Million), by Wire Type 2024 & 2032

- Figure 37: Rest of the World Automotive Wiring Harness Market Revenue Share (%), by Wire Type 2024 & 2032

- Figure 38: Rest of the World Automotive Wiring Harness Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 39: Rest of the World Automotive Wiring Harness Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 40: Rest of the World Automotive Wiring Harness Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Rest of the World Automotive Wiring Harness Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Automotive Wiring Harness Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Automotive Wiring Harness Market Revenue Million Forecast, by Application Type 2019 & 2032

- Table 3: Global Automotive Wiring Harness Market Revenue Million Forecast, by Wire Type 2019 & 2032

- Table 4: Global Automotive Wiring Harness Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 5: Global Automotive Wiring Harness Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Automotive Wiring Harness Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Automotive Wiring Harness Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Automotive Wiring Harness Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America Automotive Wiring Harness Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Automotive Wiring Harness Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Germany Automotive Wiring Harness Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom Automotive Wiring Harness Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: France Automotive Wiring Harness Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Russia Automotive Wiring Harness Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Spain Automotive Wiring Harness Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of Europe Automotive Wiring Harness Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global Automotive Wiring Harness Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: China Automotive Wiring Harness Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Japan Automotive Wiring Harness Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: India Automotive Wiring Harness Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: South Korea Automotive Wiring Harness Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Asia Pacific Automotive Wiring Harness Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global Automotive Wiring Harness Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: South America Automotive Wiring Harness Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Middle East and Africa Automotive Wiring Harness Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Global Automotive Wiring Harness Market Revenue Million Forecast, by Application Type 2019 & 2032

- Table 27: Global Automotive Wiring Harness Market Revenue Million Forecast, by Wire Type 2019 & 2032

- Table 28: Global Automotive Wiring Harness Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 29: Global Automotive Wiring Harness Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: United States Automotive Wiring Harness Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Canada Automotive Wiring Harness Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Rest of North America Automotive Wiring Harness Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Global Automotive Wiring Harness Market Revenue Million Forecast, by Application Type 2019 & 2032

- Table 34: Global Automotive Wiring Harness Market Revenue Million Forecast, by Wire Type 2019 & 2032

- Table 35: Global Automotive Wiring Harness Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 36: Global Automotive Wiring Harness Market Revenue Million Forecast, by Country 2019 & 2032

- Table 37: Germany Automotive Wiring Harness Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: United Kingdom Automotive Wiring Harness Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: France Automotive Wiring Harness Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Russia Automotive Wiring Harness Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Spain Automotive Wiring Harness Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Rest of Europe Automotive Wiring Harness Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Global Automotive Wiring Harness Market Revenue Million Forecast, by Application Type 2019 & 2032

- Table 44: Global Automotive Wiring Harness Market Revenue Million Forecast, by Wire Type 2019 & 2032

- Table 45: Global Automotive Wiring Harness Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 46: Global Automotive Wiring Harness Market Revenue Million Forecast, by Country 2019 & 2032

- Table 47: China Automotive Wiring Harness Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Japan Automotive Wiring Harness Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: India Automotive Wiring Harness Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: South Korea Automotive Wiring Harness Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Rest of Asia Pacific Automotive Wiring Harness Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Global Automotive Wiring Harness Market Revenue Million Forecast, by Application Type 2019 & 2032

- Table 53: Global Automotive Wiring Harness Market Revenue Million Forecast, by Wire Type 2019 & 2032

- Table 54: Global Automotive Wiring Harness Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 55: Global Automotive Wiring Harness Market Revenue Million Forecast, by Country 2019 & 2032

- Table 56: South America Automotive Wiring Harness Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: Middle East and Africa Automotive Wiring Harness Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Wiring Harness Market?

The projected CAGR is approximately 4.22%.

2. Which companies are prominent players in the Automotive Wiring Harness Market?

Key companies in the market include Furukawa Electric Co Ltd, Jiangsu Kyungshin Electronic Co Ltd, Fujikura Ltd, Aptiv PLC, LEONI AG, Coroplast Fritz Müller GmbH & Co, THB Grou, Lear Corporation, Nexans, Yazaki Corporation, Motherson Sumi Systems Ltd, Sumitomo Electric Industries Ltd.

3. What are the main segments of the Automotive Wiring Harness Market?

The market segments include Application Type, Wire Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Automotive Production; Growing Demand For Advanced Safety Features.

6. What are the notable trends driving market growth?

Electric Vehicles are Expected to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Fluctuating Raw Material Prices.

8. Can you provide examples of recent developments in the market?

September 2022: Aptiv Plc signed a definitive agreement to acquire Intercable Automotive Solutions from Intercable Srl for EUR 595 million (USD 600.95 million). Aptiv Plc was to own an 85% stake in Intercable Automotive Solutions post-acquisition. The acquisition will help Aptiv Plc cement its position in the automotive busbars and interconnect solutions segments.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Wiring Harness Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Wiring Harness Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Wiring Harness Market?

To stay informed about further developments, trends, and reports in the Automotive Wiring Harness Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence