Key Insights

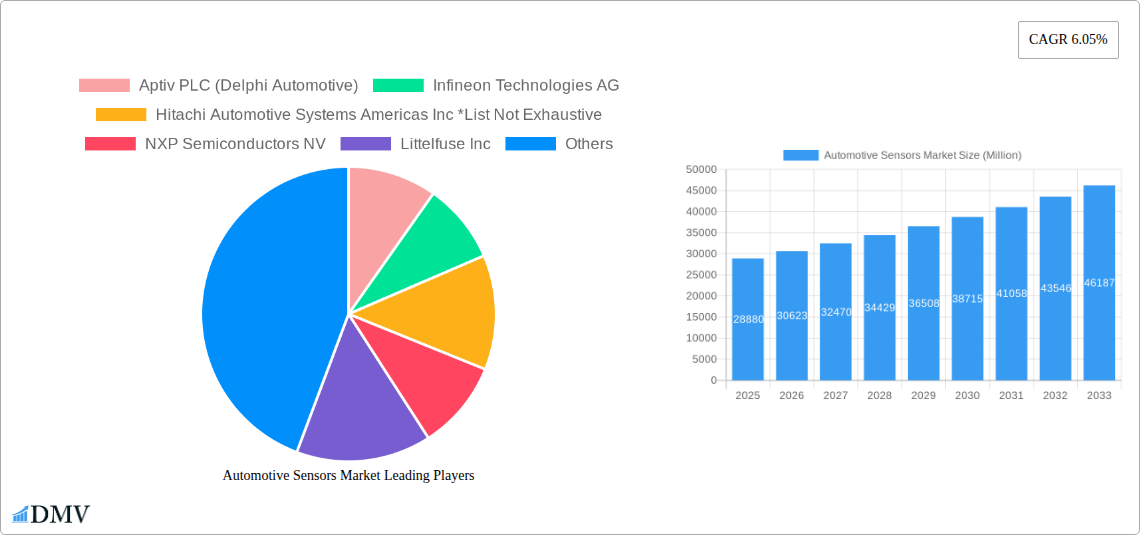

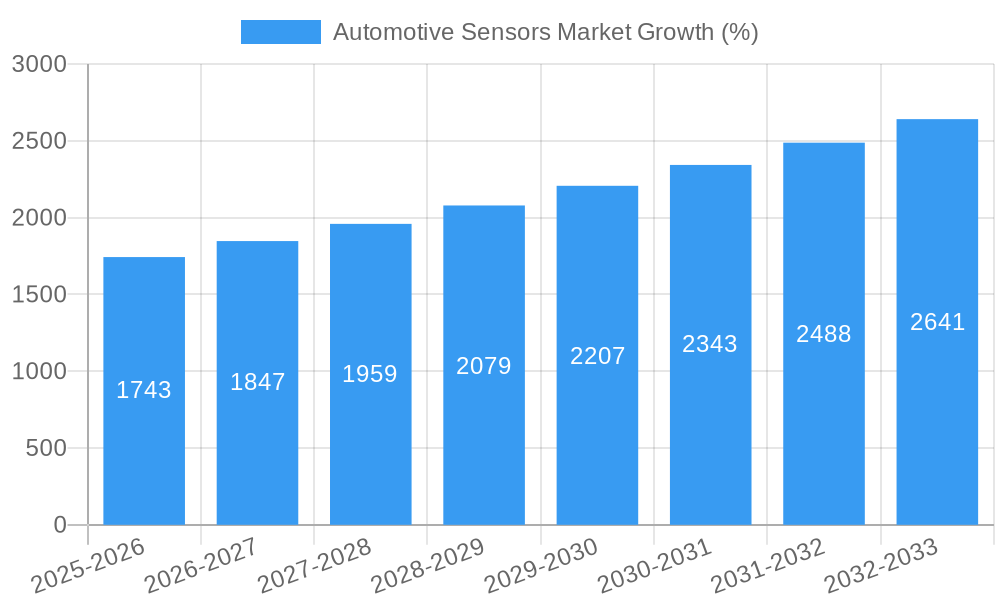

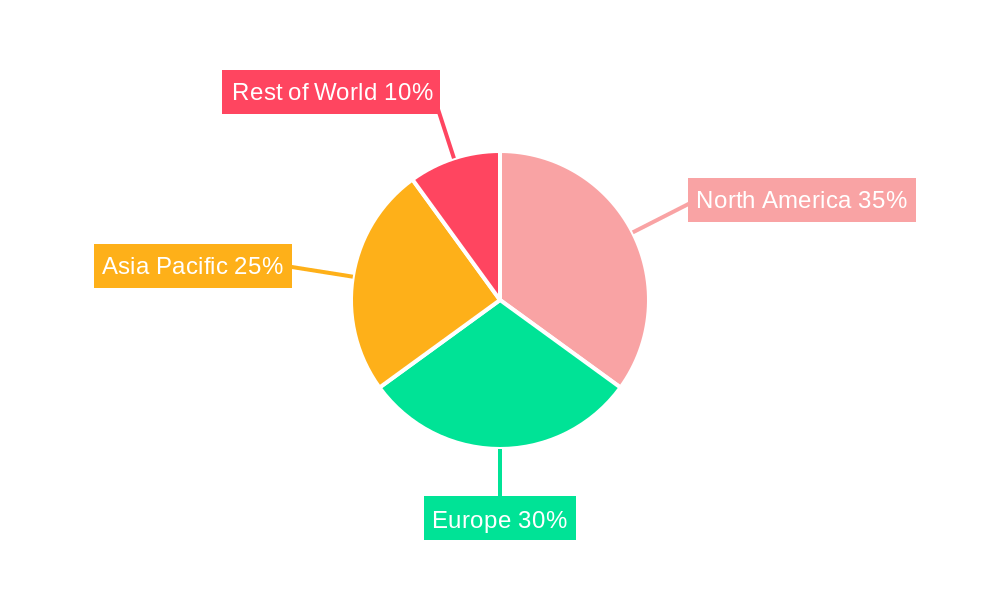

The automotive sensors market, valued at $28.88 billion in 2025, is projected to experience robust growth, driven by the increasing adoption of advanced driver-assistance systems (ADAS), autonomous driving technologies, and the rising demand for enhanced vehicle safety and fuel efficiency. The Compound Annual Growth Rate (CAGR) of 6.05% from 2025 to 2033 indicates a significant expansion, reaching an estimated market size of approximately $48 billion by 2033. Key drivers include stringent government regulations mandating safety features, the integration of connected car technologies, and the growing preference for electric and hybrid vehicles which rely heavily on sensor technology for performance optimization and battery management. Market segmentation reveals a significant contribution from passenger cars, followed by commercial vehicles. Within sensor types, temperature, pressure, and speed sensors currently hold substantial market share, but growth is expected across all segments, particularly in areas such as inertial sensors and gas sensors for emission control systems. Leading players like Aptiv, Infineon, and Bosch are strategically investing in research and development, focusing on miniaturization, improved accuracy, and cost-effective solutions to maintain their competitive edge. Regional analysis suggests North America and Asia Pacific will dominate the market, driven by high vehicle production volumes and technological advancements.

The competitive landscape is characterized by intense rivalry among established automotive sensor manufacturers and emerging technology companies. The market is witnessing rapid innovation in sensor technology, including the development of more sophisticated sensor fusion techniques and the integration of artificial intelligence for enhanced data processing. This is leading to more efficient and reliable safety and performance features in vehicles. Challenges include the high initial investment costs associated with new sensor technologies and the need for robust cybersecurity measures to prevent potential vulnerabilities. However, the long-term growth prospects remain positive, fueled by the ongoing trend towards vehicle electrification, automation, and connectivity, necessitating ever-more sophisticated and integrated sensor systems. Furthermore, the increasing demand for improved driving comfort and personalized vehicle experiences also contributes to market expansion.

Automotive Sensors Market: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the Automotive Sensors Market, encompassing market size, trends, leading players, and future growth projections from 2019 to 2033. The study period covers historical data (2019-2024), the base year (2025), and a comprehensive forecast period (2025-2033). The report offers invaluable insights for stakeholders, investors, and industry professionals seeking to understand and capitalize on the opportunities within this dynamic market projected to reach xx Million by 2033.

Automotive Sensors Market Composition & Trends

This section delves into the intricate composition of the automotive sensors market, examining key aspects influencing its evolution and growth trajectory. We analyze market concentration, highlighting the market share distribution among key players, which reveals a moderately consolidated landscape with some dominant players and several significant competitors. The report quantifies the market share of major players, providing a competitive overview. Furthermore, we explore the influence of technological advancements, regulatory frameworks (including emission standards and safety regulations), and the presence of substitute products on market dynamics. A detailed examination of mergers and acquisitions (M&A) activities within the automotive sensors industry is also included, providing analysis of deal values and their impact on market consolidation. The analysis considers end-user profiles, segmenting the market by vehicle type (passenger cars and commercial vehicles) to identify evolving consumer preferences and their impact on market demand.

- Market Concentration: Moderately consolidated, with top players holding approximately xx% of market share in 2024.

- Innovation Catalysts: Advancements in sensor technology (e.g., MEMS, CMOS), integration with AI and ADAS systems.

- Regulatory Landscape: Stringent emission and safety standards driving demand for advanced sensors.

- Substitute Products: Limited substitutes, with sensor technology often integrated into broader systems.

- M&A Activity: Significant M&A activity observed, with deal values exceeding xx Million in the past five years, driving consolidation and technological advancements. (e.g., the acquisition of TEWA Temperature Sensors by CTS Corporation).

- End-User Profiles: Shifting demand towards electric and autonomous vehicles impacting sensor requirements.

Automotive Sensors Market Industry Evolution

This section provides a comprehensive overview of the automotive sensors market's evolution, charting its growth trajectories and analyzing the underlying technological advancements and shifting consumer demands that have shaped its current state. We examine the historical growth rates and adoption metrics across various sensor types and applications. The analysis identifies key factors driving market expansion, such as the increasing integration of advanced driver-assistance systems (ADAS) and the rising adoption of electric and autonomous vehicles. We further discuss the impact of technological advancements like miniaturization, improved accuracy, and enhanced functionality on market growth. This analysis also examines how evolving consumer preferences, such as demands for enhanced safety features and improved fuel efficiency, are shaping sensor market trends and demands. The section also looks into technological advancements, specifically in the fields of MEMS technology, CMOS technology, and the integration of artificial intelligence (AI) into automotive sensors.

Leading Regions, Countries, or Segments in Automotive Sensors Market

This section identifies the dominant regions, countries, and segments within the automotive sensors market based on sensor type (Temperature Sensors, Pressure Sensors, Speed Sensors, Level/Position Sensors, Magnetic Sensors, Gas Sensors, Inertial Sensors), application (Powertrain, Body Electronics, Vehicle Security Systems, Telematics), and vehicle type (Passenger Cars, Commercial Vehicles). We offer a detailed analysis of the factors contributing to their dominance, including market size, growth rates, and underlying market drivers.

Dominant Region: Asia Pacific (driven by strong automotive manufacturing and rising adoption of advanced technologies).

Key Drivers (Asia Pacific):

- High investments in automotive manufacturing infrastructure.

- Government support for technological advancements in the automotive sector.

- Growing demand for vehicles equipped with advanced safety features and autonomous capabilities.

Dominant Segment (by Type): Pressure Sensors (due to their widespread use in various automotive systems, including braking systems, engine management, and tire pressure monitoring systems).

Key Drivers (Pressure Sensors):

- Increasing demand for advanced driver-assistance systems (ADAS)

- Stringent safety regulations.

Dominant Segment (by Application): Powertrain (owing to its critical role in engine management and fuel efficiency).

Key Drivers (Powertrain):

- Increasing demand for improved fuel efficiency and emission control systems.

- Government regulations aimed at reducing emissions.

Automotive Sensors Market Product Innovations

Recent years have witnessed significant product innovations in the automotive sensor market, driven by the demand for enhanced performance, miniaturization, and integration with advanced vehicle systems. Key innovations include the development of highly integrated sensor solutions, utilizing MEMS and CMOS technologies for improved accuracy and reliability. These advancements have led to the introduction of new sensor types with specialized functionalities, particularly in the areas of environmental sensing and driver monitoring. The unique selling propositions of many of these sensors encompass their small size, low power consumption, and high precision, catering to the stringent requirements of modern automotive applications.

Propelling Factors for Automotive Sensors Market Growth

Several key factors are driving the growth of the automotive sensors market. Technological advancements, such as the development of miniaturized, high-precision sensors and the integration of artificial intelligence (AI) for enhanced functionality, are crucial. The economic factors driving growth include the increasing affordability of advanced sensor technologies and the rising demand for fuel-efficient vehicles with advanced safety and convenience features. Furthermore, regulatory pressures from governments worldwide promoting the adoption of advanced driver-assistance systems (ADAS) and autonomous driving features are significantly influencing market growth.

Obstacles in the Automotive Sensors Market

The automotive sensors market faces several challenges, including stringent regulatory requirements and complex testing procedures that increase development costs. Supply chain disruptions, particularly concerning semiconductor components, cause production delays and impact market availability. Intense competition among established players and emerging market entrants also creates pressure on pricing and profit margins. These challenges, combined, potentially impact the overall market growth rate, even if only moderately.

Future Opportunities in Automotive Sensors Market

Future opportunities in the automotive sensors market lie in several key areas. The expanding market for electric vehicles (EVs) and autonomous vehicles (AVs) presents significant growth potential, demanding advanced sensors for battery management, motor control, and environmental sensing. The integration of sensors with advanced driver-assistance systems (ADAS) and in-cabin monitoring systems will continue to drive demand. Emerging markets in developing economies also present lucrative opportunities, as increased car ownership leads to higher sensor adoption. The development of innovative sensor technologies, such as LiDAR and radar, for enhanced safety and autonomous driving capabilities, offers immense possibilities.

Major Players in the Automotive Sensors Market Ecosystem

- Aptiv PLC (Delphi Automotive)

- Infineon Technologies AG

- Hitachi Automotive Systems Americas Inc

- NXP Semiconductors NV

- Littelfuse Inc

- Texas Instruments Inc

- Sensata Technologies Holding PLC

- Continental AG

- Robert Bosch GmbH

- CTS Corporation

- Analog Devices Inc

- Maxim Integrated Products Inc

- DENSO Corporation

Key Developments in Automotive Sensors Market Industry

- December 2022: Continental AG announced new modules and sensors for electromobility, including ADAS integrated with Ambarella's AI-powered SoC. This highlights the growing focus on electrification and autonomous driving capabilities.

- November 2022: Infineon Technologies AG launched the XENSIV TLE4971 family of magnetic current sensors, enhancing precision and reliability in automotive applications. This showcases technological advancements in sensor accuracy and performance.

- March 2022: CTS Corporation acquired TEWA Temperature Sensors, expanding its European presence and temperature sensing capabilities. This acquisition signifies market consolidation and geographic expansion.

Strategic Automotive Sensors Market Forecast

The automotive sensors market is poised for substantial growth driven by the convergence of several factors, including the rapid adoption of electric vehicles, the increasing integration of advanced driver-assistance systems (ADAS), and the rise of autonomous driving technologies. The demand for highly accurate, reliable, and miniaturized sensors is expected to continue to rise, creating opportunities for innovation and market expansion. This forecast anticipates strong growth throughout the projected period, significantly increasing the market value, though the precise amount will depend on various economic and technological factors.

Automotive Sensors Market Segmentation

-

1. Type

- 1.1. Temperature Sensors

- 1.2. Pressure Sensors

- 1.3. Speed Sensors

- 1.4. Level/Position Sensors

- 1.5. Magnetic Sensors

- 1.6. Gas Sensors

- 1.7. Inertial Sensors

-

2. Application

- 2.1. Powertrain

- 2.2. Body Electronics

- 2.3. Vehicle Security Systems

- 2.4. Telematics

-

3. Vehicle Type

- 3.1. Passenger Cars

- 3.2. Commercial Vehicles

Automotive Sensors Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Asia Pacific

- 2.1. China

- 2.2. Japan

- 2.3. India

- 2.4. South Korea

- 2.5. Rest of Asia Pacific

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Rest of Europe

-

4. Rest of the World

- 4.1. Brazil

- 4.2. United Arab Emirates

- 4.3. Other Countries

Automotive Sensors Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.05% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Buyers Inclination Toward Affordable Used Cars to Fuel the Market Growth

- 3.3. Market Restrains

- 3.3.1 Technology Advances

- 3.3.2 Older Used Cars May Lack the Latest Features

- 3.4. Market Trends

- 3.4.1. Government Initiatives And The Growing Emphasis On Safer Automotive Systems Driving The Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Sensors Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Temperature Sensors

- 5.1.2. Pressure Sensors

- 5.1.3. Speed Sensors

- 5.1.4. Level/Position Sensors

- 5.1.5. Magnetic Sensors

- 5.1.6. Gas Sensors

- 5.1.7. Inertial Sensors

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Powertrain

- 5.2.2. Body Electronics

- 5.2.3. Vehicle Security Systems

- 5.2.4. Telematics

- 5.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.3.1. Passenger Cars

- 5.3.2. Commercial Vehicles

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Asia Pacific

- 5.4.3. Europe

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Automotive Sensors Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Temperature Sensors

- 6.1.2. Pressure Sensors

- 6.1.3. Speed Sensors

- 6.1.4. Level/Position Sensors

- 6.1.5. Magnetic Sensors

- 6.1.6. Gas Sensors

- 6.1.7. Inertial Sensors

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Powertrain

- 6.2.2. Body Electronics

- 6.2.3. Vehicle Security Systems

- 6.2.4. Telematics

- 6.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.3.1. Passenger Cars

- 6.3.2. Commercial Vehicles

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Asia Pacific Automotive Sensors Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Temperature Sensors

- 7.1.2. Pressure Sensors

- 7.1.3. Speed Sensors

- 7.1.4. Level/Position Sensors

- 7.1.5. Magnetic Sensors

- 7.1.6. Gas Sensors

- 7.1.7. Inertial Sensors

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Powertrain

- 7.2.2. Body Electronics

- 7.2.3. Vehicle Security Systems

- 7.2.4. Telematics

- 7.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.3.1. Passenger Cars

- 7.3.2. Commercial Vehicles

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Automotive Sensors Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Temperature Sensors

- 8.1.2. Pressure Sensors

- 8.1.3. Speed Sensors

- 8.1.4. Level/Position Sensors

- 8.1.5. Magnetic Sensors

- 8.1.6. Gas Sensors

- 8.1.7. Inertial Sensors

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Powertrain

- 8.2.2. Body Electronics

- 8.2.3. Vehicle Security Systems

- 8.2.4. Telematics

- 8.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.3.1. Passenger Cars

- 8.3.2. Commercial Vehicles

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Automotive Sensors Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Temperature Sensors

- 9.1.2. Pressure Sensors

- 9.1.3. Speed Sensors

- 9.1.4. Level/Position Sensors

- 9.1.5. Magnetic Sensors

- 9.1.6. Gas Sensors

- 9.1.7. Inertial Sensors

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Powertrain

- 9.2.2. Body Electronics

- 9.2.3. Vehicle Security Systems

- 9.2.4. Telematics

- 9.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.3.1. Passenger Cars

- 9.3.2. Commercial Vehicles

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. North America Automotive Sensors Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 United States

- 10.1.2 Canada

- 10.1.3 Mexico

- 10.1.4 Rest of North America

- 11. Asia Pacific Automotive Sensors Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 China

- 11.1.2 Japan

- 11.1.3 India

- 11.1.4 South Korea

- 11.1.5 Rest of Asia Pacific

- 12. Europe Automotive Sensors Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Rest of Europe

- 13. Rest of the World Automotive Sensors Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 Brazil

- 13.1.2 United Arab Emirates

- 13.1.3 Other Countries

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Aptiv PLC (Delphi Automotive)

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Infineon Technologies AG

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Hitachi Automotive Systems Americas Inc *List Not Exhaustive

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 NXP Semiconductors NV

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Littelfuse Inc

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Texas Instruments Inc

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Sensata Technologies Holding PLC

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Continental AG

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Robert Bosch GmbH

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 CTS Corporation

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 Analog Devices Inc

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.12 Maxim Integrated Products Inc

- 14.2.12.1. Overview

- 14.2.12.2. Products

- 14.2.12.3. SWOT Analysis

- 14.2.12.4. Recent Developments

- 14.2.12.5. Financials (Based on Availability)

- 14.2.13 DENSO Corporation

- 14.2.13.1. Overview

- 14.2.13.2. Products

- 14.2.13.3. SWOT Analysis

- 14.2.13.4. Recent Developments

- 14.2.13.5. Financials (Based on Availability)

- 14.2.1 Aptiv PLC (Delphi Automotive)

List of Figures

- Figure 1: Global Automotive Sensors Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Automotive Sensors Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Automotive Sensors Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Asia Pacific Automotive Sensors Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Asia Pacific Automotive Sensors Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Europe Automotive Sensors Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Europe Automotive Sensors Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Automotive Sensors Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Automotive Sensors Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Automotive Sensors Market Revenue (Million), by Type 2024 & 2032

- Figure 11: North America Automotive Sensors Market Revenue Share (%), by Type 2024 & 2032

- Figure 12: North America Automotive Sensors Market Revenue (Million), by Application 2024 & 2032

- Figure 13: North America Automotive Sensors Market Revenue Share (%), by Application 2024 & 2032

- Figure 14: North America Automotive Sensors Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 15: North America Automotive Sensors Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 16: North America Automotive Sensors Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Automotive Sensors Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Asia Pacific Automotive Sensors Market Revenue (Million), by Type 2024 & 2032

- Figure 19: Asia Pacific Automotive Sensors Market Revenue Share (%), by Type 2024 & 2032

- Figure 20: Asia Pacific Automotive Sensors Market Revenue (Million), by Application 2024 & 2032

- Figure 21: Asia Pacific Automotive Sensors Market Revenue Share (%), by Application 2024 & 2032

- Figure 22: Asia Pacific Automotive Sensors Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 23: Asia Pacific Automotive Sensors Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 24: Asia Pacific Automotive Sensors Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Asia Pacific Automotive Sensors Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Europe Automotive Sensors Market Revenue (Million), by Type 2024 & 2032

- Figure 27: Europe Automotive Sensors Market Revenue Share (%), by Type 2024 & 2032

- Figure 28: Europe Automotive Sensors Market Revenue (Million), by Application 2024 & 2032

- Figure 29: Europe Automotive Sensors Market Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Automotive Sensors Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 31: Europe Automotive Sensors Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 32: Europe Automotive Sensors Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Europe Automotive Sensors Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: Rest of the World Automotive Sensors Market Revenue (Million), by Type 2024 & 2032

- Figure 35: Rest of the World Automotive Sensors Market Revenue Share (%), by Type 2024 & 2032

- Figure 36: Rest of the World Automotive Sensors Market Revenue (Million), by Application 2024 & 2032

- Figure 37: Rest of the World Automotive Sensors Market Revenue Share (%), by Application 2024 & 2032

- Figure 38: Rest of the World Automotive Sensors Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 39: Rest of the World Automotive Sensors Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 40: Rest of the World Automotive Sensors Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Rest of the World Automotive Sensors Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Automotive Sensors Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Automotive Sensors Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Automotive Sensors Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Global Automotive Sensors Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 5: Global Automotive Sensors Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Automotive Sensors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Automotive Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Automotive Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico Automotive Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America Automotive Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Automotive Sensors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: China Automotive Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Japan Automotive Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: India Automotive Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: South Korea Automotive Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of Asia Pacific Automotive Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global Automotive Sensors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Germany Automotive Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: United Kingdom Automotive Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: France Automotive Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Rest of Europe Automotive Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Global Automotive Sensors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 23: Brazil Automotive Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: United Arab Emirates Automotive Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Other Countries Automotive Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Global Automotive Sensors Market Revenue Million Forecast, by Type 2019 & 2032

- Table 27: Global Automotive Sensors Market Revenue Million Forecast, by Application 2019 & 2032

- Table 28: Global Automotive Sensors Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 29: Global Automotive Sensors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: United States Automotive Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Canada Automotive Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Mexico Automotive Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Rest of North America Automotive Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Global Automotive Sensors Market Revenue Million Forecast, by Type 2019 & 2032

- Table 35: Global Automotive Sensors Market Revenue Million Forecast, by Application 2019 & 2032

- Table 36: Global Automotive Sensors Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 37: Global Automotive Sensors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 38: China Automotive Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Japan Automotive Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: India Automotive Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: South Korea Automotive Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Rest of Asia Pacific Automotive Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Global Automotive Sensors Market Revenue Million Forecast, by Type 2019 & 2032

- Table 44: Global Automotive Sensors Market Revenue Million Forecast, by Application 2019 & 2032

- Table 45: Global Automotive Sensors Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 46: Global Automotive Sensors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 47: Germany Automotive Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: United Kingdom Automotive Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: France Automotive Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Rest of Europe Automotive Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Global Automotive Sensors Market Revenue Million Forecast, by Type 2019 & 2032

- Table 52: Global Automotive Sensors Market Revenue Million Forecast, by Application 2019 & 2032

- Table 53: Global Automotive Sensors Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 54: Global Automotive Sensors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 55: Brazil Automotive Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: United Arab Emirates Automotive Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: Other Countries Automotive Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Sensors Market?

The projected CAGR is approximately 6.05%.

2. Which companies are prominent players in the Automotive Sensors Market?

Key companies in the market include Aptiv PLC (Delphi Automotive), Infineon Technologies AG, Hitachi Automotive Systems Americas Inc *List Not Exhaustive, NXP Semiconductors NV, Littelfuse Inc, Texas Instruments Inc, Sensata Technologies Holding PLC, Continental AG, Robert Bosch GmbH, CTS Corporation, Analog Devices Inc, Maxim Integrated Products Inc, DENSO Corporation.

3. What are the main segments of the Automotive Sensors Market?

The market segments include Type, Application, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 28.88 Million as of 2022.

5. What are some drivers contributing to market growth?

Buyers Inclination Toward Affordable Used Cars to Fuel the Market Growth.

6. What are the notable trends driving market growth?

Government Initiatives And The Growing Emphasis On Safer Automotive Systems Driving The Market.

7. Are there any restraints impacting market growth?

Technology Advances. Older Used Cars May Lack the Latest Features.

8. Can you provide examples of recent developments in the market?

December, 2022: Continental AG (Continental) announced that it will show-off modules and sensors created exclusively for electromobility. Continental will debut its Advanced Driver Assistance Systems (ADAS) which has been integrated into the "CV3" SoC (System on Chip) family with artificial intelligence (AI) from semiconductor startup Ambarella.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Sensors Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Sensors Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Sensors Market?

To stay informed about further developments, trends, and reports in the Automotive Sensors Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence